Hi everyone, and happy Easter! Big news: We’re thrilled to announce that The Pause Button (TPB) newsletter is folding into Master the Meta (MTM). Fawzi and Max, founders and writers of TPB, have done an outstanding job covering the games industry over the past two years. Running a newsletter consistently over such a long period is hard work, but Fawzi and Max powered through it and converted a passion project into so much more. We’re really excited to join forces, as it is clear that Fawzi and Max not only share our aspirations for MTM’s future, but also bring TPB's unique flavor with them. They will now help level up our content, community and other important MTM initiatives.

If you’re a long-time MTM reader, things should only get better. And if you’re new, welcome! We strive to be the #1 newsletter covering the business of gaming, and we send our issues out at this same time each week.

We also occasionally publish deep dives. These include interviews with gaming leaders (like Steve Arhancet and Javier Ferreira), business breakdowns (like Stillfront and Unity), trend breakdowns (Where Crypto Meets the Metaverse), and even game design breakdowns (Genshin Impact). To everyone new and old, we’d love your feedback. Please feel reach out to Fawzi with any suggestion/concern/question on how we can continue to improve, or drop your thoughts here. Your help is highly appreciated!

Lastly, there’s also a business behind the scenes! Naavik’s consulting team helps companies design games, carry out deconstructs, conduct market research, perform due diligence, and more. Check us out and get in touch if ever interested.

Alright, that’s enough preamble. Here’s your weekly roundup and analysis of what’s happening in the video game industry…

#1: Games Drove Tencent’s Record 2020

Last week, Tencent finally unveiled its full year 2020 results, which were mostly solid. There’s a ton to dig into (400 words never does Tencent justice!) — record business outcomes, Mini Program growth, the launch of Video Accounts (to combat Bytedance), enterprise wins, a new dividend, etc. — but let’s zoom in on games. Unsurprisingly, it was a standout year for Tencent’s Online Games business. Not only was Online Games the company’s largest business segment (32% of revenue), but it was also the fastest growing (+36% worldwide revenue).

As reflected in the Q4 numbers, the swift expansion is still primarily driven by booming mobile games sales (+41% to $5.6B; in comparison, PC sales decreased 1% to $1.6B) and international games sales (+43%). It’s important to note that COVID tailwinds definitely contributed to this acceleration, and we’re already seeing clear normalization (sequential games growth was -6%). Still, for the largest gaming company on the planet, this reflects impressive execution.

Whenever digging a layer deeper, the takeaways always feel like a laundry list of accomplishments:

-

TiMi is the largest studio in the world, clocking in $10B in 2020 revenue.

-

Honor of Kings, Peacekeeper Elite, PUBG Mobile, and League of Legends all expanded their user bases.

-

Tencent successfully launched many new hits: Valorant (top new PC game of 2020); CoD: Mobile (highest DAU game launched in China in 2020); and Moonlight Blade Mobile (best performing new mobile MMORPG in China).

-

PUBG Mobile still has the highest MAU of any mobile game worldwide.

-

Tencent continued to acquire and invest in companies like Leyou, Voodoo, Wizard Games, Klei Entertainment, and more.

In general, Tencent’s strategy to 1) maintain and grow its top games, 2) launch new hits (often with partners), 3) deepen its ecosystem through improved tech and distribution, and 4) widen its global reach through dealmaking still works. Of course, the landscape continues to shift: Bytedance is accelerating its commitment to games, companies like miHoYo (behind Genshin Impact) succeeded while bypassing traditional platforms, and regulatory scrutiny still poses potential headwinds. In other words, despite clear top dog status Tencent isn’t the only notable player in town and it needs to stay vigilant. Personally, I think there’s room for multiple winners. Even if business decelerates or Tencent loses market share, I’m confident in the company’s ability to find new growth opportunities, generate gobs of cash, and deepen its ecosystem. (written by Aaron Bush)

#2: Dapper Labs Raises $350 Million

NBA Top Shot is certainly making a splash. Since its five-month beta, there have been 800K registered accounts, $500M in secondary market transactions, and now a fresh $350M cash infusion, valuing the parent company Dapper Labs at $2.6B. Most significant is that more than 330k accounts hold at least one moment (the NFT), which indicates that there is robust interest in holding these NFTs both as speculation and as stores of appreciating value. Better yet, Dapper Labs has only used 1/6th of its total funding to date. These are NBA-level numbers.

This raise comes at a time in gaming when we’re reorienting ourselves around what it means to be a fan, showcasing one’s affinity both IRL and digitally. NFTs are a tangible proof of ownership — the “currency of fandom” — and NBA Top Shot is just one proof point of this. More broadly, Dapper Labs spent the years following Cryptokitties building the architecture to power a new generation of games and NFTs at scale: The Flow blockchain. From their website, “Flow is a fast, decentralized, and developer-friendly blockchain, designed as the foundation for a new generation of games, apps, and the digital assets that power them.”

In recent months, Flow has risen to a $40B market cap. There’s no doubt that as companies leverage its composability, Flow will continue to see its value rise – and with it Dapper Labs’ relevance. Currently, over 100+ developers are using Flow to build out their programs, including Dr. Seuss, UFC, Samsung, and Ubisoft.

Zooming out a bit, there are a lot of promising applications for NFTs to enter the gaming sphere, and Dapper Labs isn’t the only player building the foundational infrastructure. The ownership, tradability, and scarcity that enable “Play-to-Earn” games and “player-owned economies” are powerful concepts; however, there’s still a lot to prove, and the path to adoption isn’t perfectly clear. For one, tokenized games can give players influence over development, and finding the right balance of centralized versus decentralized decision making is still experimental. Second, it’s hard to know what types of blockchain-based games are most likely to succeed. Certain genres? Roblox-like games that support ecosystems of sub-games? It’s TBD. And lastly, unfriendly App Store rules can make it difficult to build in-app ecosystems, which adds friction to overcome.

Those uncertainties are real and may impact the speed at which these games are adopted. That doesn’t mean, of course, that the long-term potential many dream of can’t be reached. Along with other emerging players (Immutable, in particular), Dapper Labs’ Flow Blockchain is a more than encouraging infrastructure to kick this trend off. (written by Fawzi Itani and Max Lowenthal)

Sponsored By GamerSpeak

GamerSpeak helps game companies with revenue of $200k+/mo increase their revenue and retention by 30% in 6 months or less with new or legacy titles.

We help game companies who:

• Have limited insight into what will keep their super users interested in their game for a long time

• Are looking for a long-term solution for increased revenue and retention

• Have few or no existing strategy guides.

• Have players who are unsure how the mechanics of the game work, and are not confident with their purchases.

In 4-6 months we deliver:

• An increase of 15-30% of revenue and retention

• Authentic player insights that lead to a clear understanding of what players want

• Detailed recommendations for improving monetization and engagement with new features, in-app purchases, events, VIP programs, etc.

• Strategy guides that educate players on all game mechanics, levels, features, events, and in-app purchases

"GamerSpeak’s insights into our users contributes about 30% ($300,000/mo) of our revenue and retention."

— Youngjun Hong; Producer, Netmarble F&C

Increase your game’s revenue and retention up to 30% in 6 months or less with GamerSpeak. Click here to see more case studies:

#3: Hypercasual’s 2020 and its Hybridcasual Future

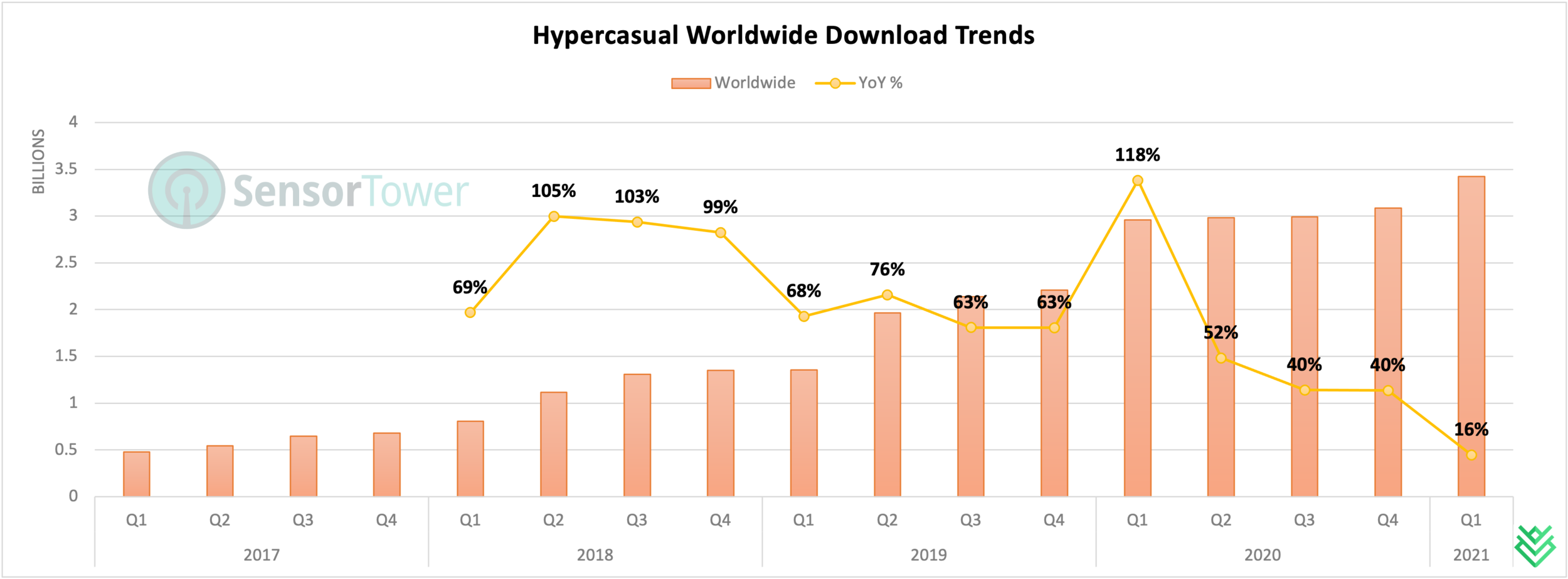

This past week, Sensor Tower released a COVID-19 App Impact report. One notable tidbit is Hypercasual’s stagnating download volumes in the US. Even more striking: the YoY growth rate continued its longer term downtrend and was even negative for the very first time. I found this data especially puzzling to see in a key mobile gaming market, since we know mobile gaming at large had a booming 2020. There are a couple ways to look at this data.

One perspective is that this is COVID related, such that the US mobile gaming audience had more time to spend on games, but chose to spend it on deeper and more engaging games. If this were true, I’d imagine the same behavior to have played out across the globe, but interestingly, Hypercasual worldwide download volumes actually grew over 2020 despite the US’s decreasing download trend.

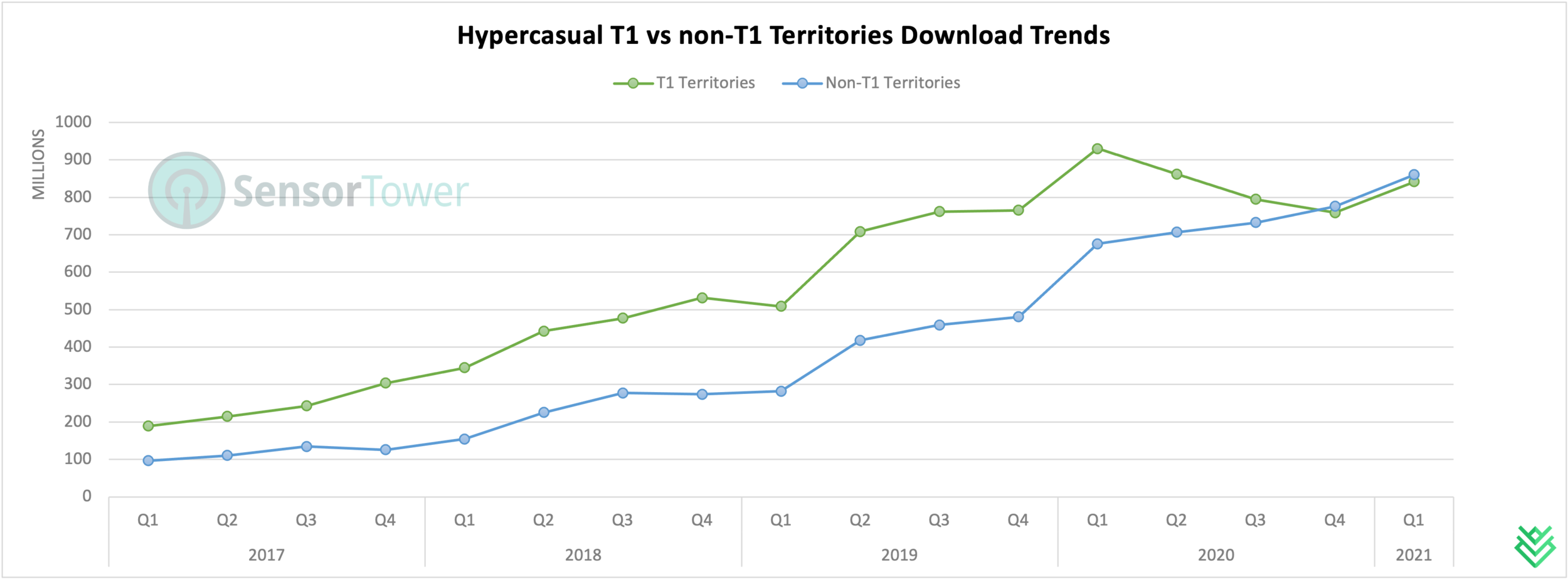

The second perspective has to do with splitting the downloads between Tier-1 (T1) and non-Tier-1 (non-T1) territories. Hypercasual clearly found its 2020 growth in the non-T1 with countries like India and Brazil leading the pack. Not only did non-T1 downloads match T1 territories, but it also seems to be on track to surpass T1 territory downloads over 2021. Further, the longer term uptrend of non-T1 Hypercasual downloads signals an ever increase need to grow outside T1 territories. It’s possible that COVID accelerated a user acquisition frenzy across genres, resulting in it becoming too expensive for Hypercasual to profitably acquire T1 users comparatively.

In terms of a future outlook, the fundamentals of Hypercasual haven’t changed since their rise in 2017. It continues to remain a genre with low barriers to entry, quick production cycles, mass appeal, highly sticky core gameplay, ultra-aggressive ad monetization tactics, and short product lifespans. That leads to a Hypercasual business sustaining through highly frequent new game launches, where LTV beats CPI at massive scale.

Over the past years, these unique genre dynamics have also resulted in fierce competition, market saturation, a lack of staying power for market leaders, and a growing need to innovate and differentiate to stay relevant (read my deeper thoughts on this here). On top of that, there is the IDFA elephant in the room, the impact of which continues to remain unclear for Hypercasual’s ad-driven user acquisition and monetization model.

There’s certainty around some of the data — 1) Hypercasual download volumes continue to grow, and 2) YoY download growth rates are slowing. In other words, while Hypercasual will continue to have its place in the future, it’s also a maturing genre. That doesn’t mean it’s stopped evolving, though. One evolution is the rise of “Ultracasual”, which are basically Hypercasual games without any loss conditions. Imagine icing a cake or painting a house with no chance of doing it incorrectly. In a way, these games feel as casual as game design can get and may be more of a short term trend.

The more interesting evolution in my opinion is “Hybridcasual” - a fundamental change to the way the industry approaches Hypercasual from design, production, and marketing profitability perspectives. Games like Archero, Mr. Autofire and Art of War are forging the path ahead here. These games mix the best design, production and marketing practices from Hypercasual with simplified meta systems, hybrid-monetisation (IAPs + Ads) tactics, and live operation activities from other genres. The end result is a game that has been de-risked through rapid iteration and market validation, has mass appeal, sustains Hypercasual like CPIs, and achieves higher than Hypercasual LTVs. That of course results in a LTV > CPI equation that helps build a more stable and long term GaaS business.

Hybridcasual has been a long time coming. I’ve written about it quite extensively over the past years here, here, here, and here, and also contributed updated thoughts here and here. We’ve also studied this evolving space quite deeply at Naavik, and if you’d like to learn more about how to build for the Hybridcasual future, please don’t hesitate to reach out! (written by Abhimanyu Kumar)

#4: Manticore Raises $100 Million

Earlier this week, UGC games platform Manticore announced the completion of its $100M Series C (at an undisclosed valuation), bringing total funding up to $160M. This comes a few months after Epic Games invested $15M, and the current round includes notable investors like XN, Benchmark, and BITKRAFT. That’s a lot of funding for a platform still in open alpha, so let’s explore the general thinking and whether those expectations are reasonable.

To start, it’s a wise time to raise capital: With all eyes on Roblox’s recent direct listing, there’s a clear appetite in the market for UGC games. Manticore’s platform, Core, caters to a fundamentally different and older demographic than what Roblox has currently, but Roblox isn’t sitting still. Roblox is working on features like higher fidelity graphics and voice chat to attract a more diverse user base (not to mention its best-in-class brand, player network, development community, team size, and financial firepower provide real competitive advantages). That said, working through technical debt and attracting entirely new audiences isn’t simple. This liminal time is what may allow others — Manticore especially — to swiftly come in, build out much more technical depth/flexibility, and carve out unique audiences. Hence the need the raise significant capital and move quickly.

Roblox deserves all the praise it receives, but Manticore is also decently positioned. According to VentureBeat, “After just a few months in alpha testing, Core already offers more than 20,000 free games, has had roughly half a million projects started on the platform, and has amassed over one million player and creator accounts globally.” The company’s partnership with Epic Games may also prove to be valuable; to start, not only is Epic investing with an aligned vision, but Core is built atop the Unreal Engine. Early access will exclusively launch on the Epic Games Store in two weeks.

And yet, there’s still plenty to be proven: Can Manticore empower creator success at scale (which correlates with platform monetization)? Can the company acquire millions of players before other UGC platforms do? Once players are acquired, can Manticore successfully retain / build networks around those new players? Will the platform successfully launch cross-platform?

All in all, I understand the need for and appreciate the speed and size in which Manticore is raising money. At this stage, acceleration is the surest way to succeed, and the massive market still up for grabs likely justifies the sizable investment. As to whether future expectations are reasonable, that’s entirely up in the air. All of those above questions (and more) still need to be answered, but the good news (as shown by Roblox) is that the market is validating these inquiries. The fresh $100M will do a lot of good, but there’s still tremendous work to do. It all boils down to quality of execution, and it will be exciting to see Manticore’s plans eventually come together. (written by Aaron Bush)

🎮 In Other News…

-

Three new Clash games from Supercell are heading for mobile - Clash Mini, Clash Quest and Clash Heroes. Link

-

Nexon Invests $874M in Bandai Namco, Konami, Sega, and Hasbro. Link

-

Lowkey raises $7M to record gameplay. Link

-

Graffiti Games raises $1.5M. Link

-

Sumo recorded 40% revenue growth last year. Link

-

Epic Games teams up with Cesium to bring 3D geospatial data to Unreal. Link

-

Fable Studio, which uses GPT-3 in its Wizard Engine, opens up their software to collaboration. Link

-

Enjin, the previously gaming-specific blockchain, announces a partnership to launch NFT blockchain on Polkadot. Link

-

Someone bought a copy of Super Mario Bros. for $660,000. Link

-

Discord and 100T made it onto Contrary Capital’s Creator Economy list. Link

-

Popular Streamer’s record-breaking subathon ended after 1.5 weeks and nearly $470,000. Link

-

A digital education company, Sandbox, continues its acquisition spree in games with its recent partnership with Fingerprint. Link

-

Among Us launched its new map, attracting 600k live concurrent on the release day. Link

-

Xbox has done an excellent job in backward comparable offerings. Link

-

Motion capture is coming to esports shoutcasters. Link

🖥 Content Worth Consuming

The Future of Virtual Events (BITKRAFT Ventures): “As remote-friendly conferences, shows, and events have become commonplace in the wake of COVID-19, few organizers have taken a truly digital-first approach, redefining what’s possible from the (virtual) ground up. Yet there is a clear opportunity: the number of organizations planning virtual events doubled in 2020, and the market is expected to grow tenfold to a projected $774B by 2030. At that size, virtual and physical events can easily coexist post-lockdown. Virtual events will offer unique selling points as either standalone offerings or supplements to their physical counterparts.” Link

Talking Strategy and Synergy with Stillfront Group! (GameMakers): “Today we are going to be talking about game publishing, the strategy behind consolidated studio organizations, and the future of the industry. This Panel Discussion is with Alexis Bonte COO Stillfront, Nadir Khan Candywriter, and Tobias Kringe Bytro Labs.” Link

Living the Dream SMP (The Verge): “The only thing more impressive than the elaborate world they’ve created is the fan base that’s sprung up around it. Dream SMP fanfiction writers dominate websites like Archive of Our Own, Dream SMP fan art can be found all over Tumblr and Twitter, and Dream SMP fan songs (including an entire in-the-works musical) get uploaded to YouTube. There is also a plethora of clip accounts that track Dream SMP stories for people who can’t tune in to each stream, full-blown fan-made animated episodes paying tribute to Dream SMP’s ongoing stories that air weekly on YouTube, and even a 24/7 news network devoted to tracking the universe’s story and hijinks. Dream SMP may exist on a tiny Minecraft server, but thanks to a fan network stretching across the globe, it’s become a worldwide phenomenon.” Link

Ubisoft is Making The Next Generation of NFT Games (Decrypt): “ ‘It’s never obvious that a company will meet success, but here, they had all the ingredients actually. A football or soccer card game is one of the simplest ways to aggregate all the value that an NFT can bring,’ said Pouard. ‘You have the players’ renown, of course. You have the scarcity. And you have the fantasy itself as a football or soccer fan. You need this kind of substrate to let your imagination grow and build your own fantasy.’ “ Link

Why Subscriptions Feel Like a Turning Point For Games (Polygon): “Microsoft’s and Apple’s bets on downloadable subscription services would seemingly place them behind their streaming counterparts in the long run, but that’s not quite the case. Their success shows that they’re neither ahead of the curve nor behind it; they’re simply meeting the expectations of their players. Apple debuted 30 games on Friday on a service that costs $4.99 a month and is often included in larger Apple product purchases for free. Microsoft’s Xbox Game Pass Ultimate tier costs $14.99 a month and includes games on Xbox console, Windows PC, and Android devices — and will now regularly feature launch-day releases from Xbox Game Studios, Bethesda Softworks, and even Sony, along with a rotating collection of more than 100 catalog titles. They’re providing the best deals in gaming at this moment.” Link

Thanks for reading, and see you next week! As always, if you have feedback let us know here.