Hi everyone. Happy Valentine’s Day and Happy Chinese New Year to those celebrating! We have no major updates this week — except to say we’re thrilled to have the InvestGame team contributing — so let’s jump right in.

Here’s your weekly roundup and analysis of what’s happening in the video game industry…

#1: EA to Acquire Glu Mobile for $2.1 Billion

On Monday U.S.-based video game giant Electronic Arts entered into an agreement to acquire U.S.-based mobile game developer Glu Mobile for $2.1B in enterprise value and equity value of $2.4B (including Glu’s ~$364 million in net cash). This deal helps EA further expand into the mobile space with Glu’s diversified portfolio across sports, RPG, lifestyle, casual, and mid-core genres. The acquisition is expected to finalize in Q2’21 and is planned to be financed by EA’s cash on hand.

Here’s the obvious question: is the deal good for EA? Well, there’s definitely lots of rationale. First, the acquisition will help stabilize EA’s traditionally hits-driven financial performance. EA’s made steady progress building its digital, recurring revenues, and acquiring Glu should help further stabilize the company’s revenue stream on a quarter-to-quarter basis. Acquiring Glu moderately moves the needle (increasing EA’s revenue ~10%), but it clearly adds meaningful scale to EA’s mobile efforts.

Second, product-wise, with this deal EA gets a huge team of 780 employees, significantly scaling its mobile game development expertise. Both companies have experience creating mobile live service games and will combine forces to further develop in this direction. Glu Mobile’s portfolio seems to fit EA’s range of lifestyle and sports titles:

-

Design Home (Glu’s highest grossing title), Covet Fashion, and Kim Kardashian: Hollywood will complement The Sims Mobile.

-

Tap Sports Baseball, Deer Hunter, and Tap Sports Fishing will be great add-ons to EA’s vast portfolio of sports titles.

These are all comparatively old titles, however, so what’s in store for 2021? This year Glu will focus on its PVP hunting game Deer Hunter World, fishing simulator Tap Sports Fishing, and sports game Tap Sports Baseball 2021 (which, again, fits perfectly into EA’s sports pack), as well as lifestyle decoration game Table & Taste and a suite of hypercasual titles labeled Crowdstar Moments.

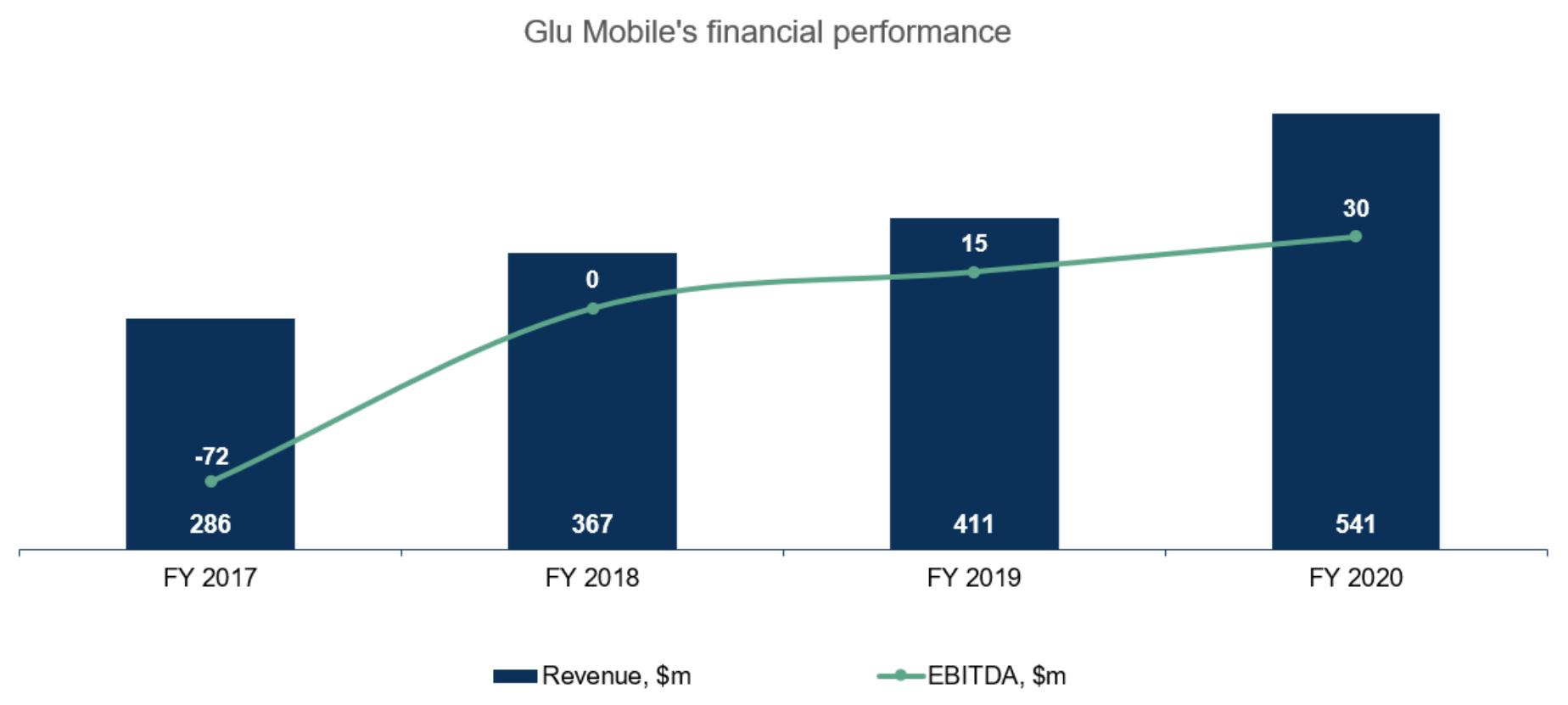

As for Glu’s financial results, the company reported $540.5 million of revenue in 2020, compared to $411.4 million in 2019, and $366.6 million in 2018 (see graph), with approximately 56.5% and 33% of sales coming from the App Store and Google Play, respectively. The majority of the total revenue (80%) is generated in the U.S., while EMEA brings approximately 10.5%.

There is one major concern here, however: based on the Glu’s current valuation and financials, there is a chance that this investment won’t result in meaningful value creation. An example of such investment from EA could be seen in the acquisition of Plants vs. Zombies series developer PopCap Games for $1.3B in 2011, which didn’t pay off. With Glu specifically, we wonder if EA can help accelerate Glu’s roadmap or whether Glu can better help EA’s existing franchises better succeed on mobile — it’s all to be determined. Apart from that, the recent Codemasters deal means that in 2021 EA will have to integrate two large businesses into its ecosystem. In other words, it could take some time before any synergies click into place.

All in all, this deal is yet another sign that the big dogs are accelerating their approach to M&A, creating some kind of… a panic, perhaps? Even if hyperbolic, the M&A landscape is clearly becoming more competitive, and there’s still billions in cash on the sidelines looking to be put to work in capital-efficient ways. Look at EA’s latest deals: just in December 2020, EA entered into an agreement to acquire UK-based racing games developer Codemasters Group for up to $1.2B, beating the offer by Take-Two. But before that, deals happened all the back way to July 2018 (EA acquired California-based mobile game developer Industrial Toys for an undisclosed sum), and November 2017 (Electronic Arts acquired California-based game developer Respawn Entertainment for $455m). Two deals in the last three years vs. two way bigger deals in the last three months — there must be reason behind this acceleration, right? We’re certainly looking forward to other huge deals on the market this year. Buckle up, everyone; we’re in for a ride. (written by the InvestGame team)

#2: Zynga’s Largest Year Yet

On Wednesday, Zynga reported results for the fiscal year 2020. The last year was indeed the biggest so far for Zynga, with net bookings growing 45% to $2.27 billion. Most of Zynga's growth last year originates from its Peak Games acquisition, but the US-based gaming giant also managed to grow some of its key live games as well as gain some ground in advertising revenue following the acquisition of the Turkish hyper-casual aspirant Rollic.

In fact, for many years, most of Zynga’s impressive growth has been inorganic, resulting from a series of successful acquisitions. In particular, Gram Games, Peak Games, and Small Giant Games have proven to be money well spent for Zynga. In addition, Zynga has done well in incrementally growing the revenue of its live games with solid live operations. Meanwhile, new game development has been struggling, with extended soft launches and numerous projects in development hell. Last year, the company finally got this monkey off their back as Harry Potter: Puzzles & Spells from Zynga's San Diego studio became the first internally developed Zynga game in years to truly succeed.

Looking forward, Zynga expects to grow pretty much anywhere it can: live games, new games, hypercasual games, new geographical areas, and even platforms outside of mobile. This does sound more like a wishlist to Santa than a genuinely focused growth strategy. That said, considering the resources at Zynga's disposal, it wouldn't be surprising if multiple of its bold growth plans do end up materializing in revenue growth during 2021.

Zynga has also asserted that its large portfolio of games - and thus abundance of first-party data - grants a competitive advantage in the post-IDFA world. For Zynga to realize this first-party data advantage, it will have to consolidate its apps under one publisher entity in Apple's App Store. It remains to be seen whether this will happen.

One thing is clear though: with $1.4 billion in cash in the bank, Zynga won't rest on its laurels in terms of acquisitions. With the pace of the consolidation that we've seen in the industry, the question is not whether Zynga will complete acquisitions this year. Even with the M&A whiz Chris Petrovic gone, Zynga most certainly will continue to strike deals. The question is whether Zynga will continue to beef up its top line by acquiring successful live games, or whether it will take a leaf out of AppLovin's book and look toward expanding to e.g. ad tech or marketing measurement instead. (written by Miikka Ahonen)

Sponsored By Heroic Labs

Heroic Labs builds server technologies that specialize in massively realtime, social, and competitive gameplay across all platforms for studios such as Gram Games, Zynga, Lion Studios, and many more.

Heroic Labs’ flagship product is Nakama - the open-source, social and realtime game server.

Read more on what Enzo Martin, technical Director at Paradox Interactive had to say about us:

“Nakama’s value is derived not just from the modern tech choices that have been carefully chosen to power the highly scalable and performant platform, but also the highly talented and friendly team that keeps the platform steadily evolving and maturing and whom have given us a white glove quality on-boarding in integrating with our games.”

#3: Take-Two Interactive’s Steady Expansion

On Monday, Take-Two Interactive reported its third quarter results. On the surface, it looks pretty decent — sure, bookings are lower than the past couple Q3s (as expected), but the business still easily beat expectations. Recurrent customer spend grew 30% (double the outlook), which helped slow the decline of digital net bookings as a whole. Under the surface, however, it was a relatively inactive quarter. The holidays make it important, but there wasn’t much going on in terms of big launches. Instead, the quarter was a reminder of how critical Take-Two’s top franchises are and how well the company is maintaining them.

For example, Grand Theft Auto (GTA) V has now solid over 140 million units. That’s obviously incredible, but what’s fascinating is that more copies of the game were sold in 2020 than any other year except 2013 when the game first launched. Plus, that massive, growing audience continues to feed GTA Online, which saw recurrent spend jump 28% year-over-year. This execution is super impressive.

Another example is NBA 2K, which saw net bookings and recurring consumer spend increase 48% and 67% year-over-year, respectively. NBA 2K21 users are playing 14% more games on average compared to NBA 2K20, and Take-Two continues to try strengthening its NBA ecosystem through NBA 2K Mobile, NBA SuperCard, NBA 2K Online in China, and its esports league. Not everything is perfect, but the ecosystem is stronger than ever.

Take-Two’s top franchises are what drive the majority of its results, but the company has also done a good job creating value through the sum of its other games. This quarter, for example, Mafia, WWE, Civilization VI, PGA Tour 2K21, as well as Social Point’s and Playdots’ games contributed nicely. Take-Two doesn’t often make outsized deals, but it’s done a respectable job steadily growing its pipeline so that a larger variety of games can influence results and make it a bit less dependent on outsized blockbusters.

Management claims to have 93 games in its pipeline — the most ever. Obviously, those 93 games aren’t created equally (ahem, GTA VI) and not all will pan out, but it is a sign that management is building the company in a way that builds value. Overweight franchises mean growth still occurs in lumps — despite impressive growth in recurrent digital spending — but the trajectory is still solid. And even though Take-Two’s price discipline means it won’t win over many deals (like losing Codemasters to EA recently), the company still has over $2 billion in net cash to put to work. Eventual mega-releases still determine the long-term fate of Take-Two, but even this relatively dull quarter was a reminder that the company’s measured build puts it on a good path.

🎮 In Other News…

-

Assassin's Creed Valhalla leads Ubisoft's biggest quarter ever. Link

-

Latitude raises $3.3 million for its AI platform that can build “infinite stories.” Link

-

French mobile studio Homa nets $15 million to create hypercasual titles. Link

-

Asmodee acquires Board Game Arena. Link

-

Sega Sammy reports sharp income decline despite soaring game sales. Link

-

According to NPD, US game spending is up 42% in January. Link

-

Bandai Namco reports rising profits amid restructure. Link

-

Maple Story and mobile expansion push Nexon to record revenues. Link

-

Tencent acquires minority stake in DayZ developer Bohemia Interactive. Link

-

TinyBuild acquires three studios. Link

-

Nazara Technologies gets $13.7m in funding. Link

-

Tilting Point sinks $60M into Match 3D developer Loop Games. Link

-

Epic Games’ MetaHuman Creator lets developers create realistic digital humans within minutes. Link

-

Nexon experiences great year as it generates $2.8 billion in 2020. Link

-

My.Games invests $1.5 million in Pizza Club Games. Link

-

Cyberpunk 2077 studio’s hacked data has reportedly been sold. Link

🖥 Content Worth Consuming

"Insane Companies No One (Everyone) Talks About" Episode #3: Roblox. (Julie Young) “I think Roblox has an amazing opportunity to build out the metaverse and to expand what it means to “game,” but I think they need to hone in on their mobile app and social networking product features in order to truly scale as a business. I think that doing so will help them attract and retain older users, remain sticky long-term, and improve monetization by expanding opportunities for Creators.“ Link

Dapper Labs: Paving The Way For Consumer Blockchain. (Delphi Digital) “Host Piers Kicks sits down for Episode 16 of Metaverse Musings with Roham Gharegozlou the Founder & CEO of Dapper Labs who built Crypto Kitties and NBA Top Shot. Most recently, they launched a new chain built entirely from the ground up after being dissatisfied with the scaling solutions available. Roham and his team are perhaps best positioned to comment on taking blockchain mainstream after not one, but two breakout successes with even more ambitious plans ahead of them.” Link

Steam game trends in 2020 - annual review. (Gamasutra) “2020 saw 9,866 games released on Steam, more than any other year. That’s 10.5% more than the 8,930 in 2019… The big increase in new game releases has exclusively come from the indie developers. These games require smaller teams and have shorter development times. Small indie teams with mostly remote teams anyway have not been slowed down by Covid.” Link

2021 Predictions #8: Three Growth Opportunities Unlocked by IDFA Depreciation. (Deconstructor of Fun) “It is tempting for mobile games marketing teams to think of 2021 as being dominated by Apple’s impending new privacy policy for iOS, App Tracking Transparency (ATT). While many teams will spend much of the year working on post-IDFA transformation plans, other secular trends within the gaming and, broadly, mobile create circumstances that -- perhaps in concert with IDFA deprecation -- can provide a real opportunity to developers.” Link

FaZe Clan, Fandom And The New Brand Flywheel. (Musings of a Wandering Mind) “In some ways FaZe Clan is what today’s major record companies aspire to be: a global entertainment behemoth with superstar artists, a massive marketing apparatus and an dictator of cool that extends into wide ranging categories, from music, to film, to TV, to merchandise and live events. Each part of their Flywheel is intentional, strategic and designed to push for progress to the next step, and the next, and so on.” Link

Thanks for reading, and see you next week! As always, if you have feedback let us know here.