Hi Everyone. As a reminder, we released our first genre report in F2P about mobile shooters. Check out the full report and let us know what you think. We’re obviously biased, but we think it’s the best genre report in the market. Better yet, we have so much more coming.

#1: The Future of Audio Ads & Predicting Web3 in 2023

Christian Facey: Building on the Cutting Edge of AdTech. In this episode, Christian Facey – co-founder and CEO of Audiomob – joins Naavik co-founder Aaron Bush to discuss the current state of audio ads, and how non-intrusive in-game audio ads can play a larger role in the future. The duo also explores why Audiomob exists, how it has scaled so far, and what its plans are for the future. Christian also shares his lessons learned as an entrepreneur, including how to plan for an IPO so early on, how to build a diverse recruiting pipeline, and how to prepare for the worst while also preparing for the best Website | YouTube | Spotify | Apple Podcast | Google Podcast.

Web3 Predictions for 2023. 2022 was a rollercoaster year for web3 gaming - what does 2023 have in store? To find out, your host Niko Vuori talks to Justin Hulog, Chief Studio Officer at Immutable. Website | YouTube | Spotify | Apple Podcast | Google Podcast.

#1: The Year Ahead for Nintendo

In my coverage of Nintendo’s earnings miss mid-last year, I wrote that the company’s competitive advantage was built around two aspects: differentiated hardware and beloved first-party IP. At the time, I worried this would ultimately lead the company astray if they over-emphasized consoles and first-party IP in favor of alternative opportunities like further investment in Mobile or third-party Switch-compatible IP.

Six months (and several large Nintendo releases) later, good to reflect on these initial assumptions to see how the company fared in 2022. Recent analysis puts the company as one of the world’s largest gaming organizations in terms of Net Cash, with around 20% of market cap (around $10 billion) in cash — there’s a lot they can do with this! It’s not unusual for APAC-driven businesses to hold cash; after all, the region makes 94% of total net cash in across the industry when you exclude less gaming-centric businesses like Microsoft. But what does a massive stockpile of cash imply about the company’s performance in 2022? What about the year to come?

Nintendo in 2022

When examining 2022 performance, there’s no better format than to look at IP and hardware. On the games side, the marquee releases for the year (Splatoon 3, Pokemon: Violet/Scarlet and Pokemon Legends: Arecus) dominated unit sales. These games have sold over 10 million combined units combined (the next highest selling 2022 release, also a Nintendo game, didn’t even break a million). That performance puts some of the company’s top sellers above games like FIFA and Horizon II in terms of sales. Meanwhile the company’s top 30 eShop titles in 2022 accounts for over half first-party content, and it increased its “playing user base” by nearly 10 million people.

Suffice to say, there is stability on the IP side. Some of the success can be attributed to its move to a single-device development, a first for in the company’s history. It’s clear that first-party releases are having a splashier impact with only one place to land. It also creates more demand for the company to double dip on revenue with DLC and other digital add-ons, a strategy that has netted them over 36 million paying subscribers for their Nintendo online platform. The opportunity to expand consumer spend with add-ons and cosmetics further allows the company to extend the lifecycle of games (and therefore the Switch itself), filling the time between new first-party releases with holdover content from otherwise popular games.

But while software continues to perform, the state of the company’s hardware business hasn’t faired so well. The Switch is entering its sixth year in development (amidst a cycle that usually lasts five to eight years) and the company is forecasting a 9.5% year-over-year decrease in unit sales due in part to component shortages.

In an effort to offset concerns, the company has rallied around product-diversification as a new narrative. 30% of hardware sales accounted for in the last fiscal year come from players purchasing additional and replacement systems. The focus on a multi-SKU line-up via the Switch Lite and OLED models, boosted by special edition consoles for titles like Splatoon and Pokemon, seem to be the answer to how Nintendo hopes to stave off flatlining console sales. The company has already gone on record stating there are no substantive hardware changes on the horizon in 2023; so, while I expect the new Zelda and Pikmin games to help drive sales in the coming year, it’ll likely expect more of the same.

Looking Ahead In 2023

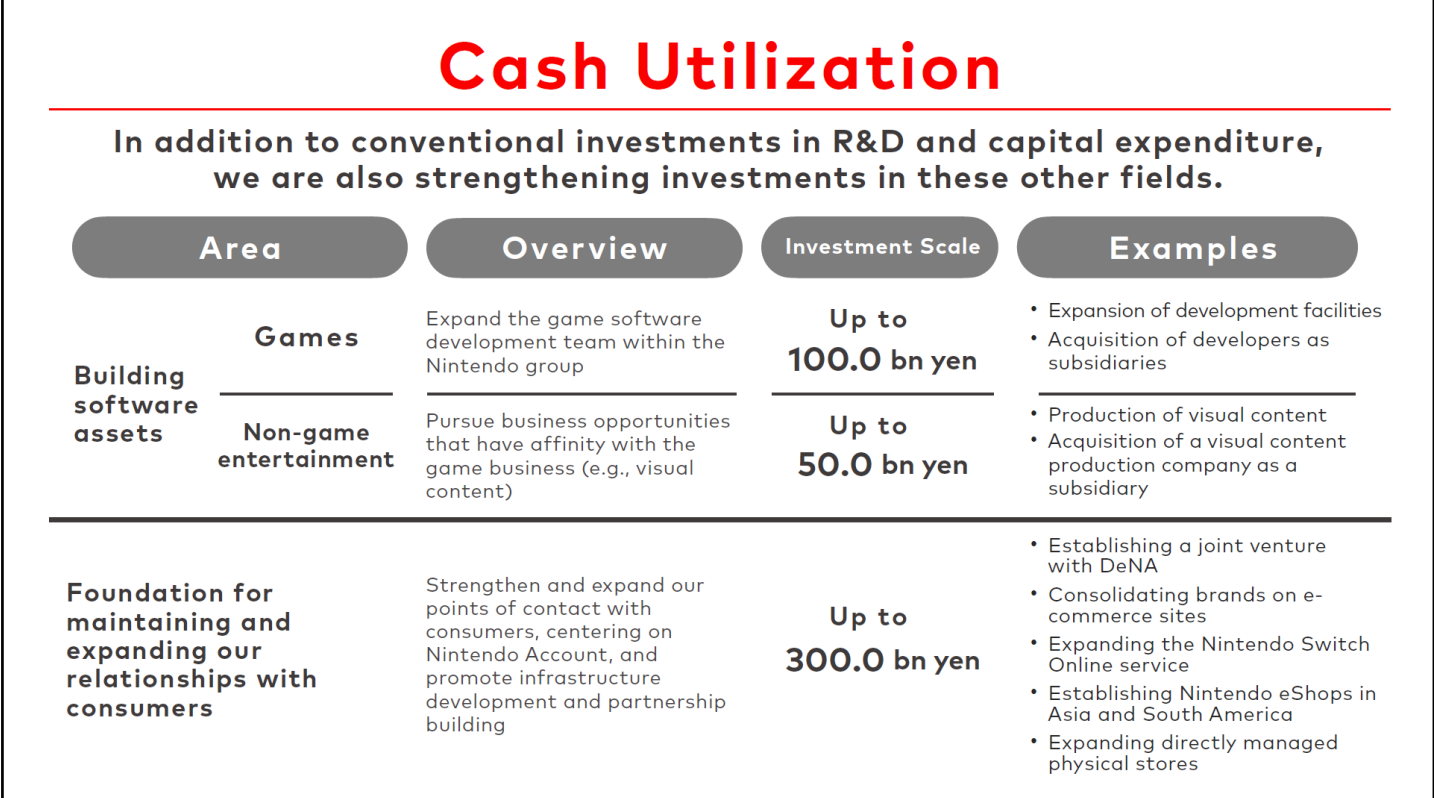

While the core model continued to deliver broadly in 2022, it's obvious that there is still room to improve. The appetite for Nintendo doesn’t seem to be slowing down. 76% of Japanese users ages 13-17 still use the device on a regular basis, while console gaming is keeping pace with both PC and mobile devices in the same cohort across the U.S. The elephant in the room is that the company continues to sit on a wealth of cash despite growing demand. It begs the question how exactly Nintendo intends to grow beyond the largely flat environment they’ve built for themselves. A review of their most recent earnings call suggests that they intend to do so in the way we’d all expect them to through IP.

On the non-gaming entertainment side, 2023 projects to be a banner year for Nintendo’s marquee characters, with the release of the Super Mario Brothers Movie and opening of Orlando’s Super Mario World theme park. Both expansionary options are in service of what the company is positioning as a play toward lifetime consumership: “A player who played Mario when they were six now teams up with their children to play Splatoon 3 and visit Super Mario World” is the crux of the scenario the company intends to bet on future growth. At its core, sits the Nintendo Account software.

Servicing 290M users, the software will be the base by which the company expects to connect with users across formats and titles. Nintendo has already invested approximately $2 billion into launching a new joint venture with software company DeNA to advance their “digitalization” efforts and ensure that they have the right infrastructure to support a transmedia approach to IP.

For the company to even invest as much as they have in digital foundations is an anomaly to previous years, and I don’t expect Nintendo’s cash position to materially change in 2023. What will be interesting to track, however, is if the upcoming non-game entertainment will fundamentally change the business’s performance. Will Nintendo movies and theme-parks go the way of mobile titles, with splashy launches and gradual investment pullbacks, or could be the catalyst for the company to finally get more aggressive in spending? 2023 will no doubt provide to be a notable year for the company, and I can’t wait to see the result. (Written by Max Lowenthal)

Just Launched: State of Mobile 2023 Report by data.ai

From data.ai (formerly App Annie), the global leader in mobile app market intelligence, this year’s State of Mobile report lays out all of the must-know data-driven industry insights from 2023 in one cohesive report. Our analysts spent over 2,000 hours studying the market during the past 12 months to surface numerous insights in categories including mobile gaming, retail, entertainment, brands, and more. All made possible by data.ai’s industry-first custom app taxonomies, Game IQ and App IQ. Read more in the report

#2: Arknights: Tower Defense Redefined

This game deconstruction originally appeared in this week Naavik Pro Free-To-Play report and was written by Matt Dion. To read the full piece or learn more about Naavik Pro, request a demo or trial.

Arknights is a free-to-play, hero collector, tower defense, role-playing game developed by HyperGryph and published by Yostar Games. The setting is a dystopian, post-apocalyptic world, and players take on the role of the amnesiac “Doctor” and lead heroes (“Operators”) from a disaster management organization called Rhodes Island.

The game features an intricate combination of tactical tower defense battles, gacha-driven hero collection, idle base-building, and cosmetic customization, all wrapped in an anime art style and an ever-expanding narrative.

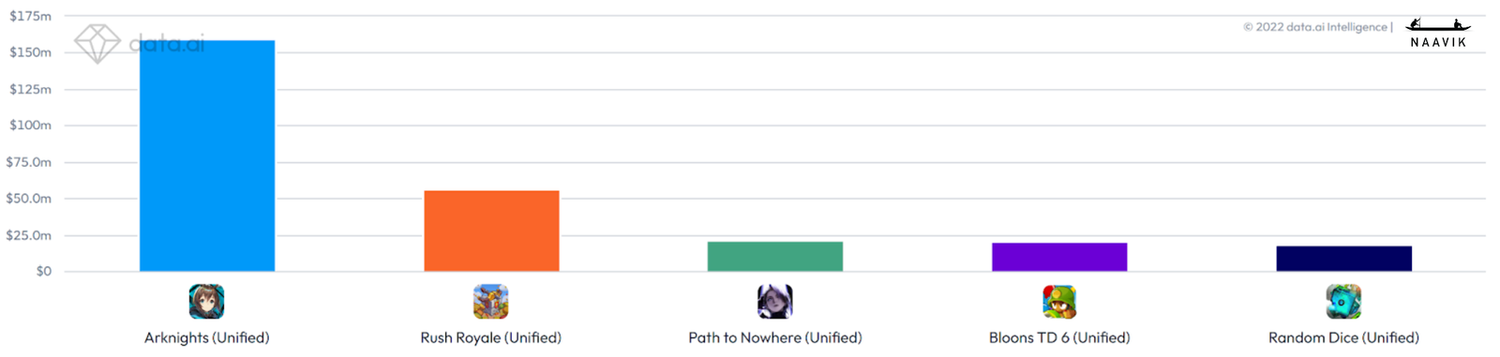

Having initially been launched in China in May 2019, the game was released to a global audience in January 2020 and has grown into a formidable powerhouse ever since, racking up over $678M in revenue across just 17M downloads, according to data.ai. No other title in the mobile tower defense genre even comes close to enjoying the level of success that Arknights does:

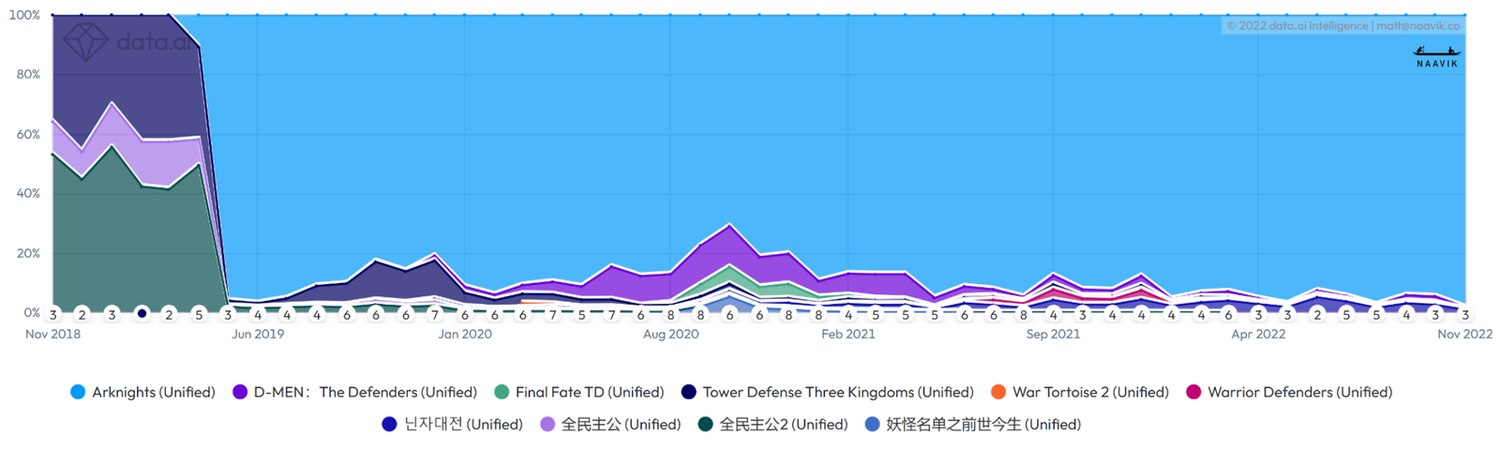

It’s hard to overstate the dominance that Arknights asserts in the tower defense category. Since its launch in mid-2019, it has managed to capture a staggering percentage of the genre’s revenues. One could argue that the game essentially reinvented the genre: prior to its launch, total revenues earned by all games in the “Tower Defense - RPG” genre (as defined by data.ai) were less than $2M per month. During Arknights’ launch month, that figure jumped to nearly ~$38M, with Arknights representing more than 95% of the total.

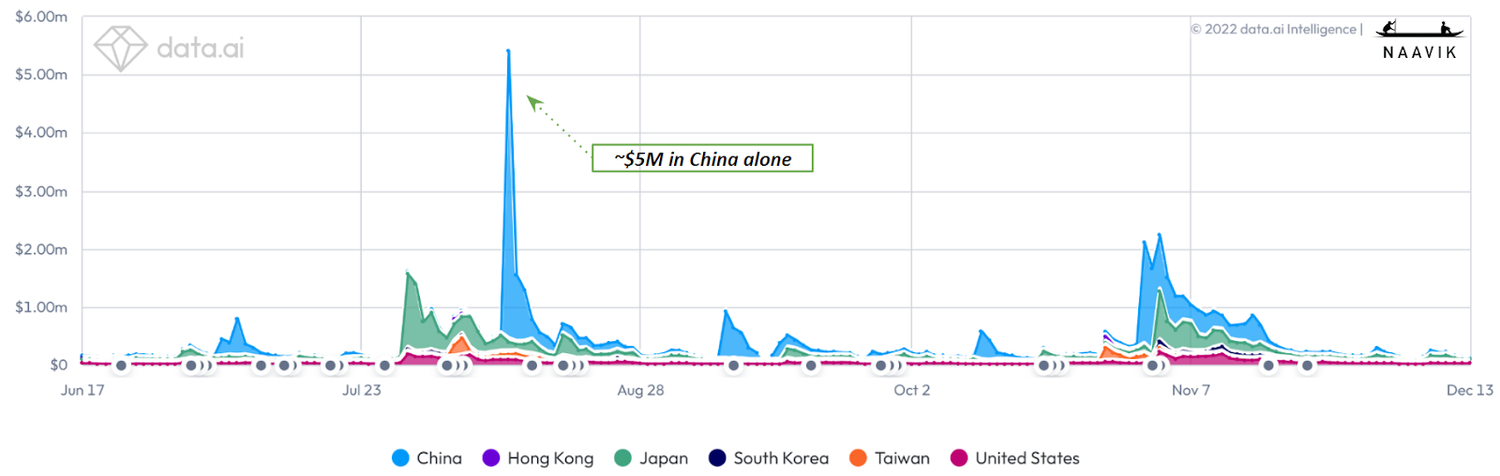

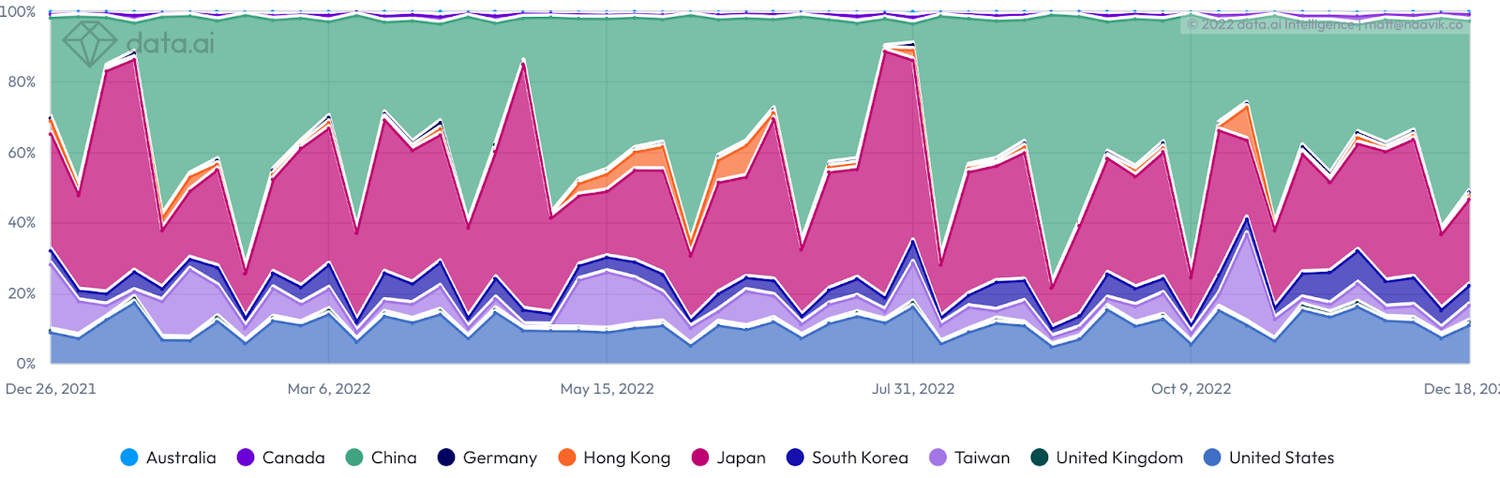

That success has continued to this day. Despite being live since 2019, Arknights achieved its highest revenue day on record just a few months ago. On August 11th, 2022, the title pulled in nearly $5M from China alone in a single day. The game also draws meaningful revenue contributions from such distinct markets as Japan (roughly equivalent to mainland China in share of revenue), United States, and South Korea.

Clearly, Arknights has dominated the competition in the “Tower Defense - RPG” genre. However, it’s also worth examining the more mass-market “Tower Defense - Strategy” genre — home to breakout games like Rush Royale and Plants vs. Zombies — for additional points of comparison in an adjacent space.

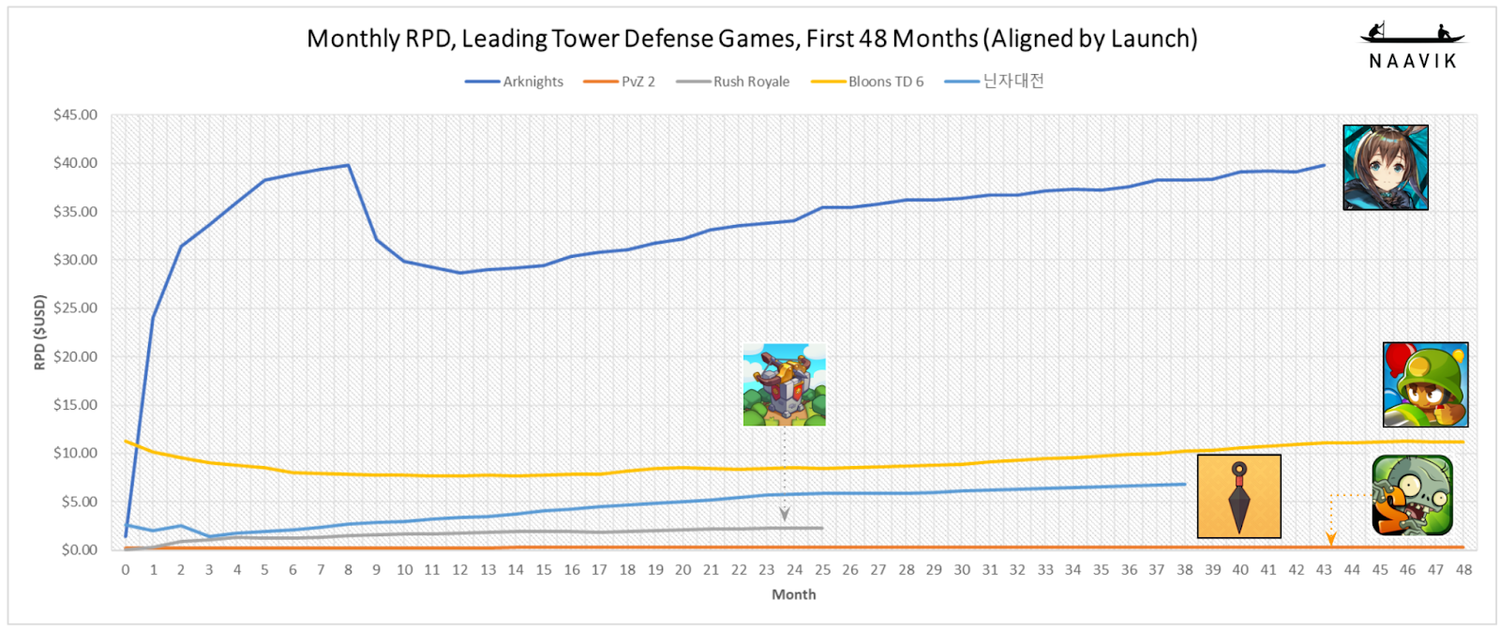

While it’s not uncommon for a China-first game to trade low downloads for higher revenue per download (RPD), the extent to which this has benefitted Arknights when compared to the competition is noteworthy. Arknights cannot boast the broad reach or lifetime download numbers of Rush Royale (37M LTD) or Plants vs. Zombies 2 (448M LTD), but it outshines all rivals with its monetization, bringing in a whopping $40 per download – nearly 4x its closest competitor.

On its way to establishing this formidable position, Arknights has bucked several trends and managed to carve out its own path. For one, the game has infused a breath of fresh air into what had previously been a stale tower defense concept by introducing a heavy dose of RPG progression, classes, and character collection. It would not be an overstatement to say that Arknights has revived tower defense.

Rather than taking the standard approach of upgrading towers with resources earned through defending, Arknights instead asks players to strategically deploy Operators across the levels using Deployment Points (DP) that slowly regenerate as the battles progress. Players can also activate special abilities for each Operator, requiring deft timing and a thorough understanding of each Operator’s kit. Level design adds a further strategic element, with environmental hazards and interactive map tiles rewarding players who know how best to utilize them and frustrating those that do not. You can get a quick overview of the basic gameplay in this video.

In a further move to contradict mobile gaming conventions, the game has leaned heavily into its expansive narrative, whereas traditionally most F2P mobile titles eschew long, drawn-out stories for quick-hitting action. Through its Story mode, Arknights drips out its unfolding narrative using an episodic format, keeping players engaged and pushing forward to learn what happens next in the story.

While it can be difficult to quantify the KPI impact of investing in a game’s narrative, we have some evidence from the world of puzzle games that challenges this notion. In an interview with the Elite Game Developers podcast, Caroline Krenzer (co-founder & CEO of Trailmix Games, makers of Love & Pies) attributed an update to Love & Pies’ narrative to a 10% increase in retention. Our friends at data.ai and Deconstructor of Fun also noted in a recent report that investing in narrative was a key driver behind the success of Metacore’s Merge Mansion this past year.

What do lessons from casual puzzle games have to do with Arknights’ success in the tower defense genre? As it turns out, more than one might think! Arknights takes several design cues from the mobile puzzle genre: from its saga-style campaign map and measured introduction of new in-match mechanics to its reliance on strategy and tactical thinking. We’ll explore this connection in greater detail later in this deconstruct, but for now it would be helpful to view Arknights’ success through this lens when trying to make sense of the developer’s various strategic choices.

Even beyond the comparisons to narrative-driven puzzle games, one can easily see the qualitative effects that the story and characters have had across Arknights’ player community. Fans of the game have produced their own fanfiction, fan art, and explainer guides for new players seeking to delve deeper into the lore. This fan engagement has even extended beyond the narrative and aesthetic of the game into other areas, such as the production of intricate strategy guides, wikis, gacha simulators, base-building guides, and much more.

This sprawling web of player creations is not only indicative of the game’s tremendous popularity among its fans but also speaks to the gameplay depth available to those in search of it. Furthermore, the sheer volume of user-created tools and guides available allows new players to ramp up quickly on what is a meaningful step-up in complexity from the standard tower defense game.

Of course, the game is not without its shortcomings. Arknights leaves much to be desired in terms of social features, for example. Tower defense is largely PvE, and while Arknights has made meaningful strides in expanding and redefining the genre, it has not been able to incorporate cooperative gameplay, clans/guilds, chat, or any other sort of needle-moving social features.

Furthermore, Arknights remains a phenomenon largely limited to Asia. Though the game has achieved outsized success beyond the Chinese mainland in places like Japan, South Korea, and Hong Kong, it has yet to meaningfully penetrate the West. Over the last 52 weeks, Arknights has never drawn more than 18% of its weekly revenue from any country outside of Asia.

Nevertheless, Arknights has clearly outgrown its tower defense roots and reached a broader audience. Its ability to draw inspiration from tower defense games, character collector RPGs, idle games, anime, gacha games, and puzzle games has led to a unique, genre-dominant title that has proven to be a sustainable revenue engine for developer HyperGryph. Additionally, Arknights’ player-friendly take on gacha monetization and live-ops has helped it to establish and maintain an active, devoted fanbase.

How has Arknights been able to accomplish all of this, and what can we learn from its success?

In this deconstruct, we’ll explore these questions and more, including:

- How did the experience of HyperGryph’s founder influence the development of Arknights?

- What differentiates Arknights from other tower defense games?

- What makes Arknights’ monetization so player-friendly?

- How does Arknights’ live-ops create such eye-popping success so long after launch?

Let’s dive in.

Content Worth Consuming

How Apple Arcade Has Grown Quietly (CNET): “Apple's mobile gaming subscription service has come a long way since its release in 2019, more than doubling its game library and offering subscribers new releases, remasters and updates every week. And it may have found its first flagship exclusive with Sneaky Sasquatch, a popular, lighthearted game about a Bigfoot-like character adventuring in the woods, hiding from campers and riding go-carts. Over the three years since its launch, Apple Arcade has continuously added new games that cater to large audiences, while also spotlighting smaller developers who might've otherwise gone unnoticed in the App Store.” Link

User Acquisition & Creative Learnings (Matej Lancaric): Matej’s 2022 learnings are a goldmine of insights. Link

2023 Predictions For Mobile Gaming (MobileDevMemo): “ATT has clearly disturbed the status quo for mobile gaming and it will continue to influence the development of the category in the coming years. ATT has highlighted the degree to which frictions in advertising and, more broadly, distribution dictate commercial outcomes within the mobile gaming space. Below I present a handful of pithy predictions for the mobile gaming market in 2023, grouped by theme.” Link

An Interview About Valve Steam Deck (The Verge): “Being the “early access game console” didn’t keep this affordable, portable gaming computer down. Frankly, it’s my gadget of the year, thanks in no small part to the 90-plus updates Valve has shipped since its debut. But the pace of updates and reliance on Linux can make it a volatile platform, too: Valve itself has occasionally introduced nasty new bugs, and game publishers have occasionally broken compatibility with their own updates. Before I take a fresh look at the Steam Deck for The Verge, I wanted to know what Valve’s intentions are for its future. To my surprise, Steam Deck designers Lawrence Yang and Pierre-Loup Griffais granted me a wide-ranging interview — revealing not only that they plan to update the software indefinitely but also that they’re still experimenting with hardware, too. Link

🔥Featured Jobs

- Dims: Game Engine Programmer (Stockholm, Remote)

- LBank: BD Manager (Remote)

- Mod.io: Developer Relations Lead (Remote)

- Immutable: Principal Engineer (Australia, Remote)

- Carry1st: Lead Game Designer — Cooperative Social Slots (Remote)

- People Can Fly: Senior Market Research Analyst (Canada, Remote)

- GoFashion: CTO / Senior Unity Developer (London, Remote)

- NetEase: Strategy & GameDev Enabling Manager (Remote)

- PlaytestCloud: Full Stack Engineer (Berlin, Remote)

- FunPlus: Lead GameDeveloper — Casual Games (Barcelona)

- Included Games: Senior Mobile Game Designer (London, Remote)

- Stillfront: SVP Operations Management & Processes (Stockholm, Remote — Europe)

- Naavik: Managing Editor (Remote)

- Naavik: Content Contributor (Remote)

- Naavik: Roundtable Panelist (Remote)

- Naavik: Games Industry Consultant (Remote)