Hi Everyone. Welcome to another issue of Naavik Digest! If you missed our last one, be sure to check out our exploration of esports betting and the benefits and risks it presents to competitive gaming. In this edition, we look at the the future of Ubisoft as the French publisher tries to diversify its gaming portfolio and explore new business models.

We would also like to remind fans of the Naavik Gaming Podcast to submit to our new mailbag. We’re inviting listeners to send in any feedback or questions to help inform our future coverage and also give us the opportunity to spotlight community insights. Are there topics you’d like us to discuss or learnings you’re keen on sharing? Do you have feedback on a past episode or just want to drop us a line? Please email us at [email protected].

Five Reflections Since Co-Founding Naavik

Today’s episode is a bit different. One of our interviews fell through, but instead of skipping an episode Naavik’s co-founder and podcast host, Aaron Bush, decided to pick up the mic and roll solo. Aaron discusses five reflections since founding Naavik — about leadership, learning from other industries, what makes the games industry special, and where we are going next. We also want to learn about what your major reflections have been since joining the games industry, no matter what your tenure is.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

Ubisoft’s Diversification Problem

Written by InvestGame

When you think of Ubisoft, it’s easy to gravitate toward the French multinational publisher’s storied, three-decade history building some of gaming’s most memorable franchises, from Assassin’s Creed and Rainbow Six to Far Cry and Prince of Persia.

However, the company has been going through a turbulent period for quite some time, with a lack of successful new releases while many of its most successful IPs lay dormant. The problem can be best summed up by looking at the crucial differences between Ubisoft and its most comparable competitors, publishers like Electronic Arts, Square Enix, and Take-Two Interactive.

While those companies have all diversified their revenue streams by exploring new gaming business models, Ubisoft has struggled to adapt to the world of free-to-play, live service, and mobile gaming. The company’s portfolio is known for its immersive and engaging game worlds and rich narratives, but the past few years have been riddled with failed attempts to capitalize on fast-moving trends and a failure to execute where it’s been needed most.

To review, since 2020: Ubisoft has cancelled seven unannounced projects, delayed its pirate game Skull & Bones numerous times, shuttered its battle royale Hyperscape, pressed pause on new Assassin’s Creed releases to reboot the entire franchise from the ground up, and engaged in aggressive cost-cutting by laying off hundreds and shuttering offices worldwide.

Is it possible for Ubisoft to bounce back? A lot is riding on the company’s ability to diversify its game lineup and also successfully venture into new markets. Let’s review where these efforts stand today and what Ubisoft is doing to try and right the ship.

Assassin’s Creed Ambitions

Far and away Ubisoft’s most promising initiative is its Assassin’s Creed reboot. After pressing pause on the series’ grueling annual release cycle following Assassin's Creed Odyssey, the company decided to let the franchise breathe while it developed a more robust lineup for the next five years.

The results so far are promising. Ubisoft now has six Assassin’s Creed games in development across PC, console, VR, and mobile platforms in addition to its Infinity project, which is billed as a kind of live service hub and multiplayer platform that will house old and new franchise releases. On Tuesday, Ubisoft said it would invest even more resources into the franchise by hiring roughly 800 more developers to the already 2,000-person team working on these new titles. If you look at Ubisoft’s most recent financials, it makes sense. “Assassin’s Creed Valhalla now has 44 percent more players life-to-date than Assassin’s Creed Origins and 19 percent more than Assassin’s Creed Odyssey on a comparable basis, with materially higher revenue per player, leading to life-to-date net bookings up respectively +82 percent and +61 percent,” the company said in an earnings release this week.

Assassin’s Creed Mirage, a return to the series’ stealth roots, is slated for release later this year and could mark the start of arguably the most ambitious release schedule the franchise has ever had. If Ubisoft is able to successfully release big-budget and narrative-focused mainline entries alongside mobile and multiplayer ones (with a live service component, one would think), Assassin’s Creed could become the centerpiece of the company’s comeback strategy.

Dormant IP

Assassin’s Creed can’t pull all the weight. And Ubisoft now has a reputation for having let some of its most successful IPs lay dormant while it diverted resources trying (and failing) to chase the battle royale trend and explore new projects. It should come as no surprise then that the company wrote off $537 million of R&D costs related to canceled games and new projects and now plans to cut about $215 million in operating budget costs by 2025.

Despite its vast portfolio, Ubisoft has struggled to shed its hit-driven approach to big-budget game development. Since 2020, the company has only released a few titles, including Mario + Rabbits Sparks of Hope (a Nintendo Switch exclusive), Watch Dogs Legion (which received mixed reviews), Immortals Fenyx Rising (a new IP), and Rainbow Six Extraction (a spin-off based on a Siege mod). All of these received mixed feedback both from critics and players, and as such their performance directly impacted the company’s financial results.

Ubisoft has made an effort of late to try and dig into its IP portfolio to try and spark new hits. It’s working on a sequel to Beyond Good and Evil, as well as licensing out development of new Splinter Cell and Prince of Persia titles. But it’s been a bumpy process so far.

Beyond Good and Evil 2 has been in production for 15 years since it was first announced in 2008, an indication the game is stuck in production hell. (It now enjoys the record for longest-ever development cycle for a game, beating Duke Nukem Forever.) The original game’s creator left in September 2020, and there is still no clear idea of when the game might materialize.

When it comes to two other major Ubisoft franchises — Splinter Cell and Prince of Persia — the studio is not even developing new titles. Rather, it has remakes in the works and is again facing trouble with development. Prince of Persia was delayed indefinitely after the premiere trailer was met with mixed sentiment, while the creative director of the Splinter Cell remake left the studio in October 2022. Once again, Ubisoft hasn’t disclosed release dates for those games.

Mobile & Live Service Shift

Ubisoft has been pursuing revenue stabilization for several years, and the most obvious way is through the implementation of GaaS monetization. Ubisoft began experimenting with the model with The Division and Rainbow Six: Siege, and later games like Tom Clancy’s Ghost Recon Wildlands. In addition to this, Ubisoft has also introduced in-game purchases in single-player games like Assassin's Creed, with plans to further expand on this approach through Assassin’s Creed Jade (for mobile), Assassin’s Creed Invictus (a multiplayer title), and whatever form Assassin’s Creed Infinity ultimately takes.

Beyond GaaS, Ubisoft is also exploring various business models. For instance, Just Dance and Trackmania have adopted the free-to-play model instead of annual releases. The company is also showing interest in subscription services, with Ubisoft+ now available on PC and Xbox, and Ubisoft+ Classic included in the PlayStation Plus premium tier of Sony’s subscription platform. Additionally, Rocksmith, a guitar-learning rhythm game, has shifted to a subscription-based model instead of relying on new releases. In its most recent earnings report, Ubisoft also said it’s seeing promising metrics for new free-to-play shooter XDefiant, with more than 1 million players.

During the last Ubisoft Forward presentation in September 2022, the company shared information about its upcoming titles and announced its expansion into the mobile market. The mobile segment is the weakest in the company’s portfolio, and as we observed during the last few years, mobile gaming is a necessity for any major publisher to keep pace with the global games business and tap new and developing markets. To that end, Ubisoft is planning tests for its mobile spinoffs Rainbow Six Mobile and The Division Resurgence and its free-to-play survival shooter The Division Heartland.

This mobile push combined with implementation of GaaS and F2P across all platforms could help to fill in the cash flow gaps between AAA releases. But Ubisoft has virtually no track record here outside its failures, most notably the shutdown of battle royale Hyper Scape last year. The upcoming Ubisoft Forward scheduled for June 2023 might give us some more details and, hopefully, some release dates to look forward to.

Financial Performance

Ubisoft's financial performance has been somewhat mixed in recent years. While the company has seen steady revenue growth, its profitability has been inconsistent due to high development and marketing costs. Additionally, the company has faced criticism for its reliance on hit-driven titles as well as a lack of diversity in its portfolio. Ubisoft, of course, has taken steps to address these issues by expanding into new markets such as mobile gaming as well as investing in new IP development.

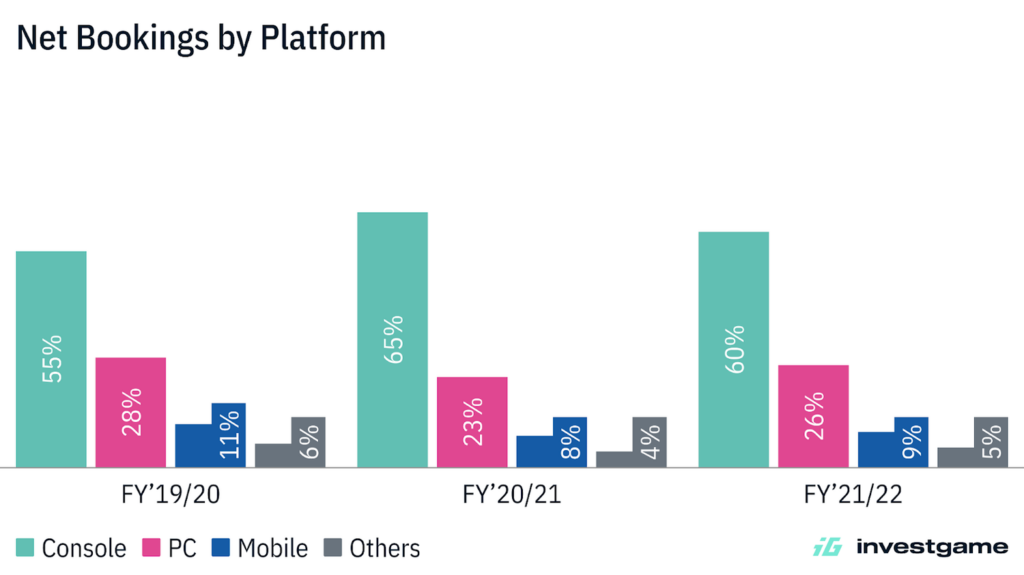

Ubisoft is continuing to struggle with the scale of the mobile gaming segment, as the overall share from net bookings is almost the same as the year prior. However, thanks to its planned releases, the situation could change. Furthermore, after the release of both PS5 and Xbox Series consoles, the overall console share sales increased by 10% to an overall share of 65% in FY2020-21. However, due to the lack of strong releases in FY2022-23, the console share decreased back to 60%.

For the last four consecutive years, the back catalog represented more than 50% of all net bookings, and the key drivers of net bookings growth were AAA game releases: Assassins Creed Valhalla in November 2020 (20 million gamers have played it up to date); and Far Cry 6 in October 2021. In FY2022-23, due to the lack of new releases and increased costs of game development, based on the Q3 FY2022-23 report, the company is expecting to have a decline of 10% in net bookings and an overall non-IFRS operating loss in the amount of €500 million.

In addition, it seems that the company has issues with the performance of its newly released games, as well as the current pipeline and mobile licensing deals. In the H12022-23 report, the company announced a significant net bookings growth for FY2022-23 and a non-IFRS operating income to the tune of €400 million. In January 2023, Ubisoft lowered its financial targets due to lower-than-expected financial performance of Mario + Rabbids: Sparks of Hope and Just Dance 2023, sending the stock tumbling by nearly 20%.

On Tuesday, Ubisoft announced its full-year results for Q4 and FY2023, highlighting the company’s dire financial situation as it continues its turnaround effort. Sales for the year were down 15% and net bookings down 18% with losses totaling €495 million. For the quarter, sales were down 56% compared to a year ago and net bookings were down 53%.

While Ubisoft forecast a 18% year-over-year decline in net bookings for the Q1, the company said it expects the situation to turn into “strong growth” for the full year with the launch of Assassin’s Creed Mirage, Massive Entertainment’s open world Avatar: Frontiers of Pandora, and new mobile titles all on the calendar.

Ubisoft’s Future

Ubisoft is a resilient company. Family-owned and controlled for more than three decades by the Guillemot brothers, the publisher stands as one of the last remaining major video game makers not owned (or about to be) by the industry’s even-larger titans.

Last year, the Guillemots sold just under half of their Ubisoft holdings to one of those very titans, Tencent, in an attempt to stave off future takeover attempts, according to Bloomberg. That gave the Guillemot family and the Chinese entertainment conglomerate ownership of close to 55% of the company and nearly a third of its voting rights. The deal also kept Yves Guillemot as CEO and his brothers on Ubisoft’s board of directors.

We won’t speculate on whether Ubisoft’s current ownership structure and managerial operations might shift in the future; big gaming companies discuss acquisitions frequently, and often these discussions never progress beyond their early stages. What is clear is that Ubisoft is betting the future of the company on its ability to expand its once-novel brand of narrative-driven, action-adventure games into all-new markets and retrofit its franchises with business models more fit for a cross-platform, free-to-play, and live service future.

Content Worth Consuming

Why Large Companies Can’t Make New Games (Nikita Tolokonnikov): “So, what are we doing here? Making games, right? And the crux of game-making? If we're not running a non-profit, it's about creating successful, ROI-positive games. But how do we design a game that's destined for success and fosters business growth? Peering at the market, it seems like no one has a definitive answer. Consequently, what follows this introduction is essentially philosophical musing on the creation of effective new games… And isn't crafting a new game fundamental to game-making? The mobile market of the last decade has been increasingly polarizing into two camps: those who create new games and those who operate and scale games, supporting them with live ops. Both roles are essential.” Link

The Game Industry of Finland (Neogames): “Over the past two decades, the Finnish game industry has experienced significant growth. Mobile games have been the primary driver of this growth during the last decade, although other platforms have also played a considerable role. In 2022, the Finnish game industry ranks among the top five largest national game industries in Europe by turnover and is a European leader in mobile game development. This publication aims to provide a comprehensive overview of the Finnish game industry in 2022. The data and information presented are based on interviews with 134 key game developer studios, supplemented by data from other sources.” Link

Christoph Hartmann on Amazon’s second attempt at making a LOTR MMO (Gamesindustry.biz): "It was not 100% clear if [the rights] went over to Tencent or not. Tencent and us talked. We know people there, I have a lot of respect for them, but it's probably better we don't work together because we're two large companies. I mean, that's a 10-year project. Who knows what's going to happen? It was better to stay friends… It was not like 'Do whatever you want, just stick to the books and the rest is just a great game.’ I don't want to go into details, but there were certain limitations so it would not have been straightforward." Link

The Untold Story of Brawl Stars ft. Frank Keienburg, Game Lead (a16z Games): “In one of the Friday updates, the game team was talking about how the game was only half where it needs to be to be a success in our eyes. It was a super sad moment. Everyone in the company was really down [thinking], ‘Are we going to kill another game?’ I was sad like everyone else, but I also got really angry because I had just really started engaging with the game. And I really believed in it. I said, ‘No this is a mistake, this game cannot die.’ I just had a strong conviction that it was a mistake to kill this game. So I wrote down like 15 things I would do, as someone who had never worked on a game, and I sent it to the game lead.” Link

How Nintendo Solved Zelda’s Open World Problem (GameMaker’s Toolkit): “To mark the release of The Legend of Zelda: Tears of the Kingdom, let's look back at the making of Breath of the Wild's open world.” Link

🔥Featured Jobs

- Esports Insider: Digital Marketing Manager (London, U.K. / Remote)

- MY.GAMES: Production Director (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.