Gaming DAOs, Designing Endgames, and Sony’s Acquisition of Bungie

This episode of the Roundtable has Florian Ziegler, Matt Dion, and Maria Gillies join Nico to discuss DAOs and their application in the gaming space, endgame design, and the big news this week on Sony’s acquisition of Bungie.

Riffing off Matt’s deep-dive into the nascent landscape of gaming DAOs on Naavik, our guests discuss what DAOs are and how they operate, particularly in the context of games. We then turn our attention to the criticality of endgame design for the overall success of any game, and what strategies and tools can help game developers navigate this challenge. Finally, the episode concludes with keen observations on Bungie’s recent acquisition by Sony.

If you would like us to discuss any other gaming-related topics, do reach out at [email protected]. We’d love to hear your general thoughts and feedback too! You can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts.

Animoca Brands Raises $360M at a $5.4B Valuation

Source: Animoca Brands

As mobile free to play companies consider the pivot to supporting blockchains and NFTs, few have had the momentum and investment spread of Animoca Brands. They’ve gone from being a brand driven mobile developer to becoming a powerhouse in the NFT gaming ecosystem during the NFT craze of 2021. They’ve continued the momentum into this year with a new fundraising round. Their fundraising has been important not just for them as a company, but for the brands and companies they partner with across the ecosystem.

In 2021 Animoca Brands was valued at $2.2B, with many assets tied up in crypto:

-

Cash balance of $35.9M, $112.1M of assets in the form of cryptocurrencies

-

Reserves of digital assets valued at $15.87B (based on CoinMarketCap), which include Animoca Brands tokens.

-

They raised $89M in May, $50M in July, $65M in Oct, $93M in Nov (for The Sandbox, led by Softbank).

2022 kicked off even stronger:

-

They raised an additional $360M at a valuation of $5.4B

-

Total capital raised so far is almost $700M for strategic investments and acquisitions, product development, and licenses for popular properties.

-

This will make sure they have enough to continue boosting The Sandbox partner ecosystem as well as sustain development even if it doesn’t pick up immediately.

Investment Strategy

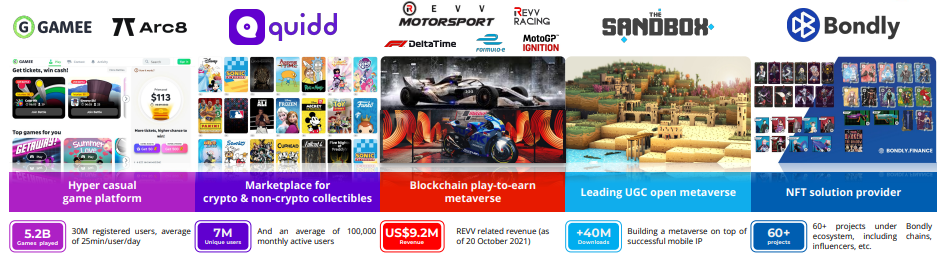

The obvious question with all this fundraising is where a lot of it goes. They currently have one of the broadest portfolios of investments across the blockchain space. Here’s a high level overview of their many acquisitions, investments and partnerships

Source: Animoca Brands

The core of Animoca’s investment strategy is their belief in the value of network effects across the NFT space and the value they see in “digital ownership”. They diversify their investments across a large swath of the industry and see a mutual need for competitor success to boost the entire industry.

During their early involvement in the breakout (and short lived) NFT hit CryptoKitties, they saw the difficulty and promise of getting businesses and customers to adopt this technology. This has given them a “rising tide lifts all boats” approach to the space due to the unique alignment of incentives in the blockchain economy. In Animoca’s mind, if the ecosystem wins, they win. Many of these investments provide different forms of infrastructure, technology or support to their current projects.

Let’s take a look at how Animoca Brands got to this point.

The Blockchain Pivot

In 2014, Animoca Brands spun out of mobile developer Animoca. Despite three years of mobile success, they sold the majority of their casual games to iCandy to get the liquidity and freedom to look for the next frontier beyond mobile. They wanted to diversify their licensed brand work into other technologies and considered emerging platforms like VR and Apple Watch. Eventually they decided to invest in AI with the acquisition of Zeroth AI Accelerator. While they’ve managed to make some use of their access to AI, the next acquisition of Fuel Powered, a developer of multiplayer tech, put them on the path they’re on today.

As it turns out, Fuel Powered also provided blockchain services for the hottest blockchain project around, CryptoKitties. After partnering with Axiom Zen to be the CryptoKitties distributor for China, Animoca Brands became excited by what blockchain could offer in terms of player ownership technology.

Source: Animoca Brands

To dive in deeper, they picked up Pixowl, a company with a familiar model of branded mobile games. Pixowl’s most successful game however, was a series built around user generated content called The Sandbox. More importantly, Pixowl had seen enormous value in user generated content and emerging blockchain technology. They planned to make an NFT version of The Sandbox as a sort of NFT driven Minecraft. I recommend reading this Pixowl presentation to get an idea of their vision.

At the time, 2018 was Animoca Brands’ best year to date with $14.9M in revenue, in big part due to mobile hit Crazy Defense Heroes and an $11M reseller deal with iClick marketing. Despite this, they started moving away from mobile to almost exclusively pursue NFTs.

Acquisition Opportunities

Created by Devin Becker

With the pivot to player ownership and NFTs, they began investing and acquiring to build a strategy against that vision. The acquisitions were varying combinations of three strengths: Brand licensing and Collectibles, Game development, and Blockchain and NFT. I’ve listed a few examples below.

-

Quidd is an example of all three strengths. Although they aren’t necessarily a games company per se, they were an early adopter of pre-NFT digital collectibles. Their marketplace works with 325 major brands, giving Animoca Brands significant access to licensing partners who see the direct value in NFTs.

-

Stryking Entertainment is a play to better understand the sports licensing market. They run an officially-licensed Germany fantasy football game. It’s a perfect fit for moving the model into NFTs as in-game assets and competing with other big players using similar models like Sorare.

-

Some acquisitions such as nWay and Blowfish were driven by strong game development experience. In the case of nWay it was also about access to licensed brands such as Power Rangers and WWE. Blowfish is now developing a high quality NFT driven game in closed beta called Phantom Galaxies. nWay manages an NFT marketplace of officially licensed Olympic collectibles to support their upcoming NFT Olympic game.

-

Animoca Brands even decided to leverage their previous hit mobile games Crazy Kings and Crazy Defense Heroes with NFT experiments in collectibles and a reward token. They use the games as an experiment to identify ways to integrate tokens and NFTs into the F2P game model.

-

Lastly, a few companies were acquired for their experience in blockchain or NFTs. Bondly successfully developed early NFTs for celebrities. Lympo uses the blockchain to provide fitness rewards and sports, an area Animoca Brands had dabbled in previously with their OliveX project.

These acquisitions helped support the three key pillars that Animoca Brands plans to expand against. Bringing these various acquisitions together allows all of them to excel in different markets while supporting the NFT vision in partnerships, design, and technology. For further reading, here’s an overview of how they see their “Key Business Units” from their most recent 2021 shareholder presentation that gives a good indicator of how they plan to utilize the acquisitions.

Source: Animoca Brands

Initial Sales and Success

Animoca Brands has released NFT game projects at various stages of development. In my mind, one of the interesting aspects of the NFT game model is the ability to sell NFTs prior to the release of the game to both build hype and fundraise, building community and market awareness. This shares some similarity with Kickstarter but actually provides tradeable assets early on. Animoca Brands did this with a few of their projects:

-

F1 Delta Time completes first crate sale, selling over $364K worth of items

-

The Sandbox land presales: the third presale event sold out in five Hours for $450K in ETH

-

Crazy Defense Heroes NFT collectibles

In particular, F1 Delta Time is an interesting example in that Animoca Brands is building an ecosystem of multiple games (Revv Motorsports, F1 Delta Time and MotoGP) that share a token (Revv), but utilize their own NFTs. Two of these projects are licensed brands and the original one, Revv Motorsports, acted as a proof of concept to be able to license the game.

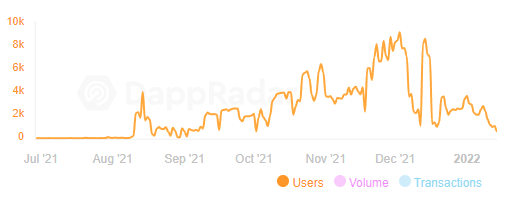

The risk with the pre-sale model, however, is that these pre-sales can be a much stronger representation of speculators and investors rather than incoming players. It’s extremely common to see an initial burst of excitement over an NFT game both in token and NFT sales, but no follow-through. Often, the initial price spikes to extremely high levels from speculative demand and sets unrealistic expectations for long term value. Once the price settles back to lows it can sometimes drive a loss of interest in the game, especially from a play to earn audience. For example, here’s the chart for the Revv token showing the spike and fall:

Source: DappRadar

Strategy Risks & The Future

Animoca Brands has had success in developing a large portfolio of games, avoiding a hit driven dependency. However, while they’ve built a diverse portfolio strategy, it’s notable that everything comes down to single risk: NFTs. Meanwhile, other traditional game development companies investing in blockchain gaming like Ubisoft are slowly dipping their toes vs. going all-in.

As with any burgeoning industry, many of the early movers may not make it to later stages. For instance, Meta deprecating Diem shows that a large investment in the space is anything but certain. Animoca Brands’ strategy of investing in a broader range of companies (that even compete with each other) is analogous to betting on multiple horses and trying to mitigate the risk across the racetrack.

It’s especially risky given the chances of a huge pullback in spending in the US. Without a large flow of excess cash, the NFT market becomes significantly weaker and Animoca Brands would have few mobile games to fall back on. The upside is that their investments are diversified enough across the spectrum that they still may see returns in their portfolio.

There’s also the question of any single NFT game’s longevity, as there aren’t yet proven models. Until NFT gaming becomes more normalized, the pattern of initial price spikes down to low prices will likely continue for many games. Games like Axie Infinity have shown that the earnings can diminish overtime, and possibly be unsustainable. As long as a company manages its budgeting well, I believe they can use that initial excitement burst of revenue to help fund further attempts.

Finally, there’s also the risks that comes with being so intertwined in Asia (Hong Kong in particular), with China’s crackdowns on tech, crypto and gaming. Part of their early success in mobile — and even with Cryptokitties — was in providing access to Asian markets. Even companies well known for this like Tencent have seen recent difficulty in importing games. I’m not sure how this will play out for them in Asian markets, particularly given the large players bases

Concluding Thoughts

Animoca Brands’ core strength lies in partnerships and working with brands. The company’s history in mobile gaming has seen a strong track record of both licensed IP and gaming. After all, this is the entire reason Animoca Brands spun off from Animoca in the first place. This success — combined with acquisitions such as Quidd and nWay — keeps the door open to ongoing licensing opportunities. Animoca Brands co-founder and current leader Yat Siu even used his history as a former employee of Atari to strike multiple deals with them for NFT projects of their IP. They’ve already leveraged their work with brands into branded motorsports NFT games, NFT marketplaces, and recently a large Sandbox presence of major brands and celebrities like Snoop Dogg, Adidas, Atari, Smurfs and The Walking Dead. I’m optimistic about this front.

However, it’s not an easy path forward. In order to be successful, they’ll need to continue replicating the strategy of bringing brands to the blockchain through games and NFTs. Most importantly, the players and collectors need to show up and stick around. The potential for overvaluation in the Sandbox was investigated recently by Naavik. Even with the other projects Animoca Brands has going, if the Sandbox fails to gain any traction this year it may significantly hurt faith in the companies’ overall investment strategy and ability to fundraise in 2022 onward. (Written by Devin Becker)

🎮 In Other News…

💸 Funding & Acquisitions:

-

This week in earnings: Microsoft | Meta | Sony | EA | Nintendo | Unity | Activision | Capcom

-

Sony will acquire Bungie for $3.6B (read our analysis here). Link

-

Midnite announced a $16M raise for a Gen Z-focused esports betting app. Link

-

Blizzard and Rockstar Veterans raised $5M for their new studio Lost Lake. Link

-

A new studio Gardens raised a $4.5M seed round. Link

-

The NYT bought Wordle for “low seven figures”. Link

📊 Business:

-

A profile on Phil Spencer and the reinvention of Xbox. Link ($)

-

Netmarble says 70% of upcoming lineup will use blockchain. Link

-

Gamestop will launch an NFT marketplace with a $100M Immutable X grant (update: they sold 1/3 of it already). Link

-

PUBG experienced a 486% increase in new players after going F2P. Link

🕹️ Culture & Games:

-

An update on Ubisoft’s esports programs. Link

-

CoD pushes into transmedia with an upcoming movie. Link

-

Fashion brands want to dress you for the metaverse. Link

👾 Miscellaneous Musings:

-

Once upon a time Sony gave their players the power to create. Link

-

Thread on NYTimes digital subscriptions, and how Wordle plays into the strategy. Link

-

Redefining immersion, play, and game economies with Brooks Brown. Link

🔥 Featured Jobs

-

Proxima: Head Of Decentralized Economies (Remote)

-

Beamable: Product Manager, LiveOps Portal (Remote)

-

Guild of Guardians: Head of Partnerships (Remote)

-

Naavik: Content Contributor — Writer (Remote)

-

Polygon Studios: VP Gaming (Remote)

-

Rec Room: UGC Development Lead (Seattle; Remote)

-

Riot Games: Biz Ops Manager (LA)

-

Ello Technology: Lead Unity Engineer (SF; Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.