Hi Everyone. Welcome to another issue of Naavik Digest! If you missed our last one, be sure to check out our analysis of Electronic Arts and Take-Two Interactive’s most recent earnings. This issue, we’re discussing Embracer Group’s ongoing struggles and its $2 billion gaming partnership deal that went up in smoke.

Embracer’s Lost Partnership & Its Major Blow to Profitability

Written by Mario Stefanidis, CFA

This piece was originally published as part of Naavik Pro’s Financial Markets Newsletter.

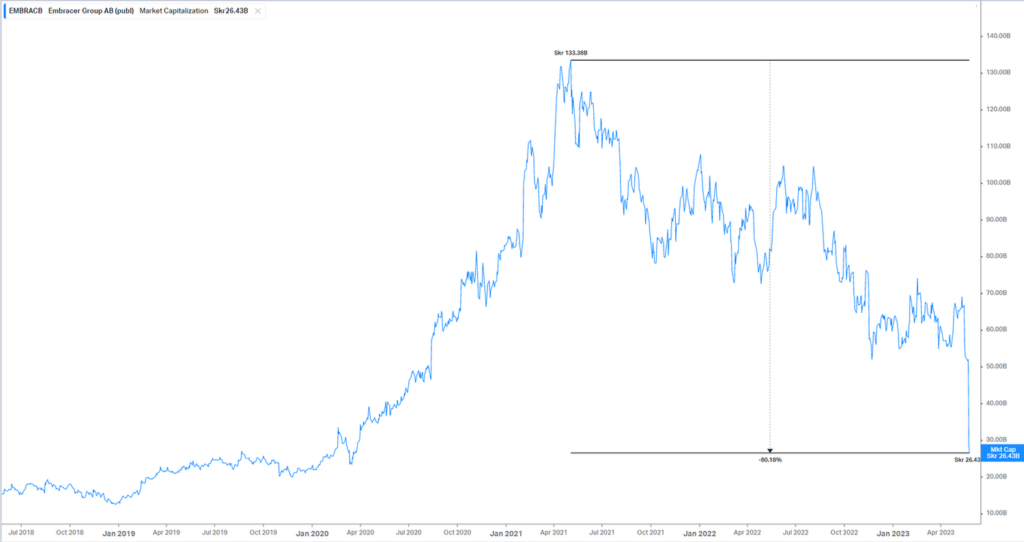

Embracer Group stock plunged by -45% in Stockholm on May 24th after reporting FY2023 earnings (ending March 31, 2023) and slashing its forecast for the 2024 fiscal year. The Swedish gaming conglomerate cut its adjusted EBIT forecast from SEK 10.3 - 13.6 billion to SEK 7 - 9 billion, a 33% decline, on the loss of a “groundbreaking strategic partnership,” which it had been touting for several months.

Embracer had previously communicated in March that the deal, as well as a number of other licensing deals, would still be closed, albeit with a one-quarter delay. Then on May 15th, the company issued a press release revising its EBIT forecast from SEK 8 - 10 billion to SEK 6.35 billion for the current fiscal year because the deals still had not closed. Adjusted EBIT came in at SEK 6.37 billion, in line with this revised forecast.

While the dip in March was quickly reversed, Embracer stock has fallen continuously since the mid-May press release. This latest dramatic decline ranks as the steepest single-day percentage plunge for a large games company in at least the last decade. As of May 25th, the company’s market capitalization of SEK 26.4 billion ($2.4 billion) has wiped out all post-COVID gains, and it’s now 80% lower than the peak valuation of SEK 133.4 billion ($12.3 billion) reached in May 2021.

Not much is known about the deal that fell through other than its magnitude and the abruptness of its termination. Embracer noted on its earnings release that the company would have generated more than $2 billion in contracted development revenue over a six-year period. The loss of this partnership is particularly painful as the company notes that the already announced deals provide “more limited short-term financial value.” In contrast, this one would’ve had long-term profit and cash flow predictability. From a communications perspective, this mega-deal has been talked up since the FY23 Q2 report released last November.

According to the company, negotiations had been taking place for seven months — since Embracer secured a verbal commitment from the prospective partner last October. Embracer CEO Lars Wingefors stated that “all documentation was finalized and ready to go” just one day prior to the earnings release, but the partner backed out at the eleventh hour. There is no word yet on whether any terms were violated, which may lead Embracer to seek legal recourse.

Since its spin out from Nordic Games Group in 2016, Embracer has been on an acquisition and licensing spree. Notable acquisitions include Saber Interactive in February 2020 in a $525 million deal, Gearbox Software in February 2021 for $1.3 billion, and Asmodee in December 2021 for €2.8 billion. Embracer’s enterprise value of SEK 43.5 billion today ($4 billion) is lower than the combined price of these three purchases alone. Embracer has around 15,000 employees; for comparison, Electronic Arts, with 12,000 employees, has an enterprise value eight times higher at $34 billion.

Furthermore, the company has taken on debt to finance these purchases. At the end of FY2021, Embracer had SEK 1.5 billion in total debt, whereas today it has SEK 21.7 billion. Cash is nominal at SEK 4.7 billion, for a net debt position of about SEK 17 billion. The EBIT-to-interest coverage ratio has declined to a worrisome 1.9x, indicating that further profitability declines could jeopardize the company’s ability to pay back bondholders.

Even at the low end of the EBIT forecast for the coming fiscal year, Embracer can still cover the interest on its debt. However, there is little to no room for any other debt-funded acquisitions, which will limit inorganic revenue growth in the near term. Given the company’s massive decline in equity value and low cash levels on the balance sheet, it would be prudent to avoid acquisitions altogether until profitability can grow sustainably.

Wingefors noted that the next 12 months will be very challenging, but FY25 and FY26 will benefit from a “strong pipeline of highly anticipated games” based on Embracer’s own and licensed IP. On May 15th, Embracer announced a new Lord of the Rings MMO, which will be published by Amazon Games and developed by Embracer’s Middle-earth Enterprises subsidiary. Embracer purchased Middle-earth last August in order to acquire complete media rights to Lord of the Rings and The Hobbit and begin licensing new projects based on the IP, though it must still work with other rights-holders like the Tolkien Estate and LOTR trilogy producer New Line Cinema under certain circumstances.

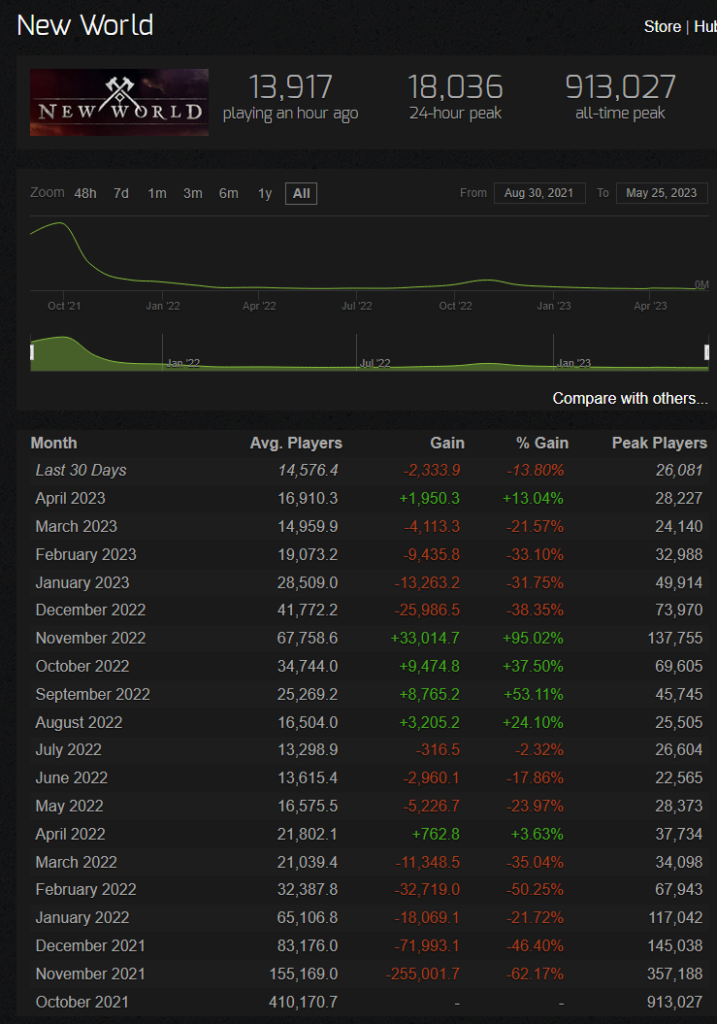

The MMO announcement did not appear to receive much fanfare for a couple of reasons. For one, it was overshadowed by Embracer’s profit warning six hours later, which caused the stock to plunge. Another reason may be due to Amazon’s questionable track record with releasing MMOs. In September 2021, Amazon Games published New World, which was developed by the in-house studio Amazon Games Orange County. Updates have been scant since launch, partially owing to the game’s pay-to-play model instead of a subscription model like a traditional MMO.

While all MMOs experience player declines over time, many have seasons (usually every quarter) that boost engagement as players vie to complete all of the seasonal content. Since launch, New World has kept the level cap and gear cap the same while adding comparatively little content. The game added seasons this February, but this update came too late, given the number of average players has fallen over 95% since launch.

Amazon’s other published MMO Lost Ark, which was released to Western audiences in February 2022, has fared a bit better. The game is free-to-play and follows a more modern MMO formula. Unlike New World, which only averages 14,000 players today, Lost Ark averages around 60,000. That’s an improvement but still not great given the level of investment. Embracer will want to partner closely with Amazon and ensure it’s putting out regular content updates for the Lord of the Rings game to maximize its chances of success.

It’s now clear that Embracer’s strategy of overpaying for acquisitions and rolling them up into the broader portfolio has failed entirely. The company states that its approach is to “empower acquired companies in order to enable accelerated organic growth,” but there is no evidence these acquired companies’ organic growth is any better than before they were bought. Revenue growth is just one piece of the puzzle, and Embracer has struggled to deliver healthy margins as a result of company-wide bloat.

The focus must now shift to maximizing efficiency for Embracer’s 12 operative groups and 15,000 employees. Given the extremely high employee count for a company with a market capitalization that barely qualifies as mid-cap anymore, we should expect layoffs, reprioritization of projects, and outright studio sales on the horizon. But even “crown jewels” in the portfolio, like Gearbox, appear to be worth much less than what they were purchased for. Gearbox was acquired for $1.3 billion in February 2021, at the valuation peak for technology companies. But the developer has yet to develop or publish any notable titles since.

At six times EV to next year’s EBIT, Embracer Group stock is extremely “cheap.” Investors are doubtful that the company will be able to control costs in the near term given the massive headcount and overhead. They’re also skeptical that FY2025 and beyond will deliver improved results. Embracer’s best bet is probably to pare down acquisitions for the next two to three years and use any free cash flow to service the debt load. Wingefors’ claim that Embracer is near a “notable inflection point” in its business is questionable, given its 130-plus subsidiaries have yet to put out a truly standout title, and there do not appear to be any other transformative deals on the horizon either.

Content Worth Consuming

What watching my daughter play The Legend of Zelda taught me (Tom Bissell / The Washington Post): “The Legend of Zelda: Breath of the Wild, released in 2017, embraced this path of divergence. It’s often considered the greatest video game ever made. Needless to say, it’s highly atypical when a series of any kind steps up to the plate for its 19th main installment and blasts the ball clear into the parking lot. I say that having barely played Breath of the Wild. Instead, I watched my daughter play it, day after day, for weeks, during the opening innings of the pandemic. This was a Zelda game all right — mysterious and endlessly traversable — but it resembled the original Zelda the way a stromatolite resembles a sperm whale.” Link

Honkai: Star Rail: Turn-based role-playing game that’s so good it’s bad (Adrian Hon / Have You Played?): “Honkai: Star Rail is a sci-fi turn-based role-playing game (RPG) where you join the crew of the Astral Express space-train and help locals deal with disasters caused by mysterious objects called ‘stellarons,’ one of which resides inside your own body. You’ll explore rich and expansive 3D worlds, fulfill innumerable quests for your crew and other friends, and battle against a never-ending stream of enemies. It’s uncommonly polished for a mobile/tablet-first game, combining some of the genre’s worst impulses (confusing and frequently meaningless battles) with surprisingly good writing and an absolutely gargantuan amount of content, all of which is theoretically available for free.” Link

Understanding the barriers facing games students — and how to remove them (Gamesindustry.biz): "Basically what we're doing is we're talking to people the year that they graduate from their game program, and every year for three years after that, to see what that transition into the games industry is like for people… So when people are coming out of their final year of their program, we're interested in what kind of things were covered in their program. Did they have opportunities for internships and professionalization? What was their game education experience like? And then, after that, we want to hear about how that transition has been going for them, what kind of networks have been supportive, how has that experience gone." Link

Investigation: Who’s telling the truth about Disco Elysium? (People Make Games): “I’ve come to Tallinn in Estonia to find out what on Earth has been happening with Disco Elysium. In about an hour’s time, I’ll be headed into that building just behind me over there to sit in a courtroom and watch Robert Kurvitz, the game’s lead writer, sue the very company he helped found in this city after being ousted by the other shareholders. This story is messy. Disco Elysium, for those that don’t know it, absolutely startled the games industry when it released in 2019 — this booze-soaked avant-garde wonder that would go on to sell millions of copies, win a bucket-load of awards, inspire a globe-spanning fandom, and even its own line of clothing. And yet, not long after the developers performed a well-deserved victory lap in the form of Disco Elysium – The Final Cut, everything seemed to come crashing down around them.” Link

🔥Featured Jobs

- Coda Payments: Managing Director, Publisher Partnerships (Los Angeles, U.S. / Hybrid)

- FunPlus: Senior Community Manager (Barcelona, Spain / Remote)

- MY.GAMES: Game Designer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.