Hi Everyone. Welcome back! Sunday’s most popular links included: GameMaker's breakdown on the four growth paradigms of gaming, details on a16z's reported new gaming fund, and a deep dive on why Amazon makes games. Let’s dive into today’s issue.

From the Archive: In Conversation with Mike Allender & Georgina Felce, Co-Founders at Talewind

Source: Talewind & James Bridle Photography

Talewind is a new, UK studio building a social sandbox RPG that’s exclusive to the Roblox platform . Founded by Mike Allender and Georgina Felce at the beginning of the year, the studio completed the Roblox Accelerator program and closed an Angel investment round of $800k to support their ambitions to build high quality, professional games for metaverse platforms. A few months ago, Naavik Content Lead Fawzi Itani sat down with Mike & Georgina discuss why they’re building on Roblox, the importance of social-first games, and how to build a strong company culture and community — enjoy!

#1: Sorare Raises $680M at a $4.3B Valuation

Souce: Sorare

Last week, Sorare announced it had raised a $680M Series B from the likes of Softbank, Bessemer, Benchmark, Accel and Blisce at a whopping $4.3B valuation (you can’t have a Softbank Vision Fund investment without a gnarly valuation). In my discussions with friends this week, there have been two main perspectives: 1) “no way this valuation makes sense” and 2) “the TAM for this business is massive”. Let’s address both, but first Sorare’s key metrics:

-

There are 600K registered users and 150K MAUs

-

There has been $150M in transaction volume since January 2021 (they don’t take a cut on P2P at the moment)

-

Sales have grown 51x YoY

-

They’ve partnered with ~180 soccer organizations

For those who aren’t familiar, Sorare is a fantasy sports league (for soccer) that leverages “seasons” of NFTs to compete in tournaments. Real world performance of the soccer players correlates to in-game performance in the leagues. Among other complex factors such as multipliers and card rarity, winning grants prizes much the same as today’s real-money games do. On first blush, Sorare might sound a lot like DraftKings or MPL (I wrote about their recent raise a few weeks back), but NFTs give the fantasy sports added depth and a secondary marketplace component – compounding sales in a way that only blockchain can enable.

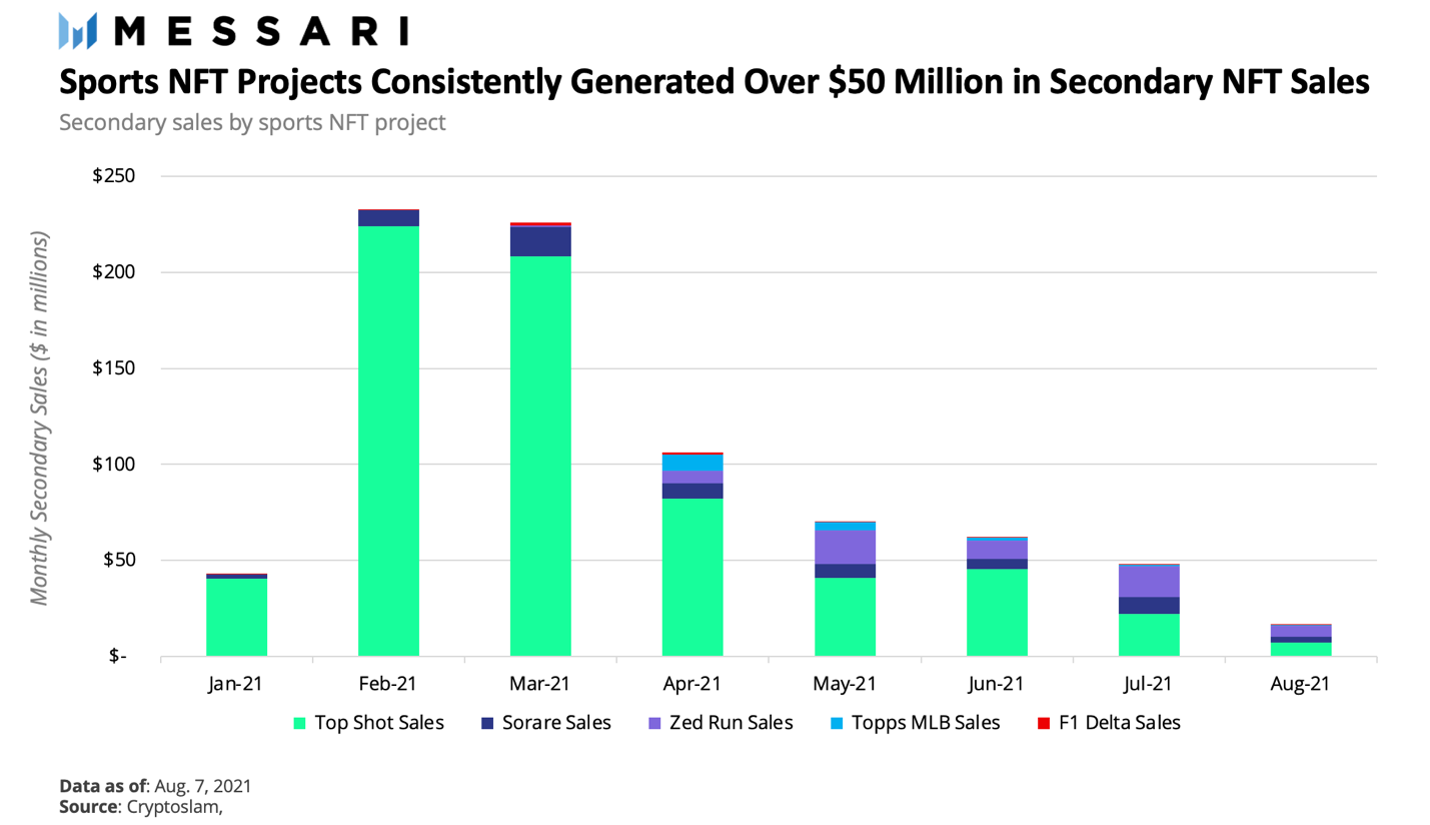

The ~40-person team certainly has executed against a seemingly successful model, but still, one of the main critiques I’ve heard is that Sorare’s valuation makes no sense. “Compared to Axie Infinity”, they say… And it’s true AXS’s diluted market cap is $4.1B and $7.5M Series A (May 2021) on 1M DAUs (perhaps a Series B round will be announced soon?). Yet, comparing Axie Infinity to Sorare feels like comparing apples to oranges – Axie is in the process of building a unique P2E game and Sorare is building against a fantasy sports vision. The assumptions, comparables, and TAMs – a few of the factors that might go into a valuation analysis – are also completely different (e.g Draft Kings market cap is $~21B; soccer has 3.5B estimated fans). Additionally, in a highly competitive market for blockchain games, there are fewer firms that might take the leap in funding Sky Mavis (Axie parent company) as you’d probably need a gaming-specific growth fund that can provide help scaling past their impressive Series A inflection vs. generalist growth funds that can provide global networks, reach, and consumer product support for a company like Sorare reaching a Series B tipping point.

I’m specifically interested in how Sorare will continue to acquire users, and what the draw for an ostensibly pay-to-play fantasy league (with potential to earn money on secondary marketplaces) will look like. Their potential user base is massive: soccer fans, fantasy sports fans, NFT enthusiasts, token collectors, sports bettors, and more. On the flip side, Sorare’s potential user base also include developers as they third-party games can be built on top of them. For brands, the value proposition of engaging fans and building new revenue streams makes sense in my mind. This will help them reach new audiences and engage enthusiasts fans with digital assets.

That being said, while Sorare has built a large moat with 180 partnership organizations, it’s yet to be seen if they’ll be able to execute on their promises. One looming threat is Dapper Lab’s recent $250M raise and LaLiga partnership (Sorare also partners with them). While CEO Roham has hinted that he believes Dapper Labs and Sorare will be complementary to one another, it remains that they’ll be catering to the same fan base and that Dapper Labs has a rich history of $780M in NBA Top Shot marketplace sales. Soccer moments are also much more “rare” than NBA ones given the infrequency of goals, which might prove to make Dapper’s moments even more popular. Contrast this with Sorare’s ostensibly ~80M in total revenues, and there’s still a lot of room left to grow. This next phase will be about reaching a critical mass of users for flywheel effects, enabling P2P transactions at scale, nurturing a network of third-party developers, and engaging existing users in novel ways. One of FIFA’s most popular game modes is Ultimate Team – why not consider the same for Sorare? (Written by Fawzi Itani)

#2: YouTube Gaming’s Livestreaming Focus

Source: Internet Matters

Looking at the biggest growth drivers for gaming over the last five years, it’s difficult not to mention livestreaming. The medium has been responsible for some of gaming’s most widely recognized moments, catapulting games like Fortnite into cultural relevance and nearly tripling in total watch time since 2019. The fact that AAA titles like Apex Legends have foregone traditional marketing in favor of streamer-based promotional campaigns speaks to how quickly the medium has cemented itself as a core part of gaming culture.

At the top of it all sits Twitch, the proverbial king of streaming platforms. Commanding nearly 30 million visitors a day, the Amazon-owned streaming veteran is seen as a monopoly of sorts, pulling in watch time that doubles the combined numbers of its primary competitors, YouTube and Facebook, and a projected $2.3 billion in 2020 alone. But for all the success the platform has found, the company seems to consistently be under scrutiny. A quick Google search yields headlines focused on opaque moderation policies, unfiltered hate speech, and accidental creator bans rather than news of successful product launches or culturally relevant events. These issues aren’t new either — news about poor content moderation and limited product innovation has plagued the platform for the better part of the last five years, and is starting to create cracks in the armor of gaming’s #1 creator platform.

As issues continue to pile up, further analysis seems to keep pointing me back towards one beneficiary of these mistakes — YouTube Gaming. The second biggest streaming platform by market share, the company has seen a 110% increase in total watch hours since 2019 and has invested significant resources into bolstering its creator and content roster. To me, this growth is not just a symptom of Twitch’s missteps, but also points to an execution strategy that is fundamentally different (and seemingly more effective) than anything Twitch has put together to date. It hinges on three factors: Product, International Markets, and Creator Investment.

Product

YouTube’s competitive advantage in content product can be distilled down to two facets: variety and volume. From a variety perspective, the company is unbeatable in the breadth of product offerings it’s been able to centralize in one place — including short-form videos via YouTube Shorts, livestreaming via YouTube Gaming, and VODs via the traditional YouTube platform. On the volume side, the company commands a massive amount of content consumption on a daily basis, using its nearly 100 billion hours of annual gaming watch time to surface different kinds of content creators to their ideal viewers via algorithmic discovery. A volume-informed, variety-driven product strategy means that Youtube can offer creators distribution and viewership that single-use platforms like Twitch cannot. It also gives them new avenues to create content without decentralizing their brand.

International Markets

Youtube’s scale gives it a leg up in emerging markets and niche communities. Only two of the company’s top ten most-viewed gaming creators hail from North America, and games like Fortnite were outpaced in watch time by non-NAMER games like Garena Free Fire. This command of the international audience means that the company will establish itself as key partner as these markets develop, identifying trends and rising titles/developers before more Western-centric audiences are exposed to them.

Creator Investment

Meanwhile, it's been reported that Twitch is decreasing its investments in exclusive streaming agreements, while YouTube has only increased its grab for creative talent. Over the last 24 months alone, the company has been able to nab big names like Valkyrae, CouRageJD, TimTheTatman, and Dr. Lupo. The long-term implications behind these signings are less about pulling in high numbers of viewers by taking creators from one platform to another, but rather taking the cultural relevancy and currency these names have built on other platforms and bringing them to the YouTube brand. As a company trailing in livestream market share, the legitimacy these names bring YouTube Gaming could offset the cost of bringing these creators on for a few years, and will likely result in the company continuing to spend on talent even if the competition won’t.

While YouTube is undoubtedly years away from taking away the throne from Twitch as “The King of Streaming”, the company has clearly laid the groundwork for an expansion strategy that plays to its own strengths in meaningful ways. It only has 6% market share today, but with the way it’s been executing so far, it wouldn’t be surprising to see YouTube break into the double digits soon. And given Twitch’s track record of fixing systemic problems so far, it’s also not unrealistic to consider that we could see a “flippening” at some point in the future, with YouTube’s competitive moat resulting in them taking majority market share from the seemingly unbeatable monopoly. I’m optimistic about the company’s long-term prospects, but now it’s a matter of waiting to see where livestream audiences migrate or remain. (Written by Max Lowenthal)

📚 Content Worth Consuming

Can Supercell Boost Beatstar Into a Major Hit (DoF): “For nearly five years Space Ape has been a proud member of the Supercell investment portfolio. Yet despite a very healthy pipeline of new games and a string of polished games in soft-launch, Space Ape was not able to produce much-coveted hit titles. The launch of Beatstar is interesting not only because it’s an incredibly well crafted and fun game, but because it is in many ways the first game published by Supercell: It has Supercell ID, it has been heavily cross-promoted inside Supercell’s games and even the Supercell CEO gave it a major shoutout in his yearly blog post.” Link

Is Axie Sustainable: (Axie Pulse): “ Ultimately, Sky Mavis needs to ensure that there is enough demand for Axies over time from people who intrinsically want Axies [or other in-game NFTs] to battle/collect/progress in the game with, versus only to earn. If most players only want to earn and withdraw more ETH than they deposit into the game, and if eventually there aren’t enough new players coming in, then there simply will not be enough ETH left in the economy for everyone to come out positive. Is driving more of this intrinsic desire for Axies possible? Of course. Axie Infinity is first and foremost a game and for the entire history of games [until now] people have gained intrinsic value from games which they traditionally actively pay for and get no monetary return — simply getting value in the form of things like fun, social-bonding, achievement, and mastery. Many early and core players likely are in this group already, it’s more so that the large influx of purely pay to earn players may need to be converted if the core cannot sustain the economy on their own.“ Link

How Virtual Worlds Work, Part One (Raph Koster): “One thing that’s really struck me is the enthusiasm for the reinvention of online world technology. Whether a particular commenter is focused on decentralization, player ownership, or user creativity, there’s clearly a lot of interest in new ways of doing things. In my experience, whenever we are exploring new ways to approach old concepts, it’s important to look backwards at the ways things have been done before. A lot of these dreams aren’t new, after all. They’ve been around since the early days of online worlds. So why is it that some of them, such as decentralization, haven’t come to pass already? The answer lies in the nitty gritty details of actual implementation. A lot of big dreams crash and burn when they meet reality – and some of our most cherished hopes for virtual worlds have pretty big technical barriers. That’s why I am writing about how virtual worlds work today, so it’s easier to have these conversations, and all reach for those dreams together. And I’m going to try to do it with minimal technical jargon, so everyone can follow along.” Link

How Arkane Studios Designed Prey (NoClip): “We talk to the team at Arkane Austin about the design of their immersive sim cult classic, Prey.” Link

Why Gaming is Becoming Mainstream (HelloMetaverse): “The stereotypes and cultural norms of gaming have been shifting dramatically in the last few years. gaming used to be heavily associated with a young and male stereotype, now that’s far from the truth. Games are appreciated by people of all genders and ages, and increasingly becoming the next gen social platform. In this episode, I explore with Jon Lai, who has been an instrumental figure in bridging the gap between the gaming and consumer tech industries, the factors that are making gaming become mainstream and his predicted trends of the trajectory of the industry.“ Link

🔥 Featured Jobs

-

Mythical Games: Principal Economy Designer (Remote, US)

-

Immutable: Business Development Manager (Remote, US/EU)

-

Mythical Games: Lead Product Manger (SF, LA, Seattle)

-

Carry1st: Ad Monetization Manager (Remote, Global)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.