Hi Everyone. Welcome back to another issue. This week, our Naavik team is putting the finishing touches on our first premium blockchain games report, which we’re excited to publish as a free sample next week! Stay tuned for more details, and big thanks to all of our pilot customers who are providing early feedback.

Naavik Exclusive: Roundtable #22

In this Metacast episode, Aaron Bush and Carlos Pereira are joined by Nico to discuss:

-

Facebook going full Meta

-

The earnings reports for Sony, Microsoft, Ubisoft, and Activision Blizzard

As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

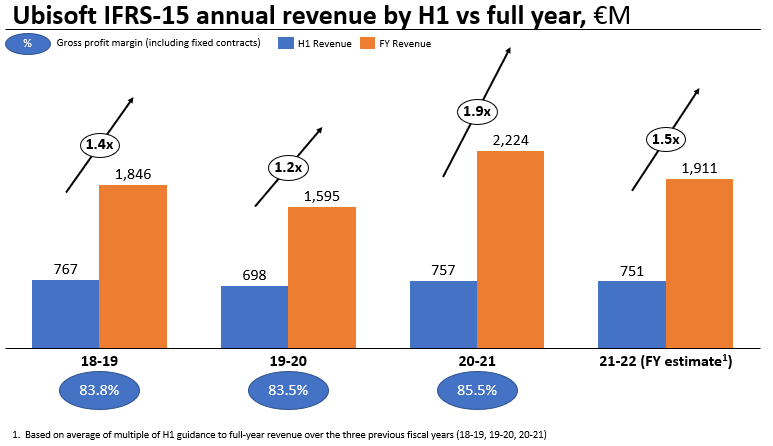

#1: Ubisoft’s Q2 Earnings & Future Crypto Investments

Ubisoft has faced a difficult couple of years. Two years ago, live ops issues — spurring from Ghost Recon: Breakpoint struggles — became apparent, which spurred meaningful reorganization. Last year, cultural issues rose to the fore, which spurred even further turmoil and reorganization that the business is still working through. And today, with the market cap cut in half from early this year and the stock trading where it was in 2017, it’s clear that difficulties and questions continue to mount. Most notably, Ubisoft continues to struggle with delays (now Ghost Recon Frontline, The Next Division 2 update, etc… on top of The Division Heartland, Skull & Bones, and many more in previous quarters), and as the company branches out into new markets (like F2P and blockchain games) many onlookers are viewing the business with skepticism. After all, if Ubisoft (despite clear wins in franchises like Assassins Creed and Far Cry) struggles to execute on its plans in its area of strength, how much should it be trusted to succeed in entirely new verticals? This is reflected in fairly weak earnings results, and delays hamper the company’s year-to-year growth. As such, expectations are low, and it’s now up to Ubisoft to prove the doubters wrong.

Source: Ubisoft

That isn’t to say Ubisoft isn’t trying, and it’s true that certain factors like COVID have been disruptive to many organizations. Over the last two years, Ubisoft has made two significant bets in an attempt to offset any growing concerns:

-

They have sought to move towards increased ownership of the player relationship across a variety of platforms. Like EA’s Origin service, Ubisoft Connect is a 3P platform that encompasses a storefront, PC launcher, and social features. Plays like this are good for retention and generating more revenue per player, but not necessarily for increasing the overall playerbase. Its scalability is limited.

-

They’ve sought to diversify their content slate away from just AAA to encompass other genres like F2P, casual, and mobile to appeal to new audiences. In this regard, execution has been lagging, certain parts of the strategy have been questionable (like M&A), and we’ve yet to see the outputs of all that is being currently developed.

This write-up could focus on the important string of delays, top franchise plans, and the company’s attempts to evolve alongside the ever-changing games industry. This is what matters most, but Master The Meta has focused on all that in the past (lastly, here).

Today, however, let’s take a peek at what’s new. In the most recent earnings call, Ubisoft CEO Yves Guillemot stated that the company wants to become one of the “key players” in blockchain gaming. As reported elsewhere, the company’s interest in the space has been long-running, and the recent investment in Animoca Brands’ $2.2B funding round feels like a natural next step in that journey. To date, Ubisoft has taken an ecosystem approach to building their presence in the space that’s worth understanding in order to analyze if the bet will pay off or not:

Building underlying tooling and infrastructure. This includes both developer tooling (e.g., Crucible’s Emergence SDK to connect applications to web3) and underlying infrastructure (e.g., Aleph.im’s decentralized cloud computing solutions for dApps). Over the long term, these investments could give Ubisoft a headstart in building out the internal studios and technical knowledge necessary for a blockchain content pipeline.

Market intelligence. While games like Star Atlas are already pushing the boundaries play-to-earn, most gamers will likely be onboarded to crypto through NFT drops in franchises and gameplay models they’re already comfortable with. The company’s investment in Nonfungible, a data platform on NFT price action, helps provide guidance on what content might monetize most effectively. In the future, it’s not difficult to imagine an internal Ubisoft studio looking at NFT price data to help plan out their content roadmap post-launch or even inform initial game pitches.

Content creation: Blockchain games will still require plenty of experimentation to determine what core loops and game design decisions resonate with players. For a publisher the size of Ubisoft, it’s much more effective to “outsource” this trial-and-error learning process to external studios like Horizon and Animoca. Ubisoft likely views these investments as OTM call options: at worst, a source of valuable knowledge in what doesn’t work with the upside of potentially insourcing successful blockchain studios.

I’d be surprised to see a true Ubisoft crypto title within the next 2-4 years: organizations of that scale simply don’t move fast enough, and it would be much less risky to integrate the technology into an existing IP like Assassin’s Creed or Far Cry. However, the company is quietly testing the waters from a number of different angles that if executed correctly, could very well result in a first mover advantage compared to some of its older, more legacy-focused competitors. There are still more questions than answers, and it’s important to remember that this is just on piece of Ubisoft’s broader game plan, but it’ll be interesting to to watch how it unfolds in the coming months and years. (Written by Naman Gupta, Senior Analyst at 2K Games)

Sponsored by Growth Fullstack

Turn your data into powerful insights - Free Trial!

“Game developers need help to make sense of the post-IDFA world of mobile marketing." - Hernan Zhou, CTO, Lucky Kat Studios

Growth FullStack does just this - helping developers and mobile marketers navigate the privacy-first marketing landscape - without expensive data science.

-

Simply collect the data that you need (from sources such as SKAdNetwork, AppLovin, and many others);

-

Store it in the way you want (using platforms like Google BigQuery, Amazon S3 and others);

-

Gain insights via an intuitive dashboard built on top of the data (such as Metabase, Tableau and others);

And optimize your campaigns activity using off-the-shelf or custom analyses.

Growth FullStack offers affordable insights via a no-code, plug-and-play model that lets you get back to making great games and apps.

#2: Goodgame Studios Becomes a 3rd Party Publisher - Will it Work?

Source: Tilting Point

Editor’s note: Goodgame Studios is a client of Naavik's, and this blurb doesn’t reflect the views of the company.

Free-to-play (F2P) veteran Goodgame Studios (GGS) announced a third-party publishing initiative, as well as the release of their first game under the new model, War Alliance. The timing is slightly surprising, as third-party publishing for F2P in Western markets has mostly gone out of fashion, except for "hypercasual". Many major companies that tried it have dropped their third-party efforts, while others that previously focused on third-party publishing, like Scopely, have since moved to a first-party model.

Usually, a business model going out of fashion indicates one of two things - either the model is fundamentally flawed, or there is a better model. This article explores why it's so challenging to leverage third-party publishing, how GGS' announcement measures up, and what they should consider to maximize success through this effort.

Challenges in Leveraging 3rd-Party Publisher Resources

On paper, adding a publisher's expertise and budget should theoretically improve a developers' chance for success. Sometimes it works; however, the additional resource can often turn out to be ineffective and, at worst, actively harmful. Let's explore three pitfalls:

1. Publisher expertise doesn't easily transfer between genres: Monetization and engagement practices that work in one type of game don't necessarily apply in another. And even within a genre, KPI benchmarks derived from an aging portfolio help very little to improve a new game going through a soft launch.

To truly help make a better game, the publisher-side teams need to not only have deep hard skills the developer team doesn't have, but also need to immerse themselves in the context of each individual game and team. "Best practices" need to be almost surgically inserted to be effective.

And the best publishers have built out "genre mastery" and technical hard skills, such as Data Science or UA Automation.

2. Distraction from making the actual game: Great business cases in gaming require fundamentally good games with a clear product-market-fit that are developed and live operated by good, focused game teams. User acquisition expertise or other 3rd party publishing activities usually don’t turn a mediocre game into a great business case, but instead add to it.

Publishing expertise can be a positive modifier if it's applied to a strong game and keeps distractions for the game team to a minimum. It can be a negative modifier if the game team is pulled into months-long integration of central publishing tech or has to onboard new people in the large publishing organization again and again. Additionally, it can break an otherwise potentially reasonable business case if the publisher (out of disappointment in the game's performance) pushes the game team to focus on short-term priorities.

3. Misalignment between the companies: Making two independent companies act in unison is incredibly difficult if the larger goals are not aligned, and the alignment in a publisher-developer relationship often ends at the level of a single game or IP.

If the publisher's expectations are disappointed or they have a significant other opportunity, it might stop UA or pull out Data Science support for a game even though the developer still sees room for investment. And if a publisher re-invests every last bit of potential profit on scaling up UA after global launch, the developer could become existentially threatened by having to carry live operations team costs.

How Does Goodgames' Publishing Announcement Measure Up?

War Alliance, the first game from the new initiative, is a Clash-Royale-like PvP duel. It was originally published under the developer's accounts and has been live with low traffic scale since June 2019 on Google Play and since October 2020 on iOS. According to Sensor Tower data, the game has yet to see any significant uplift since being re-published under GGS' account in September 2021.

Based on what is visible so far, I'm not very bullish for a few reasons. First, War Alliance’s genre is far from the build-and-battle and simulation games GGS has scaled successfully so far. This makes them vulnerable to the first challenge described above, as it will take significant time for product and BI experts to get into the necessary depth of knowledge and relationship to truly add value. This is unless, of course, GGS attracts new talent with that specific skillset even faster.

Further, GGS has deep expertise in UA and publishing operations like community management and business development, which are more easily applied to different types of games. That said, it's usually the UA that brings the biggest value, and it’s a huge challenge for only UA efforts to move the needle for a company of GGS’ scale. Unrealistic and unsatisfied short-term expectations on either the publisher's or developer's side can trigger distractions and misalignment (issues #2 and #3 I touched on above). Therefore, it’s key for GGS to keep an eye on the long-term by aligning expectations at the very start and minimizing short-term distractions along the way.

Finally, GGS begins the new initiative from a defensive position. The company hasn’t launched a hit game since the end of 2017, and it’s significantly underperformed the expectations set by its new parent company, Stillfront Group, after being acquired in December 2017 for €270M. At the time of the acquisition, Stillfront expected GGS to deliver €120-130M in net revenue for 2018. According to the latest publicly available accounts, GGS achieved €90M revenue in 2018 and 2019. According to Sensor Tower data, the studio’s mobile games portfolio, which made up around half of the company's 2019 revenues, has declined in revenue since then. It also seems to have underperformed Stillfront's EBIT expectations for 2018. Therefore, it’s important for Stillfront and GGS leadership to not rush this 3rd party publishing effort in order to protect themselves from all the issues described above. It takes time to see scalable success in efforts like this, and GGS will need to ensure Stillfront is onboard with the strategy too.

All in all, there are some pretty fundamental issues that exist in the 3rd party publishing business model, especially in a F2P context. Albeit few, there are also success cases of 3rd party publishing in the market: Flaregames with Nonstop Knight, Tilting Point with their UA automation services, and even Scopely built its revenue foundation through a co-development approach before moving into first-party publishing. Therefore, it's not impossible to pull off; it's just a much harder hill to climb versus first party publishing or M&A. On the surface, it seems like GGS’ effort might suffer from all the three fundamental issues I called out, and it’s likely that War Alliance will not be a major needle-mover for the business. However, this is also GGS’ first attempt (which is usually the hardest), and the team can learn from both War Allicance and previous 3rd party publishing success cases in order to maximize its own chances of long-term success. While I may not be bullish, I’d love to be proven wrong. (Written by Justin Stolzenberg, Co-Founder at Phoenix Games)

🎮 In Other News…

💸 Funding & Acquisitions:

-

Mythical Games raised a $150M Series C. Link

-

FTX, Lightspeed, Solana Ventures to Invest $100M in Web 3 Gaming. Link

-

The Sandbox raised $93M to expand its virtual gaming world. Link

-

Faraway raised $21M from Lightspeed Venture Partners & FTX. Link

-

Roblox developer Splash raised a $20M Series A. Link

-

Upland raised $18M for a virtual NFT real estate game. Link

-

Core Loop raised $12M to develop a sandbox MMO using blockchain technology. Link

-

OCP raised $4.3M to build a game creation platform. Link

-

Medal.tv acquired Fuze.tv and GIF Your Game. Link

📊 Business:

-

Multiple companies released their earnings reports this week: Nintendo | Activision Blizzard | EA | Square Enix

-

Devolver Digital raised $261M during an IPO on the LSE (and then acquired three studios). Link

-

Twitch Co-Founder Kevin Lin is launching a new game studio. Link

-

An outlook at the gaming & media ecosystem in 2022. Link

-

Temple Run is growing it’s brand presence. Link

-

Katana, Ronin’s decentralized exchange (built by Sky Mavis, the studio behind Axie Infinity) is now live (and launching a token). Link

-

AT&T is the first company to white-label Google Stadia. Link

🕹️ Culture & Games:

-

Major Riot Games titles are now available on the Epic Games Store. Link

-

Netflix released more details on their global gaming line-up. Link

-

Elden Ring released a gameplay preview. Link

-

How video games inspired a generation of music composers. Link

-

Honor of Kings is getting a new game. Link

👾 Miscellaneous Musings:

-

Power To The Players. Link

-

Baseless NFT hype hits a crescendo - but play-to-earn is worth watching. Link

-

‘I Could Never Abandon Them’: NeoPets Users Play On. Link

🔥 Featured Jobs

-

Virtex: Partnerships Director (Remote, Global)

-

BebopBee: Community + Player Experience Manager (Menlo Park, CA)

-

Immutable: BD Exec, Gaming (Remote, US/EU)

-

Ubisoft: Junior Technical Artist (Bucharest, Romania)

-

Hypixel: Senior Game Designer (Remote, Global)

-

Piepacker: Tech Director (Remote, EU)

-

Playco: Financial Planning & Analysis Consultant (Remote, US)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.