Hi Everyone. Welcome to another issue of Naavik Digest! If you missed Sunday’s issue, we covered Roblox's most recent earnings and the company's exploration into generative AI. Today, we look at the state of Embracer Group's Q3 results, and dive into their growing Tabletop business. Let's dive in.

Bringing Web3 Games to Mobile

Over the past 15 years, mobile gaming has grown to be the predominant form factor for gamers, generating over two-thirds of global gaming revenues, and an even bigger share of player activity. But when it comes to Web3 games, games that integrate NFTs, digital ownership and tokenized economies, they still almost exclusively exist outside the mobile app stores. Why is that?

To better understand what the mobile options are for game developers, your host Niko Vuori talks with Anil Das-Gupta (who has recently shipped a mobile game with NFT integration into the Apple App and Google Play Stores), Benas Baltramiejunas (who is in the process of shipping a mobile game with NFT integration into the Apple App and Google Play Stores) and Chris Akhavan (who recently joined top NFT marketplace Magic Eden to help Web3 game developers integrate blockchain technologies and reach more players).

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts.

#1: Embracer Group’s Q3 Earnings & The Staying Power of Tabletop Games

Last week, Sweden-based games holding company Embracer Group announced its Q3 earnings. It was an uneventful quarter for the company given the company’s past history of acquisitions — of course, the holiday season tends to produce strong sales, but with such a broad expanse of holdings there’s always more to dig into.

Financially, results were largely in line with executive expectations — Net Sales totaled $1.1B (up 128% YoY), with a $339M contribution (up 64% YoY) from PC/Console sales and a $149M contribution (up 2% YoY) on the mobile side of the house. The biggest area of note was the company’s decrease in organic growth in the PC/Console segment. Headlined by Goat Simulator 3 as the quarter’s top-selling new release, it seems as though even a company as diversified as Embracer, which boasts 98 Internal Studios, 256 distinct IPs and nearly 10,000 employees for its PC/Console segment alone, is not immune to delays from COVID-related slowdowns.

Outside of its PC/Console slowdown, the quarter was punctuated by a few other headlines:

- Embracer subsidiary Crystal Dynamics entered into an agreement with Amazon Studios to develop a new Tomb Raider game and ended development on Marvel’s Avengers

- The company acquired the team behind popular Roblox title Welcome to Bloxburg

- The company announced a new publishing arm via subsidiary Ghost Ship Games

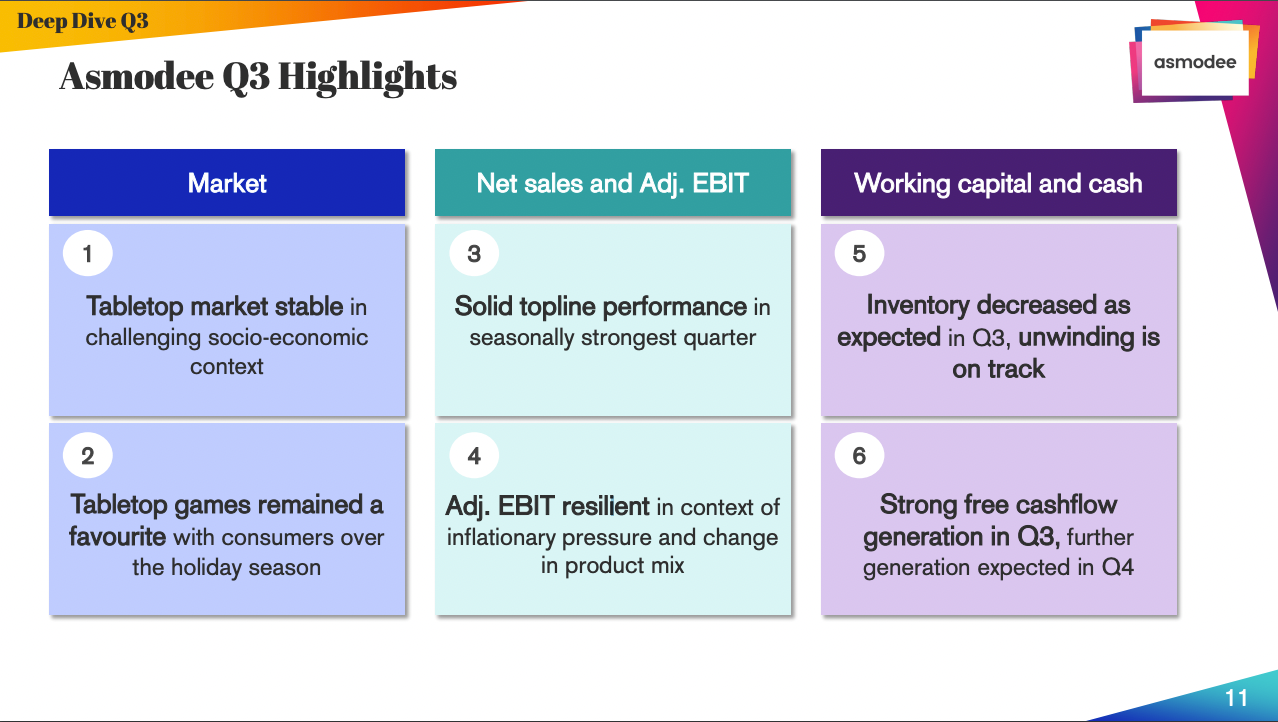

However, while the company has been on a spending spree over the last few years to bolster its PC/Console & Mobile IP library, it’s actually its Tabletop Games division that has been growing at a healthy pace, cementing the company as one of TTRPG’s biggest players. Operated through subsidiary Asmodee (which they acquired for $3B+), tabletop games accounted for 35% of the quarter’s Net Sales and (surprisingly) boasted the second best margins across the company’s four divisions (behind Mobile and ahead of Console/PC & Entertainment). Net Sales were up 28% QoQ (thanks in part to the seasonality attributed to holiday shopping sprees), and the company has a strong upcoming pipeline of board games that includes IP from series like Harry Potter, Marvel, and Star Wars. From these results alone, it seems as though the company’s $3B acquisition of Asmodee will bear fruit. It’s a welcome change for Embracer, as our pre-acquisition analysis shows a radically different business, one with an over-reliance on PC/Console (which generated nearly 85% of total sales at the time) and a tumbling stock price that required significant debt financing for the deal to go through.

With such a rapid and impactful entry into Embracer’s portfolio, it's worth exploring why exactly Tabletop Games continue to succeed where other segments have slowed. Pulling back the curtain on Asmodee’s operations reveals a beneficial mix of macro-economic factors combined with savvy internal synergies between Embracer operating units. At the forefront is the resilience we’re seeing across the broader digital and TTRPG ecosystem, as I highlighted in my recent profile detailing the growth of Chess.com. Despite socio-economic downturns, the broader tabletop mass market only saw a 4% YoY decrease compared to the same period in 2021. This decrease is even more pronounced knowing that the 2021 Tabletop market was already 25% above where it was at pre-COVID levels. Meanwhile total tabletop CAGR among 19-22 year olds remains up 11%. December 2022 also proved to be a record high in unit sell-out across the industry.

As I touched on in my coverage of Chess.com, much of this resurgence can be attributed to the proliferation of digital platforms and online native tools that help build network effects and decrease barriers to entry for what has historically been an otherwise fragmented industry. Sites like BoardGameArena and Tabletopia have made it easier than ever to find someone to play with. Meanwhile YouTube creators, Kickstarter, and even online gaming platforms have made launching, learning, and mastering new games easier than ever before. Things are looking up for the physical side of the business as well. Board games are significantly less costly than other physical toys to produce and distribute, and it’s easy to leverage back catalogs of popular games through new remixes, remasters, and special editions.

But it’s not just the industry that is growing, Embracer seems as though its been incredibly well positioned to take advantage of the space’s current tailwinds. The company continues to successfully unwind excess inventory stockpiled during COVID-19 at a consistent clip, leading to an expected 70M Euro in free cash flow over the next 12 months. Meanwhile, M&A hasn’t slowed down, with a reported five deals currently underway and eight new titles (several of which serve as joint partnerships with major external IP) released during the last quarter. The company’s revenue split for its tabletop business feel representative of these trends, with 46% of revenue coming from physical sales, 31% from collectibles, and 13% from digital platforms.

Of course, seasonality plays a role here (the holiday season is always a good time for buying), but even with gift-giving in the rear view mirror, Embracer seems well positioned to continue to grow its Tabletop business. Low-hanging fruit courtesy of the company’s massive library of games are plentiful: increased back catalog sales, variants of popular titles, and digital copies of existing games to name a few. Look deeper, and the opportunities to collaborate with the broader Embracer ecosystem feel just as interesting: a board game tie-in for an upcoming Lord of the Rings title, a re-skinned gaming-centric collectors edition for games like Catan, or maybe even a VR tie-in for a popular board game. It feels like everything is on the table and it's not hard to imagine board games moving to take nearly half of Embracer’s net sales in the coming year.

While the success of the company's tabletop division is certainly worth celebrating, it's still good to remember that the business unit is just a byproduct of the company’s broader transmedia IP strategy. Tabletop titles are just one (very lucrative) channel by which the acquisition-centric company can monetize its wealth of franchises. Brandishing a warchest that includes games, comics, and mobile titles is great for building Disney-esque ecosystems around already beloved franchises. The price of that warchest, however, is limited earnings per share and heavy debt financing, alongside growing internal complexity like bloated leadership and internal comms issues. As my colleagues at InvestGame suggested in their coverage of the business last fall, we could very well see Embracer use Asmodee and its tabletop division as a part of a broader plan to spin off various businesses into profitable, publicly traded companies in an effort to collect returns on their heavily financed acquisition sprees.

No matter the outcome, it feels clear that Tabletop games have cemented themselves as a key part of Embracer’s broader ecosystem play, and are certainly worth watching as the company continues to grow in the coming months. (Written by Max Lowenthal)

#2: Brawl Stars: A History Lesson

The is a preview of our upcoming Brawl Stars deconstruction written by Niek Tuerlings, which releases in Naavik Pro tomorrow. If you’re interested in reading the full deconstruction, or learning more about Naavik Pro, don’t hesitate to reach out!

In the F2P Mobile game development space, Brawl Stars –Supercell’s successful and revolutionary real-time Hero Battler, where players compete against one another, solo or in a team – was the cat’s meow when it was announced in June 2017; many deconstructions were released right away and in the months after, but then it got a little quiet. For many mobile developers not directly working in the competitive PvP space, Brawl Stars might have disappeared from their radar over the last few years, but this doesn’t mean nothing has happened during that time! Even before last December’s update shocked the industry with the decision to remove Loot Boxes, many meaningful events have happened to the Brawl Stars meta over the years. It’s time for a proper retrospective!

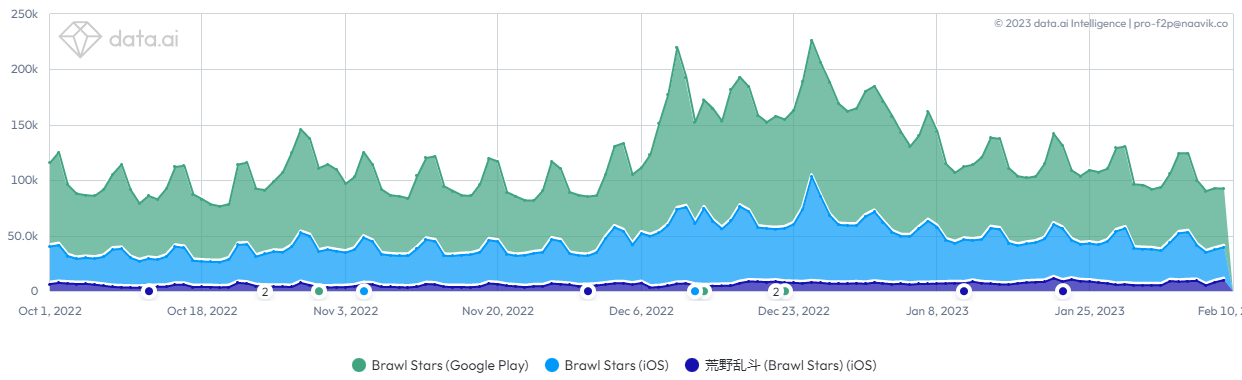

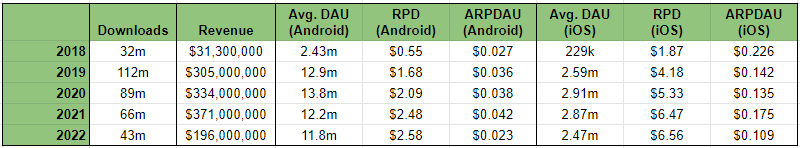

To start, however, let’s take a quick look at December’s notorious update and figure out whether it truly worked. While it’s still a little early —as a change to the core loop usually manifests itself in different long-term retention— it seems that the spike in December was a one-time occurrence. It was more noticeable on Android, which suggests that its cause was something along the lines of retargeting campaigns, which are much easier to do on Android these days. When looking at the big picture (Brawl Stars’ ~360M lifetime downloads) the 3M that seem to have been added as a result of the update are of relatively low significance.

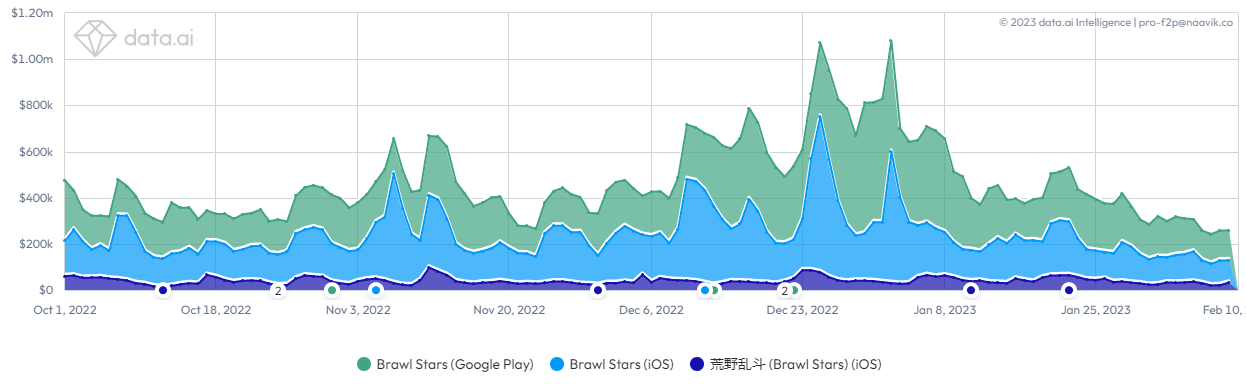

Of course the update also generated some organic buzz, but it’s quite visible that in January it was going back to normal. It’s the question how the curious players who rejoined and the new cohorts of players who started since then perform, but this is only something internal tracking data can point out. Causally, revenue shows a similar trend:

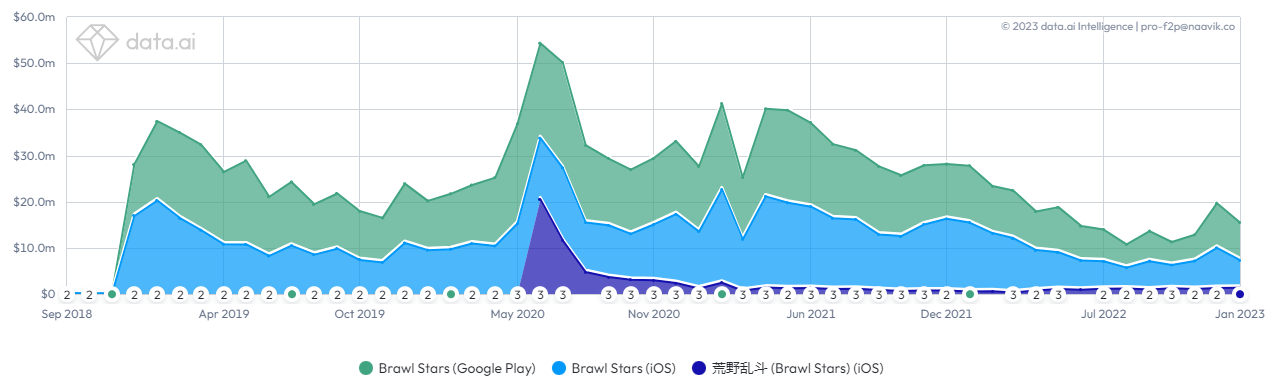

Data.ai currently shows $1.4 Billion in lifetime revenue for Brawl Stars. This makes it the fourth most profitable game Supercell has ever released globally. This sounds great, and it obviously is, but remember that Supercell only ever released 5 games globally. The game generating the lowest revenue is Boom Beach (currently showing $700 million of lifetime revenue) which is likely to be discontinued soon as it received exactly one update in 2022. The more than 10-year-old Hay Day still tops Brawl Stars with $1.52b and both Clash Royale and Clash of Clans complete the company’s top-3 with $2.75b and a whopping $6.73b in lifetime revenue respectively.

Especially over 2022, Brawl Stars has seen a very noticeable decrease in KPIs. In 2022 the game was downloaded ~32% less (average of both platforms) than in 2021 and raked in just about half of previous year’s revenue.

These are not developments any Product Lead would consider comforting, especially at Supercell, where performance standards are extremely high. But next to it being the most popular Western, mobile-only esports game, Brawl Stars is still very much alive and kicking with an average DAU of 2.5 million throughout last year.

Brawl Stars received a lot of analytical attention when it first released in 2018, triggering the industry to publish deconstructions left and right. As stated above, it has earned tremendous revenues since then, but we've also seen a steady progression of undiscussed changes to the game. It’s very difficult to find an up-to-date breakdown of the game’s feature set anywhere online. This deconstruction aims to rectify this, breaking down most of Supercell’s numerous additions and just-as-many tweaks or removals to the game’s feature set. We’ll also shed light on the impact these changes seemed to have had. Because even though the December update didn't permanently change KPIs, the game's updates over the years have more than tripled the game’s RPD since its global launch (Worldwide, iOS). The game still has room to improve —for example in terms of its minimal number of long-term progression vectors— but it has come a long way.

Read on to find...

- A quick breakdown of the game’s meta and what makes it tick

- A full overview of the game’s Events, including some short-lived ones that have since been removed

- An up-to-date analysis of the game’s currencies and systems, with comparisons to past implementations of the game’s meta (including the recent loot boxes change)

- The evolution of the game’s monetization model

- An account of the game’s vibrant eSports scene and other community efforts

- Future prospects for Brawl Stars

Content Worth Consuming

The Failures and Futures of Virtual Reality (GameCraft): “Mitch and Blake discuss the recurring industry obsession with the idea of virtual reality, beginning in the mid-1980s. Mitch recounts a story about his encounter with VPL and the weird world of digital artists and promoters in the early days of personal computing.They look at the second failed wave of VR investment in the 1990s and the importance of Neal Stephenson's Snow Crash. Mitch talks about how Linden Lab's Second Life anticipated many of the ideas of the modern metaverse. They then look at the Oculus, Facebook's decade-long failure to generate momentum behind a new wave of virtual reality, and what Apple's entry into the market may mean. They conclude with a look at the idea of the metaverse and its challenges.” Link

Bigger Means Different (SuperJoost): “According to the CMA, both Microsoft and Sony have submitted their own internal analyses on several key aspects of the proposed deal. However, the CMA also stated that “the methodology underlying the Parties’ incentives analysis, and the data inputs on which it is based, may be flawed or incomplete, and that the approach to estimating the critical diversion ratio is Page 2 of 22 not likely to be accurate.” Having spent most of my career studying concentration trends in 1 media and entertainment, and analyzing the video games industry both as an academic and an industry analyst, I submit the following observations on contemporary video games, the overall market structure, and the impact of the proposed acquisition for your consideration.” Link

Global Gaming Deals Activity Report 2020-2022 (InvestGame / Naavik): “The past 3 years have marked a cycle of robust investments and growing deal activity, which has far exceeded previous periods, and transformed the gaming industry landscape. While 2020 and 2021 turned out to be mostly vibrant and glorious for the games industry, 2022 has seen the correction of the market, exacerbating its cooling conditions: the current lumpish macroeconomic situation, post-pandemic user engagement changes, post-IDFA pressure, increased regulatory scrutiny, release dates shifts, supply chain issues, and other factors.” Link

From Gamemaker to Player Advocate (Gaming Founders Podcast): “Today’s guest is Trent Oster, CEO of Beamdog. Trent started in the game industry in the early 90s and is one of the six original founders of BioWare. You may recognize some of BioWare’s best-loved franchises - Dragon Age, Mass Effect, Star Wars: Knights of the Old Republic, Baldur’s Gate, and Neverwinter Nights. Trent left BioWare in 2009 to co-found digital distribution portal/studio Beamdog with Cameron Tofer. In this episode, you’ll hear about the origins of iconic D&D classics Baldur’s Gate and Neverwinter Night, challenges balancing team dynamics including family, the development of Beamdog’s tentpole property MythForce, and the rollercoaster days before game launch (and maybe why it’s not the best idea to personally guarantee a $1M loan).” Link

🔥Featured Jobs

- Modulate: Content Marketing Associate (Somerville, Massachusetts)

- Carry1st: Head of Product Marketing (Barcelona, Spain | Remote)

- Flick Games: Chief of Staff (Remote)

- Merit Circle: Head of Investment & Partnerships (Amsterdam | Remote)

- FunPlus: Lead Game Designer - New Casual Studio (Barcelona, Spain)

- Naver Z (Zepeto) USA: Technical Community Manager (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during a harsh period of layoffs. Every job post garners ~50K impressions over the 45-day newsletter featuring period and results in 1 - 10 applications depending on the company and role.