Decentralized autonomous organizations (DAOs) started making waves in 2021, but their impact in gaming has thus far been overshadowed by the rise of NFTs and the advent of "play-to-earn" business models. In 2022 and beyond, DAOs will have a meaningful impact on the way gaming organizations operate, fundraise, build communities, and even develop new games.

In this piece, we will explore the fundamentals of DAOs, their appeal as an organizational structure, their current uses in the games industry, and their future outlook. Along the way, we’ll also explore some of the operational challenges that DAOs will need to overcome and dive into some case studies of the most prominent DAOs working in games today.

This essay was written by Matt Dion. In addition to being a content consultant at Naavik, Matt is a product manager at EA Mobile.

Source: Unsplash

While the intersection of games and web3 has been the subject of much discussion in 2021, the majority of it has centered on so-called “play-to-earn” or “play-and-earn” business models. While these are important and deserving topics, web3 enables yet another transformative approach – one that is less frequently discussed in a games industry context, but no less significant in its disruptive potential: DAOs.

DAOs, or decentralized autonomous organizations, are the web3 version of a company or organization. These new organizational structures operate on the back of a series of interconnected smart contracts with the goal of minimizing, or even removing human input entirely.

While DAOs are not an entirely new phenomenon, 2021 saw DAOs garner increased cultural and commercial relevance, as prominent DAOs quickly rallied communities around a variety of interesting and non-traditional causes, such as:

- Reviving the Blockbuster brand

- Buying a copy of the U.S. Constitution

- Purchasing an ownership stake in an NBA team

- Sequencing our genomes

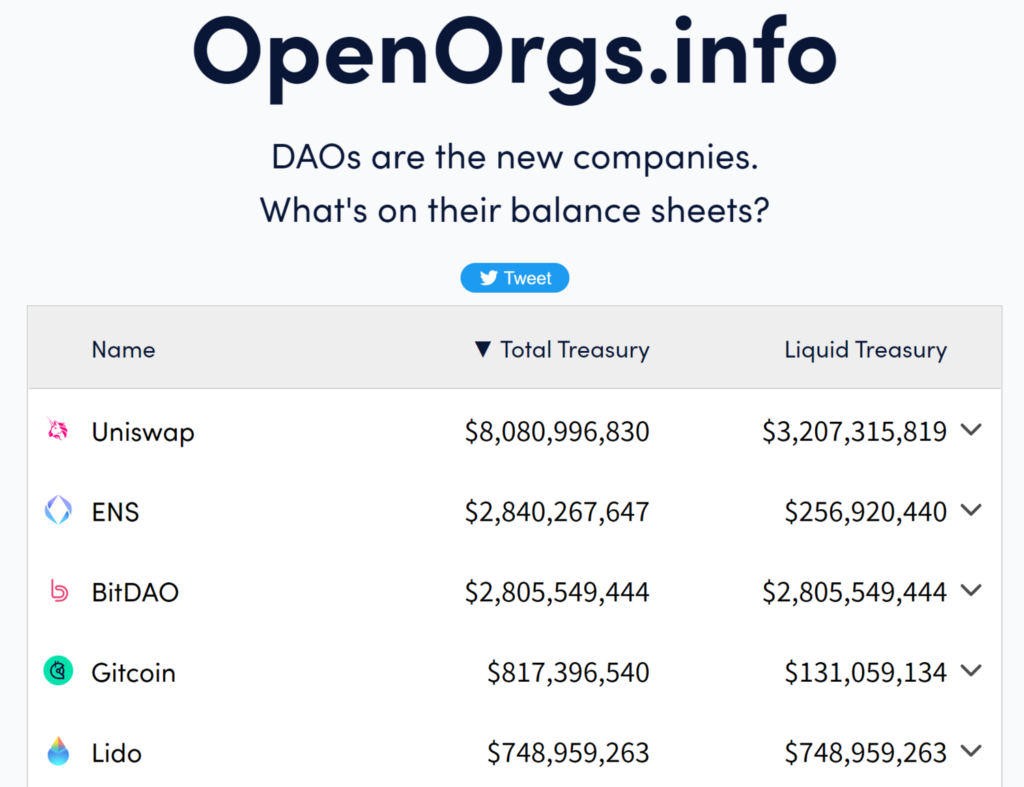

Despite these representing some of the more ambitious examples, DAOs are right to command increased attention. The top 5 largest DAOs today hold a combined total treasury north of $15B (according to OpenOrgs.info).

Just as “play-to-earn” has the potential to redistribute ownership of a game between its players and its creators, DAOs have the potential to redistribute ownership of a game amongst an entire community – be it the players, the game’s creators, its investors, community builders, or other participants.

Why (Gaming) DAOs?

Given the explosion of creative and aspirational DAOs raising money and operating in 2021, it’s not a stretch to think that the games industry will see its own fair share of newsworthy DAOs in 2022. In fact, many already exist. The most notable example, Yield Guild Games, has been at the center of much of the aforementioned debate around play-to-earn gaming, though it isn’t the only one.

However, before diving into the current state of affairs for gaming DAOs, let’s first orient ourselves. To properly understand the opportunity for DAOs in gaming, we must first understand what they enable. With this in mind, let’s first explore “Why DAOs?” before tackling “Why gaming DAOs?”

If you already have a grasp on what DAOs are and why they’re unique, you may want to skip ahead to the next section, “The Current State of Gaming DAOs”

Many web3 skeptics (often correctly) point to blockchain as a “solution in search of a problem”. Just because something can be decentralized doesn’t mean that it necessarily should be – especially if it’s already working exceptionally well. In the case of gaming, where venture capital dollars are flowing freely and the industry continues to grow at a healthy clip, many would argue that things are going just fine.

As it turns out, that’s not entirely true (an issue I’ll return to shortly), but let’s assume that it is. If a community of like-minded people forms around a shared love of games, why would they – whether player or creator – seek to form a DAO instead of an LLC, fan club, or subreddit?

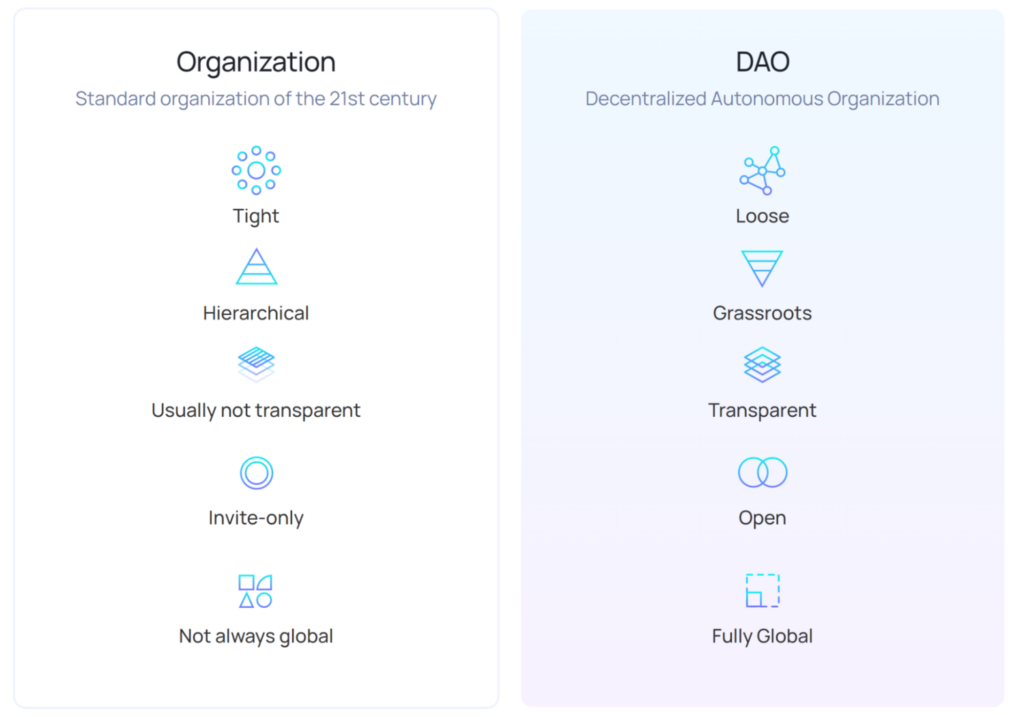

We can think of DAOs as having five main differentiators when compared to traditional organizational structures:

- Tokenized Ownership

- Decentralization by Design

- Automation via Smart Contracts

- Increased Transparency

- Ease of Capital Formation

Tokenized Ownership

While the topic of decentralization is core to web3, it is ownership that truly differentiates this movement from web2. This takes center stage when considering the transformative power of DAOs.

Instead of earning equity in the form of company stock, as one might see in a traditional corporate structure, DAO investors and contributors take equity in the form of governance tokens. These tokens – which may also provide additional benefits such as voting rights, access to special groups, airdrops, and the like – can be freely bought and sold on secondary markets, giving investors greater access to liquidity than might otherwise be available with equity grants or RSUs. In many cases, there are also no lengthy lock-up periods. In fact, many DAOs have built-in “rage quit” functions, allowing members to take their tokens and leave whenever they want, without needing approval of other members.

While this may sound like a risky proposition from an organizational standpoint (what if the biggest holders all decide to dump their tokens on the open market at once?), it allows freedom to “vote with dollars” and forces the DAO to keep its incentives aligned with those of the token holders. Talk about shareholder value!

Even beyond the more business-oriented comparisons, tokenomics provide interesting advantages over fan clubs and other social groups by providing members shared ownership in their fandom. Much has already been written about the potential for social tokens (you can read a great intro here); DAOs provide a structural framework for these communities to form and further develop. This concept has even taken hold among incumbent social platforms like Reddit, which allows any subreddit to create its own token and distribute it to its community contributors.

Decentralized by Design

The decentralized nature of DAOs can take many forms. For example, DAOs encourage (and rely heavily upon) remote work, enabling contributors worldwide to participate. While this may not seem too different from many knowledge worker jobs in 2022, DAOs take remote work a step further by enabling not just a distributed workforce, but also a potentially pseudonymous workforce. DAO contributors need not be “doxxed” to take part in the group’s activities. Many people in today’s most successful DAOs operate exclusively under online pseudonyms.

This is an important and underrated aspect of DAOs as it relates to their potential impact on the games industry. Historically, gaming has been centralized and gate-kept by in-groups (namely, white men). In the case of games industry jobs, that centralization has also traditionally taken place in or around high cost-of-living tech hubs like San Francisco, Seattle, and Los Angeles. Not only has this historically made the industry less accessible to underrepresented groups, it has also resulted in outright hostility on far too many occasions.

Decentralization enables contributors from all locations, identity groups, and backgrounds to participate in an industry that they have historically not had access to. This has the potential to radically transform both games development and games fandom.

There is still a lot of work left to be done. Many would argue that the current wave of web3 investment is being spearheaded by the same in-groups that made the games industry so insular and homogenous in the first place. While there is definitely some truth to that, I am of the opinion that decentralization in this context will erode more harmful barriers than it will reinforce.

Finally, it is important to note that while decentralization is a critical aspect of DAO formation (it is the “D” in “DAO”, after all), the level of decentralization varies from one DAO to the next. DAOs may be architecturally decentralized, geographically decentralized, financially decentralized, or otherwise. Furthermore, this level of decentralization can – and often does – change over time. Some leaders in the space have advocated for a “progressive decentralization” approach to DAOs, only decentralizing parts of the organization when founders are prepared to relinquish control to the community.

This decentralized decision making aspect is a crucial differentiator for DAOs. Enabling token holders to vote on questions of governance democratizes organizational decision making across the entire community. While this bears some similarities to stock ownership, DAO token holders have access to a much wider breadth of choices than corporate stockholders, and at much greater frequency. Furthermore, token holders also have the ability to craft their own proposals for the community to vote on. This allows anyone in the organization to let their voice be heard, and enables the best ideas to bubble up to the surface regardless of where they might come from.

Automation via Smart Contracts

Smart contracts enable DAOs to operate more efficiently, transparently, and trust-lessly than traditional organizational structures by automating business processes. Not only does this reduce operating costs (by eliminating administrative expenses, reducing turnaround times, and limiting the potential for human error, among other things), but it also makes business operations radically more open and fair.

Once agreed upon by DAO members, the rules of the organization are encoded on the blockchain and administered automatically, removing the need for management, hierarchy, or bureaucracy. As anyone who has worked at a large organization will tell you, these can all be significant impediments to organizing contributors, raising money, and moving projects forward. Furthermore, by removing these additional layers, DAOs can operate with greater speed and on smaller margins than they might have been able to otherwise.

Smart contracts are sometimes referred to within the web3 community as “money LEGOs”. This moniker highlights the composability and interoperability of the many decentralized apps created on the blockchain. DAOs can benefit from these “money LEGOs”, leveraging them to permission-lessly layer in additional functionality to their organization, such as marketplaces or cryptocurrency exchanges. This has massive potential for small organizations and solo contributors, in particular. Not only does it reduce the need for small development teams to create proprietary solutions, but it also simplifies compensation for contributors. With traditional contracts, lengthy payback periods often create cash flow crunches for small businesses. Smart contracts can cut down on this dramatically.

Transparency

While transparency has been alluded to in some of the aforementioned DAO benefits, it’s worth emphasizing how big of a change true transparency can be for organizations. Operating transparently on a blockchain means that all financial inflows and outflows are recorded publicly in real time. An organization’s financial health can be reported on up to the minute, as opposed to either a) relying on quarterly financial disclosures (in the case of publicly traded companies) or b) not receiving any information whatsoever (in the case of private firms). Additionally, a DAO’s customers, employees, and other stakeholders can track how revenues are being allocated and judge for themselves whether the funds are being spent in a responsible manner. This further reinforces stakeholder alignment, as any sort of impropriety in spending could lead token holders to divest their shares, vote to oust the previous set of decision makers, or rally around new proposals that might change organizational strategy.

Ease of Capital Formation

The final – and perhaps most widely publicized – differentiator for DAOs is the ability for organizers to quickly raise capital from all over the world in support of their causes.

While fundraising for a new venture may appear to be trivial in today’s heated market for entrepreneurs, it can actually be quite difficult depending on a variety of factors, such as location, government regulations, industry, and more. Further, we know that historically underrepresented groups, such as women and people of color, have had much greater difficulty accessing startup financing. For example, just 1.2% of the record-breaking $147B invested in American startups by VCs during H1 ‘21 went to Black entrepreneurs (according to Crunchbase). For Black women entrepreneurs, that number falls to 0.34%.

DAOs democratize access to capital, both for founders seeking funding and for investors in search of promising new ventures. We have already covered how DAOs’ decentralized nature enables underrepresented voices to more easily contribute. Similarly, DAOs allow potential investors to contribute capital regardless of their location, native currency, or accreditation status. A great example of this is the aforementioned ConstitutionDAO, which had an average contribution size of $206.26. By way of comparison, these investors would have required a $1M minimum individual net worth (or two consecutive years of gross income exceeding $200K) in order to become SEC-accredited in the United States.

It’s obvious that DAOs have many unique advantages over more traditional organizational structures, and in the next section we’ll explore how these are being leveraged by the leading gaming DAOs. However, before moving on, it’s important to emphasize one of the more common refrains heard in the web3 community: we’re still early. There are many kinks left to work out: tooling must be further developed, contributor onboarding remains a huge challenge for many DAOs, and perhaps most importantly there is a lack of regulatory clarity. This last factor could pose a major risk to the ease of capital formation and may bring unforeseen tax implications to DAO treasuries. While work is definitely being done in these areas – most notably in the state of Wyoming, where DAOs can be recognized as LLCs – there are still plenty of gray areas worth monitoring as the space evolves.

The Current State of Gaming DAOs

Now that we’ve illustrated why gaming entrepreneurs, fans, and investors might choose to form a DAO over some other type of non-web3 structure, we can examine how this early wave of adoption is taking shape.

Lately, I’ve taken to Twitter to crowdsource some of the most interesting games industry DAOs. While this list is far from comprehensive, it provides a broad overview of some of the most well-known DAOs in gaming today. I have categorized these findings into three major buckets, below:

- Gaming Guilds

- Incubators & Accelerators

- Developers

Gaming Guilds

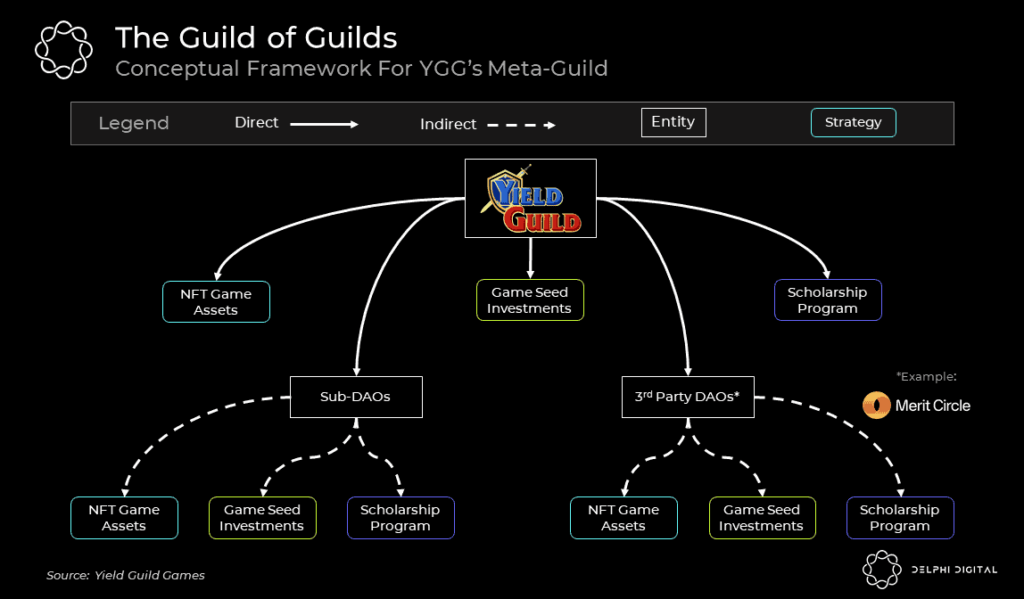

One of the first things you’ll notice from the list above is the amount of gaming guilds present, with Yield Guild Games (YGG) being by far the largest. Prior to the proliferation of web3 success stories like YGG, guilds ranged in complexity from informal groups of gamer friends to highly organized multi-game clans or even esports teams. However, with the advent of play-to-earn games, guilds have become decidedly more financialized. Many guilds operate similar to investment clubs, where shared funds are used to purchase and accumulate digital assets in games like Axie Infinity. These assets may then be lent out to members and non-members for use in yield-generation, sold for profits, or simply held as speculative growth investments. To unpack this concept further, let’s take a closer look at YGG and how it’s structured.

Most of the attention around YGG has been devoted to its scholarship program, whereby owners of NFT game assets loan them out to new players that do not own any themselves. The scholars then play games with these NFTs, earning in-game tokens and sharing the revenue. According to Yield Guild, this revenue is split between scholars (70%), community managers (20%), and YGG itself (10%), though other guilds may vary the exact distribution.

Beyond scholarships, YGG also acts as a sort of “index” of web3 gaming assets. At the top sits the overarching Yield Guild DAO, spanning multiple titles and investments. YGG also has several SubDAOs dedicated to individual games, allowing for more specialized focus from contributors. Now, Yield Guild has grown so large that it has been able to invest in third-party DAOs, such as Merit Circle and BlackPool. These third-party DAOs offer more exotic investing strategies and provide exposure to different sets of assets (BlackPool, for example, is heavily invested in Sorare as opposed to YGG’s primary focus on Axie Infinity). In this way, investors in the YGG ecosystem can opt for a variety of different approaches to web3 games investing: from passive to active management, or broad to narrow focus.

*For more on YGG, check out the Naavik interview with co-founder and CEO Gabby Dizon

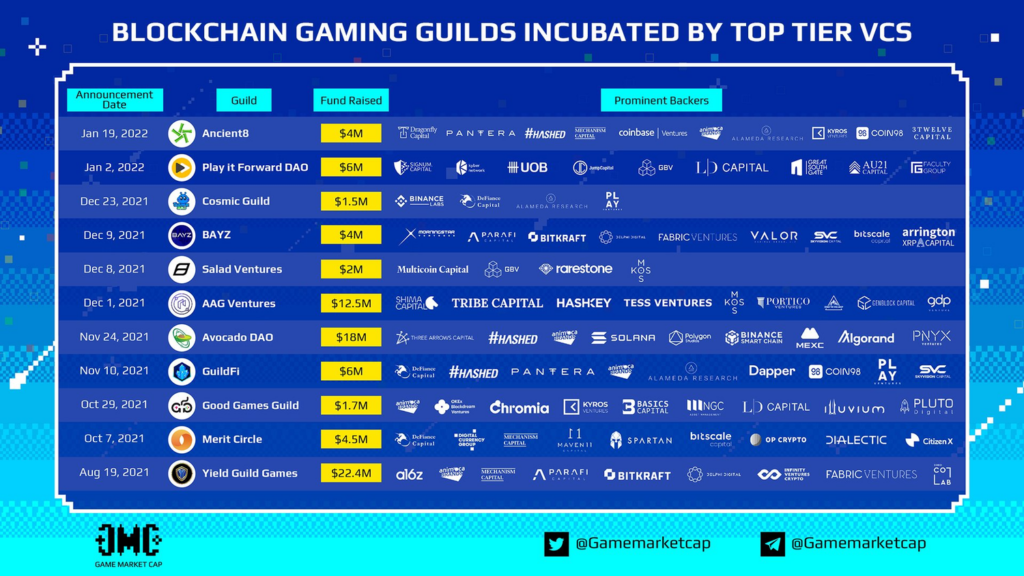

Of course, Yield Guild Games is far from the only guild operating in web3 gaming. Others include MMA Gaming, GuildFi, Astra Guild Ventures, UniX Gaming, and Good Games Guild. Some of these are focused on specific blockchains (e.g. MMA Gaming focuses on games built on Solana), while others differentiate via their management strategies (i.e. what’s done with the P2E revenue after it has been generated from gaming). GuildFi takes yet another approach, seeking to connect gamers with aggregated scholarship opportunities across multiple guilds. Regardless of the strategy, operating across multiple titles makes guilds more resilient to the ebbs and flows of player interest in any one title, and also acts as a market indicator for which games are currently attracting the most interest in web3 – a factor that has led to increased interest from VC backers, according to CoinDesk.

Gaming guilds have been a massive beneficiary of the recent bull market for web3 games (and NFTs generally). As these guilds have accumulated digital assets, a rapidly growing base of new users, speculators, and scholars have sprung up to utilize those NFTs and generate revenue. This trickle-down model works great when there are new cohorts of players coming in, but how will guilds hold up in a prolonged bear market? Tougher times may be ahead for the less differentiated guilds, or those not properly diversified across a breadth of titles.

Incubators & Accelerators

Another type of DAO seeing increased traction in gaming is an emerging class of incubators and accelerators. These DAOs are focused on growing the web3 gaming ecosystem as a whole by sharing their expertise with founders, funding promising new ventures, and supporting tools and tech solutions that can potentially benefit all web3 games.

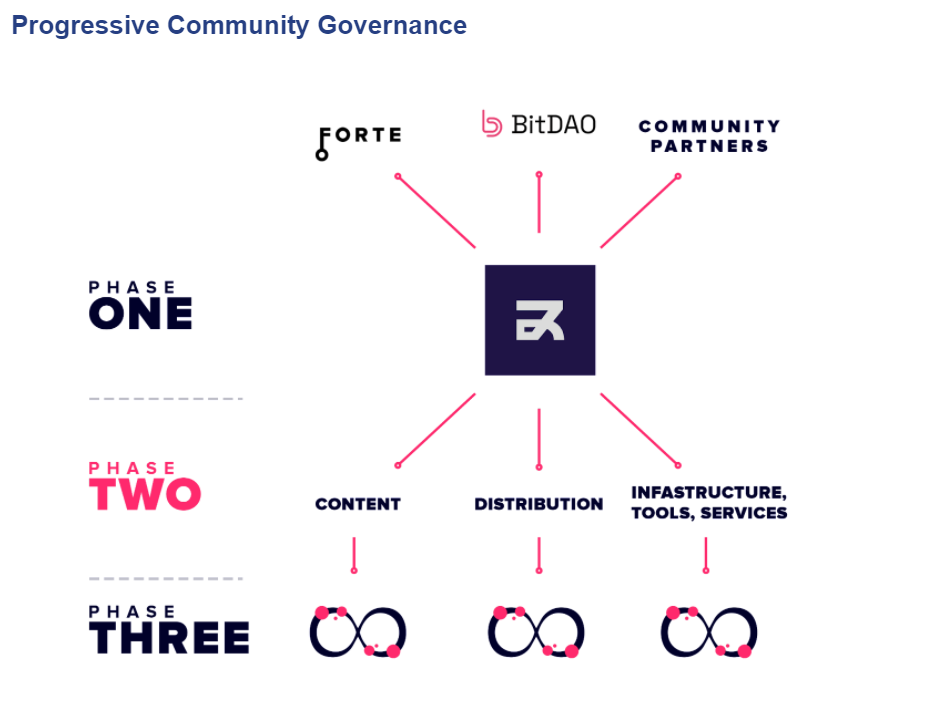

Perhaps the biggest example here is the recently announced Game7. Boasting major supporters including BitDAO, Forte, Warner Music, Solana Ventures, and others, Game7’s aim is “to accelerate the Blockchain Gaming industry through Grants, Education, and Strategic Initiatives.” The official proposal is well worth a read, as it outlines in great detail exactly the types of initiatives the DAO intends to fund.

Similar DAOs have already proven successful in non-gaming contexts – DAO Masters is one such example – while others have touched on gaming as part of their broader efforts to grow the web3 ecosystem. MetaCartel and Mantra DAO are two others opting for this approach, as evidenced by their support for MetaClan DAO (an esports DAO) and Gamestation.io (a web3 games incubator), respectively.

DAOs such as these play an important role in supporting web3 game development. By bringing together decentralized groups of stakeholders, enabling community input and ownership, and aligning around a shared vision, these DAOs are able to adopt a sort of “open source” approach to tackling some of the largest obstacles facing web3 gaming: onboarding of new players, reinforcement of open standards, and interoperability, among others. Being able to do all of this seamlessly, transparently, and immutably on the blockchain is uniquely enabled by their DAO structures.

One final DAO worth mentioning here is DivineDAO: a group dedicated to furthering the LOOT ecosystem. While it might not be considered an incubator in the traditional sense, DivineDAO aims to expand the lore and games ecosystem around the LOOT project through communal storytelling and collective experience-building while also expanding access to the project. In a way, DivineDAO can be seen as an incubator for LOOT projects exclusively.

Developers

The third and perhaps most ambitious type of gaming DAOs are those that have ventured into actual game development. Here is where red flags start to pop up for many industry veterans. Is opening development decisions to a large community conducive to making a great game? In other words, do players (or investors, for that matter) actually know what’s best for a project in development?

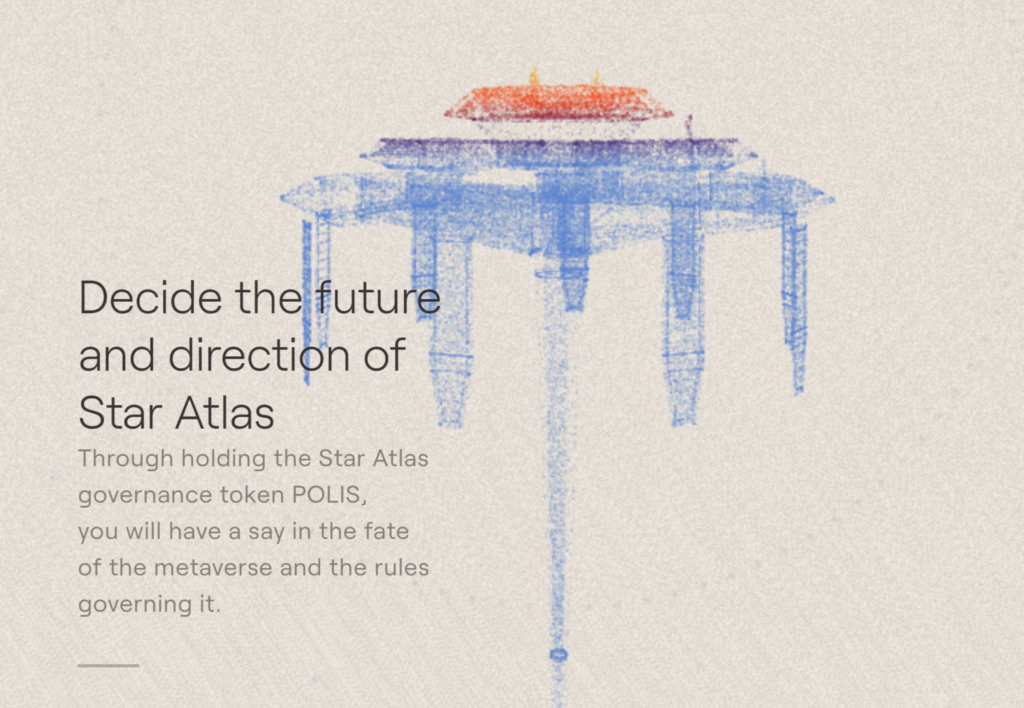

DAOs such as AavegotchiDAO, Dope Wars, and Star Atlas DAO are all experimenting in this space. Star Atlas is perhaps the most interesting example of the three, given the high bar that the company has set for itself. Star Atlas purports to be a AAA-quality MMO with huge scale, while the other examples are much smaller in scope (Aavegotchi is a simple virtual pet, while Dope Wars began as a game for TI-83 calculators). Time will tell if they are able to realize their grand visions for the game, but the hype around the project has already led to the formation of multiple dedicated Star Atlas DAOs, such as Final Frontier and Interstellar Alliance.

*For a refresher on all things Star Atlas, be sure to check out our in-depth Naavik interview and podcast with co-founder & CEO Michael Wagner

Another example worth exploring further is Decentraland’s DAO. Decentraland isn’t so much of a game, per se, as it is a virtual world – a platform upon which all manner of experiences can be built, some of which happen to be games. It’s much more akin to Roblox than, say, Activision or Take-Two. Regardless of how one might classify it, Decentraland DAO is worth examining for a variety of reasons, not least of which being that it may actually be one of the oldest game developer DAOs in existence, having released its first whitepaper way back in 2017.

Decentraland DAO, in its own words, governs “the policies created to determine how the world behaves: for example, what kinds of wearable items are allowed (or disallowed) after the launch of the DAO, moderation of content, LAND policy and auctions, among others.” Reasonable voices may disagree on whether this truly constitutes game development as opposed to, say, live operations, but the fact remains that a meaningful share of the platform is collectively governed by its community. In fact, when Decentraland’s two founders initiated the move to decentralize and hand ownership to the community via a DAO, they chose to step back from the project entirely, opting for advisory roles instead of remaining directly involved in active development.

A quick glance at the DAO’s governance area reveals a number of active proposals. Some are as simple as a quick yes or no vote banning a particular word or phrase. Others are borderline whitepapers in their own right, laying out detailed projects with reference materials, pitch decks, and requests for hundred thousand dollar-plus grants. The DAO has even funded proposals for game development, such as the Golfcraft minigolf game.

While Decentraland DAO provides an interesting example for aspiring web3 developers to look to, the platform still has a long way to go to compete with its less decentralized “metaverse” rivals like Roblox or Rec Room.

Until we see a DAO develop and release a competitive game (or games platform), I suspect that many industry professionals will be extremely hesitant to operate their own development teams in this manner. Games are difficult to make under the best of circumstances, and handing over core bits of decision-making (e.g. feature design, live operations, roadmap prioritization, etc.) to the fans could lead to potentially disastrous consequences. It could also lead to pay-for-power scenarios, where investors with enough money could simply purchase enough tokens to have their own personal priorities reflected in the game’s roadmap.

On the other hand, including community voices in game development decisions can be quite powerful. Gaming companies are already heavily invested in disciplines like user research, motivational segmentation, experience design, and the like – all of which heavily depend on input from actual players. Furthermore, consumer trust in game developers appears to be at a low point. Player expectations (perhaps buoyed by a mix of publisher over-promises and massive marketing budgets) frequently outstrip the realities of delivered products. Surely an opportunity must exist for a game developer that can properly balance the inputs of players with the expertise of game makers?

It is worth noting that democratizing game decisions is not an entirely new concept, either. CCP Games has experimented with this in EVE Online, forming a player advocacy group, and similar ideas have taken hold in World of Warcraft and Old School Runescape. There’s nothing stopping DAOs from adopting similar approaches…except for the fact that these examples were all added to existing games, while DAOs are starting from scratch. Put another way, players that have invested 1,000 hours into an existing game likely do not have the same goals and incentives as those who have invested $1,000 into a game concept.

To mitigate some of these concerns, DAOs may opt for a form of representative or liquid democracy, enabling trusted decision-makers within the community to take action with greater autonomy and scalability. Of course, this may ultimately prove to be too centralized for some to stomach, but these sort of trade-offs may be necessary. I predict that we will see a variety of different approaches undertaken by game developer DAOs in this area before any sort of best practice emerges.

If coordinating game development within a DAO structure were a no-brainer decision, I suspect that we’d see a lot more examples than the ones outlined above, particularly among the current leaders in web3 gaming. However, a quick glance at a few of the current market leaders in web3 gaming shows very few DAOs:

- Neither Sorare, nor Mythical Games – both valued north of $1B – are structured as DAOs.

- Gala Games (another web3 games company that recently raised its own investment fund) has a $GALA token, but does not offer any ownership in the company.

- Dapper Labs, creators of NBA Top Shot and CryptoKitties, is also not a DAO, though it has launched its “Dapper Collective” initiative “with the mission of bringing decentralized autonomous organizations (DAOs) to the mainstream.”

- Even Sky Mavis, developer of Axie Infinity, is not structured as a DAO (though they have outlined plans to change Axie itself into a DAO via the $AXS token).

DAOs are still relatively new, and VC-backed companies like many of those listed above have a prerogative to scale quickly. As such, it is understandable that they may not have the time or bandwidth to experiment with decentralized organizations. Yet as time passes and technology improves, I believe that we will begin to see this change as the concept of progressive decentralization becomes more widely adopted.

Future Applications

It’s clear that DAOs have arrived, but their impact on gaming and game development specifically remains to be seen. I, for one, am increasingly convinced that DAOs will have an impact on the way our industry operates, and I think we will eventually see them embraced by gamers and games organizations alike in a variety of innovative ways.

Previously, I predicted that gaming venture capital dollars would increasingly flow towards specialized region-specific investments. While I initially wrote that with traditional corporate structures in mind, I expect the same hypothesis to hold true for gaming DAOs. This has thus far proven to be the case, just a few weeks into January, with two noteworthy DAOs raising from VCs: Ancient8 (Vietnam) and IndiGG (India). IndiGG is actually one of the aforementioned SubDAOs of Yield Guild Games, illustrating just how influential YGG has become (and how promising the Indian market remains).

Guilds, accelerators, and incubators such as those mentioned above are all pretty straightforward examples as far as gaming DAOs go. These formats are already being rapidly adopted, and while they may be novel to many gamers today, I suspect that they will continue to carry out more or less the same functions that we see now: investing in digital assets, developing tech solutions, and coordinating communities across web3 with the goal of growing the ecosystem as a whole. Tools will improve and coin market caps will increase, but these DAOs will fulfill essentially the same roles. What will change, though, is the size of the ambitions for these DAOs within the games industry.

Much of this piece has been devoted to the business side of games, but consider for a moment how DAOs might change consumer behavior. We all know how vocal gamer communities can be when they believe that their favorite IPs or development studios have been mismanaged. With the organizing capabilities of DAOs, a motivated group of like-minded gamers could channel their collective enthusiasm into action, bringing greater financial pressure to bear on incumbents to make changes. If a DAO can raise enough money to purchase the Blockbuster IP, what’s to stop another DAO from raising money to buy an underutilized games IP and turn it into a web3 franchise? Or from funding a cause its community believes in, such as game worker unionization efforts?

Tokenized ownership has already been used to great effect by DAOs operating in the decentralized finance (DeFi) space, leveraging various forms of governance tokens and other rewards to incentivize votes and accumulate influence. A great example of this can be seen in the Curve Wars involving the DeFi protocols Curve, Convex, and Yearn Finance, among others. In a similar manner, we may one day see gaming DAOs competing for individual gamers’ governance votes in an effort to rally a community around their preferred vision. Composable ecosystems such as LOOT, in my view, are especially vulnerable to this sort of in-fighting as they (by definition) lack any sort of specific shared goals.

With decentralization and tokenized ownership, DAOs blur the lines between builders, players, and participants. In this way, DAOs may also prove to be an interesting evolution of the MILEs concept, enabling groups of participants to organize around a favored outcome. Imagine if each character in Rival Peak, or each franchise in Blaseball had its own self-governing DAO: participants could cast votes collectively, rally fans’ around desired outcomes, and reinforce interest in the broader experience as a whole.

Beyond players and fans, DAOs will also increasingly intersect with the burgeoning creator economy movement in gaming. In many ways, DAOs are an important next step in the evolution of the creator economy as a whole, improving creators’ ability to organize and monetize their communities while also enabling those communities to participate in ownership of their fandom.

One such (non-gaming) example of this is PleasrDAO – a DAO initially formed around NFT artist “pplpleasr” that has since grown into a major group of art collectors focused on culturally important items, famously including the 1/1 Wu-Tang Clan album, Once Upon a Time in Shaolin.

We have already seen creators like Dr. Disrespect and Pokimane create more traditionally-structured games businesses in partnership with others. DAOs enable these same creators to start businesses right alongside their communities without the need for additional business partners or financiers. Streamers, game designers, or modders could spin up a DAO with relative ease to rally a community around their mission (a topic I’ve touched on previously in reference to the team behind the wildly popular GTA V mod, NoPixel).

For game developers and publishers, the future is less clear cut. There are a host of reasons why DAO-led game development could prove difficult, some of which we’ve already outlined above. However, DAO mechanics can be utilized in a variety of less-intrusive ways that aren’t immediately obvious. The most frequent mechanic thus far has been fundraising, with many web3 projects today operating as bonafide Kickstarters. While governance tokens are an important part of DAO operations, they need not all be financialized. Tokens could potentially be earned through deeply engaging with a game, participating in player feedback groups, acting as community moderators, managing social media channels, or any other sort of valuable contribution towards the group’s larger goal.

Perhaps one reason DAOs have not yet fully taken off within game development is that making games requires a high level of coordination and alignment across large groups of people – something DAOs aspire to deliver, but have yet to fully realize at scale. Improved tooling will likely help with this (as will moving communications off of Discord and onto something more purpose-built for work collaboration), but this will take time.

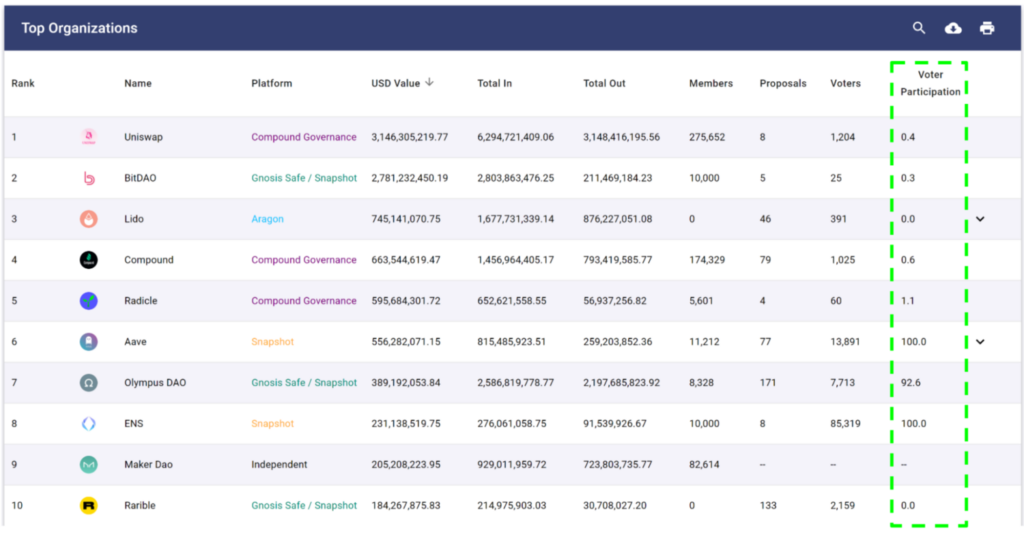

The table below, showing the 10 largest DAOs by treasury size (at time of writing), displays the massive disparity in voter participation. While these DAOs are mostly uninvolved in gaming, we observe what is basically an “all-or-nothing” pattern emerging. If DAOs holding billions of dollars in their treasury can’t reliably garner even a 10% voter turnout, can we really expect them to project manage tens or even hundreds of game developers?

Of course, this is not a perfect apples-to-apples comparison, but the point remains that voter apathy is not conducive to collectively ideal outcomes. DAOs already have a massive free-rider problem, and aspiring gaming organizations will need to solve these issues if they want to successfully decentralize. Consider also that governance tokens may change hands multiple times over the lifespan of a DAO. Token owners may have a variety of motives, ranging from purely altruistic to purely profit-driven. This fluctuation in incentives can potentially result in waffling strategies, misaligned goals, or wasted treasury funds – all bad news for a team trying to keep a project afloat.

Yet one of the most interesting advantages of DAOs over traditional corporate structures in a game development context is that DAOs don’t need to have an outright profit motive. While a corporation must focus on returning value to its shareholders, DAOs do not have this same obligation. Owing to their decentralized and autonomous nature, DAOs can operate on the slimmest of margins, funneling all revenues back into the community treasury to cover operating costs. This is particularly intriguing in a games industry context, as the need to generate revenue to cover the ever-increasing costs of game development frequently forces developers into making tradeoffs of budget or scope. This is one reason why many “indie” games are often a labor of love by small development teams, while AAA games are frequently bemoaned for carbon-copy sequels, half-baked releases, or aggressive monetization tactics. With enough community support and alignment around a shared vision, DAOs could potentially turn this tradeoff on its head, creating games for the players, by the players. When the definition of success for a games project changes from “units sold” to something more subjective like “hours of enjoyment”, the means by which a group of developers seek to achieve that goal becomes less constrained by things like profit margins or ROAS targets.

Admittedly, this is an optimistic outcome. DAOs are not going to be an easy sell for game makers. Tools and best practices will need further development before we begin to see any sort of wholesale changes to the game development process. I expect AAA developers and publishers to be among the last to adopt a DAO forma (if ever), not least of which because it isn’t really in their financial interest to do so.

Yet that doesn’t preclude today’s incumbents from exploring the possibility of working alongside DAOs. We have already seen a number of gaming organizations invest in DAOs, and I expect this to continue in 2022. For larger organizations seeking to dip their toes into the waters of web3 gaming, investing in a DAO could be an interesting low-risk, potentially high-reward experiment.

Of course, there is a whole world of developers large and small out there, many of whom may be eager to experiment with DAOs. To aspiring web3 game developers exploring DAO formation, I recommend first thinking deeply about which aspects of your game you are willing to decentralize. In other words, what are you comfortable releasing control of, with the knowledge that anyone with a digital wallet has the potential to voice their opinion?

The games industry has already embraced the inherent ambiguity of emergent gameplay, procedural storytelling, and user-generated content – is it really a stretch to believe that it might thrive amid the uncertainty of community decision-making? I believe we’ll find out soon enough.