Hi Everyone. Thanks for tuning in to another week of Naavik Digest. If you missed last week’s edition, we wrote about the year ahead for Nintendo and the company’s strategy going into 2023.

NetEase’s SkyBox Acquisition / Square Enix Analysis / Meta UA

Why are NetEase and Tencent diversifying into Western AAA game development? What should be expect from Square Enix’s continued commitments to blockchain gaming? How could EU regulations affect Meta’s performance as a UA channel? We dive into the latest game business news with Aaron Bush, Matt Dion, and your host Maria Gillies

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: How Multiplayer Updates Impact Active Users

During my summer internship at EA, one of the most interesting things I noticed was how releasing recurring and frequent updates impact daily active users (DAUs). Updates come in every form (free updates, paid DLCs, expansions, etc.) and every size: is there a perfect recipe to keep a game’s playerbase engaged in the short- and long-term? How are best-performing games doing it right?

Updates have been a core part of recent generations of games. One of the earliest to start in this trend is Team Fortress 2 in 2017, when Valve started releasing new weapons, maps, and cosmetics on a recurring basis. Recurring updates are the main solutions studios and publishers have found to extend the life cycle of video games; rather than start development from scratch every time, they leverage the same assets, engine technologies, and build something on that base. Also, by releasing updates, companies accomplish two things: 1) keeping the players engaged by giving them reasons to come back and 2) increasing average spend per user.

At a high level, we can distinguish between updates and DLCs. Updates are usually released for free in live service games and contain a mix of free and paid items. On the other hand, DLCs are expansions released for more single-player focused games — they expand the story and the lore of the game and are usually sold for anything from $5 to $40 depending on the size of the DLC.

Moreover, there are different kinds of updates. Generally speaking, we can distinguish among:

- Content updates (CUs). CUs are big updates which bring major changes in one or more of these categories: new gameplay features, new maps and/or areas to explore, new main and/or side stories, new characters, new weapons, new enemies and bosses, new events. Usually, CUs are released with a constant cadence, which can vary from 2/3 weeks to even 6 months (like for GTA Online since 2019).

- Seasonal updates (SUs). SUs come in many forms but are usually related to real-life calendar events, such as Halloween, Christmas, and other holidays/festivities. Usually SUs offer limited-time events and in-game content, which can be obtained only by playing the game during the a specific time period. SUs are usually repeated every year with minor or even no changes to the formula.

- Recurring updates (RUs). RUs are released much more often, usually every week. These updates focus on smaller changes and feature discounts and bonus earnings on selected items.

We could argue that the goal of updates and DLCs used to be different, since updates should both retain players and drive revenues up, while only the latter holds true for DLCs in most of the cases. This is also starting to change since many single-player focused games are now adding in-game purchases (see for example the latest iterations of the Assassins’ Creed franchise), and thus we could argue that DLCs also now have to keep the playerbase engaged in the long-term in order to drive in-game spend up.

For my first analysis on the topic, I picked three different games in terms of audiences, genres, and updates: GTA Online, Apex Legends, and Cities:Skylines (C:S). The first two games represent two successful cases of live service games with all the kind of updates described above. On the other hand, C:S doesn’t have seasonal and recurring free updates, but focuses on the sale of DLCs. All concurrent player data is taken from steamdb.info.

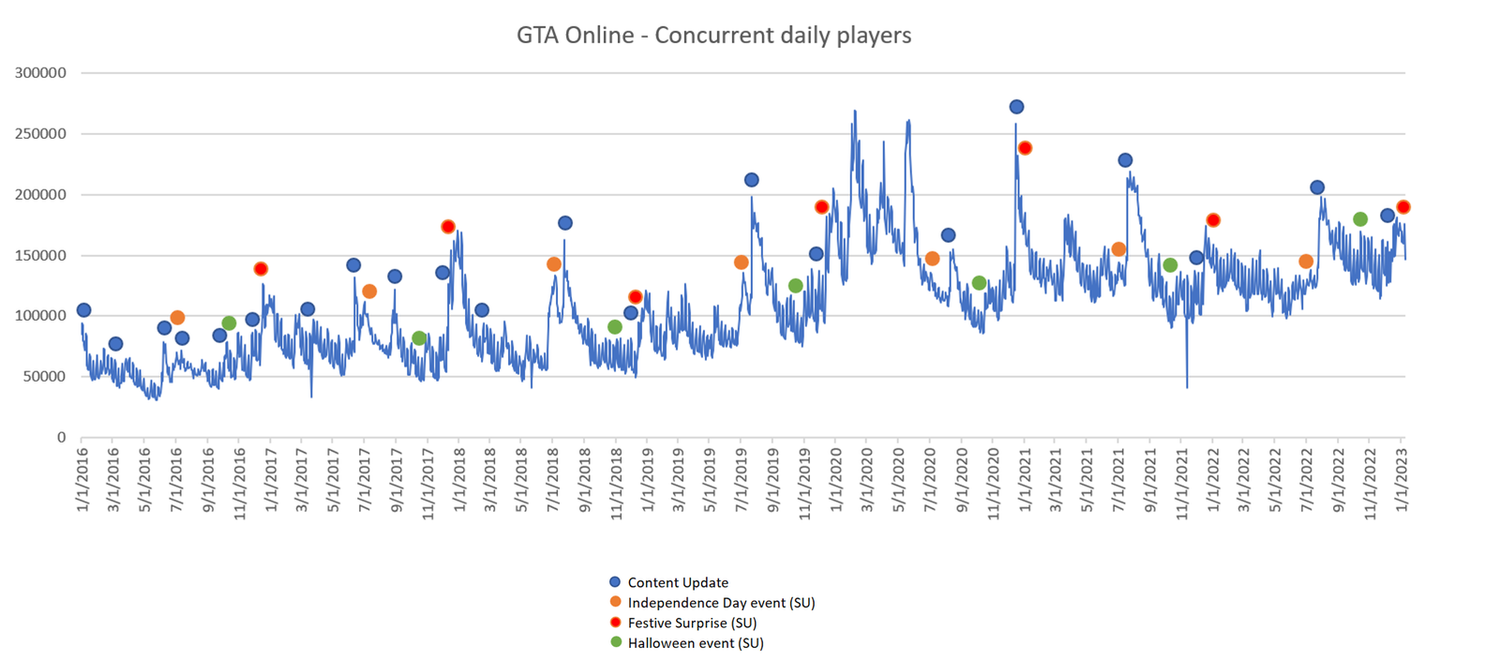

GTA Online — Is Less Better?

GTA Online has an interesting story, since Rockstar changed many aspects of the release formula over the years. If we look at the first years (2014, 2015, and 2016), GTA Online received around six CUs each year, while starting from 2019, there have been only two CUs every year. Before looking at the numbers, let’s see what’s in each CU, SU, and RU.

- CU: usually each CU has new themed missions, new online modes, new locations and businesses, tons of new vehicles, clothing items, and smaller accessories. Recently, since 2020, Rockstar started adding also missions linked to the main GTA 5 storyline.

- SU: Each SU adds themed missions and in-game items, which can be obtained only during a limited time. Each year items are basically the same with smaller twists and changes.

- RU: There are weekly recurring updates in GTA Online, which provides bonuses and discounts for the in-game items. Since these updates have been happening every week since the launch of GTA Online, they are not taken into account in the analysis.

The graph presents many takeaways:

- CUs have a great impact on active users, the number in fact spikes up as soon as a new CU is released

- Not all CUs have the same impact, though. For example, Rockstar used to release a CU in March until 2018, but interestingly the March CU did not have the same impact as other CUs released for example in July and December in terms of active users. My hypothesis here is that Rockstar removed the CU in March starting from 2019 because of this

- If we exclude data from 2020 (which is influenced by the COVID crisis), we have the first part of the graph with an upwards trend, while the second part (from 2021) has a somewhat flatter trend. The main difference between the two periods in terms of updates is that Rockstar has been releasing content less frequently: can we say that the decrease in content released has impacted the trendline? Would the trendline of the number of active users have trended upwards if Rockstar had released a March CU anyway?

- SUs do not seem to have a big impact. The only exception is the Festive Surprise update, which is launched during Christmas, so it is difficult to assess if the spikes are due to the holiday period or the SU.

GTA Online has an incredible story and is a unique game in the current landscape. The main takeaway in my opinion is that more than a tight and consistent schedule, analyzing numbers and players’ behavior can lead to great decisions, such as Rockstar’s move to reduce the number of main updates released every year in order to focus on the most successful ones and the most effective launch periods of the year to maximize the outcome in terms of concurrent players, DAUs and, potentially, revenues.

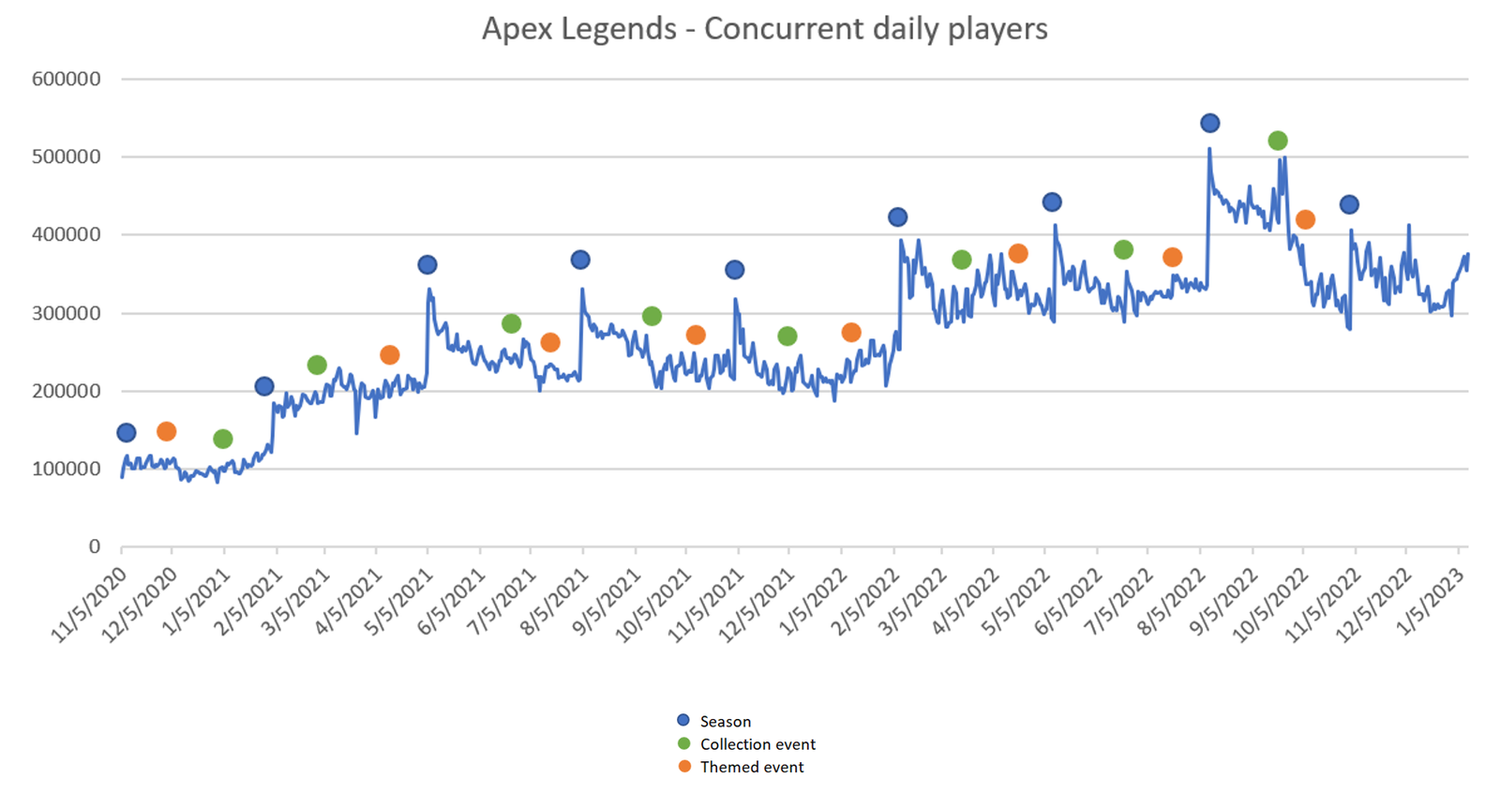

Apex Legends — Consistency is Key

Unlike GTA Online, Apex has been incredibly consistent in its update release. Content updates are called Seasons, which last on average 13 or 14 weeks, and there are smaller updates (called Collection and Themed events), which can be described as recurring events. Collection events are usually launched one month after a new season launch, while Themed events follow one month after the related Collection event (thus, two months after a new season launch). Basically, if we consider these three different update categories, there is something new going on in Apex every month. More specifically, let’s look at the content of each update:

- CU (Season): a new Season always includes a new Legend, a major map update, new loot items, and sometimes new gameplay features

- SU (Collection and Themed events): the two kinds of event are pretty similar; each one provides a new limited-time mode and cosmetics. Sometimes they also provide a small map change or a town takeover. Collection events are usually more cosmetics-focused with specific events that let you earn limited-time cosmetics.

- RU: there are recurring events in Apex Legends, such as the Xmas and Halloween updates, but they are minor updates with only themed cosmetics. It seems like they are not a main focus for Respawn.

Let’s summarize the takeaways:

- Season launches are huge in terms of impact on the active users, although the number goes down rapidly just a few weeks after the launch.

- While there is a flat trendline for Seasons launched in 2021, the trend is clearly upwards for the 2022 Seasons. It would be interesting to deep dive here and try to understand what Respawn changed.

- Also, Season 14 has been incredibly successful: it is the first season after the launch of Apex mobile (which launched on May 17th, 2022) – could this be the reason of its success?

- Themed and Collection events are successful in stopping the hemorrhage of players after a Season launch. Respawn has been incredibly successful in understanding that a major update each month is enough to keep players interested and playing until the launch of a new season.

Apex so far has had a perfect pace when launching new seasons and updates. It would be interesting to understand if the decrease in active users right after the new season can be diminished by adding more events near the season launch and by not waiting around one month as it happens now, but overall, the game shows how monthly updates are a good strategy for FPS F2P games on PC.

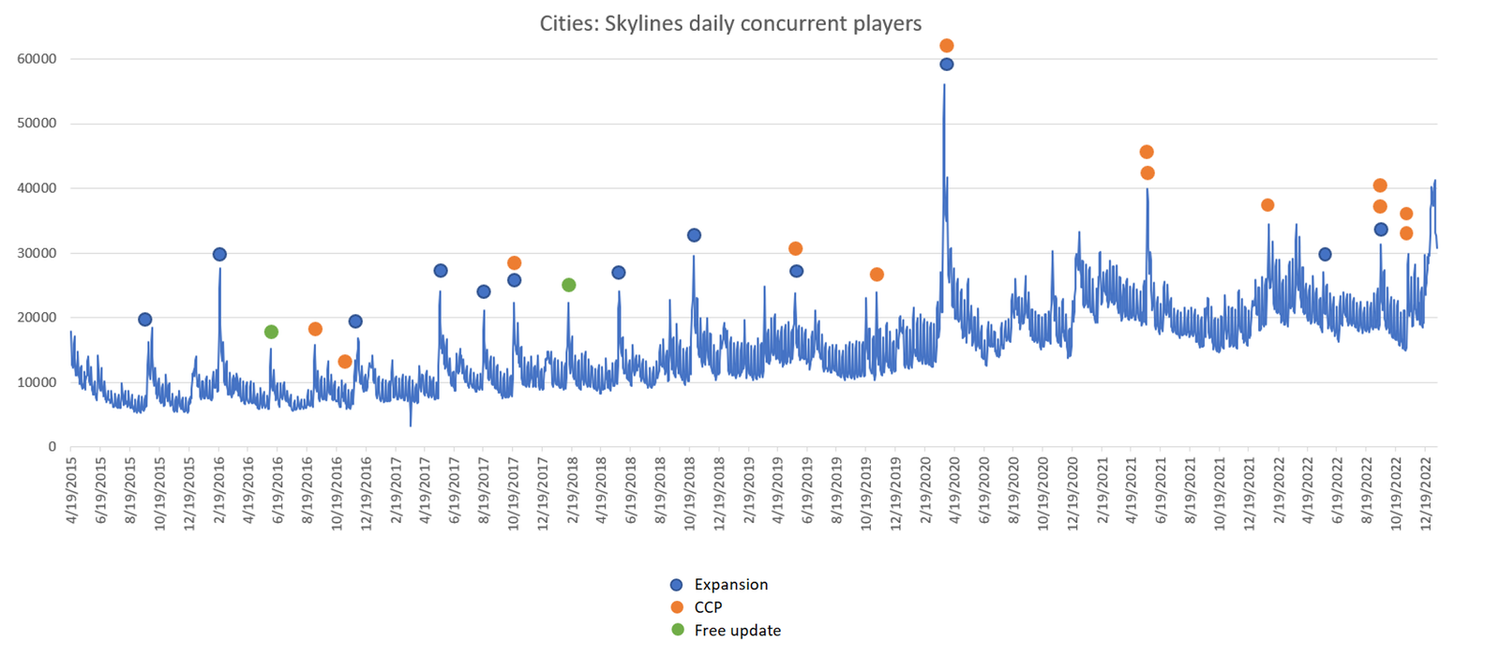

Cities:Skylines — How Do Paid DLCs Work?

As the last entry for this analysis, I have picked up a somewhat different game: Cities:Skylines (C:S). Differently from GTA Online and Apex Legends, C:S is a premium game, with expansions that are sold and not given for free. The business model is thus different, but does this change how players behave when Paradox releases a new DLC?

Let’s take a look at the different kinds of updates for C:S:

- Expansions: these are the big, paid DLCs. Each expansion changes the game considerably, with new gameplay mechanics and specific themes not initially included in the base game. Price tag is usually $14.99, but there are exceptions at $12.99.

- Content Creator Packs (CCPs): CCPs are the take on UGC by Paradox. These DLCs are smaller than the Expansions described above, and usually provide new in-game assets, but no major changes to game mechanics. They are co-developed with famous modders of the C:S community. Price tag varies between $5.99 and $4.99.

- Other minor expansions: Paradox also releases smaller DLCs, such as Music packs, with are sold for $3.99 and expand the game’s soundtrack with new radios.

The focus of this analysis will mostly be on Expansions and CCPs.

Let’s discuss some takeaways:

- Before COVID, Paradox was incredibly consistent with the DLC update schedule. Usually, two Expansions were released each year, one around March and one around October. Moreover, CCPs were usually released together with a major expansion. Unlike GTA Online and Apex, the effect of DLCs doesn’t last as much. Despite this, the frequency of updates seems enough to push the trendline upwards.

- It is interesting to see how Paradox has leveraged CCPs after COVID: between 2020 and the first half of 2022, only CCPs have been released and it seems like they have been able to have an effect on daily players similar to main DLCs. It would be interesting to see if this lasts also now that Paradox has resumed the released of in-house developed expansions.

In conclusion, C:S has adopted a release schedule for DLCs pretty similar to how new online, F2P games release updates. The model seems to work, and players do not mind paying for a base game plus additional DLCs. For sure, F2P models are great, but C:S is a great example that shows how old-style revenue models can still work in today’s market.

This first analysis has highlighted how updates (and DLCs) can drive up active players when released at the right time and frequently enough. Potential next steps could include similar analyses for other genres, focusing also on less successful games in order to understand if a lack of updates can lead to a decrease in the playerbase. Also, it could be interesting to focus on the length of the impact of these updates on the active users: how long after the release of the new update do the active players go back to where the number was before the update release? Does it depends on the kind of update? (Written by Michele Catano, MBA at Chicago Booth)

#2: Weekly News Roundup

Ubisoft can’t catch a break. This week, in a misleadingly titled statement, Ubisoft canceled three unannounced games (now seven total canceled in the past year), delayed Skull & Bones for a sixth time, is hunting for $200M in cost reductions, and significantly lowered its financial forecasts for the year. For any company, announcing this type of news would be a bad day, but for Ubisoft it has sadly become the norm. Over the past couple years, the company has struggled to properly manage live ops, find success in mobile, and stick to its launch schedules, which has led to a being a relatively bloated company with a floundering stock price. French laws also make downsizing more difficult. As you may recall, last September Tencent acquired 49% of the Guillemot family’s holding company, which owns a significant stake in Ubisoft; we said this move could help Ubisoft improve in mobile, expand more into China, and it locks in the Guillemot family’s control. Given the ongoing struggles, however, perhaps that last part needs to change. It’s rumored that Ubisoft is now considering a sale. Whether this actually happens is TBD, but it’s interesting to think about who could (or want to) swoop in. Tencent? Private equity? We’ll have to wait and see.

Hypercasual and web3 are colliding. Voodoo, one of the world’s leading hypercasual publishers, is making a big bet on blockchain gaming. The so-called “Voodoo Infinity” ecosystem, which is set to launch this Fall, will run on Polygon, entail an initial coin offering (ICO) of “Voodoo Coin,” and actively work with a new Discord community of early users and play testers. Several blockchain games are supposedly already in development, too. This news is notable, because it’s an early example of a major mobile publisher centering a big part of its strategy around web3, but it’s not as surprising as it may sound. After all, hypercasual necessitates continued evolution and experimentation, and many of the top web3 games right now (in terms of active wallets) already lean hypercasual. Of course, it’s too early to judge. Is the economy going to lean play-to-earn? How will inflation be managed? Will NFTs be involved? Will it butt heads with ever-changing App Store policies? We’ll find out eventually. (PS — Naavik Pro will be dissecting this announcement in much greater detail tomorrow.)

Everyone has a Microsoft / Activision opinion. This week, both Google and Nvidia (unsurprisingly) shared their concerns with the FTC about Microsoft’s proposed acquisition of Activision Blizzard. Nvidia, with GeForce NOW, is of course concerned about losing any further competitive advantage in subscription-related cloud streaming, and Google, which is on the cusp of shuttering Stadia and competes with Microsoft in cloud computing, would want to ensure that these changes don’t impact its mobile business in any outsized way. It’s fair to have concerns and scrutinize the terms given the size of the deal, but these concerns shouldn’t (not to say “won’t”) have an impact. It’s important to remember that even though this proposed acquisition does consolidate market share, it actually increases competition — specifically business model competition, which is healthy, completely normal across the history of the games industry, and potentially good for consumers. Concessions, like forcing certain franchises like Call of Duty to still be available cross-platform, are fine (and Xbox is onboard with that), but the FTC (and other regulators) will fail to do its job if it resorts to its typical “big tech bad” mentality versus realizing that stopping this deal would limit competition and keep the industry from evolving.

Two quick China updates. First, Blizzard is reportedly nearing the end of negotiations to lock down a new Chinese publisher to support its games (like World of Warcraft, Overwatch, and Hearthstone) in the region. This is a win for Chinese fans, should be a win for shareholders, will be a big win for whoever wins the bid, and we’ll likely learn who the winner is soon. Second, even though China’s crackdown on tech and gaming has eased in recent months, the government‘s influence has by no means waned. It was reported this week that China is taking “golden shares” of several companies, including Alibaba and likely Tencent; this means the government could simply take ~1% of the company and use these super-powered shares to demand a board seat and exert influence throughout the company. This has already happened in companies like Bytedance and Weibo, and it’s clear the government isn’t as passive as the business leaders (or international governments) would hope. It might not have an outsized impact on gaming decisions, but it certainly won’t have no impact either.

In Other News

💸 Funding & Acquisitions:

- Seidr raised a seed round led by a16z. Link

- Giga Fun Studios raised a $2.4M seed led by Lumikai Fund. Link

📊 Business:

- D&D’s update on the OGL debacle we wrote about last week. Link

- Nvidia and Google express concern over the ATVI merger. Link

- Subscription platforms for an indie game are “awesome” and “terrifying”. Link

- According to Data.ai, mobile games spending dipped to 5% to $110B. Link

🕹 Culture & Games:

- Limit Break introduced opt-in programmable royalties. Link

- Roblox is slated to launch on Meta Quest. Link

- After delaying Skull and Bones and canceling three game projects, Ubisoft is rumored for acquisition. Link

👾 Miscellaneous Musings:

- Monetization via in-game advertising. Link

- A conversation with Dhayana Sena, founder of Women at Xbox. Link

- The transition to live services continues. Link

This Week In Naavik Pro

Looking for more great games industry analysis? Check out Naavik Pro!

This past week the Naavik Pro team published:

- A game deconstruction of Marvel Snap, which quickly made a name for itself in the CCG genre.

- A new web3 gaming monthly market update that digs into the top game, user, transaction volume, and funding trends of the past month.

- Analysis on Moon Active’s acquisition of Zen Match, Square Enix’s commitment to blockchain gaming, and PUBG’s growing NFT interests.

- An updated game radar with takes on ZOZ Final Hour and Eversoul.

Next week, we’re publishing an incredible tokenomics deep dive into several games (Illuvium, Crypto Unicorns, Splinterlands, and Star Atlas), coverage on data.ai’s latest mobile games report, an exploration of upcoming web3 FPS games, and analyses on both Voodoo’s entry into web3 and Limit Break’s new royalty tech. And there’s much more coming after that!

If interested in learning more or signing up, request a demo below.

🔥Featured Jobs

- Dims: Game Engine Programmer (Stockholm, Remote)

- LBank: BD Manage (Remote)

- Mod.io: Developer Relations Lead (Remote)

- Immutable: Principal Engineer (Australia, Remote)

- Carry1st: Lead Game Designer — Cooperative Social Slots (Remote)

- People Can Fly: Senior Market Research Analyst (Canada, Remote)

- GoFashion: CTO / Senior Unity Developer (London, Remote)

- NetEase: Strategy & GameDev Enabling Manager (Remote)

- PlaytestCloud: Full Stack Engineer (Berlin, Remote)

- FunPlus: Lead Game Developer — Casual Games (Barcelona)

- FunPlus: Senior Game Developer - Unity (Barcelona)

- FunPlus: Senior Game Developer (Barcelona)

- Included Games: Senior Mobile Game Designer (London, Remote)

- Stillfront: SVP Operations Management & Processes (Stockholm, Remote — Europe)

- Naavik: Managing Editor (Remote)

- Naavik: Roundtable Panelist (Remote)