Hi Everyone. Welcome to another issue of Naavik Digest! If you missed last issue, be sure to check out our report on Epic’s Year in Review and how the company’s mission to compete with Steam is progressing. Today, we’re looking at five unique games that have broken into the Top 100 Highest-Grossing mobile and what we can learn from their success.

Unleashing Africa’s Gaming Opportunity + Using AI to Build Smarter NPCs

Lucy Hoffman: Unleashing Africa’s Gaming Opportunity. In this episode, Lucy Hoffman – co-founder and COO of Carry1st – joins Naavik co-founder Aaron Bush to discuss Africa’s exciting gaming trajectory, including how the region’s extreme diversity poses unique challenges and opportunities. The duo also explores the state of Carry1st with breakdowns of the company’s publishing, game development, and technology strategies. Lucy also shares lessons learned about managing company culture with a fully remote and rapidly growing team and how obsessing about serving customer needs could lead to even bigger opportunities down the road. Website | YouTube | Spotify | Apple Podcast | Google Podcast.

Kylan Gibbs: Using AI to Build Smarter NPCs. NPCs in games are notoriously goofy. They walk into walls, they repeat themselves over and over again and they run out of cover in the middle of a gunfight. At their best, they kind of just blend into the surroundings and the player barely notices they are there. At their worst, they actually ruin the gameplay experience. But what if we could use the latest developments in artificial intelligence and machine learning technologies to give NPCs more intelligence and real personalities? Could NPCs and how they behave become a core part of the game, even a reason to play and replay a game? Kylan Gibbs, co-founder and Chief Product Officer of Inworld.ai is trying to do just that, and joins your host, Niko Vuori, to discuss how, and why now. Website | YouTube | Spotify | Apple Podcast | Google Podcast.

#1: Cracking The Top 100: How These Five Mobile Games Broke Through

For the past five years, the mobile gaming industry’s Top 100 Highest-Grossing list has remained relatively static. Launching new games with staying power is harder than ever, while many of the top games and the developers behind them continue to capture a vast majority of player spending and engagement.

As the dust from Apple's privacy changes has finally begun to settle, mobile is also facing one of its most challenging periods to date. In 2022, mobile gaming experienced its first-ever decline amid the global economic downturn. Although revenue and downloads remain higher than in pre-COVID years, the market correction of last year has started to strain the mobile gaming ecosystem.

But it’s not doom and gloom on mobile. Despite these obstacles, five games emerged over the past 12 months and skyrocketed into the top 100 list, proving that it’s still possible to break through with the right mix of game design, business model innovation, and market fit. Let's unpack these games one by one, see what we can take away from their unique success, and try to understand how these different studios managed to innovate in their respective genres.

Note on data: Revenue (net) and download data sourced from data.ai. Numbers only cover Android's Google Play and iOS's App Store. PC versions and alternative mobile app stores are excluded. Twelve-month run rates are based on mobile net revenue from the past 30 days.

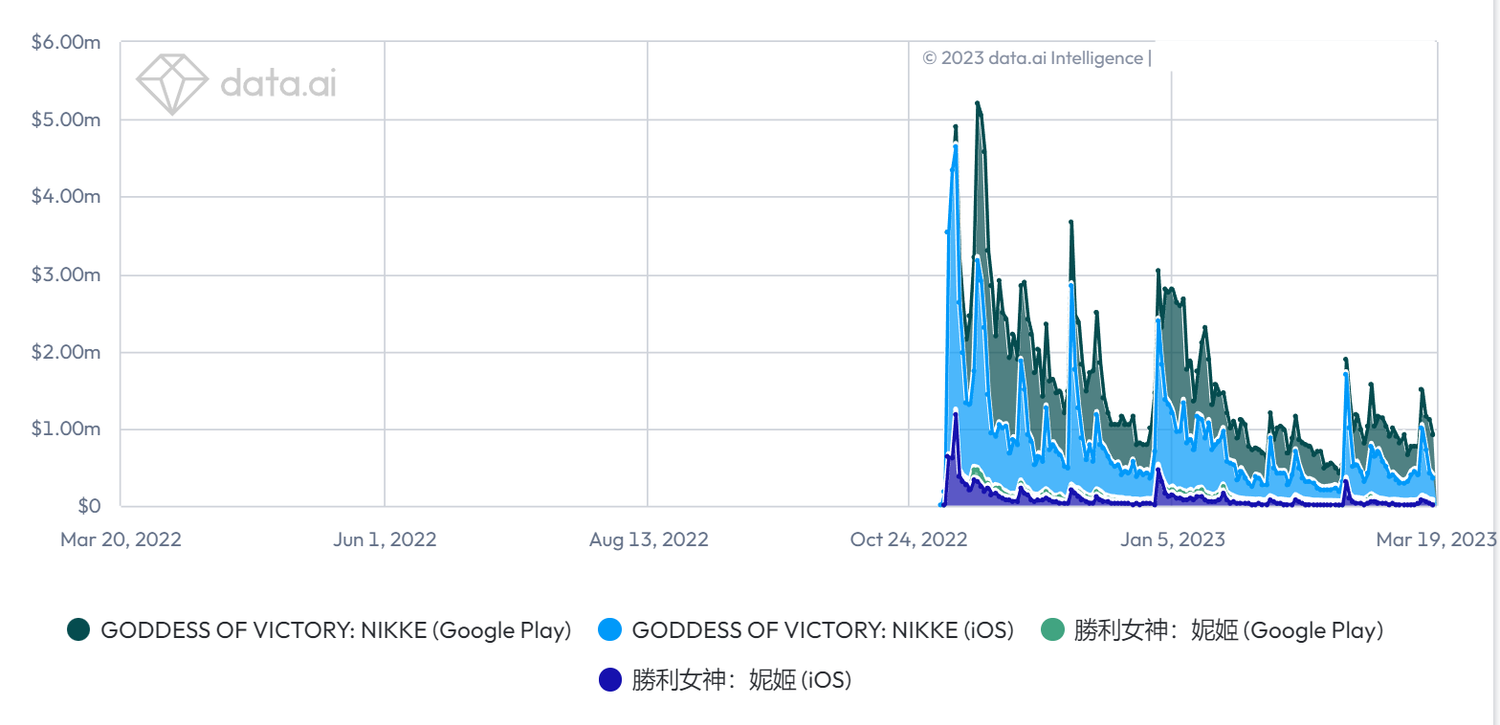

1. NIKKE: Goddess of Victory

- Released November 4th, 2022

- To date: 8.5 million downloads | $219 million revenue

- Forward-looking 12-month run rate: $345 million

Nikke is a team battler with extraordinary production values. Let's call out what Nikke is: a gacha game about sexualized, well-animated anime girls. It's not the only game that monetizes on hormones and gambling, but it certainly is among the most successful.

The game is developed by Tencent's Shift Up studio based in South Korea. As usual, success comes with practice. Shift Up has been producing so-called waifu games for years. Followers of the genre might be familiar with Shift Up's 2016 title Destiny Child, a reasonable success at the time.

Interestingly, in a time when industry pundits have advised chasing broader mainstream appeal while leaving whale-heavy niche games alone, Tencent has taken the opposite route by delivering… well, a niche game based on whale monetization. High production values and a spot-on understanding of its target ACG audience set it apart from its competitors.

2. Survivor!.io

- Released July 21st, 2022

- 59 million downloads | $341 million revenue

- Forward-looking 12-month run rate: $250 million

The awkwardly-named Survivor!.io is Habby's follow-up on Archero. It's a flawless mobile implementation of the addicting gameplay of the 2021 Steam indie hit Vampire Survivors. Habby showed the first signs of Survivor!.io in 2020, though the project went through a full pivot when Poncle’s Vampire Survivors became a surprise hit in 2021.

After Vampire Survivors went viral on Steam, it wasn't difficult to imagine how the game could be modified to work on mobile. What was hard to predict was just how well it scaled. If Nikke bases its business case on a relatively niche audience with extreme monetization, Survivor!.io does the opposite. It boasts hypercasual approachability and essential free-to-play power progression.

This formula helped Survivor!.io crack the top 50 highest-grossing games and has established the title as the preeminent roguelike shoot 'em up at a time when scores of copycats have been trying to ride the wave Vampire Survivors created.

3. Triple Match 3D

- Released April 13th, 2022

- 6.6 million downloads, $59 million revenue

- Forward-looking 12-month run rate: $166 million

Triple Match 3D has snuck on us largely unnoticed. By now, it's making a whopping half a million dollars a day in in-app purchases and still growing. The game is developed by Boombox Games, a studio closely affiliated with Ilyon, which in turn was bought by Miniclip some years ago.

Meta game and monetization design are fully solved in casual puzzles. What has remained are novel core experiences, which Triple Match 3D delivers. Triple Match 3D takes inspiration from competitors Match 3D and Zen Match and adds some best practices from level-based puzzle games.

The result is the biggest money maker in the casual puzzle genre since Royal Match, and Boombox Games have secured a spot within the Top 50 at time of writing.

4. Marvel Snap

- Released October 18th, 2022

- 14.7 million downloads, $59 million revenue

- Forward-looking 12-month run rate: $148 million

Marvel Snap is a casual competitive card game made by ex-Hearthstone developers at Second Dinner.

It would be easy to attribute Snap's success to Marvel's enormous brand appeal. It certainly helps, but it is only part of the story. Snap could have joined the numerous forgotten Marvel-themed games in the graveyard of free-to-play games. Instead, it took the industry by surprise with its grandiose launch and its longevity.

There are two remarkable feats that Snap achieves. First, Snap's core gameplay is a best-in-class design for casual card battlers. Second, Snap's progression system balances out power progression and collectibles, unlike any game before.

All three pieces are needed to complete the puzzle: the Marvel IP to help get downloads, the stellar card game to hook and engage, and progression systems that stand the test of time. Out of these, the card game design is the most challenging to deliver.

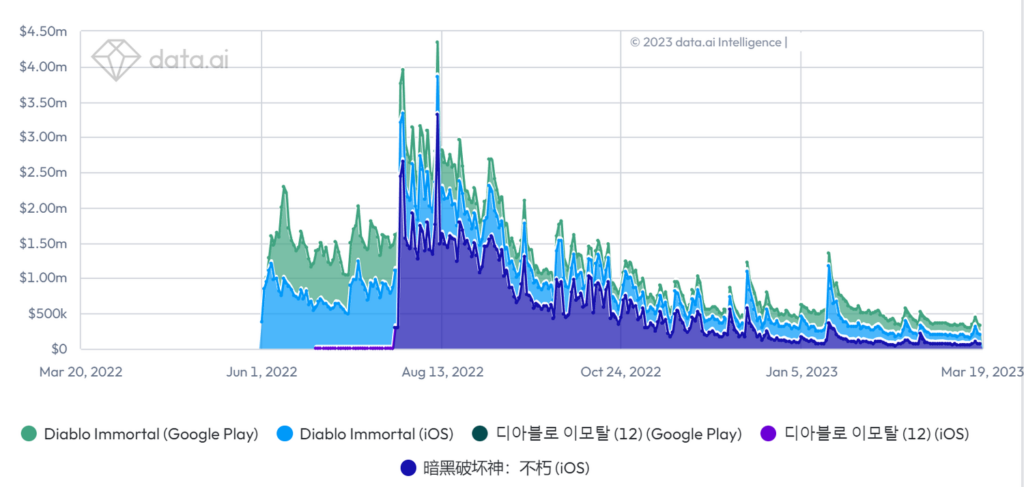

5. Diablo Immortal

- Released June 2nd, 2022

- 21.4 million downloads, $341 million revenue

- Forward-looking 12-month run rate: $135 million

Diablo Immortal is a mobile take on one of the biggest game IPs, arriving last summer armed with deep, gacha-style monetization. The game itself is a solid hack 'n slash for mobile. On the other hand, the monetization patterns might be familiar to fans of Eastern free-to-play action RPGs, but novel to most Western audiences.

As a result, when Immortal was first released, it simultaneously made a ridiculous amount of money and angered hardcore Diablo fans. While the monetization worked, the trade-off was longevity. Diablo Immortal made most of its revenue in the first six months and has declined ever since.

Key Takeaways

The staying power of F2P titles is formidable. Games like Clash of Clans, Candy Crush Saga, and Puzzle & Dragons have lived for over a decade while remaining staples of the top-grossing list; Sybo’s Subway Surfers recently surpassed a staggering 4 billion in lifetime downloads, thanks in part to a second life the game has enjoyed as a backdrop to narration videos on TikTok.

Players' engagement minutes are a resource even scarcer than their money, and live-operated games get better and better at hogging that precious time as the attention economy grows more competitive. Yet some companies still succeed in releasing new games, and with varied approaches.

For developers looking to break through, it’s a good reminder that genres need not be new and novel, like the roguelike shoot ‘em up, or well established, like the collectible card game, to be ripe for unique approaches. The same is true of targeting niche versus mainstream players. Whether the game is a competitive multiplayer title, a solo puzzle game, or a clever remix of a viral PC indie hit, there is ample opportunity to serve the right audience with the appropriate level of monetization to achieve success.

All five aforementioned games are wildly different, but the common thread is their flawless execution of a concept with inherent market demand. This is, of course, all easier said than done. But it is certainly not impossible. (Written by Miikka Ahonen, Co-founder of Lightheart Entertainment)

#2: League of Kingdoms: An Unremarkable Strategy Game With Remarkable Land NFTs

This piece is a preview of a game deconstruction written by Anthony Pecorella for Naavik Pro. To read the full piece, along with our other Naavik Pro content, request a trial now.

League of Kingdoms’ Land could become a new template for Web2.5 game design.

That’s a bit surprising since League of Kingdoms is a fairly run-of-the-mill game in many ways. As a mobile game, it is indistinguishable from other titles in the fantasy-themed 4X MMO strategy game genre. As a blockchain game, it has a lot of familiar elements: generative pet-style NFTs (Dragos), a capped governance token (LOKA), an uncapped utility token (DST), and NFT land (Land) that generates token yields over time. (Note: some of the features just listed are not yet live, but should be soon.)

We touch on all of these points and more in this deconstruction, but where League of Kingdoms really shines is in the structure and implementation of the Land gameplay. Land exists as an almost entirely separate layer from the core game, which creates a dynamic that is more app-store friendly, more consistent with blockchain ideals, and more open to player creativity and entrepreneurship.

League of Kingdoms is developed by Seoul-based NOD Games and published by Singapore-based NPLUS. Very little information is available about NPLUS, but we know a bit more about NOD Games. The company is led by CEO Chan Lee, who has a background in finance and also co-founded NEXTMATCH, a dating app company acquired for around $7.5 million USD in 2018. He is joined on the executive team by CEO Steve Hwang, who has 20 years of experience building games at Gamevil, EA, NHN, and COM2US; and COO Han Yoo, who has a background in supply chain and product management at LG Electronics.

They have put together a heavy-hitting team to develop League of Kingdoms. The core leadership team comes from Netmarble, NEXON, KAKAO Games, NC Soft, and more, with the members each having 10 to 20 years of industry experience. Per the NOD Games website, the team is also developing Crypto Sword and Magic, though it appears to either be on hold or abandoned. There have been neither any tweets nor any Medium posts since mid-2020 regarding that project.

We’ll kick off this analysis with a look at the game’s performance on mobile and browser, then look at the tokenomics, dig into the gameplay, say a few words on earning potential, and finally look at the implications of its somewhat unique NFT structure.

Content Worth Consuming

The Generative AI Revolution will Enable Anyone to Create Games (a16z): “As the Generative AI Revolution in Games progresses, it will completely reshape User Generated Content (UGC) creating a world where anyone can build games and expanding the games market beyond what many thought was possible. In the coming years, deep technical knowledge or artistic mastery will no longer be essential skills needed to develop games; instead, creators will be limited only by their energy, creativity, and imagination. Ideas won’t be cheap; they’ll be precious. Most importantly, game creation will become truly democratized and millions of new game-makers will be minted.” Link

Mo' ATT, mo' problems: Why Supercell’s next hit must overcome Apple’s privacy assault (PocketGamer): “To be clear, Supercell continues to be a highly successful mobile games company and maintains its position as one of the best in the business. Paananen is candid in the challenges he faces in his post, many of which are not mentioned in this piece. But it seems clear that even the mighty Supercell is not immune from the new mobile landscape wrought by ATT, and that is surely one of its biggest, unspoken challenges.” Link

The UX Behind TheUnlock at Riot Games: Part 1 (Cheryl Platz | Medium): “On June 13, 2022, Microsoft and Riot Games announced a groundbreaking new partnership — Riot would be bringing our free-to-play games to Xbox Game Pass members… In this new series, we’re going to pull back the curtain on some of the key components of this exciting journey from the perspective of the user experience design discipline. What did we bring to the table, how did we help, what did we learn, and what was the impact? In this first article, let’s look at how UX contributed to the business development conversations that preceded our initial contract execution.” Link

Nintendo (Acquired): “The lovable Disney-like Nintendo that we know today is a 130 year-old a playing card company (i.e. gambling), forged in the shadowy world of the Yakuza and shaped by a four-generation cycle of bitter family betrayal. And its unlikely transformation into a global multi-billion dollar media monopoly was led by an iron-fisted patriarch who — amazingly — never played a video game in his life! Get ready for one of our favorite stories Acquired has ever told — we couldn’t make this one up if we tried.” Link

🔥Featured Jobs

- Coda Payments: VP of Growth (Los Angeles, California)

- Modulate: Content Marketing Associate (Somerville, Massachusetts)

- Carry1st: Head of Product Marketing (Barcelona, Spain | Remote)

- Merit Circle: Head of Investment & Partnerships (Amsterdam | Remote)

- FunPlus: Lead Game Designer - New Casual Studio (Barcelona, Spain)

- Flick Games: Chief of Staff (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during a harsh period of layoffs. Every job post garners ~50K impressions over the 45-day newsletter featuring period and results in 1 - 10 applications depending on the company and role.