Hi Everyone. Thanks for tuning in to another week of Naavik Digest. If you missed last week’s edition, we wrote about ChatGPT’s relevance to NPCs in video games. Please check it out and let us know what you think. With that, let’s dive into this edition.

Open vs Closed Economies in Web3 Games

One of the promises of web3 is the opening up of in-game economies, and for players to retain some kind of residual value for all the hours they put into a game. In web2, the developer and the platform on which a game is played retain 100% of the economic value - web3 changes this, at least in theory, and allows players to retain an economic interest in their gaming digital assets, both the non-fungible ones - the unique NFTs they own - and the fungible ones - the in-game currencies they accumulate through time spent, trading with other players, and skilled gameplay.

In this episode, your host Niko Vuori talks to two game economy specialists — Mete Gultekin (Vader Research) and Kiefer Zang (Economics Design) — to discuss the pros and cons of an open economy design in web3 games.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Activision’s Regulatory Concerns

As part of Naavik’s 2022 predictions back in January, I wrote that gaming would come under increasing public scrutiny due to a confluence of trends: the potential for antitrust litigation, ongoing concerns over workplace conditions, and intertwining backlash against the use of loot boxes and NFTs in games, among other reasons.

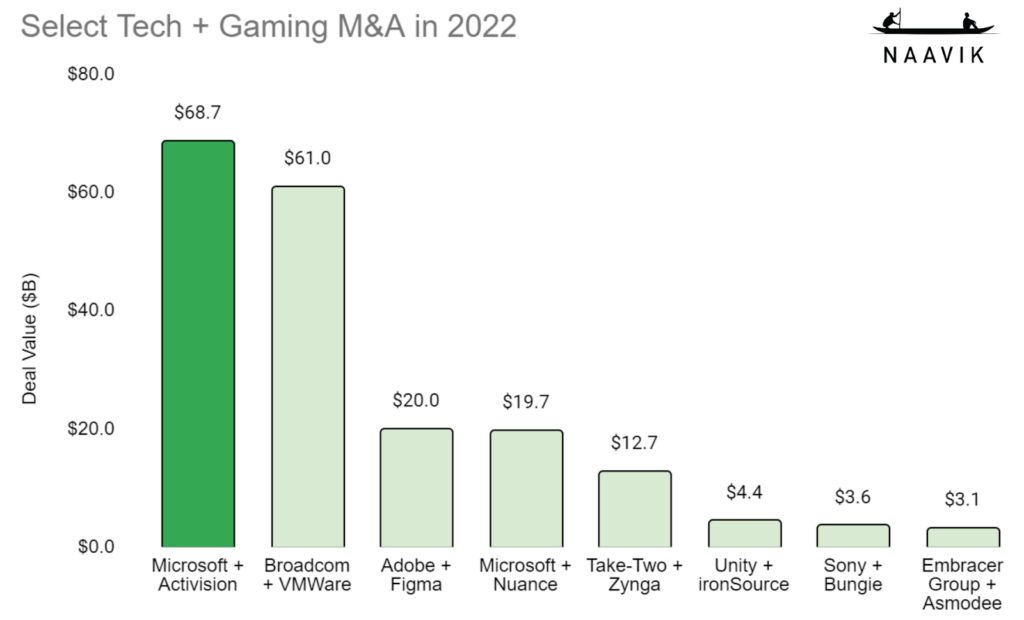

While my prediction wasn’t exactly a hot take at the time, all of the drama surrounding Microsoft and Activision-Blizzard sure is making it seem prescient. The $68.7B acquisition by Microsoft – first announced just weeks before that prediction was published – has attracted scrutiny from a number of governmental bodies across the world:

- In the United States, the Federal Trade Commission (FTC) is reportedly “likely to file an antitrust lawsuit” to block the merger, though that report may now be outdated given more recent news that the FTC is split on the issue.

- In the UK, where Activision has more employees than anywhere else save North America, the Competition and Markets Authority (CMA) is still evaluating the merger. The regulator’s investigation has revealed a number of interesting comments from both Microsoft and rival Sony coming out of its recent “Phase 1” findings.

- In the EU, the European Commission (EC) has already reported from its preliminary investigation of the merger that “Microsoft may have the ability, as well as a potential economic incentive, to engage in foreclosure strategies vis-à-vis Microsoft's rival distributors of console video games".

- In China, the State Administration for Market Regulation (SAMR) appears to be waiting on the EC’s findings, but has already rejected a request to file the transaction under a “simplified procedure”. This news comes shortly after Activision-Blizzard and Chinese publisher NetEase announced a breakup of their longstanding agreement to publish Blizzard’s games in mainland China.

Of course, the news has not been entirely negative for Microsoft and Activision: the merger has already been approved in Brazil, Saudi Arabia, and Serbia, and the two companies would surely have anticipated pushback regardless. After all, Microsoft is no stranger to antitrust concerns and the current political climate has been fairly oppositional to this (and other “Big Tech” M&A) from the outset.

Activision is undoubtedly already viewed with suspicion by the current pro-labor administration in the United States, given the company’s repeated union-busting efforts and difficulties in maintaining a safe work environment at its subsidiary organizations. The U.S. Army – itself a chronically atrocious workplace for women – has even deemed Activision-Blizzard’s response to sexual harrassment claims to be too problematic to justify maintaining its sponsorship deals.

Workplace conditions aside, why are so many entities (both inside and outside the games industry) concerned by this merger?

For starters, both the sheer size of the deal and the players involved were always going to garner a reaction. Microsoft is already just shy of a $2 trillion market cap, and this $68.7 billion deal represents the largest acquisition ever undertaken by the company. To put that in perspective, compare this deal to some of 2022’s most noteworthy tech and gaming acquisitions and it’s immediately obvious why the deal continues to make headlines.

Furthermore, the largest IP set to change hands in the deal – Call of Duty – just had its most successful mainline release ever, with Modern Warfare 2 crossing the $1B sales mark in just 10 days. This is all before we’ve really even reached the holiday season, during which we should expect an additional sales bump.

Much of the public discourse around this deal has been framed around the dominance of Call of Duty and what it might mean for consumers to have this mega franchise locked exclusively into Microsoft’s Xbox Game Pass ecosystem. Among the loudest commentators has been rival Sony, who has referred to Call of Duty as an “irreplaceable” IP, should Microsoft seek to make it platform exclusive. Sony has also described Microsoft’s proposed concessions as “inadequate on many levels”. Even EA’s Battlefield franchise caught some strays in the public tit-for-tat.

For its part, Microsoft has been quick to reframe the argument around its desire to enter the mobile market, where Activision-Blizzard would immediately make it a noteworthy contender (more on that below). As it pertains to exclusivity, Microsoft has offered arguments such as those detailed in the visual below in an attempt to persuade regulators of its good intentions. Furthermore, recent reporting indicates that concessions are expected to be forthcoming in the EU investigation, including a 10-year licensing deal to Sony.

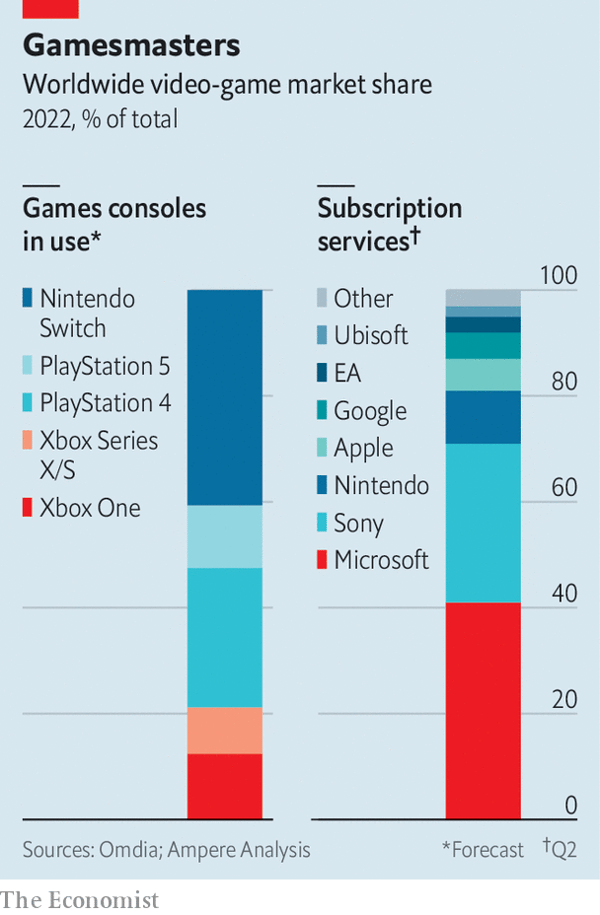

Perhaps ironically, Sony itself has been one of the biggest enforcers (offenders?) of console exclusivity in the past with franchises like God of War, Horizon Zero Dawn, and Last of Us. The company also maintains a solid lead in terms of console adoption over Microsoft.

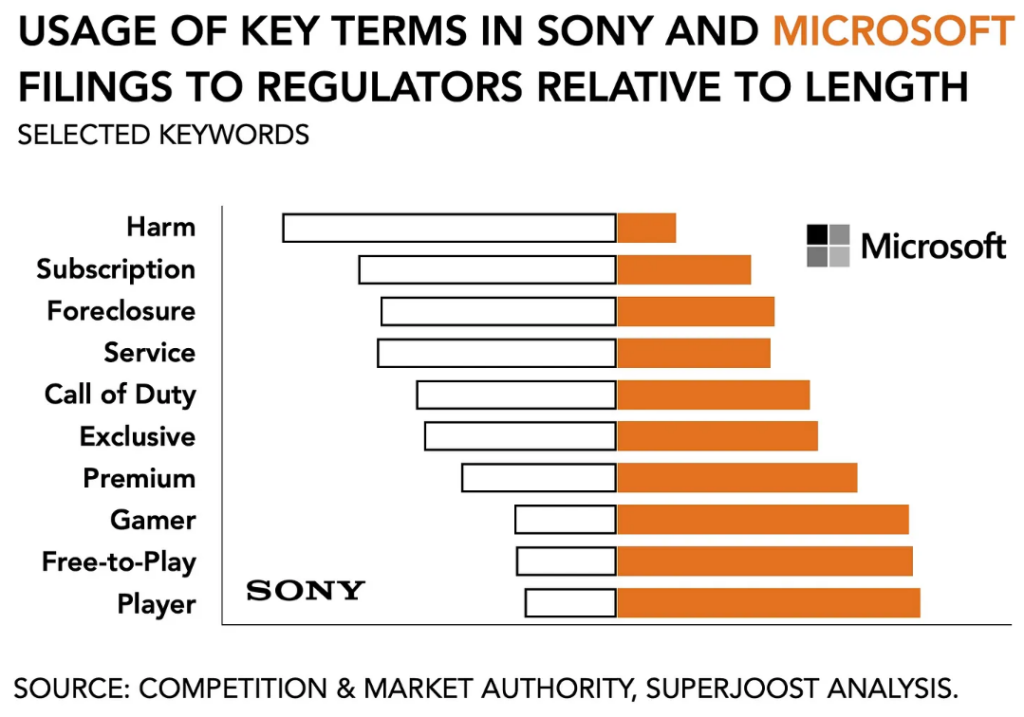

While it might play better in the press to highlight concerns over exclusivity and platform dominance, a careful analysis of the two tech giants’ legal commentary paints a slightly different picture. As Naavik friend Joost van Dreunen points out in his excellent textual analysis of documents filed with the CMA, Sony makes far fewer mentions of the “player” or “gamer” that might sit downstream of all this corporate squabbling.

Rather, Sony appears far more interested in the impact to its subscription services. This makes sense, given its relatively weak (and late-to-market) offerings when compared to the insane value and breadth of content offered by Xbox Game Pass. Likely, the company also sees the writing on the wall as other competitors (most notably Netflix, but also Nintendo, Amazon, and others) rush to make their own upstart plays at subscription offerings. While few of these offer meaningful competition at the moment, they will collectively continue to drive the content arms race among subscription platforms, where Microsoft will be better positioned to weather the storm.

As quality content becomes increasingly locked up behind platform exclusivity and the M&A landscape grows ever more competitive, the importance of steady revenue streams to de-risk content acquisition costs will only grow. This is where Activision-Blizzard’s strength in mobile plays a critical role. Though the majority of the public discourse has thus far centered on PC and console titles, we should not overlook the fact that Activision was deemed a serious enough mobile competitor to be pulled into the smothering embrace of Google’s Project Hug (an allegation that Activision has denied).

With Candy Crush (Puzzle / Match-3), Hearthstone (Card Battler), Diablo Immortal (Action RPG), and Call of Duty: Mobile (Shooter) all under its umbrella, Microsoft immediately becomes a power player in four multi-billion dollar mobile genres. The combined entity will also have several notable mobile projects in the pipeline, with Call of Duty: Warzone Mobile, Warcraft Arclight Rumble, and Age of Empires Mobile all coming to market with high expectations.

Furthermore, we know of at least one World of WarCraft mobile game that has been scrapped, as well as preliminary indications of Microsoft’s plans to spin up an Xbox mobile gaming store, signaling both companies’ intent to continue pushing forward on mobile. This should be all the more alarming to Sony, which has historically lagged behind on mobile, having only just unveiled its PlayStation Mobile division a few months ago with the acquisition of Savage Game Studios.

So where does all this leave the consumer? It will undoubtedly force some to pick sides in the console war. According to Omidia Research (as referenced in the Economist), “some 45% of PlayStation owners” play Call of Duty. On the one hand, that is a huge group of consumers to close the door on. On the other hand, it’s hard to know how many of that 45% also own an Xbox and/or PC where they might otherwise access Call of Duty, nor can we differentiate between the hardcore CoD fans that will follow the franchise to any platform and the passive once-in-a-while players. And while none of this takes into consideration the other IPs in the deal, most of Blizzard’s IPs are PC-first (and therefore less subject to the Console Wars), while the mobile portfolio will remain available on both Android and iOS.

It’s tempting to compare the developing market dynamics to those we’ve seen in the TV and movie streaming business. Many customers, as I have, will end up needing to pay for multiple subscription services in order to access all the content they want to consume, similar to paying for both Netflix and Disney+. Microsoft’s Vice Chair and President Brad Smith (via a Wall Street Journal op-ed) recently made a similar comparison, likening Sony’s objections to those of Blockbuster during the rise of Netflix.

However, unlike Netflix and Disney+, most of the leading gaming subscriptions are locked into their respective hardware ecosystems. In the same op-ed, Smith claims that Microsoft is seeking to help consumers out of this conundrum by offering games through its cloud gaming service. It seems that Microsoft will pull out all the the stops to make this deal go through, including a forthcoming 10-year deal with Sony, and now a 10-year commitment to Nintendo and Valve (in quick, sub-24 hour succession following this op-ed). To be fair, it’s unclear even if the Switch can support CoD. They also only include specific language solely around CoD and not any other ATVI games — the brand might not be as multi-platform as they make it out to be.

My guess is that most consumers, as I do, will find this argument unconvincing given the limited adoption of cloud gaming services thus far. Furthermore, the variable latency of cloud gaming severely limits the potential use cases. No serious Call of Duty fan is likely to play via cloud streaming. The same holds true for fans of other first-person shooters or any other fast-twitch game.

As of this writing, Activision trades around $76, representing a ~20% discount on the $95 per share agreed to in the acquisition. If this is any indication, there is still some pessimism on Wall Street that the deal will not get done. I happen to believe that the deal will eventually make it, through – perhaps after some concessions have been made. Even if it does not, there’s no putting the genie back in the bottle at this point. The so-called MAANG companies are all meaningfully invested in gaming in one way or another, and all of the gaming-natives are continuing to consolidate. Gamers and industry professionals alike will need to get used to an increasingly balkanized landscape for interactive content. (Written by Matt Dion)

#2: Guild of Guardians, Phantom Galaxies, Illuvium

In our previous, Game Radar piece we looked at three upcoming games (Genopets, Cross the Ages, and Aurory) under the lenses of Team, Tokenomics, Game Design, Fun, and Sustainability. We scored each of the games on each topic and giving an overall rating as well. We’re now going to look at three more games through those same lenses.

Guild of Guardians, from Immutable and Stepico, is a party-based dungeon crawler. It has a strong team and generally plays things safe from a design perspective. That’s not necessarily a bad thing though, especially with increased skepticism about web3. (Disclaimer: Naavik does consult with Immutable on Guild of Guardians)

Blowfish Studios’ Phantom Galaxies is the aesthetic opposite of Guild of Guardians’ cartoony fantasy dungeon romp. Instead it sports sleek, gorgeously-rendered mechs zipping and transforming through space with lasers and missiles dancing around the screen. It risks being more bark than bite though with a lack of details available about the project, or even the team working on it.

Illuvium needs little introduction with two of its founders becoming billionaires in Dec 2021 (and unfortunately losing that status shortly thereafter). The ambitious project already has three distinct games within it and plans to add six more. The game has had a lot of ups and downs and we discovered some unexpected facts as we dug in. We were most surprised though when we decided to take a real, hard look at their plans for sustainability — and we were pleasantly surprised.

Like last time, these games are generally in early stages and so we’re occasionally having to infer from what information is available. We’ll again give the disclaimer that we may well change our minds about these games as they get closer to launch and we see more of what there is in store for the players. Let’s dive in.

Content Worth Consuming

Super Puzzle Fighter II Turbo — 1996 Interview (shmuplations): “In this 1996 interview, taken from Studio Bent Stuff's All About Super Puzzle Fighter IIX guidebook, several key members of Capcom's arcade team discuss the making of their all-star versus puzzle game, offering insight into the genesis of the project, selecting the characters, applying their fighting game expertise to a new genre and more.” Link

Learnings from EVE Online (FOGDAO): “Hilmar Veigar Pétursson is the CEO of CCP Games - creators of EVE Online. EVE is the leading Space MMO, and it has one of the deepest and most complex game economies of any game in the world. Hilmar is joined by Carlos G. Pereira and host Nico Vereecke for a conversation about Virtual Economies, the definition of Fun, how logistics win wars, and a whole lot of space ships." Link

Tencent is Ramping Up Its Global Gaming Business (GI.biz): “Tencent has always been looking beyond the borders of its home market in China when it comes to growing its games empire, but the last two years have seen those plans advance significantly. While the company continues to generate the bulk of its games revenues from domestic titles, it has been pouring more and more investment into overseas operations and partners – even opening a handful of TiMi Group studios in the West – in the hope that it can become a truly global player.” Link

🔥Featured Jobs

- Stillfront: SVP Operations Management & Processes (Stockholm, Remote - Europe)

- Legendary Play: Senior System & Economy Designer (Remote)

- Nexus: Account Manager (Remote)

- Capcom: Business Development Manager - Esports (Remote - USA)

- Activision: Associate Manager - Global Digital Commerce (Santa Monica, CA)

- Naavik: Content Contributor (Remote)

- Naavik: Games Industry Consultant (Remote)