Hi Everyone. Welcome to another issue of Naavik Digest! If you missed last issue, be sure to check out our breakdown of the Savvy Games Group and Scopely deal. This issue, we’re discussing Warner Bros. and Player First Games’ MultiVersus, the studio’s decision to pause operations, and what that says about the broader live service gaming landscape.

In other news, our friends at a16z are hosting a 6-week startup school called SPEEDRUN. It’s a program designed to deliver cutting edge insights to build and run a successful games company. If you’re considering starting a startup, we highly recommend you apply (it’s only a 12-question application!). With that, let’s jump into this week’s issue.

Growing a YouTube Channel (Gotta Catch ‘em All)

What does it take to grow a YouTube gaming channel? In this week’s episode, your host, Alexandra Takei, sits down with Aaron Zheng, a professional VGC Pokemon player and the founder of YouTube channel Cyberton VGC. Beyond running a channel that has amassed over 50 million views and uploads videos daily, Aaron himself is the winner of five Regional Championships and two National Championships. He also shoutcasts for Pokemon International tournaments.

We explore what it takes to grow a YouTube channel, what role YouTube plays in monetization and tooling for content creators, and how video content creation can affect one’s personal life. Plus, we learn a ton about the Pro Pokemon scene! Check out Aaron’s channel here before diving into the episode.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: MultiVersus and the Live Service Struggle

Written by: Carson Taylor

MultiVersus, an upcoming free-to-play character brawler published by Warner Bros. Games and developed by Player First Games, was recently removed from digital storefronts after launching in beta last July. Despite hitting 153,044 peak concurrent users (CCU) shortly after the soft launch and generating a great deal of positive buzz, WB and Player First decided to shut the title down until its official launch some time in 2024.

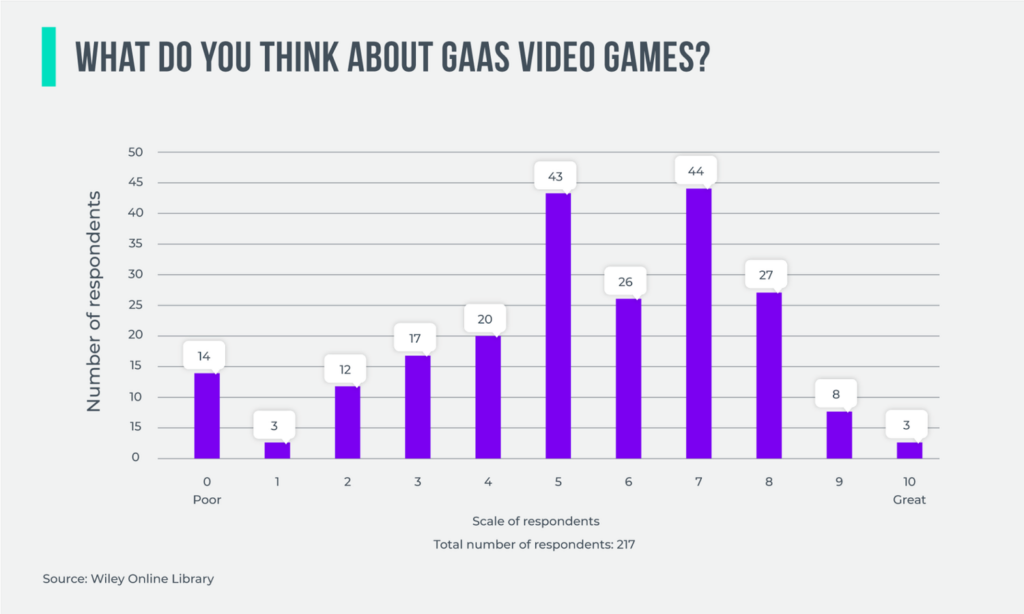

While such a drastic turn of fortune obviously raises concerns about MultiVersus’ future, this event raises even larger questions about the nature of live service gaming today. This IP-based brawler may have been temporarily pulled from distribution, but many up-and-coming live service games have been shut down permanently in recent months, despite their apparent success. As games-as-a-service (GaaS) becomes ever more the industry norm, this spate of game closures necessitates a reflection upon the challenges, consequences, and implications of this business model.

Live Service Games Are Critical to Today’s Games Industry

Live service games are fundamentally different businesses and products than other traditional boxed gaming products. There is a distinct market for games that are often free-to-play and continuously updated, and these products require a unique development approach and post-launch strategy. Both of these factors play into the spate of recent game closures, including MultiVersus’, and warrant a closer — and more critical — analysis of the GaaS model.

Live service games began to emerge in their modern form alongside the rise of mobile gaming and free-to-play, both of which almost inherently rely on the live service model to spur continued engagement and monetization. Premium games across PC and console have adopted many of the same principles over the past decade, too, as live service gaming has proven far more lucrative than the once-standard pay-to-play model.

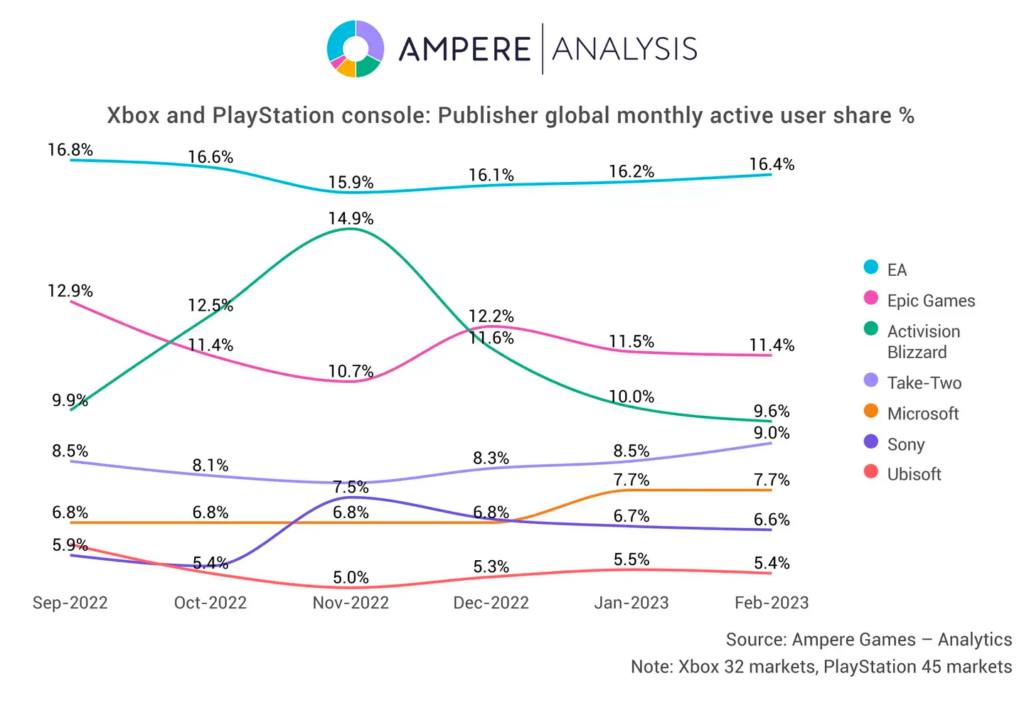

Over the past decade, major publishers like EA and Take-Two have fully embraced service-based models, and these games (FIFA, Grand Theft Auto Online) now supply the vast majority of major publishers’ revenue. Even Sony intends to launch 10 new live-service games by 2026.

These games’ strategic importance is directly tied to their ability to generate stable streams of recurring revenue over long periods of time. This is highly valuable to investors, as recurring revenue is seen as more stable and predictable compared to the boom-and-bust cycle of the pay-to-play model. Consequently, companies that have successful live service games tend to be valued more highly both in the public markets and also by VCs. This has further incentivized game companies to focus on the GaaS model.

But live service games have not proven a panacea for the modern challenges of games publishing. Beyond MultiVersus, 2023’s graveyard of live service game closures includes Velan Studios’ Knockout City (once published by EA), Apex Legends Mobile (also an EA property), Iron Galaxy’s Rumbleverse (published by Epic Games), and more. In fact, there have been many headline-worthy failures, cancellations, and even some dramatic revivals of live service games. Titles like BioWare’s Anthem, Bethesda’s Fallout 76, and Square Enix’s Marvel’s Avengers have given both gamers and developers much highly-publicized angst as high development costs and marketing budgets have been squandered trying to build the next big GaaS-based product.

These shutdowns have pointedly revealed the many challenges that come with building service-based games in an increasingly competitive entertainment industry, in which games compete just as much against one another as they do against Netflix, TikTok, and YouTube.

Structural Issues in the Live Service Games Market

There are two main categories of issues that live service games experience. Structural issues endemic to the market for service-based games make it difficult for games to acquire new users and scale, while other challenges — related to the process of game development — impact a title’s ability to retain acquired users and subsequently monetize them.

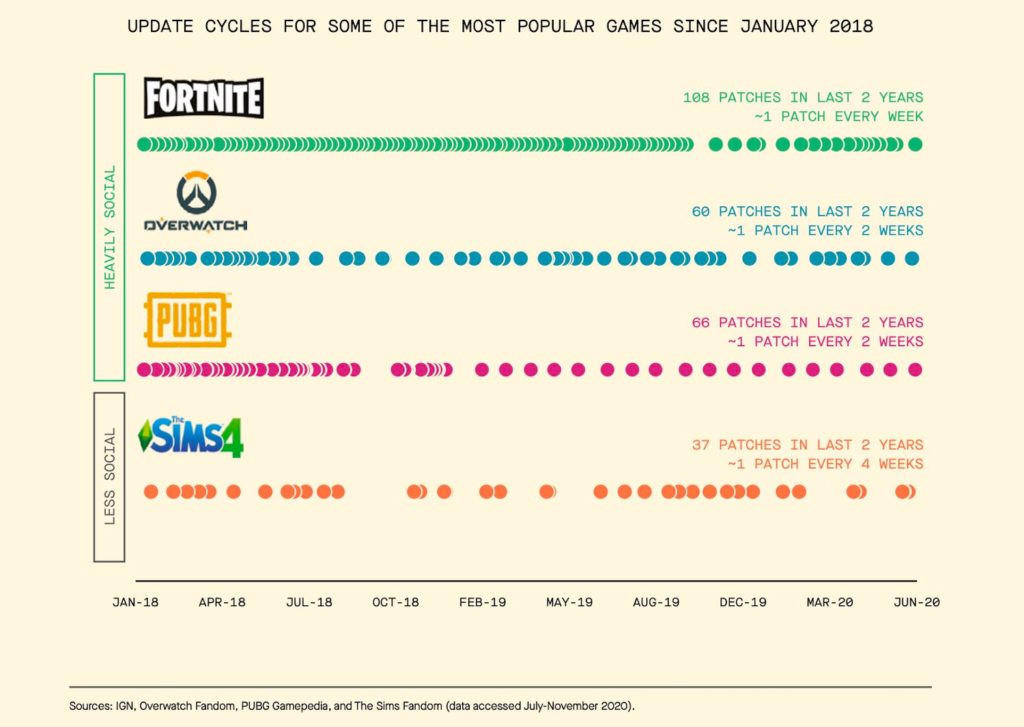

The very nature of live service games makes launching a successful new one incredibly difficult, especially as the market has matured. The established, successful live service giants — such as Fortnite, Sea of Thieves, Valorant, and others — continue to receive heavy investment to keep their large player communities engaged, sucking up player-hours that might otherwise go toward newer titles.

Live service games are so deep and demanding that it is difficult for a gamer to seriously invest time in more than one or two — and such games rely on significant time investment as a core part of their business model. As Karol Severin of Midia Research described, “Live services games are heavily commercially dependent on time spent in the game, which is correlated to in-game spend. [Meanwhile] premium games… only have to convince the user to buy the game before they get fully paid, while live services need to serve the player on an ongoing basis to extract their full return on investment."

As a result of this, the age of GaaS has had the effect of reducing player liquidity. Whereas previously, when players purchased a game and “finished” it, they would return to the market ready for another game. In the age of service-based games that have no end, far fewer players return to the market. They remain tied up in a live service game and its ongoing ecosystem, and the liquid, or freely available, number of players across games has begun to fall. As a result, acquiring players in this market is increasingly expensive, as they must often be torn away from their current games to try a new one. These “red ocean” competitive dynamics are hallmarks of a mature market, where companies grow mainly by stealing their competitors’ customers.

The current crop of game cancellations may also reflect how changes in the macro economy affect game spending. Last year, the game industry experienced a notable decline in player spending, even as engagement continued to increase — leaving the already cutthroat GaaS market competing for fewer paying players and further pushing up user acquisition costs.

The failures of high-profile live service games have shown that simply launching an amazing game with ongoing updates is not enough to guarantee success in such a pressurized market. The power of incumbent titles makes user acquisition difficult and expensive, and once acquired, developers face significant challenges to retaining these players. That in turn makes it increasingly hard for new live service games to break through, stay relevant, and generate profit.

Unique Development Issues Facing Live Service Games

While structural issues in the live service gaming market present stumbling blocks for the industry as a whole, the other category of hurdles facing the GaaS model — the technical requirements to produce these games — has a more direct impact on fate of individual studios and products.

While video games have always been uniquely complex forms of software, the technical requirements of live service games are significantly higher. As online products, live service games require a high degree of backend stability and must also accommodate enormous amounts of players. Continually updating the game with new features, systems, and content increases the likelihood that some new change will break something else — but regression testing to identify these issues becomes costlier and more complex as the game bloats. See, for instance, Blizzard’s recent launch of Overwatch 2, which involved the studio taking the game down not once or twice, but three times in a span of less than a week to fix launch stability issues.

Another issue relates to the balance of a game’s content, economy, and monetization model. Developers have to ensure that players have enough content to enjoy without feeling like the game is forcing them to grind or otherwise waste their time on pointless pursuits, whether they are new players or deep in the endgame. Players expect regular updates and new content to keep them engaged and interested. If a game fails to deliver a steady “content treadmill,” it can quickly lose players.

The never-ending task of creating new content can also demoralize and burn out developers — “the challenge [is] often the content treadmill… it’s not typically a path that's sustainable,” as Remedy’s CEO Tero Virtala put it when discussing the studio’s upcoming live service game. And since the business models are so closely intertwined, live service games also tend to employ free-to-play monetization techniques that PC and console players often detest. This contributes to a popular perception that live service games are money grabs commissioned by greedy publishers willing to sacrifice quality to chase mobile gaming revenue levels.

While these issues can understandably rankle gamers, many of the most notorious live service failures have a pattern of lackluster developer communication. If developers fail to respond to player concerns about technical issues, content, or monetization, players perceive that as the developer ignoring community feedback and prioritizing player spending above all else.

For all of these reasons, developing a live service game is uniquely challenging. Developers must constantly respond to emergent problems (often urgently), create new content, ensure the game’s ever more complex economy and technical underpinnings are stable, and manage a passionate player community. Often (especially on mobile), developers partner with Chinese studios as co-developers to tap into the Asia market, which brings its own set of unique hurdles.

Managing all of this simultaneously — with limited resources day after day — is what defines the challenges of live service game development. EA’s Anthem, one of the most high-profile console / PC GaaS failures, offers a cautionary tale. “A lack of content, the use of Frostbite, a specific lack of endgame content, a real lack of live service material, a second-rate story, bad loot, general clunkiness, bad communication on content, and more all contributed to its downfall,” reported Gamerant.

The end result of struggling with any of these core hurdles in the live service model is player churn. If not adequately addressed, churn leads to a death spiral for live service games, which rely on a healthy base of dedicated players and a constant influx of new ones to help offset those who put the game down and don’t come back. As more players churn, the more likely it is that other players churn as well.

Network effects are a double-edged sword: with fewer players, the social and gameplay experiences degrade due to fewer friends playing, longer queue times, worse matchmaking, less active player economies, and more, in a cycle that can cause a game’s player base to plummet as and the general impression of a game becomes associated with it being “dead” or “in decline.” (For an excellent deep dive on the perils of live service gaming, check out Bungie’s GDC 2022 talk on transforming Destiny 2 into a proper GaaS game and the near-fatal mistakes the studio made along the way).

No one wants to live in an online ghost town, and that is often what becomes of live services games that fail long before the plug is pulled.

Future of Live Service Games

Despite the challenges, live service games remain an important and growing segment of the gaming industry, having helped grow the sector tremendously. Developers and publishers will continue to invest in live service games to capture the stable recurring revenue and engaged player base they offer. After all, the industry’s continued push to create persistent game worlds with vibrant economies (whether they’re under the label of metaverse, MMO, or battle royale) shows no sign of slowing down.

But the closure of several seemingly successful titles indicates a potential market correction in the short term, and perhaps a pullback from some companies’ ambitions of operating numerous, successful live service games in their portfolios. Multiversus, for example, is set to return in 2024 after (I presume) working through some of the game’s retention issues. The market and the industry cannot support all of the service-based games currently in development — it is inevitable more closures and cancellations will occur in the future.

Meanwhile, Fortnite, as usual, continues to push the boundaries of live service games. Its transition to a UGC-first model is already heralding the next age of GaaS, by which makes use of its large player base to supply endless amounts of new content, generating unparalleled potential player engagement and retention while Epic itself focuses on even bigger bets. The top 10 charts are harder than ever to displace. Competing against games like Fortnite becomes even harder for new entrants when Fortnite itself encompasses an infinite library of diverse new content.

#2: Solitaire Grand Harvest: A Puzzle Game with a Casino Economy

This piece is a preview of a game deconstruction written by Harshal Karvande for Naavik Pro. To read the full piece, along with our other Naavik Pro content, request a trial now.

In July 2016, a small team of less than twenty highly skilled developers founded a new mobile games startup to work on a revolutionary new casual game. This game would “merge completely new gameplay elements with proven mechanics, combine gorgeous graphics with an adorable story, and mix laid-back action with an irresistible gameplay hook,” the company said.

This is how Austrian developer Supertreat came to make their flagship — and as it stands their only — game. Solitaire Grand Harvest (SGH) released after a little less than one year of development, and the design is fairly straightforward. The title is a level-based F2P take on Tripeak Solitaire, a variant of the classic card game in which the goal is to clear three peaks made of cards (refer here for a gameplay demonstration). Supertreat’s take on this, however, has players journey on a saga-style map, expanding their farms and harvesting their crops along the way and earning credits to raise their bets and winnings in every game.

Just within a year of launch, SGH became one of the highest-grossing solitaire titles on mobile. Given its remarkable retention metrics, the game drew the interest of Israeli mobile publisher and developer Playtika, which acquired Supertreat in 2019 for an undisclosed sum. The acquisition was primed to leverage Playtika’s background in social casino. “We are confident that by leveraging our live-ops, game economy, and performance marketing expertise we will make Solitaire Grand Harvest the number one solitaire game in the market,” Playtika Chief Marketing Officer Nir Korczak said of the deal at the time.

Even with existing juggernauts like Scopely’s Solitaire TriPeaks, Big Fish Games’ Fairway Solitaire, and King’s Pyramid Solitaire Saga, Playtika’s SGH grew to dominate the solitaire subgenre of casual puzzle games and has remained the market leader in its genre.

Since its release in June 2017, SGH has made $600 million in in-app purchase (IAP) revenue on over 53.4 million downloads worldwide, with an average revenue per download (RPD) of $11.24. Google Play is the leading platform, accounting for $316 million (53%) of total revenue and 43.6 million (82%) of all downloads, though with lower RPD of $7.25.

On iOS, the game has generated $284 million (47%) of total revenue over just 9.7 million (18%) downloads, creating an outsized RPD of $29.14. The graph above highlights the game’s increasing trendline in downloads and revenue, both of which were further boosted by the Playtika acquisition.

With IDFA depreciation on iOS starting in April 2021, SGH moved to further push their marketing efforts on Android, causing the spike in downloads highlighted above. The trendlines also highlight the strength of SGH’s retention and depth of monetization as revenue continued to increase over the last two years even as downloads declined.

Contest Worth Consuming

Generative Agents: Interactive Simulacra of Human Behavior (Google Research, Stanford University): “In this paper, we introduce generative agents — computational software agents that simulate believable human behavior. Generative agents wake up, cook breakfast, and head to work; artists paint, while authors write; they form opinions, notice each other, and initiate conversations; they remember and reflect on days past as they plan the next day. To enable generative agents, we describe an architecture that extends a large language model to store a complete record of the agent's experiences using natural language, synthesize those memories over time into higher-level reflections, and retrieve them dynamically to plan behavior. We instantiate generative agents to populate an interactive sandbox environment inspired by The Sims, where end users can interact with a small town of twenty five agents using natural language.” Link

Can Joy be Financialized as a Positive-Sum Game? (Meandering Musings): “The ‘really big idea’ of web3 games is not ownership of virtual goods, it’s creating a fungible virtual currency. Fungibility of virtual goods and currencies with real-world value (‘fiat convertibility’) enables the affinity that gamers feel for a virtual world to be instantiated in financial form. We call this ‘joy premium’… There is one critical caveat: financializing joy will be positive-sum only after the ‘real economy’ has matured in the virtual world, characterized by the production output of intrinsically motivated players pursuing exploration, crafting, production and exchange loops. Until that point, joy premium must only be earned, not bought.” Link

Rod Humble says the future of the metaverse is private and player-first (Gamesindustry.biz): “’Big’ may not cover Humble’s aspirations with Life By You. He aims to make it the ‘most fully featured life simulator ever,’ an open-ended game where users can create the people, towns, stories, and activities that matter the most to them, all in a sprawling open world where they can take direct control of denizens as they go about their lives. And when the developers haven’t included something, they want enterprising players to be able to mod it in. ‘I've always had an interest in empowering the player and the customer, versus the designer, and over the years, I think my design philosophy has shifted more and more toward that,’ Humble says.” Link

Mastering Virtual Worlds & Economies ft. Hilmar Pétursson (a16z Games): “Hilmar Pétursson is the CEO of CCP Games, the creators of Eve Online. Eve is a 20 year old MMO [that] has endured several step changes in technology, virtual economies, and game development. Following the announcement of www.projectawakening.io, we sat down with Hilmar to talk about the past, present, and future of the Eve Universe. It's rare to discuss game design with a founder who has worked within the same universe for nearly two decades — a challenge which must adapt to ever-changing economies, resources, and player behaviors.” Link

🔥Featured Jobs

- Immutable: Economy Designer (Sydney, Australia; Remote)

- Backbone: Product Manager (Remote)

- Carry1st: Head of Growth, Games (Remote)

- Astra Fund: Operations & Finance Manager (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.