Hi Everyone. Welcome to another issue of Naavik Digest! If you missed last issue, be sure to check out our analysis of Roblox’s savvy gift card strategy.

If you’re attending GDC next week, Naavik Gaming Podcast Host Alexandra Takei will be moderating a panel titled “Do Video Games Need the Blockchain?” with Frost Giant Studios CEO Tim Morten, Azra Games Founder and CEO Mark Ortero, and Deconstructor of Fun Host Ethan Levy. The panel is at 5:30PM - 6:30PM on Tuesday, March 21st. Head here for full session information.

SVB Collapse + Applovin Spawns Redemption

How did the collapse of Silicon Valley Bank affect games? Why did Applovin spin out new studio Redemption? We dive into the latest games business news with Maria Gillies, Aaron Bush, David Kaye, and your host Devin Becker.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Epic Game Store & The Battle of The Long Tail

Epic Games released its annual Year In Review for Epic Game Store (EGS), revealing in detail some key statistics about its Steam competitor’s 2022 performance. The post revealed some now-familiar numbers around usage and spend — and one big publishing announcement I’ll touch on in a bit — that further help put EGS’s uphill battle against Steam in perspective:

- MAUs and DAUs peaked at 62 million (up 6 million YoY) and 34.3 million respectively

- Total games on EGS grew by 626 titles, bringing the total to 1,548

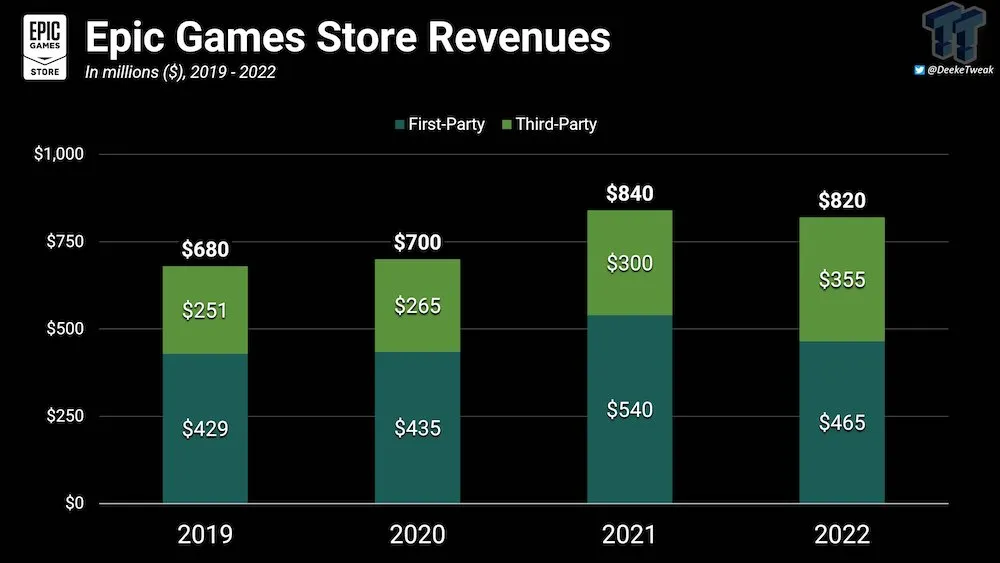

- Spend for third-party games increased 18% YoY to $355 million, while first-party spend was down 14% YoY to $465 million

- The company offered players 99 new free games, which were downloaded by over 700 million times

As analyst Simon Carless noted in his coverage, a deeper look at the metrics reveals a trend for EGS that we’ve been seeing play out since its launch in late 2018. This is mainly that GaaS-powered, first-party titles and platform-specific releases continue be the most popular games on the store. Epic-owned properties like Fortnite and Rocket League in addition to Genshin Impact — which is not available on Steam — and Tiny Tina’s Wonderlands (EGS deal) top the charts.

While this development isn’t surprising — Valve’s own games dominate two of Steam’s top five slots — it does emphasize a core issue I pointed to in my analysis of the store’s 2021 performance early last year: EGS is a top-heavy marketplace with an over-reliance on first-party games.

One year later, and the proof is in the numbers. Despite third-party spend increasing, total spend inclusive of both first and third-party games was down 2% YoY. Third-party contribution to EGS is improving YoY, but not fast enough to offset the slowdown in spending from Epic’s own first-party title. Epic knows this. EGS General Manager Steve Allison said as much in a recent interview with Axios, where he admitted the store derives almost half (in the range of 40 to 45% of revenue) from EGS exclusive titles. This is a far cry from the 75% revenue attribution seen when EGS launched years ago, but still indicates a pretty heavy reliance on a small handful of first-party titles — relative market share, though, indicates room to grow in other areas.

In my analysis of Epic’s prior year, I was convinced the solution to the problem was further development of the company’s publishing arm. To some degree, it’s still too early to tell if I was right. Epic-published Fall Guys cracked EGS’s top games, but smaller titles like PC Building Simulator 2 and Touch Type Tale II weren’t major needle movers (though to be fair they were never intended to be). I expect to see growing results here with the launch of Remedy Entertainment’s Alan Wake II later in 2023, but the budgets and development timelines for these games may not bear fruit for some time.

The other concern I have with leaning too heavily on Epic’s publishing model falls on marketplace concentration; that is, will a small portion of the games generating a large portion of the revenue turn EGS into a hits-driven platform rather than a self-sustaining marketplace? It also doesn’t help that the common narrative around EGS today is that its value is derived from first-party Epic titles and free games, while Steam is often hailed for having a large, diverse library of content (even if a majority of that content isn’t high quality.)

Data from the Epic v Apple antitrust case has already shown us that nothing besides the biggest games made an impact in the pre-publishing, minimum guarantee-centric era for EGS. Even with more of a diversified publishing budget, the battle for marketplace dominance won't be entirely won by having a more successful game in the No. 1 slot. That’s particularly true considering EGS has less than 1% of the titles that Steam has. A healthy marketplace needs to be sustained by a diverse and consistently growing array of genres and titles. By that logic, the battle Epic needs to fight is not only at the top of the funnel, but at the bottom as well.

The major development I alluded to earlier solves this exact problem, as the company publicly announced a self-publishing service for EGS. Punctuated by the store’s standard (and industry leading) 88-12 revenue share, the new self-publishing tool is designed to give small developers the ability to launch and release their own games straight to EGS without having to work directly with Epic itself.

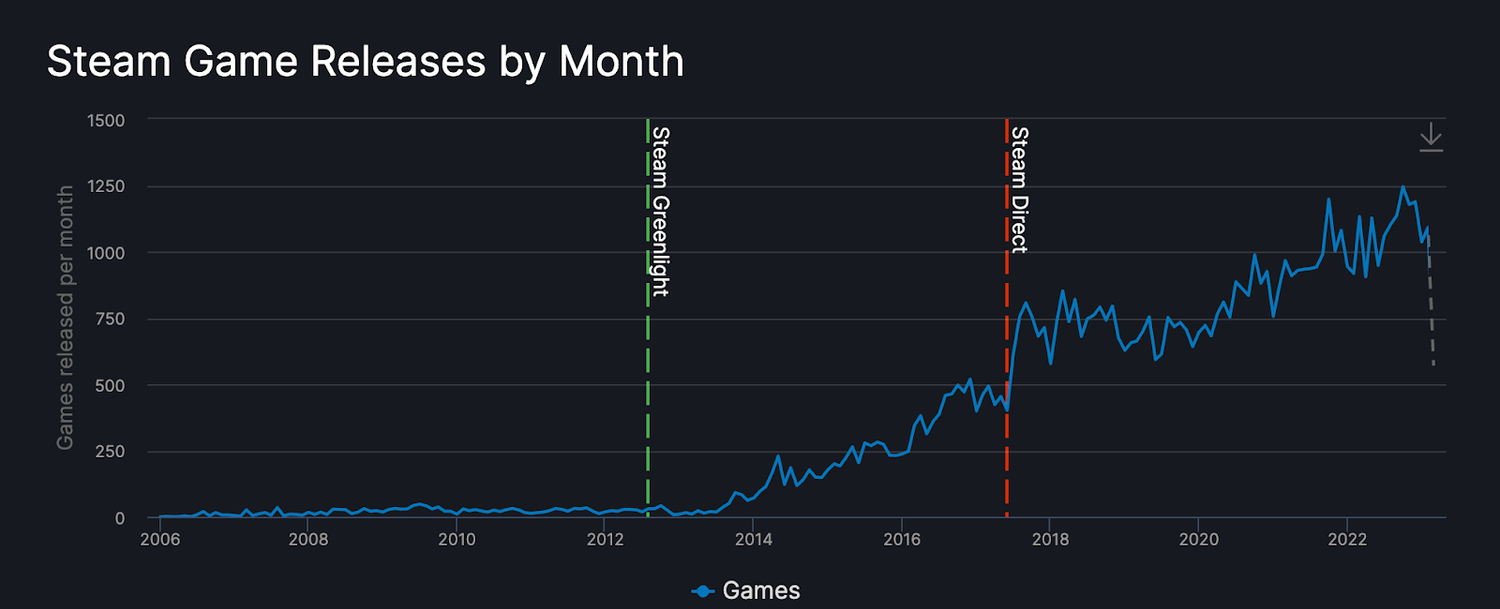

An analysis of Steam’s own self-publishing service gives us insight into the inspiration behind the launch. Originally released as Steam Greenlight, a fan-voted publishing service in 2012, the current iteration of the platform’s self-publishing arm, Steam Direct, has been a huge unlock for supply on the platform. And since the launch of Greenlight over 10 years ago, the number of games joining Steam each month has grown by over a 1,000. That is to say, the speed at which the supply on Steam has expanded has been increasing every year thanks to its self-publishing service and doesn’t show any sign of stopping.

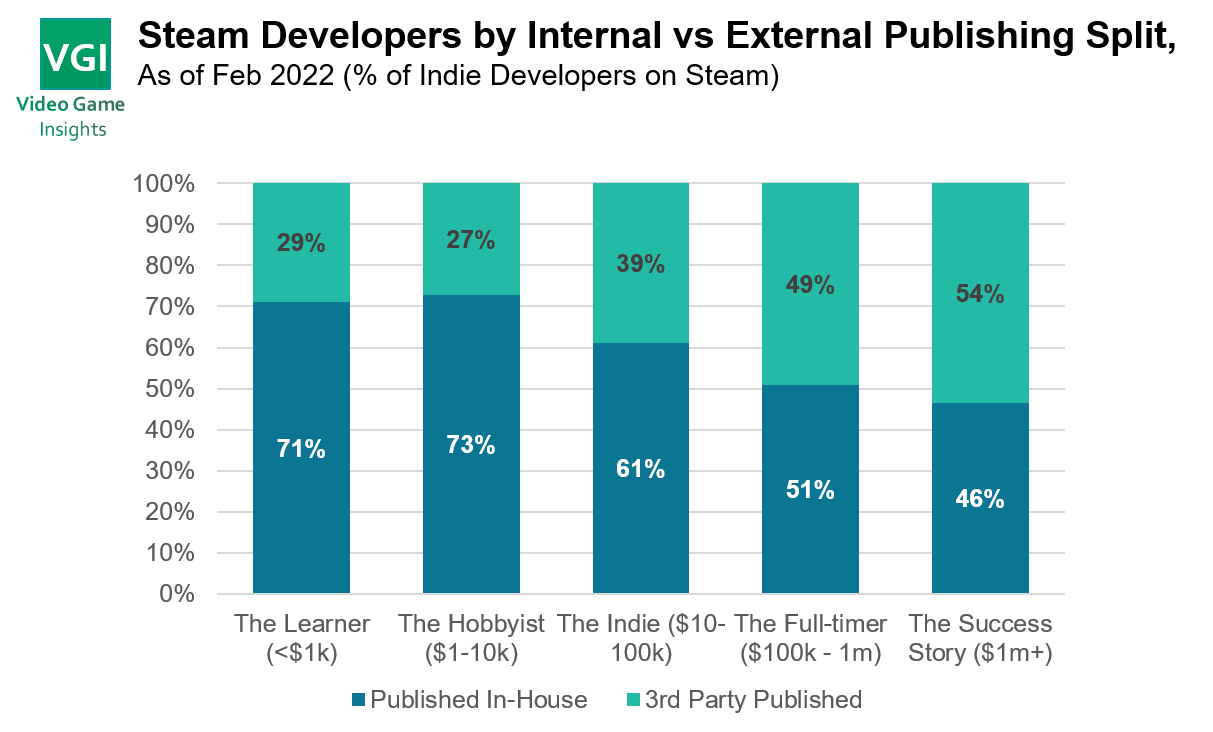

It’s clear why Epic has turned to self-publishing tools to try and replicate that growth curve. The service is meant to be the on-ramp for EGS’s sorely lacking long-tail of new game releases. Self-publishing services unlock business potential for indie developers that don't have access to the publishing and marketing resources of more mature businesses. Meanwhile, Epic’s unique ecosystem design lets them capture value across the lifecycle of a budding indie developer.

For example, early-stage developers can continue to self-publish, while rising stars will likely have the potential to be scouted and backed by Epic’s own in-house publishing arm. Even if small developers don’t generate high sales for EGS, they pad out the platform’s supply and give the company more “shots on goal” to find and nurture the next indie hit. This instead of relying on complex and resource intensive publishing deals.

The longer-term market share implications may prove vital to EGS’ growth. Epic obviously boasts a better take rate than Steam, but EGS self-publishing will ostensibly help grab market share from both Steam and other pockets of the industry that Valve isn’t focused on. Entry into the program requires integrations with EGS achievements — a system that likely drives user retention for the platform — and requires developers to implement Steam/EGS cross-play features. Steam does not afford this benefit to game makers in its self-publishing model.

The self-publishing model is also differentiated by the access it provides to Epic’s litany of backend tools and services. Epic-owned Unreal Engine waives its royalties for games released on EGS. Epic also offers a payment processor and infrastructure for online play out of the box. The company is clearly leaning into its differentiating advantages over Steam and hoping that the combination of a free-to-use game engine, more generous game store commissions, and robust tooling will be enough to win over smaller developers over.

While self-publishing feels like table stakes for EGS to compete with Steam, the full picture for the platform is starting to come into focus. Indie games powered by self-publishing, with the ability to graduate to Epic’s in-house publishing arm and use the company’s first-party Epic Online Software and Unreal Engine toolkit, is a compelling all-in-one offering.

The service also allows for blockchain games, albeit with some limitations, to present another avenue of growth. On the other hand, Valve has banned such titles from Steam. In keeping with Epic’s more developer-friendly approach, the company’s publishing arm also lets developers institute their own IAP systems, a feature that seems to be a direct shot at the iOS ecosystem and the company’s ongoing mobile feud with Apple over in-app purchasing restrictions and platform fees. It’s easy to imagine EGS’s group of free-content-centric consumers and a potential future where EGS self-publishing is allowed to exist on iOS could combine into a powerful formula for mobile takeover.

It all tracks neatly toward CEO Tim Sweeney’s grand vision of combining an Epic-owned EGS on iOS with the PC-centric EGS to create a consistent yet dominant hold over gaming. The company’s leaders have already alluded to the idea. EGS GM Steve Allison told The Verge that user profiles will play a “metaverse-type” role across EGS, Fortnite, and other platforms. Meanwhile, Sweeney has mentioned to Axios that the company has mobile app stores ready to go in the event Apple and Google ever remove restrictions on third-party distribution channels (or in the event regulators or the courts force them to).

My only concern is how much organic impact these features will have to pull in market share from incumbents, and how much Epic will have to supercharge them with financing and marketing. This might take years and years. To date, the platform hasn’t really been able to make major inroads against Steam, but one could argue it’s due to a lack of feature parity, not consumer interest, as evidenced by the 700 million free downloads in 2022. There are also several roadblocks between Epic and its grand metaverse ambitions, the least of which involves regulatory constraints and ongoing pressure from Apple and Google.

Now that self-publishing has stood up, can we expect to see EGS’s game numbers take off in 2023? This journey almost certainly warrants a follow-up in the years to come particularly as Fortnite Creative (which we could consider a form of self-publishing in its own right) launches its integration with Unreal Engine next week. (Written by Max Lowenthal)

#2: Banking Failures, Console Battles, and New UGC Modes

Banking failures frighten gaming entrepreneurs. Due to poor risk management, turbulent interest rate changes, and a rapid bank run, Silicon Valley Bank (SVB), the 16th largest American bank, collapsed this past weekend. The collapse of Signature Bank followed suit, and the ripple effects are still being felt across the global banking system. The U.S. government stepped in to backstop SVB depositors (while rightfully letting shareholders and bondholders go bust), but it has raised questions about how banks should be further regulated, manage assets, whether the insured minimum of $250,000 should increase for businesses. What does this mean for games companies? Fortunately, with the government stepping in to backstop deposits, many early stage games companies can breathe a sigh of relief that they’ll be able to access their cash and pay expenses, including payroll. Even larger companies and VCs that stored some money at SVB can rest more easily. However, the drama should be a wake-up call and a reminder that banks aren’t as risk-free as many once thought. Now, company leaders are recognizing the importance of not keeping all their eggs in one basket, while also reevaluating cash management such as through exposure to treasuries. The financial environment may get whackier before everything fully calms down, but this too shall pass.

Xbox lands additional cloud gaming deals. As we covered previously, certain regulators are caught up on Xbox’s potential anticompetitive threat to cloud gaming if the Activision Blizzard deal were to go through. Regulators are overplaying the importance of cloud gaming‘s future, but Xbox continues to try appeasing their concerns. This week, Xbox landed new 10-year deals with two more cloud gaming services, Boosteroid and Ubitus, which will gain access to all Xbox PC games, including Activision Blizzard’s games, if the deal closes. This is clearly regulatory theater — after all, neither of these services has notable scale — but they are incremental steps toward a possible resolution. We should be nearing the finish line, so expect final decisions regarding the merger to be made in the coming weeks.

The PS5 outsells the Switch in Japan. According to Famitsu’s sales data, the PS5 outsold the Switch in Japan for the first time ever. In February, the PS5 sold 367,000 units while the Switch sold 221,000 units. This is occurring largely for two simple reasons: for one, the Switch is nearing the later end of its sales cycle, and two, the PS5’s supply chain issues being largely resolved have unlocked a flood of demand. Of course, Nintendo was still ranked Japan’s No. 1 publisher in terms of games sold, and once a new Switch rolls around, Nintendo will easily be back in the top slot.

PUBG Mobile tackles UGC. As part of the game’s fifth-year anniversary, Krafton is bringing a new mode to PUBG Mobile. The mode called World of Wonder will enable users to create their own maps, parameters, and rulesets beyond battle royale, and of course have it all shared with the broader community. With roughly 30 million active users, PUBG Mobile is one of the few games with the scale to pull something like this off. It should be noted that Garena Free Fire previously launched a creative mode but only to marginal success. While this new mode will certainly unlock more optionality for players and creators, we’ll have to wait and see how the launch goes, what type of response it gets from users, and how it impacts the game’s KPIs.

In Other News

💸 Funding & Acquisitions:

- Maximum Entertainment acquired Fun Labs. Link

- Tilia, owned by Linden Lab parent Linden Research, raised $22M to handle payments for digital economies. Link

📊 Business:

- Microsoft signed fourth Call of Duty deal in fresh bid to win over regulators. Link

- Ex-Blizzard leaders created startup studio Magic Soup Games. Link

- The Pokémon Company is hiring someone with ‘deep knowledge’ of NFTs. Link

- Twitch co-counder and CEO Emmett Shear resigned after 16 years. Link

🕹 Culture & Games:

- Call of Duty: Mobile team attempted to clarify Warzone confusion: ‘We are committed.’ Link

- Google Play Games for PC is launching in Japan and Europe. Link

- Microsoft is bringing Minecraft to Chromebooks. Link

- Krafton announced a UGC mode for PUBG called ‘World of Wonder.’ Link

👾 Miscellaneous Musings:

- A survival guide to GDC 2023. Link

- Mobile games industry trends for 2023: Publishing predictions Part 2. Link

- Why game archivists are dreading the closure of the 3DS / WII U eShop. Link

This Week In Naavik Pro

Looking for more great games industry analysis? Check out Naavik Pro!

This past week the Naavik Pro team published:

- A deconstruction of Century Games’ survival sim Frozen City.

- The story behind Believer Entertainment’s open world ambitions and Series A raise.

- Our monthly web3 gaming market update.

- An analysis of the Call of Duty Mobile shakeup.

- A look at Magic Eden’s “Mint Madness” promotion.

- An analysis of the Illuvium: Beyond NFT project.

- A breakdown of Sea Limited’s Q4 F2022 earnings announcement.

This upcoming week, we’ll have a deconstruction of blockchain-based MMO strategy game League of Kingdoms, a live ops analysis of Diablo Immortal, an analysis of what Meta’s “year of efficiency” might mean for the game industry, coverage of Keywords Studios’ most recent earnings, an update on Maple Story’s web3 push, and a dive into Square Enix’s Symbiogenesis whitepaper. We’ll also have much more to come after that!

If you’re interested in learning more or signing up, request a demo below.

🔥Featured Jobs

- Coda Payments: VP of Growth (Los Angeles, California)

- Modulate: Content Marketing Associate (Somerville, Massachusetts)

- Carry1st: Head of Product Marketing (Barcelona, Spain | Remote)

- Merit Circle: Head of Investment & Partnerships (Amsterdam | Remote)

- FunPlus: Lead Game Designer - New Casual Studio (Barcelona, Spain)

- Flick Games: Chief of Staff (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during a harsh period of layoffs. Every job post garners ~50K impressions over the 45-day newsletter featuring period and results in 1 - 10 applications depending on the company and role.