Welcome to Master the Meta, the #1 newsletter about the business of video games.

Hi everyone,

We’re on the lookout for contributing writers. If you’re interested in working with us to share your insights and help us improve the weekly newsletter, please send us a message at [email protected] or [email protected], where we can share more details.

Now, here’s your weekly roundup and analysis of what’s happening in the video game industry…

🔍 Mini-Deep Dive: Genshin Impact

On September 28th, Genshin Impact made headlines across the industry. Not only did it break international launch records for a China-developed game, but it also grossed more than China’s TikTok on launch day and captured more Twitch viewership than Fortnite at the same time! Further, it’s available across PC, PS4, and mobile, enables cross-play, and a Nintendo Switch version is in the works. The game is developed by miHoYo, a Shanghai-based studio best known for producing high quality F2P mobile titles (like Honkai Impact 3rd, which, according to Sensor Tower, grossed ~$500M over its lifetime, not including China Android).

While all the vanity metrics above partially show why Genshin Impact is significant, let’s peel back three more layers. Before we dive in, enjoy the game trailer.

First - Genshin Impact is simply a great gaming experience! Heavily inspired from The Legend of Zelda: Breath of the Wild (BoTW), the game is a beautiful, narrative-driven, open world action-RPG with free-to-play (F2P) gacha (aka loot boxes) monetisation mechanics. Progression is driven through a flurry of main storyline quests and side-quests, and players have to level up various aspects of their character roster to keep traversing content. The take on the elemental-based combat system is probably the biggest difference to BoTW, and working toward mastering the unique fighting abilities of various characters is quite fun. Importantly, long-term player retention and revenue is driven by being able to acquire the rarest characters from the gacha and work towards maxing their stats out. The current character roster is about two dozen strong, which feels low in terms of depth for a gacha-driven game; however, a wide array of character upgrade options, weapons, artifacts, and other materials help bolster the gacha depth. Also, miHoYo will certainly add new characters to the gacha over time.

Comparing the art styles of Genshin Impact VS Honkai Impact 3rd. They’re quite the same and equally good!

Further, the game’s characters and world are stunningly detailed with a high quality cell-shaded art style that miHoYo seems to have perfected with Honkai Impact 3rd. And finally, the game’s soundtrack is exceptional. Under the leadership of miHoYo’s own Yu-Peng Chen, the soundtrack was recorded by the Shanghai Symphony Orchestra and the London Philharmonic Orchestra, which also did the music for the Lord of the Rings trilogy. This video is pretty exciting!

Genshin Impact truly feels like playing a console title on your mobile phone, except the vast content the game has to offer is free. I (Manyu, here) am still early into the game (Adventure Rank 10), and in the process of forming deeper design thoughts around the game’s UX, narrative, questing, character progression systems and long-term gacha revenue potential. But what I can say for now is that Genshin Impact leaves a strong first impression across platforms, which is reflected in the revenue numbers highlighted below.

Second point - miHoYo has a bold vision for Genshin Impact! miHoYo was founded in 2012 by three students who shared a passion for technology and the Japanese ACG (Anime, Comics, Games) culture. The company’s most successful game till date, Honkai Impact 3rd, was built with the core vision of creating the best Anime inspired action-RPG for the mobile gaming market, and the game is representative of the high production quality bar miHoYo sets for its titles.

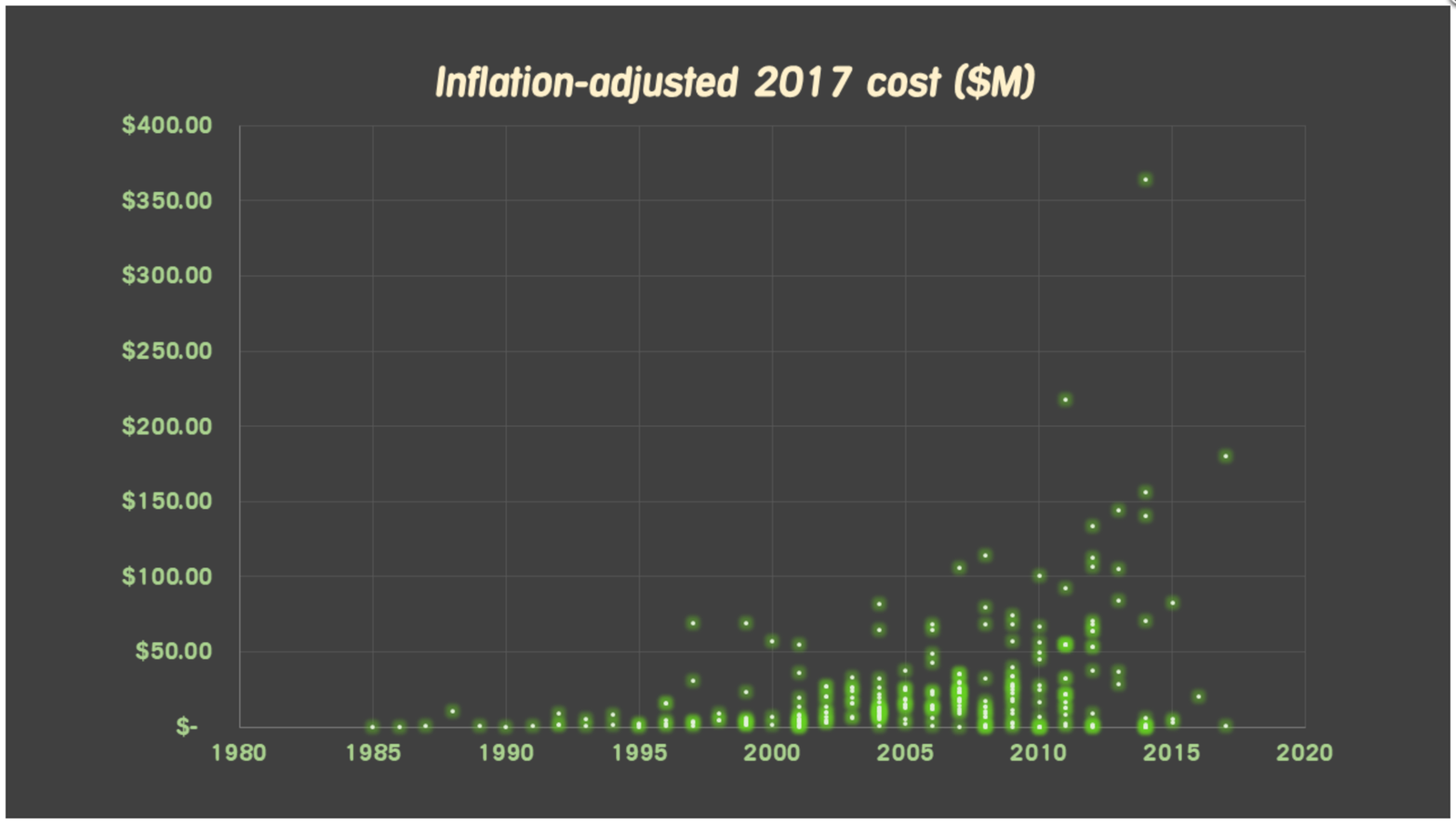

With Genshin Impact, miHoYo clearly wanted to go even bigger. The game was built with cross-platform play in mind from day one and is built on Unity (a testament to the game engine’s cross-platform abilities). Over 300 people worked on the game over a 4 year period, and the total development and marketing budget is pegged at over $100M, in the range of other high-budget AAA console titles.

A scatter plot of actual game development costs for around 250 different titles. | Source: Raph Koster’s Blog

Given the long development timeline and massive costs, miHoYo is placing a huge bet on the F2P business model to recoup their investment. Fortunately, the initial numbers look promising. Genshin Impact’s launch week revenues on iOS rival many other major Chinese launches over the past couple years. If one adds revenues from China Android, the launch numbers look even better.

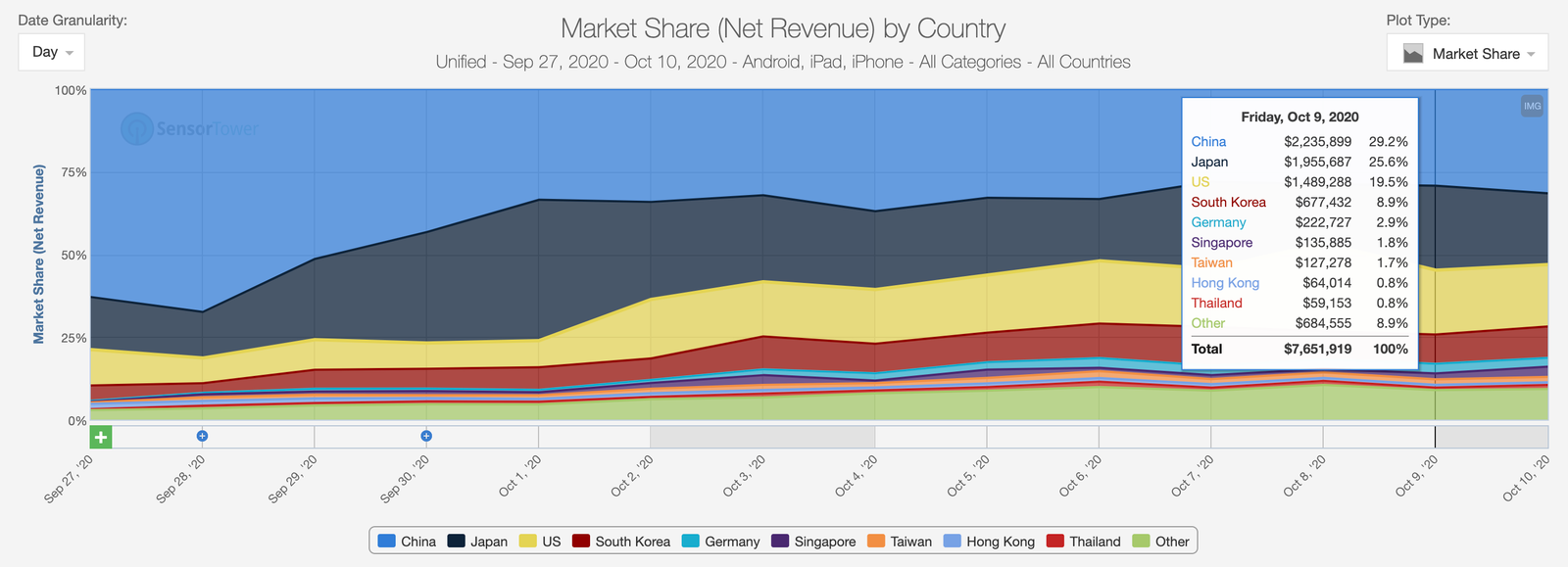

Genshin Impact’s launch week revenues on iOS rival many other major Chinese launches over the past couple years. | Source: Sensor Tower

From a global mobile revenue perspective, Genshin Impact should be compared to Pokemon Go’s launch trajectory. According to Sensor Tower, the game’s global mobile revenues across iOS and Android (likely including China Android) totaled up to $60M during launch week. Not only does that mean miHoYo grossed 60% of its investment in 7 days just on mobile, but adding in global revenues from other platforms and netting everything out means the recoup percentage looks pretty sweet. And just today, it was announced that the game has grossed $100M, equalling its initial development and marketing budget!

Genshin Impact’s launch week revenues mildly trailing behind that of Pokemon Go’s, which is a big feat in itself. | Source: Sensor Tower

That said, the cross-platform functionality has some problems. Getting cross-play to work is a headache, which means carrying progress over from device to device isn’t simple. I’m not sure whether others feel similarly, but if yes, the game drops the ball on this aspect of its cross-play value proposition. Further, the general gaming community doesn’t seem to be too impressed with the game’s performance on mobile devices, which indicates performance optimisation issues. Lastly, there seem to be an array of UX problems when playing on mobile, specifically when it comes to recreating a controls system that works across device platforms.

All that said, it’s still safe to say that miHoYo’s grand vision is coming to fruition, and they’re going to be more than happy with the long-term ROI on this game. That leads to the…

Third point - miHoYo’s design and technical prowess signals a trend we have been seeing hints of the past couple years. This trend is the rise of a new generation of Chinese game developers who are able to create fun, breakout hits for global audiences. An ACG themed action-RPG like this one would’ve usually generated >70% of its revenues only from China. But Genshin Impact is seeing a healthy mobile revenue split across all territories with US contributing ~20% and the rest of the world contributing ~25%:

Genshin Impact has a healthy split of mobile IAP revenues across key territories like China (30%), Japan (25%), US (20%) and the rest of the world (25%). | Source: Sensor Tower

This trend is even more pronounced when looking at some other recent top grossing games. AFK Arena from Lilith Games is the gold standard when it comes to Idle RPGs. Rise of Kingdoms (also from Lilith Games) helped evolve what a 4X game is today. Matchington Mansion from Firecraft Studios surprised the entire Puzzle market by being able to compete with the likes of Playrix’s Homescapes and Gardenscapes. Archero from Habby showed the industry how to evolve hypercasual to its next stage - hybridcasual. And finally, Arknights from Hypergryph was a breakout hit while massively refreshing the tower defense RPG sub-genre. Not only are all these games top grossing titles in the west, but some can also be called genre-defining. More importantly, western developers are learning from these China-developed games and rewriting mobile F2P game design best practices. In a nutshell, China is turning the tables on the west.

Genshin Impact is a huge leap forward in that race and should be celebrated by the Chinese game development community (and be a wake-up call for Western developers). It’s a brilliant, original IP product that has managed to capture the hearts (and wallets!) of global gaming audiences across PC, console, and mobile platforms. miHoYo’s daring vision is great, but it still has a long road ahead since this massive game with an enormous content pipeline needs to be live operated.

From a higher level Chinese developer standpoint, it feels like making games that also resonate with the western markets has been a challenge for a long time. Yes, significant geopolitical headwinds may continue to emerge, but it seems like miHoYo and Chinese game developers are well on their way to create new normals within the industry. And with Genshin Impact in the rear view mirror, Chinese game developer visions are only going to get bigger!

Note: We’re conducting a full game deconstruction, which we’ll send out to our subscribers soon. Make sure to subscribe to the newsletter to be the first to receive it! We’d also recommend checking out these design thoughts, which also helped inspire some of the strategy thoughts we discuss above.

📰 News

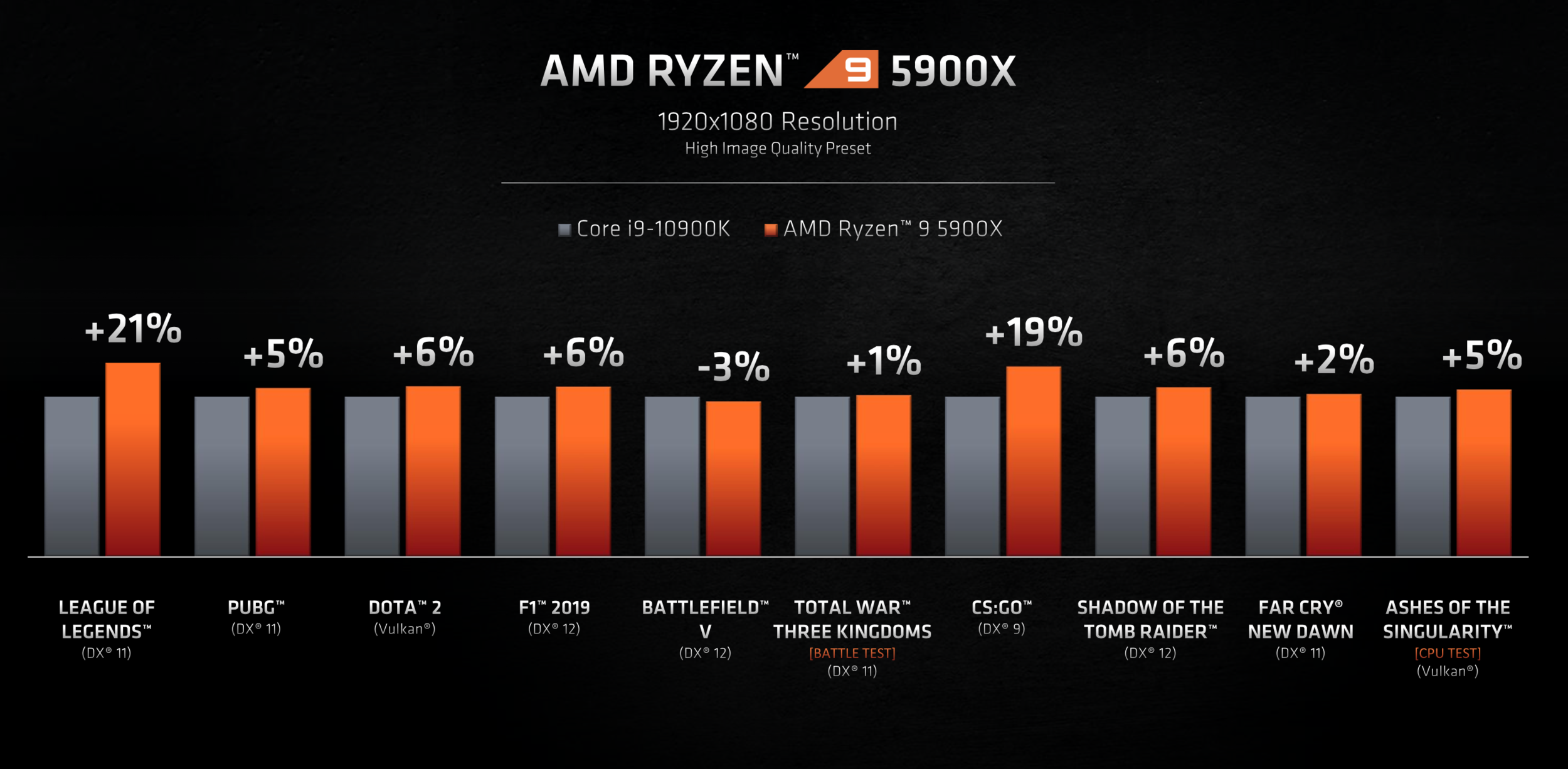

AMD had a busy week. On Thursday, the company announced its new lineup of Ryzen 5000 series desktop CPUs, which are the first to leverage AMD’s new Zen 3 architecture. There will be four tiers — available on November 5th, starting at $299 — and the company boasts that simply upgrading from the same tier of Zen 2 chip to Zen 3 chip will lead to an average 26% performance improvement. AMD now claims to have “the world’s best gaming CPU,” which is a direct shot against Intel’s Core i9 lineup which recently said it sells “the world’s fastest gaming processor.” There’s some give-and-take; for example, while Intel wins at clock speed (5.3GHz), AMD wins on power efficiency and core + thread count. But all in all, AMD obviously wants to make it clear that it’s now the best option:

Of course, Intel is already planning its 11th gen CPUs, which look to be coming out next year, so AMD doesn’t have time to rest.

Additionally, AMD used this presentation as an opportunity to tease it’s next-gen Radeon RX 6000 “Big Navi” GPUs, which will be fully unveiled later this month. We’'ll learn more in the coming weeks, but early benchmarks I’m seeing (combining the Ryzen 9 5900X with the new Radeon GPU) suggest that performance is competitive with Nvidia’s recently announced RTX 3080. It’s important to not jump to conclusions — we don’t know all the details and Nvidia’s Ampere architecture is powerful — but AMD’s progress is impressive nonetheless.

If the CPU-GPU one-two punch wasn’t enough for one week, it was also announced that AMD is in late-stage talks to acquire Xilinx for ~$30 billion. In the 1980s Xilinx invented field-programmable gate arrays (FPGAs), a versatile type of semiconductor chip that can be programmed and used to serve a wide variety of use cases with high performance. The technology was expensive and not very useful in the 80s, but today — in a world of rapidly growing data centers and ever-growing cloud-based needs — FPGAs have found their moment, and Xilinx is the top dog with more than half the market under its control.

Although I struggle to see huge synergies, I get where AMD is coming from. Tucking in the dominant FPGA seller means AMD will have an even more complete chip package when selling to big data centers, which are the largest (and often the fastest growing) semiconductor customers. Also, guess who the #2 FPGA player is? Yep, it’s Intel, which means AMD will become even more capable of competing across more dimensions. This deal has little to do with games (data centers would mainly leverage GPUs, not FPGAs, to serve cloud gaming customers), but it should lead to greater profits and resources, which can be reinvested back into R&D. We still don’t know the terms of this deal — or technically if it’s set in stone — but it would be a notable, industry-changing move for the semiconductor space.

GameStop’s “partners” with Microsoft. If you need evidence that the stock market isn’t perfectly efficient, you can now thank GameStop! On Thursday the company’s stock leaped 44% on news that it entered “a multi-year strategic partnership agreement with Microsoft.” What does that mean? Four things:

-

GameStop will use Dynamics 365 across stores/online to provide customer insights

-

Store associates will now have Surface tablets

-

Its stores will now use Microsoft 365 and Microsoft Teams

-

GameStop will now sell Xbox All Access and receive lifetime revenue of each customer who buys

In other words, GameStop found a way to make a huge announcement out of something that no other company would even need to announce. Are we supposed to congratulate them for using Microsoft services like every other business in existence? Lol.

Point #1 is mildly interesting if it leads to more targeted sales, but customer insights should be something the company already has through its PowerUp Rewards members. Point #4 is the most interesting simply because it provides a company desperate for business with a potential source of recurring revenue. We don’t know the terms and it’s hard to say how many gamers would buy Xbox All Access via GameStop vs Xbox directly, but it’s better than nothing. Does it increase the value of GameStop by 44%, though? No.

Although we wish GameStop the best, it’s hard to see how anything the company is doing will keep them relevant in an increasingly digital world. Selling next-gen consoles across a shrinking number of stores and praying that associates will cross-sell extra hard drives or Xbox All Access isn’t a panacea. No comment on the stock, but from a business strategy perspective it’s hard to be enthusiastic.

AppLovin prepares to IPO. It’s an exciting time to follow the publicly traded gaming industry, partially because the number of available companies (and types of those companies) is growing. AppLovin, which just hired Morgan Stanley, is the latest major gaming-related company to prep for an IPO. As mentioned last week with Roblox, we’ll share more insights in the future once the company posts its S-1, but we can provide a brief overview today.

For those who aren’t familiar, AppLovin was founded in 2012 as an advertising platform for mobile games. That still is the core of the business, but beginning a couple years ago the company started branching out into game development and publishing. The idea was that AppLovin could create untapped value by applying its advertising expertise to games with subpar user acquisition techniques (Tilting Point is doing something similar). Although some people have raised conflict of interest concerns, it must be working, because not only did AppLovin launch its media division (Lion Studios) in 2018, but it has since acquired or invested in Machine Zone, Belka Games, Firecraft Studios, and PeopleFun.

AppLovin has been profitable since the beginning, and will generate approximately $1.5 billion in revenue this year. When KKR invested $400 million to buy a minority stake in 2018, the company was valued at $2 billion. However, given ongoing growth, profitability, and the fact many public companies are receiving generous multiples, expect the stock to IPO at a much higher valuation. Again, we’ll learn more in the coming weeks/months, but AppLovin will be a fun one to eventually dig into.

Quick hits:

-

Rovio’s CEO is quitting at the end of the year. Link

-

Facebook Gaming surpassed one billion hours watched in Q3, which represents modest growth from the previous quarter. For comparison in Q3 YouTube Gaming and Twitch had 1.7 billion and 4.7 billion hours watched, respectively. Link

-

Amazon halted development on Crucible, a high-budget game that failed to attract players. It’s an intriguing case study. Link

-

Thunderful Group acquires Coatsink for up to £65.5 million. Link

-

My.Games, the gaming division of Russia’s Mail.ru Group, bought control of Deus Craft for up to $49.1 million. Link

-

Tilting Point acquired TerraGenesis from Edgeworks Entertainment, yet another step in its strategy of buying popular games and making them even bigger through its user acquisition advantages. Link

-

Thirdverse raised a $8.5 million Series A to expand its VR business. Link

-

Google is delaying the implementation of its mandatory 30% cut on the Play Store in India to March 2022. Link

-

JetSynthesys acquired Real Cricket developer Nautilus Mobile. Link

🖥 Content Worth Consuming

Amazon Wants to ‘Win at Games.’ So Why Hasn’t It?. “Could New World become the franchise the company has been after all these years? It’s up against some tough competition. There are only a handful of successful MMORPGs (World of Warcraft, Final Fantasy XIV, The Elder Scrolls Online, among others), and their fanbases have been playing some of them for years and years. It’s a notoriously tricky genre to break into. And it’s a reminder, too, of the strange alchemy required to make that rarest of things—a title that earns not only billions of dollars but also the allegiance of millions of discerning players. As one former Amazon employee told me, ‘There is some magic in making games. It’s not a science. No matter how big your pockets are, unless you’re building games because you want to build games, you’re not going to have success.’” Link

Nvidia CEO Jensen Huang compares the Omniverse and the metaverse. “‘Adobe is a world. Autodesk is a world. When someone is working on their content, they’re in their world,” Huang said. “These worlds are going to get richer and richer, as these worlds that you’re creating in [3D animation software] Maya start feeling like you’re in virtual reality. And so, your work group will feel like you’re in a world. And what we would like to do is to connect all of those worlds together, for the various work groups, the various studios, and they can work on one giant world, one giant piece of content. … Separation between application and this concept called a world is going to become blurrier and blurrier.’“ Link

Deep Dive In Gaming Investments and M&A. “Elite Game Developers hosted a panel on Gaming Investments and M&A. The panel consists of Anton Gorodetsky and Sergei Evdokimov from InvestGame.net, Micha Katz from Aream & Co, and Miska Katkoff from Deconstructor of Fun.” Link

Scaling a Games Studio: How to Win? “Today we’re here to talk about the biggest challenges and mistakes early stage companies have in order to scale their companies and achieve success. To speak to these issues we have arguably 3 of the best people in the world to talk about this: Travis Boatman, Gigi Levy-Weiss, and Kristian Segerstrale.“ Link

Thanks for reading. See you next week!