Scopely released Monopoly Go in April 2023, after seven years of development and nine months in soft launch. The free-to-play reimagining of this board game classic quickly became the second-top grossing game measured by daily in-app revenue; no small feat, considering how hard it is to make it to the top grossing list.

Understandably, Monopoly Go’s fast ascent stirred lively speculation about Scopely’s marketing approach, profitability, and product metrics. A wise man once said that the best way to get the right answer on the internet is not to ask a question; it's to post the wrong answer.

Lo and behold: As Monopoly Go passed the $2B gross revenue milestone, Scopely co-CEO Javier Ferreira posted about Monopoly Go’s journey in an attempt to dispense with any rumors on the game’s performance.

There's a lot to unpack in Ferreira’s post, but let’s focus on the most interesting part. That is, of course, the key numbers of Monopoly Go that Scopely disclosed for the first time.

- Over $2B in lifetime gross revenue.

- Under $500M marketing expenditure in bought media.

- Over 10M daily active users.

- Early marketing expenditure payback periods under 50 days (Ferreira’s exact wording is “measured in weeks”).

- Current marketing expenditure payback periods under 120 days.

It might not sound like a big data drop, but these data points, combined with market intelligence data and some well-grounded assumptions, are everything we need to deconstruct the free-to-play business metrics of Monopoly Go. For the purpose of this article, we take these reported numbers at face value.

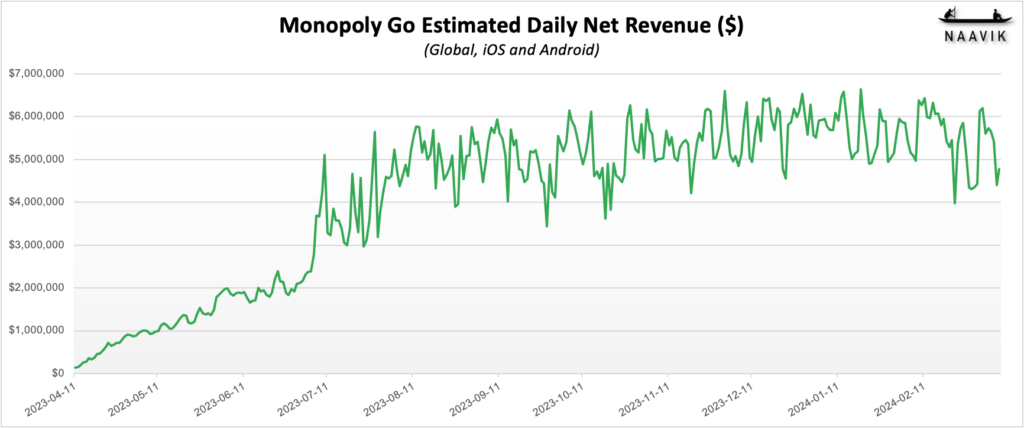

Monopoly Go’s Downloads and Revenue are Stable After Months of Rapid Growth

Let’s start with estimating the simple metrics: downloads and revenue. Services such as data.ai provide this out-of-the-box, but as with any third-party market intelligence, the numbers are estimates and not always entirely accurate.

Scopely's data indicates a lifetime gross revenue of $2B, alongside 150M downloads, offering us a means to fine-tune our numbers. Data.ai, on the other hand, has tracked 109M installs and $1.3B in revenue. Scaling the totals up to Scopely’s reported numbers (that is, adding 38% to data.ai's reported downloads and 50% to data.ai's reported revenue) and using the data.ai numbers as the basis for daily granularity provides the following estimates for downloads and revenue.

Monopoly Go saw remarkably fast growth in its first six months from April to September 2023. After that, the business has stayed fairly stable even as the number of new downloads has waned out. It does look like Monopoly Go’s high-growth phase is over, at least for now.

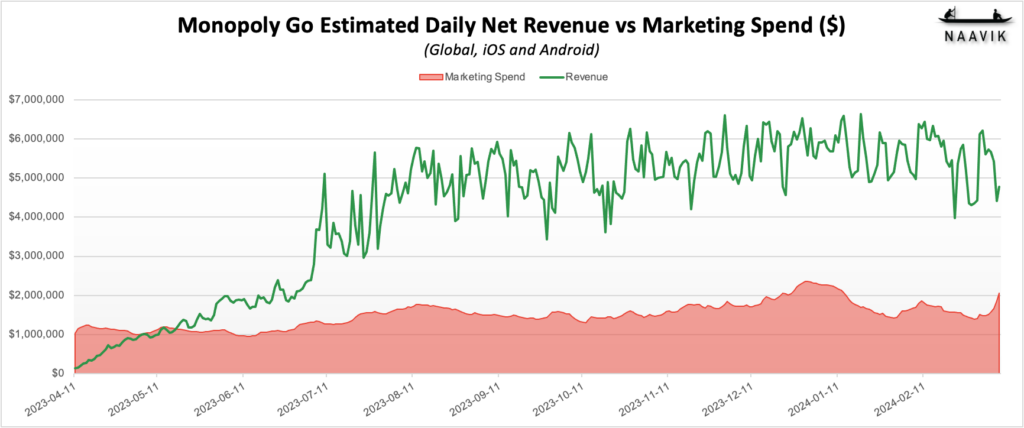

Monopoly Go’s Largest Competitive Advantage is its Low eCPI

A net revenue of $6M a day is a lot of money, but how much did Scopely spend in marketing the game to get there? According to Scopely, not a dime over $500M. Again, this gives us an anchor for the total expenditure. However, in order to model marketing spend at daily level, we need to make assumptions on cost per install.

In reality, Scopely operates on numerous channels and geos, with varying performance metrics. A more elaborate model would consider country and operating system splits, the division between attributed paid installs and organic installs, and the differences between bought media channels. Our model is as simple as it gets: We will only make assumptions about the effective cost per install (eCPI), which is your marketing spend ($500M) divided by the number of downloads (150M).

Thus, according to Scopely, Monopoly Go’s eCPI has been, on average, $3.3 for the past 11 months. In reality, the eCPI is never constant over time. Instead, each successive player is a little bit more difficult to persuade to install the game than the one before, typically resulting in increasing cost per install as time goes by. As expected, Scopely reports that payback periods have extended over time from week to months; this phenomenon clearly hints at an increasing eCPI.

Let’s make two simple assumptions here.

- The eCPI starts very low at $1.75 and increases to $5.25 over the course of 11 months, growing linearly over time.

- Marketing spend does not correlate one-to-one with downloads; instead, we model it based on a rolling average of the downloads for the subsequent seven days.

Adding these assumptions to our model results in increasing the eCPI over time and smoothening the impact of spikes in downloads, while keeping true to Scopely’s reported total marketing expenditure.

It’s worth mentioning that even a $5.25 eCPI for what is essentially a social casino game is extraordinary. Competitors such as Coin Master are happy to double, triple, or even quadruple that. Cost per install for individual performance-based campaigns at high-value geos will easily reach the $40–$60 range.

For reference, Coin Master’s to-date net revenue per download (global, iOS, and Android) is roughly $13. For any company that aims to maximize its top line without sacrificing profitability, the effective cost per install and net revenue per download will eventually almost converge: The rational publisher will continue spending in marketing until there is no profit to be made.

All in all, the freakishly cheap eCPI makes Monopoly Go ridiculously profitable. The daily marketing spend likely fluctuates around $1.5M with peaks above $2M.

It needs to be mentioned this exercise only takes into account Scopely’s investment in bought media. There are obviously other costs involved in developing and operating a game, most notable of which are the loaded cost of the 150-person development team and the license fees paid to the IP owner, Hasbro.

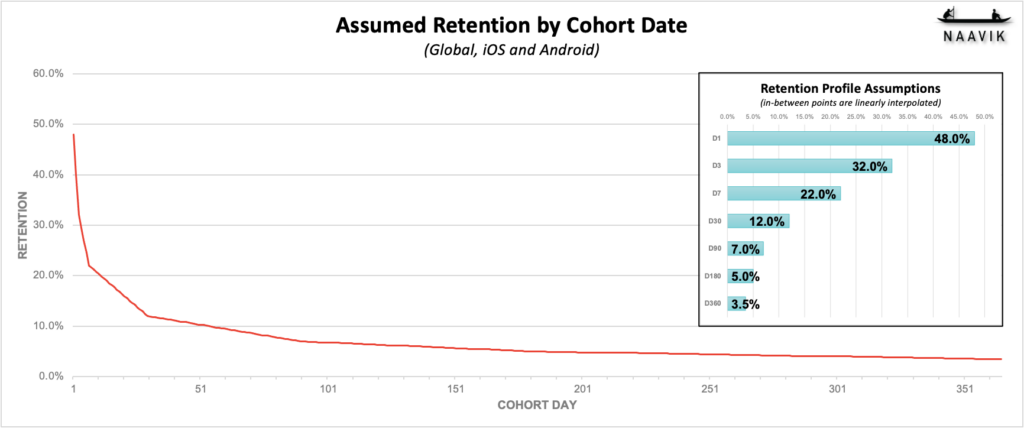

Monopoly Go’s Retention Profile Follows that of a Typical Casual Game

Finally, we delve into the product metrics powering Monopoly Go’s free-to-play business.

Admittedly, the more assumptions we make, the more room for error we introduce. However, it would be a shame to not take advantage of the final gold nugget in Ferreira’s post: the number of daily active users (DAU). According to Scopely, Monopoly Go’s DAU sits at just over 10M.

Utilizing daily download numbers and current daily active user count, we can reverse engineer — or should I say, make an educated guess about — Monopoly Go’s retention metrics. We only need to figure out which archetype of a retention profile results in a relatively stable DAU at just over 10M. Through experimentation, we find that fairly standard casual game retention numbers fit the bill surprisingly well.

With the retention assumption set, we can juxtapose Monopoly Go downloads with modeled daily active user count.

In fact, there is reason to believe that Monopoly Go’s DAU is either flat or on a slight decline after peaking in January: Daily downloads saw a significant decrease, and revenue growth stalled.

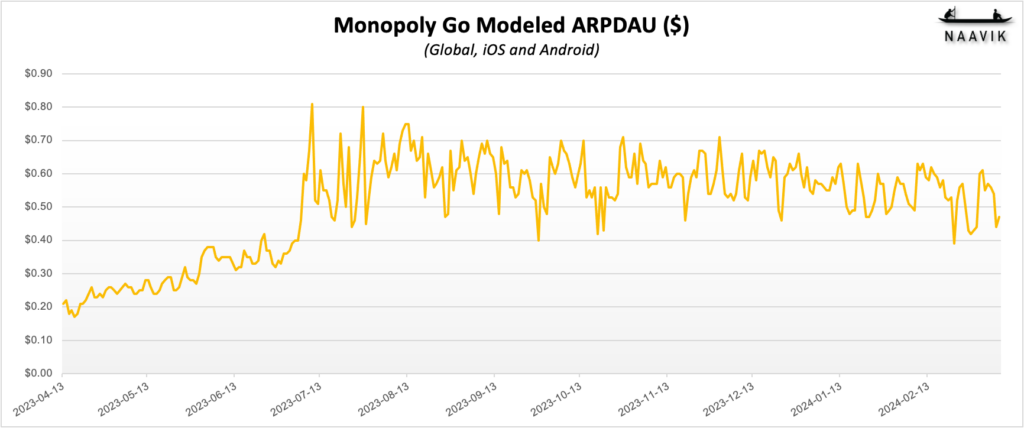

Monopoly Go Clocks ARPDAUs Above $0.50

The final piece of the puzzle is monetization. Divide Monopoly Go’s net revenue with the modeled DAU, and you get the net average revenue per daily active user (ARPDAU). The ARPDAU stands mighty at roughly $0.50 globally. It's undeniably a high figure for a casual game, though not unprecedented within the social casino genre. Paired with a respectable retention profile and exceptional acquisition metrics, it makes for a highly robust free-to-play business.

Has Monopoly Go Peaked?

Numbers do not lie, but they do sometimes lead to more questions. Arguably, the magnificent business case of Monopoly Go is made possible by the wide appeal of the intellectual property, which unlocked unprecedented distribution advantages for a proven social casino template.

However, you do need both the product and the IP. There would be no business without Monopoly Go’s stellar moment-to-moment feel-good gameplay and progression systems. Powered further with the help of the familiar board game IP, the incremental innovation in social systems certainly doesn’t hurt either.

However, it does look like the game has hit a soft ceiling in terms of growth. This does conflict with the statement of 120-day paybacks: If Scopely is still getting its money back within four months, why is it not investing even more? Or is it, in the end, already investing with much longer paybacks at a higher risk?

Likely the truth is somewhere in the middle. The profitability of marketing expenditure is a fickle beast, and it’s not unusual to see cost per install increase simultaneously with cohort quality decreasing, causing profitability to plummet. It wouldn’t be a wonder if Scopely found itself paying over $10 per user at scale when they are used to paying less than $5.

What we can be certain of is that the game is here to stay; the sheer scale it has achieved in a remarkably short time is a testament to that. Whether Monopoly Go sustains its momentum or not in the short term, it's rapidly ascending into the ranks of timeless mobile classics like Clash of Clans and Candy Crush provided that Scopely keeps its eye on the ball on live operating it.

A Word from Our Sponsor: CLEVERTAP

Do You Know the State of Play?

How are mobile games driving player engagement and revenue growth? How do studios meet, and even anticipate, demand for fresh content, exciting live events, and occasional surprises? To better understand the current state of player engagement and personalization, this data science report for mobile games gathers data from across 1,800 campaigns and over 670+ million messages sent by CleverTap Gaming customers, to outline huge opportunities for revenue optimization. Discover four strategies that allow your brand to navigate the changing landscape of personalization and find opportunities for revenue growth.

Content Worth Consuming

All of Supercell’s GDC Talks(Supercell): “GDC talks cover a range of developmental topics including game design, programming, audio, visual arts, business management, production, online games, and much more.”

‘Palworld’ Creator Explains Secret Sauce of Indie Game Sensation(Bloomberg):“This year’s biggest independent game sensation, Palworld, was crafted from the outset to be a conversation starter, according to its creator Takuro Mizobe. Being fun to play is not enough for a game in the modern social age, the 35-year-old said in an interview. A game must also be fun to watch, include multiplayer elements and encourage people to talk about it.”

On gamifying consumer apps(Elite Game Developers): “The most powerfully gamified mobile apps tie things to core human motivations, which are intrinsic by nature. They creatively use game mechanics to intensify the engagement loops in an activity not previously perceived as a game. In the games industry, developers often frown when they hear the term gamification. The distaste for gamification comes from the sense that industries outside of gaming have reduced game design to a superficial representation.”

On the Competitiveness of UGC Games Platforms (seeingthechessboard.com): “This essay is about UGC games platforms:1 How well they’re competing in the broader landscape of games platforms (meh), and how they can do better (by rewarding developers for driving inter-platform competitiveness).”

Artificial Intelligence (Ep. 16) (Gamecraft): “In their final episode of Season 2, Mitch and Blake take on the complex and highly speculative topic of the impact of recent improvements in artificial intelligence on the games business. Your hosts acknowledge that the sector is moving so quickly that this episode could be obsolete by the time it airs, and warn that it's difficult at this early moment to look too far into the future.”

How Balatro hit 1 million sales in less than a month! (The GameDiscoverCo): “We presume you have a view on why people love roguelike deckbuilder Balatro. Our 2c? It’s the joyous diversity of joker strategies in each ‘run’! (Not the same subgenre, but reminds us of The Binding Of Isaac re: radically different player outcomes.)”

Our Product Consulting Services

With our full lifecycle product and design services, Naavik is a remote product team in your back pocket. Whether it’s core/metagame concepting or feature design, economy modeling or gameplay balancing, monetisation design or live-ops experimentation, we’ve helped game teams across platforms and genres to significantly elevate their game’s KPIs. Here’s what one of our clients had to say.

“It was a pleasure to work with Naavik and leverage their expertise to improve our game KPIs. I'm quite sure that in the future, we will work with them again.”

- Daimy Stroeve, Founder of GamoVation

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.