Top News

#1: NFT Marketplace Ethical Lines Get Blurred

The war between OpenSea and the swelling wave of up-and-coming NFT marketplaces took a dramatic turn last week when rival Blur went live with its hotly anticipated $BLUR token.

A new and ambitious entrant in the NFT marketplace scene, Blur had already begun to overtake market leader OpenSea in volume back in December, after Blur said it would not enforce creator royalties in what the crypto community has been calling a “race to the bottom” to attract NFT buyers by reducing the cut of money they pay out to creators with each sale. But the launch of $BLUR kicked the competition into high gear.

OpenSea, having gone back and forth regarding the creator royalty debate, decided to maintain the fees using its Operator Filter system, a tool designed to blacklist competitors that decided not to enforce royalties on their own platforms. But in retaliation, Blur was able to use OpenSea’s Seaport protocol to bypass the filter and continue stealing market share by attracting the flip-heavy NFT traders that have composed a growing majority of Blur’s target audience.

With traders constantly looking for a price edge for flipping profit, Blur has begun to emerge as a clear favorite, especially since it provides other benefits like lower fees and an Ethereum-based liquidity pool system instead of forcing, as OpenSea does, the use of Wrapped Ethereum (WETH). Blur also acts as an aggregator and a marketplace, which makes it an attractive option for traders looking for an edge.

The release of $BLUR coincided with three airdrops of the token, referred to as “Care Packages,” that targeted different types of activity. The first airdrop was more of a vampire attack on OpenSea and other competitors, in that it rewarded Ethereum NFT traders who used other marketplaces for six months prior to Blur’s launch in October, although this list was filtered to prevent rewarding wash trades (a tactic in which traders exchange NFTs back and forth to artificially increase trading volume). Judging by the huge shift in volume from OpenSea to Blur, this attack clearly worked in the short term.

The second airdrop was for Blur early adopters who had listed an NFT before December 6th, while the third was for users who had placed bids on Blur after bidding went live. These tokens were quickly dumped on the market from heavy traders, some of whom bragged about the easy money, in turn driving viral interest in the platform. As you’d expect, this selling pressure quickly tanked the token from around $5 to around $1. Yet the promise of tangible rewards from transacting on Blur drove volume and helped the platform steal away even more market share from OpenSea.

This flurry of activity eventually forced a reaction from OpenSea, which just three days later announced a series of changes responding to Blur’s heightened competition. Conceding that traders and total volume now take priority over creators, OpenSea announced a promotional 0% marketplace fee (down from the usual 2.5%), reduced royalties to a 0.5% minimum for NFTs without on-chain enforcement, and said it would no longer ban marketplaces that were engaging in royalty reductions (in other words Blur).

Dropping royalties close to zero, effectively making them optional on the part of the buyers, punched a hole in OpenSea’s public creator-friendly stance, as it now seems competition with platforms like Blur is proving too fierce to ignore. It’s worth noting that OpenSea has little say about on-chain enforcement other than to simply not allow the NFTs on its platform, which makes the competitive stance all the more clear. It’s also worth paying attention to the details of the 0% marketplace fee, which is for an indeterminate promotional time only and has some important exceptions. The most notable of those is that the 0% fee will only apply to the most popular collections; OpenSea will still charge a 0.5% fee on collections trading below a certain undisclosed threshold or those with no royalty fees as a way to combat wash trading.

According to an analysis from Dune Analytics, OpenSea has a very low 2% in wash trading, while with Blur, it potentially runs as high as 12%. While a pretty big difference, these are both low compared to other competing platforms like LooksRare (95%) and X2Y2 (85%), thanks to incentivized trading systems. Blur is actively making sure its token rewards are set up to avoid incentivizing wash trading by focusing on providing liquidity. In this way, Blur incentivizes a game of chicken in which traders are rewarded for providing bids closest to the floor price for a collection without the sale actually happening, something Blur refers to as “risk.”

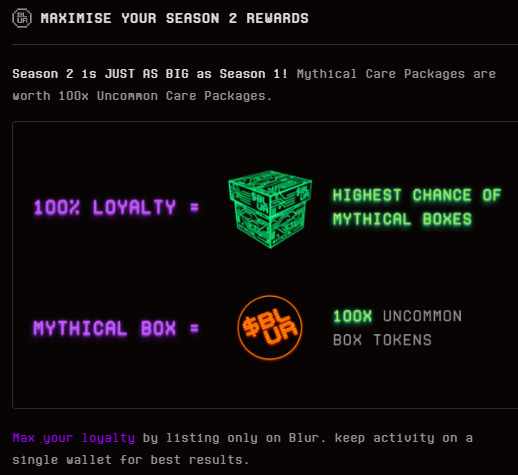

The problem with this system is how easily it can punish inexperienced traders hoping to farm airdrops; these types of traders, under Blur’s current system, are vulnerable to getting crushed by whale traders floor sweeping to pump prices before dumping on all the risk takers. There was also a three-hour cooldown on NFTs before they could be re-traded, a limit that was reduced to one hour to increase liquidity. Blur is purposely leaving out details of exactly how all these airdrops will work for what it’s calling “Season 2” and focusing on bidding and listing activity of popular collections and catering to users who display “loyalty” to the platform.

The loyalty part is where Blur is taking market competition to the next level by offering higher rewards to traders who list exclusively on Blur, even providing a tool to automatically delist NFTs from third-party marketplaces. Some traders worked around this by simply separating trading wallets, but Blur still clearly used this mechanism to lob shots at OpenSea. Blur’s scheme and its apparent success has led some in the crypto community to call on OpenSea to launch a token reward system of its own to compete, though given the heightened regulatory attention on OpenSea, that remains an unlikely prospect for now.

All of this begs the question: how is any of this sustainable? If traders are making a profit off selling $BLUR, who are the buyers and why are forking over ever-higher prices? There’s a tendency in crypto for many to treat tokens as currency based on exchange prices and market cap, but as with many assets, realizing any profit requires exchanging something with more concrete value. In order to make that happen, there either needs to be an automated market maker or a buyer as the counterparty.

The primary problem $BLUR faces right now is its lack of utility. Without a future use case, all purchase activity around the token is purely speculative. Blur’s founder, who until this week went by the pseudonym “Pacman” but revealed his identity to be that of 24-year-old Tieshun Roquerre, said his intention is turn $BLUR into a governance token as the platform becomes more decentralized. Many are interpreting Roquerre’s vision as a promise to somehow share wealth generated by the token and marketplace with owners.

But the other speculative reason to buy the token is of course to try and flip it for a profit. Realistically, this speculative valuation does not bode well for the long-term viability of $BLUR, as the more traders realize profit the more the incentive will likely decrease either through competition exceeding returns or the fees that provide the profits creating excess trade friction. In chasing after airdrop “points,” there is the possibility traders lose significant amounts on bad trades.

While it’s too early to confidently speculate on Blur’s eventual fate, the marketplace’s incentive system, like many other P2E-style moves, is a short term competitive play at best — and look at how that approach turned out for LooksRare.

The last element of the OpenSea and Blur feud worth focusing on is that all of this marketplace competition — high volumes, liquidity, floor prices, and more — will likely culminate in an unsustainable art trading market. While there are some buyers of NFTs that are in love with the art and true believers in the projects for one reason or another, the prices at which these collections trade practically guarantees only wealthier collectors will participate in the long term.

A majority of the activity around non-game NFTs is exactly what Blur is targeting: traders simply hoping to flip tokens for a profit to someone else who’s likely hoping to do the same thing down the line. That mentality made sense in an economic environment flush with cash and a crypto community riding high on hype and record cryptocurrency prices. But as the market tightens, NFT buyers will start to demand more practical utility from their tokens. This bodes well for gaming NFTs — many of the most prominent of them provide tangible, in-game utility and more than just online social status, although that will still undoubtedly play a role.

It’s uncertain right now what role game NFTs will end up playing in the marketplace. Some may act more as commodity goods that make sense to be traded for profit and others provide unique utility, where determining prices is difficult at best without relying on mismatched concepts like floor prices. One thing is clear for the future of game NFTs: if the business model relies on royalties, they need to be enforced on-chain as marketplace competition has already started driving optional royalties headed toward zero.

#2: YGG Yields a Fresh Raise

Yield Guild Games (YGG) surprised onlookers earlier this month by pulling in $13.8 million in YGG token sales led by DWF Labs with notable participation from Andreessen Horowitz as well. That's despite the industry’s shift of late away from play-to-earn and guilds in general.

The raise will help YGG develop its forthcoming soul-bound token (SBT) reputation system, which is expected to debut in March. The raise also helps support YGG’s Guild Advancement Program Season 3, the next iteration of the guild’s achievement-driven community token distribution protocol. Additionally, YGG raised a $75 million venture fund this week to help support web3 gaming by investing in other early stage token deals, which should help support its guild game partner model and act as a source of potential fund management revenue.

The plans for YGG’s SBT’s aren’t fully available, but based on statements made by founder Gabby Dizon we do have a basic idea of its intended use. Dizon believes that despite the default anonymity of web3, identity and reputation will be central to web3 gaming’s future. With so many different economic parties participating in web3 gaming, each with their own incentives and motivations, it will become important for blockchain gaming companies to vet gamers’ reputations.

Ever since the advent of Xbox Live and the arrival of Gamer Tags, many have referenced this type of online identity system as an important status and validation element in the world of online gaming. Attempts to replicate the system in mobile gaming haven’t taken off, despite Apple and Google building custom gaming profiles and achievement systems into their respective operating systems. Sony managed to create a Gamer Tag competitor in the form of PlayStation Plus profiles, and more recently Sony has even hinted at dabbling in web3 technology by launching digital collectibles and through recently unearthed NFT patents.

The key element of YGG’s push is the idea of reputation being so-called “soulbound,” or in other words untransferable and tied to the wallet of the participant. With web3 games already struggling to properly equate wallets with players, soulbound reputation systems and their accompanying tokens (SBTs) could have a major impact on player tracking if properly deployed. The system certainly doesn’t prevent playing games using multiple wallets, but it does potentially tie reputation and progress elements to a single account, in essence preventing the exchange of that particular resource between wallets.

There are different ways to handle strengthening the wallet bond such as reputational progress that gates access, perk systems, whitelisting, and different reward locking mechanisms. YGG has already stated that it intends to integrate the SBTs in some way into partner games, of which there are a continuously growing number. YGG’s investment in partner games varies from direct investment to simply owning a number of NFTs for its members. It’s unlikely YGG can dictate partner integration, but considering the benefits for game developers around understanding and vetting players, it makes sense for many of them to see it as an opportunity.

The distribution of these SBTs is likely going to be closely tied to YGG’s Guild Advancement Program (GAP) systems. Currently the GAP system is a way to distribute some of the many YGG tokens to guild members based on specific activities in partner games, referred to as “quests.” The goal is to incentivize activity in partner games both to utilize the NFTs purchased, but also as a way for partner games to drive activity with tokens based on utility instead of financial rewards.

Of course, YGG tokens can still be sold, though the price plummeted at the start of 2022 from an all-time high of around $10 the year prior to between $0.20 to $0.40. YGG offers a number of different DAO-related programs for staking the token that include other token rewards as well as access to member exclusives and DAO voting.

There are also other ways to earn YGG tokens such as tournaments, community participation, and content creation, but the GAP system provides an easy-to-understand backbone for acquisition, especially among YGG’s play-to-earn-minded player base. With GAP Season 3 launching before the release of SBT’s, any integration may have to wait until Season 4, but YGG will no doubt find other ways to test reputational earning and tracking before that happens.

As it stands, play-to-earn gamers have earned a reputation for being mercenary in their earnings-centric game loyalty. But a well-aligned reputational system could help shift the overall mentality toward “good” or “quality” players that are more desirable to developers and web3 user acquisition strategies.

The big challenge for YGG going forward is how to escape the bubble economy early P2E titles like Axie Infinity kicked off. YGG has tried with some success to build a community layer on top of the enthusiasm, especially in localized regional SubDAO’s in Asia and South America where web3 has a strong foothold. One area that has seen success around player achievement is esports, with strong showings from YGG members in Axie Infinity and Splinterlands tournaments for example. Many of the early games YGG partnered with, however, including those above mentioned titles, are still trying to dig themselves out of the inflationary P2E economic models they built and evolve toward a more competitive earning scheme for highly engaged and dedicated players rather than low-level grinders.

The benefit of a YGG partnership for these games is enhanced social visibility through the guild model, competitions, and incentivized content creation. This is not to say all games partnered with YGG rely on an older model; there are plenty of unreleased games including MetalCore, Bigtime, Phantom Galaxies, Illuvium, and even the mysterious DigiDaigaku that could prove successful with help from YGG’s motivated community.

Given the $13.8 million just received in the current investment climate, it’s clear that at least some investors have faith that YGG is adapting to the new environment through innovations like SBT reputation systems. Whether the price of YGG tokens can recover or at least maintain the current value is difficult to say, especially if the current bear market continues for some time. But hopefully the community ties are stronger than the token prices.

Upcoming Game Announcements

- Champions Ascension announced an update to be playable wallet-free (Link)

- Cyber Stadium, from the Crypto Raiders developers, revealed its unique closed loop on-chain mechanics (Link)

- Chainmonsters, the most noteworthy upcoming game for the Flow blockchain, announced a move to Immutable (Link)

- Nekoverse launched earning rewards for its testnet alpha (Link)

- Chronos: Dawn of Time, a side-scrolling ARPG, launched a beta on Elixir (Link)

- Heroes of Mavia announced it will be giving NFT land owners access on June 30th (Link)

- Derby Stars released guidelines for its early access release (Link)

- Monster Galaxy revealed updated tokenomics for its MOGA token (Link)

- Cradles, an MMORPG, announced a two-week open beta starting March 15th (Link)

Live Game Announcements

- Aavegotchi launched its new The Forge crafting system (Link)

- Axie Infinity launched Alpha Season 1 of its Homeland game for land owners (Link)

- Era7 released the details for its upcoming Challenger League S1 tournament (Link)

- Crazy Defense Heroes announced a Tower League loyalty program (Link)

- Omega Royale launched its Meadow Mayhem competition (Link)

Funding Announcements

- Azra Games raised $10 million for its upcoming Legions and Legends game led by a16z (Link)

- Strider raised $5.5 million for its story focused gaming platform led by Makers Fund and Fabric Ventures (Link)

- Empires Not Vampires raised $1 million or Paradise Tycoon in a seed round led by Shima Capital (Link)

- Nefta raised $5M at a valuation of $32.5 million in a seed round led by Play Ventures (Link)

Ecosystem Updates

- Dapper Labs announced plans to move towards NBA Top Shot purchasing on mobile (Link)

- Open Loot announced a partnership with LowKick Games for its WorldShards sandbox RPG (Link)

- Loco, an Indian game streaming platform, announced a partnership with Avalanche for web3 fan experiences on an Avalanche subnet (Link)

- Layerswap launched on Immutable to allow easier transfer of $USDC, $ETH and $IMX from CEX’s. (Link)

- KnownOrigin released easy to use and customized Creator smart contracts (Link)

- Neal Mohan who recently took over the role of YouTube CEO has expressed pro-web3 views (Link)

- SoftBank announced a partnership with Oasys to join the growing pool of validators (Link)

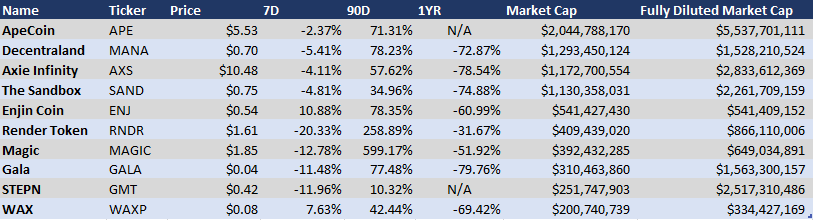

Notable Market Moves

- Enjin Coin was the overall winner this week thanks to a strong development update showing some recent progress for the ecosystem. It also gave away a free NFT to celebrate Valentine’s Day.

- WAX, as one of the few web3 ecosystems that doesn’t require a wallet plugin, also had a strong showing thanks to an announced upgrade to its cloud wallet system to make token management easier.

- Render and Magic finally saw some decent correction following recent growth, but no worse than most others tokens, which allowed both to remain largely in the weekly chart.

- ApeCoin actually fared the best of all the tokens in the red, despite the fact that it unlocked more tokens on the 17th. The drop happened at roughly the same time as other tokens, meaning the unlock had little negative on the token, and the token managed a midweek recovery with a smaller dip than others.

- As usual, we recommend a long-term outlook. This week was a bit more negative than some of the more recent really strong weeks for most of the tokens. As most tokens still follow the general price movements of Bitcoin and Ethereum, it’s always a good idea to keep an idea on those two to get an idea of general crypto movements, with exceptions around specific events or positive news. Outlier significant growth can be the start of a positive trend or simply a correction yet to happen, so a long view is best.

Content Worth Consuming

- 2023 Predictions for Blockchain Games (Deconstructor of Fun) - “Of course, F2O is not a benevolent act from well-funded games trying to give it back to the community. One of the biggest problems of blockchain games is not reaching a mass audience efficiently. Those games are trying to acquire users through free mints, taking a page out of the F2P playbook. However, if blockchain games want to be relevant in a scale that matters, they need to take the front page out of that book: existing in mobile devices. The mobile gaming market is estimated to be around 3 billion, which sounds like a dream to blockchain game developers. Existing in mobile devices means that your game will be accessible to those 3 billion players. It will make life much easier for blockchain game developers as they will be able to test their games much more efficiently while acquiring users way cheaper compared to now.” (Link)

- NFT Annual Report 2023 (NFT GO) - “Like all blockchain assets, NFTs with asset attributes have enabled many projects to thrive over the past year such as NFT marketplaces, aggregators, automatic market makers (AMM), liquidity providers, etc. The huge demand for NFT transactions over the past year has made NFT marketplaces in demand, with OpenSea one of the biggest gainers. It has also led to more NFT marketplaces and aggregators competing against one another to get a slice of the pie. At the same time, the NFT financial track has focused on liquidity and asset utilization, giving rise to NFT fractionalization and NFT lending. From NFTX and Unicly to BendDAO, such projects have battled demand depletion due to the bull-bear transition, which has also caused other projects that survived this market shift to re-examine their business model.” (Link)

- Designing Web3 Game Economies: A Delicate Balance (Game7 Conference) - “Web3 games have raised the stakes in the process of creating and maintaining game economies, with a poor design having the potential to sink a great game. Delphi Digital Game Economist, Ryan Foo; Naavik Writer, Devin Becker; Economics Design Consultant, Kiefer Zang; and Deconstructor of Fun Contributor, Eric Kress share practical strategies for designing or assessing game economies for success.” (Link)

- Web3 Gaming Token Economy (Shima Capital) - “Once a game establishes currencies and understands resources, it’s time to identify sources and sinks. Sources include coins earned in levels, periodic rewards, or prizes for completing events. On the other hand, sinks include using coins to refill lives, buy boosters, or obtain extra moves to finish a level. Keep in mind that the way a game spreads rewards and resources across different sources impacts player experience, and that an optimized game economy will have the sum of sources balanced with the sum of sinks.” (Link)

- Bringing Web3 Games to Mobile (Naavik Gaming Podcast) - “Over the past 15 years, mobile gaming has grown to be the predominant form factor for gamers, generating over two thirds of global gaming revenues, and an even bigger share of player activity. But when it comes to web3 games — games that integrate NFTs, digital ownership and tokenized economies — they still almost exclusively exist outside the mobile app stores. Why is that? To better understand what the mobile options are for game developers, your host Niko Vuori talks with Anil Das-Gupta (who has recently shipped a mobile game with NFT integration into the Apple App and Google Play Stores), Benas Baltramiejunas (who is in the process of shipping a mobile game with NFT integration into the Apple App and Google Play Stores) and Chris Akhavan (who recently joined top NFT marketplace Magic Eden to help Web3 game developers integrate blockchain technologies and reach more players).” (Link)

A big thanks to Devin Becker for writing this update! If Naavik can be of help as you build or fund games, please reach out.