Hi everyone. As you may have read in Wednesday's issue, Naavik is nearing the launch of a brand new Open Gaming Research Initiative that we can't wait to tell you more about. We'll share all the details next week, but for now please note that Naavik Digest is changing its publication cadence to Sunday, Monday, Tuesday, and Thursday. We can't wait to provide you with even more game industry research!

Now onto today’s issue. If you missed our last one, be sure to check out our dive into the early success of Blizzard’s Diablo IV and how the ARPG series is approaching monetization. In this issue, we take a look at the ongoing struggles of GameStop and examine what went wrong with its turnaround strategy.

Embracer Restructuring / Apple’s AR / Not-E3 Week

In this week's Roundtable, we discuss the biggest news from the Not-E3 showcases hosted by major game publishers like Microsoft and Ubisoft. We also debate if Embracer’s announced restructuring will help the company in the long run. Other topics on the agenda include whether the FTC can stop Microsoft from acquiring Activision Blizzard at the last second, the gritty details on how hurdle rates could be influencing investments, and what impact Apple’s Vision Pro and the Meta Quest 3 might have on XR gaming. Additionally, we touch on Reddit's controversial policy changes that led to widespread and ongoing subreddit blackouts and discuss if this protest movement might make a difference. Join us for all the latest games business news with Sebastian Park, Dave Elton, Aaron Bush, and host Devin Becker.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1 GameStop’s Failed Turnaround

Written by Mario Stefanidis, CFA, Naavik Contributor

GameStop has somehow still managed to stay relevant in 2023. The company of course continues to be volatile following earnings releases, but this one for the Q1 FY23 period came with the surprise axing of CEO Matthew Furlong. Adding insult to injury, GameStop canceled its earnings call in what appears to be a first for the beleaguered video game retailer. Little rationale was given for either decision, leaving investors more perplexed than ever.

For the three months ending April 29th, the company reported revenue of $1.24 billion, down from last quarter’s revenue of $1.38 billion and missing consensus expectations which called for $1.36 billion. Earnings per share (EPS) of -$0.14 was slightly better than expectations of -$0.16, but still represents a swing back to loss territory after Q4 FY22’s unexpected profit, GameStop’s first in eight quarters. The surprise profit was driven by cost-cutting control efforts and net sales, which were $50 million higher than estimates.

The shakeup in management added further negative sentiment to the earnings report. GameStop parted ways with Furlong “without cause,” exactly two years after the former Amazon executive was poached from his role as Country Leader for Australia. This is the seventh CEO for the company since 2008, when counting Daniel DeMatteo’s two separate tenures at the helm. Executive chairman and activist investor Ryan Cohen was appointed as the new CEO effective immediately. Cohen is the largest GameStop shareholder, owning 11.9% of the company, according to recent filings.

Furthermore, the company canceled its scheduled quarterly conference call without providing a rationale. Investors were left perplexed at these erratic moves, causing shares to fall -17.9% in the subsequent June 8th trading session, the steepest single-day decline since June 10th, 2021, after the “meme stock” craze of early 2021 had cooled off.

The Q1 recent results mark continued woes for GameStop, which thus far has failed to execute on its multiple turnaround strategies over the years. Cohen amassed the bulk of his GameStop stake in late 2020 with a profound transformation strategy for the company. His plans were to convert the retailer, which generates the majority of its revenue via brick-and-mortar operations, into a lean ecommerce operation, similar to the strategy he pursued at Chewy, an American online-only retailer of pet food and other pet products. Cohen was appointed to the board in January 2021 along with two other Chewy executives and became chairman at the annual meeting one quarter later.

The move to ecommerce has not fared as well as either Cohen or Furlong had hoped, a pivot of paramount importance given 90% of new console games are only available digitally. In the footnotes of its latest earnings, the company concluded that the decline in gross profit was “partially offset by a decrease in freight expenses as a result of lower ecommerce volume.” Ecommerce volumes declined year over year during a time when GameStop’s investments should have been paying dividends. The quarter would have been even worse were it not for “an increase in sales of new gaming hardware,” as console demand remains hot following the end of supply shortages. Software sales collapsed from $483.7 million in FY22 Q1 to $338.3 million in the current quarter, from 35.1% of net sales to 27.3%.

The main issue facing Cohen has been GameStop’s retail footprint, a problem his previous venture never faced. GameStop had 4,816 stores worldwide according to the 2021 annual report; two years later, the retail presence has been pared to 4,413 stores – primarily across the GameStop, EB Games, and Micromania brands.

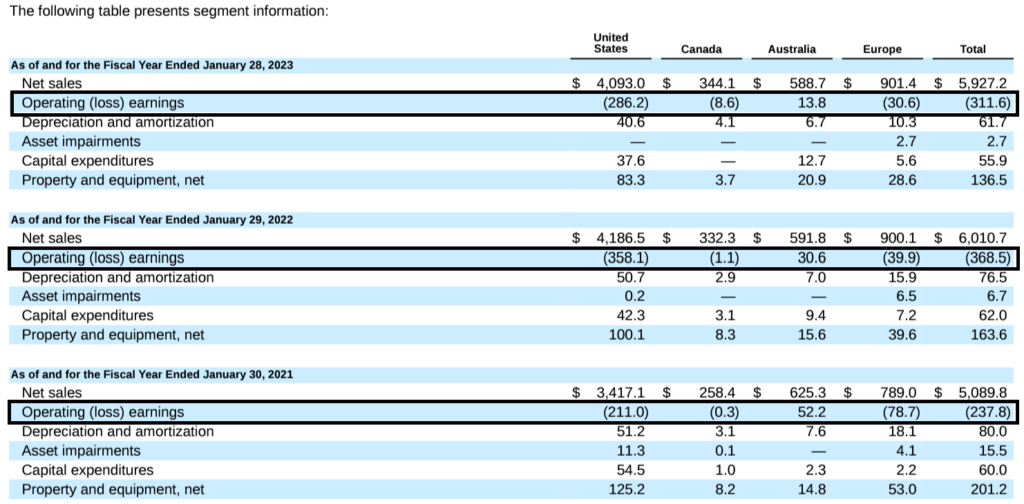

The company had previously owned Spring Mobile, and operated over 1,000 stores under the “Technology Brands” segment until Spring’s divestiture in January 2019. GameStop purchased Spring for an undisclosed amount in 2013 to diversify beyond video games into smartphones and personal electronics, an area in which GameStop had no competitive advantage. This blunder resulted in a $358 million asset impairment charge and a $32.8 million goodwill impairment charge in FY17 Q4. These stores are not included in the graph below.

The decline in store count actually began much earlier, with FY 2012 marking an inflection point for the company. Since then, stores across the gaming portfolio fell every year, from 6,602 to 4,413 today. This marks a 34% reduction, with revenue falling a similar amount over the period. The store bloat partially stems from GameStop’s failure to consolidate its gaming acquisitions, primarily after purchasing EB Games in 2005, which doubled its store count. GameStop’s store count more than doubled overnight from about 1,800 to over 3,800, and on paper eliminated its biggest rival, creating the largest video game retailer in the U.S. According to Reuters, this new entity controlled 25% of the retail video game market. By 2015, GameStop controlled a whopping 45% of physical game sales in the country.

After the purchase, many malls in the U.S. still operated both GameStop locations and EB Games locations. This became ruinous after the gradual, then sudden, transition to digital distribution, which began in the early 2010s. Stores cannibalized each other and then were eventually usurped by ecommerce, which neither brand was equipped to face.

EB Games and GameStop were fungible, both focusing on physical video game sales in a saturated marketplace. The former shifted toward retailing pop culture items in 2020, which came too late for the brand. EB Games has been the only profitable segment for GameStop, reporting positive operating earnings between FY2020 and FY2022.

However, these profits have not been enough to shore up the large losses incurred in the U.S. and Europe and are quickly waning. The EB Games brand is now, of course, defunct in North America and Europe, and all that is left are a few hundred stores in Australia and New Zealand consolidated under the Australia geographic segment for reporting purposes.

Another turnaround strategy, which was primarily championed by ex-CEO Furlong, would have seen GameStop become a one-stop shop for collectibles. As for physical collectibles, GameStop had purchased “geek culture” collectibles company ThinkGeek in 2015, but shut down its online store in June 2019. ThinkGeek once had more than 40 physical locations throughout the U.S., all of which have since been shuttered. Still, the company has been able to grow its collectibles share, which now comprises 16.3% of net sales, up 260 basis points since last year. In terms of digital collectibles such as NFTs, plans have already been rolled back after the company lost millions on its NFT marketplace venture.

GME stock does not tell the story of its fundamental troubles. Shares today are down -70% from their meme stock peak, but still higher than at any point before 2021, including the years when it notched record revenues and earnings well over a decade ago. In the three trading sessions following the earnings decline, shares have rebounded by 13.3%, retracing most of the losses. This can be chalked up to the fervent retail investor community, which continues to bid up GME shares well above what their fundamentals justify.

One benefit of GameStop’s meme stock status has been its ability to sell stock at a rich valuation. It last exploited this phenomenon in June 2021, when it sold 5 million shares to generate $1.1 billion in gross proceeds before commissions and expenses. Before that, GameStop sold 3.5 million shares to raise $551 million that April. This was only possible due to the stock being more than 30 times higher in price from the previous year. The company has yet to sell stock again, in part due to Cohen’s reluctance to invite additional dilution, but this lever always remains an option to fund any ambitious plans management may come up with.

From a fundamental perspective, the decline in stores has just resulted in a decline in revenue with little flow through to net income. Perhaps Cohen pitched the board with some sort of brilliant strategy that the rest of us are not privy to, but if this were the case, we should have heard about it on the Q1 earnings call that was abruptly canceled.

The PS5 Digital Edition marks the beginning of the end of the physical era. While some games will continue to have a physical presence via their Collector’s Editions (such as one for Bethesda’s Starfield that will retail for $300), the vast majority of unit sales are digital and this proportion continues to increase. The same way GameStop did not have an advantage selling smartphones under its former mobile business, the company simply does not have an advantage in ecommerce or with collectibles. Buying a game straight from one’s console saves so much time over navigating to GameStop’s site just to purchase a digital download.

On the collectibles front, it will still take a few years for the segment to make up a quarter of sales at the current pace. Websites like Entertainment Earth and Big Bad Toy Store have been selling collectibles for years and boast massive selections. It’s doubtful the new PowerUp Rewards structure, which will introduce 5% discounts across much of the store at the end of June, will be a dealbreaker for someone deciding to buy a statue of their favorite gaming character on one site over another. Starting June 27th, the service will be known as GameStop Pro and will cost $25 per year, up from $15.

Cohen has a lot of work on his plate in turning the GameStop ship around. His greatest ally is GME stock, which remains way above its pre-2021 price despite the fastest interest rate hiking cycle in over four decades. So far, every turnaround attempt has fallen flat, but at the current pace of cash burn and assuming no further secondaries, GameStop can continue to remain solvent for over a decade. Its biggest risk is losing the confidence of its investor base, which could spur a rapid retreat back to historical levels more than 90% lower.

GameIQ Solves The Industry's Toughest Challenges

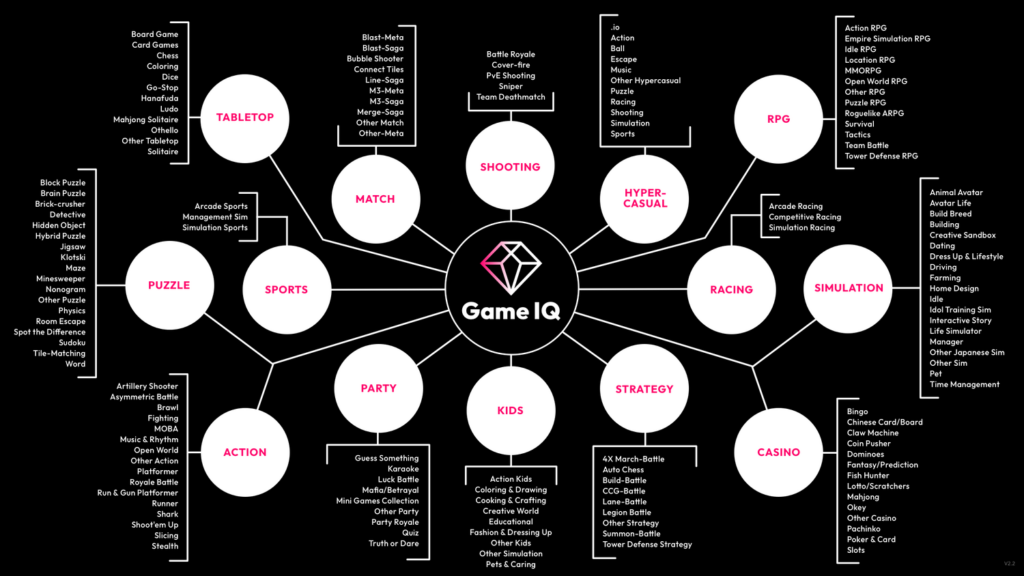

Game IQ is a market and competitive intelligence tool for mobile gaming that allows publishers to identify hidden growth opportunities, tie features to performance KPIs, and help you make difficult roadmap decisions. With hundreds of thousands of gaming apps in the app stores and thousands of new mobile games released each month, data.ai (formerly App Annie) is looking at a huge number of games to be classified. On top of this, the high granularity of our taxonomy structure makes it quite time-consuming to manually figure out into which category each game should fit.

How can we cover the vast majority of gaming apps in global markets accurately, efficiently, and in a scalable manner?

Game publishers and strategists today are facing various key challenges:

• Determining what features will provide lift

• Making roadmap decisions based on accurately modeled expected outcomes

• Discovering how competitors lifted performance through feature releases

• Benchmarking performance against competitors

• Confidently focusing on the highest potential genre for a new game release

With the enhancements we’ve made to data.ai Game IQ including Feature Tagging, Genre Summary, and Tag Trends, you can now effectively solve these challenges.

#2 Not-E3 Week, Embracer Restructures, Microsoft-Activision Shenanigans & Hyperplay’s Raise

Not-E3 week is a wrap. From Summer Games Fest to individual showcases from companies like Xbox, Ubisoft, and Capcom, the past week was filled with all sorts of game announcements. Some highlights include fresh gameplay or release dates for Starfield, Spider-Man 2, Final Fantasy VII Rebirth, Alan Wake 2, Mortal Kombat 1, Assassin’s Creed Mirage, Star Wars Outlaws, and Dragon’s Dogma 2. That’s just scratching the surface, and we could go in-depth on any one of these games; however, in general it’s clear that there’s no shortage of high-quality games on the horizon that will have to compete with each other for attention. In terms of businesses, Xbox likely eased some concerns regarding Starfield and its first-party line-up, Ubisoft’s pipeline outperformed expectations (especially with Star Wars Outlaws), and Capcom’s showcase was slow but of course took place on the heels of two major hits in recent months (Resident Evil 4 Remake and Street Fighter 6). As always, truly delivering great games is harder and more important than showcasing them, so we’ll be keeping an eye on all of these games and companies in the months and years ahead.

Embracer prepares to restructure. In previous issues, we covered Embracer’s aggressive growth-by-acquisition strategy and the fact that it sadly failed to result in per share value creation. The loss of a $2 billion contract a couple weeks ago was another major blow for the business. In the aftermath of those struggles, management has announced a new restructuring program that “is divided into different phases until March 2024 with focus on cost savings, capital allocation, efficiency and consolidation.” This likely means layoffs, project and studio closures, and a heightened emphasis on superior returns on invested capital. While unfortunate for many individuals and teams, becoming leaner and more focuses should help Embracer become more efficient and profitable, strengthen its balance sheet, and hopefully prepare for more sustainable organic growth in the future. Of course, changing process and culture around a large, decentralized organization isn’t easy, and putting centralizing pressures on decentralized operations is bound to create challenges. Best wishes to everyone at Embracer in weathering the storm and hopefully coming out stronger on the other side.

U.S. judge temporarily blocks the Microsoft-Activision deal. As much as we can’t wait to stop chronicling the ups and downs of this prospective $69 billion deal, there’s yet another update. Microsoft and Activision are racing to close the deal by the original July 18th deadline, and in order to stop the deal from closing before going to court, the FTC issued a restraining order against the merger, which a judge approved. What’s next? Well, in the next few weeks, this case is finally going to court, and it looks like a final decision (essentially whether a preliminary injunction is granted) could be made before the deadline in July. Microsoft and Activision rightly feel strong about their case, but there’s no point in speculating right now. If the U.S. judge decides not to file a preliminary injunction, it’s likely the deal goes through (and it seems like Microsoft will simply find workarounds in the U.K., the only other market where the deal is blocked). If a preliminary injunction is filed, it’s very likely game over since the companies won’t want to drag the process out longer (and Activision would walk away $3 billion richer). Let’s check back in a month.

Hyperplay raises $12 million. In short, the company is building a web3 gaming launcher that allows players to carry their wallets (of tokens, NFTs, achievements, etc.) across games. The effort began as a joint operation between Game7 (a DAO) and Consensys (which owns MetaMask), and the team is looking to be more developer friendly than what most experience with the standard 30% take rates. The money raised — in a Series A round led by BITKRAFT and Griffin Gaming Partners — will primarily go toward further development and global expansion. It’s nice to see web3 gaming infrastructure get further developed, but as with everything it’ll only succeed if and once web3-native games start to succeed at scale too.

In Other News…

💸 Funding & Acquisitions:

- M.O.B.A. Network acquired gaming modder Wargraphs for $54M. Link

- Mobile gaming studio Million Victories secured $6.5M in funding

📊 Business:

- U.S. judge temporarily blocked Microsoft’s attempt to buy Activision Blizzard. Link

- Embracer announced a restructuring program with studio closures expected. Link

- PlayStation is confident in its PS Plus strategy. Link

- Subway Surfers studio Kiloo Games laid off staff before July closure. Link

- Mobile sports game developer Nifty to close after five years. Link

🕹 Culture & Games:

- The big games, reveals, and trailers from Xbox Games Showcase. Link

- Ubisoft Forward Showcase 2023: The biggest announcements & games. Link

- Epic’s latest tool can animate hyperrealistic MetaHumans with an iPhone. Link

- Sony has started testing cloud streaming PS5 games. Link

👾 Miscellaneous Musings:

- Twitch & YouTube influencers are becoming video game publishers. Link

- Xbox is trying to turn the corner after a decade of struggle. Link

- Mario movie exec has no idea why people think a Zelda film is next. Link

🔥Featured Jobs

- Coda Payments: Managing Director, Publisher Partnerships (Los Angeles, U.S. / Hybrid)

- FunPlus: Senior Community Manager (Barcelona, Spain / Remote)

- LILA Games: Lead Gameplay Engineer (Remote)

- MY.GAMES: Game Designer (Remote)

- Nexus: Head of Sales (Remote)

- Supersocial: Game Designer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.