When discussing "crypto winter" building, it typically refers to small developers quietly creating potentially innovative projects. While many overlook the NFT market as dormant, projects fueled by NFT popularity often go unnoticed. Companies like Yuga Labs don't merely pocket bull run profits and exit; they continue building in anticipation of the next surge.

The 'Otherside' of Yuga Labs

Most recognize Yuga Labs due to the Bored Ape Yacht Club (BAYC) NFTs. However, to remain relevant, the company has aimed beyond just art. Instead of making a more obvious transition straight to games, Yuga Labs leaned toward developing its own “metaverse,” a trendy idea back in 2022. Yuga Labs’ journey, though, is somewhat intricate.

Like many web3 NFT projects, BAYC anchored itself in a dynamic, quirky, and occasionally juvenile lore. This was apparent when its first game, “Dookey Dash,” was based on racing through the sewers to help uncork the rear end of Jimmy the monkey.

The company’s stride toward interactive platforms ultimately began with "The Otherside" project announcement in April 2022, the anniversary of BAYC NFTs. The Otherside emphasizes “shared experiences” — from games and concerts to chat areas. While many virtual worlds echo this sentiment, handling vast audiences in one spot remains a technical challenge. To help solve these technical issues, Yuga Labs collaborated with Improbable, specialists in this domain. To test the technology, Yuga Labs conducted exclusive "trips," including "First Trip" and "Second Trip" events, each allowing more players and evolving experiences. These test runs were well received for actually demonstrating that Yuga Labs could at least scale up to a reasonable number of players, but the experiences themselves were rudimentary one-shot events.

Like other so-called metaverse endeavors, Yuga Labs sold NFT land parcels, termed "Otherdeeds." Although these had various features, their immediate relevance was minimal. Given BAYC NFTs' value at the time, however, Otherdeeds became a significant success, with a booming secondary market. The first tangible experience, "Sewer Pass," surfaced unexpectedly in January 2023, but not as part of The Otherside.

The Sewer Pass

The Sewer Pass experience ran until mid-February and was somewhat perplexing — not so much in understanding the rules or offerings, but rather in the unspoken strategies Yuga Labs employed to amplify anticipation around revealing the greater purpose of any given asset or activity. It began fairly straightforward: BAYC NFT owners could each claim a Sewer Pass NFT. While the Sewer Pass NFT wasn't particularly captivating, it granted access to a limited-time "endless runner" game, "Dookey Dash," centered on a sewer mission. Rather than focusing on a game for gameplay’s sake, the initiative resembled a time-sensitive competition. A few complex rules defined score tracking, which was tied to the specific NFT and its wallet. After the contest concluded and cheaters were removed, scores were embedded into the NFTs and became tradable. This setup made for some interesting trade dynamics, and the highest-ranking Sewer Pass holder also secured a special Golden Key NFT, which later sold for approximately $1.6M in Ethereum.

This Sewer Pass laid the groundwork for another game via the process of burning NFTs to get the next one. First, the Sewer Pass NFTs converted into Power Source NFTs, whose purposes initially were a mystery. Power Source NFT attributes were tied to the Sewer Pass NFT scores from which they originated, lending significance to the Dookey Dash contest. In time, it was disclosed that Power Sources could morph into mech NFTs named HV-MTL for an upcoming game.

HV-MTL

Transitioning from monkeys and sewers to mechs is unusual, but Yuga Labs’ new game, HV-MTL Forge, which launched on June 29th, is equally peculiar. According to Yuga Labs, it “start[s] as a blend of a pet game and casual world builder, and evolves into a competitive dungeon crawler.” The goal is transformation: evolving an EVO1 mech to EVO2 over six seasons, with each season offering upgrades based on gameplay. Players engage in straightforward management tasks, handling energy and other resources, while treating their mech somewhat like a pet. In essence, it mirrors Facebook-era social games, minus the social feed. The initial three seasons emphasized making various choices of how to evolve your HV-MTL in addition to forge development like building paths to various portals.

However, September 7th marked a shift with the start of season four, called “the hunt,” which introduced a dungeon crawling feature in which players embark on expeditions to collect materials, battle monsters, and craft equipment, power-ups and keys. Although these expeditions are more captivating than the prior mundane tasks, the gameplay remains relatively basic, and we’re curious to see where this all ends up by the end of season six. Many players have grown weary of the casual format, but many Yuga Labs enthusiasts are sustaining interest. Nevertheless, the floor price for an HV-MTL NFT on OpenSea stands at $380. Trading volume has declined dramatically, plunging from nearly $19M in March to $673K in September, as reported by CryptoSlam.

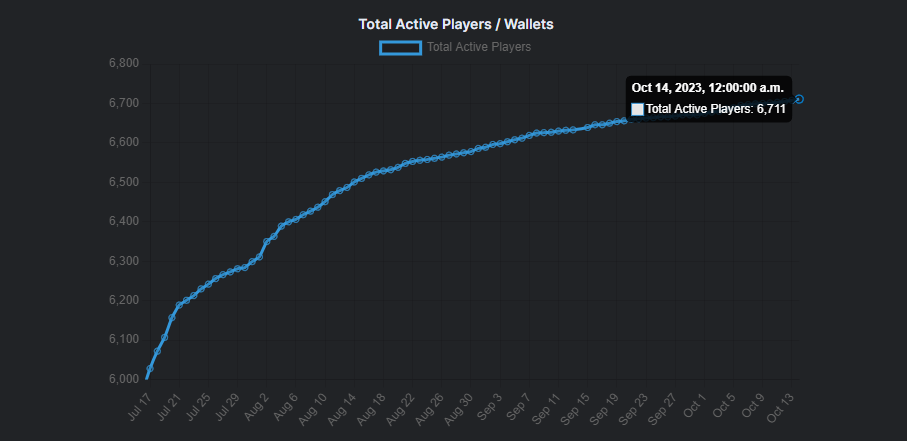

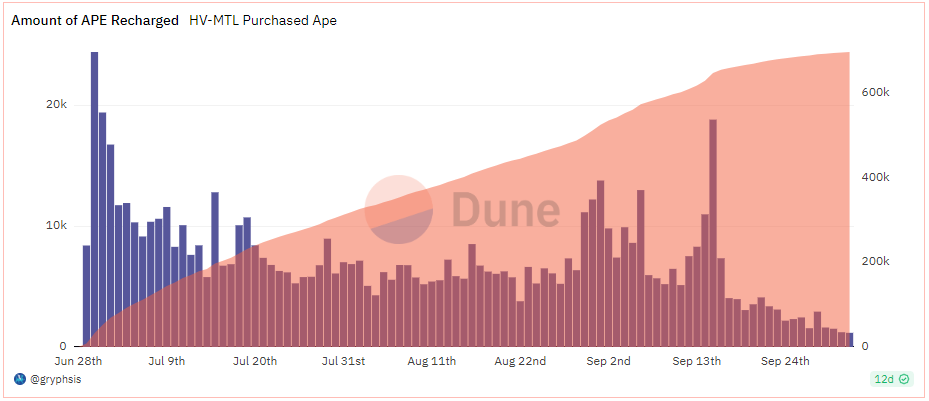

According to third-party site otherside-wiki.xyz, there has been a slowdown in growth through August and September with the number of active wallets making it to just over 6.7K using 18.9K NFTs at the time of writing. Given the cost to play of at least $300, these types of games are not really geared toward getting a mass of players, but it’s worth noting there are about 2.8K HV-MTL holders not playing and about 9.3K HV-MTL NFTs sitting idle. The hope, of course, would be that these players would at least be whales looking to spend in-game frequently. It does seem like spending in terms of APE tokens in-game isn’t too bad, at 700K APE in the last 90 days. It’s tricky to measure that spend in dollars due to not knowing when it’s swapped for, but right now, at a price of $1, that’s a minimum of $700K, but it is probably over $1M given that the price when the game launched was around $2.20. That’s a rough average estimate of $11.6K a day from 100 or less wallet addresses on most days. It’s not Candy Crush of course, but that’s not bad for a game most forget even exists.

Another financial dimension to these endeavors is Yuga Labs' token, Ape Coin ($APE). Launched in March 2022 before The Otherside announcement, initial public allocations went to BAYC and MAYC NFT holders. Although primarily intended to fuel Yuga Labs’ games, it's now utilized by entities like Animoca Labs, who've collaborated with Yuga Labs on projects including Otherdeeds.

Yuga Labs has made sure to push the usage of APE tokens, with APE being required to mint an Otherdeed, buy power-ups for Dookey Dash, and speed up timers and other items in HV-MTL. Despite efforts from Yuga Labs, the token (which at one point had the largest market cap out of all gaming-related tokens) is now smaller than Axie Infinity’s AXS, The Sandbox’s SAND, and Decentraland’s MANA.

There is another evolving branch of Yuga Labs’ gaming universe that has far more obvious ties to The Otherside and just launched at the end of September: Legends of the Mara (LotM).

Legends of the Mara

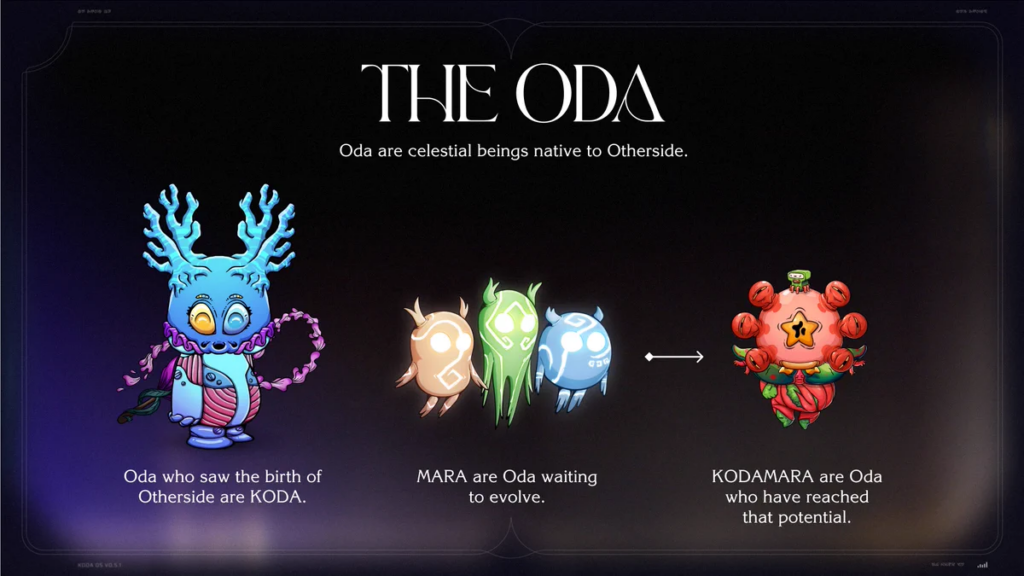

The Legends of the Mara (LotM), reminiscent of HV-MTL's forge play, is currently a simple game but with plans for expansion. Developed in collaboration with Animoca Brands and iCandy for the web version, and Faraway Games (creators of web3 games Mini Royale: Nations and Faraway Land) for the forthcoming Unity version. The game launched on September 26th, requiring specific NFTs to play — namely an Otherdeed Expanded and any of the "Oda" beings (Koda, Kodamara, or Mara), all of which spawn or convert from the standard Otherdeed NFTs. Notably, only about half of Otherdeed owners have transitioned to Otherdeed Expanded, even though retaining the older form offers no advantages. This indicates that many still view land more as an investment, aren’t paying attention, or just aren’t interested anymore. Clearly, there’s a lot of NFT and user complexity here!

Within the game, Otherdeed Expanded NFTs become cards with dedicated slots for farming, hunting, and enchanting. The gameplay centers on assigning the Oda to these roles. Farming produces "sediment fragments" collected over time, hunting relates to the Shatter mini-game for loot, and enchanting amplifies the previous roles by enhancing stats and reducing wait times. In the Shatter mini-game, hunters challenge creatures, the Shattered, using combined strength and player-activated cards for boosts and special attacks using strategic timing to maximize rewards. There's also a Shatter leaderboard that awards seasonal loot based on rankings.

APE tokens can also be used to purchase Myst, the game’s premium currency, which mirrors how many mobile games employ premium currencies. For now, Myst primarily helps expedite timers, but hopefully there are plans for more, like the Shop that exists in HV-MTL. As the game enters its first season, players anticipate more twists, especially regarding the utilization of sediment, loot, and artifacts.

Regarding secondary market impact, the demand for Koda and Otherdeed Expanded NFTs has been diminishing, with Kodas seeing a steeper drop. We lack data on Maras since Yuga Labs withdrew them from OpenSea and similar platforms, protesting unenforced royalties. They've shifted their focus to platforms like X2Y2 instead. Even with the game only being out for just 18 days, players have already spent approximately $420K in APE tokens on the game from just 1.9K wallets, or $221 per wallet. If it was able to continue with that rate, it comes to an average of $700K a month, matching what it took HV-MTL 90 days to accumulate. Clearly, hunting for whales is going well for Yuga Labs just based off the funnel from the expensive NFTs, with the current top spender even named “Robert-The-Whale.” We can’t assume it will continue like this forever, and we don’t know what Yuga Labs’ expenses look like, but given what is a relatively low production value game so far, there is definitely some potential left in this market if retention holds. The benefit to Yuga Labs is that those sinking so much money in the brand and the NFTs needed to play, there’s a higher chance of retention than simple F2P games.

The Future of Yuga Labs

Undoubtedly, Yuga Labs has thrived thus far, with robust sales, royalties, and a $450M seed round in March 2022. Its BAYC NFTs became a cornerstone of web3 culture during the NFT surge. As the trend wanes, though, a more serious approach might be in order than mere humor.

To help with this transition, Yuga Labs hired CEO Daniel Alegre, who previously worked with Activision Blizzard and Google, in early 2023. To diversify beyond NFTs, Yuga also recently onboarded Michael Ghory (ex-Nike, Adidas, and Coach) as VP of Apparel and Lifestyle, and Lorenzo Colaiori as Director of Animation. The acquisition of multimedia metaverse firm Roar Studios in July aims to bring additional production value to The Otherside. Additionally, Yuga Labs invested in spatial computing startup Hadean this month, eyeing enhanced tech capabilities for massive user concurrency.

Yet, challenges loom. A day after the Hadean investment, Alegre announced a restructuring, with undisclosed layoffs. Alegre also signaled cutting projects that shifted focus away from The Otherside, leaving fans hoping HV-MTL and Legends of the Mara games won’t get axed. This was also paired with a promise of regular Otherside development updates, which certainly entices NFT holders, and a “third trip” progress reveal would create significant buzz. We’ll have to wait and see what management has in mind.

Yuga Labs has primarily developed games reminiscent of the Facebook and Flash era, but with the added facets of NFT interaction and cryptocurrency IAP. While the company didn't originate as a game developer, it has been actively enhancing its talent pool and collaborating with seasoned developers like Animoca Brands, iCandy, and Faraway Games. However, integrating new developers and producing more intricate games takes time with no reliable way to speed that up. NFT-centric games also require a balance between gameplay and brand IP development, which sometimes diverts Yuga Labs' focus. Layoffs from other projects within the company suggest this balance has been challenging.

There's little doubt of plans to further integrate The Otherside, HV-MTL, and Legends of the Mara. But a glance at top spenders for HV-MTL and LotM reveals minimal player overlap. HV-MTL, being more affiliated with BAYC owners and less with The Otherside, could be considered for potential sunsetting post its sixth season. Conversely, LotM offers landowners continuity with the universe as The Otherside evolves. Although it's currently performing well revenue-wise, it seems like an underdeveloped concept Yuga Labs aims to expand. If future Otherside demos impress and LotM becomes a gateway for early resource advantages, its success could be sustained longer.

The appeal for status NFTs like BAYC has waned significantly. For context the current floor price for a BAYC NFT is around $39K which is still a luxury price, but consider that, that same NFT sold for nearly three times as much at $123K back in January. The real challenge is whether luxury NFTs can maintain relevance in gaming, given their elite yet narrow player base. The exclusivity of these high-priced NFTs may lose its luster if no one is really paying attention to the games. Over time, it's anticipated the player base may shrink as some whales offload their NFTs at discounted rates, mostly attracting existing players to add to their collection for less. Yuga Labs will eventually need to decide between focusing solely on exclusive items or diversifying their NFT range. This shift is already demonstrated by HV-MTL ($380 to play) being more affordable than LotM ($741 to play). It’s likely that The Otherside may be that compromise in opening up to a large audience but with owners of its high-end NFTs getting much more status, assuming the audience is still there when it finally opens up. The biggest advantage Yuga Labs might have is using interoperability to give NFT owners a way to show off in other games to keep them relevant and paraded in front of the masses.

Gaming Market Update: October 7th - October 13th

By Mario Stefanidis, CFA, Naavik Contributor

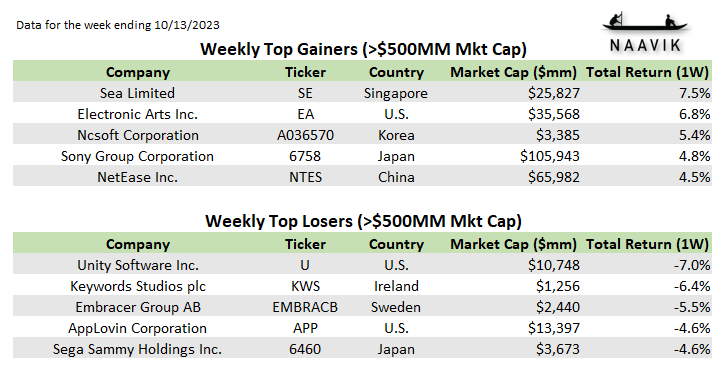

- For the week ending October 13th, 2023: The average return for gaming companies tracked by Naavik with a market capitalization exceeding $500M was -0.1%. The S&P 500 returned 0.5% and the Nasdaq-100 returned 0.2%. Full access to the Naavik Gaming Company universe is available here.

- Unity (NYSE: U) declined -7.0% last week, following the departure of CEO John Riccitiello, who had led the company since 2014. Riccitiello and Unity have been embroiled in controversy since instituting new pricing changes in September, initially intended to be based on installations rather than the existing per-seat model. Unity amended its pricing model, offering a flat 2.5% of a game's revenue, but the discontent and eroded trust remains. The board will launch a search for a permanent CEO; James Whitehurst, an adviser at the private equity firm Silver Lake and a previous CEO of Red Hat, is stepping in as interim CEO.

Riccitiello played a significant role in Unity's growth over the past nine years, with half of the world's top games reportedly built using its engine. However, the company has continually operated at a loss, with an accumulated deficit of $2.7B as of June 2023. Silver Lake holds 9% of Unity’s outstanding shares and is the second largest shareholder behind Sequoia Capital. It’s likely that whichever CEO takes the reins next will focus more on bringing the company to profitability, along with increasing trust with developers again.

- Electronic Arts (NASDAQ: EA) rose 6.8% as a result of speculation that the company may be bought by Disney. Bloomberg reported that CEO Bob Iger’s deputies are advising him to acquire EA to turn Disney into a gaming giant, moving away from licensing. EA held the exclusive rights to develop Star Wars games for 10 years – products of which included Star Wars Jedi: Fallen Order and Survivor, developed by Respawn Entertainment, and Star Wars: Squadrons, developed by Motive Studio – but that deal is now expiring.

Such an acquisition is highly speculative, and Disney has not confirmed or denied any rumors. Disney also has its hands full as management navigates the ever-changing television industry, especially with a debt-heavy balance sheet. However, if Disney were to make a big jump into gaming, which makes sense at some point, EA is a solid target: It’s a large, cash-flowing business; it’s successfully worked with Disney IP; and Disney would acquire notable IPs like Mass Effect, Dragon Age, and The Sims. And, if Disney decides to stay dedicated to sports, EA Sports is a great asset too.

Notable Venture Financing Deals

- Stockholm-based VR studio Fast Travel Games raised $4M in its latest venture round. This is the same amount the studio had raised in its July 2021 Series B. CEO and co-founder Oskar Burman said the money will go toward developing its own IP for VR platforms and to support publishing initiatives. Its developed games include Apex Construct, The Curious Tale of the Stolen Pets, and Cities: VR, to name a few. On the publishing side, it started a dedicated arm in 2021 led by Patrick Liu, who was previously Mojang’s Head of Games. Thus far, it has published numerous indie titles which, like its own games, are mostly on Steam and Meta’s Quest Store. Burman cites the growth of the VR games market as a catalyst for the additional funding, with PSVR 2 and Quest 3 having been released this year.

- Space Rock Games raised $1.2M in seed funding. The studio, based in New Zealand, is working on Criminals Within, an asymmetric couch co-op title. It is set in a medieval fantasy kingdom, is being developed using Unreal Engine 5, and is slated for the latter half of 2025 on PC and consoles. Initial funding for Space Rock Games was sourced locally, including contributions from family and the New Zealand government's venture fund. With the recent funding, the team's focus has shifted to securing a publisher. Space Rock Games is the first New Zealand gaming company to acquire VC investment. The studio has 16 people and has kept costs low through a remote work setup and use of tax breaks.

- Sony introduced a new funding initiative aimed at African businesses. The Sony Innovation Fund: Africa will be allocating $10M for startups in film, music, and gaming. This follows the closure of Sony’s Innovation Fund 3, which invested a total of $215M in emerging tech firms. The new fund will prioritize seed and early-stage rounds, and provide support in the form of subsequent investments in portfolio businesses. CEO of Sony Ventures Gen Tsuchikawa said the funds are intended to aid young African creators with IP support, collaboration opportunities, marketing insights, and other resources that Sony can offer.

Notable Strategic Investments

- Modern Times Group acquired a 70% stake in Swedish mobile games studio Snowprint Studios. The price will amount to a “1.8x multiple of 2023 revenues for Warhammer 40,000: Tacticus,” the studio’s new mobile game which launched last year. This will be based on full year 2023 results, and MTG expects the studio to generate $30M-$35M across its whole portfolio. MTG also stated that the purchase price will be approximately 10% of its current cash position, which, as of its latest quarter, was SEK 3,871M ($351M). At the midpoint, this implies Warhammer will generate $18M in revenue this year, with the remaining approximately $15M going to its other two mobile games: Rivengard, a tactical RPG released in 2019, and 2017’s Legend of Solgard, a puzzle RPG. The press release also stated the remaining 30% stake is expected to be acquired in 2025 or 2026, with the valuation contingent on the studio’s future performance.

Since selling its esports organization ESL Gaming for over $1B to Savvy Games Group, MTG has transitioned to a pure developer and publisher. Its other holdings include InnoGames, Kongregate, Ninja Kiwi, Playsimple, Hutch, and now Snowprint, a portfolio which showcases a mobile-first approach. MTG is one of the rare gaming holding companies still purchasing studios, given it still has a significant cash position on its balance sheet.

- Fragbite Group (STO: FRAG) has acquired fellow Swedish studio Fall Damage for SEK 20M ($1.8M). Cash considerations are $900k with the other half in shares. The four founding members of the studio are subject to a 36 month lock-up agreement, and can earn an additional SEK 400M ($36M) depending on performance. Established in 2016 by veterans from DICE, Fall Damage is currently working on ALARA Prime, a tactical FPS game featuring three-player teams. The team believes its design makes it suitable for esports, as it incorporates features for marketing, social media, and commercial partnerships. The game is expected to release Q3 2024, and financial projections for 2025 range between SEK 480M and SEK 680M in net sales. Fragbite will issue shares at a price of SEK 2.33 each, resulting in a dilution effect of approximately 4.4%. Alongside the issuance, Fragbite is exploring a potential SEK 20M loan to finance Fall Damage's operations and the development of ALARA Prime.

Featured Jobs

- MoneyPlant AI: Founding Engineer (Pune, India)

- Zedge: Mid/Senior UX Designer (Vilnius, Lithuania)

- FunPlus: Lead Game Designer (Barcelona, Spain)

- FunPlus: Senior Game Artist (Barcelona, Spain)

- FunPlus: Senior Game Developer-- Unity (Barcelona, Spain)