Welcome back to another edition of Master the Meta by Naavik. This week, we launched a YouTube channel for readers and listeners who prefer video-based podcasting. We’d love it if you subscribed and shared with anyone you think might enjoy the watch! As always, if you have any gaming-related topics or gaming expertise / perspective that you’d like to bring to the podcast, please feel free to reach out.

Roundtable #35: Roblox’s Results, Global Gaming Deals Activity in 2021, & Nintendo Direct

In this Metacast episode, Anton Gorodetsky, David Amor and Yonatan Raz-Fridman join your host Maria Gillies to discuss:

-

Roblox’s fourth quarter results

-

Global Gaming Deals Activity in 2021, according to InvestGame’s report

-

Nintendo Direct announcements.

If you’d like us to discuss any other gaming-related topics, do reach out at [email protected]. We’d love to hear your general thoughts and feedback too! You can find us on Spotify, Apple Podcasts, Google Podcasts, our website, Youtube, or anywhere else you listen to podcasts.

#1: Roblox Q4 Earnings: Slowing User Growth But Promising Fundamentals

Source: Yahoo Finance

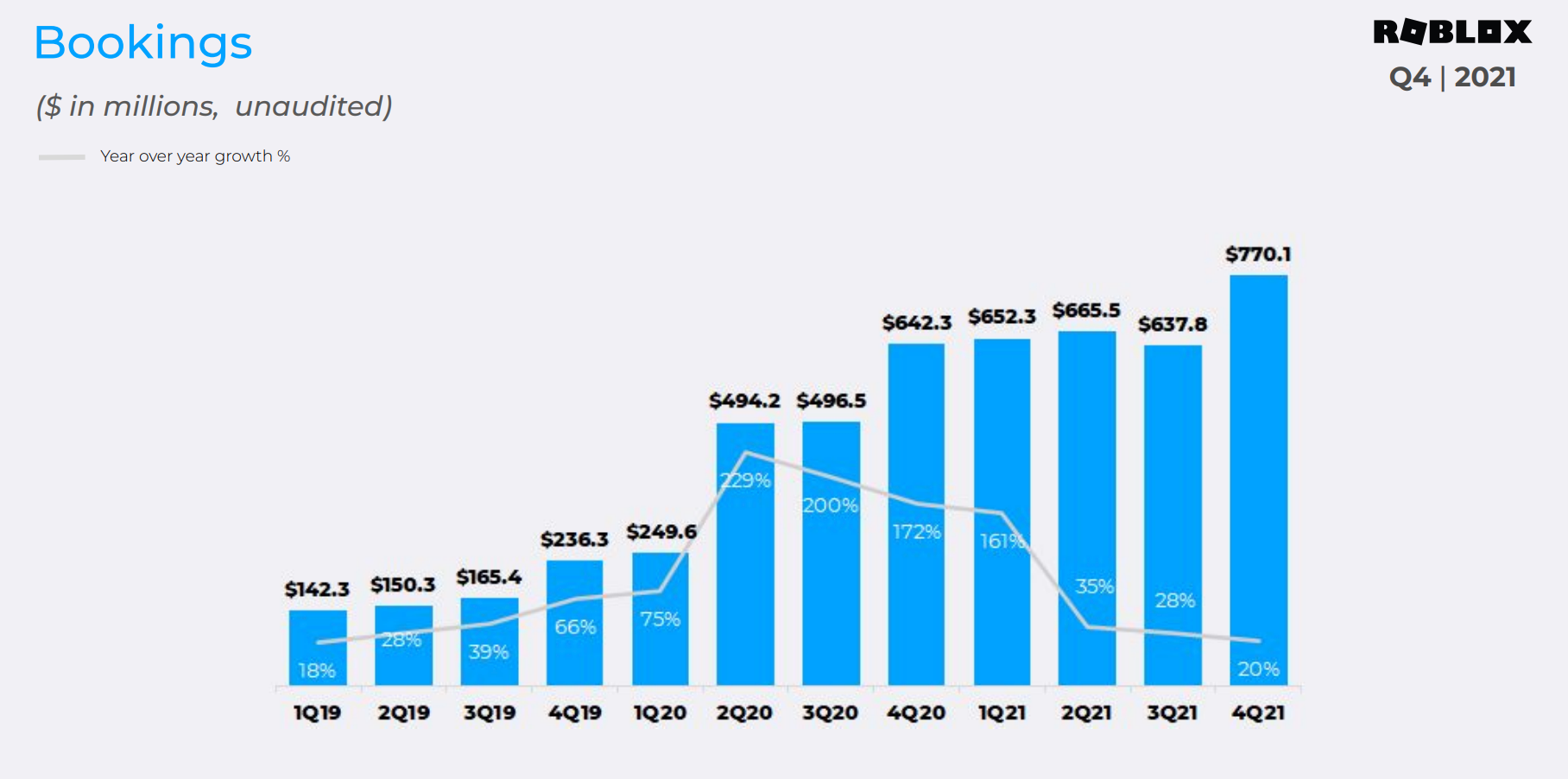

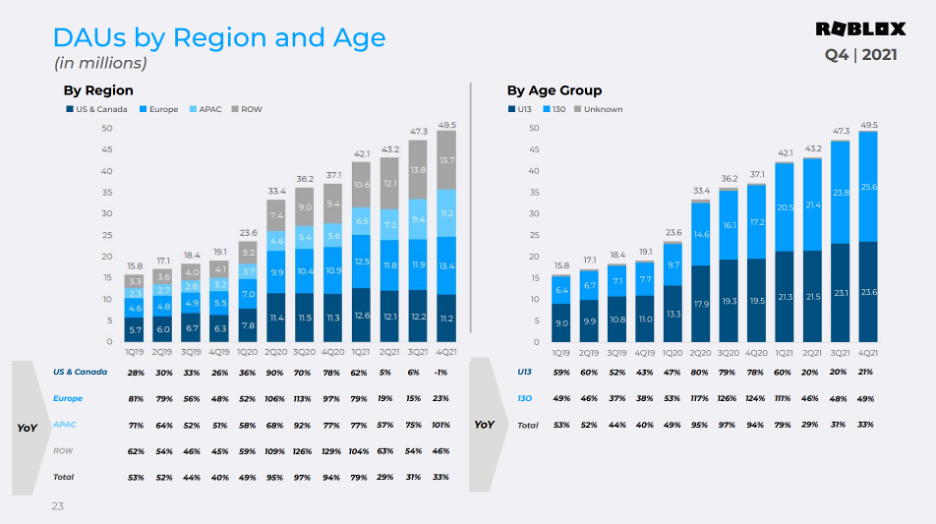

These past few weeks we’ve seen the public market battering of so-called “pandemic stocks” – Zoom, Peloton, Roblox, to name a few – as we find a semblance of balance between digital and physical experiences. I’m particularly interested in the resiliency of Roblox. Earlier this week, it reported $570M in Q4 revenue, up 83% YoY, on 49.5M DAUs (up 33% YoY). These are amazing numbers, but the concern around Roblox is that bookings growth has slowed (as a reminder, revenue lags bookings). The assumption is that revenue will slow when it’s reported later down the line. So, despite the high revenue growth, the 20% YoY bookings growth tampered expectations and the stock fell 20%+ after the announcement.

Source: Roblox Q4 Supplemental Materials

This earnings report, the qualitative felt more important than the quantitative because it signaled a slight shift in priorities from user growth to user engagement. Let’s start with the well-known priorities we’ve discussed previously:

-

International Expansion: While most bookings are still driven by the UK/US, a previous (and continued) focus on international expansion has been seeing dividends: Japan and India, two key markets, saw 100% YoY growth. LATAM and EMEA are also following suit. And the largest key market, China, has dealt with significant industry headwinds, with Roblox shutting down its app there. Should Roblox unlock efforts here, growth will compound in new ways.

-

Aging up: Aging up has long been the largest critique of Roblox, and for good reason – the vast majority of users are ages 9-12, where Roblox has captured significant mindshare (even though the average user spends about 178 minutes on Roblox). However, Roblox has been intentional about driving new user growth in 13+ demographics and retaining existing users through new experiences and UGC (on both sides, development and consumption). Further, there has been a recent trend of VC-backed studios developing on Roblox that bodes well for a more diverse audience. I’m confident in Roblox’s ability to capture further attention here.

Source: Q4 Supplemental Materials

International expansion and aging up have long been priorities for Roblox, but I’d argue that recent developments spell even bigger opportunity.

-

Brands and Commerce: This past year, Roblox had 12 brand partnerships and six music events. I think this is the single-biggest value add for Roblox – brands like Gucci are figuring out compelling ways to build awareness, drive digital revenue (near 100% margin for them), and build digital experiences. Roblox – with its ~50M DAUs and emphasis on digital avatars and utility-based cosmetics – is the perfect platform for brands to reach a wide and existing audience. Should Roblox perfect a self-serve platform for brands and demonstrate compelling user engagement, this should grow to be a significant revenue driver.

-

Ad Ecosystem: Sure, Roblox benefits from brands driving more ecosystem-native marketplace purchases, but brands also have large marketing budgets. Roblox’s ad ecosystem is probably the best (worst?) kept secret in the industry, with enormous potential. Developers can pay in Robux to promote their experiences on the Roblox “marketplace” of experiences – they’re essentially reinvesting the capital they make from their experiences into a marketing budget to promote themselves and get a brand flywheel spinning. For reference, Amazon generated over $31B (where commerce search starts > Google) and Instacart projects $1B in 2022, two marketplace comparables. With IDFA and Meta’s advertising woes, I can imagine a scenario in which brands divert budget to market their own immersive, experiences. The important consideration here will be to balance brand experiences with game experiences in order to avoid cannibalization and to drive sustained engagement.

-

Leveraging acquisitions: Roblox has notably reported DAUs vs. MAUs, so most of their operating leverage is geared toward raising the DAU number especially outside of weekends (I assume in part to show user engagement). To this end, the company’s acquisition of Guilded hints at creating experiences both in-app and out-of-app to drive engagement growth. Other acquisitions like Loom.ai indicate that Roblox is thinking about what identity means in and around virtual experiences. As they build out experiences beyond play like education and commerce, having the technical infrastructure to support these digi-physical interactions will be a considerable moat (e.g its superb rollout of spatial audio) – after all, Roblox has always justifiably prided itself on its technical platform.

Source: Roblox’s Developer Economics

Importantly, what underpins the Roblox flywheel is a deep focus on its game economy. Roblox currently has an exchange rate of ~$.0035 per Robux earned to calculate the amount of real currency. What this incentivizes is for developers and brands to reinvest that capital back into the platform rather than necessarily cash out. This is where Roblox’s operating leverage comes from: a mix of working capital (at favorable rates for the platform) and a massive user base. In 2021, developer exchange fees totaled $538M (60% YoY), which means that at current exchange rates, developers earned ~153B Robux (of which, some may have cycled through the platform vs. being spent by users).

Even though creators only earn 30% of a virtual item (excluding the premium subscription multiplier), the bet is that the benefits of reaching an existing audience outweighs the cost. This is especially so for brands as they’re essentially opening up digital revenue streams that weren’t previously available to them. At near 100% margins, that 30% is wholly captured and at more favorable rates than physical products because of the margin profile and the brand flywheel. Therein lies the value proposition for Roblox. As they onboard more DAUs – demonstrating their engagement value to commerce-based projects compared to other platforms – they kickstart an upsell opportunity. It’s not just the marketplace or subscription value, but also the compounded value of the ad ecosystem and even further by the exchange rate — so, Roblox transitions from primarily being a subscription (estimated ~60-70% gross margins) and digital goods marketplace (~23.8% gross margin) to also a large ads platform (~100% gross margins, assuming no platform tax). Perhaps this value will even exceed that of current “game” experiences.

So, yes, Roblox isn’t without its problems: bookings and user growth is slowing and their future expansion hinges on international user bases that, while largely untapped, come with significantly lower purchase power than their US/UK counterparts. The company also has to contend with their core user base aging up, creating risk of significant churn if the Roblox platform cannot meet the changing needs of its increasing older audience. But a sole focus on user growth misses the long-term view. With $3B in cash on their balance sheet, Roblox is reinvesting in high-value opportunities (like commerce) that still feel greenfield and nascent. While the post-covid whiplash on growth rates is real, Roblox is in a great position to execute on this go-to-market strategy, to continue building out its tech stack, and to expand out its consumer offering. This will seed an even more culturally relevant company in the future. (Written by Fawzi Itani)

#2: Does Xbox Really Intend to slice up the platform ‘tax’?

Source: Game Developer

Google’s chief legal officer Kent Walker lit up Microsoft on Twitter a few days back around the Open Apps Market Act being pushed in the U.S. Senate and by MS: “Disappointing that Microsoft would lobby so hard for a law targeting its competitors, while carving out its own exception for Xbox, which requires its own billing system, doesn’t allow loading of other stores and actually charges higher fees to developers.”

What does the Open Apps Market Act actually say? The Verge has a good explainer, noting that it it mandates “companies that operate app stores with more than 50 million US users [not to] engage in certain potentially anti-competitive behaviors.”

[BTW, a side note to end: the Open App Markets Act, as written, would also apply to the Steam marketplace, as far as I can work out. So that would mean Steam would also have to offer alternate payment systems, if this was passed? That would be a bit wild.]

The bill would enable things like allowing choice in the in-app payment processor and allowing devs to be able to contact customers directly, plus allowing consumers to install third-party apps — including rival stores — without using the App Store, and even be able to use those stores as system defaults.

The kicker? The bill “defines the term as a ‘publicly available website, software application, or other electronic service’ on ‘a computer, a mobile device, or any other general purpose computing device.’” That appears to exempt consoles like the Xbox, PlayStation, and Switch, which “feature locked-down app stores but are specialized gaming devices.”

This is just one of a number of bills floating around, of course. But the basis of Epic’s legal attacks on Apple and Google — because this is largely who is being targeted here — also decided to take this ‘plz ignore consoles’ legal tack. So this loophole — which is ‘justified’ by saying many consoles are loss-making — isn’t a Microsoft-created construct. But it’s a good point for Google to push back on.

So how is Microsoft responding? As part of its recent, aggressively proactive attempts to set the antitrust/regulatory agenda around its acquisition of Activision Blizzard, given larger government scrutiny on big deals, Axios was briefed by MS: “In a new store, developers would someday be able to choose to use Microsoft's payment system and other services, such as streaming tech, or not.”

Specifically, Xbox’s Sarah Bond told reporters in a briefing alongside Microsoft’s Satya Nadella and Brad Smith: "We're going to evolve the business model [on Xbox] to support how much of the functionality we're providing them that they adopt.” Which is… a very interesting thing to say?

There is a marked lack of specifics here. But the implication is that Microsoft could provide a menu of services — payment platforms, use of streaming services, etc. So they would allow some developers and publishers to pick and choose, and pay Xbox less than 30% at some non-specified point in the future.

Is this a big deal, and what would it really mean for all of you? Here’s our view:

-

If you look at the money riding on this — yes, 30% of EA and other third-parties’ Xbox revenues is probably a decent sum. But Microsoft doesn’t have a massive percentage of its overall parent company riding on the ‘30% platform tax’ biz model. And that diversified portfolio is allowing it to say the previously unthinkable. (It also helps with ActiBlizz antitrust hurdles.)

-

Xbox saying ‘you don’t want your game to use cloud streaming? We’ll charge you 25%* instead of 30%’ is relatively logical. Minor, but logical. There may be other fractional services, which would allow Xbox to say ‘our base platform cut is 20%*, and you can take or leave this other 10%’. That’d be the clever pitch to make. (*All percentages made up by me.)

-

The most complex area is payment services. The big gotcha is that you still have to pay back the platform something afterwards — a whopping 27%, in the case of that recent Apple vs. The Netherlands test case. Even if Microsoft is more generous, player friction/confusion over payments may become an issue. So using a separate payment processor isn’t necessarily a slam dunk.

-

Most importantly - Microsoft’s ‘player-centric’ future strategy is around running both a large scale paid subscription service (Game Pass) and owning multiple live-service multiplatform titles (Minecraft, Call Of Duty, etc). Getting Xbox Game Pass fully onto mobile — or greater cross-platform control of its portfolio in general, with less walled gardens - is a business win for Microsoft that significantly overwhelms any hit to ‘Xbox as a walled garden’.

An important related detail: at no point are any of these gov bills trying to set a ‘fair percentage’ for platform cut. Nobody is going to wave a magic wand and do that. That’s simply too much of an over-reach by government. And even if tried, it would almost certainly be reversed by the courts.

My conclusion for most regular-sized devs would be, then: Microsoft could easily reduce its overarching platform cut on Xbox via this method, and may end up doing so in the next few months/years. But it won’t significantly shift the directional flow of players and revenues on the platform, which is towards recurring revenues via either subscription (Game Pass) or IAP/DLC (Games As A Service), and away from ‘one-off payments per game’.

I’ll be exploring this area in the near future: firstly, Game Pass gets seen as the chief harbinger of biz model change for small/medium devs, and is sometimes (unfairly?) pilloried for it. But there’s an argument that a ‘no-reset PC/console generation paradigm’ is actually leading this shift. We’ll try to define and explain that. And secondly, we’ll try to round up where we think the future is going for all parties, with help from Spry Fox’s David Edery. He’s seen a few paradigm shifts himself — and worked on an early incarnation of Xbox Live Arcade, a precursor to wherever we are now. (Written by Simon Carless. This blurb was originally published in The GameDiscoveryCo newsletter)

🎮 In Other News…

💸 Funding & Acquisitions:

-

Tripledot Studios raised a $116M round at a $1.4B valuation. Link

-

Nacon acquired Daedalic Entertainment, makers of Lord of Rings: Golum, for $60M. Link

-

Krafton acquired 5minlab, the developer behind Smash Legends. Link

-

Return Entertainment raised a $6M seed round. Link

📊 Business:

-

Singularity 6’s Palia announced a F2P vision and business (this transparency is awesome). Link

-

Google is rolling out a privacy sandbox for Android. Link

-

Epic Games launched a digital fashion embedded education track (among other courses). Link

-

MiHoYo launched a cross-media brand called HoYoverse that incorporates games, anime, and other entertainment. Link

🕹️ Culture & Games:

-

Peloton is leaning into gamification. Link

-

After the Wordle acquisition, the NYT rebranded its games division. Link

-

Garena Free Fire was banned in India. Link

👾 Miscellaneous Musings:

-

Lost in Wonderland, exploring the web3 gaming rabbit hole. Link

-

Who will build the Disneylands of the Metaverse? Link

-

How to soft launch a game from an ad monetization perspective. Link

-

An interview with Ryan Watt, CEO of Polygon Studios, on why he made the move and his bullishness on games in web3. Link

🔥 Featured Jobs

-

Mighty Bear Games: Senior Technical Artist (Singapore)

-

Mighty Bear Games: DevOps Engineer (Singapore)

-

My.Games: Head of Communications — PC & Consoles Projects (Amsterdam)

-

Proxima: Head Of Decentralized Economies (Remote)

-

Beamable: Product Manager, LiveOps Portal (Remote)

-

Guild of Guardians: Head of Partnerships (Remote)

-

Polygon Studios: VP Gaming (Remote)

-

Ello Technology: Lead Unity Engineer (SF; Remote)

-

Naavik: Content Contributor — Writer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.