Hi Everyone! Welcome back to another issue. Sunday’s issue had lots of interesting stories — the most popular links were the Unofficial Pokemon Blockchain whitepaper, Ludocious’s piece on Space Ape, and Kyle Russell’s primer on Loot. Let’s dive into today’s issue.

Naavik Exclusive: In Conversation with Uri Marchand, CEO & Founder at Overwolf

Source: Overwolf

We recenrtly had the pleasure of interviewing Uri Marchand, Founder and CEO of Overwolf. Overwolf is a modding-as-a-service platform that enables game developers to build a UGC strategy, and creators to easily build and scale mods and apps for their favorite games. We discuss why Uri is so bullish on creators, the future of modding, learnings from building a company, and much more. Check out the transcript or audio-only version of the interview below!

#1: Playtika Acquires Redecor Maker Reworks for up to $600M

Source: GamesIndustry.biz

Last week, Playtika announced that it is acquiring Finnish home design app maker Reworks for $400 million in cash and an additional $200 million in an EBITDA-dependent earnout.

Helsinki-based Reworks was founded in 2018. From day one, Reworks decided to go head to head against Glu’s Design Home, which was for long the lone competitor in the interior decoration genre. Redecor, Reworks’ response to Design Home, was initially launched in December 2018. Reworks spent 16 months honing the product in soft launch until publishing it globally in April 2020.

Reworks scaled up Redecor’s business fast and with remarkable capital efficiency. A $400 million exit after three years and just $5.8 million in venture capital funding is nothing to sneeze at. Notably, it's not the first exit for the founders: the core team previously founded and sold off Sumoing, the creator of the similarly-named coloring app Recolor.

Playtika, on the other hand, was founded in 2010. It was acquired early on by Caesars Interactive Entertainment and proceeded to make its name as a social casino developer until getting bought again in 2016 by the Chinese company, Giant. Even though the lion’s share of Playtika’s business is still in social casino titles, it has recently expanded from its roots to other casual genres. It acquired Jelly Button (Board Kings) in 2017, Wooga (Pearl's Peril, June's Journey) in 2018, Supertreat (Solitaire Grand Harvest), and Seriously (Best Fiends) in 2019.

Reworks is a logical continuation to Playtika’s previous acquisitions. The demographic make-up of Playtika’s games share similarities: social casino, hidden object, solitaire, and casual puzzle all skew towards adult women. It's not far-fetched to claim that Redecor's audience has similar traits. Fierce competition for new installs as well as changes in privacy regulations both add to the value of a company’s existing user base. Successful cross-promotion between apps is not trivial, but similar demographics can certainly help.

Another consideration is one of mere market share. In recent years, companies such as Playtika and Zynga have employed a similar, bold M&A strategy: they've paid a premium for category-leading companies with successful live games. The approach is understandable, considering how notoriously difficult it is to develop new games. It has also shown results: all of the four aforementioned studios have seen their business grow since getting acquired by Playtika. Needless to say, the acquisitions of Gram Games and Small Giant Games have similarly turned out tremendously well for Zynga.

Finally, let’s dissect the price tag. According to Sensor Tower, Reworks made about $48 million in gross IAP revenue last year (the revenue roughly aligns with Reworks' reported revenue number for 2020, which is €41.8 million; the data is available from the Finnish Trade Register). This year, Reworks’ revenue has remained stable and the company is tracking towards roughly $105 million in yearly revenue. This produces a 3.8x revenue multiple for the $400 million cash consideration and 5.7x revenue multiple for the full $600 million that includes the earnout. The valuation certainly looks like a sweet deal for Reworks—perhaps Playtika wasn’t the only one shopping. (Written by Miikka Ahonen, Co-founder of Lightheart Entertainment)

Sponsored by Dive

Analytics & LiveOps for innovative platforms

Roblox? NFTs? Snapchat?

Dive's data customization tools support even the most innovative gaming platforms.

Dive is the first analytics & LiveOps solution that provides deep insight into Roblox games & the metaverse and offers unique LiveOps features like segmentation and A/B testing for some of gaming's fastest growing titles.

Our dedicated data expert team offers a unique hands-on approach to support you in every step of the process.

#2: ProbablyMonsters’ Monster $200M Series A

Source: Business Insider

On September 1st, ProbablyMonsters announced their massive $200M series A raise. It was led by their original investor LKCM Headwater Investments, the private equity arm of Luther King Capital Management, who has approximately $25 billion in AUM. According to press releases, ProbablyMonsters will use the fundraise to expand various capabilities of their technological platform, which allows its three internal studios to take more risks on exploring new types of player experiences and creating new triple-A IPs. Additionally, the funds will be used to enhance benefits to its employees and further accelerate the growth of its already 230 person strong team. There are three points that immediately stood out to me about this company.

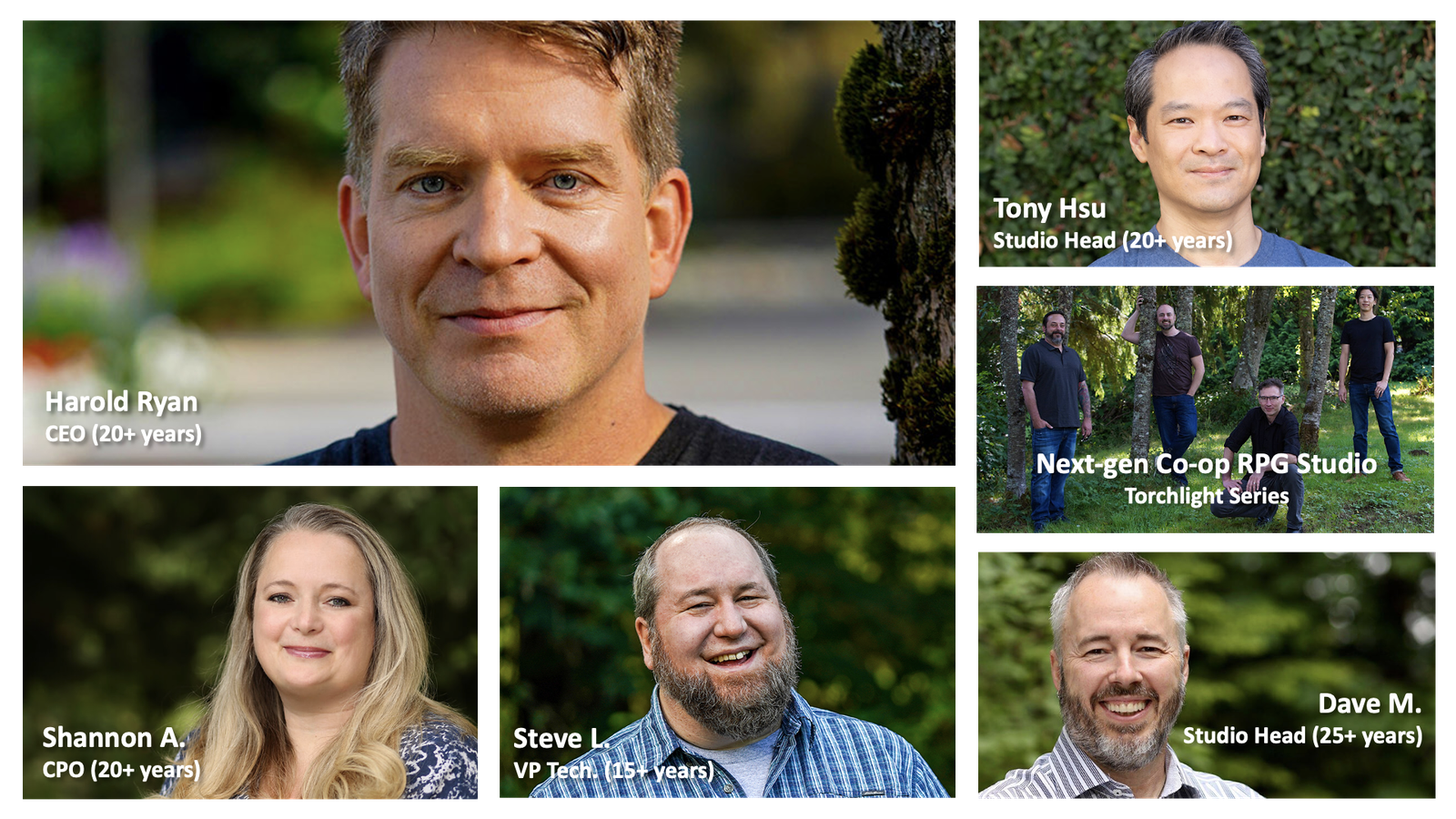

#1 The Leadership: ProbablyMonsters is led by none other than Harold Ryan, ex-CEO of Bungie. With over 20 years of games industry success, he has been responsible for generating over $5B of revenue through iconic franchises such as Halo, Destiny, Age of Empires, and MechWarrior. In short, he not only understands what success looks like, but also has repeatedly manufactured it. Further, he’s not the only veteran on the core leadership team. The fact that ProbablyMonsters’ original investor increased their position in the company says a lot about their trust in the company’s leadership to multiply the value of the significant series A.

Source: ProbablyMonsters

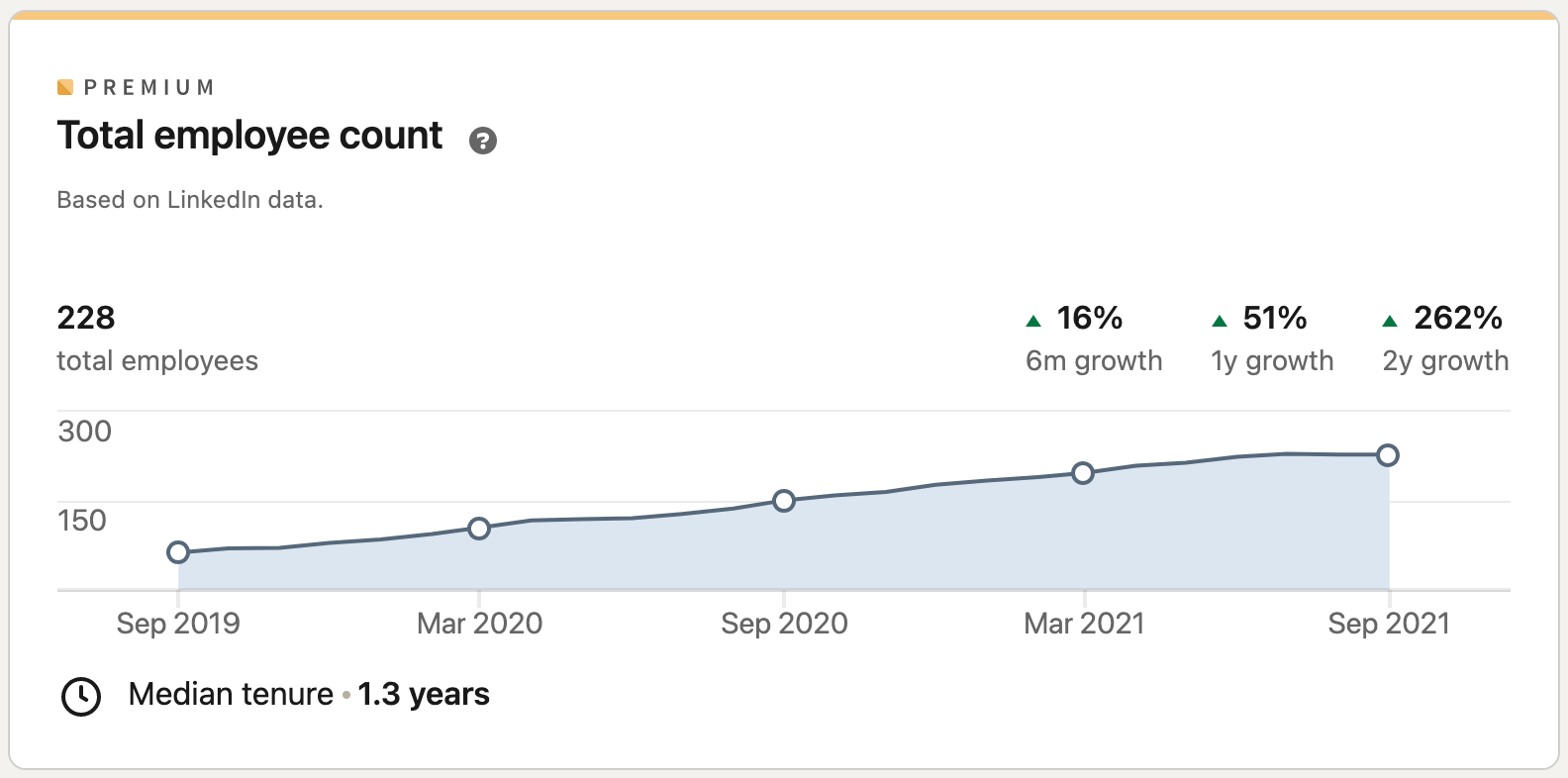

#2 A Unique Mission: The company's mission is to “unite, guide, and empower developers to create exceptional entertainment experiences that delight gamers”. Ryan is executing on that through “providing a positive and well-resourced environment with strong compatible cultural ties” across its family of internal studios, which are built for long-lasting titles and to eventually make exceptional AAA games. Given the growing negative narrative around AAA game development culture — inadequate compensation and unstable employment, to name a few reasons — the counter-positioning of this mission feels spot on to help attract talent. According to LinkedIn’s metrics, the company has managed to grow employee count, quite impressively, by +262% over the last two years. Check out these videos to get a better feel of the company’s culture.

#3 The Company Structure: ProbablyMonsters is currently structured as three studios with independent game development visions, all plugging into a centralised business platform that provides early stage infrastructure and long-term support in leadership, operations, analytics, QA, community engagement and live-operations. The goal of this structure is to empower studios to lead their teams and develop games free of “distraction”. One way to explain this structure is that it runs parallel to Stillfront’s decentralised model, but implemented in a Zynga-esque way. The other way to view it is that it isn’t unique when compared to how other major AAA gaming outfits organise their internal studios to increase operational efficiencies. Either way, ProbablyMonsters is not deviating from proven models to allow its studios to focus on what they’re good at and what ultimately matters — making games.

Source: GeekWire

As David Amor succinctly puts it, ProbablyMonsters has basically raised $200M to manufacture a runway of 2,000 person working years — using the rule of thumb that running a studio costs $100k per person per year. From that lens, it’s easier to put into perspective the “stable work environment” mission the company is gunning for. While it currently sounds like ProbablyMonsters is doing all the right things, maximising company lifespan, job stability and employee happiness will eventually come down to the market success of the games themselves. There is still a lot left to prove. It’ll be interesting to see whether the company’s leadership, culture, structure and technological platform enables its people and studios to create those notoriously elusive AAA hits! (Written by Abhimanyu Kumar)

📚 Content Worth Consuming

Gabby Dizon — Mapping The Metaverse Economy (Colossus): “Gabby Dizon is the co-founder of Yield Guild Games. We cover YGG’s decentralized structure, the unit economics of its business model, and how Gabby thinks about the volatility of crypto assets when trying to build a durable, long-term business.” Link

Game Engines On Steam: The Definitive Breakdown (Game Developer): “Have you ever wondered which game engines are most popular? Unity seems like it's used the most, but does Unreal dominate in the AAA space? These questions are answerable in principle, but until recently nobody has had good enough data to tell us much. It's even possible the companies themselves don't know precisely. So I've maintained a site called gamedatacrunch.com for a while that slices & dices publicly available data about games on Steam. We worked with xPaw, the maintainer of steamdb.info to try to discover the underlying game tech behind every game on Steam. Joining the SteamDB data to information we've already gathered on gamedatacrunch.com, we were able to get create rough numbers for game engines across a number of factors. So let's dig in and see what fun stuff we found!” Link

Blockchain Gaming’s Beginnings (SuperJoost): Early successes like Axie Infinity and Sorare have convinced some that blockchain gaming is already there. Others say not yet. An explosion of speculation and subsequent volatility in digital currency markets, a rapid influx of investment capital, and the relentless headlines about high-priced NFT transactions have the makings of what my colleague at NYU, Aswath Damodarn, calls the Big Market Delusion. It leaves us with little nuance. You either think blockchain gaming is all hype, or the future of gaming. To make more sense of things, let’s take a step back.” Link

Prologue is Huge, But Here’s The Vision for Artemis (VentureBeat): “Brendan “PlayerUnknown” Greene made news this week as he left Krafton, the company that published his tremendously successful PlayerUnknown’s Battlegrounds (PUBG) battle royale game, and he started a new studio in Amsterdam called PlayerUnknown Productions, funded by Krafton. He further revealed Prologue, a tech demo that his team will create in the coming years. Prologue will be a huge virtual world, with some previously unfathomable dimensions of 64 kilometers on a side. That is as big as open-world games get. But that’s not all. In an exclusive interview with GamesBeat, Greene said that Prologue is just what its name implies. It is a single-player game where you can wander in the wilderness. But it is setting the stage for something bigger: Project Artemis. If Prologue is impossible to build with current game technology, then Artemis will be even more impossible, as an Earth-size virtual world. But Greene is still going to try.” Lin

🔥 Featured Jobs

- Mythical Games: Principal Economy Designer (Remote, US)

- Mythical Games: Lead Product Manger (SF, LA, Seattle)

- Carry1st: Ad Monetization Manager (Remote, Global)

- BITKRAFT Ventures: Crypto and Gaming Analyst (Remote, US or EU)

- Supersocial: Head of Business Performance (Remote, US)

- Supersocial: Principal Analyst (Remote, US)

- Metafy: Senior Technical Recruiter (Remote, US)

- Metafy: Lead Marketing Designer (Remote, US)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.