AppLovin has been on a wild ride. After the company’s stellar stock market debut in 2021, its share price went into a tailspin, losing almost 90% of its value in 2022. The share price has rebounded by more than 500% since the beginning of 2023.

The business has also undergone a significant evolution, with its software (ad-tech) business becoming the largest revenue generator, while its apps (mobile games) business underwent a major restructuring. Today, we’ll provide an updated snapshot of the business, discuss the company’s evolution, and offer some thoughts on its future.

Business Snapshot

AppLovin operates under two segments: software and apps.

1. Software (56% of Revenue and 85% of EBITDA)

AppLovin’s software business primarily services mobile gaming companies looking to drive user acquisition and monetize their ad inventories. Its software revenue comes from three key products.

- AppDiscovery (about 65%-70% of software revenue)

AppLovin operates the third-largest mobile gaming in-app advertising network after Google and Meta, facilitating over $4B of advertising annually (approximately 15%-20% of the market).

The cornerstone of AppLovin’s ad network is its AppDiscovery product, which provides advertisers with performance-based advertising tools to optimize spending against specific performance targets. The company most commonly charges on a cost-per-install (CPI) basis for each successful conversion.

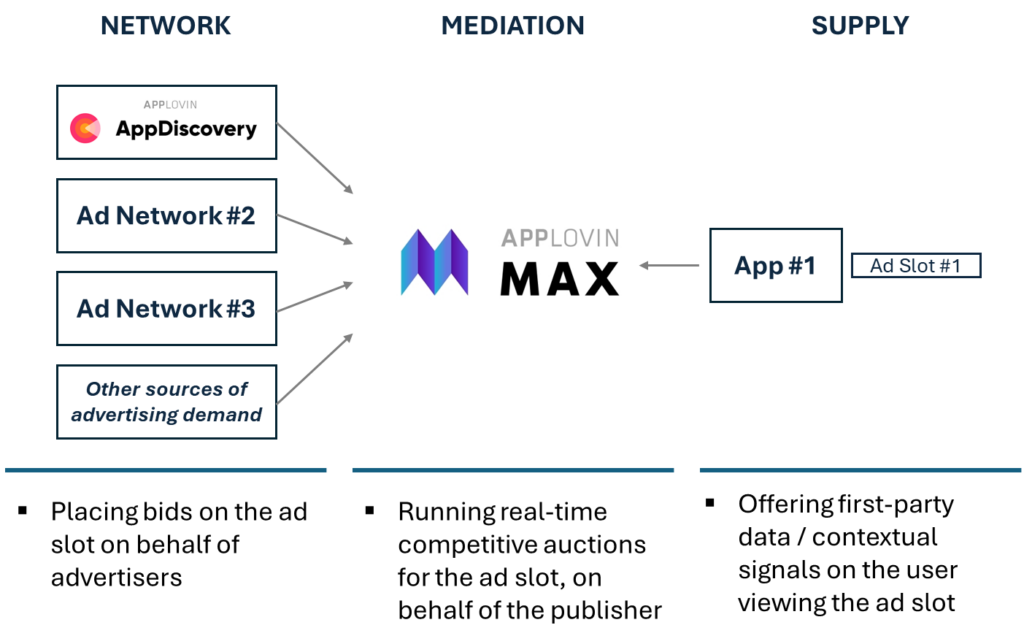

Publishers — referring to anyone offering advertising inventory — connect to ad networks like AppLovin to find the best bids for their inventory. Whenever the network successfully places an ad with a publisher, it pays the publisher on a cost-per-thousand-impressions (CPM) basis and keeps about 20%-30% of the proceeds for facilitating the transaction.

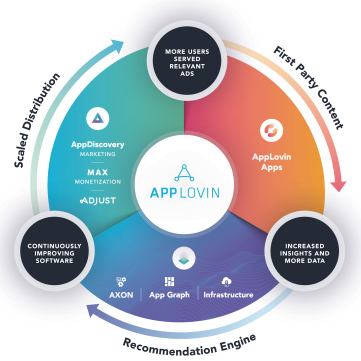

AppLovin’s machine learning algorithm, AXON, facilitates the matchmaking between advertisers and publishers. AXON is powered by the data gathered from advertisers and publishers transacting on the network and proprietary data generated by AppLovin’s other lines of business.

Advertisers and publishers typically work with multiple ad networks simultaneously to maximize profits.

- MAX (about 20%-25% of software revenue)

MAX is a mediation platform that helps publishers run real-time competitive auctions for their ad inventory to maximize revenues. The solution is offered free of charge to publishers, and MAX makes money by charging third-party advertisers who bid through MAX a 5% fee.

Once a mediation solution is integrated into an app, it’s typically a hassle to switch out, from an engineering standpoint. Sometimes, the analytics provided by the mediation solution also become ingrained into internal business processes, creating a larger lock-in effect.

While MAX doesn’t drive as much revenue as the AppDiscovery product, it’s perhaps AppLovin’s most valuable asset because of the pricing data it gathers from competing ad networks and publishers. With more than 60% of the market share in mediation, MAX provides AXON with huge troves of data to train on.

- Adjust (approximately 10% of software revenue)

Adjust is a software-as-a-service solution that helps mobile advertisers attribute credit for installs/user engagement to specific marketing channels/campaigns. It’s a small piece of the total business, but similar to MAX, offers useful app data that is used to improve AXON.

2. Apps (44% of revenue and 15% of EBITDA)

Apps encompass a portfolio of more than 200 free-to-play mobile games across five genres, developed by 11 internally owned studios. The games leverage AppLovin’s software products to advertise and monetize and, in return, provide AppLovin with first-party user data. The apps portfolio skews heavily toward casual, match-three, and card/casino games, which AppLovin views as having lower development risk and more predictable returns. In 2023, about 70% of the revenue from apps came from in-app purchases (IAP), with the remaining 30% or so coming from in-app advertising (IAA).

Business Evolution

2021: The Sensational Debut

At its core, AppLovin has always been an ad-tech business. Its decision to enter the game development/publishing business in 2018 was driven by advertisers and publishers being unwilling to share user data with AppLovin, which was then still a smaller network. The company realized it needed first-party data to compete with Google and Facebook, so it went on a game studio acquisition spree. It would acquire and/or partner with game studios, make substantial investments in user acquisition to grow the games, and take the first-party data to train its algorithm.

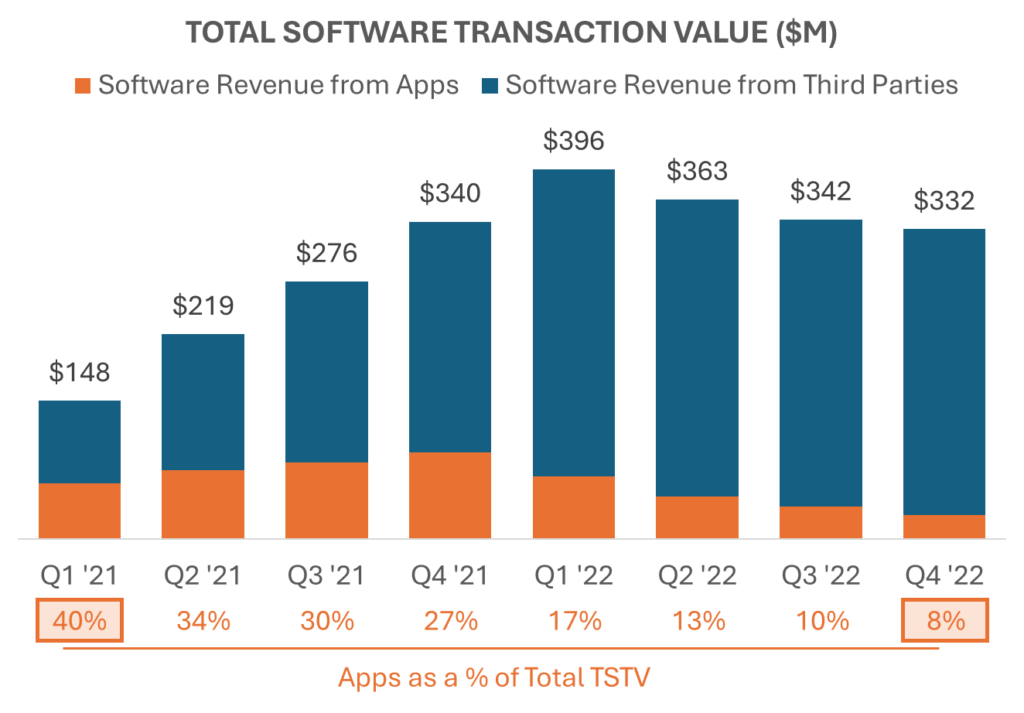

Given the perceived conflict of interest with its customers from the software business, this strategy wasn’t universally loved, but the company pushed forward. By the time of its IPO, the apps division made up more than 80% of total revenues. The apps part of the business was also exhibiting exceptional growth, increasing 56% and 70% in 2020 and 2021, respectively. The segment was identified by management as one of the key inputs to the "strategic flywheel" behind AppLovin’s success.

The gears were also starting to turn in software, with that division going from 5% growth between 2019 and 2020 to tripling in size between 2020 and 2021. Its growth was almost entirely organic, and was driven by the combination of the launch of AXON and Apple’s IDFA changes, which knocked Facebook off its pedestal and reallocated advertising spend to networks that adapted quickly.

Combining these factors with a rosy stock market backdrop, AppLovin had a stellar debut in its first year of trading. By the end of 2021, the share price was up 55% since its IPO, and the company was valued at $39B — more than 50 times its 2021 EBITDA. (For context, the average S&P 500 company was trading at 17 times the EBITDA at the time.)

2022: Bad Financial Results but Strong Execution

The cards were stacked against AppLovin in 2022. The company knew it wouldn’t be able to deliver financial results that lived up to the stock market’s lofty expectations, but it executed many strategic initiatives that set up the company for success in 2023.

AppLovin’s first major task in 2022 was integrating MoPub, which it acquired from Twitter in late 2021. MoPub was the No. 2 player in mediation, and AppLovin had to go through the tricky process of shutting down MoPub and migrating the customers onto MAX. To avoid churn, AppLovin paid out $210M in incentives and also temporarily halved its 5% mediation fee. This hurt short-term financials but successfully reached 90% retention for MoPub’s largest publishers.

Combining MAX and MoPub was transformative for AppLovin, not just because it combined the two leading players in the market — making MAX the natural choice for advertisers and publishers to integrate with — but also because it provided AppLovin with one of the best data sources in the post-IDFA world. By analyzing what different competing ad networks were willing to bid for different ad placements, AXON could identify new advertising pairs, take advantage of mispricings, and calibrate its own pricing behavior to stay competitive. This played a critical role in the upgrades to AXON’s machine learning algorithm in 2022 (more on this later).

AppLovin’s second order of business was decoupling the fast-growing and highly profitable software business from its slowing apps segment. As Apple’s IDFA changes reached mass adoption in late 2021, the games more reliant on targeting started to weigh on the broader portfolio. In response, AppLovin announced in early 2022 that it would start running the apps business as a standalone division, and explore options to sell or divest pieces of the business.

This was a 180 from AppLovin’s "strategic flywheel" story, but it made sense.

The decreasing significance of apps on the network, coupled with the IDFA changes reducing cross-app tracking efficiency, diminished the division's strategic importance to AppLovin. Advertiser and publisher attitudes were also shifting as they realized the benefits of sharing more data with AXON, further reducing the company’s dependency on apps.

By the end of 2022, AppLovin reduced its number of studios from 20 to 11. This streamlined the company and allowed management to focus on the crown jewel, software.

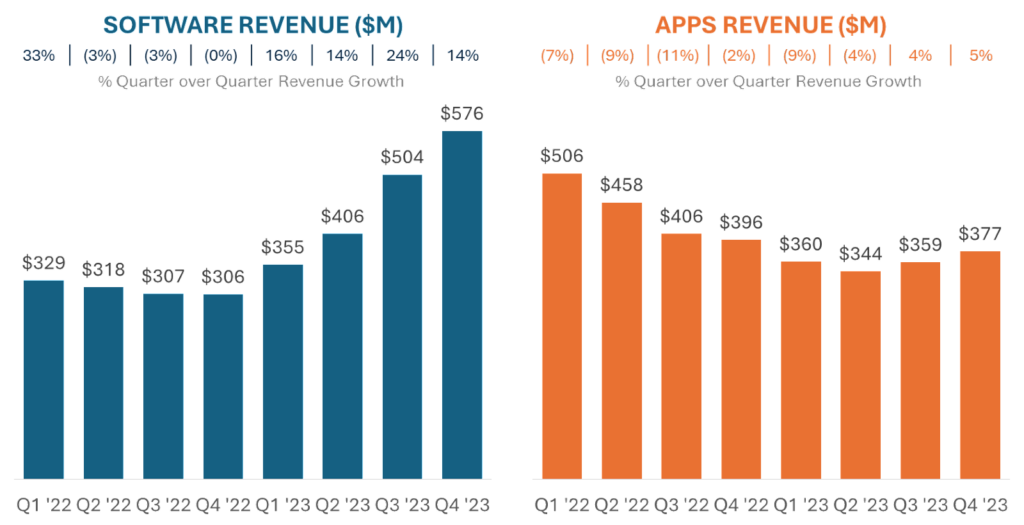

After integrating MoPub, the software business had a strong start to the year, growing 33% quarter-over-quarter in Q1 2022. Unfortunately, business momentum started to slow as mobile gaming companies started pulling ad spending as they adjusted to the COVID hangover and post-IDFA reality. The software business reported three consecutive quarters of flat revenue, and investors worried the software business would be weighed down by the ad spend downturn. While the business looked stagnant on paper, the R&D team was hard at work on the next iteration of its machine learning algorithm, AXON 2.0. This investment ultimately played a huge role in AppLovin’s success in 2023.

We would be remiss if we didn’t mention AppLovin’s unsuccessful public bid to merge with Unity in 2022. Needless to say, the company had a busy year!

2023: Reaping the Rewards

In Q1 2023, AppLovin launched AXON 2.0, which was more efficient than its predecessor and drove four consecutive quarters of double-digit quarter-over-quarter growth of its AppDiscovery product. The software business ended the year up 46%, which is particularly impressive given the challenging economic backdrop and another stagnant year in mobile gaming. The company also benefited from Unity's self-inflicted wounds and challenges with integrating ironSource.

The apps business was also stabilizing and starting to show signs of growth in the later half of the year.

Responding to its robust performance, shares surged 278% during the year, boosting the company's valuation by almost $10B. Undoubtedly, AppLovin had an exceptional year; the lingering question is whether it can sustain this momentum.

What’s Next?

The primary impediment to AppLovin’s sustained growth has remained the same since the company’s inception: its dependence on Apple and Google (Android).

Performance-based advertising relies on building a comprehensive digital footprint of a user and serving them with ads that have the highest chance of conversion. Over the years, regulators have become increasingly stringent about the data being collected by large technology companies, and Apple and Google are both taking steps toward enhancing user privacy. This, in turn, makes performance advertising more challenging.

Apple was the first to move toward a more privacy-friendly operating system, releasing the opt-in consent mechanism for tracking in April 2021. In conjunction, it also started pushing its privacy-friendly attribution platform, SKAdNetwork (SKAN), as the default way to track ad campaign efficiency. Facebook was particularly hard hit because of its reliance on IDFA to track users across apps and pivoted to SKAN to become compliant with Apple’s new regime. The scrappier ad networks like AppLovin and ironSource quickly shifted over to fingerprinting (e.g., IP addresses) for user tracking, which provided much better user visibility than SKAN. These moves led to a reallocation of advertising spending from Facebook to companies like AppLovin and ironSource (Unity).

Unfortunately for AppLovin, Apple has made it clear it intends to crack down on fingerprinting. Forced adoption of SKAN would require AppLovin’s machine learning algorithm to relearn how to effectively target the approximately 60%-65% of users who opt out of sharing their IDFAs and are currently tracked via fingerprinting. In September 2023, Apple started requiring apps with SDKs that could be abused for fingerprinting to provide reasons for why those SDKs are needed. This policy is set to become more strictly enforced in 2024, with apps that have fingerprinting technology at risk of being banned from the App Store.

Another risk to consider is a wild card: that Apple ultimately decides to launch its own privacy-friendly ad network on iOS. For many years, Apple has been hungrily eyeing the hundred-billion-dollar advertising business Meta has built in its backyard, and expanding into advertising could move the needle for the world’s second-most valuable company.

Google, on the other hand, has been slower to implement privacy changes, but is also looking to reduce advertiser dependency on tracking individual users. It is currently beta-testing its new privacy-friendly ecosystem, which will restrict the permissions and memory tracked by third-party SDKs (used by ad networks), and provide new targeting and attribution tools that obfuscate user-level data. This retooling will force the third-party ad networks to relearn how to target efficiently on Android, and Google’s ad network will likely continue to win on its own platform as it benefits from having the best first-party data.

Growth Opportunities

The biggest tailwind for the business is the underlying growth of the mobile advertising industry, which has historically grown at a double-digit CAGR. While AppLovin’s software business primarily plays in the $27B gaming app install subsegment of the broader mobile advertising market, its expansion into mediation allows the company to share in the spoils from more nongaming advertiser dollars flowing into the mobile gaming ecosystem.

The company should also see growing ad supply from developers since targeting high IAP spenders has gotten harder, and teams become incentivized to shift to more ad-heavy monetization.

Another tailwind the company could benefit from is the increasing regulatory scrutiny of Apple and Google’s anti-steering practices on their app stores. If alternative payment channels become mainstream, this could help game developers see increased LTVs and drive reinvestment into user acquisition.

AppLovin’s strategic moves over the past few years have also reinforced the company’s position in its core market. Most notably, the acquisition and integration with MoPub secured AppLovin a permanent toehold in the mobile advertising ecosystem with a sticky software solution that is highly synergistic with its broader business. Separating the software and apps divisions also resolved a longstanding conflict of interest that had troubled game developers for years. Lastly, the reinvestment in R&D enabled the launch of AXON 2.0, which helped the company drive outsized growth in a relatively flat market in 2023.

While AXON 2.0 will continue to improve as it trains on AppLovin’s ever-expanding database — a self-reinforcing flywheel — the growth driven by the algorithm’s efficiency gains will be nonlinear. Quoting AppLovin’s CEO from 2022 (when things weren’t going as well): “For investors that understand, it's not going to happen every single quarter. We can't predict tech enhancement. But when it happens, it's a step function. And because of the scale that we operate at, that step function can drive a huge ability to generate increased cash flow over time.”

Beyond gaming, the company has also made some bets on growing adjacent markets, such as performance advertising in CTV, and advertising solutions for carriers and OEMs. These ventures don’t contribute significant revenues today but could provide incremental upside in the future.

Conclusion

While AppLovin will undoubtedly be negatively impacted by the increasingly stringent privacy rules, the company has demonstrated a strong ability to adapt and excel through these changes in the past. The company was well prepared for the IDFA changes in 2021 and positioned itself to benefit as the market leaders ceded share. It judiciously reinvested these gains into acquisitions and further bolstered its technological advantage, paving the way for outsized growth in a challenging environment. Additionally, the company remains poised to capitalize on broader market trends, such as the ongoing influx of advertising dollars into mobile platforms, the growing incentives for publishers to monetize through advertising, and regulatory changes that could increase LTVs and drive reinvestment.

In summary, while the company might encounter some obstacles in the near future (fingerprinting, we’re looking at you), AppLovin's management team has a proven track record of successfully navigating roadblocks. Ad-tech is a tough market, and most companies here don’t survive very long, but AppLovin has a team that can adapt and thrive for a long time.

A Word from Our Sponsor: GRID

Unlocking the Potential of In-Game Data for Everyone

GRID is a game data platform offering esports data infrastructure, management, and distribution solutions to the leading game publishers, including Riot Games, Ubisoft, and KRAFTON, and tournament organizers in the VALVE Ecosystem for CSGO and DotA2, collaborating with PGL, IMG, WePlay, or Perfect World.

Through GRID Distribution Solutions, over 350+ integrated customers across 20 use cases, from talent scouting to AI applications, get access to live game data. The customizable GRID Data Portals provide a tailored data experience for various user groups, including competitive stakeholders, and the GRID Open Access provides free entry to esports data for fans, developers, community creators, and academic projects.

GRID's mission is to democratize access and unlock the potential of game data for everyone.

Content Worth Consuming

MapleStory Universe GDC 2024 Session Full Script (medium.com): "Hi everyone, I’m Keith, head of strategy at MapleStory Universe (NEXPACE). I’ve been working on MapleStory Universe since its inception in 2021. It’s both my debut at GDC and I’m super excited to share insights from our journey. Today, I want to focus on the development process of MapleStory N, our flagship PC MMORPG in MapleStory Universe. Specifically, I’ll elaborate on how we’ve infused real-world economic principles into the game system."

Summerhouse & the rise of the 'chill game' on Steam (The GameDiscoverCo): "So, we’ve been watching the success of Summerhouse ($5), a self-described “small-scale building game and a love letter to the feeling of long lost summer afternoons”, over the past couple of weeks. It launched on March 8th, and we can reveal it’s just hit 120k units sold on Steam. According to our externally-sourced estimates - which actually underestimate Summerhouse’s success, it was #9 in ‘most-downloaded new Steam game in March 2024’. Well, it’s really #6, now we know the exact sales numbers. So it’s worth examining."

We Need To Talk About Gaming’s User Acquisition Problem (gamedeveloper.com): "In the dynamic world of mobile and live service gaming, success hinges not only on the quality of gameplay but also on the size and engagement of the player base. User acquisition is therefore the lifeblood of the gaming industry, driving growth, fueling revenue, and cultivating vibrant, engaged communities. But there’s an emerging problem – attracting and retaining players isn’t as easy as it used to be."

Why the “old game good, new game bad” discourse actually matters (pattheflip.medium.com): "New fighting games are bad, actually is one of the neverending topics of common fighting game conversation, and it has endured since the beginning of the genre itself. Legends say that as soon as the first Street Fighter II cabinet materialized into the world, a guy materialized next to it to helpfully inform people that SF2 was for casuals because special move inputs in SF1 took real skill."

Is the AI Flood Here Yet? How Many Games Have Released in 2024 (howtomarketagame.com): "Every year, I look at how many games have launched and how many have reached “Real Steam” (which I arbitrarily pick as having 1000+ reviews.) This year I want to track it throughout the year. Are we on track to have a blockbuster year of hit games? Is AI going to flood steam with thousands and thousands of generated art? In today’s blog I am looking at the games released in the first quarter of the year (Jan 1 – March 30th)"

Our Gamification Consulting Services

Today, we’re highlighting our gamification consulting services! Applying game mechanics to all sorts of applications has proven to boost retention, engagement, and revenue — but doing it right can be harder than it seems. More specifically, Naavik offers constructive gamification deconstructions, gamification workshops, and ongoing flexible support. Here is what one of our clients had to say.

“I highly recommend Naavik's two-day workshop on gaming mechanics. Their AMA provided valuable insights on the fundamentals of gaming mechanics, and the hands-on session was very engaging. The knowledge gained from this workshop has helped our team think more intentionally about how we leverage gaming mechanics for growth at Grammarly.”

- Shane Fontane, Senior Manager of Growth Design, Grammarly

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.