Chinese developer Lilith Games has had a significant impact on the mobile F2P landscape over the past decade. Established in 2013, it is focused on developing and publishing RPG and strategy games for global audiences. Initial breakouts included Soul Hunters (an RPG) and Art of Conquest (a strategy game), and these successes enabled the team to go up a level in 2018.

That year, both AFK Arena (an idle RPG) and Rise of Kingdoms (a 4X strategy game) were launched globally and quickly rocketed toward the top of the charts.

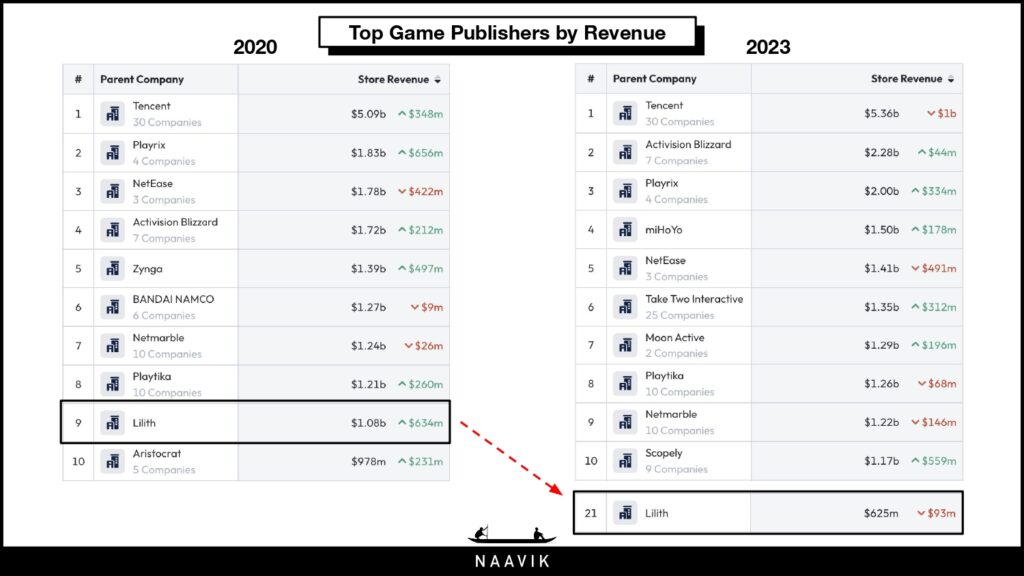

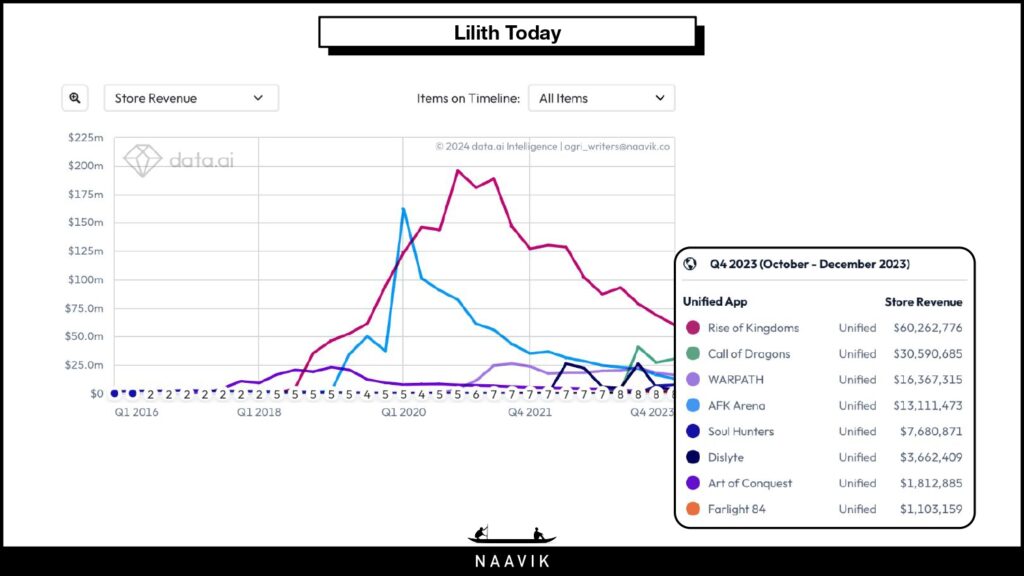

By 2020, Lilith had generated $1.08B in store revenue by data.ai estimates, making it the ninth largest mobile game publisher worldwide. (Please note that all download and revenue numbers in this piece are data.ai estimates.)

However, in 2023, a mere three years later, Lilith ranked No. 21 on the same list with $625M in yearly revenue, down a whopping 42% since 2020. That’s still revenue many teams can only dream of, but clearly something changed. Let’s take a closer look at the rise and fall of this powerhouse, and where Lilith might go from here.

Game Releases & Revenue

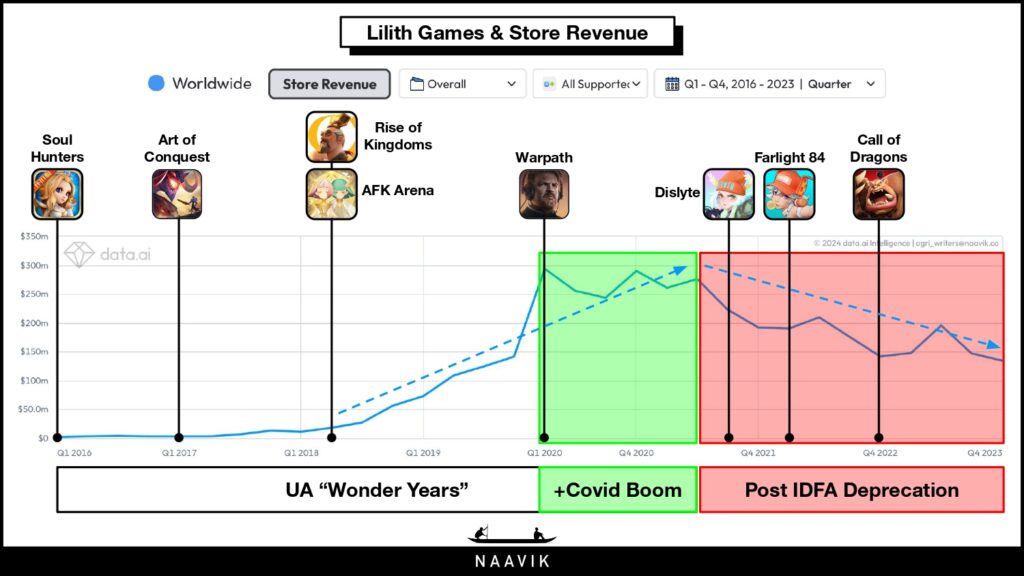

Strategy games and gacha RPGs are known to be reliant on both highly targeted UA and whale-driven IAP monetization. Throughout 2018-2019, in the UA "wonder years" of app event and value optimization, Lilith was able to grow its top titles significantly — AFK Arena and Rise of Kingdoms made $147M and $279M in 2019, respectively.

That was followed by Lilith’s best year, 2020, which benefited with the industry’s broader Covid-19 boom. The release of a new 4X strategy title, Warpath, coincided with explosive growth for its flagship titles. From 2019 to 2020, AFK Arena grew 124% to $453M, and Rise of Kingdoms grew 125% to $626M in store revenue.

Things took a sharp turn in Q2 of 2021 with Apple’s IDFA deprecation coming into full force. It directly impacted Lilith’s targeted UA capabilities, and therefore IAP revenue generated across all of its gacha RPG and 4X strategy titles plummeted. Dislyte, a gacha RPG released during this tumultuous period, failed to gain traction, and Farlight 84, a battle royale fast-follow, was Lilith’s first big flop.

In addition to the challenges posed by IDFA regulations, Farlight 84’s aesthetic, reminiscent of Fortnite, struggled to distinguish itself in a market saturated with popular shooters such as PUBG, Fortnite, and Call of Duty: Mobile. And Dislyte’s pop aesthetic diverged significantly from the classic Dungeons & Dragons-inspired fantasy aesthetic of leading RPGs such as Raid: Shadow Legends and Empires & Puzzles.

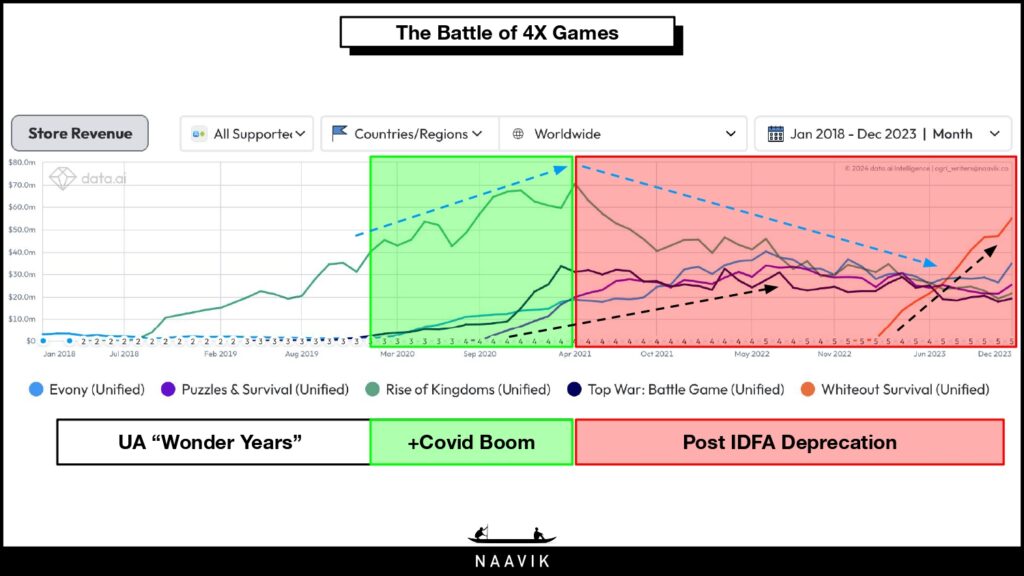

Lilith’s biggest title, Rise of Kingdoms, struggled in the post-IDFA world, falling from No. 1 to No. 4 on the strategy game rankings. Other game companies started cracking the code by "genre-mashing" their strategy titles in order to appeal to broader audiences.

- Evony’s Pull the Pin minigames let players solve puzzles and earn resources for their bases.

- Whiteout Survival’s squad RPG mode enables players to form teams of characters and battle for resources for their bases.

- Puzzles & Survival’s match-3 takes a page out of Empires & Puzzle’s match-3 battles by letting players assemble a team of characters to earn resources for their bases.

- Top War’s merge mechanics embedded light puzzle gameplay in which two of the same units can be merged to create stronger units for battle.

Several of these games saw decreases post-IDFA, but Rise of Kingdoms had the steepest fall, in part because it failed to incorporate genre-mashing tactics like its competitors, which could’ve enabled it to better craft more widely effective UA tactics. According to data.ai, Rise of Kingdoms ended 2023 with a yearly IAP revenue of $316M, a 50% drop from its 2020 high of $626M.

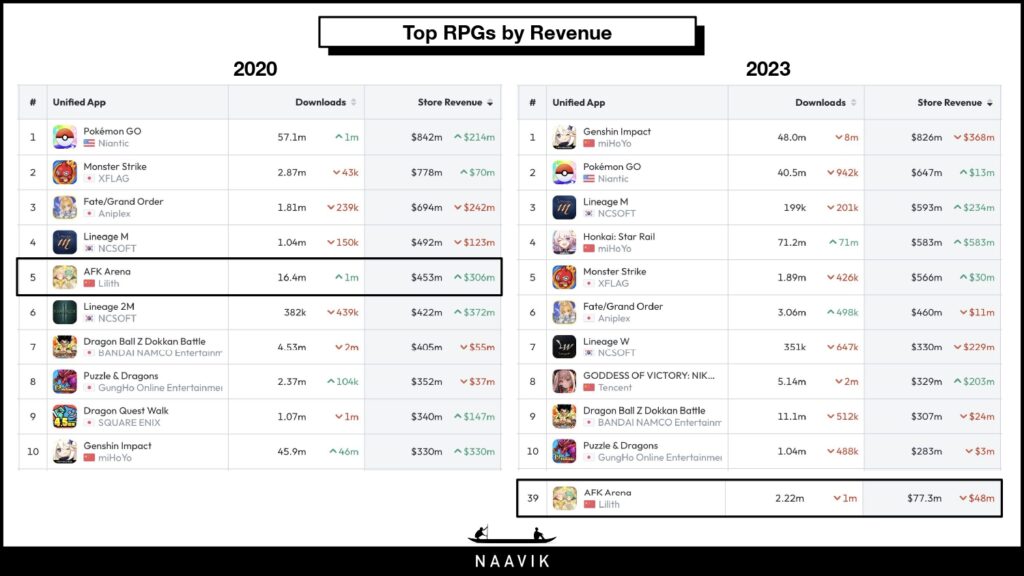

AFK Arena, along with all leading RPGs, also faced IDFA headwinds, and struggled under the weight of new ACG RPG releases like miHoYo’s Genshin Impact and Honkai: Star Rail, as well as Tencent’s Goddess of Victory: Nikke.

What’s more, Lilith struggled to dominate the idle RPG genre it had come to define with AFK Arena, as Pixel Heroes by Chinese developer More2Game and MementoMori: AFKRPG by Japanese developer Bank of Innovation topped the idle RPG grossing charts. By the end of 2023, AFK Arena’s annual IAP revenue was down to $77.3M, down 83% of its 2020 high of $453M.

Aside from post-IDFA woes, AFK Arena is a gacha RPG whose long-term monetization is dependent on operating an evergreen gacha mechanic and all the elements surrounding it, such as the token system, duplicate system, and collection drivers.

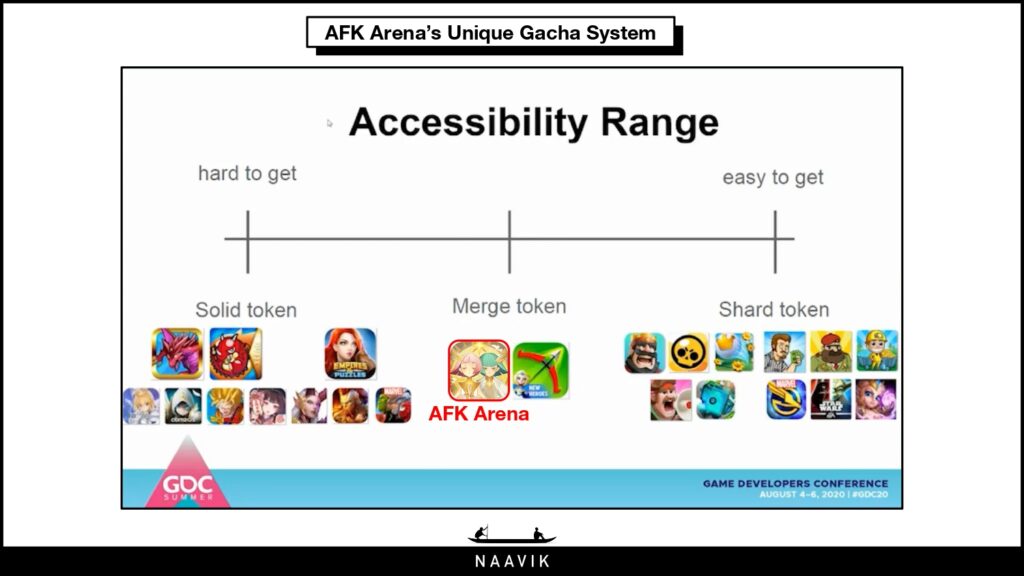

Specifically, AFK Arena uses a "merge token" gacha system that allows lower rarity heroes to be merged with their duplicates to increase their rarity, increasing the accessibility of higher rarity heroes. The game also has a generous gacha base drop rate of 4.61% for the highest rarity heroes. This is vastly different from "solid token" gacha systems for games like Puzzle & Dragons, Genshin Impact, and Empires & Puzzles, which require players to pull higher rarity heroes only from the gacha, making them harder to access. These games have a much stingier gacha base drop rates of between 0.6% and 1.3% for their highest rarity heroes.

As highlighted in our miHoYo summary, the Genshin Impact maker modeled its gacha system after Puzzles & Dragons, which has demonstrated long-term success as a F2P gacha game. In contrast, AFK Arena’s novel approach to the gacha mechanism remains untested on a larger scale, and is currently adopted by less prominent gacha games such as Archero, while Puzzles & Dragons has maintained its robust performance more than 12 years after its debut.

After the COVID boom, Lilith’s games have continued to steadily decline, while new games have failed to reach the highs of their predecessors. In Q4 2023, the new 4X title Call of Dragons earned half the revenue of Rise of Kingdoms, and Warpath only earned roughly a quarter.

All this said, Lilith stays committed to its “developed in-house, published worldwide” ethos, and has just released a follow-up to AFK Arena, AFK Journey. It mirrors the fantasy RPG style of Genshin Impact, featuring a visually appealing design that resonates with the market. It also incorporates a gacha system akin to those found in top-performing games, moving away from the "merge token" gacha model in favor of a more traditional and successful "solid token" gacha mechanism. This imminent release may also help explain why support of the predecessor, AFK Arena, has waned, leading to its outsized loss of revenue and market share, which could be at least partially corrected by this new game.

Lilith is navigating the heightened competition and stagnant growth of previous titles by adopting a more established design and monetization strategy. By adapting to market shifts and aligning more closely with established F2P business models, Lilith has positioned itself for a potential resurgence.

Much rides on the launch of AFK Journey, but, of course, the team likely has more in its pipeline, which also could contribute to returning growth. We’ll have to wait and see, but if history is any indicator, it’s dangerous to bet against Lilith.

A Word from Our Sponsor: RALLYHERE

The Backend Platform Trusted by Over 200 Million Gamers Worldwide

Already trusted by over 200 million gamers worldwide, RallyHere is the Gaming Backend Platform and Service founded by the makers of SMITE, Paladins, and Rogue Company. With over 20 years of experience, our veteran teams have successfully built, launched and grown cross-platform live-service games.

Game developers leverage RallyHere's expertise and tooling, covering matchmaking, cross-platform accounts, server optimization and orchestration, real-time live ops management, player progression, and community engagement, to streamline their development processes, increase speed to market, and maximize their resources.

Want to know how RallyHere can help you with your live service game?

Game of the Week

Truck Star: Chrome Valley Customs, But With Trucks

Written by: Jordan Phang, Naavik Consulting Partner

- Developer: Century Games

- Publisher: Century Games

- Platform: Mobile

- Status: Soft Launched March 2024 (Australia, UK, Canada)

- Genre: Puzzle and decorate

- Gameplay: Link

What Is It?

Truck Star is a puzzle and decorate game focused on a male audience, similar to Space Ape’s Chrome Valley Customs (CVC). The main difference here is that instead of restoring cars, you’re restoring trucks. But why trucks? Surely that’s a niche interest?

Well, actually…

The Google trends for both “custom truck” and “custom car” in the U.S show they are basically as popular as each other, with trucks even coming up on top on occasion.

So is it just a clone of CVC? Partly, at least with the whole concept of restoring a vehicle. But there’s an even more influential inspiration behind it: Royal Match.

From the UI placement, the portrait orientation, and most importantly, the match-3 puzzle feel, the similarities are plain as day.

Century Games has done a great job getting the snappiness and juice from matching pieces. In fact, it even feels even slightly snappier and juicier than Royal Match and Chrome Valley Customs. To prove that, we compared the number of frames for a tile to drop. Both CVC and Royal Match took about 10 frames for the entire sequence, including the post-landing follow-through (which is subtle, but noticeable in motion). While Truck Star completed it in a speedy eight frames.

But Truck Star isn’t just blindly copying, it’s also innovating. Besides the usual obstacles you have to clear, it has some intriguing new mechanics, including clearing the board so a truck can reach its destination.

What’s Century Games’ Master Plan?

Is it merely aiming to grab a piece of the male-focused puzzle pie and go head-to-head with CVC? Somehow, I don’t think its ambitions are as low as that. As seen in our Whiteout Survival deconstruction and its foray into Roblox, Century Games is not one to shy from going for new audiences.

So far, there’s no hint of Truck Star transitioning into a midcore title like Whiteout Survival did, but my gut tells me that more competitive (and male-focused) elements are not far away. At the very least, alliances and collections are coming soon, and it’ll be interesting to see where it goes from here.

Our Investment Support Services

Over the past few years, we’ve had the privilege of supporting several great investment firms in and around gaming. Our team, which is deeply experienced and uniquely positioned at the cross-section of gaming, technology, and finance, is available to provide market and investment research, due diligence, and advisory support. Here is what one of our clients had to say.

“The gaming industry's complexity, marked by its diverse audiences, products, platforms, and business models, requires relevant and current insights. Naavik's research has been instrumental for our team, keeping us up-to-date on various trends and developments across the entire vast playing field.”

- Juha Lindell, Director of Platform at Play Ventures

Whether you invest in public markets, venture capital, private equity, or are a business or investment bank facilitating deals, we’d love to help you meet and exceed your investment goals. You can learn more here and reach out below. Also check out our expanded consulting service portfolio here.