Source: Zephyrnet.com

This research essay was originally posted on Naavik Pro - the #1 research portal for blockchain and F2P games! We serve both investors and developers with our premium research. Make us your remote games research department today!

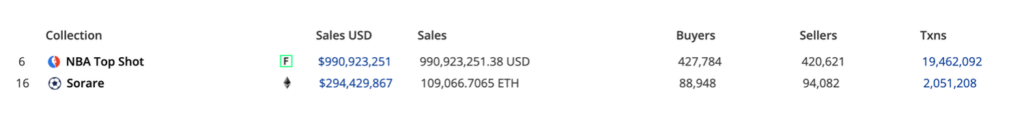

We’re seeing a Cambrian explosion of blockchain-based sports NFT games come to market. A few standout projects like NBA Top Shot and Sorare have demonstrated the potential to build in this space, and there is appetite for another breakout title. Over the past year, these games have received $1B+ in funding (including Sorare’s $680M Series B and Dapper Labs’ $505M Series C & D), ranging from simulation to collectables to live gameplay. The big question — why now?

My favorite articulation of a ‘why now’ comes from GOALS, a FIFA Ultimate Team (FUT) alternative: We take the opposite approach and instead acknowledge our users' right and demand for a secondary market. With the rise of web3, we believe the timing is right and technology mature enough to create a game where we promote P2P trading of in-game assets. Through the use of blockchain and non-fungible tokens (NFT), every asset will be fully owned by the player, and not by us.

In short, NFTs for sports games are a natural segue because the consumer behavior for them already exists. Sports in particular have a near-religious fandom to them, with Americans alone spending ~$60B on them each year. Fans now want new ways to express their fandom. On the flipside, leagues also want new ways to drive revenue, and to better engage new and existing fans. What blockchain tech enables is a more seamless P2P transaction experience (which by extension also means owning the assets) and for the consumer to share in the upside of the project.

Leagues like MLS, the NFL & NBA all recognize the potential of these emergent digital revenue streams but have their own considerations when thinking about a partnership:

- Leagues or governing bodies are sophisticated in how they divide up their rights, and there is precedent in how they can monetize it across a variety of channels (e.g the NFL’s Monday, Thursday & Sunday Night football are all operated by different media entities).

- A league isn’t beholden to licensing its brand in perpetuity to the same company (e.g. ironically, Fanatics struck the new partnership with the MLB and acquired Topps, which held the previous rights, for more than half their proposed SPAC value).

- They recognize the expertise partners can bring, so they choose to outsource development rather than doing it in-house.

- But a sports game’s success isn’t necessarily contingent on a league’s brand either even if it might amplify it.

This is a complex, deep space to dive into. While there are already a variety of successful models that have been built, sports NFT projects like NBA Top Shot and Sorare (which has 230+ league partnerships and counting) only scratch the surface — the space is still clearly nascent with a myriad of areas that are fertile for innovation or reimagining of existing designs.

This piece will focus on evaluating what has worked and hasn’t, surveying the landscape of current players and providing thought frameworks to push our thinking further along.

The Rise of NBA Top Shot

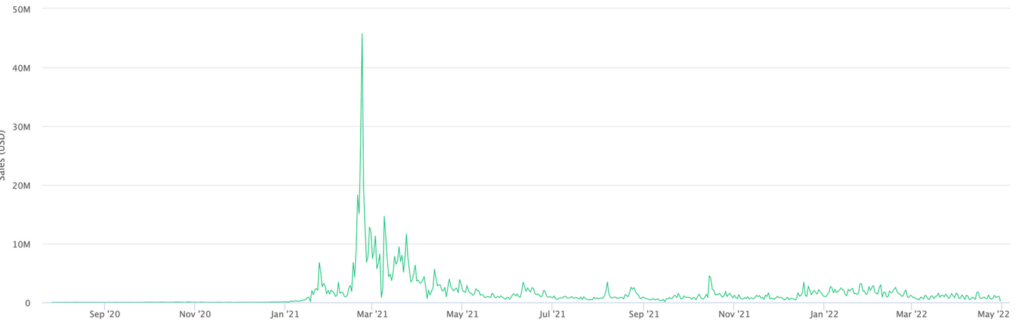

2020 was a keystone year for sports NFTs when Dapper Labs teamed up with the NBA to launch Top Shot, a pseudo-trading card platform where people can buy player highlights and trade/sell them on a marketplace. After a few months, interest and activity in the marketplace briefly skyrocketed.

Top Shot is often credited as the catalyst for retail interest in NFTs and crypto broadly, but importantly, it created the fiat on-ramps and consumer experience that enabled for this to happen. As a proprietary marketplace for NBA highlights built on Flow and a licensing partner to the NBA, Top Shot executed seamlessly. But… it was also just that: a marketplace. There was no additional utility beyond buying/selling/trading, no interoperability between platforms to show off collections, no game elements like managing/TCG/simulation.

The NBA partnership with Dapper Labs had seeded the foundation for new modalities of fan engagement — players buying highlights and trading for their favorite ones. This was largely buoyed by what was at the time burgeoning consumer interest and secondary market price upticks in collectables like Pokémon & sports cards, a chunk of the $370B global collectables market — but it remained that there was still a lot of work to be done for the sports market more broadly.

So, Top Shot had catered toward the collectables zeitgeist, and while they’re still performing relatively well today (not in comparison to early 2021 performance, but more so on a consistent revenue basis), high levels of card inflation and lack of new buyers has caused secondary volume to plummet. This is what Ethan Levy calls an “abundance of scarcity”, a boom and bust cycle driven up by new speculators continuing to prop up prices.

There are a few takeaways from Top Shot’s journey:

- There is immense latent consumer demand for this category, and that demand seems to center around profit potential and virtue signaling.

- Sports have highly targeted demographics with 1) willingness to spend and 2) discretionary income. This encompasses speculators, spectators, and superfans.

- Likeness and licensing around sports (e.g. a league or a player’s performance) can jumpstart user acquisition. For the platform, this is beneficial if it can compel users to stay. For the league, this is advantageous because it drives licensing revenue back to the league at no incremental cost (and, if they considered doing so, back to the players whose likeness they use).

- While collectables are a coveted market category with macro tailwinds (largely driven by PFP NFTs, physical trading cards, video games, sneakers, and designer toys), the way Top Shot designed collectables without utility isn’t enough to retain users for long periods of time. The abundance of scarcity and lack of engagement layers led to a non-retentive marketplace metagame. In other words, once people buy the highlights they want to own, there is no reason to engage any further, except when they want to sell/flip it.

Although Top Shot has lower volume today, it is still undoubtedly a trailblazer in the NFT sports game category by uncovering previously untapped fan demand for collectables in sports (ownership of moments). This was arguably uniquely enabled by NFTs. Dapper Labs clearly embraced the tech, learned from Crypto Kitties and applied it to a new space. At the same time, NBA Top Shot’s experience is just the tip of the iceberg.

If this space wants to reach its full potential, both investors and developers will need to focus on one-upping NBA Top Shot’s experience multiple times over. I believe that will start with a focus on introducing more engagement layers…. (to continue reading, please subscribe to Naavik Pro)

A big thanks to Fawzi Itani for writing this research essay!

This research essay was originally posted on Naavik Pro - the #1 research portal for blockchain and F2P games! We serve both investors and developers with our premium research. Make us your remote games research department today!