Hi everyone — welcome to another issue of Naavik Digest. If you missed our last one, be sure to check out our breakdown of last week’s flood of Activision Blizzard news, including its most recent earnings announcement and some major changes to Overwatch esports.

In this issue, we’re diving into the future of Xbox Game Pass and trying to answer the crucial question of whether subscription gaming, as Microsoft envisions it, will be a net benefit for the industry.

Inside Gardens: From Journey, Sky & Edith Finch to a New Collaborative Game

Chris Bell and Stephen Bell have been involved in several defining games like Journey, Sky: Children of the Light, What Remains of Edith Finch, and Blaseball. However, their new project is tackling a whole new level of ambition. In this episode, Naavik co-founder Aaron Bush joins the Bell brothers to discuss their new company Gardens, its unique game in development, and how this project both builds on insights from previous projects and comes with fresh challenges. They also dig into life as first-time founders, goals for their company’s culture, and how they managed Gardens’ recent $31.3 million Series A.

As always, you can find the Naavik Gaming Podcast on YouTube, Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

Is the Industry Ready for the Next Phase of Xbox Game Pass?

By Nick Statt, Naavik Managing Editor

After more than 18 months of regulatory scrutiny and court battles, Microsoft is finally in the home stretch of closing its Activision Blizzard acquisition, pending some final legal skirmishes with regulators in the U.S. and the U.K. That means in as soon as a few short months, we could begin to see the benefits of the merger bearing fruit in the one place they’re arguably needed most: Xbox Game Pass.

Throughout its public statements on the deal and in its back-and-forth with the Federal Trade Commission, Microsoft has made clear that Game Pass is the lynchpin of the entire Xbox ecosystem and the pillar of its gaming distribution strategy going forward. With both Bethesda exclusives and ABK’s deep library of Activision and Blizzard titles at its disposal, we’re about to see a supercharged version of Game Pass that will undoubtedly have major ripple effects on how video games are funded, developed, distributed, and monetized.

While Game Pass has not quite had a Netflix-style effect on the industry to date, this new and more robust version of the subscription platform might start influencing gaming in unprecedented ways. It begs a vital question: Is a subscription-first console and PC gaming model, once fully scaled, going to be a net positive for the industry, or might it have unforeseen, potentially negative consequences?

Let’s dive into this question across three areas of interest: the console business, Call of Duty, and the gaming subscription market.

Game Pass is Microsoft’s Path Beyond the Console

Microsoft has not been quiet about its losing position in the console market. The impetus of the ABK deal, and the Bethesda acquisition before it, is Xbox needing more first-party exclusive games with which it can grow Game Pass to compete with PlayStation.

Throughout the PS4 era and now into the PS5 one, Sony has used its market leader position to vacuum up the majority of third-party console game sales and microtransaction revenue compared to Xbox, in addition to securing timed exclusives. “Every time we ship a game on PlayStation... Sony captures 30 percent of the revenue that we do on their platform and then they use that money among other revenue that they have to do things to try to reduce Xbox’s survival on the market,” Xbox chief Phil Spencer said during his testimony at the Xbox-FTC trial.

Spencer even cited a potential PlayStation exclusivity deal with Bethesda for Starfield as the instigating factor for its acquisition of Bethesda parent company ZeniMax. But he also clarified that he’s not interested in using Sony’s playbook to similarly harm PlayStation.

Instead, Microsoft's goal appears to be accelerating its ecosystem growth so that it continues to become less dependent on unit sales going forward. While Sony makes most of its money on selling first-party games and collecting commissions on third-party sales, Microsoft wants to derive most of its revenue from Game Pass subscriptions and the second-order effects of having more players in its ecosystem across console, PC, and mobile.

Microsoft has acknowledged a cannibalization effect due to Game Pass, in which players purposefully opt not to purchase Xbox games knowing they can play them on its subscription platform. But at the same time, the company says the presence of Game Pass has increased full-game sales (because players can try before they buy) and that Game Pass subscribers play more games on average and spend more within those games on microtransactions.

Microsoft says it also offsets unit sales cannibalization by compensating developers with upfront payments, additional payouts based on usage, and other incentives. Sony’s Jim Ryan claimed otherwise, saying publishers see Game Pass as “value destructive,” though it’s not clear which companies he was referring to. Activision Blizzard CEO Bobby Kotick surprisingly agreed somewhat with Ryan, saying during his testimony in the FTC trial, "I don’t agree with the idea of a multi-game subscription service as a business proposition going forwards, but we [Activision and Microsoft] can agree to disagree.”

With the introduction of Activision Blizzard games on Game Pass, we may see a major boost to these second-order effects Microsoft has credited with helping it grow Xbox revenue since it introduced the subscription platform in 2017. While Microsoft has not disclosed Game Pass revenue, estimates put the service at between $1.2 and $1.8 billion annually and Spencer has said the service is profitable. Games like Diablo IV and upcoming Call of Duty titles, after the expiration of Activision and Sony’s publishing deal, may substantially boost Game Pass adoption — and Xbox revenues as a result.

We don’t yet know what effect this may have on PlayStation’s business, or if Sony will feel the need to compete by beefing up its own PlayStation Plus subscription, acquiring more studios, or making more aggressive plays on PC. But at least in the console gaming market, a more robust Game Pass and healthier competition between Microsoft and Sony would suggest a net positive for the segment, which has been declining for some time now. At a minimum, it will offer a better value to subscribers in the short term by adding significant value to the library with only incremental increases in the cost of the plan that Microsoft implemented this month.

Call of Duty Remains a Major Question Mark

Despite how much attention the Call of Duty franchise attracted throughout the ABK deal deliberations, we have very little concrete information as to how the merger might affect the property going forward. As it stands, the existing publishing deal between Sony and Activision means almost every element of Call of Duty will remain largely the same through the end of 2024. After that, however, the situation gets murkier.

Microsoft made a repeated pledge that it wouldn’t make Call of Duty exclusive to Xbox, and then it at last secured a last-minute deal with Sony earlier this month to keep the franchise on PlayStation over the next 10 years. So we know for certain now that Call of Duty will remain multiplatform, which is undeniably the best move for the overall game industry today. Cutting out PlayStation players to juice Game Pass subscriptions and Xbox hardware sales would only ever have hurt Microsoft, and the company said as much in its regulatory findings and public statements.

But Microsoft’s deal with Sony doesn’t appear to involve any restrictions on how the Xbox platform treats Call of Duty. That means Microsoft may, and likely will, put future installments after 2024 onto Game Pass while also preventing them from being made available on PlayStation Plus. One of Sony’s major concerns that the FTC echoed at trial was that having Call of Duty on Game Pass would emulate a foreclosing effect. So even if Call of Duty was still playable on the PS5, it may as well be exclusive to Xbox if players are able to play it with just a $10 Game Pass subscription. The judge ultimately did not buy that argument.

But it’s still a point worth examining. The strength of Game Pass is not just the volume of games it provides for a low monthly cost, but also the access to otherwise full-priced, first-party titles that in a pre-Game Pass world you would have had to pay $60 to $70 for. If given the choice between buying Call of Duty on PlayStation or Xbox, a player who owns both consoles would undoubtedly choose the Xbox version. But the percentage of consumers who own both consoles in the U.S. among the entire console-owning population is about one in five, according to analyst firm Circana (formerly NPD Group). It seems far-fetched to think that any consumer will buy an Xbox just for a Game Pass access to Call of Duty, pending any other incentives Microsoft starts to bundle with the product.

It’s also important to note that Call of Duty remains one of the last pay-to-play multiplayer games in the industry relative to its size, considering many of its biggest competitors (and even its own Warzone spinoff) are now all free-to-play. Game Pass and F2P don’t mix well outside some isolated experiments like Valorant because of the fundamental business models, but Call of Duty might, in fact, present the perfect Game Pass multiplayer addition due to its annual frequency and its status as the best-selling console game virtually every year for the last two decades, with the exception of years in which Rockstar releases a new game.

It’s clear why Sony sees this as an existential crisis. The company even admitted that it funds its first-party gaming efforts in part using the massive revenues it draws from just being the primary destination people purchase Call of Duty games every year. If there is a substantial switching effect to Xbox’s version of Call of Duty because of Game Pass access, that could in turn result in financial hardships for PlayStation. But it’s unlikely we’ll see this type of consumer switch for quite some time, and Microsoft has gone on the record promising feature parity and other concessions to appease regulators.

Needless to say, Sony will need to respond in some fashion, and in fact it already appears to be doing so with its major live service push designed to help it build a Fortnite or Call of Duty of its own. But Microsoft will also need to tread carefully if it doesn’t want its approach to the ABK deal to be seen in hindsight as a move explicitly to harm PlayStation players. That could seriously hamper future deal plans and would also spoil any consumer goodwill it has maintained through its defense of the deal and its willingness to play nice with Sony in the short term.

Subscription Gaming is Small — But It’s Just Getting Started

While Game Pass generates a tremendous amount of discussion about the future of the industry, the overall subscription gaming market remains relatively tiny — and it’s not really growing all that much. Circana reported last month that subscription gaming revenues in the U.S. grew just 2% year over year. “Finding new subscribers beyond the console ownership base has proven very difficult thus far,” wrote analyst Mat Piscatella.

We know from Sony’s latest earnings report that about 17% (about 8 million people) of its total PlayStation user base subscribe to its Premium tier, while just 13% (about 6 million people) pay for PS Plus Extra. Microsoft’s last reported stat for Game Pass was 25 million subscribers way back in January 2022, which suggests the service hasn’t grown that much at all since or the company might be more eager to share an updated figure. Last year, research firm Ampere Analysis reported that subscriptions represented just 4% of overall North American and Europe video game spending, for a total of about $3.7 billion. Spencer has also disclosed that he doesn’t see Game Pass expanding past roughly 10-15% of overall Xbox revenue.

Subscriptions are clearly a promising growth area, and Microsoft does enjoy a majority of the current game subscription market thanks to Game Pass. But it’s now becoming obvious that a Netflix-style transformation for the industry is not happening any time soon, if ever. Instead, we should expect modest growth, though adding Activision Blizzard’s library to the catalog combined with the release of this year’s Starfield should provide a boon Game Pass has so desperately needed over the last 18 months.

The real question going forward will be what are the ripple effects of Game Pass once it scales to two or three times its current subscriber base. As more games are added and an increase in subscribers follows, we may see a rapid flywheel effect that results in more developers finding the Game Pass audience (and what Microsoft has to offer in upfront payment and other incentives) more attractive. That, in turn, will draw in more subscribers, much in the same way streaming video services led by Netflix exploded in growth over the last decade.

This will create a massive consumer benefit, as the value of Game Pass will undoubtedly grow as its library expands. This may result in Microsoft further raising prices to match demand and continue to afford increasing content acquisition costs, as was inevitably the case of streaming video. This is all the expected course of subscription gaming taking on a larger role in the industry. But it does raise serious questions about how the model might cap the financial upside of bigger-budget projects, which may ultimately influence what kinds of games get made and the monetization choices that drive game design.

It’s certainly true that games like Starfield would sell more copies as a third-party, cross-platform release than it will this fall when it arrives on Game Pass for PC and Xbox only. The same is true for future Diablo releases and the eventual Elder Scrolls VI. For first-party games, it makes sense for Microsoft to continue sacrificing unit sales in exchange for the benefit of Game Pass and overall ecosystem growth as it sees fit.

But we could see a scenario in the future where releasing third-party games onto Game Pass allows Microsoft to capture more of the benefit than developers ever could by forgoing cross-platform releases or a more platform-agnostic business model like free-to-play live service. That is, unless Microsoft can somehow compensate studios at a rate commensurate with the value it's extracting out of its subscription business. Even then, it will require developers to think hard about the type of business model they’ll want to employ and whether the subscription model even makes sense.

For now, it’s likely subscription models like Game Pass will provide a strong net benefit to both game makers and consumers as they continue to scale up for the foreseeable future. But just as we’ve seen the deteriorative effects of certain subscription models expose unsustainability in Hollywood, we may farther down the line begin to experience a similar crunch in the game industry. Ballooning budgets combined with even thinner margins will almost certainly affect the kind of games that get made, and such conditions won’t be conducive to taking risks or fostering innovation.

We won’t get any easy answers about what Game Pass will look like in five or 10 years, or if the Netflix moment for gaming is truly around the corner or still perhaps decades away. But right now, it feels like Microsoft’s stated ambition of growing its audience beyond the ceiling of the console industry and into new territories using mobile, cloud, and Game Pass is not the doomsday that Sony and subscription naysayers would like us to believe. That doesn’t mean the risks aren’t there. But as it stands, the benefits are too great to ignore.

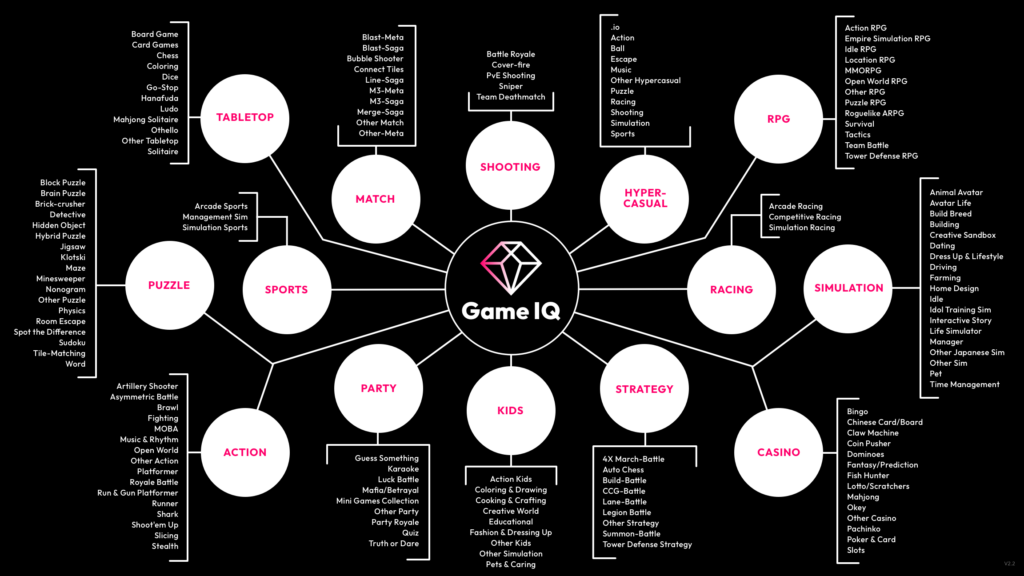

Sponsored by Data.ai: GameIQ Solves the Industry's Toughest Challenges

Game IQ is a market and competitive intelligence tool for mobile gaming that allows publishers to identify hidden growth opportunities, tie features to performance KPIs, and help you make difficult roadmap decisions. With hundreds of thousands of gaming apps in the app stores and thousands of new mobile games released each month, data.ai (formerly App Annie) is looking at a huge number of games to be classified.

On top of this, the high granularity of our taxonomy structure makes it quite time-consuming to manually figure out into which category each game should fit. How can we cover the vast majority of gaming apps in global markets accurately, efficiently, and in a scalable manner?

Game publishers and strategists today are facing various key challenges:

- Determining what features will provide lift

- Making roadmap decisions based on accurately modeled expected outcomes

- Discovering how competitors lifted performance through feature releases

- Benchmarking performance against competitors

- Confidently focusing on the highest potential genre for a new game release

With the enhancements we’ve made to data.ai Game IQ including Feature Tagging, Genre Summary, and Tag Trends, you can now effectively solve these challenges.

Content Worth Consuming

The neverending game: How AI will create a new category of games (Jonathan Lai / a16z): “The early discourse on the Generative AI Revolution in Games has largely focused on how AI tools can make game creators more efficient — enabling games to be built faster and at greater scale than before. While true, we believe the largest opportunity long-term is in leveraging AI to change not just how we create games, but the nature of the games themselves. We’re excited about the opportunity for generative AI to help create new AI-first game categories and dramatically expand existing genres. AI has long played a role in enabling new forms of gameplay — from Rogue’s procedurally generated dungeons (1980) to Half-Life’s finite-state machines (1998) to Left 4 Dead’s AI game director (2008). Recent advances in deep learning enabling computers to generate new content based on user prompts and large data sets have further changed the game.”

How 25 years of Yu-Gi-Oh prepared Konami for live service games (Jeffrey Rousseau / Gamesindustry.biz): “Shortly after Yu-Gi-Oh became a serial anime inspired by the late Kazuki Takahashi's manga, it spurred on an official card game and video game franchise. With each iteration of the animated series, the card game has seen new cards, and the video games have continued in their own way. Now 25 years later, Konami's digital card game is one of its most popular series. GamesIndustry.biz sat down with senior Konami developers behind the Yu-Gi-Oh games to discuss their commercial success over the years.”

World of Warcraft fans fool AI site into writing about a fake feature (Cass Marshall / Polygon):“It doesn’t take a keen expert to realize that Glorbo isn’t real, as a new feature or otherwise. It’s a silly-sounding word, padded with enough made-up copy like ‘I feel like Dragonflight has been win after win so far, like when they brought back Chen Stormstout as the end boss of the new Karazhan? Absolutely amazing!’ to hopefully fool an AI. Sure enough, the ploy worked: An outlet called The Portal, which is published by the esports platform Z League, went for it. The Portal has since taken down its Glorbo write-up, but an archived version exists, and community site Wowhead wrote about the topic as well.”

Chella Ramanan, narrative designer (Simon Parkin / My Perfect Console): “My guest today is a writer and narrative designer for independent and blockbuster video games. Born in London she studied English Literature at Kingston University, then completed her postgrad in journalism. She worked as a freelance writer, contributing to the Guardian and the BBC, often covering games and the lack of representation of people of colour within the industry. In 2014 she took a course titled Writing For Games, which resulted in Before I Forget, an affecting indie game in which you play as a dementia sufferer. In 2020 she joined Massive Entertainment, the Swedish developer of The Division series, to work as a senior narrative designer on Avatar: Frontiers of Pandora, an open world action-adventure game based on the James Cameron-directed Avatar films.”

Featured Jobs

- Immutable: Business Development Manager (Remote)

- LILA Games: Backend Developer (Bangalore, India)

- Nexus: Head of Sales (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.