Hi Everyone. Thanks for tuning in to another week of Naavik Digest. In case you missed it, we recently partnered with Delphi Digital to release the definitive guide to Web3 Games in 2023. Be sure to check it out! We also wrote a spotlight on Minecraft and compare its creator economy to other UGC games in last week’s edition, be sure to give it a read!

What Was Left Unsaid by Playtika’s Proposal and Jam City’s Exits?

What problems would Rovio’s acquisition solve for Playtika? Why did Champions Ascension spin into Plai Labs? We dive into the latest game business news with Abhimanyu Kumar, Matt Dion, and your host Maria Gillies.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: What F2O Can Learn from F2P

The blockchain games scene has started to move past the ponzimonics of 2021-2022. Blockchain games used to start with huge NFT and token sales, claiming that the players should “invest” in them. As it proved to be an unsustainable player experience and business model, experienced game developers started bringing best practices from the traditional games sector. For example, the rising trend of F2O (Free to Own) — which I believe bears a strong resemblance to F2P (Free to Play) — has pioneered new ways to acquire users and kickstart projects. Champions Ascension, a PVE game on PC developed by a very experienced F2P team on Ethereum, is one of the games that is making the shift from priced mints to free mints. The transition of free mints will fundamentally change the way blockchain games teams will market their games moving forward.

Spotlight On Champions Ascensions Paid Mint

In December of 2021, during the raging bull crypto market, Jam City announced that it had started working on a blockchain game. For many, this was an interesting and surprising move as most of the blockchain “games” were developed by crypto native teams, not by actual gaming companies. Jam City was one of the first gaming companies to announce a blockchain initiative. After this announcement, the company quickly moved to conduct its first NFT sale the following February. Consistent with the trend of most other blockchain games and collections at the time, the sale consisted of 10,000 unique Hero NFTs that the players would use once the game went live.

However, Jam City’s strength in traditional game development didn’t help with its mint when the reveal of NFT metadata got messed up. Each NFT had certain attributes tied to value/scarcity within the collection. This can be a rarity based attribute like common, uncommon, and rare or something that only makes sense within that collection like a body part.

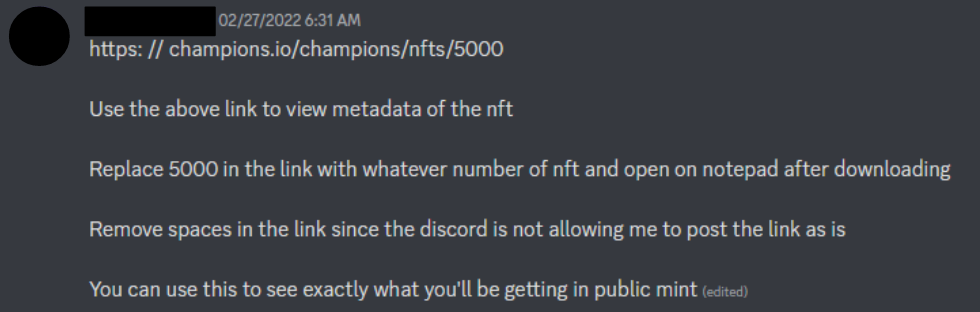

While the mint was still happening, unminted NFTs’ metadata files explaining everything about each of them were leaked and people could see the attributes. This practically meant that people could snipe NFTs, i.e; that is, they could wait until the NFT they wanted was next and mint it. Of course, it created a huge backlash within the community, who were paying almost $2,500 for a single NFT while others had disproportionate information.

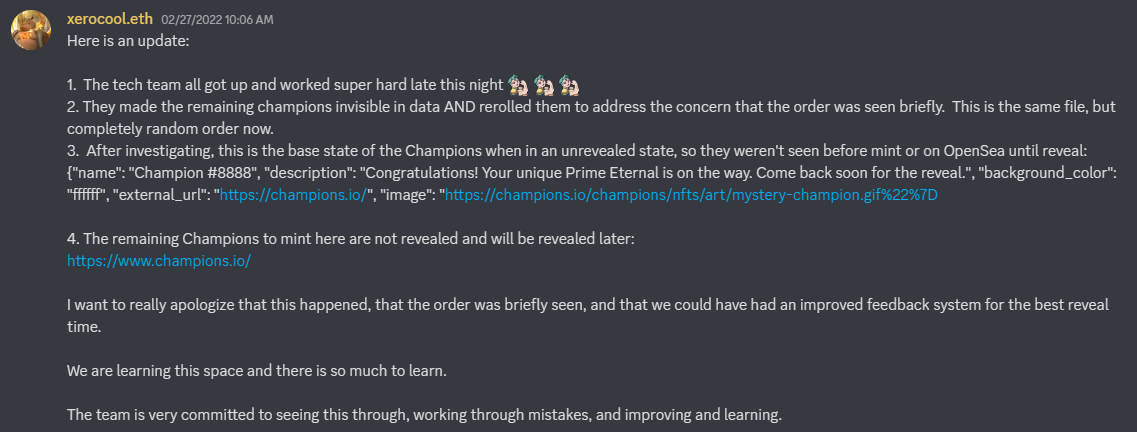

In a short amount of time, this caused people to sell their recently minted NFTs even below the price they paid. The Discord chat of Champions Ascension became the embodiment of FUD (Fear, Uncertainty, and Doubt). The metadata issue was fixed and the remaining NFTs were rerolled (shuffled) so that the previous info about each unminted NFT would be useless. These were all very well planned and executed, but even then they could only sell 7622 out of the 10,000 available NFTs at the end.

Plai Labs and Champions Ascension’s Free Mint

Fast forward 11 months to today, and now the team developing Champions Ascension has spun out of Jam City to create Plai Labs, which took the Champions Ascension IP with it and launched with a $32M seed round from a16z. With this new structure, the team announced a free mint with 10,000 NFTs and were able to sell out! It was based on a tiered system that let people mint at different times (e.g earlier times depending on tiered status).

The last tier was the “public” one which practically meant everyone was able to participate thus generating a lot of interest. Looking at the new collection, 3,941 wallets own those 10,000 NFTs and 1,547 of them are people who already owned NFTs from the previous sale. So, not only was the company able to acquire almost 2,500 new users, it was also able to generate a lot of interest thanks to their free mint.

F2O Resembles F2P But It’s Not Perfect By Any Means

Despite the renewed energy around free mints, there have been a variety of issues brought up by analysts:

- How can the team effectively reach out to existing holders to determine mint timing? If a player didn’t actively follow announcements of Discord or Twitter, they probably didn’t know there would be a free mint available.

- The Tier windows are exceptionally short and for a US audience. How can you create a sense of inclusivity when mint times were in the middle of the night for international audiences?

- Gas wars still exist. Due to high demand, gas fees skyrocketed — can you even consider this a “free” game when people mint at $350+ in gas fees?

- How do you determine the success of a free mint? This was ostensibly a free mint but it still favored existing holders plus insiders. Is that truly fair distribution?

- Are 2,500 new users enough to keep this game afloat? And how does the Plai Labs team think about bringing in new players into their ecosystem?

Considering the fact that this game started its journey with a sale that wanted its players to spend almost $2,500 for a single NFT on a pre-launch game and is willing now to give away 10,000 NFTs for free tells us something significant: the blockchain games marketing and sales strategies are evolving and they are becoming much more like F2P (the caveat here is scarce items that can potentially be sold for more on secondary).

One of the most important things that F2P games provide is having options. People are free to try any game however they like without an entry barrier. Once they are in, they can spend in exchange for the additional value that those games offer: from skins that only serve vanity purposes to in-game boosters that help players progress. Since this model has been dominant for more than a decade, it’s hard to ask players to spend thousands of dollars to play a game without being sure if it’s worth it.

With this in mind, seasoned game developers like Gabe Leydon connected the dots and saw the opportunity in free mints. Perhaps one of the highlights from blockchain gaming in 2022 was Limit Break’s DigiDaigaku and its free mint that saw a huge interest and is still one of the hottest topics in the industry. While Limit Break doesn't have a game out yet, it is using the fame and credibility of its founder in order to attract attention and have players’ trust. Of course, not every game has such a person or a team that can run a whole PR campaign single handedly. However, as free mints become more common, I’m sure the marketing strategies will continue to evolve. Game developers who realize it will likely pivot to a mix free mints just like Champions Ascension (and potentially some higher priced mints, if there’s a big enough community). In this way, those games will be able to reach a much wider audience thanks to not having an entry barrier (like a F2P game) in addition to using it as a monetization method through the commissions from the secondary sales!

It is important to note here that even though a blockchain game might adopt F2O, it still needs to have a stable game economy and secondary market that does not depend on speculation of assets. It is quite possible for a F2O game to start with a free mint and then create a bubble through increasing NFT prices while the game stays essentially the same. This being said, I do think free mints are a good first step towards having a more sustainable game economy thanks to people not investing any money upfront. The same problems we have all seen last year will resurface again if it starts and ends with free mints. Players should have incentives other than the increase of their game assets’ value.

So, it looks like blockchain games have a new challenge: figuring out what makes a free mint successful. For games that already did priced mints, it’s definitely going to be harder as they already have a certain floor price. They need to figure out a way that will do justice to their players that spent money while also giving something meaningful for their new players, too. For games that haven’t sold any NFT so far, they have the chance to adopt the Free to Play (or Free to Own as Leydon likes to call it) way right from the start. No matter which side of the story they are on, I think the second wave of blockchain games will have to borrow much more things from the traditional F2P world if they want to succeed. (Written by Ahmetcan Demirel)

#2: Xbox Underwhelms

Xbox’s earnings could’ve been better. In short, Microsoft’s/Xbox’s total gaming revenue fell 13% year-over-year and saw roughly equal negative contributions from hardware (-13%) and content/services (-12%). Unsurprisingly, 1st and 3rd party revenue both declined, with Game Pass continuing to creep higher. While record highs for Game Pass subscribers, streaming hours, and monthly active devices are nice to see, the well-rounded revenue decline isn’t awesome. The content/services part is somewhat expected as we wait for more launches to hit, but the drop in hardware is a result of both lower average prices and volumes, which isn’t great to see so early on in the console cycle. Now, all eyes are on two main factors. One, can Xbox level up its first party initiatives? Games like Redfall and Starfield — not to mention this week’s shadow release of Hi-Fi Rush — have many optimistic, but further progress is needed if Game Pass, in particular, is to rise to meet its potential. And, two, what will happen with the Activision Blizzard deal? So far regulators have been against the acquisition, but if it falls through, then what? Much time will have been wasted that could have gone into other smaller, less controversial deals that add up. The long-term vision around cross-platform subscription experiences is exciting, but much more execution is needed to get there.

Metacore acquires Supercell’s Everdale. It’s not often we see companies acquire a discontinued game, but that’s exactly what happened this week. Everdale, a casual farming simulator game, was sunsetted by Supercell late last year, as it never quite showed the level of upside Supercell was looking for. But is Everdale not performant enough for Supercell or not performant enough in general? We’ll find out soon enough. As we discussed in a previous deconstruction, Everdale took the unique approach of incentivizing a high number of check-ins instead of a high amount of time spent playing, which created interesting complications around monetization. After all, can a game that doesn’t optimize around time spent playing (and rather short check-ins) still become a major revenue hit? We’re curious to see where Metacore — the Finland-based company behind hit-game Merge Mansion — takes the game next, including just how much they’re willing to change it.

Troubles mount across the esports world. It’s long known at this point that esports companies are both highly competitive, little differentiated (usually), and typically survive on lackluster business models. Over the past couple weeks we’ve seen a handful of troubling stories. For starters, FaZe — which is best known for its large roster of creators — is facing big financial issues; after going public via a SPAC half a year ago, the stock price has fallen from a high of $24.69 to a meager $0.74 (a $53M market cap) and now faces the threat of delisting. Is this a surprise? We’re also seeing issues mount in the Overwatch League (whose days may be limited). After years of high operating costs and low revenues — not to mention exorbitant buy-ins for franchise teams — plus the fact Overwatch was left largely devoid of new, great content for a couple years — teams have begun a collective bargaining process to hopefully attain economic relief. Lastly, even a promising company like 100 Thieves — which appears to have a real business across several diverse revenue streams — recently conducted layoffs. If the strongest orgs feel the need to cut back, it’s not a great sign for everyone else.

Fractal launches on Polygon. Fractal, the web3 gaming focused marketplace and platform (created by ex-Twitch founder Justin Kan), has been branching out recently. The platform initially was built for Solana, but the team added support for Ethereum last October and just announced that it will now support Polygon. This is a nice pick-up for Polygon since Fractal is a popular platform for players to discover new web3 games. And it’s a very nice addition for Fractal, since Polygon can bring its full ecosystem to the table; in fact, it was simultaneously announced that 30 Polygon-based games would support Fractal at launch. Tomorrow, Naavik Pro is diving even deeper into this deal if you want to learn more, but for now we’re just excited to see cross-chain ecosystem partnerships gaining steam.

In Other News

💸 Funding & Acquisitions:

- Earnings: Mircrosoft

- Voldex, a studio that primarily builds on Roblox, raised a Series A from a16z. Link

- Metacore acquired Everdale from Supercell. Link

- Turkey-based Games United raised at a $60M valuation. Link

- Merriam-Webster acquired Quordle

📊 Business:

- Where are people going to advertise their games in 2023? Link

- LoL was hacked, but no player data was compromised. Link

- WaPo shut down launcher (a huge loss for the games journalism). Link

🕹 Culture & Games:

- Playtika launched a web3 gaming experience for Slotomania. Link

- Among Us VR has sold 1M copies. Link

- Netflix games have passed 40M cumulative downloads. Link

👾 Miscellaneous Musings:

- How battle passes, multiplayer events, and targeted ads changed Beatstar’s trajectory. Link

- Xbox Developer Direct. Link

- Prime Gaming 2022 year in review. Link

- Roblox 2022 year in review. Link

- What is the most useless piece of video game knowledge you know? Link

This Week In Naavik Pro

Looking for more great games industry analysis? Check out Naavik Pro!

This past week the Naavik Pro team published:

- A deconstruction on home design game Redecor, including analysis of the impact of Playtika’s acquisition and its massive economy changes.

- A tokenomics deep dive into Illuvium, Crypto Univorns, Splinterland, and Star Atlas. We introduce a new concept called “the smoke test” to help determine whether any web3 game is ponzinomic or not.

- A research essay on Africa’s mobile games market, plus the role of Carry1st as an emerging developer and publisher in the region.

- Analysis of MAG Interactive’s Q1 earnings, Yuga Labs’ first game, Dookey Dash, as well as coverage on Plai Labs’ spin-off out of Jam City.

- An updated game radar with takes on Ultimate Sackboy and Frozen City.

This upcoming week, we’re publishing our next mega mobile genre report on the puzzle market, a research essay about the emergence of web3 FPS games, analysis on Coin Master’s recent surprising growth, coverage of Fractal’s move onto Polygon, and an update on Parallel (and its upcoming card game). And there’s much more coming after that!

If interested in learning more or signing up, request a demo below.

🔥Featured Jobs

- Dims: Game Engine Programmer (Stockholm, Remote)

- LBank: BD Manager (Remote)

- FunPlus: Lead Game Developer — Casual Games (Barcelona)

- FunPlus: Senior Game Developer - Unity (Barcelona)