Hi Everyone. Welcome to another issue of Naavik Digest! If you missed last issue, be sure to check out our writeup on the state of the VR industry in 2023. This issue, we analyze the plethora of MMOs receiving VC investment and why the genre is enjoying so much renewed interest as of late.

GDC Shakeups

We finally got progress on Microsoft’s Activision Blizzard acquisition. Unity joined the mandatory AI bandwagon at GDC. There’s yet another web3 organization of companies bidding for influence. Dark & Darker went from early hype to major controversy. Rovio turned down Playtika’s proposal. Tencent shared its earnings report for digging into. The much rumored Counter-Strike 2 was officially announced.

Epic pushed deeper into UGC for Fortnite with big creator economy changes. Dive into the latest games business news with Aaron Bush, Matt Dion, Felipe Mata, and your host Devin Becker.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: The MMO Gold Rush

EVE Online developer CCP Games raised eyebrows recently when it announced a $40 million funding round led by Andreessen Horowitz. Perhaps you, like many of us here at Naavik, had a familiar reaction: “Yet another MMO…?”

While gaming entrepreneurs have never been shy about tackling ambitious projects, it seems that more and more studios are entering the fray with aspirations of developing massively multiplayer online games (MMOs). Historically, MMOs have been among the most expensive and complex genres to tackle for even the most experienced development teams. That’s due to these games’ massive scale, scope of work, technical challenges, and live service content treadmill.

Yet MMOs also yield some of the largest financial rewards to developers and publishers that can effectively execute. A successful MMO can last for several years, giving developers true staying power and potentially bringing in billions of dollars. When done well, the success of a single MMO can support a games business for five to ten years, and in some cases even longer.

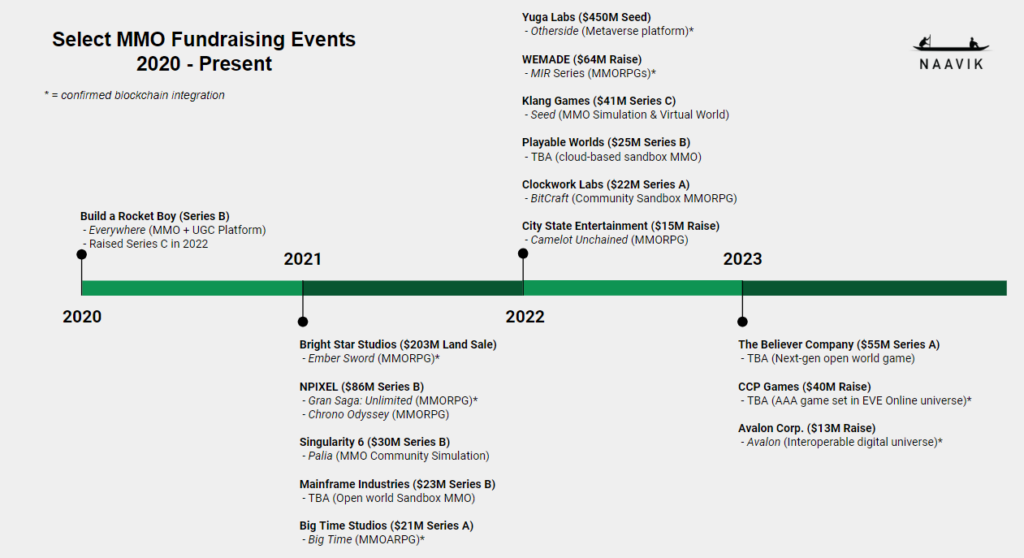

This high-risk, high–reward dynamic may partially explain why the category has become so attractive to venture capital firms. A single successful investment in a live service game at the scale of popular MMOs could return an entire fund. As such, it’s not surprising to see a flood of investments backing new MMO developers — especially when considered in the broader context of gaming VC in 2021 and 2022.

Much of this tracks with the spike in games funding across the board in 2021 and 2022, with last year marking the biggest year on record for gaming industry deals. The list of MMO developers raising a round in 2022 in the graphic above is only a small slice of the overall volume of deals; it could have easily been twice as long.

It’s easy to see why so many MMO developers are now attracting such hefty investments. For one, hype around “metaverse” companies, accelerated in part by Facebook’s rebranding as Meta in October 2021, dovetailed with the rise in prominence of web3 gaming. That in turn created a glut of investor interest in companies operating at the intersection of social networks, gaming, VR, and crypto. Additionally, the incredible track records and talent behind some of these ventures — not to mention the strong undercurrent of streamer interest in MMOs — means the industry is paying closer attention to the genre than it has in years.

While the selection above is far from exhaustive and inclusive of some projects with scarce publicly available information, there appears to be a directional trend toward larger, more social, and more community-driven online multiplayer games. Whether these new titles are traditional MMORPGs, “metaverse” plays, UGC sandboxes, or something in between does not matter. Investors are looking at social, online, and high-engagement virtual worlds as the future of not just entertainment, but also commerce, finance, and maybe even work, too.

Given that the term “MMO” is both widely used and poorly defined – encompassing titles as disparate as Animal Crossing, EVE Online, Roblox, and World of Warcraft, among many others – this article will ignore genre differences and instead focus on the business opportunities presented by these types of “massively multiplayer” games.

From my perspective, there are three macro dynamics driving the wave of investor and developer interest in MMOs. We’ll walk through each one by one:

- Vulnerable Incumbents

- Growth of UGC & the Creator Economy

- Demographic Trends & the Battle for Attention

Vulnerable Incumbents

Though MMOs are incredibly challenging and costly to make, there is evidence to suggest that the market has room for new entrants.

Last year, I covered the launch of Amazon & Smilegate’s Lost Ark and dug into the market opportunities for new MMOs. At the time, I noted that “among ‘The Big Five’ MMORPGs identified by game critics (World of Warcraft, Final Fantasy XIV, Elder Scrolls Online, Black Desert Online, and Guild Wars 2), not one was released more recently than 2015 (unless we count mobile versions).” Though Lost Ark has found some success, the top of the market has not seen many major fluctuations in the year since that article’s publication.

With the genre leaders all nearly a decade old or more (World of Warcraft came out in 2004!), there is a clear opportunity for a next-gen MMO to take center stage. More than simply improving on visual fidelity and other technical elements, new titles can seek competitive advantages in areas that would be far too difficult or costly for incumbents to retrofit into existing business models. That includes features like crossplay/cross-progression, blockchain-enabled game economies, tools for creating user-generated content (UGC), integrations with the broader “creator economy,” and support for newer hardware platforms like virtual and augmented reality.

UGC & the Creator Economy

As platforms like Roblox and Fortnite have shown, making UGC tools available to players and supporting creator communities can result in significant revenue and engagement. The emergent behavior that can spring from custom worlds, bespoke experiences, digital fashion, and so on allows players to develop a deeper emotional (and perhaps also financial, in the case of blockchain MMOs) investment in the content they create and share with others.

Layering in creator economy elements via revenue sharing and royalties can also be a significant engagement driver for game developers, as creators are able to better monetize their content and time spent in a given MMO. This in turn encourages them to continue creating and engaging with the platform. This is certainly the bet Epic Games is making with Fortnite, given its recent “Creator Economy 2.0” announcements. Already more than 40% of player game time in Fortnite is spent in creator-built content, and the company now intends to share close to half of its net revenue from the platform with third-party creators.

While incorporating these features does not guarantee success, it does allow a virtual world to serve more needs for a wider variety of people. Gamers have many different motivations for engaging with virtual experiences — players don’t log on to Fortnite just for the gunplay, but also to socialize, compete, and create. If one title can satisfy multiple use cases at once, then that game’s developer will be better positioned in the ongoing battle for attention against other forms of media. In the case of MMOs specifically, the scale and openness of these virtual worlds naturally lends itself to a variety of player use cases.

Furthermore, the addition of UGC elements also allows developers to shift some of the content creation workload to users. Not only does this ease the burden of the MMO content pipeline, but it also enables players to mold the game world according to their vision, rather than relying on developers to meet the varied needs of a diverse MMO audience. Developers can further analyze trends in player creations and play patterns to gain early signals of what types of custom content works in their games (and thus merits further investment) and what might be worth abandoning.

Demographic Trends & the Battle for Attention

Because of their vast scope and endless content roadmaps, MMOs are demanding in terms of hours of playtime. As these games grow their audiences and layer in sticky social features, they begin to benefit from network effects. This ability to capture engagement is increasingly important for the games industry more broadly, as the competition for players' attention only grows fiercer.

Social media firms, streaming platforms, games, and interactive experiences are all competing for the same finite share of users’ daily screen time. A sufficiently deep and engaging MMO can lock in meaningful chunks of player engagement from a highly sought-after audience, giving its developers a potential advantage over the competition. In other words, an hour spent on one platform is an hour not spent on a competitors'. Stickiness also provides developers with deeper and more lucrative monetization opportunities. A highly engaged and retentive audience can unlock all sorts of cross-selling and business development opportunities, as games like Fortnite, Roblox, PUBG Mobile, and Genshin Impact have all proven with countless IP crossovers and promotional events.

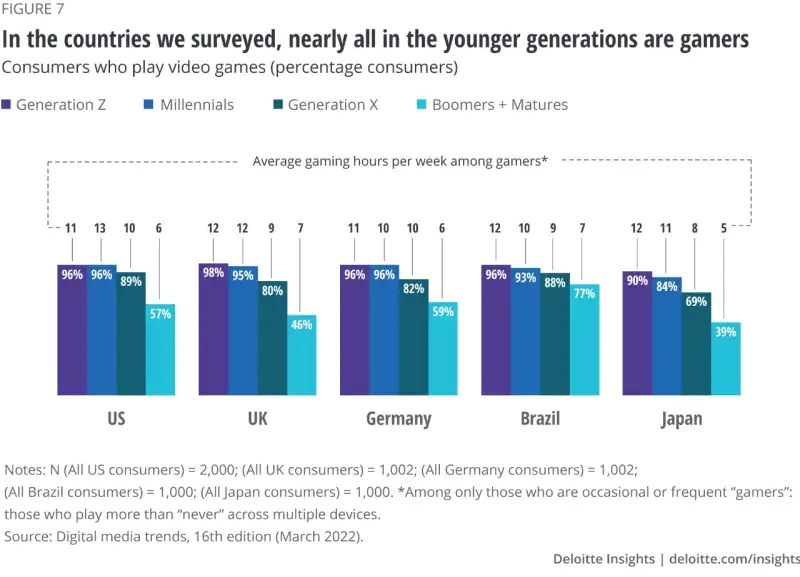

This dynamic is further exacerbated by shifting demographic trends, with Gen Z more likely to engage with games than any previous generation. This implies that the potential payoff for a successful MMO based on a new IP, in contrast to formatting that IP in a different media context like television or film, is perhaps higher than ever before.

Newer audiences are more fluent in games than past generations. As such, many of the most successful new transmedia properties, from The Last of Us and League of Legends to Cyberpunk and Castlevania, have used existing gaming fan bases to build inroads into untapped media formats like anime and prestige live-action TV.

Given the market opportunity for successful MMOs, it’s worth noting that it’s not only VCs and startups placing bets on new MMOs. Incumbent publishers are also making a variety of moves in this area — particularly in Asia, where NCSOFT, Bandai Namco, Kakao Games, Nexon, WEMADE, and others have already confirmed one or more MMO titles in development.

The picture is less clear among the big AAA publishers in the West, though the aforementioned announcement from CCP Games is certainly one to watch. Other big names include Soulframe (from Canada-based developer Digital Extremes, best known for hit MMO Warframe), Dune: Awakening (from Norwegian developer Funcom), and the long-rumored League of Legends MMO. Interestingly, all three of those developers are owned by Tencent — a decidedly non-Western entity with many other investments in MMOs and MMO-adjacent technologies.

Another potential player straddling both East and West is Sony, which acquired Bungie in 2022 specifically for its live service chops running the free-to-play MMO looter-shooter series Destiny. There have even been rumors of a Horizon Zero Dawn MMO in the works, too.

Of course, a huge development budget (whether VC- or corporate-derived) is no guarantee of success. One need look no further than Cloud Imperium Games, developers of long-awaited space MMO Star Citizen, for evidence of that. As of September 2022, Cloud Imperium had reportedly raised more than $500 million from its backers dating back to 2012, with only an alpha build available to the public thus far.

The gold rush for the next hit MMO is pulling in billions of dollars across the game industry. While many of these titles may not see the light of day for a few more years, given the lengthy development timeline for games of this scale, it’s clear the potential payoff has caught the eye of investors and developers alike. With so much funding and talent entering the space, it’s inevitable the “Big Five” will see a shakeup in the coming years. Whether this breakthrough MMO will be at the hands of a new venture or an incumbent publisher remains to be seen. But either way, I’m looking forward to exploring the future of these exciting virtual worlds. (Written by Matt Dion)

#2: Rejections, Restructurings, Remakes, and More

Rovio rejects Playtika. Back in January, Playtika proposed an all-cash acquisition of Rovio at $9.05 per share — a 55% premium at the time. Since then, other suitors have joined the party. This past week, we learned that even though Rovio is still considering other offers, it has officially declined Playtika’s bid. Although we don’t have any inside knowledge, it’s not difficult to see why. Playtika doesn’t have a great recent track record with M&A (many acquired teams and games have been made worse), and its financial position is more precarious. From Playtika’s lens this might actually be a blessing in disguise; after all, even though attaining proven games, valuable IP, and genre diversification is a great qualitative boost, the company currently has net-debt of $1.6B (40% of its market cap), and another large deal would strain the balance sheet further. Playtika continues to be stuck between a rock and a hard place, and we suspect Rovio will find a new home sooner than later.

Electronic Arts “restructures”… again. EA announced this week that it is both laying off another 700 to 800 employees and reducing its dedicated office space. This, of course, comes after cutting 200 QA workers last month, plus the shutdown of Industrial Toys just a couple months prior. For context, EA employed 12,900 people this time last year, so the total layoffs likely range from roughly 7-9% of the total employee count. In short, while layoffs are never fun to see, this follows a wider trend across gaming and tech in general. EA continues to focus on its cost structure and narrow in on what management perceives to be its most important growth opportunities. The business is still incredibly profitable, and these changes shouldn’t affect the results of its most important and needle-moving franchises.

Another week, another successful remake. Capcom’s Resident Evil 4 Remake officially sold 3 million units in only two days. For context, the previous three Resident Evil (RE) games — RE2 Remake, RE3 Remake, and RE Village — sold three million in one week, two million in five days, and three million in four days, respectively. This acceleration is a clear win for Capcom, but it also signals a golden era of remakes in general. Games like Final Fantasy VII Remake, The Last of Us, Dead Space, and Demon’s Souls have all performed quite well, and the pipeline across publishers of all types continues to grow.

Controversy strikes Dark & Darker. Following rising tensions between Nexon and Ironmace (the developer of D&D that hired several ex-Nexon employees), police raids, and now a DMCA strike claiming stolen code and game assets, D&D — an extraction fantasy MMO of sorts — was delisted from Steam. This story is largely gossip, and the legal system will resolve the situation, but there’s still some signal to be found among the noise. First, we’ve long thought that the extraction subgenre has the potential to become an emerging trend, and the early success of D&D helps prove that point. But second, it’s clear that many others are looking at the space competitively too, including obviously Nexon. Extraction games will likely see growing interest in the shooter genre, but D&D shows that the interest could expand even wider.

In Other News

💸 Funding & Acquisitions:

- Keywords Studios snagged market firm Digital Media Management for $67.5M. Link

- Take-Two Interactive acquired mobile retro-games service GameClub. Link

📊 Business:

- EA is restructuring and will lay off 6% of workforce. Link

- Sony’s PSVR2 headset sales are off to slow start. Link

- Blizzard, NetEase partnership reportedly broke down over misunderstandings. Link

- Australia proposed labeling games with loot boxes M for 15 and over. Link

- Roblox’s new advertising preempts legislation but still sees criticism. Link

🕹 Culture & Games:

- E3 was canceled. Link

- Xbox’s Chris Charla said Game Pass isn’t disruptive. Link

- Roblox released two new generative AI tools for Roblox Studio. Link

- MultiVersus’ open beta is shutting down, but the game is set to return in 2024. Link

👾 Miscellaneous Musings:

- Fortnite’s generous new creator economy has an epic catch. Link

- Sybo talked about ‘evergreen’ Subway Surfers success at GDC. Link

- The Economist on why video games are on the rise. Link

This Week In Naavik Pro

Looking for more great games industry analysis? Check out Naavik Pro!

This past week the Naavik Pro team published:

- A joint deconstruction of Electronic Arts’ Golf Clash and Zynga’s Golf Rival.

- A research essay on the state of wallets in web3 gaming.

- Earnings deep dive on Tencent’s Q4 2022.

- Analyses on GameStop, Huya, and DouYu earnings.

- A breakdown of Epic’s major Fortnite announcements from GDC.

- A new Game Launch Radar featuring Merge Vikings and Call of Dragons.

This upcoming week, we’ll have a deconstruction of Solitaire Grand Harvest, a dive into Immutable and Polygon’s zkEVM partnership, earnings coverage on CD Projekt Red, and an analysis on the growing financial impact of video game remakes. We’ll also have much more to come after that!

If you’re interested in learning more or signing up, request a demo below.

🔥Featured Jobs

- Coda Payments: VP of Growth (Los Angeles, California)

- Lila Games: Systems and Economy Game Designer (Bangalore, India)

- FunPlus: Lead Game Designer - New Casual Studio (Barcelona, Spain)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.