Hi everyone — welcome to another issue of Naavik Digest. In the event you missed last week’s major announcement, we’re thrilled to finally launch the Open Gaming Research Initiative. If you've followed Naavik for a while, you know we work hard to publish great, free content for the games industry every week. What this launch does is take our free content efforts to the next level.

In addition to our new publishing cadence of four Naavik Digest issues per week, we’re excited to expand our content to include more games industry analysis in collaboration with outstanding creators and keystone gaming brands. Whereas most great research is either paywalled, siloed, or scattered, everything we do is going to be free, enormously collaborative, and all in one spot.

We're lucky to have an amazing community of creators who are not just experts in their fields — as executives, game designers, investors, and more — but passionate about learning in public. The team has grown at a mind-boggling pace over the past couple of years, and we're gearing up for higher-quality output than ever before.

Now onto today's issue. In the last Naavik Digest, we discussed whether Valve’s policy change regarding generative AI in Steam games was too restrictive. Today, we’re exploring how top publishers are approaching indie games and discussing both what's changing in the market and where it’s headed in the future.

How a Master Investor Breaks the Rules & Gamifies Life

David Gardner, co-founder and co-chairman of The Motley Fool, is not just a legendary investor, but he has also pulled off something special: successfully embedding game design into his life and business. In this episode, Naavik co-founder Aaron Bush joins David to ask how gamification can level up anyone’s life or business. They also discuss how David’s “Rule Breaker Investing” principles can apply to the games industry, why conscious capitalism deserves more attention, and end with a fun game of Buy, Sell, or Hold. If you are at all interested in investing, building companies, and leveraging game design, this episode is a must-listen.

This episode is brought to you by Dive! Dive is a fully outsourced BI-as-a-Service solution that provides an enterprise-grade data platform and services for gaming studios on all platforms. It also saves studios hundreds of thousands of dollars yearly. To learn more, check out Dive’s offerings here.

As always, you can find the Naavik Gaming Podcast on YouTube, Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

What Do Big Publishers Want with Indies?

By Carson Taylor / Naavik Contributor

Indie games are increasingly important businesses to some of gaming’s largest companies. Newzoo estimates the indie market pulls in $2 billion in revenue ($1 billion of which comes from PC gaming) annually, and the market is growing at a 7% CAGR. While indie games have always been a creative keystone within the wider gaming industry — especially since third-party game engines like Unity made game development much more accessible for small teams — the market has grown into a sizable financial opportunity over the past decade.

As it has matured, the indie scene has gone through enormous changes, both positive and negative. On the negative side, discoverability has become a major concern for indies as the barriers to entry (both in terms of development and digital distribution through Steam and other marketplaces) has continued to fall. This so-called “indiepocalypse” has been an ongoing challenge since at least 2015 and has continued through the present day.

However, there has been a great deal of positive change too, notably the increasing efforts large companies are making to support indie developers. Platforms like Xbox and publishers like EA have been taking indie games seriously for years, and their involvement in the space is only growing. In general, while each of these companies may prioritize different objectives when engaging with indies, there are five core strategic themes running through all these businesses:

- The publishers form relationships with top independent development talent, which they sometimes invest in or acquire.

- Independent developers stimulate innovation, bring new ideas, and employ diverse business models outside of the big publishers’ sports and live-service titles.

- Indie labels expose publishers to meaningful revenue potential, especially in genres and formats in which they typically don’t compete.

- Indie games help big companies build a more diverse content library, attracting and retaining more players, which is especially important when that content is monetized through subscriptions or an exclusive storefront.

- Indie studios benefit publishers’ IP strategies by creating new IP and even breathing fresh life into legacy IP.

In the future, the intersection of indie games and the industry’s largest corporations will continue to deepen. Big companies seek what indies provide for the reasons listed above, while indies benefit from the deep financing and marketing resources that often make the difference between success and failure in such a crowded market. However, this relationship will continue to evolve as big publishers’ interests change and the diversity of publishing options for indies grows. This piece will explore in more detail how top publishers are approaching indies and discuss both what's changing in the market and where it’s headed in the future.

EA Originals

As the creative and financial output of indie gaming have grown over the past decade, larger companies have pursued a variety of approaches in building relationships with indies, such as offering publicity, unique funding structures, and traditional publishing. The current crop of such offerings, best demonstrated by EA Originals, Take-Two’s Private Division, and the Square Enix Collective, all emerged in the mid-2010s to formalize their parent companies’ indie partnerships. These units donned a less corporate, more indie-friendly branding by taking on the look and feel of proper indie “labels.”

EA began its indie journey with the release of Unravel in 2015 and formally announced the creation of its dedicated indie publishing initiative, EA Originals, in 2016. The label provided an incredibly generous deal to its developers: EA published and marketed the studios’ games, and gave all profit back to the developer after recouping costs. Even despite not directly profiting, EA still receives a number of benefits from the program.

Matt Bilbey, the longtime EA exec who launched the label (and who has since joined London Venture Partners), described how Originals helps connect EA with new developers and unique concepts. Many at EA also noted the program’s genuinely altruistic nature, with the intent to “support more and more of these studios and bring their vision to a world stage, helping them develop the best possible game they can with resources and facilities that they wouldn’t typically have access to,” as head of EA Partners John Gamon described. EA Originals also helped alleviate its parent company’s public reputation as greedy corporate “bad guys,” both within the industry and among its consumers.

But there has also been a less-highlighted, but perhaps increasingly important, rationale for EA Originals: helping to meaningfully grow and sustain the company’s distribution business by developing a diverse content library. At the time EA Originals launched, EA’s PC games were mostly exclusive to its desktop launcher Origin. The exclusivity of interesting indie games like Unravel, beyond EA’s typical sports and shooter fare, helped attract and retain players to the service and as a result brought more attention to other EA titles. Origin has since been rebranded and is no longer EA’s exclusive PC distribution channel, but the EA Play subscription service and EA’s PC launcher both benefit from a diverse content library in which Originals plays a key role. The same philosophy also applies to Microsoft’s ID@Xbox and Sony’s PlayStation Indies programs to bring independent games to their competing platforms and services.

EA Originals has seen a number of high-profile successes. Hazelight’s It Takes Two was one of the most beloved games of 2021, selling over 10 million copies as of February 2023 and winning Game of the Year at the 2021 Game Awards. Unravel, from Coldwood Interactive, and Hazelight’s first game, A Way Out, have also been critical and commercial hits. Some of these outperforming studios are even now “graduating” into more traditional publishing contracts with EA outside of the Originals label.

With years of experience, an established reputation, and a number of successes under its belt, EA Originals is expanding its purview, as Gamon put it recently. “We are moving away from niche… We've discovered a desire for bigger, better and more innovative titles that complement the EA portfolio,” he told Gamesindustry.biz earlier this year. As Originals’ titles get bigger, they become less traditionally indie — in fact, the label’s latest title Wild Hearts is actually a partnership with publicly-traded KOEI Tecmo.

The label has also encountered new challenges as it’s taken on more complex projects and its ambitions have grown. Velan Studios’ Knockout City started as an EA Originals-published paid game, but Velan later shifted to a free-to-play model and, as a result, left its contract with EA to self-publish. But despite the business model pivot, Velan announced the game would shut down in February 2023 due to fierce competition in the live services market.

Take-Two’s Private Division & Square Enix Collective

Take-Two’s indie label, Private Division, which launched in 2017, has pursued a different strategy by focusing from the beginning on larger-scale games from mid-size independent developers with proven track records producing AAA titles. Take-Two exec Michael Worosz said this would provide the label with an untapped talent pool it could leverage. Like EA Originals, Private Division allows independent studios to retain control of the IP and maintain full creative license in developing their games. Yet the label steps in with the full force of Take-Two’s marketing power when it’s time to release a title.

Private Division also differs from EA’s approach in that it has directly facilitated some of Take-Two’s acquisitions since its inception. The company bought the rights to Kerbal Space Program from its independent developer Squad in 2017 and in 2022 purchased British indie studio Roll7. The label hasn’t shied away from profiting off game sales either.

Private Division has continued to expand in the years since launch after the successes of Kerbal Space Program, The Outer Worlds, and OlliOlli World. On its fifth anniversary, the label announced the new Private Division Development Fund to finance smaller games than its typical partners create (though those games will remain self-published and Take-Two does not take an ownership stake in the studio itself). It also moved upmarket into something as traditionally “non-indie” as licensed games, signing a deal with Unity-owned Wētā Workshop to publish a Lord of the Rings title. Most recently, it announced a deal to publish a new IP from Pokémon developer Game Freak.

While perhaps the most high profile, EA Originals and Private Division are by no means the only indie labels from big publishers. Square Enix announced its Collective initiative in 2013 with a decidedly unique structure: Indie studios would send pitch decks to Square, and then Square would run a weekly online poll for the public to vote on their favorite proposals (though Square had the ultimate say on which games to back).

Game teams were expected to finance themselves through crowdfunding, which Square helped to facilitate alongside providing marketing and PR services in exchange for 5% of revenues. Over time, the Collective adopted a more traditional financing and publishing role while also expanding into mobile and tackling larger projects. However, it has seen its share of recent challenges, with early partner Bulkhead Interactive backing out of their arrangement (despite Square Enix having bought a 20% stake in the studio) and expressing disappointment with the deal, while Collective creator Phil Elliott departed last year. Still, the label has a bona fide hit in PowerWash Simulator and big plans for the future.

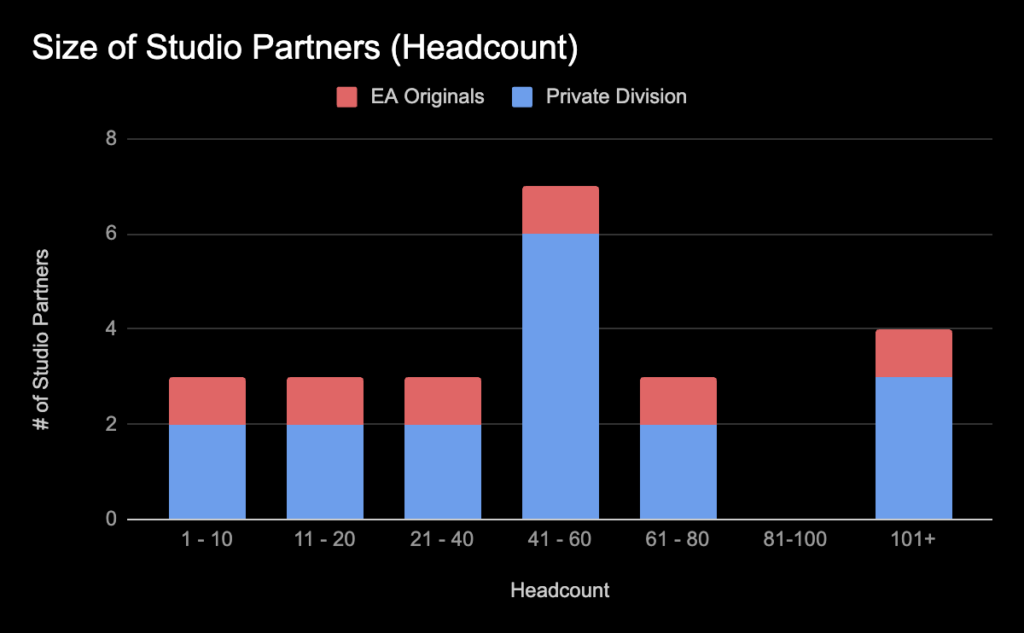

In each case, the indie labels of big publishers have evolved into the de facto means by which the publisher releases games from third-party studios of nearly any size or status. While indie games are often smaller in scope than AAA, that does not mean the titles published by the likes of EA Originals or Private Division are tiny — most of the independent studios that have published titles through these labels have 40-plus employees, and their games have budgets in the millions of dollars. ”Independent, not indie” is a good way to put it, and this trend of “triple-i” games seems to be where most of these labels are finding success and doubling down.

The larger teams receiving indie label backing underscores the publishers’ conviction that they have the unique ability to finance and market more ambitious titles to commercial success. “We think we have a financial ballast to make the development investments we need and ensure every game is successful with the right amount of marketing behind it,” Take-Two’s Worosz said.

The Future of Indie Games & AAA

These major publisher-owned labels have come about alongside other major changes to the way indie game publishing and financing functions. Over the past decade, a new crop of indie publishers — most prominently Annapurna Interactive and Devolver Digital — have established themselves. Meanwhile, crowdfunding has evolved beyond Kickstarter, venture capital has become increasingly viable, and the barriers to self-publishing have continued to decrease.

At the same time, companies like Microsoft, Sony, Tencent, NetEase, and Embracer have pursued more and more studio acquisitions to beef up their content portfolios and developer ecosystems. Interesting new models, such as influencer-led publishing and publishing collectives, are also taking root. The indie labels from the likes of Take-Two and EA fit into this dynamic new landscape by offering independent developers relatively high levels of non-equity project financing, creative control, and world-class publishing operations, all of which are attractive options among a widening variety of alternatives.

The intertwined critical and commercial importance of indie gaming to the AAA industry is only becoming more clear, even as indie publishing continues to evolve on its own. In the future, we should expect to see more publishers enter this space; a greater alignment of a publisher’s indie label with its broader content strategy; new entrants and incumbent restructuring; and a continued blurring of the lines between indie development, UGC, and modding.

Beyond EA, Take-Two, and Square Enix, other large companies are pursuing their own indie publishing efforts. Sega Europe launched its Sega Searchlight program in 2016, and Riot Games announced its Riot Forge third-party publishing arm in 2019. Indie publishing remains a tough business, however, even for large corporations: Private Division laid off staff recently, and Activision Blizzard’s resurrected Sierra label never quite took off. Embracer, acquirer of a number of previously independent studios, also announced major restructuring. Incumbent indie publishing leaders, and the VCs who prefer to back studios who self-publish, are also highly competitive players in an increasingly crowded market, even as there are more indie games than ever.

As content strategy and high-value IP become increasingly important to the leading gaming platforms and publishers, there will be more integration of publisher IP with indie games. This will go both ways: Top publishers will depend on indies to create exciting new IP that might then be turned into a franchise, while also giving independent studios access to established IP to create more unique content. Riot Forge was created to allow indies to expand the Runeterra universe, and Square Enix Collective began by making some of Square’s legacy IP available.

Meanwhile, Take-Two’s Private Division is following the former strategy. Worosz explains that indie games “plant the seeds for new intellectual property. The games industry, not unlike other parts of the entertainment industry, continues to have lots of sequels for its major franchises … initially good IP can kind of punch through, but it’s the sequel that has the larger economic windfall attached to it. We need to continue to plant the seeds of new IP and the way we can do that is to work with independent developers.”

All the while, the very definition of independent games is changing, as UGC and modding remove the barriers to game development in the same way Unity did a decade ago. Fortnite and Roblox are as likely to host the next indie hit (and in some ways, they already do) as Steam. As these hobbyist developers continue to professionalize and grow, they will start to resemble many of the independent PC and mobile studios of a prior generation. UGC publishing is still a nascent field, but its growth is likely to attract larger publishers over time, perhaps in a similar fashion to traditional indie games.

Enterprise-grade BI-as-a-Service Solution.

Dive is the only tailor-made, cross-platform, BI-as-a-Service provider for gaming studios. Dive’s outsourced data service and tools replace the need for a full in-house team, saving studios hundreds of thousands of dollars yearly.

Dive was founded by Elad Levy, an industry veteran, investor, and advisor, who sold his previous gaming company to Playtika and scaled it to a $1B valuation using the power of data.

Dive manages over 60M MAU of data from game studios, handling everything from the technical aspects of data to the analysis part:

- Designing, creating, and maintaining a Data Warehouse per studio

- Data ingestion from different sources (client, s2s, marketing networks, attribution providers, etc.)

- Normalizing, processing, and validating the data

- Visualization: creating easy-to-follow dashboards, and ad hoc analysis

- Segmentation of data for easy-to-use LiveOps events

We help analyze anything from game economy balance, retention, progression, ROAS, and other business KPIs to more complex analysis and prediction models. And we’ve built an enterprise-level LiveOps tool that enables our partners to take action on that data.

Interested in learning how Dive can unleash the power of data for your business?

Content Worth Consuming

Roblox’s generative AI has seen a ‘promising start’ but is only just beginning (Aaron Astle / PocketGamer.biz): “The prevalence of AI has only increased through 2023 thus far, from chatbots to generative artwork and even games development. Back in February, Roblox revealed its vision for generative AI in Roblox Studio, hoping the tech would empower everyone to become creators. We spoke with the head of Roblox Studio Stefano Corazza at the time about his vision for the future of Roblox with such technology. And now, with the system in play and the first results 'in' we caught up with him for an update.”

Why do games media layoffs keep happening? (Khee Hoon Chan / Gamesindustry.biz): “Layoffs are now endemic to the games media landscape and the broader journalism field, with many affected sites held together by a skeleton crew or operating with a masthead of newer writers. Just last month, Inverse laid off some members of its editorial team. In April, Waypoint, the games vertical from Vice Media, was unceremoniously shut down, alongside organisation-wide layoffs in the parent company. And prior to its shuttering was a brutal slashing of jobs across several publications, including The Washington Post's Launcher, Fanbyte, and websites under the Gamurs Group and Future plc media groups. One of the most common challenges many of the news teams faced, according to conversations with several affected journalists and editors, was the pressure to meet traffic and revenue metrics.”

The unfair lie that ruined demos (JB Oger / The Arcade Artificer): “Many game developers believe demos hurt sales, yet none can tell why. I can't remember the first time I heard this 'fact,' probably on a forum or during my game studies. All I know is that I just accepted it. It felt a bit sad because, like everyone, I grew up playing so many demos for games I never intended to buy. In a way, it felt like exploiting the system, feeding my insatiable hunger for fresh content while saving money for the bigger fishes. It's not worse than piracy, for sure, but it somehow didn't feel morally right. And that's probably why I easily accepted the idea that ‘demos hurt sales.’ But it was a lie. Or, at least, it was a claim made without strong supporting evidence. For this weird reason, what was a staple of video game marketing faded out for years. To this day, some developers keep believing that demos negatively impact games, even when current-day data says otherwise.”

Unity's AI dreams (Stephen Totilo / Axios): “New artificial intelligence tools promoted by tech giant Unity will help game developers, not put them out of work, the company’s CEO, John Riccitiello, tells Axios. ‘Some companies will try to make the same game with less to save money,’ Riccitiello says, acknowledging that AI tools could compel some companies to cut staff. ‘And other companies are going to try to make a better game with the same or more, now that they’ve got so much more power … My guess is that camp two wins.’”

Featured Jobs

- Coda Payments: Managing Director, Publisher Partnerships (Los Angeles, U.S. / Hybrid)

- FunPlus: Senior Community Manager (Barcelona, Spain / Remote)

- LILA Games: Lead Gameplay Engineer (Remote)

- MY.GAMES: Game Designer (Remote)

- Nexus: Head of Sales (Remote)

- Supersocial: Game Designer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.