Hi Everyone. As earning’s season draws near, we wanted to reach out and give our community the chance to contribute”. Do you have a specific company you’d like us to cover? Hit reply and let us know and we’ll write about it in an upcoming issue!

Roundtable: STEPN — Move-To-Earn or Ponzinomics?

In this Metacast episode, Matt Dion, Abhimanyu Kumar and Nicolas Vereecke, join host Maria Gillies to discuss:

-

Ubisoft Attracts Buyout Interest

-

Meta’s Struggle to Recover Market Value

-

Playable Worlds’ Recent Raise

-

STEPN: Move-to-Earn or Ponzinomics?

You can find us on Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts.

#1: Microsoft Reports Q3’22 Earnings

Source: Microsoft

Microsoft’s Earnings

Microsoft has been one of the key players in the gaming industry for a long time now, yet over the last few years, the company has significantly expanded its gaming division, including two recent record-breaking M&A deals: the $7.5B purchase of Zenimax and $68.7B acquisition of Activision Blizzard.

It’s worth examining Microsoft’s earnings report this week and then putting them in context of these acquisitions.

-

The release of Xbox Series X/S (Xbox hardware revenue increased 232% compared to Q3’20 FY)

-

Expansion of Game Pass portfolio (+34%) increased Microsoft Gaming’s Revenue from $2.3B in Q3’20 FY (Q1’20 CY) to $3.5B in Q3’21.

-

In Q3’22 the Revenue growth continued, reaching $3.7B. This dynamic is driven by the acquisition of ZeniMax, strong console sales performance (+14% YoY growth), and growth of Revenue generated by Xbox content and services, including Game Pass subscriptions (+4% YoY growth, which was below expectations).

-

Microsoft projects “gaming revenue in the June quarter will decline ‘mid to high single digits’ amid continued tough console supply conditions and lower numbers of gaming hours coming out of pandemic (though still higher numbers of hours than before pandemic).”

Xbox quarterly revenue | Source: Derek Strickland

But no matter how large the Microsoft Gaming division is, it is still relatively small, compared to the overall business of the company: gaming revenue accounted for only 7.6% of all Microsoft Revenue in Q3’22. Evidently, the Zenimax deal has helped Microsoft Gaming to boost its revenue — since the acquisition, Zenimax not only brought seven studios with a massive library of publicly and critically acclaimed titles, but also made several successful releases, including TES V: Skyrim Anniversary Edition and Deathloop (released on Microsoft Windows and as a temporary exclusive for the PlayStation 5). However, after the Xbox Series X/S launch, the overall growth of the gaming division was slow (though stable).

One of the more possible reasons for this is the lack of GaaS projects, with higher LTV and more predictable cash flows. Some of the largest recent releases of Microsoft are Forza Horizon 5, Psychonauts 2, and Halo Infinite. Forza showed the best start in Xbox’s history, but it is still mostly a single-player racing game with multiplayer elements, while Psychonauts 2 (which also showed decent sales) is a purely single-player game. As for Halo Infinite, the series has been long known for its multiplayer, but the latest game started losing an audience shortly after the release, due to the lack of content. Now 343 Industries is currently working on bringing new content to its multiplayer mode. Those are highly profitable and successful titles, but their potential revenue will still be far off from the numbers of such ever-green GaaS projects like GTA, FIFA, or Fortnite.

But then again, if you’re looking at their strategy of locking people into their ecosystem vs. profitability, there’s no need for Microsoft to prioritize this over growth.

Microsoft & Activision Blizzard

In Jan’22, Microsoft announced the largest acquisition in gaming history, buying Activision Blizzard at a 45% premium to its market capitalization. Activision Blizzard stockholders have already approved the transaction, but there are still risks that the deal will be blocked by antitrust enforcers. For Microsoft, this acquisition adds not only a list of AAA games like Call of Duty; World of Warcraft; Overwatch, and Diablo, to its Game Pass (which has been reported to have reached 25 million subscribers, of which 10M subscribe to the higher tier), but also helps to diversify the company’s revenue streams.

With ATVI’s decreasing but still massive number of 372 million MAU in Q1’22 (vs. 435 million in Q1’21), Microsoft’s gaming financials will be less tied to its AAA releases, while also helping them enter the mobile gaming market (Candy Crush Saga, Crash Bandicoot: On the Run). The rapid Game Pass expansion pursues the same goal, guaranteeing a stable cash flow from the subscription model and ecosystem lock-in.

Though the ATVI deal solves some of the Microsoft’s problems (at least on paper), the former has been experiencing certain difficulties itself. From the financial perspective, in Q1’22 Revenue decreased to $1.77B vs. $2.75B, Net Income fell to $395M vs. $619M in Q1’21. Furthermore, ATVI also shows a negative trend in keeping user retention on a stable level: in Q1’22 Activision saw a decrease to 100M MAU vs. 150M MAU in Q1’21; Blizzard showed 22 million vs. 27 million, and King saw 250M MAU vs. 258M.

This is at least partially caused by both the relatively poor performance of the major releases, and the lack of new ones: Call of Duty: Vanguard sold worse than the previous game in the series; a new WoW Dragonflight expansion will be released this fall, while the previous one received negative reviews from gamers, and saw a continuous decrease of the audience; Overwatch 2 and Diablo IV were both postponed. King was the only division showing financial growth despite the slight audience decline. And don't forget, the company also faced public accusations of sexual harassment and discrimination among its employees, which also resulted in a serious stock decline.

Despite the financial stumble of the company, Activision Blizzard will soon release a bunch of long-awaited games, with the potential to offset the negative trendline: Diablo Immortal, DIablo IV, Overwatch 2; Call of Duty: Modern Warfare 2; and the new mobile game in the Warcraft universe. This may result in Microsoft buying ATVI on the low, and closing the deal right when the company starts to grow again.

In my opinion, the Activision Blizzard acquisition will clearly change the balance on the market, as well as the Microsoft Gaming public and market image. But it doesn’t mean that Microsoft is will stop; rather, they may continue to ride this M&A momentum. Moreover, the company may change its focus, and gain momentum on the middle-size deals and venture activity. After all, Microsoft has more than enough resources at hand, and the success of the Microsoft Gaming division may prove that the gaming industry is worth investing in further. (Written by Anton Gorodetsky)

#2: Cookie Run: Kingdom’s Bountiful Appeal

Source: CookieRun

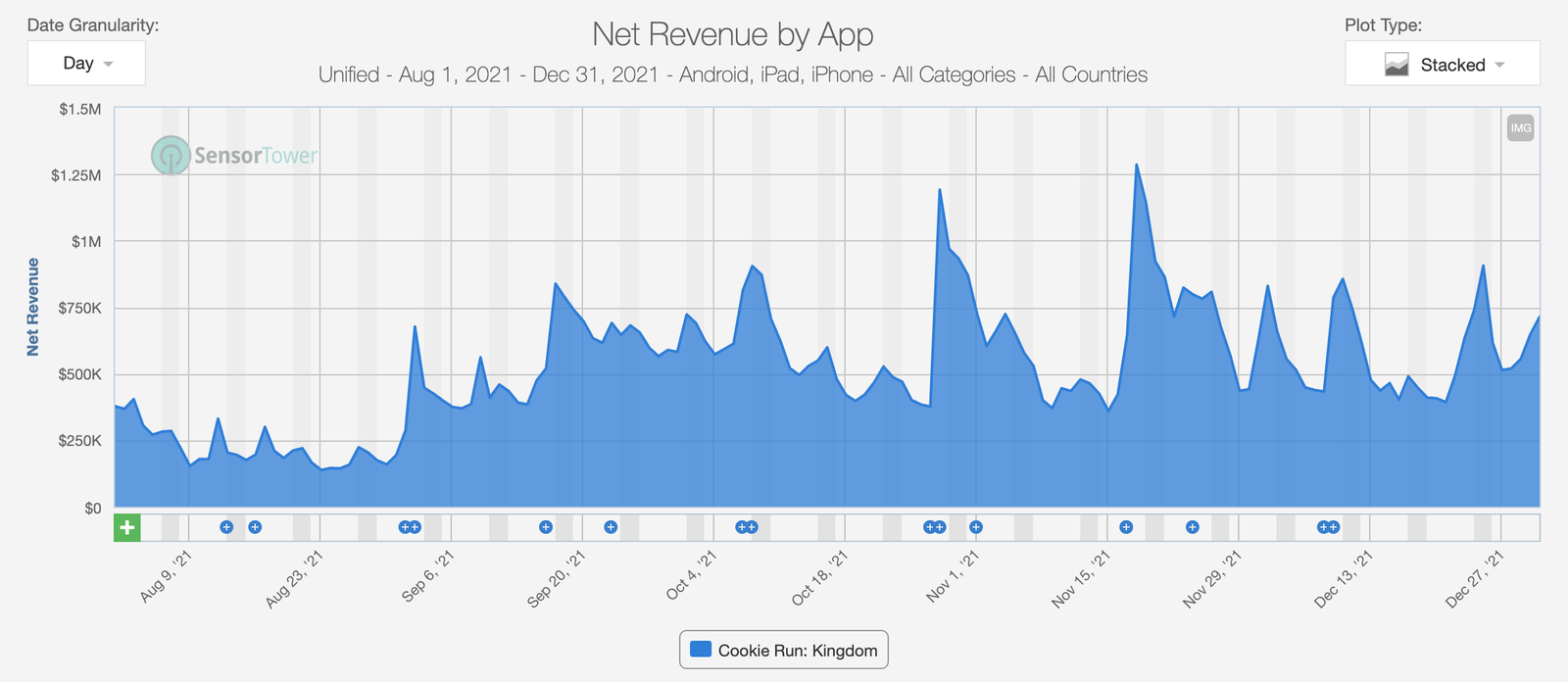

Last September, something started rumbling and tumbling in South Korea. Devsisters’ YouTube channel had been teasing it for weeks. Cookie Run: Kingdom — the first auto-battler featuring the well-known casual game IP — had its most important update as of yet to be released soon! None of it was a lie. The game more than tripled its run rate in the months that followed.

Source: Sensor Tower

Since March 2021, the game had been enjoying big success in South Korea, the birthplace of the Cookie Run franchise. Although it had been downloadable worldwide since then, the game only gained popularity in Japan and the US half a year later.

Several auto-battlers have been released over the years, but none of them have a case as special as Cookie Run: Kingdom. The Cookie Run IP saw the light in 2009, and while other successful games in the genre, like Disney Heroes: Battle Mode, have much stronger IPs, they’re not as profitable as Cookie Run. Some stats:

-

In the last quarter of 2021, the game had the No. 1 top-grossing spot in the "Turn-Based RPG" category, leaving heavy-hitters like Dragon Ball Z Dokkan Battle, Marvel Strike Force and RAID: Shadow Legends behind.

-

Last year, Cookie Run: Kingdom ranked second in terms of downloads in the "Team Battle" category. Only Hero Wars was downloaded more.

With over $220M in lifetime revenue to date, it is currently one of the biggest in its category. (Written by Niek Tuerlings)

🎮 In Other News…

💸 Funding & Acquisitions:

-

Earnings this week: Meta | Microsoft | Activision

-

China’s Gaming Engine Coco Raised $50M, expands beyond gaming. Link

-

Venly, a crypto wallet with deeper games integrations, raised $23M. Link

-

Ola GG, a YGG subDAO for hispanic gamers, announced an $8M round from BITKRAFT and Galaxy. Link

-

GamerGains raised a $5.8M seed round to enable crypto earning on any game. Link

-

Playmint raised $4M for it web3 MMOs (Congrats to our Naavik colleague, David, on the raise!). Link

📊 Business:

-

Lilith Games launched a publishing brands called Farlight Games to focus more on global localization. Link

-

Mattel, which recently launched an experience in Roblox, is in talks for a potential sale. Link

-

Netflix plans to have 50 games by EOY 2022. Link

🕹️ Culture & Games:

-

Microsoft will host an Xbox and Bethesda showcase in June. Link

-

A cute story on Halo, relationships, and video games. Link

-

How and why players play games. Link

-

Twitch is reportedly making changes to its steamer payouts. Link

👾 Miscellaneous Musings:

-

A game engine to play them all. Link

-

Unionization and inequalities in the games industry. Link

-

Problems with the gaming industry and the promise of P2E games. Link

-

Learning journey through game design. Link

🔥 Featured Jobs

-

Konvoy Ventures: Investment Analyst (Denver, CO)

-

LILA Games: Game Designer, Systems & Economy (Bangalore, India)

-

OpenBCI: AR/VR Demo Creator - Neurotech (Brooklyn, NY)

-

Immutable: Sr. BD Manager — Gaming (Remote)

-

Immutable: Business Development Manager — Web3 Gaming (Remote)

-

Solana: Gaming Engineer — Blockchain/Web 3.0 (Remote)

-

Naavik: Content Contributor — Writer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.