Hi Everyone. Welcome back to another issue. Last week’s most popular links were Amy Wu’s thread on blockchain games, the details behind GOALs a new multiplayer NFT game, and Richard Bartle’s PDF Book on designing virtual worlds.

Naavik Exclusive: Roundtable #12

In this Metacast episode, Jayne Peressini, Miikka Ahonen and Yonatan Raz-Fridman are joined by your host Nicolas Vereecke to discuss: Google’s response to Epic Games with ‘Project Hug’, how to successfully build a fully remote organization, and Supercell’s new game Everdale.

As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Supercell Launches Everdale

Source: Supercell

Last Monday, Supercell released co-operative farming game Everdale in select countries. There are two takeaways from the launch: the first one concerns the concept and design of the game, while the second one pertains to how Supercell has experimented with the game up until now.

First, let’s take a look at the experience that is Everdale. To put it short, the game is a spiritual successor to Hay Day. As expected, the player is given a lush, cartoonish village and asked to build it up, harvest resources, and craft items. What sets Everdale apart from Hay Day and other simulation genre competitors, such as Sim City and Township, is its focus on co-operative play. In Hay Day and Township, the social elements are an important end game feature; in Everdale, co-operation is at the core of the game.

Furthermore, interacting with Everdale is a surprisingly intense affair. Instead of merely placing buildings and harvesting crops, the player assumes control of individual workers in a game mechanic quite reminiscent of classic real-time strategy games. As nothing happens automatically without the player’s supervision, optimal play requires countless of microsessions during the day.

These design choices make the game either more engaging than the competition, or needlessly tedious, depending on whom you ask. However, it’s the co-operative elements where the game really shines. It’s been a good 12 years since our aunts and uncles started asking us for help with their cows in Farmville, and quite a few games since then have taken a stab at creating a city building experience that feels genuinely social. Everdale’s “Valley system” with its construction, trading, and shared progress succeeds in creating a feeling of true co-operation, much more so than any other game in the genre.

Next, let’s examine Supercell’s approach to experimentation during Everdale’s development. Everdale, in fact, already launched as early as September 2020 as Valleys & Villages. To avoid unwanted attention, Supercell set up a shell company in Singapore and published the game under Osmium Interactive. After the game’s release, Supercell acquired bursts of users from both high-volume countries (i.e. Philippines) as well as more typical soft launch countries (i.e. Canada). These bursts coincided with seven major client updates to Valleys & Villages before the game was eventually published as Everdale earlier this week.

Notably, after all this, the game hasn’t yet released globally. While the experience feels quite complete, much of the bread and butter free-to-play features — from battle passes to monetization-first events — are still missing. Considering this, it’s likely that the game team’s focus is on engagement metrics rather than profitability or scaling up. Supercell seems to stand firm by its long development cycles: Everdale spent 11 months in secretive open beta, and we just witnessed the onset of its actual soft launch.

All in all, Everdale is a well-designed game that’s quite unlike anything else out there. It’s remarkably hardcore and at times tedious, but it also does some things so well that it will undoubtedly find an engaged audience. When all is said and done, two questions remain: whether Everdale’s design innovations can improve on tried-and-true farming mechanics, and whether the audience will be large enough to Supercell’s liking. (Written by Miikka Ahonen, Co-founder of Lightheart Entertainment)

Sponsored by Gamerspeak

Building a Low-Cost Gaming Community for Your Pre-Launch Game - Free Article!

Building and launching a Discord server for your gaming community can be a daunting task. It takes time, resources, and effort to build a community worthy of your players' attention.

GamerSpeak can make it easy. With their free Server Template, explore the most effective tips, tricks, and resources on the best way to build a valuable and engaging community on Discord.

#2: Netmarble Breakdown

Source: LinkedIn

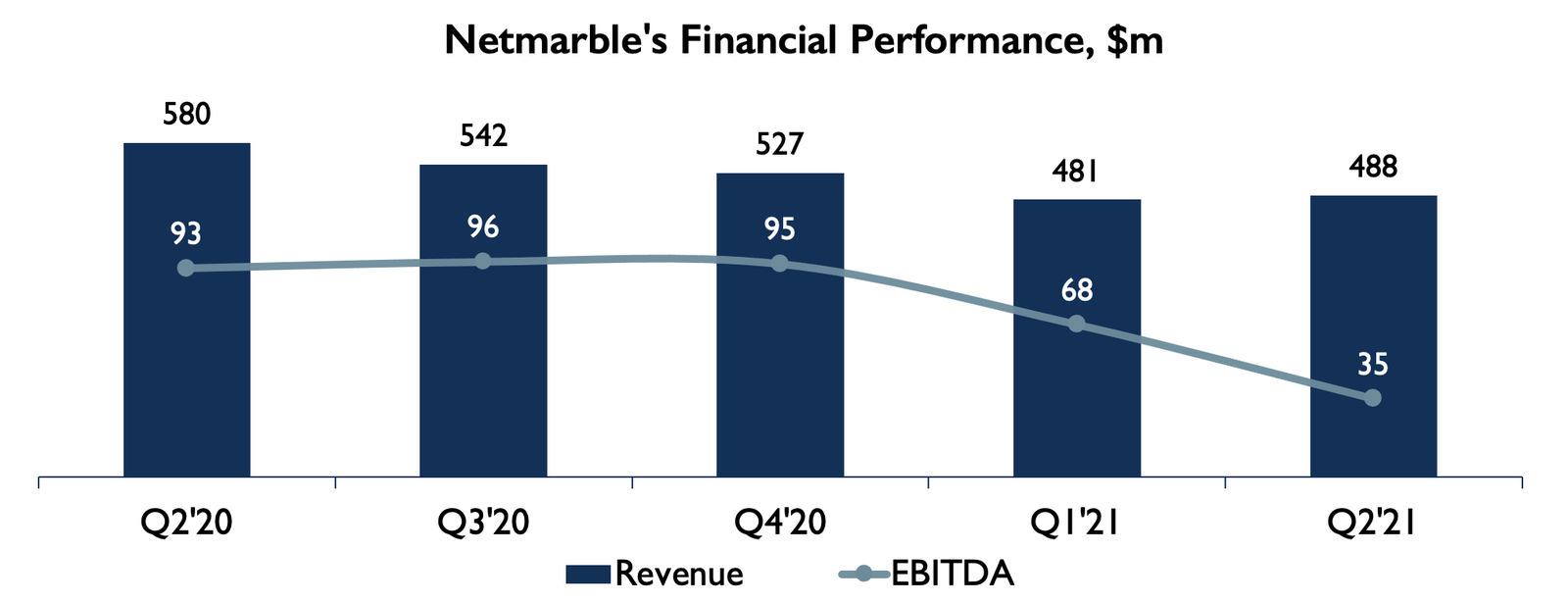

Seoul-based mobile games publisher and developer Netmarble reported its Q’2 financial results a few weeks back, but it’s worth taking a look at the company’s performance given its size. It showed a decline across almost all frontiers, compared to the previous year — revenue dropped by 15.8%, EBITDA plummeted by 61.8%, and Net Profit decreased by 43.4%. Such a decrease in metrics can be explained by the strong performance of previous quarters driven by the lockdown. Today, it’s a challenge for any game company to keep their audiences and attract new ones as many countries lift their restrictions and people return to their previous pre-Covid lifestyles, but that’s only a part of the picture.

Another reason for the decline is the ongoing growth of the costs. First, the company saw a 29.5% increase (from $66M to $85M) in marketing cost compared to Q1’21 due to promotional events and the release of Ni no Kuni: Cross World. This may seem high at the moment, but the potential ROI should probably cover the costs, considering the popularity of the new title. Another consideration that influences Netbarble’s Revenue is its high dependence on third-party IPs — around 44% of operating costs ($40.3M) in H1’21 come from the necessity to pay the commission fees. Last but not least is a 7.8% increase in labor cost compared to Q1’21. All this led to a 57.9% decline in EBITDA, and a 22.1% drop in Net Profit compared with Q1’21. So how does the company face these challenges? It’s moving forward to diversify its product portfolio.

Currently, Netmarble is known for its vast portfolio of RPGs, MMORPGs, and Casual games. Its best-grossing titles include Marvel Contest of Champions, The Seven Deadly Sins: Grand Cross, and Ni no Kuni: Cross World — together these games generate 38% of Revenue, distributed almost equally between the three. Considering the rapid growth of Ni no Kuni: Cross World which was launched at the beginning of June in give APAC countries and is yet to be released worldwide, we may expect its further expansion into other markets. The other 31% of Revenue comes from seven other titles, while 31% more comes from the rest of Netmarble's portfolio.

At the beginning of this month, Netmarble announced a $2.2B acquisition of SpinX Games — social casino games developer with cumulative downloads exceeding 65M, according to AppMagic. This is the second acquisition Netmarble has made this year — in February, the company increased its development capabilities buying a major stake in American work-for-hire studio Kung Fu Factory.

The decline in Revenue, combined with marketing and operational expenses growth, and dependence on third-party IPs is part of the strategic rationale behind the SpinX Games acquisition. The company is ranked third in global mobile social casino genre sales and is the fastest-growing company in the genre with impressive financial performance. In the first half of the year, the company generated Revenue of $288M, which is almost a third of Netmarble’s Revenue over the same period. It seems like Netmarble understands its weaknesses and hopes to fix the problem — with this deal, Netmarble improves its financial performance, expands its pipeline, and enters a new genre.

We should also note that the Covid-19 pandemic affected the development process, which led to delays and changes in release dates. The upcoming games pipeline until the end of 2021 looks solid and can positively affect financial performance, especially the most-anticipated MARVEL Future Revolution. Considering everything above, we can assume that Q3’21 financials will show a different picture. (Written by Andrei Zubov and Vlad Sergeevykh of InvestGame)

🎮 In Other News…

💸 Funding & Acquisitions:

-

Nexters, the company behind Hero Wars, went public via SPAC at a $1.9B valuation. Link

-

Rally raised $50M for its social tokens platform. Link

-

Infinite Canvas raised $2.8M for its publisher model for user-generated content experiences. Link

-

Unity acquired Oto, an AI chat analysis platform. Link

-

BLVKHVND, a DAO for decentralized esports (“dsports”), raised a $1M crowdfunding round through Mirror. Link

-

Azerion announced its acquisition of mobile advertising company Keymobile. Link

📊 Business:

-

In a surprise move, Apple is “letting developers accept payment outside of the App Store”. However, there’s still a considerable amount of friction. Apple later clarified that developers can use email (or other forms of communication) to notify about alternative payment methods. Link

-

Netflix is testing its first foray into gaming in Poland through its Stranger Things brand. No IAPs and a separate app experience. Link

-

Playrix’s Gardenscapes passed $3B on mobile. Link

🕹️ Culture & Games:

-

Fortnite introduced an in-game MLK experience. Link

-

Supercell launched its latest title, Everdale. Link

-

Parsec released support for MacOS. Link

-

A round up of the biggest headlines from Gamescom. Xbox | Playstation

👾 Miscellaneous Musings:

-

Verge’s guide to platform fees. Link

-

Everything you need to know about Halo’s story so far. Link

-

Structural advantage in the games industry. Link

🔥 Featured Jobs

-

Mythical Games: Principal Economy Designer (Remote, US)

-

Mythical Games: Lead Product Manger (SF, LA, Seattle)

-

Carry1st: Ad Monetization Manager (Remote, Global)

-

BITKRAFT Ventures: Crypto and Gaming Analyst (Remote, US or EU)

-

Supersocial: Head of Business Performance (Remote, US)

-

Supersocial: Principal Analyst (Remote, US)

-

Metafy: Senior Technical Recruiter (Remote, US)

-

Metafy: Lead Marketing Designer (Remote, US)

-

Not Doppler: Senior Data Analyst(Remote, Global)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.