Hi Everyone. We’re back from a short holiday hiatus and ready to tackle the second half of the year. There’s a lot to dig into and catch up on!

Quick note before diving in: The next Pocket Gamer Connects digital event is happening throughout this week, and Naavik’s rockstar consultant squad is representing.

- July 14th, Wednesday (4pm UK time): Philipp Zupke joins the “Taking Blockchain Gaming Mainstream” panel

- July 16th, Friday (11am UK time): Thomas Baker joins the “Live Ops as the Fountain of Youth: Can Games be Eternal?” panel

These discussions should be excellent, and there’s still time to register with a Naavik -20% discount. Hope you enjoy it!

Naavik Exclusives: NoPixel and The Future of UGC + Roundtable #6

NoPixel and The New Creator Auteurs

The latest essay from Matt Dion explores why NoPixel — a mod-driven role-play server for Grand Theft Auto V — is not only a wildly successful project, but also a pioneering step in the next evolution of user-generated content (UGC). The essay walks through modding’s key evolutions and dissects what’s next as trends like the creator economy, improved modding tools, and even decentralized autonomous organizations (DAOs) all come together. Make sure to check it out below!

The Metacast Roundtable #6

With Nico back from his honeymoon (congrats!), The Metacast is returning with a bang.

This week, Nico is joined by new panelist, crypto guru and previously published MTM writer Piers Kicks (crypto-focused VC at BITKRAFT and Delphi Digital), as well as Jayne Peressini (VP Growth at Gala Games) and Naavik’s own Aaron. The episode covers:

- The play-to-earn model — lessons from early winners like Axie Infinity, challenges to sort out, and thoughts on what’s next

- Facebook’s future with VR — Oculus’s strategy, what’s needed for mainstream adoption, and the role of ads

- Bold predictions — you’ll have to listen to find out!

#1: Dream Games Raises $155M at $1B Valuation

Last week, Istanbul-based Dream Games raised $155M in a Series B round led by Makers Fund and Index Ventures. The funding round values Dream Games at $1 billion. Dream Games is the developer of the latest casual puzzle phenomenon, Royal Match, and the company previously raised $50M in a Series A round in February, just four months ago. Prior to that, Dream raised $7.5M in seed funding in November 2019.

The core team of Dream Games is ex-Peak (Toon Blast, Toy Blast), and it definitely shows. Dream Games employs a similar strategy of zero nonsense and 100% execution: a razor-sharp focus into building and operating the best puzzle game in the market, relentless effort in optimizing ad creative, and aggressive application of capital into user acquisition.

Moreover, it's easy to see the logical evolution from Toy Blast to Toon Blast and from Toon Blast to Royal Match. Royal Match doesn't bring anything new to the genre; instead, it offers everything essential but nothing needless. The game is rumored to command the highest retention numbers in casual puzzle. The claim is easy to believe, considering just how clean and polished the experience is.

The sheer volume of Dream's user acquisition has certainly raised some eyebrows in the past months, as Royal Match has boldly stolen market share from incumbents King, Playrix, Zynga, and AppLovin. Pretty much all of Dream's revenue growth has taken place since March. Just in the past eight weeks, Dream has been able to grow Royal Match's revenue by a whopping 7% per week (according to SensorTower data).

As a result, Royal Match has reached a yearly run rate in the ball park of $200 million in net revenue ($290 million gross), extrapolating from the last 14 days of revenue data. Considering this in addition to the fact that the game is still growing, it's not surprising that investors would value Dream at $1 billion: a $290M run rate works out to a 3.5x revenue multiple.

Valuation aside, the pace at which Dream has executed is breathtaking. In May 2019, the founders were still working at Peak. After raising the seed round in November 2019, Dream initially released Royal Match in the app stores in July 2020. The game spent seven months in soft launch. Once globally launched, it took only four months for Dream to reach the position they are today. All told, Dream Games went from zero to a unicorn in less than two years.

Raising a nine-digit Series B only four months after Series A hints that Dream has successfully applied the previously raised $50M and that it has no plans to stop here. The strategy that Dream Games is betting on worked wonders for Peak, and there's no reason it won’t work for Dream. (Written by Miikka Ahonen, Co-founder of Lightheart Entertainment)

#2: Axie Infinity’s Resurgence

Source: Crypto Daily

I’ve written about Axie Infinity in the past and even covered Yield Guild Games a couple weeks ago, but I’m continuously surprised about what I learn when diving into the wild world of crypto and play-to-earn (P2E). For example, while preparing for this week’s podcast episode, I did a double take at a couple Axie Infinity numbers (remember, this is a game / marketplace where players collect and battle digital monsters and earn rewards).

First, according to Messari, Axie Infinity’s token (AXS) officially hit a reported market cap of $1B+ (with a fully diluted market cap of over $5B). Wow. It’s not all speculation either. According to Token Terminal, over the past 7 days alone Axie Infinity generated $21.5M in revenue, the project’s biggest week ever. Paired with a recent tweet that mentioned the game hit 350,000 DAUs, that translates into some impressive revenue per user metrics (which makes sense when players need to buy in to play). Looking at this chart of the past 180 days, it’s easy to see how exponentially rising revenues (the green bars) are contributing to a market cap resurgence (the purple line):

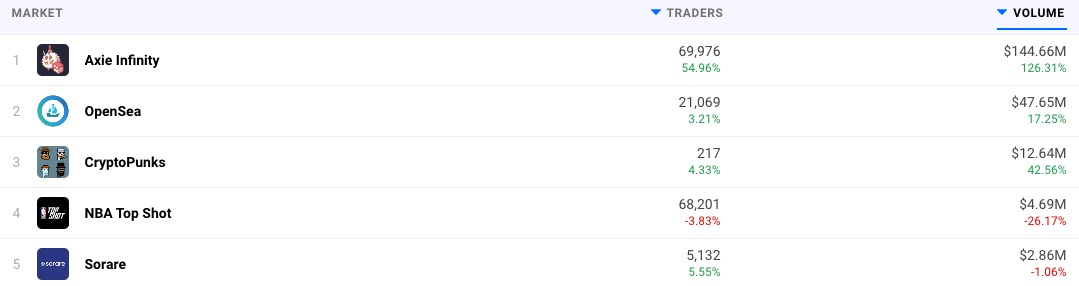

That’s not all. As you can see in the image below, over the past week Axie Infinity experienced 3x the volume of the next closest NFT marketplace (OpenSea) and likely more volume than all other NFT marketplaces combined (and now has the fourth highest all-time volume):

Source: DappRadar

I won’t make predictions about Axie Infinity. I’ll also be the first to admit several caveats: Axie is currently an outlier, P2E won’t apply to all games, and the hype cycle will hit hard at times (interest, sentiment, and prices will wildly swing). After all, we wrote about NBA Top Shot as the big hyped topic only a few weeks ago, and the world moved on to the next thing. If you listen to The Metacast this week, everyone also agrees that P2E infrastructure, developer tools, and design best practices all need further work.

So what’s the point of sharing these big numbers? It’s to highlight the stakes involved and at least partially verify P2E’s legitimacy. As a tokenized project, how value is captured is different from a game fully owned by a corporation, but it doesn’t mean serious value can’t be created. In some instances, I expect this new model can actually create more value by better incentivizing and aligning interests with a game’s community. If Axie Infinity can hit these heights, it’s not hard to imagine how even higher heights can be accomplished by future teams who work with improved infrastructure and apply lessons learned from today’s pioneers. It will take time, and we’re still scratching the surface of what’s possible, but if Axie Infinity has proven anything it’s that the P2E genre shouldn’t be ignored. (Written by Aaron Bush)

Sponsored By… Ourselves?!

That’s right. Before we onboard new sponsors, we want to take a moment and remind everyone what Naavik has to offer. Since 2019, Naavik has built a rockstar team of consultants that enable game studios and companies across (or adjacent to) the gaming industry — like BITKRAFT, Square Enix, Ubisoft, Facebook, Immutable, and 50+ other clients — to master the business of gaming.

Our work centers around three key service verticals:

- Research & Diligence - Data-backed market, trends, genres and company research or due diligence reports

- Audits & Deconstructs - Hypothesis-driven and detailed game audits and deconstructions

- Product & Design - Design specs, economy modelling, live-ops strategy, and more

Whether your company is designing a game, wanting to learn about a new market opportunity, hoping to improve UA strategy, conducting diligence on an acquisition, or tackling other opportunities - we’re available to help you better navigate the future of fun. To learn more, do visit our website and reach out through the contact form!

#3: MTG Acquires PlaySimple

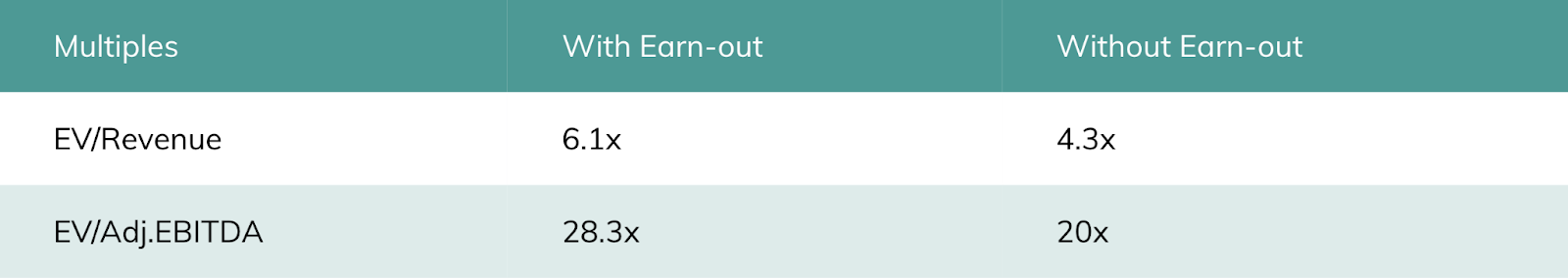

Source: InvestGame

Modern Times Group, the Stockholm-based investment holding company with assets in esports and gaming, is set to become one of the largest Nordic gaming companies with yet another deal announced on July 2 — a Bangalore-based leading word games developer PlaySimple was acquired for up to $510M. The sum is paid in two considerations: $360M upfront (paid 77% in cash and the rest in Class B MTG shares), and $150M in earn-out consideration, paid in cash if certain (undisclosed) targets are met by PlaySimple. Based on PlaySimple’s financial performance in 2020 (Revenue of ~$83m and Adj. EBITDA of $18m), the transactions multiples are:

The acquisition is one of the largest exits when it comes to Indian gaming startups. Since its inception in 2014 (by ex-Zynga dev team), PlaySimple has raised a bit more than $4.5M, with the latest $4M Series A round closed in November 2016 from Elevation Capital and Chiratae Ventures.

With the acquisition, MTG not only increases its presence in one of the most promising gaming markets but also expands into a new niche genre — F2P word games. Currently, PlaySimple operates nine live word games with 7M MAUs and 70M lifetime installs. Among the best-known titles of the company are Word Trip, Daily Themed Crossword, Crossword Jam, and World Wars. Now the company is working on four more games, which are expected to release later this year. There is not much information about the upcoming projects, but PlaySimple announced its plans to expand into card games in the near future.

We don’t usually see many Nordic gaming companies buying Indian mobile developers (Stillfront acquiring Moonfrog is another example). However, the deal goes in line with MTG’s M&A strategy. Since 2017, MTG’s made four diversified deals with a wide geographical and genre spread: New Zealand-based mobile tower defense games developer Ninja Kiwi (2021; for up to $189M), England-based mobile racing games developer Hutch (2020; up to $275M), US-based web gaming portal Kongregate (2017; $55M), and Germany-based browser and mobile games developer InnoGames (2017; $90M).

In addition to these M&A deals, MTG expands its presence in the gaming market through its VC fund focused on esports, games, and tech & tools investments. Last year, the company participated in five early-stage rounds, investing in three mobile studios — Bazooka Tango, Dazzle Rocks, and Dorian, as well as esports media platform BoomTV, and social media creative tools creator Koji. This year, however, MTG has not yet disclosed its participation in any investment rounds.

Overall, we see the company gaining momentum, increasing both the frequency and the size of its acquisitions. Through the PlaySimple deal, MTG has not only ‘another studio’ in the portfolio, but also a team with extensive expertise in the promising Indian market. The PUBG Indian case is a good example of how important it is to properly enter new markets knowing all the intricate details there. India is one of the countries with a high potential for gaming audience growth, and MTG sets out to be one of the few gaming companies with a wide presence in this market. PlaySimple is the second studio MTG has acquired in 2021 and the third it has acquired during the last eight months. Inorganic growth strategies have increasingly become commonplace for Sweden-based strategic investors, with other active buyers being Embracer, Stillfront, Enad Global 7, and Thunderful Group. We have every reasons to expect new deal announcements from MTG this year. (Written by Andrei Zubov and Vladimir Sergeevykh of InvestGame)

#4: Putting the Switch OLED Model into Perspective

Source: The Verge

The gaming community hyped itself up with high hopes for major Switch hardware improvements, especially 4K resolution. All hopes and chatter pointed to a “Switch Pro.” And well … in the grand scheme of announcements, Nintendo’s reveal of the “new” Switch was a major bummer. For all the anticipation, Nintendo made only three changes: a larger OLED screen (only relevant in handheld mode), “enhanced audio,” and an improved kickstand. This is such a “Nintendo Move” — they do what they want even if it’s not the perfect business decision or what its fans want (that said, I might still buy it). While not much has changed, it’s important to contextualize this announcement in the larger landscape.

Nintendo is notoriously slow at hardware improvements, but we can think of the OLED model as the “new standard” rather than as an “upgrade.” With this new baseline timed with the 2021 holiday season and a $50 price increase, we shouldn’t expect a Switch Pro to be released any time soon (maybe next year?). What we do is know is that the Switch is still selling like hotcakes, with nearly 85M units sold; notably, it’s on track to surpass the Wii’s ~102M total units sold. The Switch has a long sales life, closer to how the DS worked (which had many versions) than something like the Wii (which had one core version). With the Switch released almost five years ago, Nintendo is content to focus on extending the life of the Switch through various iterations and its ongoing stream of exclusive games.

For hardcore gamers, most of the muted response is due to the fact that this OLED model doesn’t offer enough improvement to be upgrade-worthy. Another reason for lesser enthusiasm is due to other rapid changes happening elsewhere in the gaming ecosystem. For example, Xbox is rapidly bringing its vision of Game Pass to life, taking market share away from Switch’s indie titles by bundling similar games (not to mention xCloud and the potential for Game Pass to work on mobile, thereby competing with the Switch’s handheld mode). Sony is also on an acquisition spree but pursuing a wholly different AAA strategy. So, where does this leave Nintendo?

For one, Nintendo continues to market the Switch as both a handheld and console; its ethos is “on-the-go” and “platform-exclusive” titles where top-line graphics, online play, and competitive storefronts don’t necessarily matter in the same way they do for other companies. Nintendo positions itself to compete on slightly different dimensions.

Second, it’s important to note that gaming is bigger and more diverse than ever — there are more platforms than ever, more business models than ever, more onramps for user-generated content than ever, and more ways to spectate and compete. In short, Nintendo, which hasn’t really evolved its core strategy, continues to feel increasingly niche as the gaming industry grows and evolves around it. Of course, it still stands that the Switch is a unique entry point for more casual gamers: the Switch is lower cost, family-friendly, and boasts plenty of relatable titles and easy-to-pick-up games.

All in all, the OLED model is mostly targeting new customers (unlike a future Pro model, which will also be bolstered by upsells to existing Switch users). For the casual gamer most anywhere in the world, Nintendo is still in a great position to capitalize. (Written by Fawzi Itani)

🎮 In Other News…

💸 Funding & Acquisitions:

- Singularity 6 raised $30M ahead of its Palia launch. Link

- SciPlay acquired Koukoi Games, which developed hit title Om Nom Run. Link

- Sony acquired Nixxes Software and HouseMarque.

- It’s rumored that Sony also acquired Bluepoint Games, maker of Shadow Of The Colossus. Link

- Discord acquired Ubiquity6 in what seems like an acqui-hire play. Link

- Krafton acquired content production firm Thingsflow. Link

- Indian streaming company Loco raised a $6M round led by Krafton. Link

- Coinbase Ventures led a seed investment in Bling, a mobile game studio that develops games that let people earn crypto. Link

📊 Business:

- According to Sensor Tower, Ni No Kuni: Cross Worlds hit $100M in 11 days. Link

- Roblox announced a partnership with Sony Music. This follows last month’s $200M lawsuit for DMCA violations. Link

- A version of PUBG specifically made for India called “Battleground Mobile India” was launched earlier last week. Link

- Backbone announced a partnership with Xbox Game Pass on xCloud’s launch day on iOS. Link

🕹Culture & Games:

- Turnip.gg, a community gaming platform, crossed 2M members after 8 months. Link

- Tencent will use face recognition to curb time spent playing games for minors. Link

👾 Miscellaneous Musings:

- A Twitter thread breaking down the Axie Infinity business. Link

- A cloud gaming overview by the NYT. Link

- Salone Sehgal, a GP at Lumikai, wrote a thread on why VC is becoming more interested in gaming. Link

📚 Content Worth Consuming

Talewind’s Plan to Become The “Supercell of Roblox” (GI.biz): “Talewind's first answer to this [aging up] is Breezy Bay, a game it describes as Animal Crossing meets Runescape. Players are given the chance to transform an empty island into a haven of their choosing, whether that's a peaceful forest kingdom or an outlandish waterpark filled with waterfalls and log flumes. As with Nintendo's title, you'll be able to visit other islands but rather than exchanging friend codes, waiting on loading screens and suffering a reset if someone drops out, Breezy Bay enables players to swim or ride seamlessly to other users' islands in order to trade goods and explore other people's creations.” Link

How China’s Political Influence is Changing Game Development (GI.biz): "Likewise, the country's regional dominance can also be felt through its colossal games market: now with a staggering number of 325.4 million PC players, making China's PC market the largest in the world. Even for an industry that prides itself as staunchly apolitical -- that is, with most big developers steering away from expressing any overt political messages in their games until very recently -- the global games industry has seen its fair share of contentious incidents, following China's increasingly assertive bid to exert its sovereignty over countries like Taiwan and Hong Kong." Link

The Game Industry’s Great Exclusivity Race Is All About Securing The Future (Protocol): “The common theme here is that all three platform owners have an ecosystem they want to sell. Sony wants people to buy new PS5s and to pay for PlayStation Plus; Microsoft wants people to buy an Xbox (or a PC) and subscribe to Game Pass; and Facebook wants people to buy an Oculus Quest 2 and buy all their software through the Oculus Store.” Link

How To Price Items for F2P Games (IronSource): “Much has been written about managing discounts to lower the price of currencies in games. But barely anything's been explained about the other piece of the puzzle - the default price of items. In this session, Javier Barnes, Senior Product Manager at Tilting Point, explains the best pricing techniques for in-game content, price elasticity, how specific game mechanics can affect pricing mechanisms, and more.” Link

🔥 Featured Jobs

- EA: Level Designer — Battlefield Mobile! (Pasadena, CA)

- EA: Lead Game Product Manager (Pasadena, CA)

- Metafy: Senior Product Manager (Remote, US)

- Carry1st: Producer (Remote, Global)

- Lightheart Entertainment: UI Artist (Helsinki)

- Lightheart Entertainment: Senior Game Programmer (Helsinki)

- Immutable: Economy Game Designer (Sydney)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — right here.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.