Swedish holding company Aonic’s $110M acquisition of nDreams follows an initial investment of $35M in the UK-based VR developer in March 2022. Aonic is headquartered in Sweden – the promised land of gaming roll-up strategies – and its team is split between Stockholm and the UK. Its key personnel include CPO Olliver Heins (Ex-Goodgame and Bigpoint) and CEO Paul Schempp (previously at Goldman Sachs). Its strategic approach mirrors early Embracer, focusing on acquiring small to mid-sized companies to find value through shared services.

Further details on the company are scarce, including the amount of deployable capital it has, but Schempp does have close ties to a Luxembourg-based investment company Active Ownership Capital, which presumably is backing Aonic.

Aonic's portfolio is diverse and nDreams joins PC and console developers Tiny Roar, Otherside, BKOM and Milkytea, Apple Arcade developer Red Games, and a kids' game platform Tutotoon. The common thread is a dedication to creative indie studios, with a notable absence of mobile free-to-play outfits.

The narrative that companies such as Embracer and Aonic like to tell is that they provide publishing expertise and shared services so that developers can focus on game development. Aonic’s strategy is essentially trying to beat incumbent indie publishers with an in-house team. The firm has also invested in two ad tech outfits, presumably intending to offer shared services for its portfolio companies. Considering the diversity of the studios in its portfolio, getting there in practice may prove difficult. Ultimately, it is stability and access to capital that are the most important benefits a holding company can bring as an owner.

In a sense, Aonic is cutting out the middleman. On the other hand, publisher-developer relations are sometimes antagonistic for a reason: it's in the publishers' interest to limit risk. Absorbing the risk of failed projects and financially struggling in-house studios is precisely what Embracer is dealing with – a story that Aonic will not want to retell.

Despite recent roll-up failures, there's no fundamental issue with this acquisition strategy. In order to succeed, Aonic will need deep pockets and above-average capacity in vetting its investment targets. That said, the scattered nature of Aonic’s investment bets – as well as its bullishness on nDreams specifically – is bound to raise some eyebrows.

Is VR Finally a Thing?

Founded in 2006, nDreams is known for high-end VR titles such as Synapse and Ghostbusters: Rise of the Ghost Lord. nDreams was early to pivot into VR, and has focused on VR experiences since 2013. The company has grown rapidly over the past few years and now employs around 250.

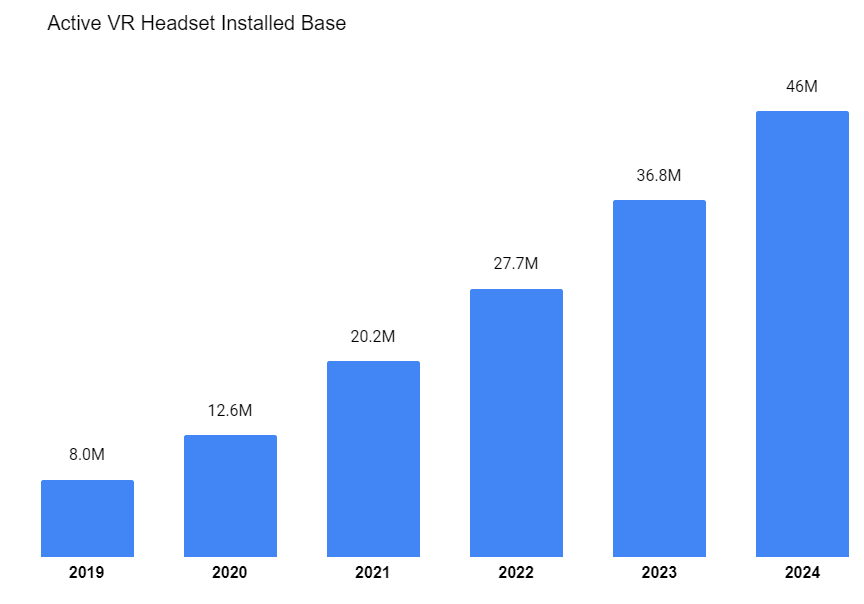

Even so, $110M for a VR studio is a lot. Aonic is banking on further future growth, and the thesis is not entirely unfounded: the installed base of global VR headsets has surged since 2019. Newzoo has estimated that active headsets from all manufacturers combined will reach 46M by 2024, which is nearing a respectable console installed base. For comparison, Nintendo Switch has sold roughly 130M units.

However, it’s not an apples-to-apples comparison. Engagement on VR compared to other forms of gaming is still abysmal, and VR revenue is not fully consumer-driven, but heavily subsidized by hardware makers like Meta and Sony. Finally, the hardware market is fragmented between Meta, Sony, ByteDance, and a number of smaller manufacturers.

All in all, the sale of nDreams is an excellent lesson in persistence. Making games is hard, and creating VR games is extra hard. If your company can truly become the best in the world in something, you will find a buyer. Even in a relatively niche market, that can lead to very favorable outcomes. The acquisition certainly looks like a great deal for nDreams; it remains to be seen whether it’s equally good for Aonic.

A Word from Our Sponsor: LIGHTSPEED GAMING

Partnering with Extraordinary Founders in Gaming and Interactive Technology

Lightspeed Venture Partners is a globally leading venture capital firm with over $29B under management and more than 500 investments across the U.S., Europe, and Asia. Over the past two decades, the firm has partnered with hundreds of exceptional entrepreneurs and has helped build and scale companies to achieve 190+ IPOs and acquisitions.

With its dedicated gaming practice, Lightspeed Gaming, the firm invests from an over $6.5B pool of early and growth-stage capital — by far the largest set of funds with a dedicated gaming practice. Lightspeed's team combines deep expertise in gaming interactive technology with a global multistage investment platform and a culture that truly puts founders first.

Selected investments include Epic Games, Inworld AI, and The Believer Company — as well as game designers and producers who led the creation of titles like Fortnite, Call of Duty, League of Legends, Wild Rift, Apex Legends, Overwatch, Valorant, StarCraft II, and Warcraft III.

For more information or if you wish to reach out, check out the link below:

In Other News

Funding & Acquisitions:

- Saga raises $5M more in seed funding for Web3 protocol development.

- Sleek raises $5M for Web3 social networking.

- Aonic acquires nDreams for $110M.

- Layer AI seed round raises $1.8M to bolster generative game art production.

- What's the gaming M&A market like in 2023?

- Games VC funding down 68% YoY per PitchBook Q3 report.

- Ubisoft teams up with Animoca Brands on Web3 metaverse Mocaverse.

Business & Product:

- Nvidia reports record Q3 results driven by surging demand for AI.

- Mobile game mortality rate is 83% within three years.

- NetEase profits up 23.4% as Justice and Racing Master drive strong Q3.

- Netmarble cuts losses by 90% in Q3 despite revenue decline.

- Readygg partners with Aptos Labs to bring more players to Web3 games.

- Embracer debt reduced to $1.4B as restructure continues.

- Spirittea amasses $1M in revenue.

- GameMaker ditches subscription model for indie developers.

- Sledgehammer Games says Modern Warfare III gameplay hours are up versus previous games.

- China's game market to grow 5.2% this year.

- Mattel163’s CEO Amy Huang on transforming classic brands into digital experiences.

- Assassin's Creed, Spider-Man, Mario and PS5 deliver strong sales in October.

Miscellaneous:

- Supercell’s Clash of Clans team doubled in size in 2023.

- Supercell-backed studio Papukaya is closing down after three years.

- Why Supercell rebooted its creator program

- Infinity Ward opens a new studio in Austin, Texas.

- Eminem Fortnite live event and skin leaked for Chapter 4 finale.

- GAM3 reveals shortlist for Web3 gaming awards with $2M prize pool.

- "All the stars aligned. Now it’s full steam ahead!" MTG's CEO Maria Redin looks back at 2023.

- Tim Sweeney: We were willing to sue Sony for cross-play.

Our Product Consulting Services

With our full lifecycle product and design services, Naavik is a remote product team in your back pocket. Whether it’s core/metagame concepting or feature design, economy modeling or gameplay balancing, monetisation design or live-ops experimentation, we’ve helped game teams across platforms and genres to significantly elevate their game’s KPIs. Here’s what one of our clients had to say.

"It was a pleasure to work with Naavik and leverage their expertise to improve our game KPIs. I'm quite sure that in the future, we will work with them again.”

-Daimy Stroeve, Founder of GamoVation

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.