Hi Everyone. No major updates today. We’re hard at work helping clients and catching up on the flurry of industry news. If you want to check out all of our content and services, visit our newly updated website.

Naavik Exclusive: Roundtable #10

In this Metacast episode, Nicolas Vereecke is joined by Aaron Bush, Anton Gorodetsky, and Grigory Bortnik to discuss;

-

Ubisoft’s shift in strategy

-

InvestGame’s H1 2021 Game Deal Report

-

Jam City’s cancelled SPAC

As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Zynga’s Q2 FY21 Earnings

Source: SEC

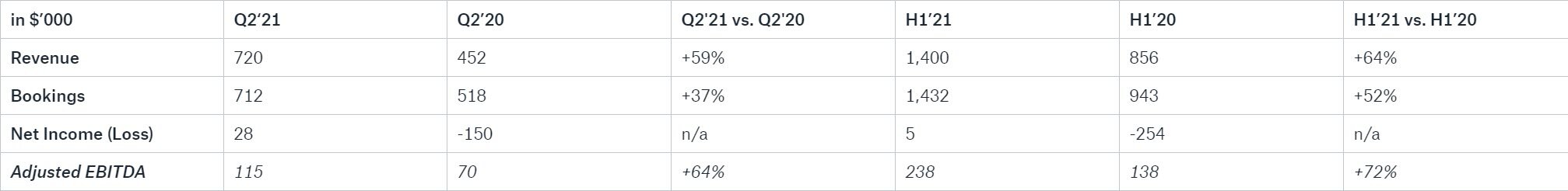

San-Francisco-based mobile games developer and publisher Zynga released its Q2’21 financial results, reporting solid growth with $720M quarterly Revenue (+59% YoY) and $712M in Bookings (+37% YoY).

That said, their stock fell 20% on the news. This was in part due to looser COVID restrictions and the short-term impact of IDFA. We previously wrote about how Zynga has been thoughtful with IDFA (Ads and M&A), and suspect that long-term things will be fine. From their quarterly letter:

Toward the end of Q2, as communities began to reopen and reduce their COVID-19 restrictions, we saw softness in our bookings primarily driven by declines in player cohorts who installed our games in the early part of 2021. At the same time, the adoption of Apple’s privacy changes resulted in a higher cost to acquire our players. In response, we scaled back our UA spend to maintain target returns, resulting in fewer players installing our games during this period.

Despite the market’s reaction, Zynga is staying true to its course: inorganic growth in new markets, an ad ecosystem, and in-house game development. Though its release date has shifted quite a bit, Farmville 3 is the next large launch for them. In addition, two-thirds of the $720M Q2 '21 Revenue and Bookings came from Zynga’s ‘forever franchises’. These are eight titles generating 66% of the total Revenue and 65% of the total Bookings: CSR Racing, Empires & Puzzles, Merge Dragons!, Merge Magic!, Toon Blast, Toy Blast, Words With Friends, and Zynga Poker. Most impressive here is that five of these titles are published by the companies acquired by Zynga over the last 3-4 years: Peak Games, Small Giant Games, and Gram Games. Though we don’t see Rollic’s products in the list, the games of the hyper casual-focused company have surpassed 1 Billion in total downloads worldwide, and are continuing to lead the charts; this success has already led to a record $133M (+110% YoY) in advertising Revenue and Bookings.

It’s clear that Zynga's active inorganic growth strategy has presented great results so far. The company shows no signs of stopping: this year, it has already announced two acquisitions for a combined value of $775M. In May, the company entered into an agreement to acquire 100% of US-based mobile ads and monetization platform Chartboost for around $250M in cash, closing the deal on August 4, 2021. This week, Zynga also entered into an agreement to acquire Chinese studio StarLark, known for the Golf Rival game, for $525M in cash and stock. Golf Rival is the world’s second-largest mobile game in the golf genre, after Playdemic’s Golf Clash (Electronic Arts is currently in the process of acquiring Playdemic from WarnerMedia’s subsidiary TT Games for $1.4B in cash). Moreover, the new China-based studio expands Zynga’s presence in APAC, opening the door for potential acquisitions in the area. The company has managed to establish a Turkish hub of mobile games developers (Peak Games, Gram Games, Rollic, Uncosoft), so considering China is worth more than 25% of the world’s mobile games market ($29.2B in 2020, up 30.9% YoY, according to Niko Partners), it’s not unexpected they’re trying to do the same in China.

Their growth strategy is best reflected from their recent letter:

Execution of our multi-year growth strategy enables Zynga to drive recurring organic growth from our expanding live services portfolio and new game pipeline. In addition, we are investing in hyper-casual games, cross-platform play, international expansion and advertising technologies – all of which have the ability to meaningfully increase Zynga’s total addressable market and further enhance our competitive advantage and growth potential within the interactive entertainment industry.

(Written by Andrei Zubov and Vlad Sergeevykh, InvestGame team)

#2: Lessons From Activision Blizzard’s Troubles

Source: IGN

Earlier this week, Activision Blizzard reported its Q2 results — which expectedly saw bookings mildly decrease year-over-year — but the more important story revolves around company culture. Let’s break down what happened and how companies can learn from Activision’s mistakes (Big thanks to everyone who emailed me resources and recommendations last week).

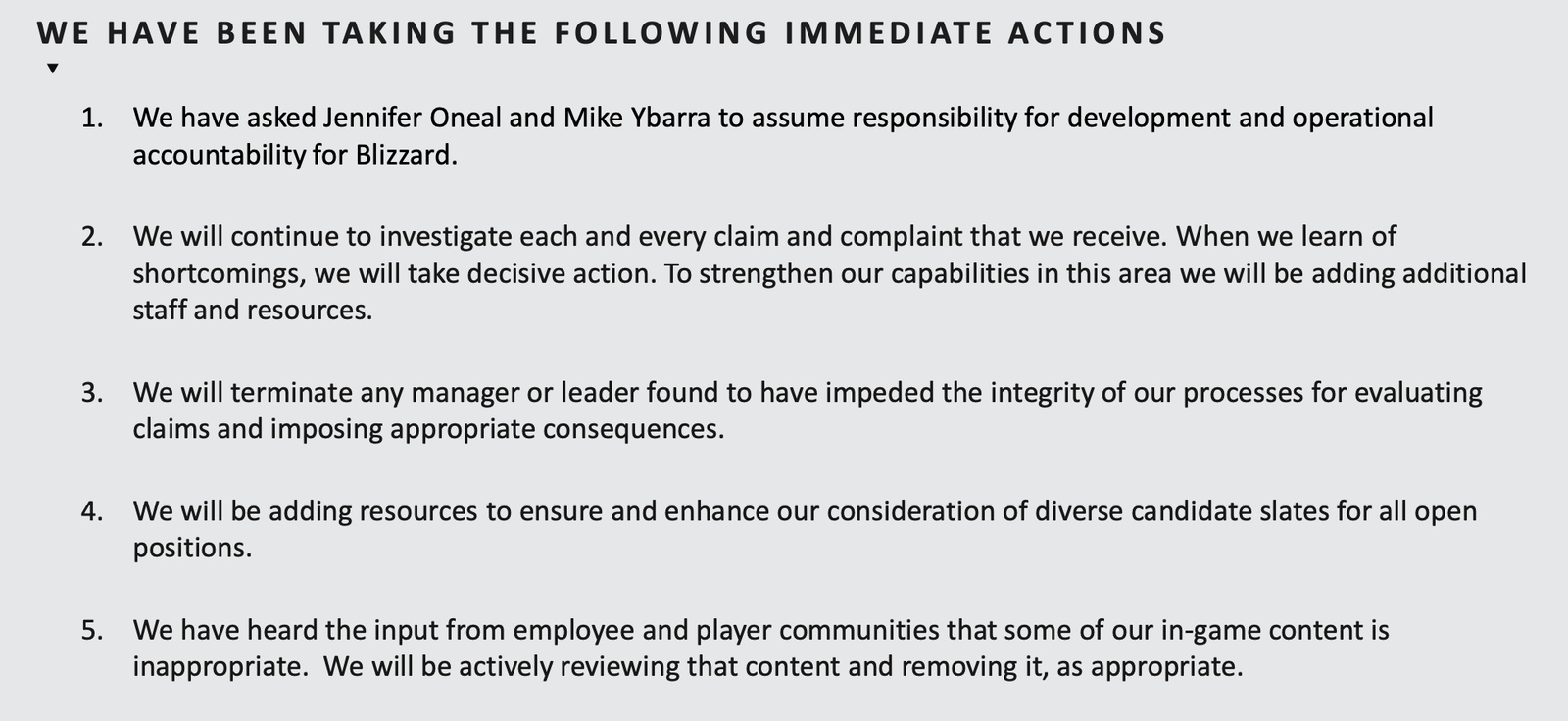

On July 21st, the state of California announced a lawsuit against Activision Blizzard on claims of workplace discrimination and sexual assault. The details of the filing were truly horrible. Shortly after, CCO Frances Townsend emailed staff a tone-deaf email (essentially denying the allegations), after which employees signed a public letter demanding changes and conducted a walkout (which is when public markets really started taking notice). Since then, the company hired law firm WilmerHale (known for union-busting) to investigate the claims and “fired” Blizzard President (J. Allen Brack) + SVP of HR (Jesse Meschuk). This is the latest:

Source: Activision Blizzard

To be clear, these are good initiatives and likely needed. However, it took too long to get to this point. Activision is simply another example of broader industry issues. Company cultures can’t be changed in an instant, but I’m also disappointed in how company-specific conversations are progressing. For one, being “anti-harassment” is table stakes, and it’s crazy to me that companies still struggle so heavily with this. Ideally, there should be a strict, zero-tolerance anti-harassment policy from the get-go so that companies can focus on other initiatives. To this end, here are some helpful resources I came across:

-

GamesIndustry.biz compiled a list of resources for victims of workplace harassment.

-

Emily Greer (CEO of Double Loop Games) gave a GDC talk in 2020 about preventing abuse and building team trust (+ followed up with a helpful Twitter thread)

-

Deconstructor of Fun published a blog post about four steps leaders can take to stop or avoid harassment in their companies.

The next step after anti-harassment is becoming serious about diversity and equity. I won’t claim to be an expert on this — we have room to improve at Naavik — but what’s not talked enough about is that diversity and equity is only the starting point. I like the DIBS (Diversity, Inclusion, Belonging, Success) philosophy. In essence, having diversity isn’t enough if everyone doesn’t feel included; inclusion isn’t enough if people don’t truly feel like they belong; and belonging isn’t enough if it doesn’t lead to measurable success. In other words, diversity is the starting point that often takes intentional effort, but what leaders ultimately need to strive for, measure, and be held accountable to is diverse-driven success. Here are a couple good resources / examples:

-

Gamecity Hamburg is hosting a free panel discussion on Diversity Management in the Games Industry on August 12.

-

Fostering Diversity in Games — a GDC panel from 2018.

-

Tips for more diverse panels, conferences and similar events (The German Games Industry Association)

-

The recently announced BITKRAFT Diversity Commitment framework takes steps to improve diversity in hiring, events, selecting co-investors, and more. Over 90% of its portfolio companies are also committing to the proposal.

I’ll close with a personal book recommendation — Conscious Capitalism, which advocates that companies have a responsibility to find win-wins that serve all stakeholders (customers, employees, suppliers, shareholders, etc.). Part of our industry’s issue is that certain stakeholders (shareholders) are often more heavily optimized than others (employees). When we see threats of unionization out of companies with 40% operating margins, it’s obvious there needs to be some sort of rebalancing. And, in the case of Activision Blizzard, even if “rebalancing” sounds like it leads to a worse outcome for shareholders, the book ultimately makes the data-driven case that serving all stakeholders is not only the right thing to do, but it’s fundamentally good for the business. Doing right often drives the business forward.

There’s more work to be done, but if there’s any silver lining to recent troubles it’s a call for the rest of the industry to do its part to level up. This isn’t a one-and-done conversation, so if you have any more resources or recommendations, I’d love for you shoot us a message. We can certainly share it with our community. (Written by Aaron Bush)

🎮 In Other News…

💸 Funding & Acquisitions:

-

It’s earnings galore: Square Enix | Take-Two | Nintendo | EA | Activision | Sony

-

Netmarble announced that it would spend $2.19B to acquire SpinX Games, a developer of mobile casino games. Link

-

Embracer Group acquired eight more companies for $213M. Link

-

Skillz invested $50M in Exit Games, bringing robust multiplayer technology to their platform. Link

-

Spanish Studio UnusuAll raised $3.6M from strategic investor, Garena. Link

-

Planetarium raised $2.6M, with participation from Animoca Brands. Link

-

Plarium acquired Helsinki-based FuturePlay for an undisclosed amount. Link

📊 Business:

-

Blockchain gaming startups raised $476M in H1’21. Link

-

Riot Games is opening a studio in China. Link

-

Oculus has shipped over four million Quest 2 units in the US. Link

-

According to Streamhatchet and Youtube data, mobile gaming dominated peak CCU for esports. Link

🕹️ Culture & Games:

-

Someone made Google Maps for Breath of The Wild. Link

-

Waze now lets you use Master Chief’s voice as your guide. Link

👾 Miscellaneous Musings:

-

GI.biz’s list of resources for victims of sexual harassment in the workplace. Link

-

A comprehensive list of academic articles published about Twitch and live-streaming. Link

-

Sensor Tower released a 2021-2025 mobile market forecast. Link

🔥 Featured Jobs

-

Not Doppler: Senior Data Analyst (Sydney or Remote) (Remote, Global)

-

EA: Level Designer — Battlefield Mobile! (Pasadena, CA)

-

EA: Lead Game Product Manager (Pasadena, CA)

-

Metafy: Senior Product Manager (Remote, US)

-

Carry1st: Producer (Remote, Global)

-

LightHeart Entertainment: UI Artist (Helsinki)

-

LightHeart Entertainment: Senior Game Programmer (Helsinki)

-

Immutable: Economy Game Designer (Sydney)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.