Hi everyone — welcome to another issue of Naavik Digest. If you missed our last one, be sure to check out our dive into how major publishers are approaching indie games — including what's changing in the market and where it’s headed in the future.

In today’s issue, we’re analyzing the state of fighting games and discussing what’s on the horizon for the genre as it continues to grow, evolve, and make room for new players. We're also publishing a new deep dive breaking down the web3 gaming market for the month of June.

#1 June 2023: Web3 Gaming Monthly Market Update

By Devin Becker, Naavik Contributor

This Naavik Exclusive features a comprehensive breakdown of the web3 gaming market for the month of June, including a detailed analysis of notable web3 game releases, unique active wallet stats, transaction trends, and funding announcements. In these monthly market reports, we’ll help you gain a better understanding of how the web3 gaming landscape is evolving, who’s winning and losing, and how the market is responding to rapid change amid unprecedented regulatory pressure on the broader crypto industry.

#2 The Evolution of Fighting Games

By Aaron Bush, Naavik Co-Founder

Fighting games are one of the oldest forms of gameplay – going all the way back to Sega’s Heavyweight Champ in 1976. Not only is the genre healthier than ever, but it’s also currently undergoing continued evolution and gearing up for its next phase.

According to Market Growth Reports, the entire fighting game genre clocked in at $1.4B in sales in 2022 and is expected to continue growing nicely over the 2020s. In part, the market has expanded over the past decade because of the addition of mobile — including games like Marvel Contest of Champions, Dragon Ball Legends, and more — but the traditional console market (and PC to a lesser extent) isn’t sitting still, either. Longtime followers of the industry know there are a small handful of primary contenders duking it out for market share:

- Mortal Kombat: It’s the No. 1 best-selling classic fighting game series, having sold over 80 million units since its inception. The franchise is also on a good trajectory, with the most recent installment, Mortal Kombat 11 (2019), selling 15 million units — its highest yet. (The second best-selling was Mortal Kombat X (2015) at 12 million units.)

- Tekken: This classic franchise has sold approximately 55 million lifetime units. Notably, the most recent installment, Tekken 7 (2015) was the highest selling, hitting 10 million units, and Tekken 8 is right around the corner.

- Dragon Ball: It might surprise some people to know that this franchise is historically the second-best-selling (excluding Smash), very slightly edging Tekken out in units sold. Dragon Ball Xenoverse 2 (2016) and Dragon Ball FighterZ (2018) have both sold north of 10 million units.

- Street Fighter: This franchise has sold approximately 50 million lifetime units, but it’s also on a decent trajectory. Street Fighter V (2016) sold over 7 million units, a slight dip from Street Fighter IV, but the recently released Street Fighter 6 has already sold 2 million units in just its first month.

- Super Smash Bros.: Many die-hards wouldn’t consider this franchise a “real” fighting game, but let’s consider it for the sake of the exercise. Sales have fluctuated as Nintendo’s consoles boom and bust, but the most recent installment, Super Smash Bros. Ultimate, has sold over 31 million units (an impressive 25% attach rate to the Switch).

Of course, those brands aren’t alone — franchises like UFC, Injustice, Marvel vs. Capcom, Soulcalibur, etc. — have also carved out their own niches and competed for market share, but the big five above is where most of the action is. What’s notable is that each and every one of these leading franchises was created in the 20th century (most in the 80s). In order to grow and maintain relevance, they’ve each had to evolve over time, and the current moment is no different.

Just take a look at Street Fighter 6, which was released in June. In many ways, the game serves the franchise’s core audience well — classic controls, both new and returning characters, staple multiplayer modes, a new real-time commentary feature (including the voices of popular fighting game commentators), and all on Capcom’s newer RE game engine. However, what’s unique about this launch is how many steps the team took to make the game friendlier to larger audiences in an attempt to overcome the stereotype that “fighting games are hard and not for everyone.”

For example, the game’s new World Tour mode is a refreshing open world-based single-player mode with customizable avatars, lots to do, and training options with notable characters — a first for the franchise. Beyond that, the development team launched a couple new, simplified control schemes (Modern and Dynamic) plus several audio and visual accessibility features. Given the game’s score of 92 on Metacritic and solid early sales, it’s safe to say that the changes are working largely as intended.

As Street Fighter innovates, Mortal Kombat isn’t resting on its laurels, either. The franchise, which is developed by NetherRealm Studios and is now published by Warner Bros. Games, is gearing up for its next launch on September 19th. The new installment is Mortal Kombat 1, marking the series’ second reboot (the first was in 2011). As you can see in the official gameplay debut trailer, the gameplay looks sharp yet familiar. The game likely won’t push fighting game boundaries as much as Street Fighter 6, but through “reimagined versions of iconic characters as they’ve never been seen before, along with a new fighting system, game modes, bone krushing finishing moves, and more” it appears to also be thinking about how to best modernize the game and open it up to new audiences. Given the trajectory of the installment’s sales, and the fact it's the first new installment on next-gen consoles, it should also sell quite well over time.

It’s also worth noting that the rest of the industry is building for the future, too. Tekken 8 may launch in early 2024, a new Dragon Ball Z fighting game (Dragon Ball Z: Budokai Tenkaichi) was recently announced, and UFC 5 was just unveiled, too. While some of these sequels may continue performing well regardless of whether they innovate, it’s hard to shake the thought that even larger changes are emerging – with competing franchises and business models on the horizon.

Perhaps the genre’s largest shake-up will come with the eventual launch of Project L, Riot Games’ Runeterra-themed fighting game in development (see early-stage gameplay here). Not only does Riot have a penchant for launching great games (like League of Legends, Valorant, or Legends of Runeterra) that carve out market share from incumbents, but the company is also entering the fighting game market with an entirely new business model: free-to-play (F2P).

Yes, technically this won’t be the genre’s first F2P entry. Two other more Smash-like games, Multiversus and Brawlhalla, both found notable audiences via an F2P model. However, Multiversus couldn’t maintain its audience (we covered its live ops struggles previously) and is looking to relaunch in 2024. Meanwhile, Brawlhalla, which innovatively supports cross-play and boasts over 80 million lifetime players, is another step removed from what many “core” fighting game players are looking for.

All that said, as many of the classic fighting game franchises are lowering barriers to entry and creating more welcoming experiences for new players — and getting rewarded as a result — it’ll likely be Riot with its F2P model that has the greatest impact and creates the most welcoming environment for new fighting game players. That doesn’t mean these classic franchises are KO’d or that premium games are finished; if they’ve been around for 30 years, they’ll likely be around for another 30. And who knows when Project L will even launch — or if it’ll live up to the hype!

However, in the same way F2P changed the landscape of other PvP genres — and classic franchises like Call of Duty, Destiny, Rocket League, or even Fall Guys felt the need to adapt — it wouldn’t be shocking to see the next few years of console and PC-based fighting games experience more change than in the last 20. And whoever creates a great game that lowers the barriers to entry to most might end up the ultimate victor.

Sponsored By Pragma: The Backend Game Engine

Pragma is a Backend Game Engine founded by the engineering leaders who built the platforms for some of the largest live service games including League of Legends, Fortnite, Destiny 2, and Plants vs. Zombies 2. Pragma powers services like accounts, matchmaking, and player data for the world’s most ambitious live service games.

The Pragma Backend Game engine is the only solution that is truly extensible so that game designers aren’t blocked by clumsy black-box designs. With Pragma, studios no longer need to hire a large backend team and get the ultimate piece of mind that their game will always be ready to scale.

#3 Gaming Market Update: June 30th - July 7th

By Mario Stefanidis, CFA, Naavik Contributor

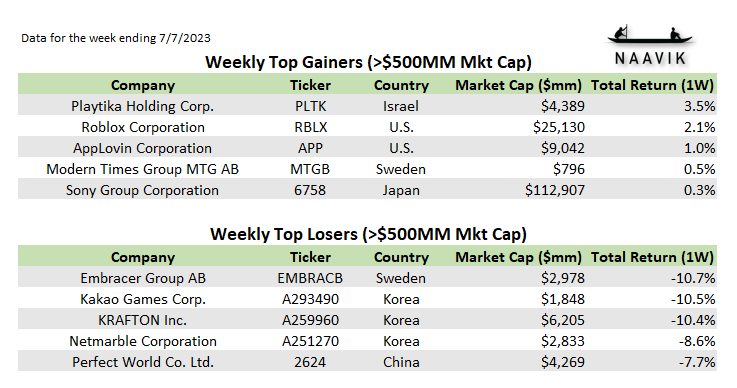

- For the week ending July 7th, 2023: The average return for gaming companies tracked by Naavik with a market capitalization exceeding $500 million was -3.5%. The S&P 500 returned -1.2% and the Nasdaq-100 returned -0.9%. Full access to the Naavik Gaming Company Universe is available here.

- Gaming stocks had a challenging week, with only six of the 46 companies with a market cap above $500 million experiencing an increase. The decline was led by mid-cap Asian companies, namely Korean gaming publishers. Asian markets have slid in recent weeks, led by poor economic data out of China, the region’s largest economy.

- Embracer Group (STO: EMBRAC-B) fell -10.7% after announcing a $182 million secondary offering pricing shares at SEK 25. The day before the announcement, shares closed at SEK 27.54. Since the company was offering these new shares at a sizable discount, the price immediately fell. CEO Lars Wingefors used the announcement to reiterate Embracer’s FY 2024 Adjusted EBIT forecast of SEK 7-9 billion, which ends on March 31st. Year-to-date declines for the group’s stock are -49.1% through July 7th, the most among tracked gaming companies.

- Kakao Games (KRX: A293490) fell by -10.4% amid investigations from South Korea’s market regulator, the Fair Trade Commission. Kakao’s subsidiary, Kakao Entertainment, is accused of unfair practices in its relationships with its subcontractors. This adds to an ongoing investigation probing game publishers launched in May, which targets Kakao Games itself.

Notable Venture Financings

- New games studio Garden raised $31.3 million in Series A funding, one of the largest such rounds of the year. The syndicate consists of a noteworthy cast of partners across the game industry, including co-leaders Lightspeed Venture Partners (LSVP) and Krafton. Moritz Baier-Lentz, a partner and head of gaming at LSVP, will be joining Gardens’ board of directors. Other participants include executives with ties to Microsoft, Sony, Nintendo, and Riot, among others.

- Gardens first raised a $4.5 million seed round in July 2021 led by Transcend Fund. The studio was founded by industry veterans Chris Bell, Lexie Dostal, and Stephen Bell, and has since expanded while maintaining its remote-first focus. Collectively the team has worked on titles including Journey, Sky, and What Remains of Edith Finch. Gardens should be thematically similar to these titles, featuring elements of exploration with positive emotional elements.

- The studio is continuing work on its “ever-evolving online PvPvE fantasy adventure sandbox ARPG.” Participants in the fundraising round had the opportunity to play a demo of the game behind closed doors, which received a very positive reception.

- Our interview with Chris and Steven Bell will be coming soon to the Naavik Gaming Podcast.

- Finger sensing and haptic technology startup Aito raised $6.5 million in its latest funding round, bringing total financing to date up to $23.5 million. Aito aims to enhance the user experience by incorporating touch and haptic feedback into laptop keyboards, enabling users to feel physical sensations while typing. Aito’s main product is an ultra-slim haptic touchpad that responds in various ways to gestures like controlling volume, scrolling, and more. The company, which is based out of Amsterdam, plans on using the additional funds to develop new laptop haptics applications.

Notable Strategic Investments

- Lighthouse Games, the newly founded studio from Playground Games founder Gavin Raeburn, received an undisclosed minority investment from Tencent. While the exact terms were not disclosed, the amount of funding was substantial. It was described as “game-changing” and one that “sets Lighthouse on course to become one of the U.K.’s top AAA studios.” In an interview with GamesIndustry.biz, Raeburn described the financing as purely financial and said it would allow the studio to chart its own creative direction. The studio is currently working on an unannounced IP. It is unknown whether the title will be in the racing genre, considering Raeburn’s four decades of experience spans time at Codemasters, where he led the production of the DiRT, GRID, and F1 series, and at Playground Games, where he created the Forza Horizon franchise.

- Atari made a minority investment into Playmaji, the American company behind retro gaming console Polymega. The console can play discs and cartridges from a number of platforms, including PlayStation, Sega Saturn, NES, SNES, and Nintendo 64. The new investment and partnership will see Atari bring hardware and software integration with the Atari VCS to Playmaji. It also includes functionality with the Polymega App, an emulator which can play, install, and manage legacy games from physical media on various devices.

- CoolGames was acquired by Keesing Media Group, the leading European publisher of puzzle print magazines. CoolGames is a web developer of HTML5 casual games, which includes publishing to platforms such as Facebook Play and Google GameSnacks. In addition to developing its own IP, many CoolGames titles are based around licensed content, such as last year’s Battleship game on Snapchat based on the Hasbro IP. Both companies are headquartered in Amsterdam. The CoolGames team of more than 40 employees will continue to operate independently under the new ownership.

Notable Studio Updates & Partnerships

- Sega is scaling back plans for blockchain games. In an interview with Bloomberg News, COO Shuji Utsumi said that all internally developed titles using the technology were shelved due to the “boring” nature of play-to-earn games. External partners will still be allowed to use characters from smaller franchises for web3 applications like NFTs. Utsumi was asked whether Sega’s upcoming “Super Game,” which it hopes to release by March 2026, will include blockchain elements. He said the company remained open to the idea, but the inclusion of blockchain would be contingent on the technology’s further development.

- Tokyo Broadcasting System Television (TBS Television), one of Tokyo’s five private broadcasters, announced the creation of TBS Games. This new division marks a “full-scale entry” into the games business, according to the press release. The company aims to enter many gaming markets by 2030 including “consumer, mobile, PC, arcade, card, board games.” Some of TBS Television’s programming has already been adapted into video games via external developers, such as Ultraman and Sasuke (Ninja Warrior).

- IO Interactive, best known for developing the Hitman series, opened a new studio in Brighton, U.K. This is the video game developer’s fifth studio, adding to the existing ones in Malmö, Barcelona, Istanbul, and its headquarters in Copenhagen. IOI Brighton will collaborate with the rest of the network in developing the studio’s upcoming Project 007, which will be a James Bond origin story.