Welcome to Master the Meta, the #1 newsletter focused on the business of video games.

Here’s your weekly roundup of the best content in the video game industry.

✍️ From the Archive

6 Big Mobile Gaming Trends — “If you’re serious about understanding — and capitalizing on — the future of gaming, you’re insane to not be learning about mobile. As I stated in my 2019 Annual Review, ‘if the future of gaming is anything, it’s mobile.’ This post is my attempt to share what I’ve learned so far.” Link

📰 News

Activision Blizzard’s Q1 earnings. The company beat expectations and raised guidance primarily because Activision Blizzard’s three main franchises (representing ⅔ of 2019 revenue) — Call of Duty (CoD), World of Warcraft (WoW), and Candy Crush — all performed admirably:

-

Call of Duty: Modern Warfare has sold more units than any previous CoD game life-to-date, Warzone now has an audience of 60+ million, and Call of Duty: Mobile is steadily increasing its reach, engagement, and bookings (with more room to improve).

-

After doubling last year (mostly due to the release of WoW Classic), WoW continues to grow its active player community by releasing more content. The next expansion, Shadowlands, is coming later this year.

-

King accelerated MAU growth, payer trends were more favorable this quarter, and Candy Crush Saga was once again the top-grossing title on US app stores. Importantly, advertising net bookings grew 75%, which is impressive growth but I don’t want to see King become much more reliant on ads (vs in-app purchases).

Not everything is rosy — The Overwatch League is imploding and Activision’s Glassdoor reviews are brutal — but the company is mostly executing according to its plan. Investing more in ongoing content and live ops will keep players engaged, mobile remains the largest opportunity, and there’s room for more new games and engagement models. Unless the company screws up its top franchises, we should expect continued long-term growth and abundant cash flow production. Link

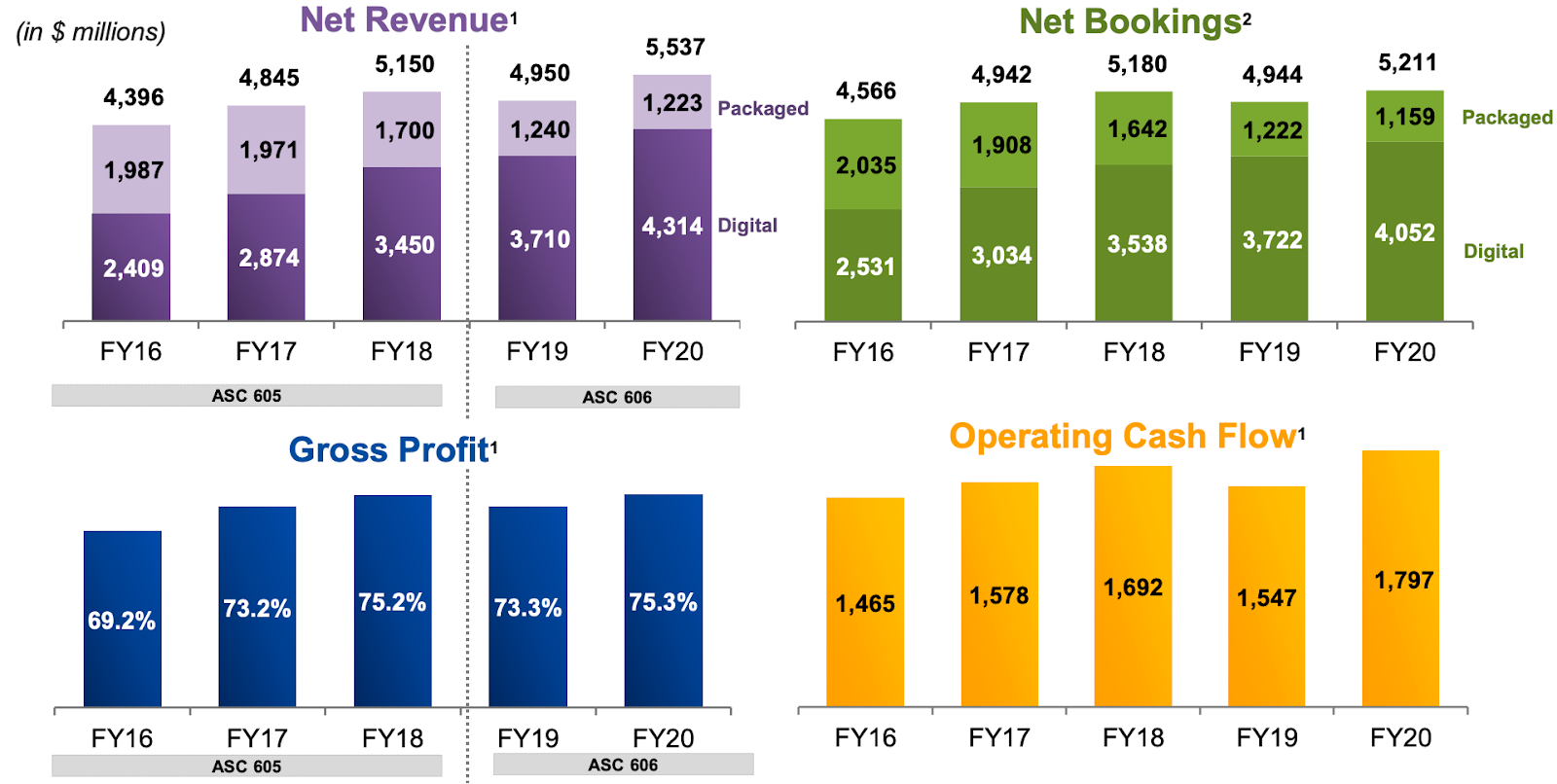

Electronic Arts’ Q4 earnings. Nothing about this specific quarter was too exciting. It’s just a continuation of EA’s slow and steady growth:

The company’s digital performance — led by impressive work in live ops (Ultimate Team, Apex Legends Battle Pass, etc. — is the real star, which keeps players engaged longer and generates high margin revenue. Results may be slightly bumpy depending on when games are released, but the long-term story will likely be a continuation of the above — a slowly growing, highly profitable, and increasingly digital business. EA will soon support Stadia and bring more games to the Switch, and although these efforts + its EA Access subscription service add a bit more revenue, they don’t seriously move the needle.

What would move the needle is cracking the nut on mobile, whether through acquisitions, an internal reorg, or more co-development partnerships. It’s EA’s biggest opportunity by far. There’s minimal progress here, but hopefully that changes in time. My next deep dive will partially tackle how EA can find and execute on its path to mobile. Link

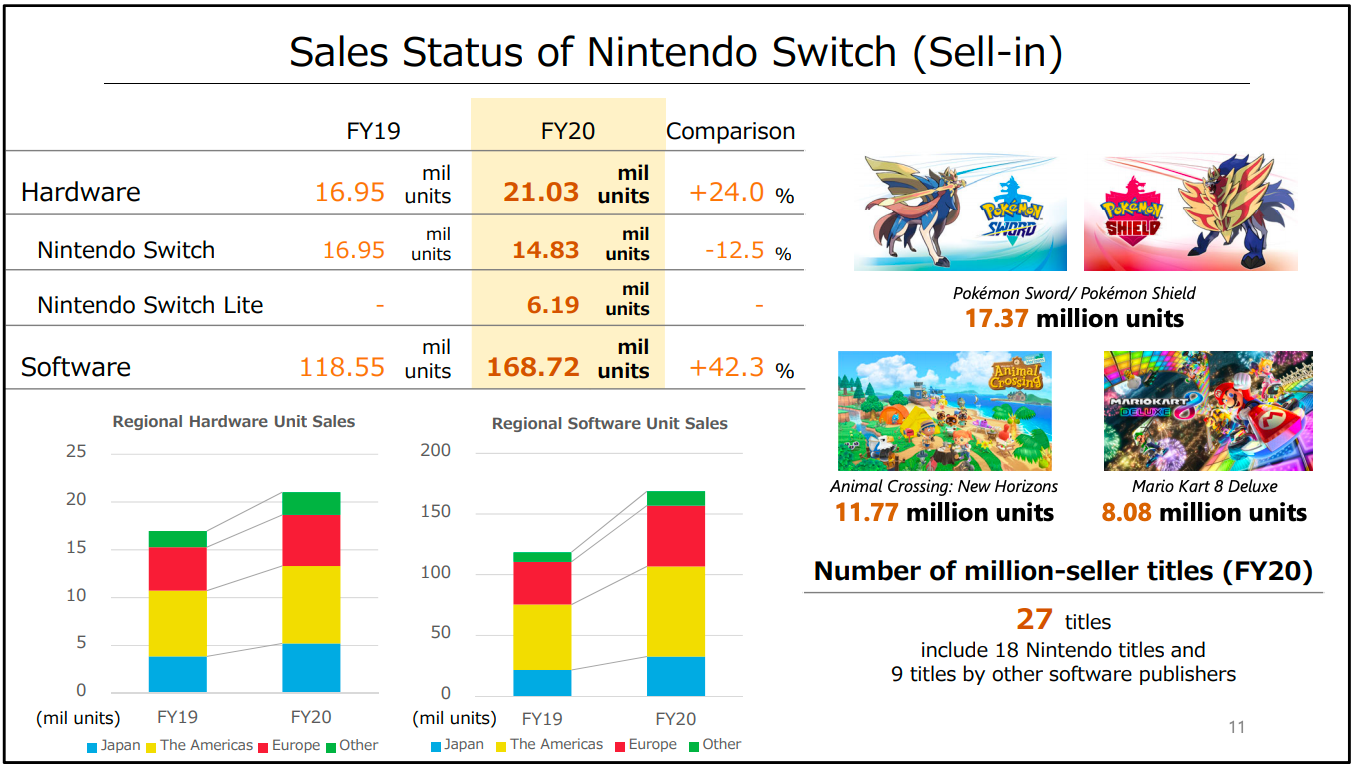

Nintendo’s Q4 earnings. Nintendo had a more exciting quarter than most other public gaming companies. Even while facing supply chain issues, net sales and profits grew 9% and 33%, respectively, as demand accelerated:

The hardware growth is impressive (the Switch Lite really stepped up), but the software growth — which is much higher margin — moves the needle even more. For the fiscal year that just ended, software was 48% of revenue (more than usual), and although 83% of that was still first-party, the company is getting better as selling extra DLCs, which provide additional growth. Of course, Animal Crossing New Horizons' breakout certainly helped (and drove more Switch purchases); the game sold more copies in its first 6 weeks than all previous Animal Crossing games sold in their entire lifetimes. What’s crucial to note, however, is that much of this success is just being pulled forward from the future. Management is already forecasting declining sales & profits for the next fiscal year, and the business remains highly cyclical. Efforts like mobile could reduce cyclicality, but that’s wishful thinking at this point (sense a theme yet?). All in all, Nintendo executed a great year that will be hard to top without some broader strategy change. Link

Zynga’s Q1 earnings. Zynga is easily one of the more interesting public market gaming companies, primarily thanks to its strong business momentum. This quarter, net bookings grew 18% year-over-year, mobile average bookings per DAU grew 27%, gross margins ticked up, and the acquisitions of Gram Games and Small Giant Games are performing very well. As a whole, results easily beat expectations.

What’s encouraging about Zynga is that there’s little reason this momentum would disappear anytime soon. The company’s forever franchises (like Words With Friends, CSR2, Merge Dragons, and Empires & Puzzles) are holding strong, the development of “bold beats” (ongoing content) is driving higher engagement, the pipeline of new games looks fairly promising (Harry Potter: Puzzles & Spells, Puzzle Combat, and FarmVille 3 are in soft launch), and Zynga has abundant ammo for additional tuck-in acquisitions. Of course, mobile gaming is still a competitive and ever-evolving industry, so management needs to stay vigilant and future-proof the business, but so far everything looks promising. Link

Capcom’s Q4 earnings. I’ve never been super interested in Capcom since the legacy business lines weigh down the results of the core digital gaming business. In many ways it’s unfortunate, but in weak gaming years — like this past year — it brings some stability. Full year net sales declined 18.4% even though operating income rose 25.8%. The sales decline is mostly due to the lumpiness of major releases, but higher digital sales of DLCs (Monster Hunter World: Iceborne) and catalogue titles (Devil May Cry 5, Resident Evil 2, etc.) held up relatively well and pushed overall margins higher. Results will continue to be lumpy, there’s still little to no effort in mobile, and there’s more room for digital to push operating margins even higher. But is there anything to be thrilled by or eagerly expecting (from a business angle)? Probably not. Link

New rounds of funding. The pace of private investments appears to have slowed a bit, but there’s still some action:

-

Sensor Tower raised $45 million in PE funding to accelerate the growth of its app intelligence platform. Link

-

Guilded raised $7 million to build a Discord competitor. Maybe there’s something I don’t see, but the odds of overthrowing Discord are quite low. Link

-

Rogue Games raised another $2 million to expand its publishing ambitions from mobile to console. Link

(Note: There’s certainly a lot to learn about the gaming industry from public companies, and there are always public businesses to be impressed by (like Zynga and Sea Limited in 2019). However, most of the innovation and much of the industry’s growth is being created by (usually VC-backed) companies that are still private. Even though they deserve more attention, it’s harder to cover those companies the same way — much less info is public — but it’s an area I definitely hope to improve at.)

First Look Xbox Series X Gameplay. Xbox unveiled its first look at some Xbox Series X games. The problem? The game selection started off weak, nothing showcased why the Series X is special/powerful, it wasn’t clear what games were or weren’t exclusive, and it didn’t actually show any gameplay (despite the title of the event). No wonder there are far more thumbs down on YouTube than thumbs up. Fortunately, there’s still time for Xbox to learn, improve, and redeem itself. Link

🖥 Content Worth Consuming

Cloud Gaming: Why It Matters And The Games It Will Create. “There is a tremendous amount of confusion around cloud gaming: what it is, why it matters, what it will allow, who can deliver it, how much it will grow the market, etc. This is further complicated by misunderstandings around how online multiplayer works in the first place and what will and won’t change when a “console moves to the cloud.” This leads to bad headlines and excessive hype. The essay below is focused on explaining the overall future of cloud-based gaming, the experiences it will enable, and the first new “genre” of game it’s likely to create.” Link

10 Years of Excellence - Deconstruction of Supercell. “The objective of this analysis is to provide a prediction on Supercell’s future and, where possible, make suggestions on their path forward. To do so, we will deconstruct Supercell’s strategy, portfolio, culture, and M&A efforts. We will also discuss how the market has evolved in the last 10 years and discuss the implications of this evolution for Supercell.” Link

(Early) Thoughts on Valorant. “Valorant is Riot Games’s new FPS currently in closed beta for PC platform, and its first new game IP since League of Legends a decade ago. There’s a lot riding on this game: in the short to mid term, this game will largely determine whether Riot is an multi-IP games studio,1 or “just” the League of Legends company (which to be clear is an extremely enviable position). It’s also a major test for Riot’s R&D process, as the game has been in development for over 6 years.” Link

VR could seize its moment — if the big players would cooperate. “VR isn't there yet, and every extra obstacle thrown in front of consumers is losing a substantial chunk of potential audience, at a time when the overall audience is so small that every lost user genuinely hurts. It's not (just) about the people who bought an Index or a Vive for Half-Life: Alyx and find themselves frustrated by the mess of incompatibility and exclusivity among VR devices. It's about everyone they tell about it, every post they make on social media about it, and every potentially interested consumer who lands on a YouTube video saying ‘okay, so to play this on your new headset you'll need to jump through all these hoops, and this other game won't work at all, and...’” Link

Magic: the Gathering: Twenty Years, Twenty Lessons Learned. “Magic the Gathering head designer Mark Rosewater shares twenty lessons learned over twenty years of designing one of the world's most popular collectible card games. Watch to learn lessons such as ‘Restrictions Breed Creativity’, ‘Fighting Human Nature Is a Losing Battle’ and ‘If Everyone Likes Your Game, But No One Loves It, It Will Fail.’” Link

Fortnite’s Party Royale. Fortnite continues to experiment with fighting-free live events and is slowly shifting from game to platform. “Here is the full coverage of the Fortnite Party Royale premiere Dillon Francis, Steve Aoki, and Deadmau5. Each artist performed a set of their hit music and the concert event lasted for about an hour with flashy lights, neon visuals, and new paint launchers to hit other players with for a colorful twist.” Link

See you next week!