GM Everyone! We have milestone news to share: Naavik’s first premium research service on blockchain games is now live! And there is more to come in the following months.

Below, we showcase our sample report and Metacast conversation with the team who put it all together. The feedback we've received from pilot customers and readers until now has been overwhelmingly positive, so we hope you enjoy it too!

This report is designed for anyone funding, leading and building blockchain games, or simply who wants to be more immersed and knowledgeable about the rising tide of this space. Our mission is to serve as your personal blockchain games research department!

Naavik Exclusive: Roundtable #22

This episode is a discussion about our blockchain games sample report. Jimmy, Lars and Aaron are joined by Nico to discuss important industry developments (like web3 games platforms, plus the race for blockchain gaming talent) and dig deep into Axie Infinity. We walk through the game's history, game design, tokenomics, economic issues, future roadmap, and how we think the development team can set itself up for greater success.

As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Axie Infinity: Infinite Opportunity or Infinite Peril?

Editor’s note: This is the introduction to the full game deconstruction in the sample report. The report was written by Jimmy Stone, Lars Doucet, Anthony Pecorella, Aaron Bush and Abhimanyu Kumar.

By now, most everyone has heard of Axie Infinity, the current flag-bearer of the emerging play-to-earn (P2E) business model. From the whitepaper: “Axie Infinity is a Pokémon-inspired universe where anyone can earn tokens through skilled gameplay and contributions to the ecosystem. Players can battle, collect, raise, and build a land-based kingdom for their pets.”

You may have seen a bunch of wild stats but have questions about where everything — Axie Infinity specifically and blockchain games more broadly — is headed. After all, most games don’t create documentary-worthy income-generating opportunities like Axie Infinity does in Southeast Asia.

Most games aren’t supported by burgeoning yield-generating scholarship programs that provide thousands of players access to scarce NFTs. Further, most blockchain games don’t earn revenue at levels that compete with the biggest and best crypto projects. Also, the vast majority of games (of any type) never see day-90 player retention stay nearly identical to day-30 player retention, even among their golden cohorts.

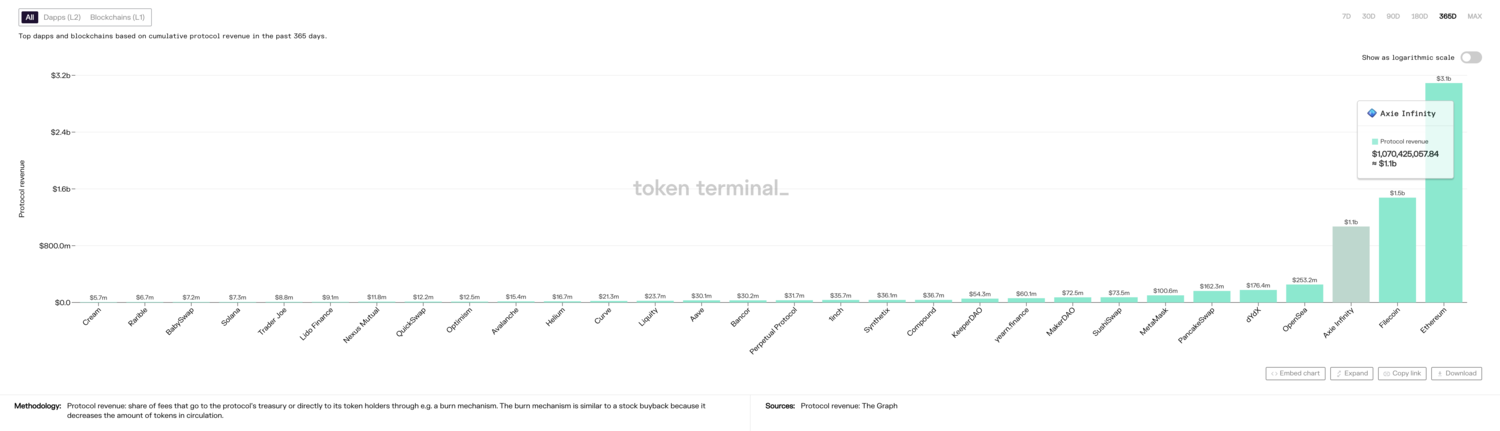

Source: Token Terminal

Finally — and despite being an unfair apples-to-oranges comparison — most games don’t capture value in their governance tokens that rival the market caps of some of the world’s biggest gaming companies. As you can see in the chart below, the fully diluted value of Axie Infinity’s AXS tokens rival the largest publishers in size and on a non-diluted basis is about as large as Zynga. Yes, there are caveats, and, yes, we can (and will!) criticize whether it’s reasonable or unreasonable, but Axie Infinity is showing the industry that value can be created and captured at scale in an entirely new way.

Source: Messari

How is all this possible? How do the game, economy, and tokenomics fundamentally work? Is there a catch, and, if so, what is it? Is Axie Infinity sustainable, will true decentralization occur, and how must the project evolve if it hopes to continue its long-term growth trajectory? What are the potential pitfalls, and what type of value creation is possible if the pitfalls can be avoided? These are the questions this report attempts to answer. However, before we dive deep into the present and future states of Axie Infinity, let’s take a step back to better understand how we got here.

Sponsored by Growth Fullstack

Turn your data into powerful insights - Free Trial!

“Game developers need help to make sense of the post-IDFA world of mobile marketing." - Hernan Zhou, CTO, Lucky Kat Studios

Growth FullStack does just this - helping developers and mobile marketers navigate the privacy-first marketing landscape - without expensive data science.

-

Simply collect the data that you need (from sources such as SKAdNetwork, AppLovin, and many others);

-

Store it in the way you want (using platforms like Google BigQuery, Amazon S3 and others);

-

Gain insights via an intuitive dashboard built on top of the data (such as Metabase, Tableau and others);

And optimize your campaign's activity using off-the-shelf or custom analyses.

Growth FullStack offers affordable insights via a no-code, plug-and-play model that lets you get back to making great games and apps.

#2: The Rise of Token Dedicated Funds And Its Potential Implications

Source: GamesBeat

Editor’s note: This is the introduction to the full game deconstruction in the sample report. The report was written by Jimmy Stone, Lars Doucet, Anthony Pecorella, Aaron Bush and Abhimanyu Kumar.

When it comes to dealmaking, the games industry is having quite the 2021. According to investment bank Drake Star Partners, the first nine months of 2021 saw $71 billion in 844 announced or closed deals. For VCs that focus on private placements, there was a record $9 billion raised over the period with $1.8 billion of that total invested into blockchain gaming companies. Importantly, this nearly $2 billion figure only includes equity-based investments and excludes any investments into fungible and non-fungible (“NFTs”) tokens. And there are several venture firms now raising capital around this strategy.

Indeed, October 2021 was busy for VCs announcing new funds in this emerging space. So far, this fund formation can be divided into three categories:

-

Funds focused on both equity-based & token-based investments: Galaxy Interactive announced a $325 million fund that will make both equity and token investments in games and related technologies.

-

Funds focused on fungible & non-fungible token investments: BITKRAFT Ventures announced a $75 million fund focused on making token investments in blockchain games and digital entertainment.

-

Funds focused on only non-fungible token investments: Meta4 Capital announced a $100 million fund focused on making “rare” NFT investments with backing from well-known VC Andreessen Horowitz.

It is important to note that the above categorization applies to traditional VC funds. Perhaps the first investors to pool assets to purchase gaming NFTs were gaming guilds, like Yield Guild Games (“YGG”). In addition to providing “scholarships” to gamers who can’t acquire the assets necessary to play and earn in games like Axie Infinity, YGG also has invested directly in game tokens themselves. However, these guilds are structured differently than the traditional VC funds discussed in this analysis. With the GP/LP structure of traditional VC funds, the fund’s GP manages fund activity. Conversely, YGG is structured as a decentralized autonomous organization (“DAO”) whereby YGG issues tokens that allows its holders to decide on many governance decisions. YGG’s recent token issuance raised $12.5 million and sold-out in 30 seconds. In short, YGG and other decentralized gaming guilds are also major buyers in this space.

Source: Yield Guild Games

For General Partners (“GPs”) of traditional VC funds, the decision to launch token-specific funds seems to be primarily driven by 1) dynamics around token investment size and 2) Limited Partners’ (“LPs”) concerns about regulatory risks. With regards to the former, token issuances (“mints”) are typically smaller and allocated across a wider pool of participants than a traditional venture round. As a result, a token allocation may not consistently meet a VC fund’s minimum check size, making a token strategy at odds with a traditional equity-based fund’s investment mandate.

On regulatory risk, there is still much uncertainty about how governments will treat fungible and non-fungible tokens. In the US, Gary Gensler, the Chairman of the Securities and Exchange Commission, has criticized crypto and suggested that the space needs stronger investor protections. Simply put, the rules are still being written in real-time. LPs who allocate capital to gaming VCs may be comfortable with venture risk but not this novel regulatory risk. BITKRAFT founder Jens Hilgers cites regulatory risk as one driver of their token fund formation in a recent interview with GamesBeat: “investing in tokens as an asset class is something where, after consultation with some of our LPs, we got to know that some of them are actually not comfortable investing in something that’s still — I don’t want to call it the regulatory wild west, but regulation is still in the making.”

In addition to new venture fund strategies, the amount of capital flowing into game-based tokens has a few other potential implications:

-

More blockchain game projects. Projects usually complete an initial token mint prior to actually developing a game. Developers use proceeds from the token issuance to fund their project roadmap, which includes the game’s development. The process is similar to how Kickstarter works. With even more funding flowing into blockchain game tokens via fund formation, developers are likely to have more confidence that they can raise the funds necessary to execute on their game ideas, resulting in more blockchain game projects.

-

Potential governance issues. Several blockchain games have announced governance tokens that allow holders to directly influence a project’s direction. The idea is to decentralize ownership among a game’s users and community. However, there could be governance issues if institutional investors -- who are primarily motivated by financial returns rather than fun gameplay -- end up centralizing ownership in a project by acquiring a sufficient number of tokens. Much like we see in public equity markets, are we going to see “activist” token funds emerge that re-shape the direction of projects? Will investors always play nice with gamers? VC firm Andreessen Horowitz has written extensively about governance and token delegation best practices. Among their decisions, a16z is transferring their voting rights to others so that these “delegates” can more actively participate in a project’s governance. This is similar to a shareholder proxy. Per its writing, a16z seeks individuals with diverse perspectives, alignment to the project’s success, commitment to the project, full independence from a16z, subject matter expertise, and a history of stewardship. While this approach is to be admired, we can imagine instances where issues arise and/or parties have an opportunity to act in bad faith.

-

More funds to share with a game’s community. More funds flowing into token economies means that blockchain game studios have more funds to share with their communities. This dynamic can create a strong network effect that differentiates blockchain games from traditional ones. In doing so, certain metrics - such as UA costs and retention metrics - will likely benefit, all else equal. However, the longer-term success of blockchain game economies will still depend on attracting users who are not primarily motivated by financial returns, in our view.

-

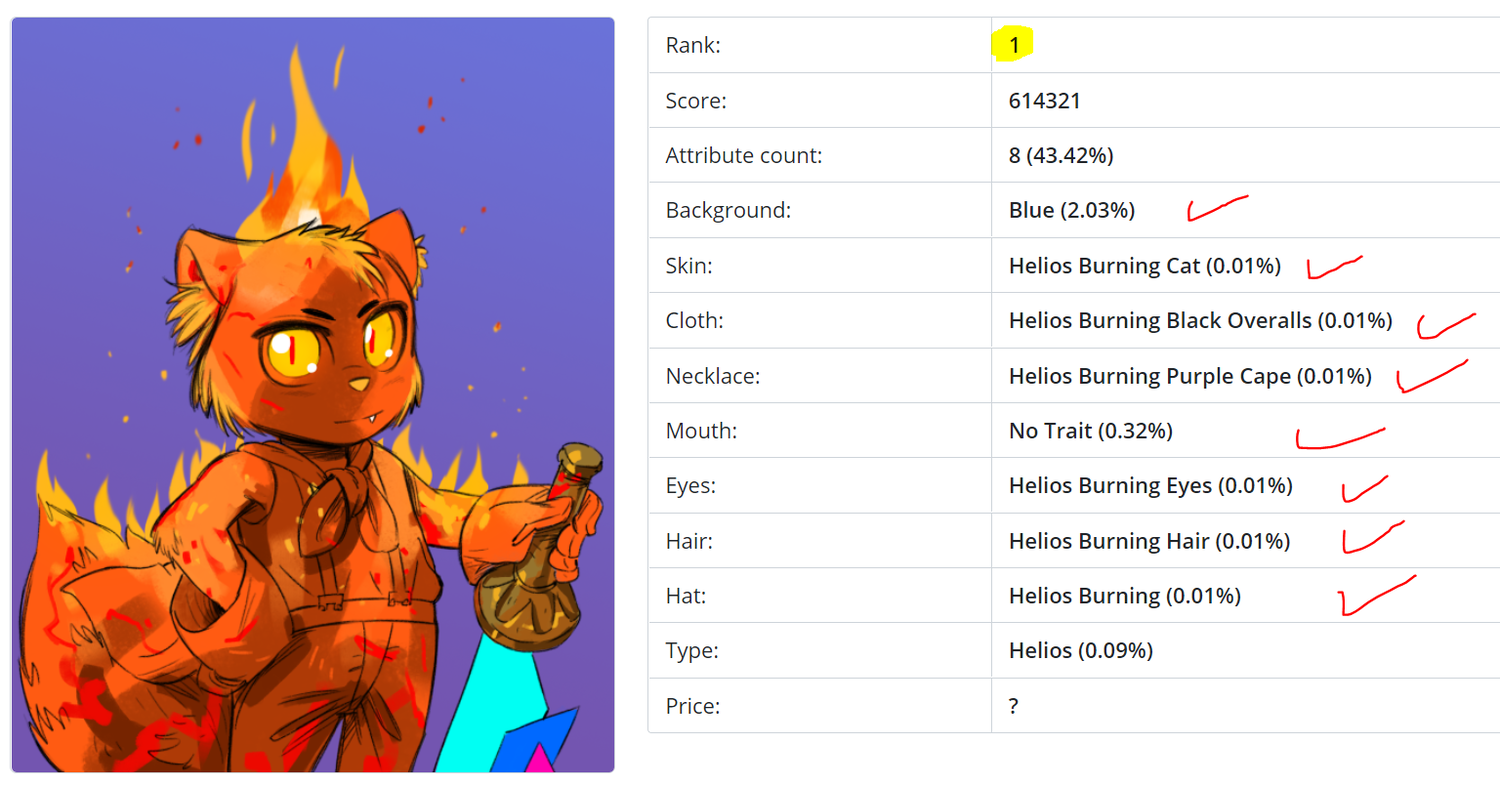

Higher prices especially for rare and popular tokens. This is perhaps the most obvious. More capital chasing tokens will result in higher prices for fungible and non-fungible assets, all else equal. For example, a digital asset fund purchased the rarest NFT in the Aurory project (a blockchain fantasy RPG) for 2,400 Solana tokens, equivalent to $384,000 at the time.

Source: sigil.fund

With the abundance of capital being raised, these are exciting times for the blockchain gaming ecosystem. At Naavik, we expect to see more token dedicated fund announcements in the coming months. And we will be watching closely how potential regulations and new funding strategies influence this fast-emerging space.

🎮 In Other News…

💸 Funding & Acquisitions:

-

It’s the home stretch for earnings: AppLovin | Zynga | Unity | Roblox | Krafton

-

Unity acquired Weta Digital for $1.625B. Link

-

Forte raised $725M, its second funding round of 2021. They are now working with over 40 game developer partners. Link

-

Mod.io raised a $26M Series A (you can find our chat with Founder + CEO Scott here). Link

-

AudioMob raised a $14M Series A led by Makers Fund and LVP. Link

-

Neon raised $10.5M for a blockchain-based shooter. Link

-

Edgegap announced a $7M Series A. Link

📊 Business:

-

Niantic announced Lightship, a platform for building metaverse apps. Link

-

Netflix launched games to iPhone and iPad globally. Link

-

Team Liquid is partnering with Coinbase Link

-

“Tencent says it has the technology to build the metaverse and Beijing does not oppose the concept” (yet). Link

-

Ultra announced its first partnership with Skybound Entertainment. Link

-

Over 600 teams are building on the Flow Blockchain (developed by Dapper Labs). Link

🕹️ Culture & Games:

-

Riot Games strikes again, with Arcane debuting number one on Netflix in 38 countries. 1.4M tuned into the Twitch co-stream. Link

-

Matthew Ball’s original metaverse essay was auctioned as an NFT and bought for 100 ETH. Link

-

Discord teased a web3 integration and rolled back plans after public feedback. Link

-

Genshin Impact plans to dive into UGC and fan-fiction. Link

👾 Miscellaneous Musings:

-

Decoding The Use Cases For Blockchain Gaming. Link

-

Animal Crossing: New Horizons and the Limits of Today’s Game Economies. Link

-

Forte + Solana — Chatting about the underlying infrastructure-related in relation to games. Link

-

Brian Cho thread on web3 x gaming. Link

🔥 Featured Jobs

-

Virtex: Partnerships Director (Remote, Global)

-

BebopBee: Community + Player Experience Manager (Menlo Park, CA)

-

Immutable: BD Exec, Gaming (Remote, US/EU)

-

Ubisoft: Junior Technical Artist (Bucharest, Romania)

-

Hypixel: Senior Game Designer (Remote, Global)

-

Piepacker: Tech Director (Remote, EU)

-

Playco: Financial Planning & Analysis Consultant (Remote, US)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.