Hi Everyone. We have another big announcement this week! Naavik is excited to announce that data.ai (formerly App Annie) is our new data partner for all things mobile. The platform, which generates valuable AI-driven data insights, will power our content, research, and consulting operations going forward. You'll see us leverage the platform's data both in this newsletter but also our deep dives and premium content as well.

We are also thrilled to work with data.ai because of the team's longtime and growing dedication to the games industry. You can learn more about the platform's gaming solutions here, but also check out Game IQ, a powerful tool to help teams slice-and-dice all sorts of games industry data.

Lastly, data.ai's gaming team has a great roadmap we're excited to use more and more ourselves, and we suspect you will too. We'll all have more to share about that in the future!

This Week on The Metacast

Reimagining NFTs — On this week’s Crypto Corner, Luda CEO and Cofounder Vijay Sundaram joins Nico Vereecke for a conversation about community driven IP creation and the current state of Web3 Games. The duo also discusses what Vijay is building at Luda, and how he envisions NFTs can be much more than just a collection of 10,000.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Omega Strikers’ Launch

Source: Omega Strikers

Super Mario Strikers on GameCube (and the ensuing franchises) was one of my favorite games growing up. It was a no-brainer for me to download Omega Strikers, Odyssey Interactive’s debut game in the sports brawler genre which released 1.5 week(s) ago on Steam. As others have described it, the Overwatch / LoL meets Rocket League game doesn’t disappoint: it’s easy to pick up and play against others, there’s high variability and scalability in character / map positioning and ability, and the single camera angle makes it fun as both a player and viewer.

Background Context

I’ll leave a full game deconstruction and analysis of Omega Strikers for when this launches on mobile, but what intrigues me most from a business perspective is that this is one of the first games launched by ex-Riot Alumni in the 2018-2022 funding craze (is there a Riot syndicate out there we should all know about?!). The four founders sport a variety of compelling experiences across the Riot ecosystem, ranging from engineering, product management, and growth on Team Fight Tactics (they built this game) and LoL, leaving Riot for a smaller team environment — their website says it best in that they “strive to build games that ignite the competitive spirit and reward dedication with a sense of growth and purpose.”

As readers of Naavik Digest have probably gathered, there have been more than a few Riot-founded companies funded by the Makers Funds’, BITKRAFTs’, and a16z’s of the world, and while there’s no doubt that these are talented founders who can build a great game, Odyssey Interactive’s Omega Strikers is one of the first games to debut from the Riot mafia. I feel like the spotlight is on them. Its launch offers us generous perspective into the company’s strategy — what worked / hasn’t worked, what’s to come, and what to look for. Odyssey Interactive, the developer behind the game, raised a $6M seed in 2020 from Golden Ventures and a16z. My assumption is that they also raised a Series A at some point before the launch to fuel the marketing push.

I love that people are already discussing builds | Source: Dot Esports

From WaPo’s excellent interview: “Odyssey Interactive president Andrus said that “Omega Strikers” originally started off as a straight-up action game that went through several prototypes. But adopting the sports angle allowed the team to hit two seemingly contradictory objectives: adding the Core (the game’s giant hockey puck) made the game easier to understand, and also introduced an extra layer of mechanical complexity.”

It’s no easy feat to pivot, iterate, and find a sense of product market fit in under two years — cheers to the team for this debut launch! Indeed, Omega Strikers hits on a variety of positive secular trends in gaming: a largely cosmetic-based economy with anime (ACG) aesthetics, genre-mashing in F2P (3v3 sports Brawler that is heavily-inspired by predecessors), cross-platform intentions from the get-go, and an IP-related expansion strategy. This seemingly has the foundations of a good game, so let’s get into it.

Omega Strikers’ Successful Launch And The Importance Of Their Creator Program

To start, Odyssey Interactive nailed their launch. When I tuned into Twitch, they had partnered with OfflineTV for a Twitch takeover of the game, driving 70K+ viewers. The studio is also working with creators to include a 1% revenue share for whichever creator community wins the most games over the course of a season. This is such a creative and community-oriented approach to launching a game.

Source: TwitchMetrics

This will also be a valuable creative marketing push and engagement driver for the game over time, which has seen declining viewership numbers since the launch. Player counts seem to be normalizing as well. But through more tournament and streamer activations, like the upcoming Vtuber event (the meta trend here is that everything is consumed by ACG), they’re executing to solve this problem. Engagement and scale over time are clearly top of mind for the team.

Source: SteamCharts

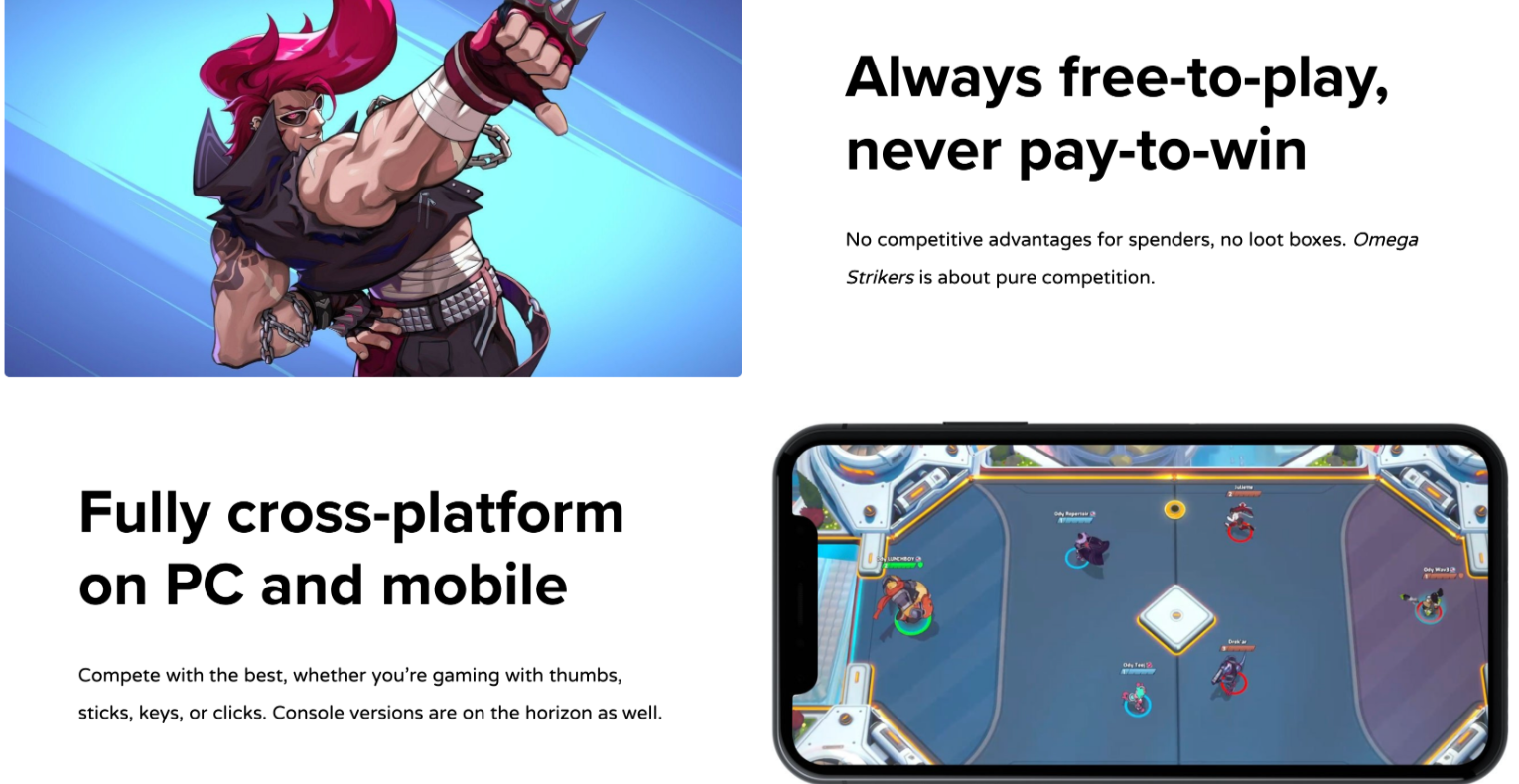

It’s important to reiterate why Omega Strikers is pursuing this marketing strategy — because they’re pushing cosmetic-based monetization, it’s critical that they reach a certain scale for the unit economics to make sense. For the game to be successful, it's not just about nailing the core gameplay that will create a sustainable cosmetics-based economy, but audience scale will ultimately bring this economy to life. Cosmetic-based economies require social proof and virtue signalling for long-term scalability and sustainability, and that’s why audience scale is key. According to game’s website, they are vehemently against monetization methods like loot boxes or gacha.

This focus says a lot about the game, and also what companies they’re treating as inspiration / direct competitors. To give one small example, very few companies have robust creator programs — Fortnite pioneered a scaled version with Ninja, CoD has inklings of one that works, Brawl Stars (i.e Supercell at large) and Stumble Guys have pushed the envelope on what a F2P mobile version could look like, and Nexus has built the infrastructure to power this for others.

Source: Omega Strikers

The 1% creator program should help to kickstart and maintain that audience scale. It will also lead to engagement over time, as creators share in the upside of game. All this said, I believe cross-platform — leveraging the PC audience into a mobile one that monetizes — will be the long-term accelerant for this trend.

Steam, Cross-Platform, and Reviews

Omega Strikers is only available on Steam (Windows) even though they have every intention of being cross-platform. At the time of writing, it ranks #61 on Steam’s (new!) top-selling charts, which is testament to the momentum around its launch. It also has 5000+ positive reviews. Most praise the game’s accessibility, short games, and less “sweaty” ranked mode. And I’ve anecdotally heard from a few friends that they love getting in a few games in before a meeting because games can take less than four minutes. On the flip side, most negative reviews revolve around latency issues (perhaps the infrastructure wasn’t ready for a global launch), lack of communication capabilities (which seems purposeful on Odyssey’s end to avoid toxicity), and an imbalance in certain characters. All these seem solvable particularly as the company moves cross-platform and reaches more players, which they’ve clearly laid the foundation for in a variety of ways:

“To that end, “Omega Strikers” offers a generous array of input options. PC players can choose between using a mouse and keyboard or joypad, both of which can be remapped. Mouse and keyboard users can move their characters around the arena using either the keyboard (WASD configuration) or mouse (MOBA configuration). There are also several toggles such as an ability indicator and strike indicator which give more precision over attacks at the expense of speed.”

It’s a curious decision to have only launched on Steam given the purported platform-agnostic nature of the game — why didn’t they just launch everywhere? — but perhaps it was a decision to iterate on learnings for the true cash cow upcoming on mobile. Indeed, the game was built to accommodate a wide array of use cases and end demographics, and I’m particularly excited about their mobile port.

Art Style and IP Expansion

Source: Omega Strikers

The rise of ACG aesthetics in video games is also a noteworthy callout. Even Japanese music can be heard in the trailer and game. Limit Break and Genshin Impact are two examples we’ve previously explored at Naavik — what’s different in the case of these two companies, however, is that they target the wider, higher ARPU demographic that ACG can drive. For Omega Strikers, it’s possible the ACG art style actually ends up working in a different way to broaden the top of the funnel, which is perfect for the audience scale strategy mentioned above.

Since Omega Strikers will likely be a purely cosmetics based economy, it might not be the case that the ACG art style will necessarily lead to the high ARPU audience we’ve traditionally seen in comparable games. And to be fair, at Naavik, we’ve mostly seen higher monetizing ACG audiences in mobile F2P gacha-based economies. Vis-a-vis Omega Strikers, it’s clear that they’re going for a PC/Console-first audience who might also like to play the game on mobile, and that audience doesn’t necessarily have a high overlap with the mobile-first gacha-economy audience. In fact, they don’t want this at all. Should high ARPUs exist in this game, they’ll need to nail core gameplay first. But the goal will be a broad top of funnel.

The art style also speaks to how the studio wants their players to engage with the Odyssey characters, much in the same way Riot has pushed forward their IP through Arcane and through new games like Project L or TFT (even this TikTok trend for Genshin is a perfect example of how this player engagement might manifest with characters). A multi-game studio that uses the same IP, I believe, will be a core strategy for the studio. I can imagine Odyssey Interactive launching multiple games through their IP and building out their own launcher, similar to EGS, Riot, and Steam. To be clear, this is a huge upside scenario. Base case, Omega Strikers needs to demonstrate it can have longevity.

While I do think that Omega Strikers presents a solid array of characters, the studio has a lot of work ahead to make them resonate with their players in a way that will 1) monetize them and 2) sway them to play other Odyssey Games on IP alone. Whether Omega Strikers will be that keystone game, time will tell, but my gut tells me a successful mobile launch (and some competitiveness built in) will play a key role in determining this future. (Written by Fawzi Itani)

#2: Love & Pies Game Deconstruction

Source: Trailmix Games

This is the introduction to a full game deconstruction of Love & Pies, written by Niek Tuerlings. Check out Naavik Pro to request a demo, read the full write-up, and access our entire research library.

Let’s set the scene. It’s summer 2017, and after developing and growing Farm Heroes Saga into a $1 billion hit, King VP Carolin Krenzer and Game Director Tristan Clark leave the company to explore other ventures. Half a year later, Trailmix sees the light of day. The startup introduces a strong and ambitious vision: “To make experiences with richness and depth, while remaining accessible, long-lasting and built to fit into a player’s daily life. All while combining great storytelling with the best in free-to-play mobile.”

This story is ultimately about how a two-person startup evolved into a Supercell-backed, 30+ people team studio with a mobile hit so wholesome and beautiful that it won TIGA’s Best Casual Game award last year. Like any success story, though, it’s not without struggle. The studio’s casual merge hit, Love & Pies, was in development for three years before launching mid-2021, and for most of that time it was not even a merge game!

More specifically, Trailmix has been partnering with Supercell since the $4.2M seed round in February 2018, after which the Camden-based team started scaling up slowly but surely. You can check out the company’s website for a more detailed timeline on how Trailmix brought Love & Pies to life.

Before diving into the details, it’s important to distinguish the casual-merge core game from the rest of the merge market segment. The traditional merge-3 gameplay, popularized by Merge Dragons in 2017, inspired casual game developers like Metacore to create a more accessible gameplay variation based on a merge-2 mechanic. This resulted in 2020’s Merge Mansion, which is still the top dog in the genre (excluding the merge-3 titles). Merge Mansion’s sudden success led to a gold rush in 2021, with everyone jumping in to take advantage of this fresh core mechanic’s high retention rates. Interestingly, the only thing Love & Pies and Merge Mansion had in common when the latter came out was its meta game, classified either as Puzzle & Decorate or Invest & Express, depending on who you ask.

During the merge craze in 2021, lower-fidelity games like Merge Villa and Merge Life that use hypercasual, ad-driven monetization started popping up and raked in a good share of downloads (and therefore revenue). More recently, after the mania cooled off at the start of 2022, a select few casual merge games managed to achieve some ROI on their user acquisition spend. For example, Mergedom: Home Design, which uses a hybrid monetization model with the option to remove ads through an IAP, has seen some traction. Love & Pies also falls in the mid-section of the market in terms of downloads, together with other perseverant competitors like DesignVille, Merge Inn, and Travel Town.

Source: Data.ai

From a revenue perspective, not much has changed in the casual-merge segment over 2022, as Merge Mansion is still the game to beat. In fact, the only two other games that have been able to meaningfully capitalize on their players in terms of IAPs are Love & Pies and Travel Town. Both games are currently earning more than $1M in monthly revenue, which is a nice achievement for studios with a headcount of <50 people. For the sake of comparison, though, Merge Mansion will most likely hit the $10M monthly revenue mark for the first time come September or October.

Source: Data.ai

Last May, Supercell drew a similar conclusion regarding Love & Pies’ achievements, which led to another $60M (majority stake) investment in Trailmix to grow the game. Since Metacore’s Merge Mansion isn’t that much of a competitor for Trailmix — as they are both funded by Supercell and therefore perhaps knowledge-share — Love & Pies is in a pretty good spot.

On a more personal note, to me as a game designer, the most interesting part of the Love & Pies story so far is the bold pivot Trailmix undertook to transform its beloved puzzle game into a less risky product. How did the company find out that it was the right decision to change course so dramatically? To answer this question, throughout this piece, we’ll also have a look into the game’s old mechanic, its innovation and pitfalls, because as Trailmix has proven: It’s never too late to pivot and change the core mechanic of your game!

To truly understand Love & Pies’ ins and outs, this essay will reflect on:

- The level-based puzzler Trailmix switched from before the game became casual merge-2

- Deconstructing its core gameplay strategy, metagame, live-ops, narrative, board balancing, end of content, and monetization

- What aspects of the game drive its strong retention

- How Supercell’s investment is being spent and how the revenue is being returned

- What the game is still lacking and what improvements could be made

Content Worth Consuming

Clash Quest, The Unofficial Postmortem (DoF): “After 16 months in soft launch, Supercell’s Clash Quest has reached the end of its run. The game has not achieved the business objectives set by Supercell and the game will shut down. Following an excellent postmortem by Laura Taranto, Javier Barnes and Anette Staloy, host Ethan Levy sits down with the writers to discuss what went right and what areas of improvement for Clash Quest. We discuss the writer’s experience playing and interacting with the Clash Quest community over the past year and a half, what they enjoyed about the game, and why they think the game was not able to meet its retention and monetization targets.” Link

Growing The Icelandic Games Industry Beyond CCP Games (Gi.biz): “As a small country with a population of around 350,000 people, Icelanders like to joke that everyone is practically related – but that's certainly the case in the local games industry thanks to CCP Games. Celebrating its 25th anniversary in June, CCP Games has been Iceland's biggest success story – not just for its persistent space-based MMO Eve Online, but also laying the foundations for other game companies to spring up over the years. In fact, new studios are still being founded by former alumni; Parity Games, for example, is led by CEO and co-founder Maria Gudmundsdottir, who worked at CCP for 12 years.” Link

How Townscaper Works (GameDeveloper): “Townscaper is a small game, with big ambitions. A city builder in which players can simply add or remove a block from the game world. With this limited toolset, you can craft everything from idyllic seaside towns to a horizon spanning metropolis. A procedural generation engine running under the hood caters to the unique topographies players establish and refines the world with each new action taken. But how is it capable of expanding, and rebuilding the world with such consistency? While also introducing fun and novel ideas for players to discover on their own.” Link

Ultima Online Turns 25 (Raph Koster): “In many ways the influence of UO is so pervasive that it isn’t visible. Whether it’s Runescape, Minecraft, Eve, DayZ or Neopets, those younger folks probably played something that was inspired by UO in some fashion, and don’t realize how big a shift from prior games it represented. These days, when people say they are sick of crafting being in everything — it makes me want to apologize a little bit. Won’t apologize for games that let you sit, decorate a house, or go fishing, though. I’m running low on specific stories about UO and its development, so instead, I’ll just point back at older ones.” Link

🔥Featured Jobs

- Legendary Play: Senior System & Economy Designer (Remote)

- Bungie: Director of Product Management (Remote - US)

- Guerrilla Games: Technical Animation Manager (Amsterdam, Netherlands)

- Manticore: Head of HR and Recruiting (Remote)

- Disney: Investment Team Analyst (Remote)

- a16z: Business Games Analyst (Remote)

- Naavik: Content Contributor (Remote)

- Naavik: Games Industry Consultant (Remote)