Written by Devin Becker, Naavik Contributor and Blockchain Lead at Nami

It's tough in web3 gaming currently, but farming game Pixels has not only survived at a time when much of the game industry is making cuts, but has also effectively leveraged the web3 ecosystem for user acquisition.

So let's examine the strategies Pixels has employed so far, because though the game is small, there are still interesting takeaways here.

What Is Pixels?

Pixels was launched as a pre-alpha in 2022. It is a free-to-play, multiplayer farming and crafting game often compared to Stardew Valley. It combines a socially focused world with a mix of creative and economic tasks, incentivized with play-to-earn token elements to keep players engaged.

Unlike web3 social spaces like The Sandbox or Decentraland, it features 2D pixel art and is browser-based, making it easily accessible on both desktop and mobile platforms.

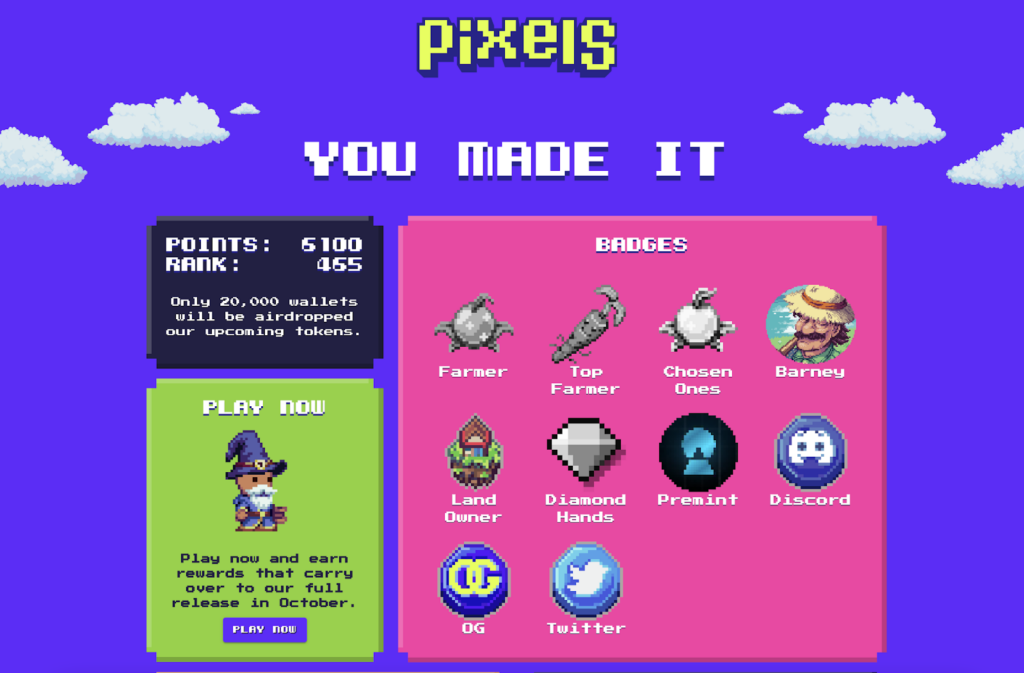

The game includes NFT land and an on-chain token. The NFT land provides farming space for meaningful participation in the economy and progression. The "soft currency" token $BERRY was launched in the fall of 2022 with a unique “play-to-airdrop” system. This system airdrops the token to the top 20K wallets on a point leaderboard, which players could climb by owning NFT land, earning badges, and engaging in general gameplay.

From 2022 to 2023, the game experienced significant growth, scaling up to 100K monthly and 5K daily active wallets. Its biggest leap, however, came at the end of October 2023.

The Migration to Ronin

After operating on the Polygon blockchain for over a year, the Pixels team announced a migration to Sky Mavis’ blockchain, Ronin, in October. This move was intended to reduce gas fees and attract new players from the existing Axie Infinity ecosystem.

It also enabled players to start earning $BERRY by completing challenges and selling their gameplay-generated resources, enhancing the game's play-to-earn model and making it more appealing to its user base as well as to those on Ronin.

The Ronin migration was a resounding success. Within two days of going live on Ronin, Pixels saw a 10 times the increase in users, with over 50K daily active unique wallets (DAUWs). This surge in activity was not just from existing Ronin users; activity increased across the entire network from 20K to 70K DAUWs.

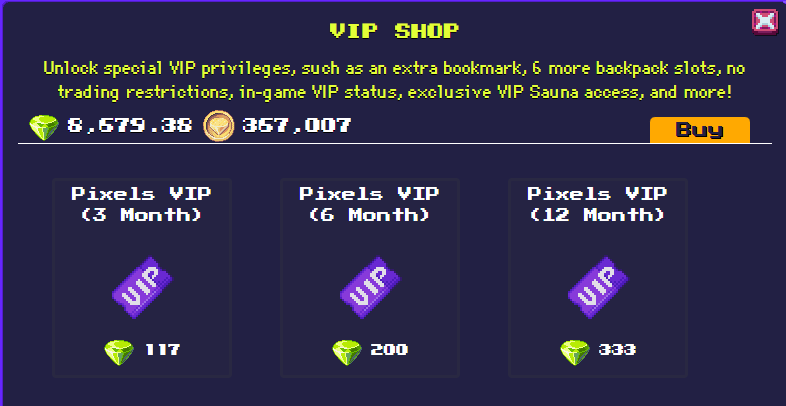

While Pixels CEO Luke Barwikowski estimates that around 40% of the DAUWs are bots, he also noted there were almost 5K VIP members paying approximately $10 per month for premium in-game features. The game also has a reputation system that can help mitigate the impact of bots on resources through trade limits.

The success didn't stop there, though. In November 2023, Pixels managed to double its DAUWs again, climbing to 115K, with VIP membership more than doubling to 11,247 subscribers. The momentum has since continued, with DAUWs recently reaching 316.8K on February 20th, 2024. The Ronin network has also seen benefits, with active addresses skyrocketing from 20K at the start of November 2023 to a peak of 897K on February 19th. During the same period, the Ronin network token, $RON, significantly increased in value from $0.50 to $3.46.

This rapid growth is most likely a mix of migrated players, existing Ronin users, speculating bots, and a heavy helping of those simply fearing missing out on anything that’s on an upswing. It’s unlikely to be a game that has any chance of long-term profitability for players, so there should be an eventual drawback in numbers, but the growth of VIP purchases is a good sign of some stickiness for new players.

Addressing Economic Challenges

Growth in many web3 games can also have an unfortunate side effect: inflation. The $BERRY token was averaging a 2% per day inflation rate (a whopping 1377 times the annual expansion of supply), which is manageable with untradable currencies, but it becomes problematic when they can be traded openly.

The $BERRY token was successfully migrated to Ronin along with the game, but in early February, Pixels announced the $BERRY token would be sunsetted, with $PIXEL becoming the sole main token.

In short, the Pixels team had essentially reached the same conclusion as most game economists: An inflationary “soft currency” should not be tradable, or it erodes its own value over time. The $PIXEL token had always been intended to be the “hard currency” premium token and would retain that focus, while $BERRY would be replaced by an off-chain currency, Coins. To help players make the transition, the $BERRY in players' accounts would be automatically replaced with $PIXEL at an exchange rate of 1,000 $BERRY for 7.6175 $PIXEL. This has allowed Coins to be better utilized as a standard virtual game currency as part of the typical economic loop without concerns of it heavily bleeding into the overall economy.

There were also two initiatives launched to seed $PIXEL into the hands of players and perhaps even acquire some new users. The first was a massive airdrop of 20M $PIXEL tokens to those staking Ronin’s $RON token, based on the amount staked and split over two 10M airdrops one month apart. This acted as a big thank you to the community that had boosted the game to such milestone numbers, as well as a way to potentially interest any nonplaying stakers in trying the game out.

The second initiative was a play-to-airdrop 2.0 campaign for $PIXEL. The campaign ran for two weeks, targeting 8K players in addition to the 20K players who had received the 1.0 airdrop. The distribution would again use badges and game tasks to accumulate points for a leaderboard, but with increased scrutiny on potential bots before awarding the airdrop.

This airdrop had an even stronger effect than 1.0 due to the increased attention on the game. These one-offs don’t necessarily increase the retention of these new players, but they still can have an effect of reactivating lapsed players and encouraging them to migrate if they hadn’t already. Despite the attempt to sound innovative by coining a new "play-to-x" term, it’s just a leaderboard competition driven by gameplay and boosted by purchases.

Token Performance and Market Reception

The success of Pixels was also mirrored in the performance of its token. When the $PIXEL token was launched on Binance in February, it quickly captured the market's attention, boasting an impressive 24-hour trading volume of over $500M and experiencing a significant appreciation.

The token launch wasn’t the only monetary change for Pixels, as it was recently announced that the Pixels Foundation raised $4.8M in a strategic round with participation from Framework Ventures, Collab+Currency, Volt Capital, Yield Guild Games, and Mechanism Capital, among others. While that isn’t as wild as the raises seen in 2021-2022, it’s still a fairly sizable amount given the game’s scope and modest team. It’s unclear how the funding will be allocated, although the team has already had to increase overhead for servers and infrastructure, and will likely expand live ops to improve retention. This also provides the runway needed to implement many of the new usages for the $PIXEL token.

Takeaways

A key element of Pixels' appeal is the balance it strikes between being a social platform and a game. The community aspect of web3 is particularly strong at the moment, bolstered by platforms like X, Discord, Telegram, and regional networks, especially within guilds.

Pixels offers a simple, browser-based 2D chat environment with a town center and various public and private spaces for socializing and farming. This setup encourages players to visit both types of spaces without forcing spontaneous grouping.

Furthermore, incorporating a daily cycle that involves energy gating and farming ensures that engaged players log in regularly, creating a social version of Farmville that Facebook never achieved. Socializing within the game has proven to be more effective for retaining players than Discord channels, especially since localized chats encourage more players to participate rather than just lurking on public channels.

Regarding the balance between gameplay and social interaction, the inclusion of NFT land serves both purposes rather than merely being a speculative investment. Owning land for farming and building personal spaces makes more sense than the speculative land sales seen in many metaverse projects.

The land in Pixels features various biomes and resources, along with diverse land shapes and features for aesthetic and functional choices, serving as both a progress indicator and a social status symbol.

Pixels has also focused on building for the web3 native audience. This includes the wallet, NFT, and token integrations, as well as community engagements. For instance, the team has leveraged being 2D to incorporate a large number of PFP (NFT profile pictures) projects into the game — such as Proof Collective, which was recently acquired by Yuga Labs, and Animoca Brands’ expanding Mocaverse project — which acts as a user acquisition vector for PFP owners.

When it comes to engaging other communities, however, the move to Ronin was by far the strongest move. It doesn’t make sense for many games to move to Ronin if they are finding success elsewhere, but the Pixels team felt a strong alignment with Sky Mavis. Pixels’ gameplay was a good fit for the semicaptive audience on Ronin, which was waiting for a solid Axie-based farming game but lacking any good in-game social areas to assemble in.

It was no doubt a fair bit of work to make the migration (although Sky Mavis likely helped), but it was likely very cost-effective from a user acquisition standpoint. Instead of trying to market to players elsewhere, Pixels simply moved to where the players were, that had a strong chance of being receptive to the project. It also helps that being on Ronin reduced gas fees compared with Polygon, benefitting both the Pixels team and players.

The Pixels team has made both stumbles and smart moves around tokens. Having an inflationary tradable token is a mistake many early web3 games made, but Pixels admitted the issue, and made bold steps to try and correct it. The $PIXEL token ended up having a solid launch on popular exchange Binance, and another airdrop event spread the love to those invested in Ronin’s success.

Across web3 gaming, these airdrop events are catching on mostly due to the ability to drive activity across a larger number of players than are actually awarded, acting as much stronger motivational leverage than direct play-to-earn elements. With Pixels, specifically, there are also clear uses planned for the token, as the team is treating it as a tradable premium currency and has quickly made it the way to purchase VIP membership. The VIP membership also showed some thought toward monetization prior to the introduction of $PIXEL.

The play-to-airdrop events are also a decent idea to incentivize some competitive play for a short-term event, but not something you can run all the time. Axie Infinity already showed that leaderboard-based winnings aren’t necessarily a great way to consistently distribute a token.

All in all, it's too early to determine if Pixels will continue to grow and succeed (although living up to its lofty $2.6B fully diluted valuation is unlikely), but it's still worthwhile to look at any successes in the web3 space in context to understand what may work in the future. Pixels itself doesn’t represent a new era of web3 or make significant changes to the issues web3 gaming has yet to solve, especially around sustainability.

It has, however, shown the benefits of adapting a game to leverage its strengths, and of not being shy about admitting and fixing issues. It also highlights the current social core of web3 that contrasts the space with much of mobile and console gaming. And, lastly, as we see a new wave of web3 games emerge in the coming months and years, we expect the lessons learned from games like Pixels to have a noticeable impact.

A Word from Our Sponsor: NEFTA

Superior IAA Revenue from iOS Users Who Opt-out of Tracking

Nefta's advertising network provides a privacy-compliant solution to the problems publishers and advertisers face, diminishing revenue and eCPMs from iOS users that opt-out through ATT. Nefta has devised an approach using first-party data to improve in-app advertising revenue.

Publishers integrate an SDK natively or via LevelPlay or Max mediation and add Nefta's game event taxonomy to gain greater insights into player behaviour. Nefta's platform observes these game events and usage patterns on an app-by-app basis and applies advanced machine learning and behavioural analytics to create profile groups. Nefta discovered that certain profile groups are more likely to click certain creatives resulting in greater audience engagement, ad interaction, and revenue growth.

This is how we are able to drive superior results for advertisers while increasing ARPDAU for publishers, in a 100% privacy-compliant way.

Game of the Week: Warframe Comes to Mobile, 11 Years Post-launch

Written by Abhimanyu Kumar, Naavik Co-Founder

Developer: Digital Extremes

Publisher: Digital Extremes

Platform: iOS only, with Android coming soon

Status: Global iOS launch on February 20th, 2024

Genre: Action RPG / Looter shooter

Gameplay: Link

What Is It?

At its heart, Warframe is a free-to-play action RPG/looter shooter where players command a Tenno, fitted with a Warframe to become a warrior-robot hybrid that feels like an absolute war machine. Players fight through short levels to gather items that help them unlock, upgrade, and customize new and existing Warframes.

Warframes are varied around combat and elemental themes, allowing players to use entirely different powers, weapons, and movement types. The play itself can be solo, co-op, PvP, and open world. And while there's narrative woven into its multiplanetary questing, crafting, and character progression and customization systems, the real allure for us lies in its seamless combat.

The game’s combat design is a major highlight in our eyes. Unlike most action RPGs where a character has a relatively fixed style of combat across battles, every Warframe (currently 55 types) not only has a foundational set of abilities that helps make them unique, but they also are allowed to arm themselves with a primary, secondary, and melee weapons from a range of more than 500 items, each of which play slightly differently. The end result is endlessly fresh combat, which is amplified with very unique character movement.

Warframe Mobile is a full parity port of its PC/console counterpart that includes over 10 years of incredible content from its massive and constantly evolving free-to-play sci-fi universe, and the ability to play along with over 70M players through full crossplay capabilities. It is free-to-play with microtransactions for item bundles, cosmetics, crafting timer skips, player marketplace trading, and more.

How’s It Doing?

In little over a week, Warframe Mobile has garnered more than 600K downloads, about $100K in revenue, and a 4-star rating on the App Store. It also doesn’t seem like any mobile performance marketing is currently active on the game.

After sinking multiple hours into Warframe Mobile, we’d say the 4-star rating is currently justified. It seems Digital Extreme’s aspiration to deliver a full parity mobile port in terms of gameplay, content, systems, frame rates, and graphical fidelity took priority over optimizing the game’s UI/UX for a mobile-first player, and making it bug- and crash-free.

In other words: Digital Extremes has its work cut out adapting Warframe’s mobile experience to three mobile gaming realities — people don’t have much time, and so they expect things to work, they play on small screens, and they use their fingers to do so. The miniaturized-for-mobile version of the Upgrades screen below should help illustrate the arduous and precision intensive process it can become to perform the right upgrades to one’s Warframe quickly.

This is probably not only bleeding into the game’s retention and engagement metrics on mobile, but also the currently poor monetization performance with a first-week RPD of approximately $0.20 in the U.S. Diablo Immortal showcased a first-week RPD of about $3.00 on iOS in the U.S.

This isn’t a perfect comparison due to differences in monetization system designs between the games, but such a huge gap also showcases the scope of monetization improvement potential Digital Extremes has, while still staying true to its overall free-to-play monetization systems design. Based on its successful track record with heavily community-driven live ops over the last 11 years, maybe Warframe Mobile one year hence isn’t going to look like what it does today, and that’s probably going to be a good thing for various mobile metrics.

Why Go Mobile, and Why Now?

Warframe has a long history, and it is one of very few games that has been able to sustain its total player community and active player base over multiple years. This can clearly be seen in the Steam concurrents graph below.

But that doesn’t necessarily equal growth. According to Leyou’s last financial report in mid-2020 (Leyou was Digital Extreme’s parent company, before Leyou was purchased by Tencent in December 2020), Warframe’s revenues were showcasing a declining trend even though the game’s community was still growing, albeit with reduced momentum every year.

At around the same time, Leyou’s leadership regularly hinted at expanding Warframe to mobile. Digital Extremes revealed it was developing a mobile prototype back in 2021, so the mobile SKU has been three to four years in the making. It also invested €12.5M into Finland-based Nitro Games to help develop Warframe Mobile.

In the face of declining annual revenues since 2019, slowing player base growth over time, and a three- to four-year co-development period for the mobile SKU, it makes sense that Warframe decided to go mobile 11 years after launch.

Maybe the decision to go mobile could’ve been taken sooner, but it’s probably the co-development relationship with Nitro Games for a full parity port of a AAA PC/console game with very significant depth (not an easy task!) that slowed things down the most.

While it is too early in Warframe Mobile's journey to make any definitive predictions, it will be interesting to see a few things going forward:

- With a fresh €3.5M in funding to continue development of Warframe Mobile, can Nitro Games (a mobile game developer and publisher) work with Digital Extremes to adapt Warframe Mobile better to the platform, without compromising on delivering the full Warframe experience?

- Will the above help improve the game’s base monetization metrics on mobile?

- What impact would mobile-centric performance and brand marketing activities have on Warframe Mobile’s overall performance metrics?

Our Investment Support Services

Over the past few years, we’ve had the privilege of supporting several great investment firms in and around gaming. Our team, which is deeply experienced and uniquely positioned at the cross-section of gaming, technology, and finance, is available to provide market and investment research, due diligence, and advisory support. Here is what one of our clients had to say.

“Having closely worked with Naavik since the firm’s launch in 2019, it’s been an absolute joy to see their growth. At Lightspeed, depth is our center of gravity. The same goes for Naavik. Their success to date is a testament to the team's uncompromising quality work and thoughtful commentary.”

- Moritz Baier-Lentz, Partner at Lightspeed Gaming

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.