Hi Everyone. Welcome back to another issue. Quick note: now would be a great time to join the Naavik Discord server! If you'd like to engage in rich discussions with some of the sharpest minds across the gaming industry, we’d love to have you come join us!

Naavik Exclusive: Roundtable #21

This week, Aaron Bush, and Abhimanyu Kumar join Nico to discuss:

-

The current state of Loot, the popular NFT project

-

NFT Galleries (check out Nico’s)

-

Founder-led gaming companies

As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: FaZe Clan Is Going Public At A $1 Billion Valuation

Source: WSJ

FaZe Clan, the popular esports and entertainment company, is officially planning to go public via a SPAC. Not only will it rock the ticker symbol $FAZE, but it’s looking to support a $1 billion dollar price tag. The implications behind the move are massive, but the company’s financial profile leaves me skeptical about where it plans to go from here. Let’s dig in deeper.

For the better part of the last year, I’ve been thoroughly convinced that creators are going to play an increasingly important role in shaping the future of the games industry. The speed at which these content-centric companies can create culturally relevant moments and then monetize them through merchandising or partnerships isn’t something that a standard publisher can match. The cultural currency that these brands collectively command is often enough to make or break entire games or companies at their discretion.

The issue, however, with content-driven companies like FaZe Clan, is the natural scalability constraints of content production. One person can only edit so many videos, record so many podcasts, or write so many newsletters without the business having to increasingly pour more money into making bigger and better content or hiring more people to increase the rate of production. These constraints limit overall output, which therefore limits the financial growth and potential upside of a business like FaZe. Profitable scalability must also come from additional diverse sources.

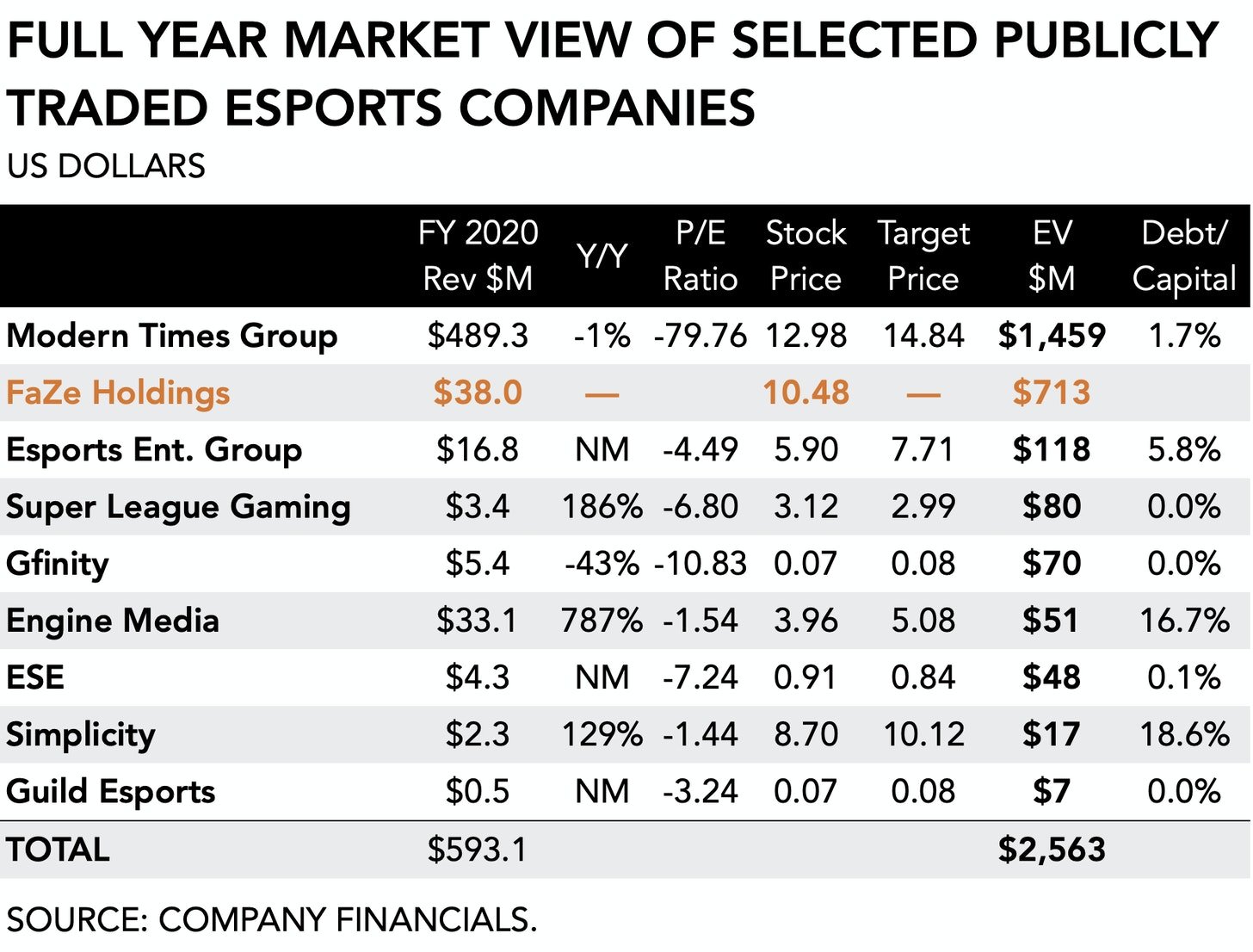

Unfortunately, being a publicly traded esports company to date has typically not been a profitable venture, and most companies like FaZe have struggled to create diverse, scalable revenue streams. As Joost Van Dreunen pointed out in his excellent breakdown of FaZe’s public offering, most esports / content companies fairly universally remain unprofitable and support negative P/E ratios as a result.

Source: SuperJoost

The truth behind the numbers is that most of these businesses have yet to find revenue streams that are substantive and consistent enough to offset the value that content (read: brand deals + sponsorships) can bring. Esports presents opportunity, but it’s difficult to forecast substantive revenue based on teams of consistently rotating players playing games with constantly changes metas. Even with more stable league-based structures like the Call of Duty League (CDL) popping up, we’re still very much in the early days of gaming “leagues” and even further away from teams like FaZe receiving the kind of consistent advertising or media deals that teams in leagues like the NFL or NBA receive.

While FaZe doesn’t need to replace content completely, it does need to have other revenue sources that can rival it in the case of another “adpocalypse.” For context, in 2020 brand sponsorships and content production made up $29 million of the company’s $38 million in revenue (76%), merchandise contributed $7 million (18%), and esports earnings of $3 million (8%) made up the remainder. And, of course, the margin profiles between these business lines ranges quite a bit. On paper, having four multi-million dollar revenues streams is certainly nothing to scoff at, but it’s likely not enough to justify a $1 billion valuation.

FaZe knows this, which is why they referenced multiple new — and theoretically more stable — revenue streams in a recent 8K filing. Most notably, FaZe mentioned building a “metaverse” via NFTs and expanding its offerings through M&A. However, NFTs are a pretty nascent industry, and M&A comes with its own host of complexities and risks. It feels somewhat premature to denote that either will become the second or third biggest revenue generators for the company, and it’s even more premature to assign a ten-digit valuation to a low-margin company that’s betting the house on a set of offerings that are still in their earliest innings.

That said, if anyone can figure it out it will be FaZe Clan. The company already reinvented itself from a small group of Call of Duty trickshotters into a publicly traded company, and it managed to amass an incredibly dedicated fan base in the process. The fact that being a FaZe fan is more “lifestyle” than it is a fandom means that if the company actually can bring exciting new business models to market outside of content, it won’t have to look very far to find a rabid group of consumers ready to spend money on it. It just remains to be seen what exactly that big new moneymaker will be, how much it can scale, and therefore how much it can really help FaZe become a unicorn. (Written by Max Lowenthal)

#2: Piepacker Raises $12M to Grow Instant Games

Source: ScreenRant

Despite the sunsetting of the Flash standard earlier this year, the world of instant games continues to live on. In fact, it’s garnering renewed interest from investors and players alike for its ease of use, instant shareability, and low barriers to entry. This is why the recent Series A raised by instant games platform Piepacker caught my eye.

Launched in 2020, Piepacker is a browser-based platform that brings together online multiplayer retro gaming with video chat. The company quickly gained a following after emerging from Y Combinator, and it has continued to add a host of interesting features, including controller support, AR filters, and the ability for players to import their own retro games into the Piepacker platform. The recent $12M Series A — led by Lego Ventures with support from Makers Fund, V13 Interest, and others — will fuel the company’s expansion onto new devices and into new territories.

Where Piepacker differs from other venture-backed instant games companies is in its focus on retro games and the emulator community. In a LinkedIn post last year, cofounder and CEO Benjamin Devienne alluded to this as a founding ethos for his company:

Source: LinkedIn

While I have not seen any sources for that statistic and certainly question it (for example, most retro games come in packaged files by the thousand, potentially leading to overstated demand numbers), Devienne does make an interesting point. By targeting a specific niche, Piepacker is able to differentiate itself from other instant games companies focusing on largely interchangeable casual or hypercasual titles. Interestingly, one of Piepacker’s advisors is Justin Waldron, co-founder of both Zynga (itself a beneficiary of early Flash game development) and recent instant games venture darling Playco.

The combination of retro games and a “low tech-friendly” platform (as Devienne describes it) makes a lot of sense. There may be an audience here for parents sharing game experiences from the past with their children, for example, or for players who don’t own modern consoles but may have owned retro consoles previously. Piepacker has several titles that readers of a certain age may recognize, such as the Worms and Earthworm Jim franchises, spanning multiple genres (sports, racing, fighting games, platformers, etc.).

Furthermore, an underappreciated benefit to the “retro” moniker is that it has no set definition or cut-off date. Just as “classic rock” has slowly crept its way forward to encompass the grunge and alt-rock bands of the 90s, so too will “retro gaming” eventually encompass beloved platforms like the Nintendo 64 and PlayStations 1, 2, and 3. This seems like a reasonable path forward for Piepacker as its technological capabilities improve; in fact, Piepacker supports several PS1 games already.

On the other hand, Piepacker is a licensee and therefore must pay for the privilege to use these retro games. While the cost to do so for little-known games like Top Racer or Night Slashers is probably negligible, it is likely a different story when considering better-known IPs with more established audiences. Since this may not be a scalable solution over the long run, Piepacker has also sought to create its own “exclusive original retro games,” in addition to exploring other broadly appealing genres such as card and board games.

The other major area that the company has focused on is supplementary social experiences, with features like video chat, AR filters, and more. While these add-ons are novel by games platform standards, they may actually be seen as table stakes when considering the competition in the instant games space. Social networking behemoths like Facebook (er, Meta?) and Snap have all made investments in instant gaming themselves and may pose significant challenges to Piepacker’s ability to scale.

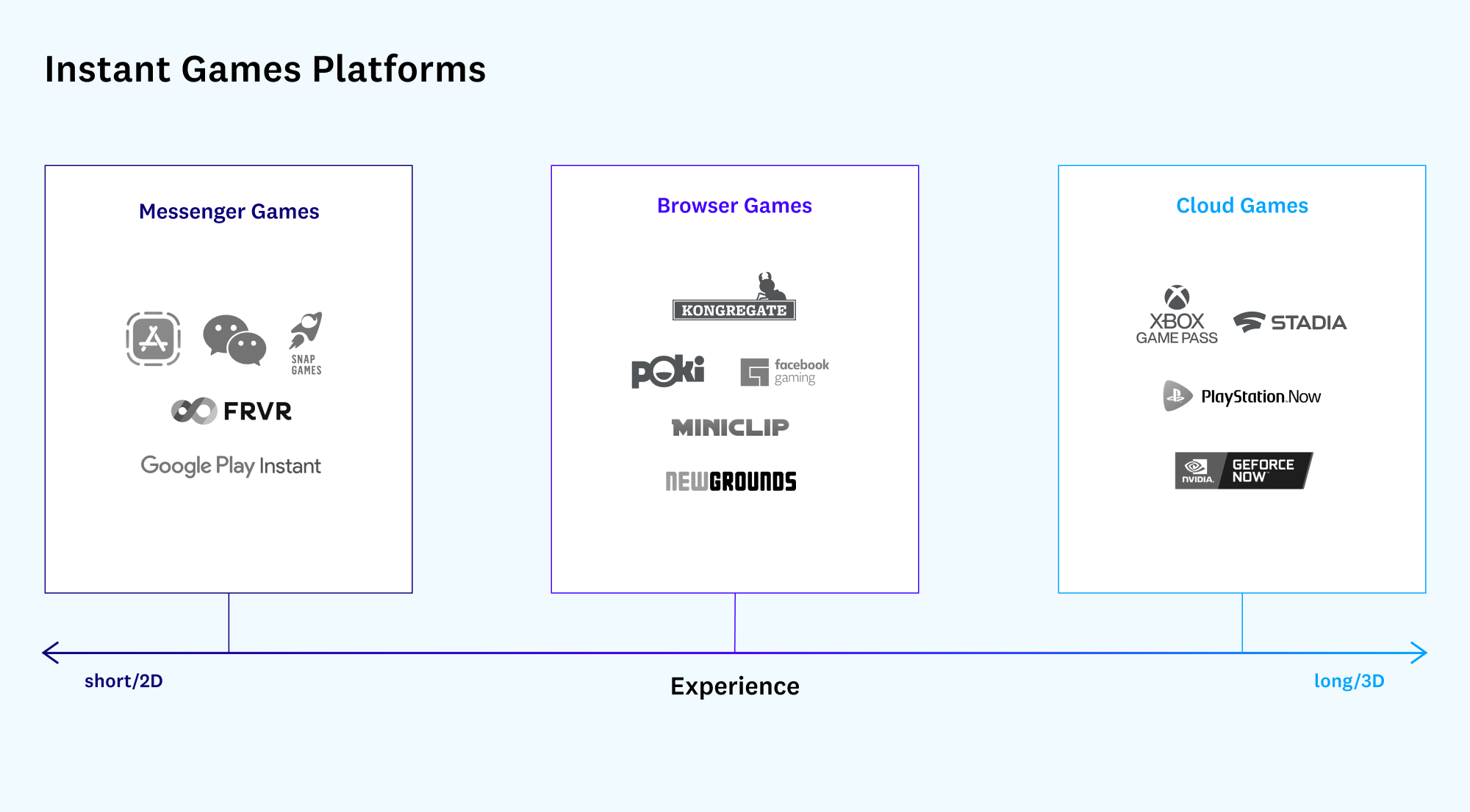

Source: a16z

When considering Piepacker’s place within the instant games framework outlined by Andreesen Horowitz partner Jonathan Lai (above), we see a variety of large competitors in the “Browser Games” space. Kongregate (Modern Times Group), Facebook Gaming (Meta), and Miniclip (Tencent) are all backed by publicly traded firms, and while that doesn’t guarantee security by any means, it does illustrate the challenges ahead for Piepacker. With strong headwinds working against it, will the retro gaming community propel the company to new heights? Or will it ultimately get absorbed by a larger company in the rapidly consolidating games industry landscape? As someone that grew up playing many of these retro games myself, I’ll be watching this space closely in the future. (Written by Matt Dion)

🎮 In Other News…

💸 Funding & Acquisitions:

-

Krafton acquired Unknown Worlds, the team behind Subnautica. Link

-

Thunderful acquired Robot Teddy to create a new investment arm. Link

-

Pragma raised $22M to power the backend of games. Link

-

Admix raised $25M to expand the world of in-game advertising. Link

-

Sipher raised $6.8M to build a PC-based blockchain game. Link

-

Gigi Levy Weiss is launching a new $450M NFX fund. Link

-

GreenPark Sports raised $31M ahead of its first NFT drop. Link

-

Hawku raised $4M for a gaming + NFT marketplace. Link

📊 Business:

-

Facebook is rebranding to ‘Meta’ as it refocuses on becoming a metaverse-first company. Link

-

Microsoft released its Q1 earnings results. Link

-

Sony released its Q2 earnings results. Link

-

Ubisoft released its first half earnings results. Link

-

Activision Blizzard outlined additional steps it’s taking to become a more inclusive company. Link

-

Goodgame Studios established a new publishing division. Link

🕹️ Culture & Games:

-

Twitch streamer Pokimane is launching RTS, a gaming-centric talent agency Link

-

Warner Brothers is building a free-to-play Smash Bros. competitor Link

-

Chipotle is opening a store in Roblox Link

👾 Miscellaneous Musings:

-

Indie tides start turning. Link

-

Why sell your game studio? Link

-

Facebook is bringing GTA San Andreas to VR. Link

🔥 Featured Jobs

-

BebopBee: Community + Player Experience Manager (Menlo Park, CA)

-

Immutable: BD Exec, Gaming (Remote, US/EU)

-

Ubisoft: Junior Technical Artist (Bucharest, Romania)

-

Hypixel: Senior Game Designer (Remote, Global)

-

Piepacker: Tech Director (Remote, EU)

-

Playco: Financial Planning & Analysis Consultant (Remote, US)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.