Source: VentureBeat

Forte and Naavik recently teamed up to provide ongoing deep dives geared toward helping game developers better build, launch, and scale successful and sustainable blockchain games. This is the second essay in our series, spearheaded by Maxime Eyraud.

Designing and operating a game can be daunting enough in and of itself. Add to that the complexity of blockchain technology, and you're in for a wild ride.

In a recent essay, we shared an introductory framework that we think can help game developers make sound decisions when it comes to their game's architecture, design, and economics before diving head-first into blockchain’s potential. We believe making time to research the blockchain's nascent space and define your needs and priorities is a necessary first step to create compelling games that will not only attract users but also stand the test of time.

Fortunately, you don't need to reinvent the wheel. Using some of the blockchain’s most central and exciting attributes — namely decentralization, composability, and true digital ownership — you can tap into an ever-growing stack of chains, protocols, and applications to kickstart and scale your game’s development.

By the end of this article, you’ll have a good understanding of how blockchain gaming infrastructure works, how some of the most prominent titles in the space are using it today, which teams to work with, and how it can help you bring novel capabilities to your own game.

What is Infrastructure?

Defining Infrastructure

Before we can look at blockchain gaming’s nascent infrastructure, it’s important to know exactly what it is we mean when we talk about infrastructure.

In the physical world, infrastructure can be defined as “the set of fundamental facilities and systems that support the sustainable functionality of households and firms.” It’s composed of both public and private structures that span everything from transportation to energy, to the information and communication sectors, to agriculture and manufacturing. Put differently, infrastructure is the underlying support system of what businesses, industries, or entire countries rely on to function not just properly but sustainably. Interestingly, we tend to notice it only when it’s lacking; most of the time, we’re content just accessing its services without getting into the nitty-gritty of how they work or why they’re even here.

All these systems are core to the business realm. As industries emerge and mature, there is often a massive market opportunity in addressing not the end consumer, but the businesses that serve them. This "picks-and-shovels" approach can be observed across industries and has historically enabled numerous industry giants in the Web2 world.

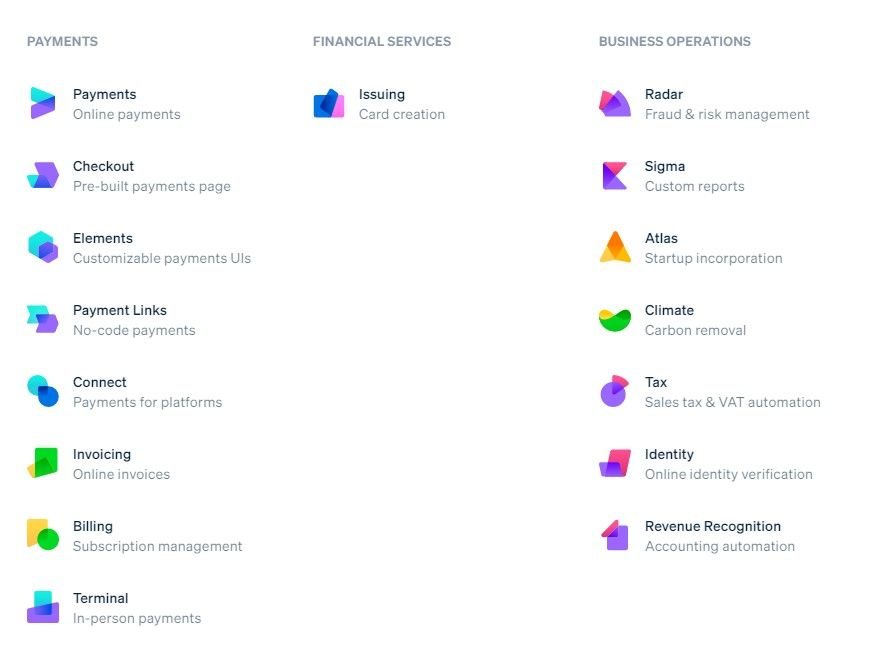

In finance, service providers like Visa and Mastercard have long served as the pipes for instant, global payments; today, a more web-native competitor can be found in Stripe — whose mission is, adequately, “to increase the GDP of the Internet.” In ecommerce, Amazon and Shopify have similarly become vital infrastructure for millions of merchants, who gain easy access to th

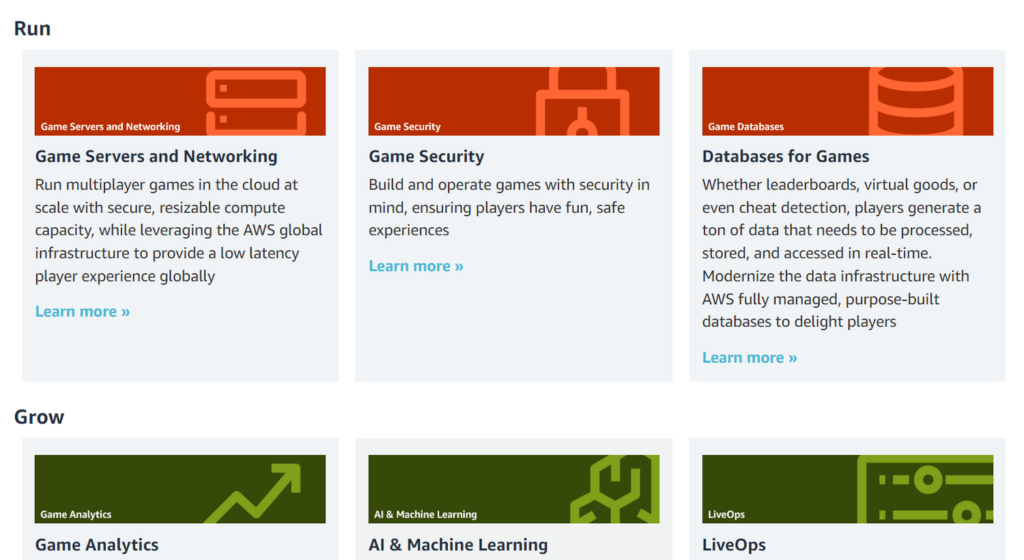

Of course, infrastructure can also be found in our (and, we’re guessing, your) favorite sector: gaming. Here, companies like Unity and Epic Games have become fundamental to the creativity and business of millions of developers who use these engines and ever-growing sets of tools to develop, scale, operate, and monetize their games. Further down the stack, cloud computing services including AWS, Google Cloud, and Microsoft Azure are now just as vital to the industry — so much so that most of them now offer gaming-focused cloud architectures for everything from remote graphical workstations to real-time matchmaking to game analytics.

This quick overview shows us two things.

Firstly, infrastructure is constantly evolving. With time, the companies that can make themselves essential to the functioning and success of others tend to grow increasingly valuable as they expand on their original value proposition. Unity and Epic Games both did so through aggressive R&D and M&A, acquiring specialized software companies across photogrammetry, animation, and virtual production tools. Vertical integration also allows infrastructure companies to pick on growing pain points and quickly allocate resources to solve them for their customers. In turn, their comprehensive offerings mean they’re able to solidify their dominance in the marketplace by capturing more of the value chain.

Secondly, infrastructure is mostly… invisible. Just looking at a game, you’d be hard-pressed to guess which engine was used to build it, or which cloud back-end its servers rely on. What you care about is that the game is good, that you can play it without lag, and that you’re matched with players with similar skill levels. To the player (or, more generally, to the user), the service provider remains just that. In fact, tech infrastructure can become so ubiquitous that most companies end up relying on the same few building blocks, unbeknownst to their respective users: 94% of gaming studios are Unity customers.

Why Infrastructure Matters

Looking at the sheer size and success of infrastructure giants, you could be forgiven for thinking that they extract vastly more value than they offer. Yet as these players solidify their position and broaden their product offerings, they enable entire ecosystems to form, scale, and thrive on top of them.

For one, infrastructure enables new entrants to focus on their core competencies. Think of all the variables you as a game developer need to consider at launch: What will the physics of your game look like? Where will you store your data, and how will you scale your servers as usage grows? How will you distribute your game and acquire players? Today, a developer could use widely available engines such as Unity, Unreal, or Godot for its physics, AWS or Azure for its cloud back-end, the App Store or Google Play Store for distributing its app, and Facebook or TikTok for acquiring users — to name just a few of the many options available.

What if every new entrant had to invent its engine, cloud back-end, app store, and ad network? Not only would that be incredibly inefficient at the company level, requiring substantial funding to even get started; it would also drastically slow down the pace of innovation at the industry level, since most participants would be spending their time and capital concurrently tackling the same basic problems. Instead, infrastructure solves this by providing early-stage companies with building blocks they can use for most of their needs, before optimizing at the margin of the stack later on. This means faster execution, iteration, and scaling, at lower costs.

Of course, highly specific needs may still require custom-built solutions: innovation across the stack happens in part because newcomers are able to overcome current technological shortcomings on their own. Netflix is famous for developing Open Connect, its own in-house content distribution network, to ensure consistent delivery of its content. Likewise in gaming, Rockstar Games developed its own proprietary game engine, RAGE. Over time, specialized pieces of software can become external-facing products in their own right — thus turning into industry-specific infrastructure software themselves. Every valuable piece of technology that becomes readily available to the broader market is one more barrier to innovation that’s lifted for future participants.

Infrastructure also enables developers to focus on the application layer, as things like networking, storage, delivery, and monetization get solved further down the stack. This drives ecosystem-wide innovation to expand the supply of content and experiences available. For example, the rise of Facebook enabled social gaming, as developers like Zynga were able to tap the platform’s for distribution and user acquisition. Similarly, real-time engines such as Unity and Unreal today provide developers with a comprehensive software suite to handle major technical hurdles including a game’s physics, logic, and more. This means they can focus instead on their titles’ art, design, and economy, which more directly contribute to their uniqueness, appeal, and overall success.

Beside relying on organic growth, large infrastructure players will typically also accelerate and subsidize innovation. This can be done in a number of ways, from providing capital (e.g. Epic Game’s grants), resources (e.g. AWS’ cloud credits), mentorship, and early access to proprietary software (e.g. Epic’s Unreal Engine 5). All these initiatives can help kickstart solid developer ecosystems, which leads to more – and more diverse – content and experiences for end users, which only makes the underlying platforms more attractive — and so the cycle continues.

Blockchain Infrastructure: The Path, Destination & Trade-Offs

Web2 Infrastructure and its Trade-offs

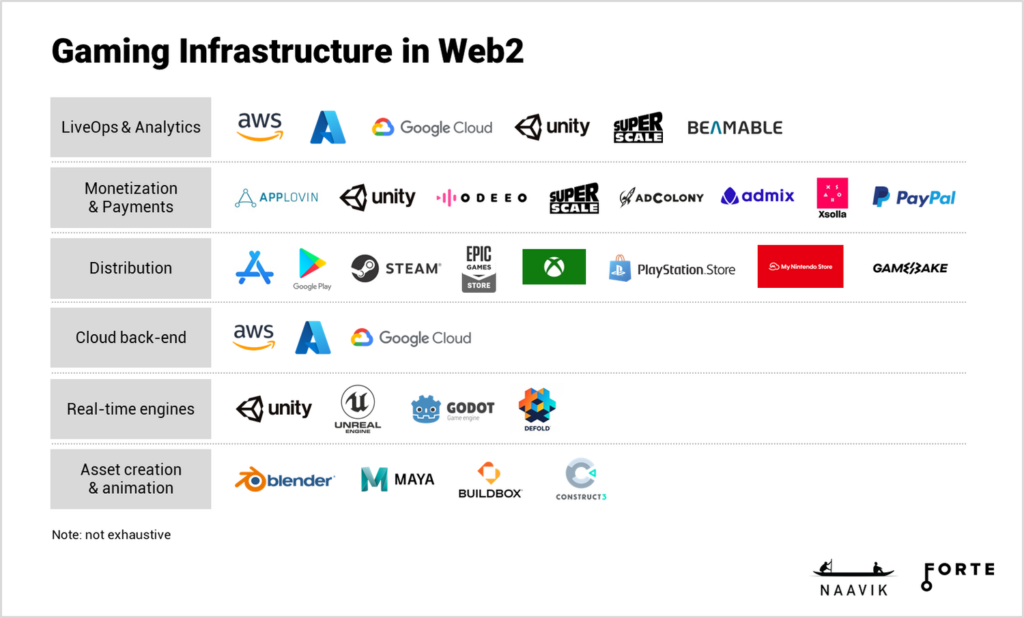

We now have a better sense of what the current gaming infrastructure is and what it’s for. But what does it look like? At a high level, it looks something like this.

Chances are, you know most of these names. Some of them, like Unity, AWS, or Steam, are now go-to providers for developers big and small; others, like Admix and SuperScale, are up-and-coming startups addressing them with, for now, more limited offerings. No matter their stage of development, these companies are serving all players in the same agnostic way.

Yet they do so with sometimes very different models. While Blender is “owned by its contributors,” available as “Free and Open Source software,” and funded only by corporate memberships, the majority of the stack consists of for-profit companies. This has important consequences for what their products can be used for, how much it costs to use them, or even who’s allowed to use them.

But before we dive in, it’s important to note that we’re talking about trade-offs here, not problems per se. While some Web3 maximalists may be prone to denounce the Web2 modus operandi as inherently flawed, these platforms have nonetheless empowered millions of individuals and businesses to produce, scale, and monetize creative work in ways that weren’t possible before. As both a medium and an industry, gaming has certainly benefited: the rise of social gaming on Facebook and free-to-play mobile gaming on the App Store is proof enough that success can be achieved despite sometimes abusive terms.

With that in mind, Web2 as it stands today does come with some limitations. Let’s work through them.

Lock-in

Ask any hardcore Web3 believer, and you’re likely to first hear about Web2’s uncompetitiveness. Untransferable user data and a propensity to fear, rather than embrace, competition mean Web2 platforms tend to seize every opportunity they get to lock in users. This can be felt in a number of ways.

One of them is proprietary ecosystems. For example, Microsoft, Sony, and Nintendo have all made sure over the years to integrate the hardware and software aspects of gaming into a unified experience. This prevents players from switching between the companies’ respective ecosystems or to mix and match between them. To buy a particular console means to buy into its ecosystem, which not only determines the content you’ll be able to access — exclusivity is rising — but also comes with friction costs later on.

Another consequence is pricing power, or, more largely, the ability to dictate potentially abusive financial terms. For example, Apple’s sway over distribution, acquisition, and monetization in mobile gaming through the App Store has enabled the company to reach what is arguably a dominant position, most visible in its much-criticized take rate. The company also prevents developers from using any service providers in their apps that might circumvent Apple Pay and enable them to increase their margins.

Finally, another consequence is platform risk, the kind that arises when a business builds on top of an existing platform in order to leverage its services and reach. Due to a lack of both channel diversification and ownership, any sudden change in that platform’s terms or strategy may put your activity at risk. For example, and though we’ve mentioned earlier that Facebook was a boon to Zynga, the end of that exclusive relationship struck a heavy blow to the game developer. No matter the platform, over-reliance is likely to lead to a position of vulnerability.

Censorship

Censorship can be defined as a system in which an authority limits the ideas that people are allowed to express or the actions they’re allowed to take.

It’s a power that Web2 has wielded in various ways, with the field of social media offering some of the best-known examples. Meta’s 2018 decision to ban crypto-related ads from Facebook, and its reversal more than three years later, showcased the sometimes capricious nature of walled gardens and the danger in relying on Web2’s infrastructure and reach to promote Web3 products. But gaming hasn’t exactly escaped this trend. In October, Valve banned blockchain games and NFTs from using its platform Steam. Considering Steam’s currently central role in the distribution and monetization of games, this decision left a vacuum that will need filling if blockchain-gaming is to find mainstream success.

These examples go to show that top-down censorship can potentially affect any person or company, as long as the entity responsible for the underlying infrastructure — be it political or technological — has a say in their behavior.

What Blockchain Infrastructure Is Building Towards

For all its trade-offs, Web2 is unlikely to go away anytime soon. On that note, DarkstarDAO recommends looking at Web3 on three different time horizons: as testing ground, as complement, or as critique. Take a long enough view, and all three actually live on the same spectrum.

What this means is that the two worlds will continue to coexist, at least for some time. This is true both at the organizational level — i.e. LLCs will thrive alongside decentralized organizations like DAOs — and at the technological level. For example, Epic Games’ CEO Tim Sweeney has stated that the company is committed to making its stores more open and to “[recognizing] universal ownership.” As Valve banned NFTs from Steam in October, Sweeney instead reiterated that the Epic Games Store will welcome all games, blockchain-enabled or not.

Other Web2 giants are just as likely to find a place of choice in a Web3 future: in January last year, web security provider CloudFlare announced it aims to be “one of the many technical platforms that supports Web3 and the growing Metaverse ecosystem.” That the company is featured in Sorare’s stack seems to validate these ambitions. Similarly, the capabilities of engines like Unity and Unreal still make them the default creative software for blockchain-native game developers. As these companies’ interest in blockchain matures and they start to allocate more resources to it, the lines between what is or isn’t Web2 or Web3 will continue to blur.

A Primer on Blockchain Infrastructure

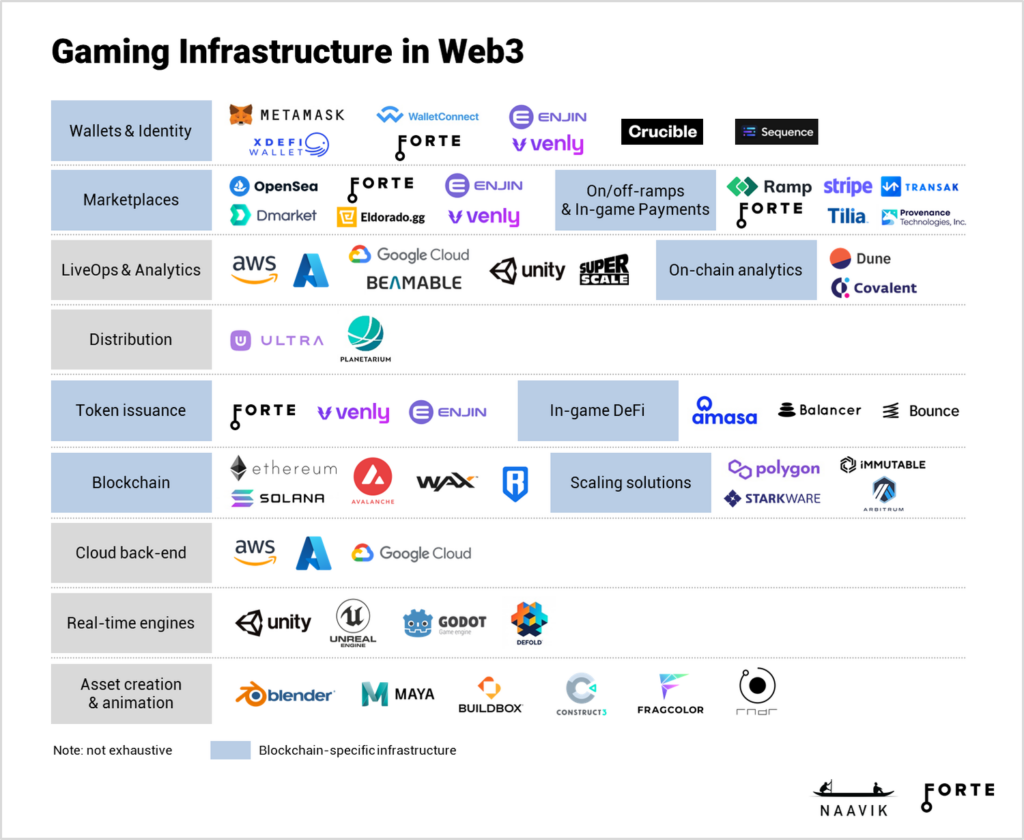

At first glance, blockchain gaming infrastructure doesn’t look too different from its Web2 predecessor. Judge for yourself.

In areas like asset creation & animation, real-time engines, cloud back-ends, and LiveOps & analytics, the same tools and companies can and are being used in Web3. Because blockchain games are, well, games, they rely on the same building blocks: creative software, scalable servers, and data-driven optimization are as crucial to them as to any Free-To-Play mobile game. Horizon Blockchain Games, for example, leverages Google Cloud and AWS for application hosting, and Figma and Photoshop for design.

Things start to look very different as soon as you enter the “blockchain” aspect of blockchain gaming, and the diagram above will naturally need updating as the market itself evolves and matures. Then, every decision you make, every feature you plan on adding, requires some distinctively blockchain-native piece of software. First, of course, you’ll need to choose your Layer 1 blockchain, the most consequential building block in your entire stack. Then come other functions like NFT and currency issuance, DeFi-related features like staking and liquidity pools, identity & fund custody.

All this, and more, we’ll cover in the next section. But first, it’s important to understand that Web3’s paradigm has as much to do with technology as it does with more philosophical stances. Let’s talk about decentralization, interoperability, and composability.

Decentralization

In blockchain, decentralization refers to the transfer of control and decision-making away from a centralized entity and to a distributed network.

It has several benefits. Firstly, it provides a trustless environment in which members don’t need to know or trust each other to work together: consensus is reached technically through the blockchain’s validation mechanism instead of socially through human interaction. Secondly, it improves data consistency across the network, limiting the risk of losing information as it circulates. Thirdly, it ensures that no single node can lead to the accidental or deliberate failure of the network. Fourthly and lastly, decentralization optimizes the distribution of resources, which leads to better service through better incentives.

In more practical terms, decentralization helps mitigate potential abuses of power, namely a platform’s lock-in and unilateral censorship. For example, Vitalik Buterin famously became interested in the potential of decentralized technology after a World of Warcraft patch nerfed a component of his favorite character. The idea of “true ownership” typically associated with NFTs is a central element of the broader decentralized ideal.

Ultimately, decentralization shouldn’t be thought of in absolutes, but rather as a continuum, as explained in Variant’s Jesse Walden’s landmark essay. The developers most adamant about it may want to grant players governance rights, whereas others will try to preserve full control over their titles. Sky Mavis, which aims to ultimately become a Decentralized Autonomous Organization, has laid out steps towards that goal in its whitepaper — it’s now at the “Version 2” stage of the process, with plans to fully decentralize by September 2023. Time will tell if decentralization is beneficial to gaming for reasons other than philosophical.

Interoperability

Interoperability is the ability for an asset to be used across multiple apps, protocols, and/or chains. It relies on the widespread adoption of open standards in the transfer, storage, and treatment of both data and assets.

Interest in interoperability surged in the past few months, for several reasons. Firstly, the growth of the broader NFT market drew new eyes (and capital) onto the transformative potential of blockchain-native digital assets. Secondly, a handful of projects started building with interoperability in mind from day 1. Metakey, Jadu and BYOPills, among others, are creating and distributing “Metaverse-ready” 3D models — of passes, hoverboards, and consumables, respectively — that can be used across virtual worlds. Meanwhile, Galaxy Fight Club is trying to build “the first Cross-IP PVP game for the NFT Universe,” by integrating with third-party characters, weapons, and consumables.

Underlying all these examples is a belief that enabling users to seamlessly carry and use their assets will make for richer experiences across the board for all stakeholders.

Indeed, and in contrast with Web2’s typical lock-in, interoperability provides players with an opportunity to effectively exit a game and move their belongings and progression along with them towards greener digital pastures. This benefits developers, too. Firstly, they’re able to bring third-party goods into their games, something that could dramatically decrease development time and costs while extending their games’ shelf life. Secondly, cross-game interoperability allows them to tap liquidity wherever it may be, generating incremental revenue in the form of secondary sales on external marketplaces.

Ultimately, interoperability allows for greater alignment between developers’ and players’ interests, and has the potential to grow opportunities within and across virtual worlds by orders of magnitude. More liquidity, larger TAMs, and greater utility mean every creator, either casual or professional, is incentivized to produce and circulate more digital assets, in more places. This could unlock a new, mutually beneficial transaction layer across the entire ecosystem, a model Forte calls Community Economics.

Composability

Composability is the ability to mix and match software components. Like interoperability, it’s made possible technically by the prevalence of open-source code and ecosystem-level standards such as ERC-1155 and ERC-20 tokens; and culturally by an ethos of open, transparent collaboration. If interoperability is about circulating and using assets as they are, composability is about turning them into something more.

Using NFTs as building blocks, for example, lets developers expand on a set of primitives in a decentralized fashion. The best example of this is the Loot ecosystem, whose members are all building on top of the same deliberately abstract, RPG-themed NFTs.

Yet composability applies not just to individual NFTs, but to games, mechanics, protocols, and even entire blockchains. The prevalence of open-source code and the ability for anyone to access, read, and utilize a wallet’s transaction history on the blockchain’s ledger allow developers to fork and improve on existing incentives, capital efficiency models, or interfaces. This fosters ecosystem-wide innovation, as protocols are incentivized to continuously serve users in the best way possible if they hope to attract and retain them.

Recent history presents us with a few good examples. One of them can be found in the world of DeFi, where SushiSwap, a decentralized exchange and Automated Market Maker forked from UniSwap, siphoned its predecessor’s liquidity in what has come to be known as a vampire attack. Something similar happened in January to OpenSea, the leading NFT marketplace, when newcomer LooksRare drew in the platform’s active users with a genesis airdrop of its own token, LOOKS.

Composability is increasingly present in gaming, too. Open standards around fungible tokens allowed Axie Infinity players to move their hard-earned SLP bags to third-party exchanges like UniSwap in order to swap them for ETH or enter liquidity pools. In DeFi Kingdom, Heroes are interactive NFTs that can be loaned for JEWEL, which acts as both a token and in-game currency. Players can then stake their JEWEL to trade them for xJEWEL, a governance token; or place that liquidity in “the Garden” to gradually receive plots of digital land proportional to their share. In Treasure, composability is used as a storytelling tool: the team suggested using LP tokens as keys to unlock “new time periods” and “new realms” within the game, and MAGIC — the game’s token — as “a natural resource that is unfairly and unpredictably distributed around the Treasure metaverse.” Composability tends to blur the lines between fungible and non-fungible assets by enabling one category to produce more of the other.

Blockchain Infrastructure in Practice

We’ve just covered what are some of the blockchain’s most defining attributes: how it’s supposed to work, in theory. But what about in practice?

From our own observations, many blockchain proponents today tend to put forward only the technology’s potential, to the risk of overlooking some of its most pressing issues. Some of them may do so because they’re trying to sell you on their vision and turn you into a user of their blockchain-enabled product — incentives, incentives… Others may be trying to take “the long view,” dismissing any of the technology’s limitations as short-term hurdles to overcome, not actual deal breakers.

All this makes it all the more important, albeit difficult, to grasp exactly where blockchain technology stands today with regards to its many promises. The blockchain isn’t a cure-all for gaming any more than it is for any other industry, and understanding its constraints can help developers better assess some of the risks that come with implementing it across their games.

Centralization is Still Possible

At the organizational level, centralization is fairly obvious. Indeed, some of the most successful blockchain games in use today, including Axie Infinity and Sorare, come from centralized organizations. These entities have organizational charts, offices, payrolls, and everything else that you would expect to find at any “normal”, non-blockchain company. Adequately, the decision-making is coming from the top as well: for example, Sorare’s partnerships and features are designed and managed in a top-down fashion, without the involvement of players. In other words, building on and for the blockchain does not necessarily make these companies any less centralized.

This applies to other areas, too. At the technical level, most blockchain games rely on centralized databases and services, with data stored on-premise or in private servers, in proprietary code that’s mostly hidden from third-parties. A massive influx of new players caused Sky Mavis’ servers to go down last year, leaving only the team in capacity to bring them back online. The consequences of financial centralization can be just as dire: over $500M in ETH and USDC were recently stolen by a single individual from Sky Mavis’s Ronin Bridge, a reminder that centralization allows for potentially disastrous attacks.

Still, we want to emphasize that centralization isn’t inherently bad — trade-offs, not problems, remember? In theory, it allows for stricter, and hopefully better, protocols when it comes to how users’ data and funds are collected, accessed, and used. In the recent Ronin breach, the hacker was able to steal the funds after they gained majority control of the network’s validator nodes. The root cause, Sky Mavis stated, was “the small validator set which made it much easier to compromise the network.” Yet you could argue that centralization was precisely what could have prevented the breach in the first place, had more stringent security standards been implemented. As the company wrote on Twitter, “racing for main-stream adoption, [it] made some trade-offs that ended up leaving [it] vulnerable.” The issue, then, was not so much centralization alone but insufficiently secured centralization. To boot, freezing stolen funds after a hack can only be done with the support of centralized exchanges and token issuers. A helpful rule of thumb, then, could be to not seek decentralization for the sake of decentralization, but build towards it as your organizational and technological capabilities improve.

Censorship is Still Possible

As fully-fledged companies with legal structures and representation, entities like the ones we’ve just described operate under sometimes stringent legal constraints that span fraud monitoring, security law, and consumer protection.

This applies to games across all genres and at all stages of development. As pointed out by Naavik’s own breakdown of the game, The Sandbox’s Terms suggest that the company abides by Hong Kong jurisdiction; should it decide to enforce its policy more strictly, it could start moderating content deemed illegal in the country. In August last year, the Philippine Bureau of Internal Revenue (BIR) announced that Axie Infinity players must register to pay taxes on the income they generate from the game. We expect this kind of legal and financial scrutiny to only increase for blockchain gaming in the coming months and years.

Still, not all censorship comes from governments. Indeed, developers themselves are free to enforce their own terms, some of which may at times go against the Web3 ideals of censorship-resistance. For example, Sky Mavis in October banned all low-level players from earning SLP inside Axie Infinity. Meanwhile, the Sandbox makes it clear it “retains the right to moderate and review Assets for copyright infringement and to remove Assets from The Sandbox that violate these Terms.” As blockchain games continue to attract larger audiences and open themselves to user-generated content, such instances of top-down moderation may become more common.

Lock-in is Still Possible

Despite the promises of asset interoperability and data portability, blockchain projects and companies are still able to maintain some kind of stronghold over their user’s engagement and capital. There are several reasons for this.

Firstly, not all code is available for others to build on top of, or even inspect. While this certainly limits the potential for exploits, it also prevents others from forking your game. With no substitute, or better, SUSHI- or LOOK-like incentives, to farm elsewhere, players are more likely to stay in the same spot.

Additionally, competition doesn't preclude dominance. Indeed, the companies, applications, or protocols that most closely fit the market’s current narrative or provide the most value to their users are still able to capture, maintain, and grow their market share. Axie Infinity grew to prominence not just thanks to its gameplay, but because it was early in the market, became somewhat synonymous with Play-To-Earn in mainstream media, and was supported by a “human layer” of cooperation in the dozens of gaming guilds whose scholarship programs essentially subsidized adoption. While this success enticed many a developer to embrace blockchain gaming, Sky Mavis has continued to benefit from its first-mover advantage.

Interoperability is Limited

That interoperability is theoretically feasible doesn’t make it widespread.

As a whole, blockchain gaming is actually increasingly fragmented between multiple ecosystems, as “alt” Layer 1s such as Solana and Avalanche continue to attract users and capital with distinct value propositions. Save for a few rare cases like Blockchain Monster Hunt, a lack of time, resources, or technical skills prevents most games from operating across chains.

This creates inefficiencies. Each new blockchain that embraces gaming as a use case fragments the total user base and liquidity even more. Chain-specific games also call for chain-specific marketplaces, preventing the aggregation of the supply and demand for in-game assets. And while cross-chain bridges do exist, they have their issues: not only are they prone to hacks, they also force users to go through tedious context-switching, handle numerous transactions, and bear the associated costs.

Interoperability isn’t looking much better on the IP front at the moment. Though cross-IP play — as recently exemplified by Yuga Labs’ leaked pitch deck — and cross-game IP have sparked excitement, they still rely on developers’ consensus to integrate them inside their own titles. As demonstrated by Naavik’s own Matt Dion, interoperability in practice must account for “a multitude of possibilities around file formats, visual rendering, design choices, item utilities, various blockchain technologies, and token standards...in addition to the willingness of other creators and IP holders to do the same.” All this makes it “a massive undertaking,” for both individual developers and the ecosystem at large.

This shouldn’t deter you from exploring its potential. Like decentralization, interoperability offers a wide spectrum to play with, and token standardization is still ongoing, which means still new applications for it will continue to emerge. It’s worth keeping an eye out to see where and how you may use them inside your game.

A Closer Look at Blockchain Gaming Infrastructure

Blockchain

First things first: let’s start with the blockchain, evidently the most basic and important infrastructure layer developers need to pick for their games.

Although blockchain gaming was born on Ethereum mainnet, you now have access to a much broader range of options. In recent months, Ethereum’s scalability issues and their associated gas costs have pushed many to turn to Layer 2 solutions in order to make transactions inside their games more palatable. In October last year, Virtually Human Studio’s ZED Run integrated Hyphen, Biconomy’s cross-chain bridge solution, to let players transfer funds from Ethereum to Polygon and back without ever leaving the app.

Meanwhile, gaming is starting to take off on other L1 chains. Avalanche has Crabada, Solana has many active game developers, while Splinterlands on WAX was reaching an average 353K Unique Active Wallets in 2021. With their modular infrastructure, networks like Cosmos and Avalanche allow developers to quickly deploy their own blockchain to serve their needs: DeFi Kingdom recently made the most of it by launching DFK Chain, its own Avalanche subnet and the first of its “Outposts.”

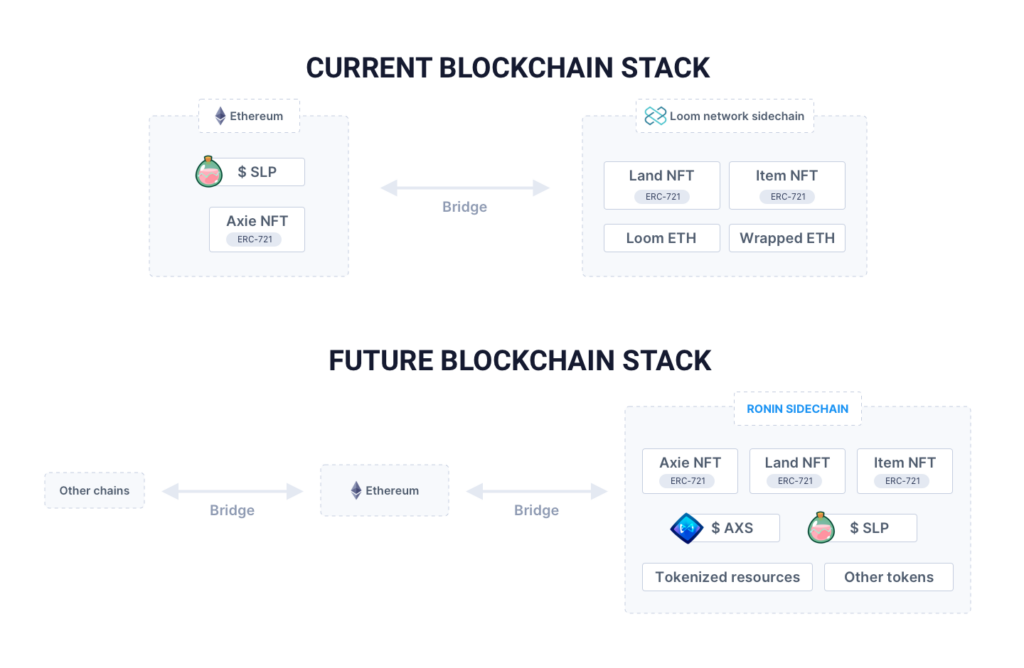

Although it makes the decision process more difficult, this newfound optionality is a boon. Depending on their priorities, and what kind of players they hope to attract, developers can make the most of those chains’ respective strengths, whether it be speed, scalability, or low transaction costs. They can also start from scratch, should they ever want to. For example, Sky Mavis’ decision to build its own sidechain Ronin instead prompted the developer to decide on the future characteristics of its proprietary architecture. The result was a chain designed specifically for gaming and optimized for near instant transactions and negligible fees.

Admittedly, Sky Mavis only took on this task for lack of a better alternative. As pointed out by Nansen, “most existing Layer-2 solutions today are built with DeFi and payments in mind, not gaming.” And “other potential solutions, such as zkSync [...] were too new and did not have the proper infrastructure to cater for the needs of Axie Infinity.“

The developers entering the space today will find an entirely different, and much richer, landscape to compose from.

To capitalize on Ethereum’s early-mover advantage and strong network effects, we suggest you look at solutions like Polygon and Immutable. Compared to mainnet, these L2s enable transactions at a much faster rate, require low computing power, and have lower environmental impact — any NFT that is created or traded on Immutable X is 100% carbon neutral. As of recently, both of these players are also well capitalized, which should help with their staying power; and have launched their own funds to support gaming NFT projects building on their networks.

If you’re willing to explore other L1 solutions, a good option in our view could be Avalanche. With its Subnet offering — “a dynamic set of validators” enabling developers to launch and operate their own application-specific networks —, you can operate your game on top of the Avalanche network while enjoying total performance isolation. This means your game’s performance and user experience remain unbothered by external events that may induce network congestion on another application. DeFi Kingdom recently leveraged that technology to launch its very own DFK chain.

Creative Tools

Creative tools may be the area of the blockchain gaming stack where infrastructure is lagging the most. This begs the question: do developers actually need blockchain-native creative software?

After all, the visible part of most of today’s NFTs is put on-chain, not designed there. 2D content is still being created in software such as Photoshop and Illustrator; 3D content is still being produced in Blender, Maya, and After Effects. And, as mentioned, even some of the most notable blockchain games are using non-blockchain creative software in their workflows: Immersive 3D world Wilder World is developed on Unreal Engine 5, while this job description for a 3D animator at Illuvium mentions that the ideal applicant should be an “Expert in Maya.” From the perspective of the player, it doesn’t really matter if the creative process happens on-chain or not. Why, then, would developers bear the cost of transacting over the blockchain?

Still, things are changing. Firstly, creative software companies increasingly understand the opportunity in enabling creators to engage with the blockchain as early as possible in their workflows: Adobe announced last year it’s looking to add a “Prepare as NFT” option to Photoshop. Secondly, the rise of blockchain-enabled UGC worlds such as The Sandbox, equipped with their own online editors, could further blur the lines between the creation and minting stages of the process.

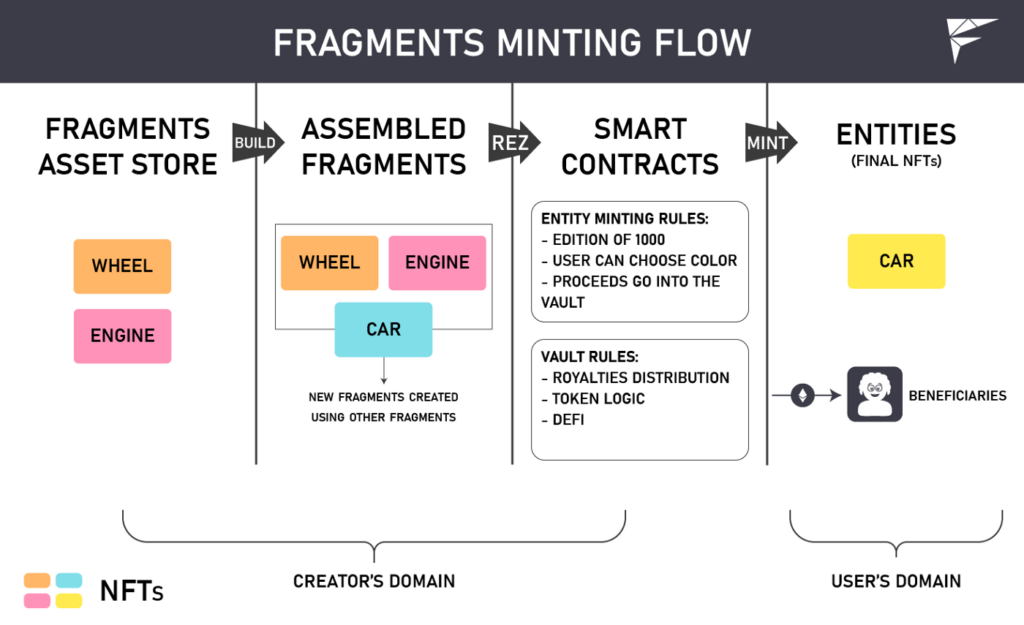

In the meantime, and if you’re set on using blockchain-native editing tools, we recommend you take a look at Fragcolor. The company aims to build “the first interoperability & moddability native game engine” and to enable a “Create-to-Earn” economy, a creator-focused equivalent to Play-to-Earn. Under this model, each and every game asset is considered a “Fragment” and can be used with others to compose a final NFT. Each sale then splits revenue to assign royalties to the respective creators of that NFT’s Fragments.

If you’re using Unity, consider using Venly’s Unity plugin, which enables you to manage in-game items as blockchain assets compatible with Polygon. The solution also lets you visually edit NFT contracts and tokens through the Venly Manager window; deploy new contracts and tokens from within the editor; and read your players’ wallets to update token quantities. This is one of the most seamless integrations we’ve come across with established Web2 software.

Identity, Fund, & Asset Management

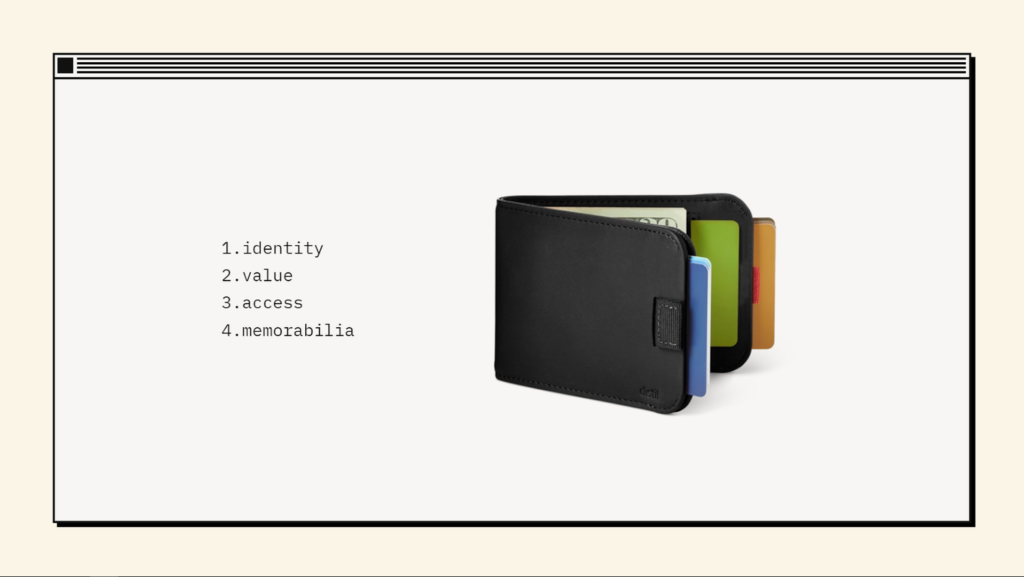

Wallet-based login is a staple feature of Web3, and one that has been abundantly covered in the last few months. As Seyi Taylor aptly puts it, it simultaneously represents your identity, carries value, provides access, and saves memorabilia. Like the rest of the crypto space, blockchain games are looking to make the most of this potential.

At first, you may think that identity management is enough. If the issue is just signing in to a game, why would players require fund custody? But in Web3, the two go hand in hand: your wallet is both your passport and your inventory. Further, the Play-To-Earn model is already driving the rapid financialization of gaming — more on this in a minute. As more blockchain games start to integrate undoubtedly financial features like token swaps, staking, liquidity pools, and auctions, the need to onboard users with dedicated tools will only grow.

Furthermore, the integration of NFTs as a core mechanism within games calls for secure, intuitive storage and custody solutions. Indeed, NFTs are not just in-game items, but can represent your progression inside a game, a RPG class, or a pass to access a particular dungeon. As the wallet comes to consolidate more and more of a player’s game-specific identity and accomplishments, it’s vital that developers start taking the matter seriously.

Fortunately, they can now leverage useful building blocks in this area.

If your players are not blockchain-native, we strongly recommend you look at custodian solutions such as Forte’s or Venly’s wallet, both of which are streamlining the onboarding of mainstream gamers. For example, Venly users can create a wallet using email or a social account; this gives you access to multi-factor authentication, recoverable wallets, and customer support. Meanwhile, Forte’s wallet is fully customizable, letting you maintain a consistent UX across the player flow. With its focus on compliance, the company also handles KYC and AML on your behalf.

What about the non-custodial side of the spectrum? On this front, a solution we like is XDEFI. Emile Dubié, the co-founder of XDEFI, recently suggested that developers will be able to customize the wallet’s UX to their needs to enable game-specific user flows — for example, abstracting away DeFi-related capabilities like swaps that are not needed in your game. Custom skins and UIs will also make the wallet integral to the play experience. We think this approach is a great compromise as it simplifies onboarding while maintaining the ownership that comes with non-custodial wallets. Cross The Ages is set to leverage those capabilities.

Other players in this exciting area include Crucible Networks, Enjin, and Ultra — with many more teams probably working on it, too.

Marketplaces

The introduction of NFTs generally has a profound impact on a game’s economy. Among these assets’ most discussed attributes is liquidity: the idea that players can buy and sell in-game items on the free market if they decide to part with them. Yet liquidity is only possible where and when the supply and demand side of a trade meet. Hence, marketplaces.

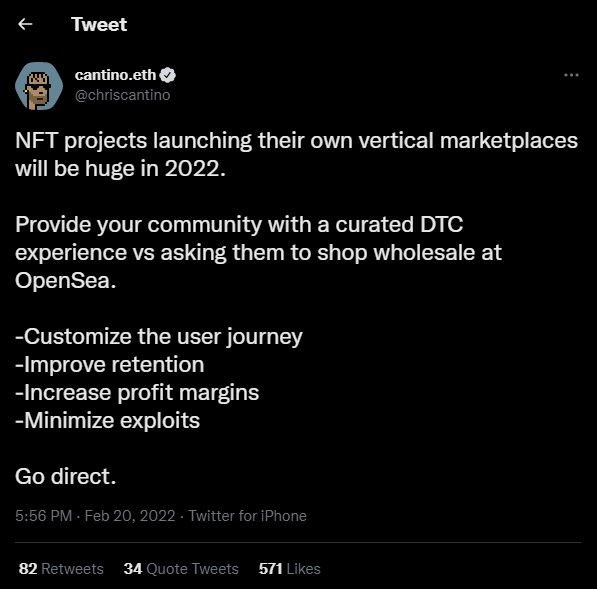

Today, most trades take place on third-party marketplaces such as OpenSea and DMarket. These destinations provide collectors with a range of features to set their selling or buying price, using either fixed prices or auction models. As neutral infrastructure using open blockchain standards, they welcome assets from all games and genres, and provide holders with valuable liquidity from a single point of access. Yet all signs point towards further integration of this aspect of the value chain directly inside blockchain games. It’s worth exploring why.

In-game marketplaces bring a number of benefits, as demonstrated recently by Web3 investor Chris Cantino. Firstly, they enable developers to own and customize the user journey through game-specific flows and interfaces. Secondly, they reduce friction, thus improving retention: players can find liquidity right inside their favorite games, where other users are the most likely buyers for what they have to sell. Thirdly, they increase profit margins, as creators get to bypass the marketplace fees that typically taxe a project’s secondary revenue, and can choose their own take rate instead. Fourthly, they minimize the risk of exploits, since everything is now under the direct control of the developer.

Here, we recommend you take a look at Forte. The company’s solution not only makes it easy to launch your own in-game marketplace, but also lets you tap outside demand by connecting with other chains and exchanges as well. This has the potential to maximize liquidity for your players, which provides greater incentives to actively contribute to your in-game economy. Venly’s Market API comes with a similar proposition and the ability to use your preferred payment providers and accept fiat payments to accommodate crypto beginners.

No matter how expansive your marketplace, be sure to emphasize security and compliance. By and large, ubiquitous anonymity has led even the most publicized NFT marketplaces to be notoriously ripe with wash trading, as affluent collectors can evade taxes by deliberately selling some of their assets “at a loss” to themselves. These places are also subject to numerous copyright infringements, with bad actors directly copying other people’s art to lure unsuspicious buyers into purchasing a fake. Forte acknowledged these issues early on and today provides both tax planning and IP protection for its partners’ marketplaces.

In-Game Economics

We’ve mentioned above how the Play-To-Earn model is driving the rapid financialization of gaming. In fact, some observers have suggested that these games may be the perfect wedge to onboard users into DeFi at large. But while “Play-to-Earn” makes for a catchy value proposition, it fails to encompass the extent to which blockchain gaming is now integrating well-known DeFi mechanisms.

More and more blockchain games have started to introduce blockchain-native financial features, as the presence of not just NFTs, but fungible tokens for in-game trading or governance, has given developers an opportunity to make the most of composability. For example, a few days after a much-publicized airdrop of its governance token AXS, Sky Mavis introduced staking capabilities inside its game as a way “to reward [its] community members for having a long-term mindset.”

If you’ve done your homework and are sure your game can stand the test of financialization, here are some solutions we think can help you stand out.

In the area of liquidity pools, Balancer comes with an attractive value proposition. Its Balancer Liquidity Bootstrapping Pools (BLBP) are “designed to allow DeFi protocols to acquire capital from a smaller amount of liquidity than would usually be required when seeding a pool” on AMMs such as UniSwap or SushiSwap. The declining price mechanism of BLBPs enables interested users to wait until they are comfortable with the price before acquiring tokens. Illuvium integrated Balancer pools ahead of launch as a way to attract external capital and connect with third-party communities. Liquidity pools are a good way to rapidly make your game’s governance more decentralized.

But perhaps you’re looking for more niche use cases? In that case, take a look at DokiDoki, which lets you deploy gachapon-inspired digital vending machines. Using the tool, you can create a new in-game gachapon machine; set its name, token, and price per play; load your game’s own NFTs as prizes; and earn tokens in real time as players use the machine. This could be a smart way to gamify the distribution of NFT inside your game while also earning passive revenue.

Payments

Where there are marketplaces to browse, goods to desire, and, more generally, money to be made and spent, you’re sure to find payments. Therefore, all financial aspects of blockchain gaming, from the presence of NFT to the ability to earn cryptocurrencies as a reward for your actions, now call for dedicated solutions.

Perhaps the most important blocks to consider on this front sit at the very beginning and the very end of the user journey: adequately, on-boarding and off-boarding solutions (commonly known as on- and off-ramps) have become vital to the success of blockchain games.

Here, we suggest you consider Ramp, whose intuitive solutions have become a go-to for some of the space’s most prominent blockchain games including Sorare and Axie Infinity. According to Ramp’s own analysis, the integration made the onboarding on Sorare 40% faster and more streamlined. In the same fashion, Ramp now lets Axie Infinity users purchase assets directly from Sky Mavis’s Ronin chain. Ramp’s initial analysis found that it was able to reduce the game’s on-ramp to 19 steps and 12 minutes, a stark departure from the previous flow of nearly 60 steps and an average onboarding time of 2 hours.

Solutions like Ramp’s are crucial to games that present their players with an initial barrier to entry — e.g. Axie Infinity’s requirement for a team of three Axies to start playing — or whose gameplay tends to encourage repeat payments — e.g. Sorare’s focus on card collecting. In both instances, Ramp shortens onboarding by enabling users to “top up instantly without ever leaving the app or giving data to 3rd-party exchanges.” This reduces friction and ensures developers have total control over their game’s flow.

But there is more to in-game payments than on- and off-ramps. If you’re looking to not just reward, but empower your players, you may want to look at Amasa. This particular protocol aggregates micro income streams and automatically swaps them into stablecoins on a rolling basis in order to shield them from market volatility. It also enables users to tap into “community-approved DeFi investment portfolios” to maximize their yield. In our book, this sounds like an incredibly attractive premise: as the variety of possible gameplays increases within blockchain games, maximizing their yields will make sure players are incentivized to keep playing.

The Emergence of End-to-End Solutions

While we’ve focused on individual building blocks, a handful of companies are now arming developers with integrated solutions that aim to address all their needs in a turnkey fashion.

This trend shouldn’t come as a surprise — as former Netscape CEO Jim Barksdale famously said, there are only two ways to make money in business: “bundling and unbundling.” The current attempt at integrating more of a fragmented stack is only the latest, now blockchain-specific, example of the former approach. In more ways than one, the blockchain only makes it more needed. Since composability and forkability mean any new entrant can launch their own version of an existing tool or protocol (at least in theory), they are, in essence, unbundling forces. In contrast, vertical integration is all about bundling.

Here, two companies have come with equally compelling, albeit very different, offerings: Forte, and Ultra. Let’s work through them in turn.

Since inception, Forte has aimed to provide game developers with an end-to-end infrastructure for implementing and running blockchain-enabled services inside their properties. Taking a first principles approach, it has made sure to offer every one of the fundamental building blocks that make a blockchain game what it is. Today, the company works with developers on most of their blockchain-related needs, including embedding cross-chain wallets, minting and selling NFTs, designing in-game economies, and implementing on- and -off payment rails.

Across all these features, and in contrast with the rest of the industry, Forte has been focused on regulatory compliance. As a centralized company itself, it has obtained multiple licenses that enable it to offer “enterprise solutions for token issuance, custodianship, exchange, fiat, and virtual currency purchases.” Importantly, working closely with regulators means it can provide developers with future-proof tools, rather than constantly react to regulatory scrutiny.

While this last point is often overlooked, building with a long-term mindset and keeping up with local and international regulation may in fact be the only way to safeguard your titles against legal hurdles in the future. For example, Meta’s regulatory tango with Germany’s Federal Cartel Office over the company’s cross-app data collection has put it in a difficult position in the country since the court’s first ruling in 2016. After regulators in Europe in May hinted at new legislation regarding transatlantic data transfers, the company threatened to shut down Facebook and Instagram in Europe on the basis that this would “materially and adversely affect [its] business, financial condition, and results of operations.” Gaming has faced similar struggles: multiple countries have limited or altogether banned loot boxes in an attempt to regulate predatory microtransactions. The smallest sign of upcoming changes to local regulations can have significant implications on your ability to operate and monetize. Things like KYC (Know Your Customer) and AML (Anti Money Laundering), in particular, should be monitored carefully.

Ultra comes with a very different value proposition. The company provides developers with an integrated distribution platform from which they can primarily upload, distribute, and update their games (Ultra Games, a blockchain equivalent to Steam); geofence content to implement competitive pricing; and create, program, and sell NFTs from a single interface. Additional features include the ability to launch and manage “gamification quests,” messaging, and a notification system. As a cross-platform SDK, Ultra allows developers to make games and apps for MacOS and Windows, Linux, Android and iOS, Nintendo, Xbox, and PlayStation. At a time when Valve has declared itself hostile to all things blockchain, we think a company like Ultra makes for an attractive destination for blockchain games across genres.

In our view, integrated solutions could prove especially compelling for certain categories of developers, including:

- Non blockchain-native developers looking for additional guidance in areas both technical and legal (KYC, AML…);

- Established publishers looking for Enterprise-level service including dedicated account management and customer support. For example, Ultra is working with AMD and Atari, while Forte counts Zynga and Kongregate as clients.

- Venture-backed studios that prioritize speed of execution over costs in order to quickly capture market share.

As the blockchain ecosystem at large continues to grow and the number and complexity of potential combinations across the stack increase, more and more developers should resonate with this sort of offerings. We might also see infrastructure players consolidate more of the value chain through M&A, like Unity and Epic Games did before them. For example, Forte recently acquired N3twork’s Scale Platform to help blockchain developers grow their businesses. Specialized tools are likely to become attractive acquisition targets in the coming years.

How To Leverage Blockchain Infrastructure for Your Games Today

By now, you should have a good (or at least better!) understanding of how blockchain infrastructure works, and of its most notable developments in blockchain gaming at large. Here, we’d like to leave you with a few practical prompts that hopefully will help you make the next key decisions as you go on to make the most of the Web3 stack for your game.

Know your audience

Are you hoping to turn gamers into crypto adopters, or crypto enthusiasts into gamers? By understanding how much prior knowledge of blockchain technology your target users have, you’ll be able to determine how much focus you should put on things like UI, onboarding, identity, funds, & asset custody, and community support.

Know your needs

How intense of a crypto-driven economy are you building towards? Are you thinking of implementing NFTs, or NFTs alongside fungible tokens? If the latter, are you planning to introduce a dual system consisting of a governance token and another token for in-game spending (à la Axie Infinity)? The more varied the assets, the more tools you’re likely to have to integrate. For example, NFTs alone may call for an in-game marketplace but not require liquidity pools. And to not just weigh but incentivize governance, you’ll likely need to use some kind of staking. If you’re not careful, these features could complexify your game for players.

Know your priorities

How committed are you to blockchain's core principles such as decentralization and composability? What are you willing to sacrifice to make your game the most successful it can be? Knowing this should help you determine things like which chain to adopt, decentralized vs. centralized hosting, or whether or not you'll make your own code open-source — and therefore, your game, forkable.

Know your constraints

What legal environment do you operate under? Is your organizational and legal structure ready to operate at a global level, or will you need to obtain specific licenses for accepting, handling, and transferring funds? KYC and AML requirements are serious matters, and regulation is coming fast. Make sure to future-proof your game and operational framework or you’ll have a lot of catching-up to do.

Know your strengths and weaknesses

Ultimately, how much support do you need? Do you have the multidisciplinary skill sets to integrate various building blocks on your own, or is it best to go with an integrated solution? Would you rather spend whatever capital you have on an integrated solution, or compose your own stack from the open source web instead?

Embrace composability

Answering all these questions should help you get a better sense of exactly which building blocks to take advantage of. Still, you might be having a hard time picturing what the whole stack might look like for you. Let’s work through a few hypothetical cases together.

First up is a AAA PC RPG game.

- At the creation layer, complex graphics and physics call for comprehensive creative suites like Unity that can handle most of your creative needs, while also enabling you to pull from their 3D asset marketplaces. Blockchain-native creative tools aren’t needed here: focus on your art and gameplay instead.

- If you’re aiming for a full-fledged virtual world, you’ll want to decentralize governance in order to foster bottom-up creation and long-term stewardship. Here, you can explore liquidity pools (e.g. Balancer), staking, or a combination of both to distribute governance tokens to your community early on. If you’d like to reward early adopters, take a look at MultiSender, which lets you batch send both fungible and non-fungible tokens to multiple addresses.

- Across all these potential features, be sure to consider compliance; this is the surest way to protect your title against the legal challenges that are sure to emerge as regulatory scrutiny grows. Having built with that goal in mind from day 1, and with officially sanctioned financial licenses for developers to leverage, Forte is best positioned on that front.

- Going a step further, consider making DeFi integral to your gameplay, in the same way that games like DeFi Kingdoms, Crypto Raiders, and Treasure have. Blocks including staking, liquidity pools, even lending and borrowing, can be integrated into your game’s world building efforts with great results. One option here is Pawnfi, a protocol that offers various modules for leasing, appraising, and selling assets including LP tokens, NFTs, and more.

- A RPG game will logically call for a marketplace: where else would users trade their hard-earned artifacts? Here, we recommend integrating this aspect of the game as early as possible. Not only will this ensure a more consistent play experience, you’ll also get to capture more of the value by earning marketplace fees. Here, you could look at Forte’s secure marketplace, Venly’s Market API, or leverage Larva Labs’ recently open-sourced interface. If you’re trying to maximize liquidity, Forte can help you connect to multiple blockchains and exchanges simultaneously.

Next up is a mobile card collecting game.

- Here, the creation layer probably won’t require the most elaborate of creative software: 2D is likely to be enough for your needs.

- Any successful collecting card will generate a considerable volume of simultaneous transactions. Yet most of the assets being exchanged may be of low value, making it that much harder to justify the high transaction costs that currently burden Ethereum’s mainnet. Opting for an alternative L1 or a L2 scaling solution like Immutable (e.g. Illuvium) or Starkware (e.g. Sorare) should be a priority.

- Due to the nature of your core gameplay, your potential user base may be more casual than in the previous example, and therefore less blockchain-native. As a result, implementing a custodial wallet like Forte’s or Venly’s could be a valid solution to make sure you’re able to serve the average, non-technical player. Because these products come with whitelabeling options, you will be able to maintain a consistent look and feel and UX inside your game.

- In addition, a card collecting game is likely to drive shorter engagement than an IP-rich RPG would. This makes it less likely to justify going through a tedious onboarding via a third-party exchange, passing KYC, and moving funds to a wallet. An on-ramp such as Ramp or Kado seems like a must-have.

- In-game economics blocks like liquidity pools and staking probably shouldn’t be your focus, as DeFi-related features would introduce unneeded complexity.

- Instead, consider making your analytics as comprehensive and open as possible. The more in-game trading data your players have access to, the more likely a new class of full-time collectors is to emerge — think of how Sorare enabled SorareData. This is how you build an ecosystem of apps on top of yours. While building a proprietary dashboard might not be a priority, you can also create one easily using tools like Dune Analytics and Covalent.

Conclusion

Though blockchain gaming infrastructure can feel overwhelming at first, any developer with the right motivations would be wise to make the most of it. Gone are the CryptoKitties days, when one could only build on Ethereum’s mainnet. The range of chains, protocols, and applications available to build and enrich games continues to grow at a fast pace, unlocking new use cases along the way.

For better or worse, the financialization of blockchain gaming also means developers should aim to explore the entire Web3 stack, not just what they consider adequate gaming-related applications. For example, growing competition for players’ time and liquidity is likely to make financial incentives more and more important to a game’s success. To account for this trend, developers may want to experiment with a variety of tools, from liquidity pools to staking to yield aggregation.

For now, we can only encourage you to explore further — and if you need any guidance along the way, we at Naavik and Forte won’t be far. Make sure to reach out if we can be of assistance.

To learn more about how Forte's platform can help your team better build and manage blockchain games — from compliance and liquidity to in-game wallets and marketplaces — check out Forte's website. Plus, feel free to contact the team with any inquiries.

Also, make sure to subscribe to Naavik Digest below to stay up to date on upcoming future essays in this series, plus all of our best content. And if you want even more — ongoing premium game deconstructions, research essays, and market updates — make sure to check out Naavik Pro.