Recently we’ve had news that several major game developers and publishers are pulling back on plans for F2P live service games, either by outright cancellations or pivoting to premium:

- September 2023: Sega canceled F2P live service shooter Hyenas.

- October 2023: Disney/Gameloft announced that planned F2P live service title Dreamlight Valley will be paid.

- November 2023: Sony’s planned 12 live service games by 2026 is cut to six and Remedy announced rebooting F2P live service title‘Project Vanguard’ to go paid.

The F2P live service business is over half of the total game industry’s revenue. While it is the most successful business model in the market, it comes with far greater risks than selling premium games with a fixed upfront cost. So let’s get into the nuances of F2P live services gaming and why some companies are pulling back from it.

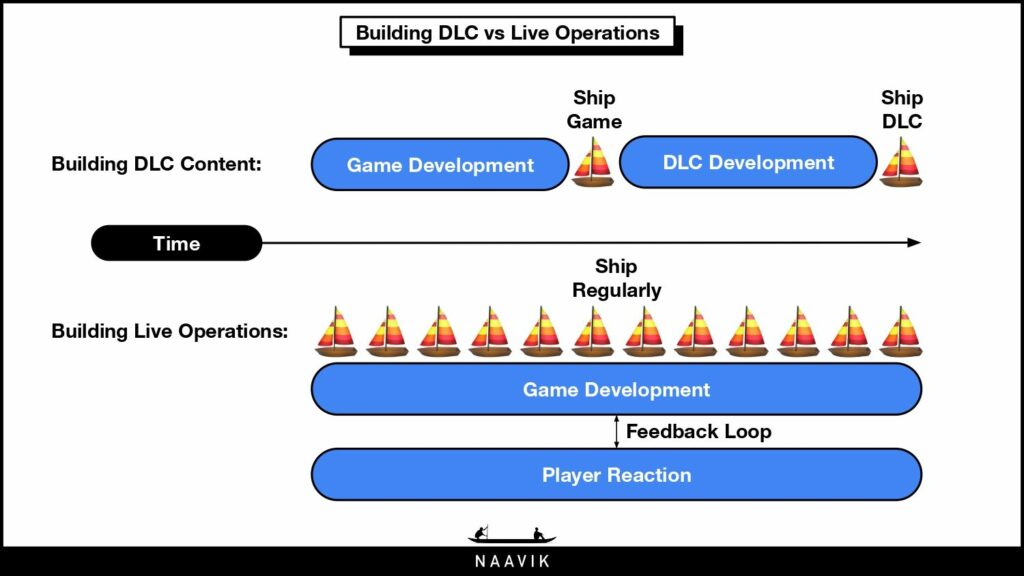

Most traditional game developers who sell paid games fall short when distinguishing between building DLC content and live operations. Building DLC content for a paid title is a linear extension of the development cycle after the game’s release: a chunk of content is created using the same infrastructure as the initial game, and is shipped and sold at a later date.

Building live operations requires game development infrastructure built to continuously iterate and improve the live game, by using feedback loops from player reactions back to the developer. The goal of live operations are player retention and maximizing LTV, to keep the potential addressable audience healthy.

One of the reasons F2P live service games can work is pure TAM, and being able to attract LTVs of $5-10 with huge scale. This makes mobile naturally suited for them versus the smaller pool of players on console and PC. Apart from audience size, product discovery is also a potential issue, with UA campaigns placing a mobile game in front of millions of players – the same can’t be applied to console and PC.

Pivoting a game development studio from paid games to F2P with a goal to build games for live operations means reworking the organization structure, staffing, cost of content, and risk profiles. These are all compounding factors that make it challenging to create the right environment. Let’s look at some examples of recent pivots that shed light on these challenges.

Disney/Gameloft’s Dreamlight Valley

The planned F2P live service game Dreamlight Valley was launched as a premium game in early access in September 2022. Gameloft released various content updates less than two months apart and yet on Steam it saw its player base dwindle over time. Though falling to a third of the player base a year later might seem acceptable at a glance, these are all premium players who paid for entry.

Given Gameloft institutionally understands F2P, one underlying reason for sticking to the paid model for release would be that the game’s underlying F2P monetization has been challenging. It would have also been difficult to overcome player sentiments and bad press surrounding getting content for free that others paid for. Hence in the case of Dreamlight Valley, the F2P release seemed to risk the entire endeavor altogether, so the last minute pivot to paid is a way for Gameloft to salvage its investment.

Remedy/Tencent’s ‘Vanguard’

Remedy has made a similar change in strategy for its F2P live service project, ‘Vanguard’. As we covered in our Alan Wake II digest, Remedy started the development of a F2P cooperative PvE shooter with Tencent titled‘Vanguard’ in 2021. This title is being co-financed by Remedy and Tencent, with Remedy aiming to publish the title worldwide except for key Asian markets, where Tencent would localize and publish, while also potentially porting to mobile. Revenue sharing then begins after development costs are recouped.

Cut to two years later and Remedy has rebooted the title as a paid game, citing uncertainties in creating a successful F2P product. In this case, a studio with core competencies in developing paid games and DLC pivoted back to playing to its strengths. Also, with the silence surrounding sales of Alan Wake II, reducing risk on future bets might be necessary.

Sega/Creative Assembly’s Hyenas

Sega’s cancellation of F2P live service shooter Hyenas has a nearly identical story to Remedy’s – that of a studio working outside its core competency returning to its strengths. Developer Creative Assembly is primarily a paid offline RTS game-maker best known for the Total War franchise – Hyenas, an online FPS, was cancelled because Sega feared it would fail to meet quality standards.

A key distinction here from the Remedy story is that the game had already reached open beta stage, and scrapping it meant Sega abandoned its most expensive project to date.

Sony Delays Live Service Games

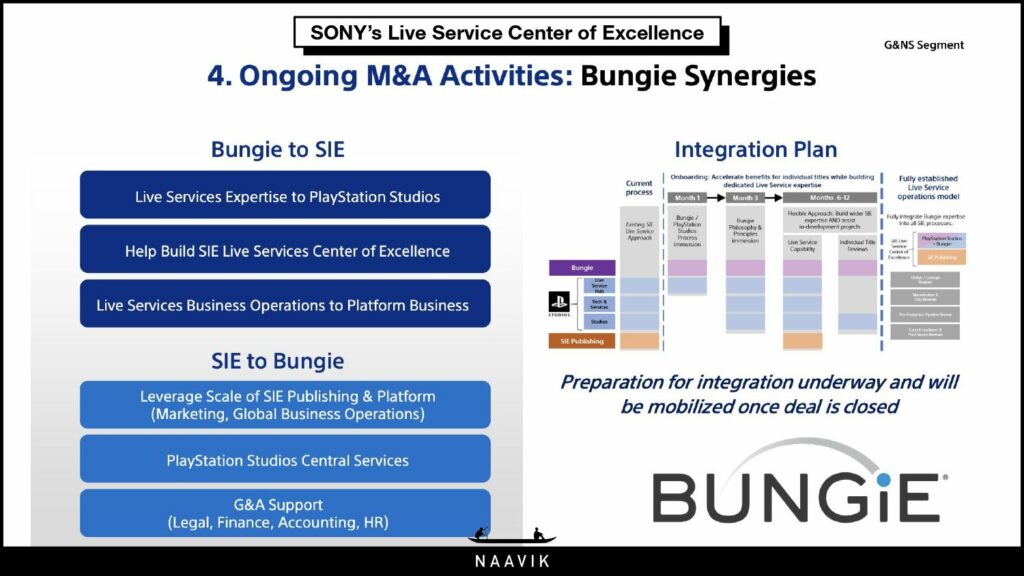

Since October 2019, Bungie has been operating its flagship shooter, Destiny 2, as a F2P live service game. It was initially published as a paid live service title by Activision in 2017. Sony acquired Bungie in Jan 2022 to bring its expertise in live services to PlayStation Studios, creating a ‘Live Service Center of Excellence’. The plan was to release 12 live service games by the end of 2025, and 55% of PS5 investments going into building live service games.

The reveal of Sony’s live service future was teased in May’s PlayStation Showcase. This was followed by the announcement in September that Jim Ryan, the CEO behind Sony’s live service plan, was stepping down. A month later, Sony delayed Bungie’s forthcoming title Marathon and the next Destiny 2 expansion amid layoffs. A month after that, Sony announced delays to half its live games, citing quality concerns.

It has not been easy for Destiny 2, Bungie and F2P live service games at Sony in general. With reports suggesting it is missing revenue targets by 45%, it’s no surprise that Sony also paused development of a live service game for The Last of Us after four years. PlayStation learned that making these games is harder than expected, and not something it is good at – yet.

The Big Picture

F2P live service games are a risky venture in the current business environment, as they could determine the complete success or instant death of a studio. The potential of massive, uncapped gains brings with it new, complex problems for game developers to solve. It takes a lot of time and investment to develop live service skills and expertise, so cutting back or pivoting to paid titles is a way of addressing the challenge with due diligence.

We will continue to see F2P live service games growing in popularity as occasional hits break out and more companies try them for smoother, recurring revenue. Studios with experience in F2P games will have an advantage over those that accustomed to making premium games. For now, it looks like experienced cross-platform operators like HoYoverse, Tencent, Roblox and ABK (to name a few) will spearhead bringing F2P live service games to traditionally premium games markets like console and PC.

A Word from Our Sponsor: ZEBEDEE

Where Fun Meets Bitcoin!

ZEBEDEE is a fintech and payments processor with a plug-and-play API plus SDK, enabling developers to easily integrate instant, borderless low-fee payments into various applications using the Bitcoin Lightning Network. Offering transactions with fees of less than one cent, ZEBEDEE already powers over 4,000 developers across a variety of sectors, including gaming, streaming media, and social media, processing 10,000-plus million transactions monthly.

Early adopters have reported impressive results. For instance, Square Enix experienced an 82% increase in ARPDAU for its game Ludo Zenith, Fountain Podcasts doubled its user base after integration, and Fumb Games saw a 1,215% player retention increase for Bitcoin Miner. ZEBEDEE targets the growing demand for borderless transactions, ensuring that digital businesses can effectively engage and monetize a global user base, including the unbanked.

In Other News

💸 Funding & Acquisitions:

- US FTC tries again to stop Microsoft's already-closed deal for Activision.

- GameOn Technology changes its name to On as it raises $25M.

- AppsFlyer closes the year with second acquisition in less than a month.

- Arcweave raises $850K to build AI-powered game creation tools.

- Former Activision Blizzard CEO supports GameTree's $1.7M seed round for AI app to unite gamers.

- Hearst Newspapers acquires Puzzmo.

📊 Business & Products

- US predicted to account for 40% of growth in mobile gaming revenue in 2024.

- Q3's biggest genres saw 700% more downloads on Google Play than Apple App Store.

- Hybridcasual conquers the $2B mark in 2023.

- November’s top grossing mobile games worldwide.

- The industry will rally soon, says RallyHere head.

- Twitch to cease operations in South Korea next year.

- Candy Crush to lose its crown in 2024? But overall mobile game revenues will be up.

- King has soft launched Candy Crush 3D.

- Only 36% of PC games are purchased at full price.

- TinyBuild lowers revenue forecasts, settles legal dispute with Versus Evil.

- Mobile AR users are projected to reach 1.7B by 2024.

- GameStop posts lower sales, reduced losses

- With GTA 6 not due until 2025, what will drive games in 2024?

👾 Miscellaneous:

- Loot box State of Play 2023: A global update on regulation.

- Rovio closes Studio Lumi.

- THQ Nordic delays Alone In The Dark reboot.

- Bandai Namco launches additional stores in the UK.

- The African games industry in numbers.