Both of China’s top mobile publishers are currently launching licensed basketball games - a phenomenon which sheds light on major trends in the Chinese domestic gaming market, and perhaps more importantly points towards the future of licensed sports titles globally.

Dunk City Dynasty, also known as Hoop Heroes, focuses on 3v3 half court street basketball - a quicker, more casual game mode with a long history in games dating back to EA’s famed NBA Street series. NetEase has had the game in soft launch since spring of last year, quickly boosting the game to half a million cumulative downloads before steadying the player base at about 12K DAU. NetEase appears to be readying the game for global launch though, given comments by CEO William Ding on the company’s latest earnings call and accelerated growth on the game’s Discord and other social channels. According to early estimates from data.ai, the title is already outperforming competitors.

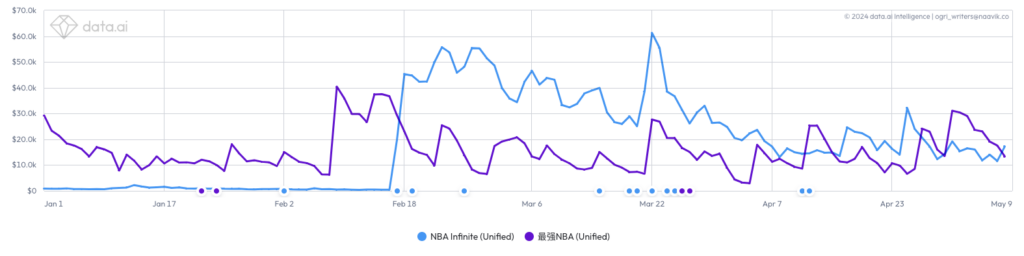

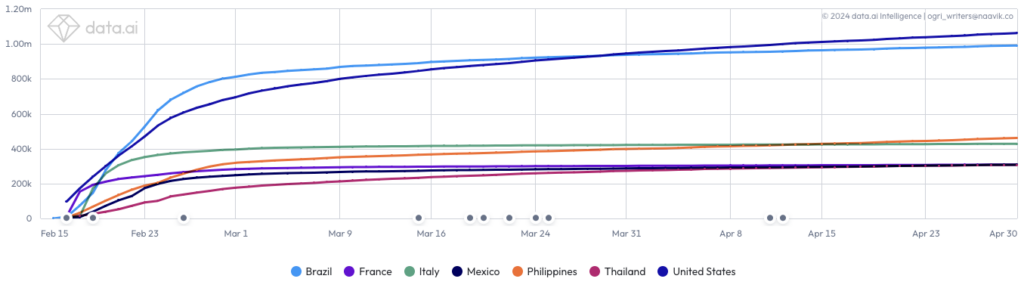

Tencent’s NBA Infinite is also a 3v3 multiplayer basketball game. Covered as part of Naavik’s Game of the Week by Jordan Phang in the Naavik Digest from Apr 28, it entered soft launch in summer 2023 before Tencent began scaling it globally this February, timed with the NBA All-Star Game. At a high level, gameplay is similar to Dunk City Dynasty: players control a single basketball star during a 3v3 online match, with stars having specific abilities that charge up during gameplay and can be activated at strategic moments in the match.

What Does This Mean for China’s Top Two Publishers?

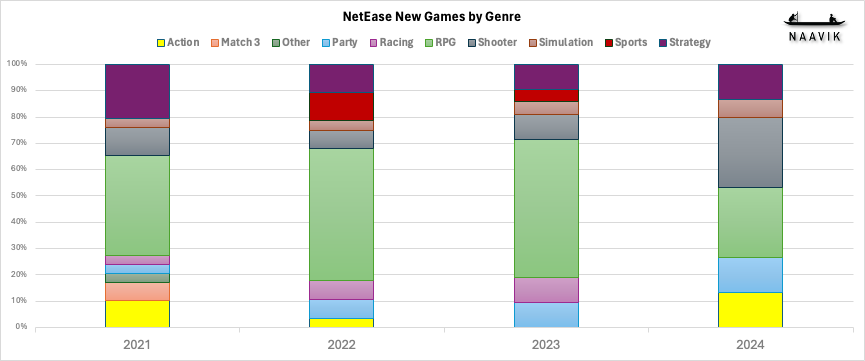

For Tencent, and especially NetEase, genre diversification and global expansion have become the primary strategies for their content portfolios. These companies have historically dominated the market thanks to strength in hardcore, highly monetizing genres like MOBAs, shooters, and RPGs, but increasing domestic regulation limiting playtime and spend has stunted continued growth in these genre’s evergreen titles like Arena of Valor and Game for Peace. Both companies have struggled to bring their MOBAs and RPGs to foreign audiences - instead seeing studios like Moonton and Hoyoverse succeed there - but Tencent’s shooters do very well internationally, and NetEase has seen some foreign success with its Knives Out battle royale. Still, the priorities for both companies have clearly shifted towards new genres: Tencent’s bosses are telling studios to develop Palworld-like games, both companies are fighting to establish dominance in UGC party platformers, and NetEase’s upcoming Racing Master is meant to test the mobile racing sim genre in China.

All of this is meant to achieve revenue growth through audience diversification by applying their scaled game development and publishing machines to new genres that will appeal to new domestic and international players - who shy away from both companies’ hyper-competitive titles and complex MMOs.

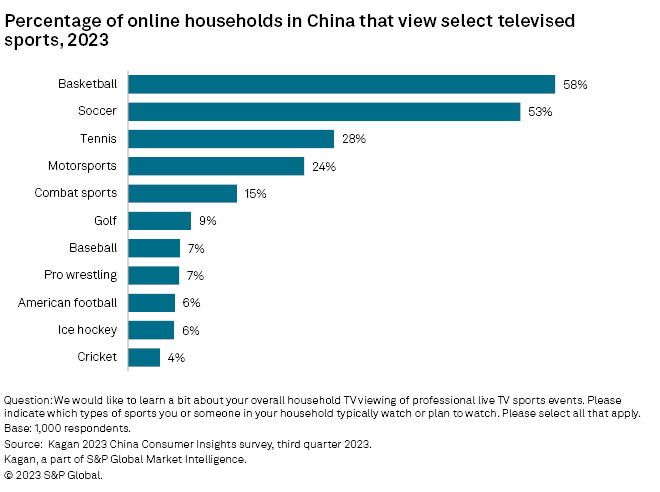

Sports games are potentially a powerful shortcut to achieve that goal, especially basketball. In terms of reaching new gamers domestically, basketball has become increasingly popular in China, with 24% of Chinese adults saying they are avid NBA fans. Games are regularly broadcast on state-run China Central Television as well as streamed on Tencent’s video platform, and the league has inked a deal with TikTok competitor Kuaishou to be the official short form video partner in the country. The domestic opportunity for both NBA Infinite and Dunk City Dynasty is riding on these trends.

Of course, basketball is also increasingly one of the most popular global sports, with star athletes from every corner of the globe. Basketball trails only soccer, tennis, and the Olympics in worldwide sports appeal. As Tencent and NetEase focus on expanding their publishing businesses abroad, latching onto IPs as globally recognizable as the NBA and its star teams and players is a compelling tactic.

NBA Infinite is actually Tencent’s second licensed basketball title after releasing 最强NBA (Super NBA) as early as 2017. That game continues to do well but is not localized outside of China and is thus meant to be a purely domestic product. NBA Infinite, on the contrary, has been marketed globally and widely localized. Most of its early user acquisition campaigns have made use of social media ad inventory, reaching users on social media — this aligns with Tencent’s goal of diversification into acquiring new types of players beyond existing core gamers, though the game is still marketed through rewarded video in other mobile titles.

Along similar lines, NBA Infinite also features a creator program. Sports games are a popular subgenre of video creators on console, mostly centered around the marquee titles from EA and Take Two. Tencent is clearly going to see if it can activate new creators on mobile, and reiterates its intent for NBA Infinite to be a game for global markets by requiring that participating creators must publish at least 75% of their content in English.

Both games are chasing after the same goal: a hit mobile-first basketball game that could be a meaningful driver of organic growth for a scaled publisher. The sport has become an increasingly popular global pastime second only to soccer in worldwide appeal, and NBA superstars increasingly come from a wide variety of countries, often activating large new fan bases as they reach the league. In an era where IP-driven organic installs are a good hedge against expensive paid UA, the value of basketball IP is clearly growing.

Take-Two has been able to achieve this to a large degree by funneling players from its behemoth console franchise (where it faces no competitors) to mobile - NBA 2K Mobile and the recently launched NBA 2K24 MyTeam (a mobile extension of the franchise’s card collection mode) are both integrated with the console SKUs and have over 50% market share in mobile basketball games, largely driven by organic downloads thanks to the cross-promotion from console on top of the mobile-first IP driven organics.

Tencent and NetEase likely see a different opportunity - to pursue a somewhat more casual audience that is not necessarily playing basketball games on console, a player base that 2K will almost inevitably dominate. To that extent, both of the Chinese publishers’ decision to feature 3v3 games, as opposed to the standard 5v5 matches present in actual NBA basketball and in Take-Two’s offerings, ensure quicker matches and shorter session lengths. This in turn could lead to a larger focus on more monetizable meta gameplay (upgrading players, etc) as opposed to a more accurate simulation gameplay present in NBA 2K. MyTEAM is focused almost entirely on this form of meta gameplay as the core concept revolves around collecting player cards and accumulating a team for idle competition, but the audience for this game, while highly monetizable, is still centered primarily around existing players of the console franchise.

Sports Licensing as a Dynamic New Opportunity

One of the key distinctions between Dunk City Dynasty and NBA Infinite is their use of licensed IP, and it points towards a changing landscape for sports licensing in games overall. NBA Infinite has gone the traditional route with an official license from the NBA. NetEase, however, pursued a different tactic - licensing players directly from the players’ union, the National Basketball Players Association (NBPA). This means Dunk City Dynasty does not feature teams, such as the Lakers, but instead only has the rights for individual athletes, which leans into this dynamic by centering the game’s core premise on pickup street ball.

Economically, both licenses will eat into the revenue for each game, though it is likely that the NBPA charges lighter royalties than the NBA itself since it licenses fewer elements (only players, not teams). This could give Dunk City Dynasty more attractive unit economics, and though NBA Infinite will likely get broader organic reach and bigger co-marketing opportunities thanks to its official league partnership, the growing celebrity status of individual players relative to their teams or the league as a whole could work in NetEase’s favor, if they play their marketing cards right.

The fact that NetEase could even contemplate launching a licensed basketball product without the NBA itself highlights the growing fragmentation of sports IP holders in games, a shift that may make some of the world’s most recognizable IP accessible to more game publishers. Already, basketball has evolved from relying on a single primary licensor (the NBA) to become an IP that game publishers license from individual players - Steph Curry’s UEFN title, for example - and of course, the NBPA for Dunk CIty Dynasty. In soccer/football, EA famously abandoned its primary licensor, FIFA, but had already aggregated rights to the highly fragmented sport with hundreds of leagues, teams, and more into a single product.

This trend of widening IP sources extends beyond men's professional sports. Women’s basketball is soaring in popularity, and though the WNBA license has been incorporated into the NBA 2K franchise for years, the value of the IP will likely continue to grow such that the WNBA could be a more effective independent licensor in the future. And in college sports, the Name, Image, and Likeness (NIL) policies have reopened a major source of IP for games. EA is relaunching its NCAA College Football series later this year as a result (though is not allowing the athletes to negotiate fees for using their NIL), but there have been no announcements about resurrecting its college basketball or baseball franchises yet - a possible opportunity for other game publishers. These developments can be highly dependent on the particular sport’s organizational structure and audience size - professional golf is undergoing a major schism with LIV emerging as a competitive league to the PGA, for example, and the power of the NCAA over American college athletics is waning relative to the growth of regional superconferences; fragmentation of this nature opens the licensing market further. On the other hand, a sport must have a large enough audience to support multiple licensed titles, which is not often the case. Professional hockey, baseball, and UFC, with much more centralized competitive organizations (and therefore licensing structures), as well as relatively smaller audiences, are more likely to continue the status quo, for example.

Sports IP has long been dominated by a very small handful of publishers, with rights bestowed by a single primary IP holder to these companies, who then operate a game franchise centered on an annual premium console release augmented with IAP and a F2P mobile tie-in. The future of sports licensing looks very different, and is starting to come into shape as a diversified, dynamic marketplace. More and more, there is a larger pool of attractive licensors including professional leagues, college sports, women’s sports, players' unions, teams, and individual athletes - and at the same time, a wider range of platforms through which to push sports-related IP, giving developers more options to create unique experiences and potentially avoid the limitations of traditional licensing or even publishing arrangements. Steph Curry’s UEFN game singularly demonstrates what this future might look like: the IP of the star athlete is brought directly to Fortnite players, without needing to go through the NBA, in an endless runner experience that does not promote the sport so much as the brand of Steph Curry himself - while cutting the publisher out of the equation at the same time.

Meanwhile, even as sports-related IP becomes more accessible to game publishers, and the value of it to drive organic installs increases as IP becomes more popular, the potential cost to developers could rise. Television and streaming rights for major sports leagues continue to climb ever higher, as does the valuation of teams and contracts for star players. As the IP holders see bidding wars for access to their content — will they raise royalty rates for the use of that IP in games?

Genre Diversification and Sports Licensing

When examining the mobile sports game landscape, the largest opportunities seem to be in sport simulation - the largest market segment by revenue - or in management sims, a more niche segment but one that monetizes very highly. These are the areas where the leading basketball incumbent, Take-Two, has staked its claim, and also where EA plays with its soccer and American football offerings. In basketball in particular, Take-Two dominates both of these mobile segments by reaching console owners who want an accurate mobile sport sim and/or an integrated card game that appeals to management sim fans. Tencent’s NBA Infinite, with its official league license and simulation-based gameplay (though more casual than 2K, certainly, since it focuses on 3v3 matches) is also competing in this space.

But while at a high-level, it seems like the arcade sports segment is not the optimal place to play, its been this area that has seen of the biggest breakout hits in recent years - games like Tennis Clash, Golf Rival, and Tap Sports Baseball. This is the type of success NetEase is hoping to replicate with Dunk City Dynasty, and though it skews somewhat more core-focused than those titles due to its landscape orientation and realtime PvP gameplay, its strong performance in soft launch positions it for a shot at becoming a major hit.

Even so, at the scale both companies operate at, what can represent a truly meaningful outcome for these recently launched titles compared to the behemoths in their current portfolio? This begs the question of whether these titles are actually good investments for either company - especially Tencent. If the goal is to reach new global players who are NBA fans, why go head-to-head against a powerful incumbent like Take-Two, when there is likely a larger, relatively untapped audience for more casual basketball titles that NetEase may be reaching?

Final Thoughts: the Future of Sports in Games

Sports IP is becoming more fragmented, reducing the barriers to entry for game publishers interested in using such IP to more efficiently acquire new users and create compelling experiences. As two of the world’s top publishers, and the largest players in the Chinese market, seek to diversify their offerings, they’ve also turned to this shifting sports market with different tactics both in terms of licensing and genre / casual appeal.

Overall, sports in games are undergoing several changes that are redefining a previously stagnant market dominated by the console duopoly of EA and Take-Two, with implications across the global mobile market. Sports IP can increasingly come from more sources than just a single league, which provides more opportunities for more publishers to benefit. All of this is taking place against the backdrop of increasing global popularity and financial value of these IPs, from basketball to American football. For game publishers, this market has likely never been more accessible or valuable, but it requires a careful evaluation of how exactly to play.

A Word from Our Sponsor: NEFTA

Superior IAA Revenue from iOS Users Who Opt-out of Tracking

Nefta's advertising network provides a privacy-compliant solution to the problems publishers and advertisers face, diminishing revenue and eCPMs from iOS users that opt-out through ATT. Nefta has devised an approach using first-party data to improve in-app advertising revenue.

Publishers integrate an SDK natively or via LevelPlay or Max mediation and add Nefta's game event taxonomy to gain greater insights into player behaviour. Nefta's platform observes these game events and usage patterns on an app-by-app basis and applies advanced machine learning and behavioural analytics to create profile groups. Nefta discovered that certain profile groups are more likely to click certain creatives resulting in greater audience engagement, ad interaction, and revenue growth.

This is how we are able to drive superior results for advertisers while increasing ARPDAU for publishers, in a 100% privacy-compliant way.

In Other News

💸 Funding & Acquisitions:

- VaultN secures $1.6m in seed funding round

- PlanetPlay parent acquires Playmob

- Sharp Alpha closes $25M+ Fund II to back gaming, sports, media startups

- Subscrible raises $300,000 to launch ad-free mobile games platform

- Steel City Interactive raises £15m in funding

📊 Business & Products:

- Honor of Kings set for June 20th global launch after $15 billion+ revenue in China

- Ubisoft’s mobile revenue plummets as Assassin’s Creed Jade goes MIA

- Nexon banks on $22bn IP Dungeon & Fighter being a mobile hit in China as Q1 revenue declines

- Why Lego sees its gaming future in Fortnite

- 65% of Gen Z gamers spend over 3 hours a day playing video games

👾 Miscellaneous:

- Epic Games hit with €1.1m fine for unfair commercial practices in Netherlands

- Microsoft announces the Proteus Controller, a gamepad for Xbox gamers with disabilities

- Crucible unveils Emergence Marketplace for interoperable game assets

- Ukie partners with Tencent Games for Video Games Growth Programme

- Develop:Star Awards 2024 finalists announced

Our Design Consulting Services

Today, we’re highlighting our full lifecycle design services. This includes customised game deconstructions, core/metagame concepting, feature design, economy modeling, gameplay balancing, monetisation design, and much more across platforms and genres. Here is what one of our clients had to say.

“I worked with Naavik for over a year on our RPG and it was quite possibly one of the best consultation and cooperative design experiences I've ever had. They quickly demonstrated their expertise in ideation, documentation, communication, and iterative design. I would gladly make use of Naavik's skills again and I would encourage anyone else looking for expert game design support to reach out to them ASAP!”

- Josiah Wallace, Senior Game Design Manager at Immutable

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.