Hi Everyone. Thanks for tuning in for another week of Naavik Digest. If you missed last week’s edition, we shared a spotlight on Rec Room, putting them in context with other UGC platforms. With that, let’s dive into today’s issue.

Why Meta’s Stock Crashed and VR Gaming Predictions

In this week’s Metacast Roundtable, we dive into the latest game business news with David Amor, Matt Dion, and your host Maria Gillies. The trio discusses the latest earnings from Microsoft, Sony, and Rovio and what we can learn from them. They also explore Meta’s latest earnings and why the stock’s decline means for the AR + VR industries.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Role-Playing Games Are On A Growth Trajectory

D&D (and by extension, the role-playing genre) has seen a major resurgence. Particularly these past few years during the pandemic (33% growth just last year), there have been a plethora of digital tools pop up like StartPlaying, One More Multiverse, Roll20, and Role that enable a range of activities — from finding Dungeon Masters to building your own games.

To be fair, this isn’t a genre I’d necessarily think of when looking at the gaming landscape but there are compelling tailwinds on the longstanding genre’s digital transition that make this a worthwhile refresh. I would argue there have been some recent developments — like the increased consolidation of D&D IP by Wizards of the Coast and the proliferation of Open Game Licenses — that warrant another look at the category.

D&D is such a big part of the market that it’s worth taking a look at it as a standalone entity, but a few years back, Jon Lai at a16z published a great overview of the market, making the case that modern digital tools (streaming, UGC, audio-first experiences, and online community platforms) will reimagine player experiences for the genre. I definitely recommend reading that piece for context.

In conjunction with this recent article, a few key stats to understand:

- D&D boasts 50M lifetime players

- 40% of players are women

- A large age range of players: 24% of players 20-24 years old, 18% of players 25-29 years old, and 18% of players 30-35 years old

Source: Grognardia

These are really compelling demographics, and even more so because D&D is a notoriously complex and time-consuming game. However, the core issue I see with D&D today actually centers around how D&D perceives and extends its own IP. The game takes up so much mindshare for both new and experienced players that the idea of nascent businesses building around such a centralized IP feels fraught: Who is to say that the team behind the IP itself wont simply pull a Nintendo and limit IP exposure for third-party opportunists? Indeed, Hasbro (which owns Wizards of the Coast, publishers of D&D) seem to be making moves in this direction, but also justifiably prioritizing this segment for themselves as it consistently delivers higher operating margins for the business. Here are some of the more recent developments:

- Acquired D&D Beyond, a licensed compendium and set of tools for the game, for $150M. This has 10M players, 85% of whom are in the US. The acquisition will help push the game more concertedly overseas and also acquire digital players.

- Building a virtual tabletop for a more integrated D&D experience

- Updating ruleset and game next year

- Estimated $100-150M in revenue (at large, Wizards of the Coast and Digital Gaming Revenues were up 42% to $1.29B in 2021 alone)

- New leadership in Cynthia Williams and Dan Rawson — this is an elite team to bring digital commerce experiences to the fold

Open Game Licenses (OGL)

Why this all matters I believe boils down to D&D’s open gaming license. A few years back, D&D opened up its IP for anybody to create games under the D&D brand, with D&D taking a royalty through their marketplace Dungeons Masters Guild. Open sourcing their IP essentially created a whole new fervor around the brand — experts could create more beginner-oriented guides and experts could create games they’ve always wanted like the famous Pathfinder.

Anyone who buys a game under the OGL will also likely buy the original version of the game (D&D wins twice). But for the parent brand, the OGL gives fans the ability to engage with the IP in a wholly new way — creating worlds themselves —and importantly, allows the brand to build vertical marketplaces for its IP. This is not only more revenue potential because of the marketplace, but also more opportunity for the root brand to better understand consumer preferences, both creators and players. There are tens of thousands of variations of this for D&D alone.

Although D&D owns so much of the current market, other role-playing games have started to notice the success of the OGL and integrating a community-owned perspective into their own strategies: Mork Borg is a popular Swedish role-playing game that sees its royalty-free open game license flourish on Kickstarter (they’re releasing their second base pack Cy Borg); Cortex Prime and Modipheus are two larger publishers that have also opened up their IP in recent months; and even Critical Role, the voice acting group for D&D, has published their own games — you can imagine they’ll build a marketplace to curate fan-made content of their IP, too.

The impact of this is super positive, expanding the pie of the genre and getting more people to play the games. I imagine more tools will be developed to meet these new needs and that larger publishers will be acquisitive of tools that exist today to better meet the digital needs of players. Today, role-playing not only encompasses D&D-esque games but also sandbox environments like Dream SMP and NoPixel — anything that has the possibility to include creative “conversation”, lore, and fandom. This is a fascinating genre that’s set to grow significantly over the next few years and I believe will seed new player experiences. (Written by Fawzi Itani)

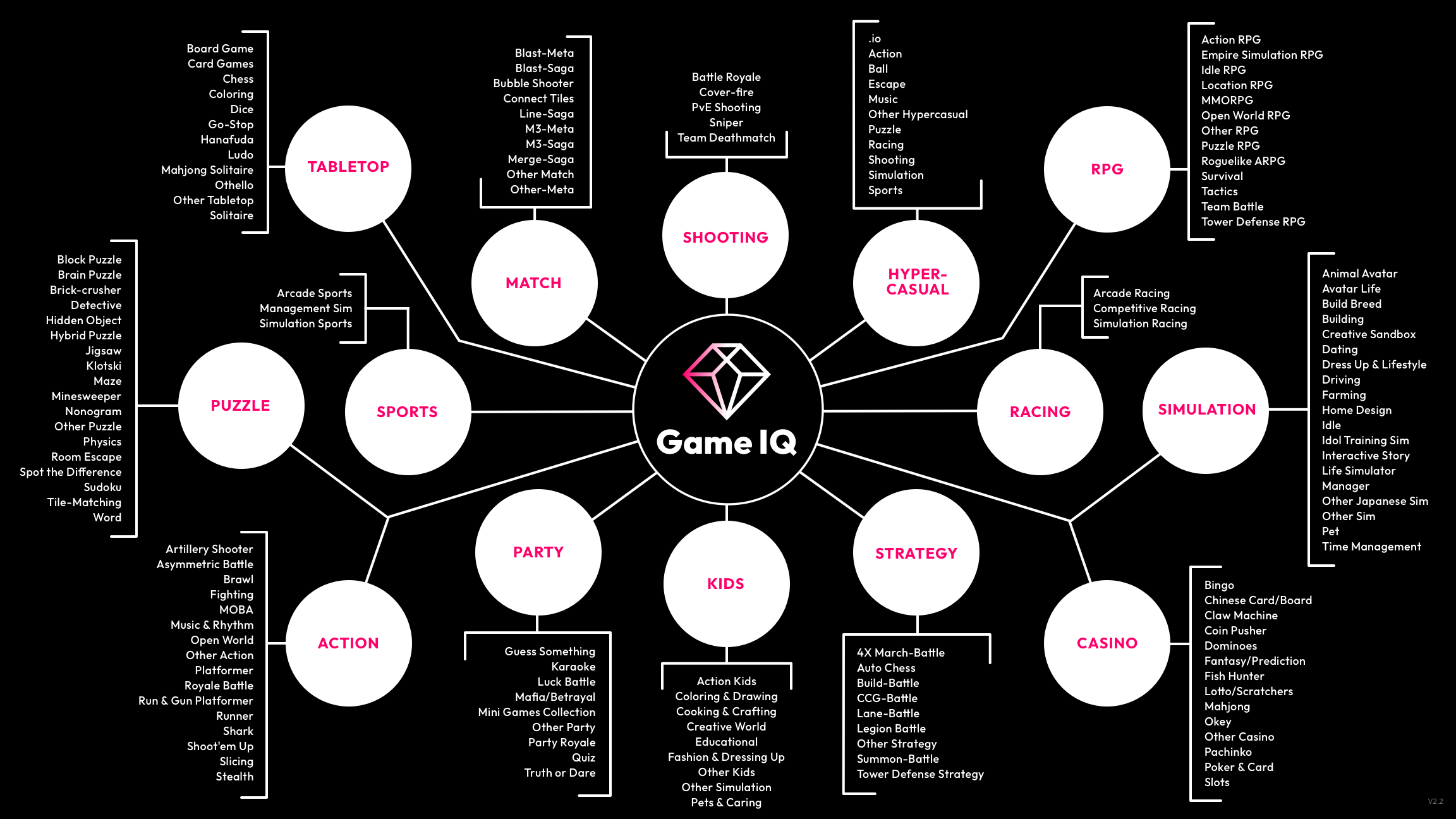

GameIQ Solves The Industry's Toughest Challenges

Game IQ is a market and competitive intelligence tool for mobile gaming that allows publishers to identify hidden growth opportunities, tie features to performance KPIs, and help you make difficult roadmap decisions. With hundreds of thousands of gaming apps in the app stores and thousands of new mobile games released each month, data.ai (formerly App Annie) is looking at a huge number of games to be classified. On top of this, the high granularity of our taxonomy structure makes it quite time-consuming to manually figure out into which category each game should fit.

How can we cover the vast majority of gaming apps in global markets accurately, efficiently, and in a scalable manner?

Game publishers and strategists today are facing various key challenges:

• Determining what features will provide lift

• Making roadmap decisions based on accurately modeled expected outcomes

• Discovering how competitors lifted performance through feature releases

• Benchmarking performance against competitors

• Confidently focusing on the highest potential genre for a new game release

With the enhancements we’ve made to data.ai Game IQ including Feature Tagging, Genre Summary, and Tag Trends, you can now effectively solve these challenges.

#2: Weekly News Roundup

Source: TechCrunch

Sony Reports Earnings: Sony cut the profit forecast for its games segment by 12% to $1.5B (despite revenue for this quarter rising 12% to $5.2B in part due to favorable FX impact), “with recession fears limiting consumer appetite for games”. Interestingly, momentum for old games has faltered (one of their strategies in addition to expanding to mobile and PC more concertedly) while momentum for new titles remains steady. In the quarter, the company sold 3.3 million PS5 units and targets sales of 23M PS5 units next year. Additionally, operating income decreased almost 50% primarily due to acquisition-related costs.

Sony’s PS Plus subscriber also numbers fell from 47.3M to 45.4M, indicating further decreases in consumer discretionary spending. It’s interesting to put these in context of Xbox Game Pass’s strategic announcements last week (the last reported number was 25M). The silver linings amongst the news is that Sony continues to ramp up unit production heading into the holidays and PS+ revenue increased despite a loss in subs. There's alot to be optimistic for heading into the next quarter.

Sony Teases PSRV2: Sony also announced its latest VR headset, the PSVR2, which will cost $550 (cheaper than Oculus but still more that a PS5 and requires one to operate). Sony’s PSVR 2 will release next February at a price of $550 ($150 higher than the Quest 2 and the original PSVR). It looks like a fun device that’s a clear improvement over its predecessor: 2,000 x 2,040 resolution per eye, 110° field of view, several cameras for movement tracking (including eye tracking), and a 90Hz refresh rate. The specs look generally compelling, and the initial line-up of games shows some promise: Horizon Call of the Mountain, Resident Evil Village, The Dark Pictures: Switchback VR, plus some notable non-exclusives like Zenith: The Last City. Of course, the price point (which is higher than a PS5) and the fact that it must be tethered to a PS5 will limit unit sales (which in turn may drive few VR content investments). The original PSVR is reported to have sold a bit over 5M units — roughly a 4% attach rate. PSVR 2 will likely see similar results unless Sony invests outsized amounts into ongoing, high quality exclusives. That’s not something to bet on yet, but continuing to invest in VR R&D keeps Sony in the game for whenever VR finds its mainstream moment. And for gamers who want to splurge, they're bound to have a fun time.

EA Reports Earnings: The story of EA's earnings is (again) a live services model that drives consistent revenue, propped up by FIFA 23's launch. Indeed, ~65% of the company's $1.7B total net booking was driven by live services. And interestingly, FIFA's launch sold an extra 10% in its first four weeks compared to FIFA 22. In line with expectations, Q2 net revenue was $1.9B. Management highlighted the continued strength of engagement (despite FX impacts to the business) across EA's core IP and a continued slate of releases in the pipeline (including one unnamed major IP).

🎮In Other News…

💸Funding & Acquisitions:

- Earnings: Rovio | EA | Capcom | Sony

- Playgig, led by a former Riot team, announced a $10.85M seed. Link

- Microsoft participated in a funding round for WeMade. Link

- Freedom Games raised $10M in a round led by Play Ventures. Link

- Modl.ai raised $8.5M from GGP. Link

- Netflix acquired Spry Fox (Plug: you should check out Daniel Cook’s blog). Link

- 1047 Games bought anti-cheat software EQU8. Link

- Blockstars raised $5M in a round led by Play Ventures (congrats Niko!!). Link

📊Business:

- Niko Partners predicts the China gaming market will decline 2.5% YoY. Link

- CoD Modern Warfare II topped $800M in three days. Link

- Dapper Labs laid off 22% of its staff. Link

- The PSVR2 will launch in February (and at $550!). Link

- Embracer closed a former Square Enix studio. Link

- PlayStation Plus subscribers fell this quarter. Link

🕹Culture & Games:

- Probably Monsters (finally) released the name of their game — Battle Barge. Link

- Square Enix revealed its first NFT-based game. Link

- After reported growth in the Xbox’s PC segment, Twitch subs and Xbox Game Pass PC revealed a limited time partnership. Link

- TikTok will have more integrated gaming efforts with a dedicated mobile games tab. Link

- The Sonic series has sold over 1.5M copies. Link

👾Miscellaneous Musings:

- Gen Z fuels fashion and brands in virtual spaces. Link

- Guide to making narrative games. Link

- A Clash Royale update worth understanding. Link

This Week In Naavik Pro

Looking for more great games industry analysis? Check out Naavik Pro!

This past week the Naavik Pro team published:

- A post-mortem on EA’s acquisition of Glu (namely, what went wrong)

- Research on why China’s mobile games market is experiencing significant declines

- An updated game radar with takes on Shankstars and Solitaire: Pet Story

- Analysis on Apple’s new NFT policies and MetalCore’s Open World Alpha

Next week we’re publishing a deconstruction on Marvel Contest of Champions, deconstructions on 3 upcoming blockchain games (Genopets, Cross the Ages, and Aurory), plus analyses on Wildlife’s new studios, the staffing shake-ups at major web3 companies, as well as Hyperplay and Metamask’s new collaboration. And there’s much more coming after that!

If interested in learning more or signing up, request a demo below.

🔥Featured Jobs

- Legendary Play: Senior System & Economy Designer (Remote)

- Nexus: Account Manager (Remote)

- Capcom: Business Development Manager - Esports (Remote - USA)

- Activision: Associate Manager - Global Digital Commerce (Santa Monica, CA)

- Naavik: Content Contributor (Remote)

- Naavik: Games Industry Consultant (Remote)