Introduction

Alien Worlds is a blockchain-based economy simulation game running on Ethereum, WAX, and BSC. It launched in late 2020 and is a poster child for the early blockchain games.

Alien Worlds is published by DACOCO.io, which is based out of Switzerland and is one of the pioneers in the blockchain space. Its founding members are Michael Yeates, Rob Allen, and Sarojini Mckenna. The team’s earliest work dates back to 2018 when they designed and initiated eosDAC, the viral airdrop and tokenized DAC block producer. A DAC (Decentralized Autonomous Corporation) is a company managed by a group of people self-governing and functioning autonomously and guided by smart contracts. This structure is important in the context of this deconstruction, because one can see its guiding principles in many of the decisions made by the team. Its belief in community, fairness, decentralization, and ownership has been the lens to make decisions like going multi-chain, storing assets on IPFS (Decentralized File Storage), along with many others. Although it has 11 investors, the only on-record funding seems to be from its ICO for $2M during March 2021.

The game’s lore revolves around the Federation, which in 2055 discovered cryptic messages from aliens while mining for bitcoin. This led to the discovery of a wormhole that let humans travel to exoplanets in the far corners of the galaxy. The main objective of the game is to mine the rare on-chain currency Trillium (TLM) from 7 different planets. Planets within this metaverse are DAOs that receive daily TLM from the central metaverse smart contracts. Players, or as they are called in the game, Explorers, engage through mining, acquiring and renting land, voting for Planetary Governance to impact TLM and NFT payouts, among other strategic actions.

The Core Loop of Alien Worlds is very straightforward. On close observation, the entire gameplay revolves around players' need to equip themselves with powerful tools. All players get a basic avatar and tool by default. They then have to choose the Planet and Land that they wish to mine, as different types of land have different mining potential. The outcome is also based on the tools that the players bring in to mine. After the mining process is completed, players get rewarded with TLM and may also get NFTs. The TLM can then be used to Shine (upgrade) the Tools or Stake — both of which are ways to get more TLM.

As a game (if it can be called that), Alien Worlds is not fun in the traditional sense of the word. This limits its potential to keep real players engaged in the long-term.

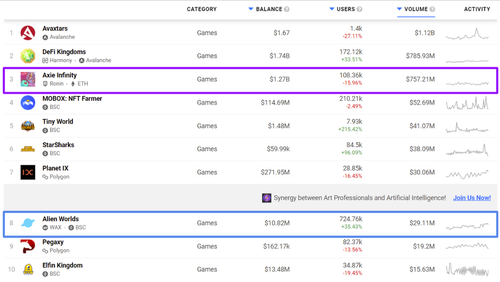

The two main metrics to look at are the Users and the Transaction Volume. Here, when we look at users, these are unique wallets and are prone to bots. So this number needs to be taken with a pinch of salt. The transaction volume is a good indicator of the economic activity in the game.

As of the time of writing, Alien Worlds has the most MAWs (Monthly Active Wallets) at 724K. In the past, this #1 rank of Alien Worlds has moved from time-to-time but it has stayed in the Top 10. There has always been stiff competition from Splinterlands when it comes to MAW. However, when it comes to 30-day Transaction Volume, Alien Worlds stands at Rank 8 with $29M.

There is an interesting juxtaposition to be made to Axie Infinity, which has MAWs of 108K and monthly Transaction Volume of $757M. This means that even with a 7x lesser wallet base compared to Alien Worlds, Axie Infinity has a 26x larger volume. This has primarily to do with the fact that players can start in Alien Worlds without a heavy initial investment. It’s also the reason why it has a much healthier userbase.

Axie Infinity has a Transaction Volume/Users that is 174x as compared to Alien Worlds. What remains to be seen is if the Alien Worlds economy is sustainable.

Though it is difficult to accurately understand the location of players, a quick look at the website visitors can be indicative of the geographic distribution of the player base. Compared to some of the top games right now that are very popular in the East, Alien World’s popularity is comparatively spread out.

- Hypothesis 1: Since, as a game, Alien Worlds is not as fun to play compared to some of these other games, the players in the East (primarily Philippines) have not migrated to it. This also makes it less suitable for the Guild/Scholar model which has gained traction in South East Asia.

- Hypothesis 2: The simple gameplay makes Alien Worlds very bot-able. A large number of bots means that people anywhere in the world can engage and earn out of the game leading to a large spread of users across different geographies.

This leads us to the 3 main questions that we want to ask for Alien Worlds:

- How does the money flow through Alien Worlds’ economy, and is it fundamentally sustainable?

- What is the role of bots in this economy?

- What updates will (or should) the game implement in the future?

Let’s dive in.

How TLM Flows in Alien Worlds

To understand if the economy is sustainable, it is important to understand the economy itself, and a good way to do that is to “Follow the Money.”

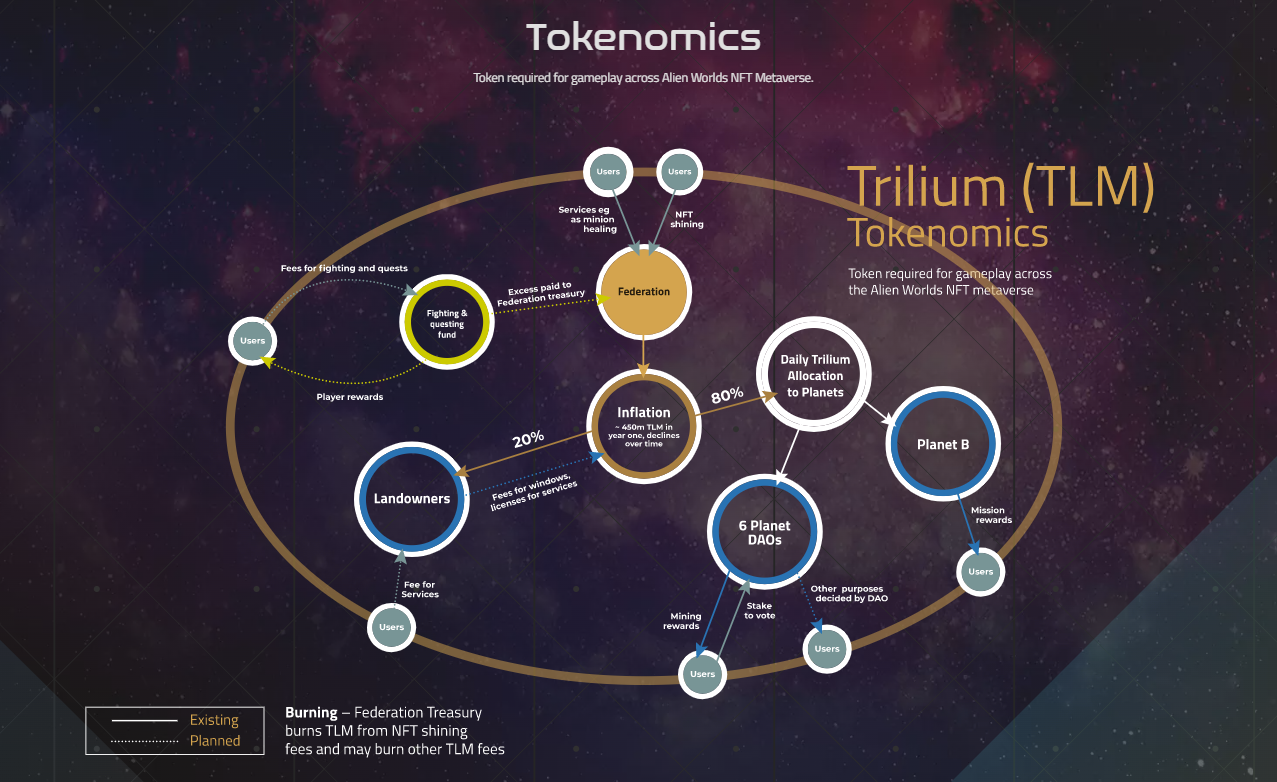

Although the traditional Game Core Loop is important to understand the gameplay, the Economy Flow Diagram is an important tool to understand how a blockchain game functions. Let’s expand upon the important parts of this diagram.

Federation

The Federation is a smart contract that can be thought of as the Central Bank in this world. It not only manages this TLM but also the rules surrounding other aspects of the ecosystem. Its main function is to manage the distribution of TLM to Planets. This is part of the main gameplay element of Alien Worlds, which is called the Mining Game, where players use the Tool NFTs at their disposal to mine TLM out of different planets. Currently, the Federation manages the outflow of TLM (but there will be features in the future that will act as an inflow of TLM).

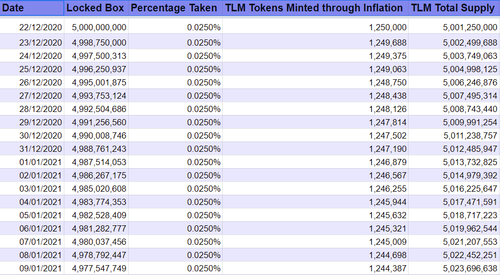

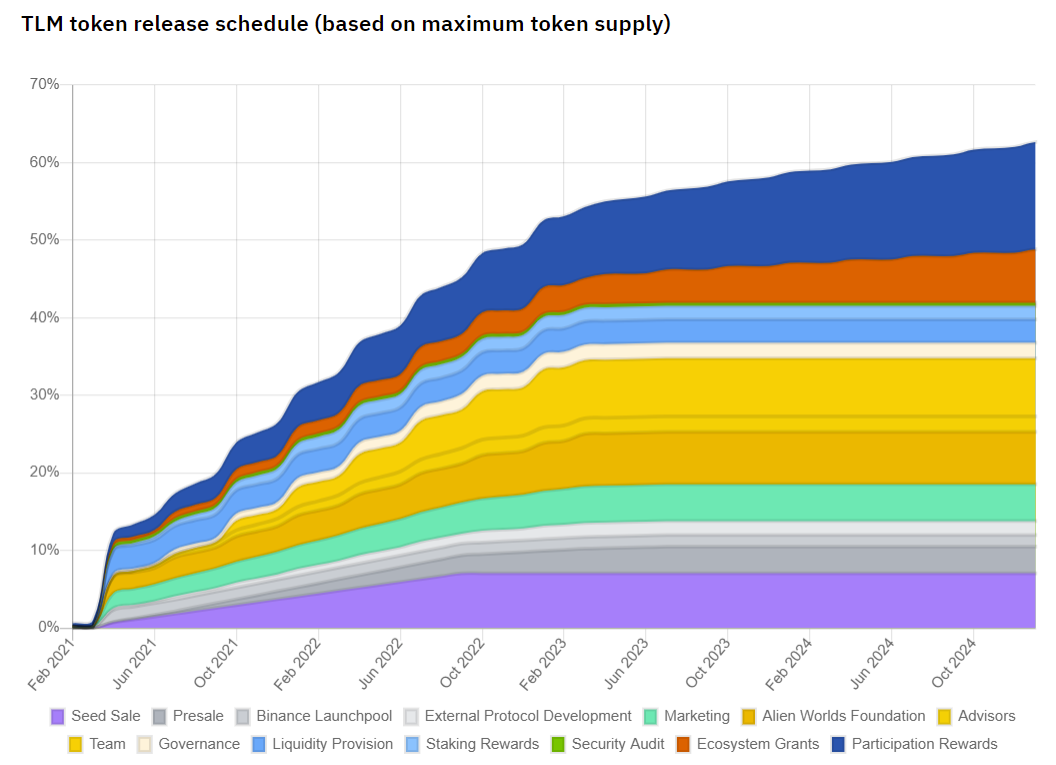

This sheet describes how on a daily basis TLM from the Participation Rewards pool is distributed to Planets. As part of the TLM tokenomics, the Participation Rewards are the funds allocated to be distributed from the game to the players. The max total supply of TLM is 10B of which 5B has been allocated towards Participation Rewards. In the above two charts — which portray the token release schedules in 2020 (left) and 2040 (right) — the TLM Tokens Minted Through Inflation are the daily allocation of TLM to the planets. What is interesting is that this is a percentage of the total TLM in the Locked Box (Federation). The current percentage is 0.026%. Every day the TLM in the Locked Box decreases and the TLM allocated to the Planets decreases.

The above chart illustrates the tokenomics of the game where even at the end of 2024 only 60% of the TLM will be distributed. The rest of the distribution will theoretically continue till infinity. This is clearly inspired by the halving system of Bitcoin and is unlike most other games where the token release schedule reaches 100% in 4 to 5 years.

What makes TLM interesting is that even though there is a limited amount of TLM (10B), it acts as an inflationary currency. This gives it the unique advantage of being constantly rewarding to users while maintaining scarcity.

Planets

Every Planet is treated as a DAO (Decentralized Autonomous Organization).

There are a total of 7 planets in Alien Worlds - 6 of them are on WAX and one Planet is on Binance. Initially, when Planet Binance was not there, the daily allocation was 0.025%. When the Planet Binance Missions were added, this increased to 0.026% so that the new planet would not cannibalize the share of the older planets.

The next important part of the flow of TLM is to determine how much is to be allocated to each planet from the Daily TLM Allocation. This is done by a simple equation:

The 3 components of this allocation are:

- Staking: All players get to stake TLM to their favorite planets. Staking not only gives players additional TLM based on the Staking Rewards allocated in the 10B TLM pie, but it also gives them voting rights in every planetary DAO. Staking affects the price of TLM because it effectively takes the TLM out of circulation. This reduces the supply of TLM in the exchanges, thereby increasing its price.

- NFTs: While players mine land, they also get NFTs. The most important of these are Tools that are used to mine for TLM. Players can also get Weapon NFTs that will have utility in features to be released in the future.

- Mod: This is primarily a live ops tool for the developers to determine how much importance is to be given to staking vs engagement. As per the above equation, if MOD > 0.5, then more emphasis will be given to TLM staked on a planet while determining how much of the daily TLM is to be allocated to that particular planet.

Players can choose which planet to mine based on how much TLM can be mined from a particular planet at a point in time. In the above example, mining on Veles is the obvious choice.

Economy management in blockchain games will depend not just on engagement but also on factors that affect the price of the currency. It is a fine dance between rewarding Investors vs Players (sometimes they are the same), as both are important for the functioning of the game.

Land

Most of the interactions in Alien Worlds happen with Land at its center. The first sale happened in December of 2020 through a Dutch auction where the prices go down throughout the auction until everything sells out. The mint price was anywhere between $450 to $15, based on the Dutch auction format. A quick look at the Atomic Hub (marketplace for assets on WAX) shows a price anywhere from $5,000 to $30,000 (though there are sellers who have listed their land for as high as $3,000,000!).

To understand what makes the land so expensive, let’s take a look at how it works.

A piece of land has 5 key attributes:

- The Planet that it belongs to

- The TLM that can be mined from it

- The chance of minting an NFT by mining the land

- The time needed to wait before mining on that piece of land again

- Proof of Work requirement to prevent network abuse and disincentivize automation

Another important aspect of Land is its type. As you can see in the image above, there are 22 different types of land spread across the 6 planets; this totals 4,800 units of which 3,343 can be owned by wallets. The distribution of these different types on a planet gives every planet a unique flavor.

Miners can decide to mine on a land based on these attributes and the tools that they possess. This mining game is the main source of TLM for the players.

From a landowner's perspective, they can charge a commission on the TLM earned after each mining. This is an important decision that the landowners make. If they charge too high a commission on a piece of land that does not reward a lot of TLM, then players might not decide to mine on that piece of land. However, if they charge too little commission on a popular piece of land, they might lose out on potential earnings.

It's not just the landowners who decide how much they can earn through commissions. The planetary DAOs can decide on how much of the TLM allotted to the planet can be used for the mining game. This decision is made through voting by the players who have staked TLM on the planet. So it is in the landowners’ best interest to be part of this decision by staking as much TLM to the planet they own land on as possible.

Currently the 3,343 plots of land are owned by 510 wallets. This means that every wallet owns 6.5 plots of land on average. The above chart paints a scarily accurate representation of the 80:20 rule where 20% of the wallets own 79.75% of all land plots.

Like a lot of blockchain games, in order to incentivize whales to keep investing in the project, the DAO voting power is based on the amount of token staked. This carries the risk of the “rich getting richer,” but unfortunately, whales are the ones supporting these economies at this point in time. Fundamentally, this veers away from the promise of decentralization, as this is akin to the richest person’s vote being “more” equal than others’ vote.

Although landowners are the whales in Alien Worlds, the Staking mechanism pushes them to take their TLM out of circulation so that they can have more say in the governance. This ensures that they don't remain completely inactive.

Tools

Now that the TLM has moved from the Federation to the planets, and then to the Land, it is time for it to come into the hands of miners. This is primarily done through Tools. These Tools are NFTs that must be equipped to mine TLM.

The Planet Mining Pot is filled once a day from the TLM allocation to a particular planet. Afterwards the TLM is continuously dripped into the Current Mining Pot over the span of the day. This is the pot from which players mine. Since all of these steps happen on a % basis, the system will never theoretically run out of TLM. One issue could be that the amount that players mine can be slightly impacted by the amount mined beforehand from the Current Mining Pot, but the impact is reduced since it is drip-filled continuously over time.

The Tool NFT has the same attributes as the Land NFT. Players can take in 3 Tools to mine a plot of Land. Three calculations happen here:

- Mining Reward: This is a function of the tool’s mining power (which describes what percentage of the planet’s current mining pot can be mined by the tool) and the Land mining multiplier (which is based on the “quality” of the piece of land in addition to the sum of the tool multipliers taken in). This then gives you a total mining power which is a percentage. There is, however, an 80% max cap to this. This percentage is then applied to the Current Mining Pot of the planet to determine the TLM that is mined.

- Chance of NFT: This is a function of the Land Multiplier and the sum of the Tool Luck. There is a step 2 that determines the rarity of the Tool NFT which will be dropped.

- Cooldown: This is the time players have to wait between mines, and it’s a function of the Land charge multiplier and the Tool charge time. This ensures that players are not able to use the most powerful tools very frequently.

At present, there are 53 different types of tools with varying rarities. The complete list can be found here.

Another way in which players can impact the ability to earn more TLM per mine is by Shining (or upgrading their NFTs). There are multiple shining levels:

Every Tool NFT has the following Rarities. These rarities are fixed for a particular Tool:

- Abundant

- Common

- Rare

- Epic

- Legendary

- Mythical

Every Tool has the following Shine levels:

- Stone

- Gold

- Stardust

- Antimatter

Tools of all Rarities start at the Stone Shine level, but the Max Shine level that can be achieved for tools of different Rarities is different. Shining to the next level requires TLM as well as 4 NFTs of the previous Shine level, which will be burnt. The TLM used for shining is also burnt. This reduction in NFT supply helps keep their prices from plummeting (as we’ve seen in other games that failed to implement appropriate sinks). At the same time, the team is constantly dropping more NFTs to keep the community engaged. The burning of TLM increases its scarcity.

Shining NFTs is the single largest sink of TLM in Alien Worlds. Importantly, the NFT-burning mechanic helps the game team manage the demand and supply of these NFTs based on the number of players engaging with the game.

Missions

The 7th Planet in Alien Worlds, Planet Binance, can be mined through missions. In order to play missions, players will have to connect their Metamask wallet since this feature is built on the Binance chain. This is interesting because Alien Worlds requires players to connect their WAX wallet to play the main game but needs them to connect their Metamask wallet to play a particular feature in the game. It is a cumbersome experience but makes for an interesting case for multi-chain implementation.

These missions last anywhere from 1 week to 12 weeks. There are multiple mission types with TLM as well as NFT rewards. When going on a mission, players have to stake TLM for the duration of the mission. The TLM rewards are based on the number of players who are going on the mission at that time. In the image above, every spacecraft requires 1,000 TLM to be staked. The currently engaged spacecrafts are 480. This means that every spacecraft will get a reward of 62.5 TLM after 4 weeks. That is a 6.25% return in 4 weeks. This number, however, highly depends on how many spacecrafts are going on the mission; the higher the number, the lesser the reward per spacecraft.

Staking is the predominant method in Alien Worlds to have the control supply side of TLM.

Economic Sustainability

Now that we have an understanding of how TLM flows through the game, the sustainability of the game will be fundamentally based on the demand vs supply of TLM. It boils down to demand for the token outstripping supply over a long period of time all while properly managing the source and sinks.

Let’s look at how Alien Worlds manages this source and sink. At this point in time, the source of TLM from the Federation to miners or landowners happens through the pseudo-inflationary Daily Planetary Allocation described above. The size of the Federation treasury only has an outflow and no inflow as the TLM from Shining (the only sink in the game currently) is burnt.

Based on the above source and sink management, let's see how the following metrics of Alien Worlds have fared:

- Market Cap

- TLM Price

- TLM Transaction Volume

- Wallets

Since the start of 2022, the total wallets have stayed roughly constant at 200K per day. The TLM Market Cap has also stayed around $100M while the price of TLM has dropped by more than 50% in 2022 itself. The Transaction Volume has been stable and is closely related to the Market Cap.

The important point to note here is that Alien Worlds is a F2P game, and players don't need to buy TLM or Tool NFTs to start earning TLM (although they need to stake WAX in order to start playing, but it can be recovered back). If players purchase the Tool NFTs the earning potential will be much higher. However, these NFTs are purchased in WAX and not TLM.

The players who are playing for profit need to figure out how soon the cost of the NFTs that they buy in WAX can be covered through the TLM that they will earn as miners or landowners. It is difficult to calculate the ROI of a Tool, as the amount of TLM you can mine at any point in time is not deterministic.

The ROI of land can be estimated. Taking into consideration the current price of TLM to be $0.1 and the daily release schedule of TLM to planets, one can assume that this is divided equally among the 3,343 plots of land, with every plot taking a commission of 20%. If the price of TLM remains constant, based on the above assumptions, the Landowners will be able to mine $2,500 worth of TLM in 1 year. At the time of writing, the cheapest piece of land in the store is $5,000. That would provide a yield of 50% (unsustainably high in real money terms).

The system does not need new players to fund this TLM, as the Federation is the only source of TLM and this theoretically continues till infinity. At this point in time, the Mining game is the primary source of TLM, and Shining is the primary sink of TLM (when it is burnt). Staking through Governance and Missions removes the TLM from the supply, creating an artificial scarcity. This is the primary reason for the market cap to remain constant while the price drops. Even if new players are added, they don't necessarily need to shine their Tool NFTs in order to start earning TLM. Since the daily allocation of TLM is fixed, if the number of wallets increases, the earnings per wallet will decrease. Although rising prices of TLM/NFTs would still mainly hinge on rising demand (aka more players) as much as healthy sinks that reduce supply, this structure does not look like that of a ponzi scheme.

The Market Cap of Alien Worlds is primarily supported by the staking mechanisms which create an artificial scarcity. It becomes less and less lucrative for new players to start playing the game as the price of TLM is declining, while new TLM is being sourced and staked at the same time. The TLM-burning mechanism through Shining seems to be taking care of the additional TLM in the system that is being sourced but not staked.

The aim should be to increase sinks that will create a demand pressure on TLM increasing its price and market cap.

The Role of Bots

Bots are a reality of this ecosystem, and Alien Worlds has faced its fair share of problems with them. This article states how the team approaches bots. The main pillars of this approach are:

- Study the data with the help of the Community to identify bots.

- Flag these bots (but have provision for unflagging).

- Handle the damage to the ecosystem through changes in probability structures of NFT drops.

Compared to other games, Alien Worlds might have a larger bot problem because:

- Its simple structure makes it easy to build a bot.

- The main incentive in the game is mining TLM. Hence, there is a larger motivation to build a bot for Alien Worlds.

- Since the gameplay is single-player, players don't encounter bots and their gameplay as such is not directly impacted. This means that there is less motivation in the community to find these bots.

Let’s try to understand how big the bot problem is.

The above graphs point towards the game having 170,000 active miners in 24hrs (7-day avg) and 80,000 active miners in 1hr (7-day avg). This means that the Hourly Active Wallet/Daily Active Wallet ratio is close to 47%. This means that, on average, miners mine for just more than 11 hours a day. This is an absurd number. Let's assume that a bot plays 24 hrs a day. Using this assumption, let's try to model how many bots can there be in the system by assuming different values of playtime for a Non-Bot player.

Based on the above simulation, the maximum number of Bots that can be present in the game is 45%. The reality, however, will lie somewhere in between. If we assume that the average player engages with the game 3 to 6 hours a day (which still might be aggressive), the percentage of bots would range between 30%-40%.

However, the question to be asked is, are bots all that bad for games like Alien Worlds? I would argue that they are not — at least not as much as others may think. Not only do they keep the game economy running for a game that is not inherently retaining, but they also do not greatly disturb the experience of other players. What remains to be seen is if 30%-40% of “players” being bots is helping the game economy or not. If bots extract more value than they put in and take earning potential away from actual players, then that’s an issue. But if they are staking and removing supply out of circulation, then it somewhat mitigates the problem. My guess here would be that most of these bots are programmed to stake their TLM earnings to Planets taking the TLM out of supply helping sustain higher TLM prices. The game would likely be more rewarding to real players if there were fewer bots, but any crackdown should be taken with care, given the complexity of the game’s economy.

Past and Future Roadmap

Three main events have helped grow Alien World’s transaction volume.

- April 2021: Alien Worlds Deployed on BSC (Binance Smart Chain)

This was the single most important step taken by the team and was executed to perfection. The transaction volume jumped by 100x over the month. The event was publicized by Binance due to the win-win nature of the move; BSC got utility from one of the largest blockchain games. For Alien Worlds, its users got to experience ‘invisible blockchain’ tech, low gas fees, and access to the numbers and tech of the Binance ecosystem. I see this to be a strategy adopted by games on-chain, and if I have to draw similarities to Web 2, it's akin to launching the game on a new platform.

For any blockchain game, though the selection of the first chain is important, it will not necessarily be the only chain that it operates on. The selection of blockchain will also depend on what kind of game it is and what elements of the game the developers want to keep on-chain, as the user experience and flow differs from chain to chain. The ecosystem is constantly evolving with new functionalities / trade-offs in different chains, and developers need to keep a close eye on what’s going on if they hope to best enable their games to reach the biggest audiences in friendly ways.

2. June 2021: New Method for NFT Game Card Allocation

The unprecedented growth in Alien World’s userbase after the deployment on BSC spurred economy-related challenges. As the number of users increased, the NFTs and TLM mined were much more than anticipated. Owing to the limited nature of NFTs and TLM, the earnings per player dropped. Now, since players were not able to earn as much as they were before, the transaction volume was reduced.

As the transaction volume was going down, another move that the team made was to make the Rare tools even more powerful. This was met with a lot of backlash from the players and rightly so. From a business point of view, it does make sense to keep the whales happy. However, due to the interconnected nature of the economy in Web 3, such moves might not go down well with the community and may have been a contributing factor to the declining transaction volume.

This double whammy likely pushed the team to make major changes to the game. One of those was to change the method in which the NFTs were distributed. In the new method, the game awarded a set number of NFT game cards of each Rarity per hour. The more luck a player generates during that hour, the greater chance the miner has to get these NFT game cards. This ensured that engagement was rewarded along with luck and was a contributing factor to the recovery of transaction volume.

The community has a much larger role to play in Web 3. Focusing on fairness and rewarding engagement (and not just pure luck or money) will go a long way in creating sustaining ecosystems.

3. October 2021: Missions on BSC

Players now can send virtual spaceships on missions and receive NFTs for use within the game, as well as acquire NFTs created by various player communities who host frequent events and activities. Players need to stake their TLM to go on missions. Just like Web 2, parallel opportunities to earn in the game will always be appreciated. The balancing should ensure that it does not harm the economy.

Apart from these updates targeted at increasing transaction volume, the game also launched an update to make it easier for users to play on the mobile web browser (not a mobile app). The interesting part here is that the WAX wallet works flawlessly on the mobile web browser. However, players will not be able to go on Missions on mobile web browsers, because that part of the game needs to connect to Metamask, which currently isn’t compatible with mobile web browsers. Though it brought in some players for a short period, this spike was not sustainable.

Alien Worlds is a living and breathing project with an ambitious roadmap ahead of them. Their updates can be categorized into 3 themes: 1) Updates for Players, 2) Updates for Landowners, and 3) Updates for Community.

Updates for Players

- In the near-term, the plan is to add more Quests and an engaging storyline to build out the universe. Though this is a good touch, it will have to be part of the core loop for it to make any meaningful difference.

- In the medium-term, the team wants to release its fighting game. It is meant to be a new mode in the same game but the details are yet to come. They have already been dropping NFTs for the game over the past couple of months, and this update cannot come any sooner. Rumors are that this is supposed to be a turn-based PvP battle game using NFTs that will have an entry cost of TLM. If that’s true, this has the highest chance of changing the trend of the declining price of TLM through consumable TLM spend and improving the engagement in the game through a feature that is fun to play.

- In the long-term, the plan is to give more levers to the players by adding functionality to Hero, Avatars, and Minions and to make the game more immersive.

By the end of 2022, we will start seeing AAA quality games in the blockchain space, and there is a risk of games like Alien Worlds losing their players if they are not able to meet growing player expectations.

Updates for Landowners

- In the near-term, the team wants to give Landowners more ways to make their land attractive by having a Landowner-specific NFT-mining distribution mechanism. This would help engage the whales in the game and incentivize them to not just be bystanders.

- In the medium-term, the plan is to make it easy for the landowners to be able to sell NFTs on their land plots. The team will need to provide clarity on the kind of NFTs that can be sold here.

- In the long-term, the team wants to provide additional functionalities to landowners by giving them terraforming and farming abilities. This feature would help add sinks to the landowner loop, which is where most of the game’s whales lie.

Landowners are an important part of the whale population. Their moves not only impact the price but also the experience for the players, as the current gameplay happens completely on Land. When it comes to landowners, the updates need to push them to be more engaged — otherwise they extract more value than they add. They currently enjoy a lot of economic power, and the aim should be to give the governance power not on the basis of this economic strength but on the basis of engagement.

Updates for Community

- In the near-term, the aim is to bring in players from other projects through cross-promotions.

- In the medium-term, the goal is to enable governance where the DAO will be able to make decisions regarding the game. For example, what percent of the Planet TLM pot is to be allocated to the mining game? We are still far away from a point when the control of games can be handed over to DAOs. Looking at the high skew of whales in the game, this likely isn’t a good move. After all, the whales would likely juice the incentives for the “elite” landowners (themselves), and communities in general do not have the skills of professional game/economy designers.

- The long-term vision is interoperability where NFTs from other projects can gain utility in Alien Worlds. I am highly skeptical of how this would be executed.

Community is key for Web 3, and players’ expectations of ownership and governance will have to be looked at seriously. However, we are yet to see how interoperability would be executed, and it’s mostly a pipe dream, especially when talking about completely separate gaming ecosystems interoperating.

Conclusion

Alien Worlds is an OG of the blockchain gaming space. It looks bad, has very non-engaging gameplay, but it’s made a lot of money for some people. However, despite that, it hasn't been able to grow. One can say that the entire market is in a slump, but it's difficult not to expect growth from one of the oldest running games having the highest number of wallets playing it.

Here are a few suggestions for the team to consider to help it stay relevant going forward:

- Any game needs to be fun enough so that players don't mind spending just for that fun. This will help create a healthy cycle where the time spent by some players can be monetized through other players who would like to skip the grind. This is where Alien Worlds definitely lacks. It might be difficult to pull off a skill/twitch-based experience, but given the current structure, a 4X model with deep community interaction can be a way to go. EVE Online can be looked at for inspiration.

- The 30%-40% estimation of the bot population might not be causing too much trouble for now, but it isn’t sustainable. The objective should be to create a gameplay experience so that creating bots will become more difficult. This will also incentivize the community to be more active and vigilant in hunting down bots, as it might directly impact their gameplay.

- How much is too much time between selling NFTs and having a utility for them? Alien Worlds might unfortunately find the answer for that if they do not release the fighting game that will give utility to the Weapon and Crew NFTs that have been selling for the past couple of months. The suggestion would be to prioritize the fighting game update.

- The staking elements in the game are strong and have helped keep the economy stable. However, the current opportunities for sinking TLM are very little, and that is one of the reasons why the market cap has not been able to grow. The new fighting game may be able to provide opportunities for these sinks. One suggestion here would be to have consumable sinks for TLM in the form of temporary boosters for different elements of the gameplay.

Alien Worlds is a mature project in the Web 3 gaming space with a relatively large wallet base. There is a lot to learn from this project; however, for it to stay relevant over the next couple years, it needs to up its game and fast.

Big thanks to Karan Gaikwad for writing this deconstruction! If Naavik can be of help as you build or fund games, please reach out.