This Match analysis is one part of Naavik Pro’s recent mobile puzzle genre report. In the full report, we cover top performers, top regions, notable events, and several other important subgenres in similar depth: Merge, Word, Solitaire, Hidden Object, and Other. If at all interested in the puzzle market, this report is an absolute must-read.

We publish a new genre report each month and cover every genre in our six genre groups (Shooters, Puzzle, RPGs, Arcade & Sports, Strategy & Card, Lifestyle & Simulation) twice per year. If you or your team might be interested, visit here for more info and to request a demo.

Downloads – ATT Dampens Match-3 Growth

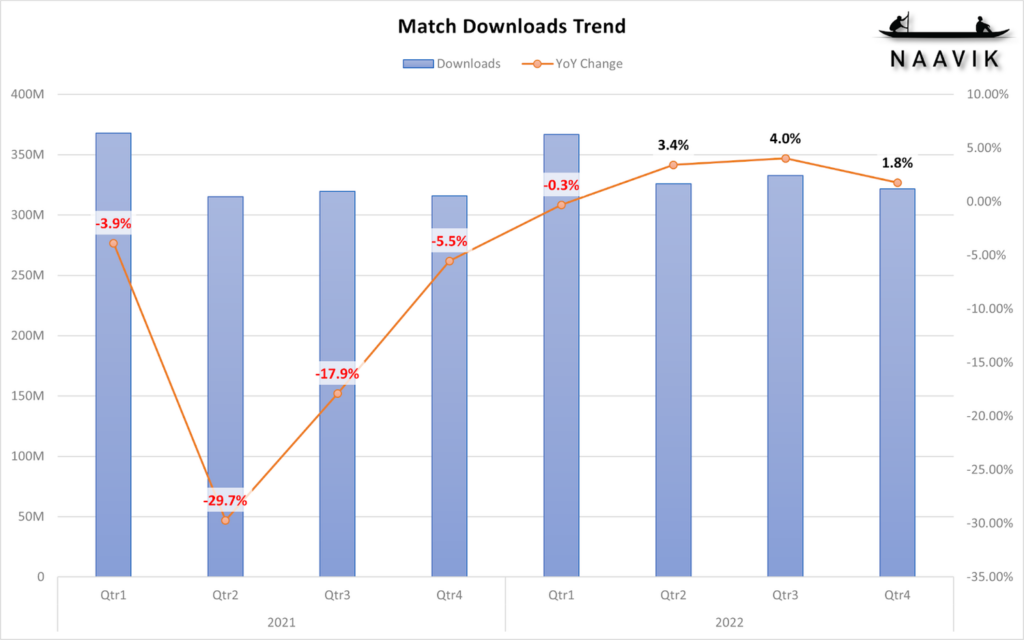

iOS 14.5 was released in April 2021, which caused publishers to clamp down on UA. While the absolute numbers are pretty flat, the line for YoY growth (in the chart below) is a perfect glimpse into how publishers reacted to Apple’s industry-changing move. There was a sharp retraction in downloads followed by a slow return to positive (albeit small) growth in 2022, which indicates that publishers are starting to come to grips with ATT.

What are these companies doing? Our resident UA expert at Naavik, Matej Lancaric, has some tips:

- Run campaigns on TikTok. He often finds that it gives better performance compared to other channels.

- Consolidate your campaigns. Run fewer campaigns with higher budgets to quickly learn what works and what doesn’t.

- Group countries into tier buckets based on their LTV/ROAS numbers. Example tiers below.

- T1: US, UK, CA, DE, FR, AU, KR, JP, CH

- T2: DK, FI, NO, SE, NL, ES, IT, HK, SG, NZ

- T3: PL, CZ, SK, BE, AT, IE, TR, UAE, SA, TW, TH

- Experiment with creatives.

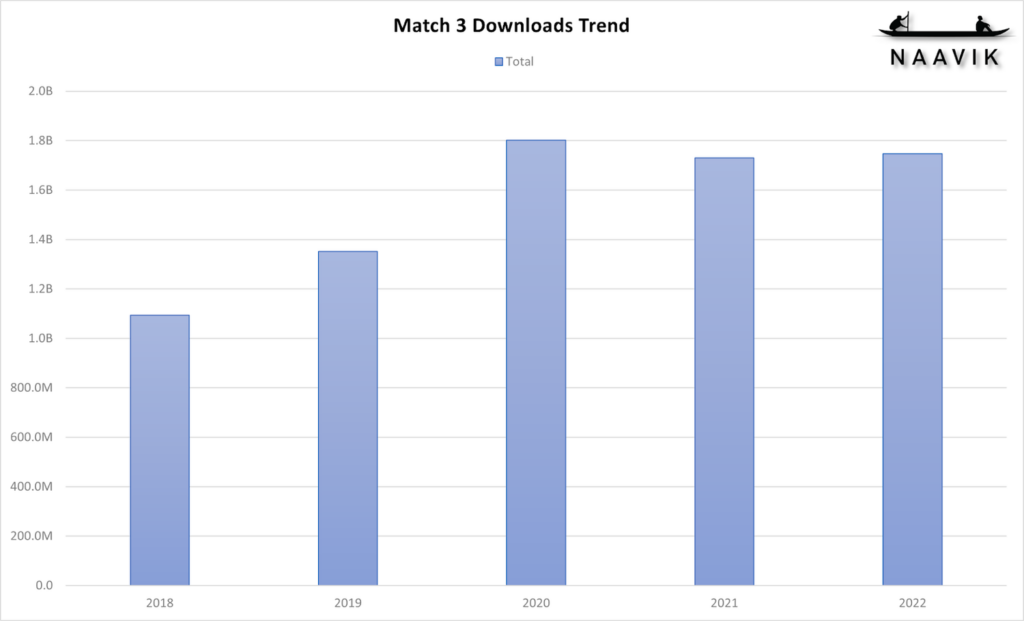

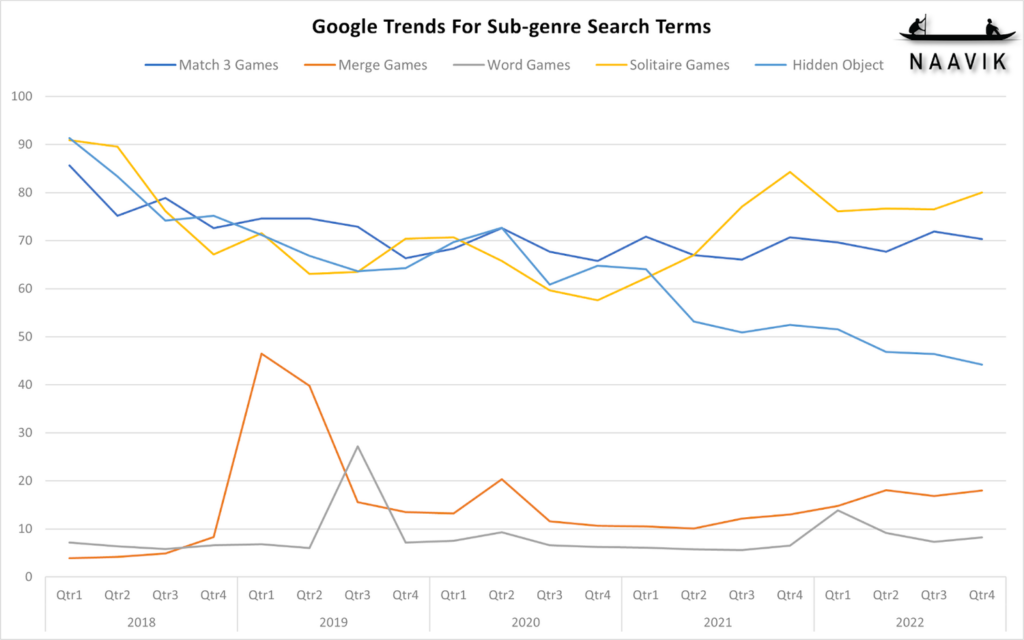

As we see from the chart above of the past five years, the downloads spree in 2020 has set a new baseline for downloads. What we also see is that Match has been on a slight downward trend since 2020. Have we reached peak Match interest? The Google trends chart below of the 5 subgenres adds some evidence to that position, as Match-3 games have declined in popularity over the past 5 years.

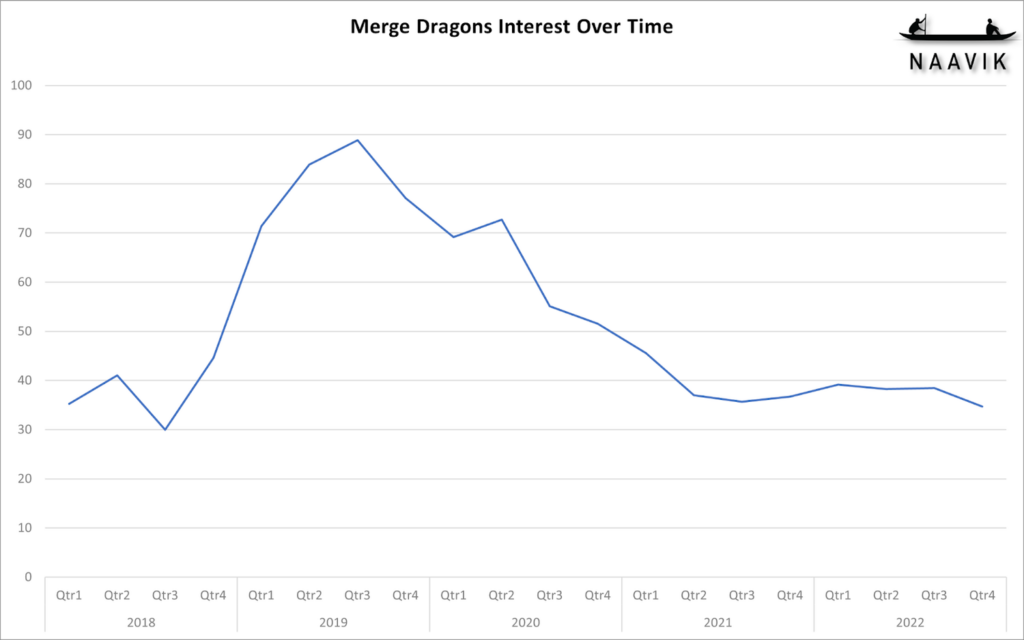

Note: That huge spike in search for Merge games in the first half of 2019 was due to the popularity of Merge Dragons, as searches for the game name spiked around the same time.

That said, the decline in interest seems to have flattened out over the last three years instead of continually declining like Hidden Object games. The fact that new Match games like Royal Match have been released with great success means that there still is significant interest in the subgenre. We’ll continue monitoring this and, in the next Puzzle report, will have six more months of information to see if Match is stagnant or if it can still grow.

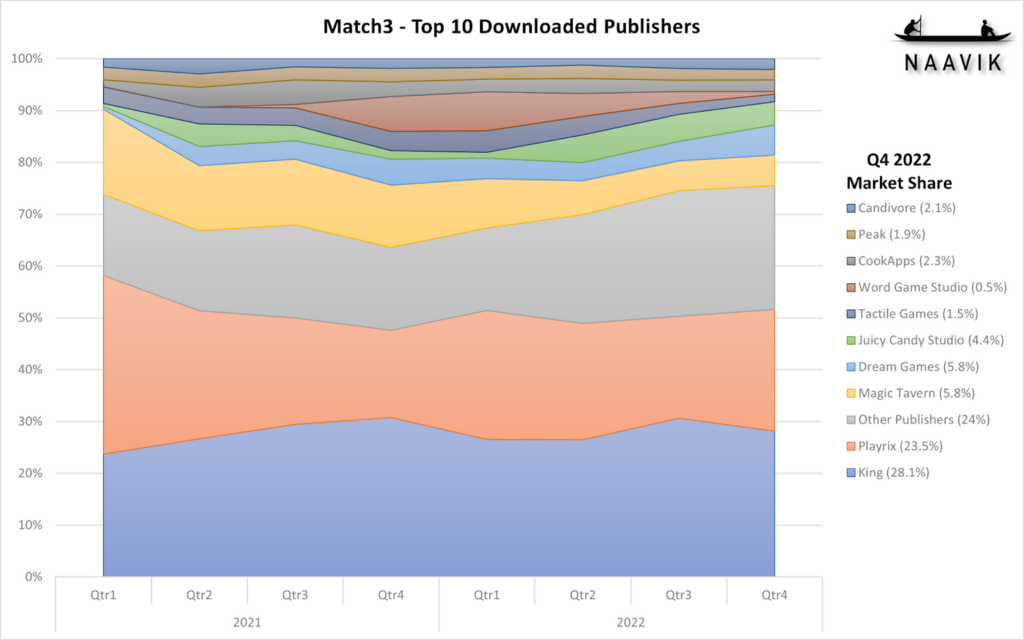

The next step in our analysis is to look into individual games, but Match-3 doesn’t see a significant concentration of downloads into a few games (the top 10 games make up 65% of downloads). Therefore, it may be worth viewing the data grouped by publishers first, where the top 10 make up 81% of the market, before we take a look at the top games.

We can see that Playrix was losing downloads moving to Q4 2021 but began clawing some back in 2022. Other points of interest are how Magic Tavern has lost significant market share over the past two years, which seems to have been taken up by Dream Games, Juicy Candy Studio, and Other Publishers.

There was also an interesting movement in the appearance (and then seeming disappearance) of publisher Word Game Studio. To get more information on the events, we’ll need to go into game-level data for the top 10 games.

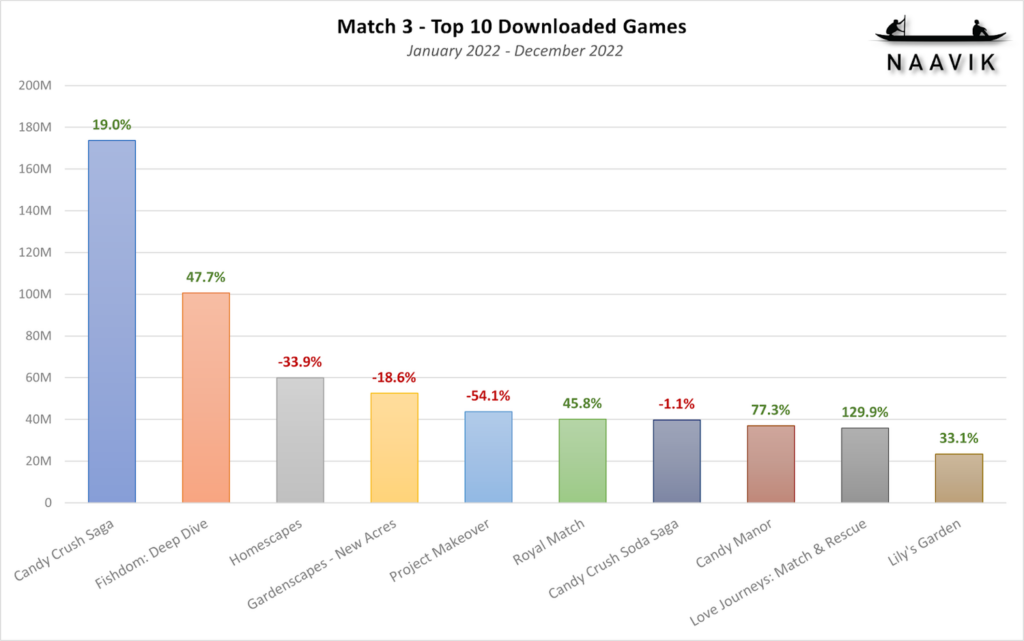

Here, the top 10 downloaded games represent around 65% of all downloads for the subgenre, surprisingly led by… Candy Crush Saga (did the suspense kill you?).

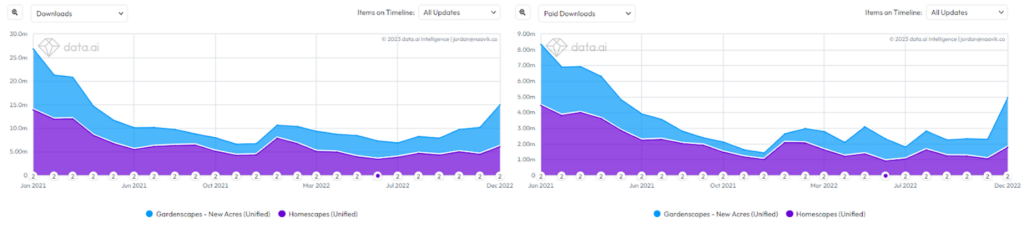

We see that of Playrix’s three games in the top 10, Fishdom managed very good growth for the year, but both Homescapes and Gardenscapes were down. Both “scapes” games have been steadily declining since they peaked during the pandemic. This is partly because both games have steadily decreased the amount of advertising. The chart below shows downloads for both games on the left, and paid downloads on the right.

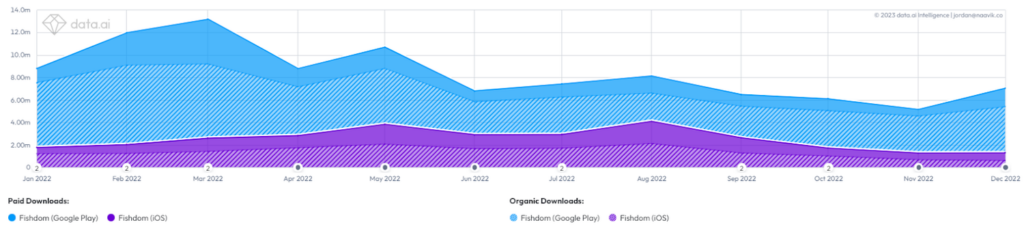

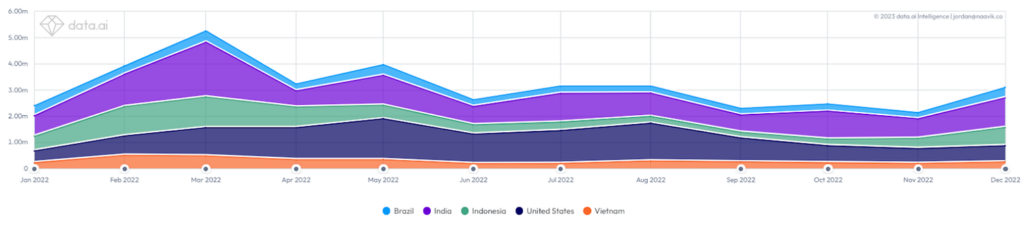

We can see that paid downloads began decreasing in Q1 2021 and have not recovered to previous levels, which indicates that Playrix is finding it difficult to optimize ad spend for these games post-ATT. In contrast, Fishdom has grown +48% YoY, and this was, in part, due to a UA drive in Q1 2022 that focused on Android.

The majority of downloads during this time came from India and Indonesia and were likely acquired for potential ad revenue, as both countries index high in terms of downloads (India at #1 and Indonesia at #3) but are not major contributors to IAP revenue.

There might be more to the story here for why Playrix decided to grow Fishdom versus Homescapes/Gardenscapes. We’re currently looking into the same and shall report back soon.

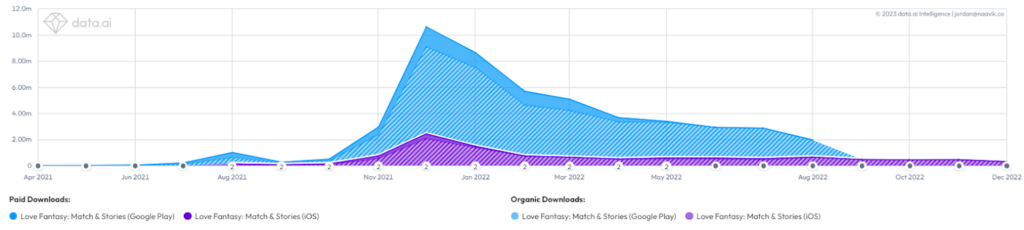

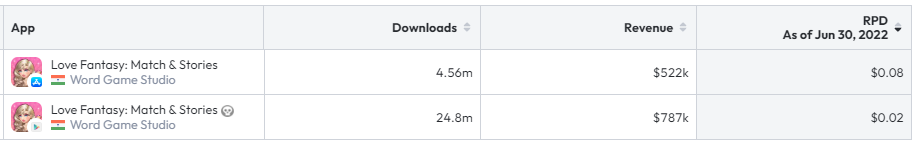

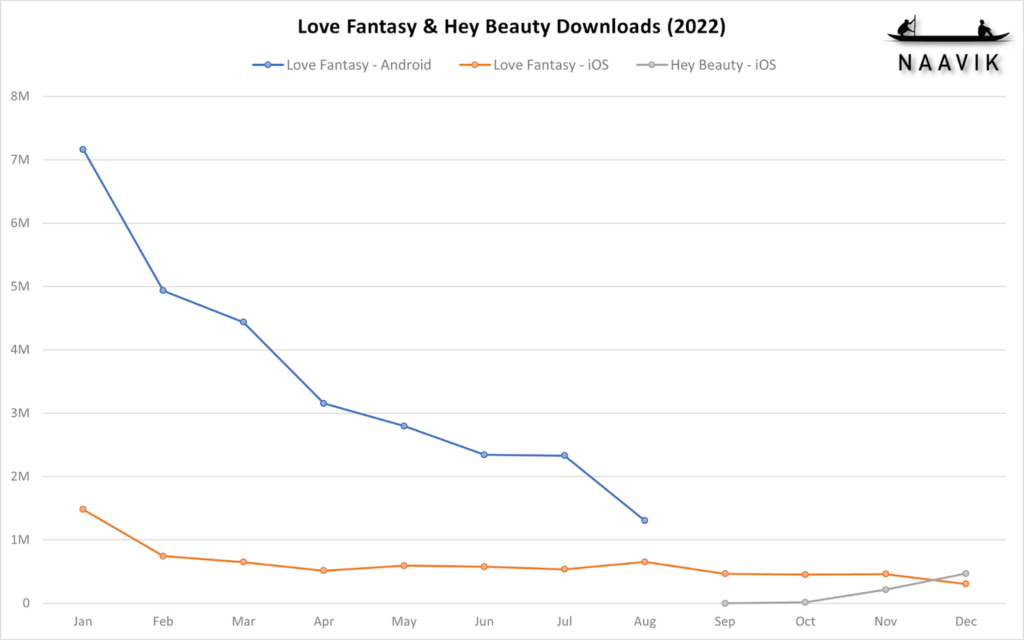

In regards to the strange activity (appearance, then disappearance) of Word Game Studio, it’s due to its game Love Journeys: Match & Rescue (also called Love Fantasy), which was one of the top 10 downloaded Match-3 games of 2022. It was actually released all the way back in March 2021 but only gained traction at the end of the year with the help of a UA campaign. It was one of the most downloaded apps (not games, apps!) for a period of time on both Android (peaked at 6th on December 20th, 2021) and iOS (peaked at 2nd on December 6th, 2021).

That explains the emergence, but why did it suddenly see such a drastic decline? Well, the Android version of the game was mysteriously removed from the Play Store in August 2022. The company website was set up only to host the privacy policy, and an attempt to investigate some of its developer accounts like Appzoa (the developer account under which Love Journeys was published) and Taptekinc (the account for its hypercasual games) also results in a single webpage with no information. Without any leads, we’ll need to make an educated guess, and there are usually only two reasons why an app may be pulled. It’s either underperforming or has violated platform rules.

As we see above, the RPD (taken from January 2022 - June 2022, before the Android version was pulled) of the games is woeful, with the Android version being the worse offender. For context, the RPD for Match games in the same period was $3.80.

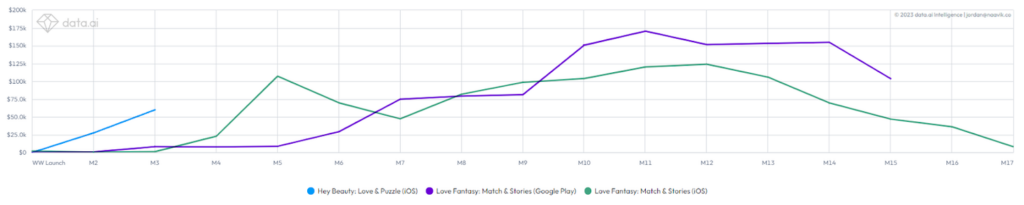

So it looks like the poor performance of the Android version resulted in it being pulled, but there’s a twist here. Right after the Android version of Love Journeys was removed, the developer account Appzoa released a new Match-3 game called Hey Beauty on iOS.

It featured a new theme (including a child that you can also dress up, which is something we’ve not seen before), but the core gameplay remained exactly the same. This strategy of quick game relaunches with new themes is something we also saw in our Puzzles and Survival deconstruction. It remains to be seen whether it will be a growing trend in a market where differentiation and ROAS optimization are becoming harder and harder by the day.

Perhaps Word Game Studio could see the writing on the wall and decided that instead of trying to bail out a sinking ship, it would just construct a completely new one instead. Being a hypercasual publisher as well (the list below shows all of its games, the majority of which are hypercasual), it would have plenty of experience in this sort of quick and ruthless ROI assessment.

This strategy, while still in the early days, looks to be working, and a comparison of the games’ revenue aligned by launch date shows Hey Beauty starting very strongly against its predecessor. In other words, it is very interesting to see how the scale of product performance impacts pure theme changes.

Its early RPD is also better than its predecessor, being at $0.13, but it is still far behind subgenre benchmarks. Whether this continues to grow and becomes a real success remains to be seen, but if it can repeat the same strategy that grew Love Journeys’ downloads, it may be a game to watch in 2023.

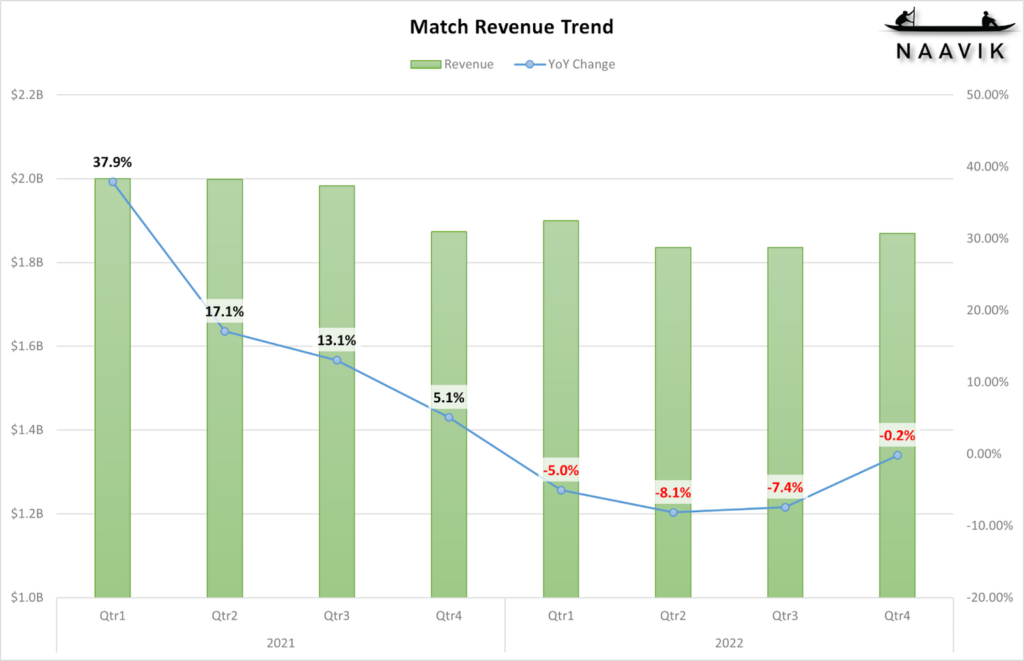

Revenue – Down But Not Out

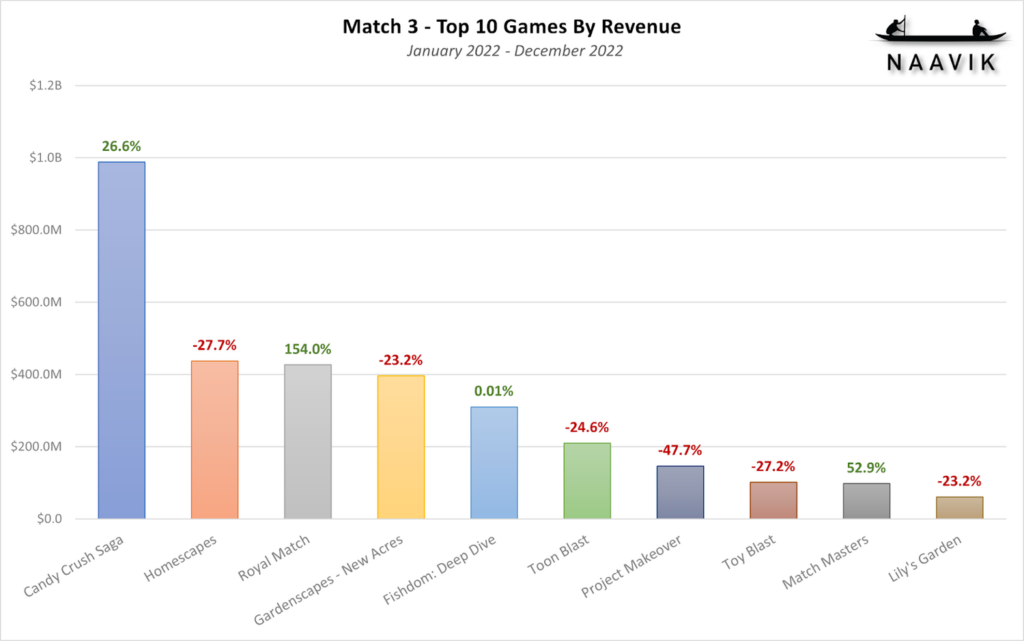

Unlike the small recovery in downloads we saw in 2022, revenue for Match-3 games has tanked over the past 12 months. This reflects the revenue trend for the entire genre, as covered above.

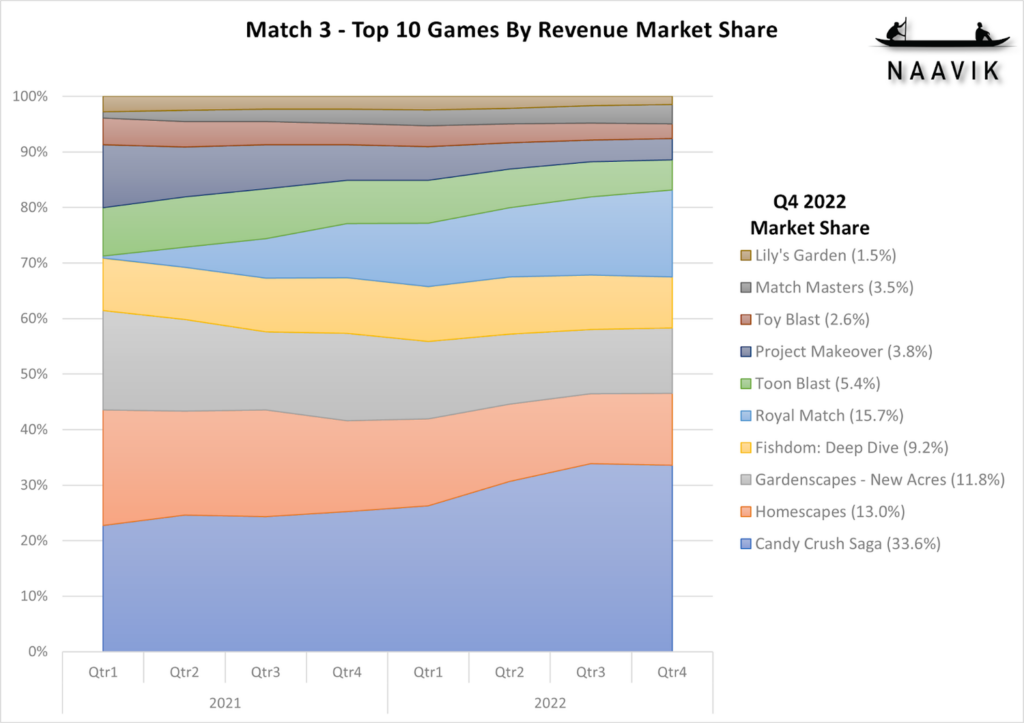

Again, unlike downloads, we do see that revenue is concentrated into a few games, with the top 10 making up 82% of the market share.

Most of the games reflect the subgenre trend, with double-digit negative growth rates, but with the exception of Candy Crush Saga, Royal Match, and Match Masters. Royal Match stands out with its incredible growth, but as we mentioned in the downloads section, this was due to its launch date. It's a testament to how well the Dream Games team has executed that even if we compare H2 2021 to H2 2022, we still see growth of +76%.

That growth is all the more obvious when looking at the top 10 by market share. What’s the reason for this growth? Well, we’ve conveniently written a thorough deconstruction of the game that you can access here, but in lieu of reading that report, we summarized the five things that Dream Games did to make Royal Match a success.

- Meticulously focusing on player experience above anything else; conviction to remove friction.

- Not treading into puzzle & decorate waters but catering the game to classic match-3 players.

- Doubling down on loss aversion while monetizing heavily on the most wealthy part of its audience.

- Keeping feature scope manageable instead of expanding the game into many possible directions.

- A/B-testing every change to make sure optimizations actually pan out as intended.

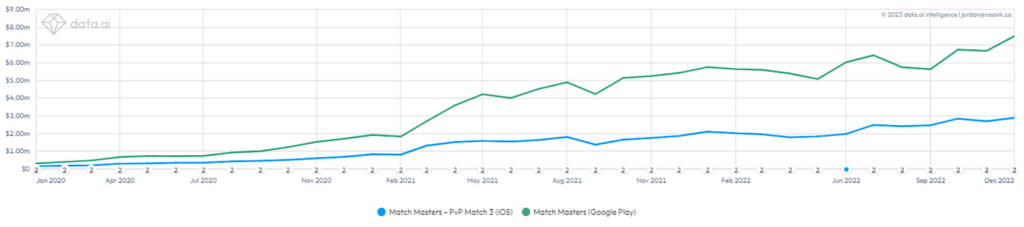

Match Masters by Candivore also saw strong growth of +53%. If you’re not familiar with Match Masters, it’s a PVP Match-3 game where players take turns to make matches on the board to earn points. Example gameplay can be found here. Like most Match-3 games, it monetizes on boosters, except that you can imagine that in a competitive situation, the loss aversion is cranked up even more. This has given the game a healthy RPD of $4.82, which is even greater than that of Candy Crush Saga and Homescapes.

The game has actually been in existence since 2017, but it really only began generating serious revenue in 2021 (in particular, Android revenue), and since then has been growing from strength to strength.

Why did Match Masters see that surge in revenue that began in March 2021? As reported by Venture Beat, during that time, Candivore received an injection of funds to the tune of $12M to grow the game. To see why scaling up the game made sense for Candivore, we need to dig a little into its product design.

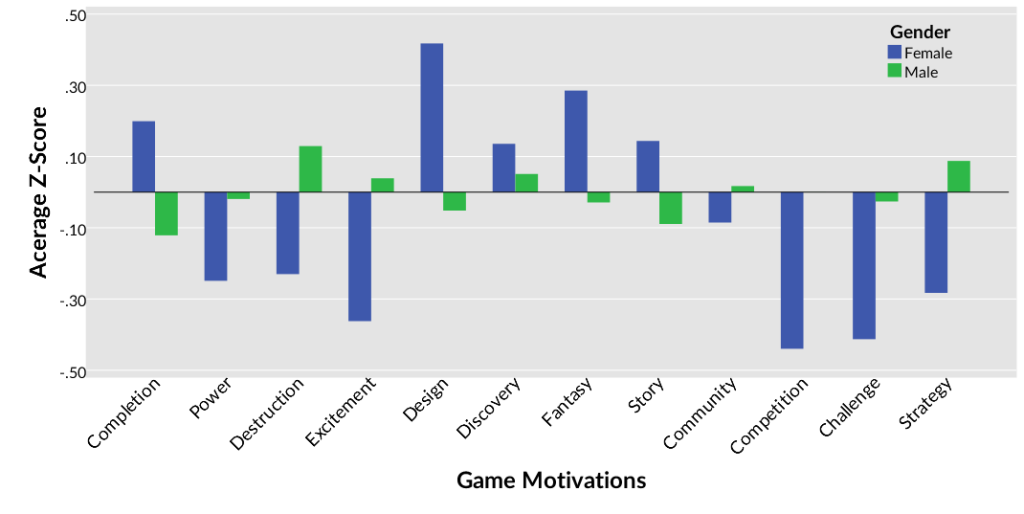

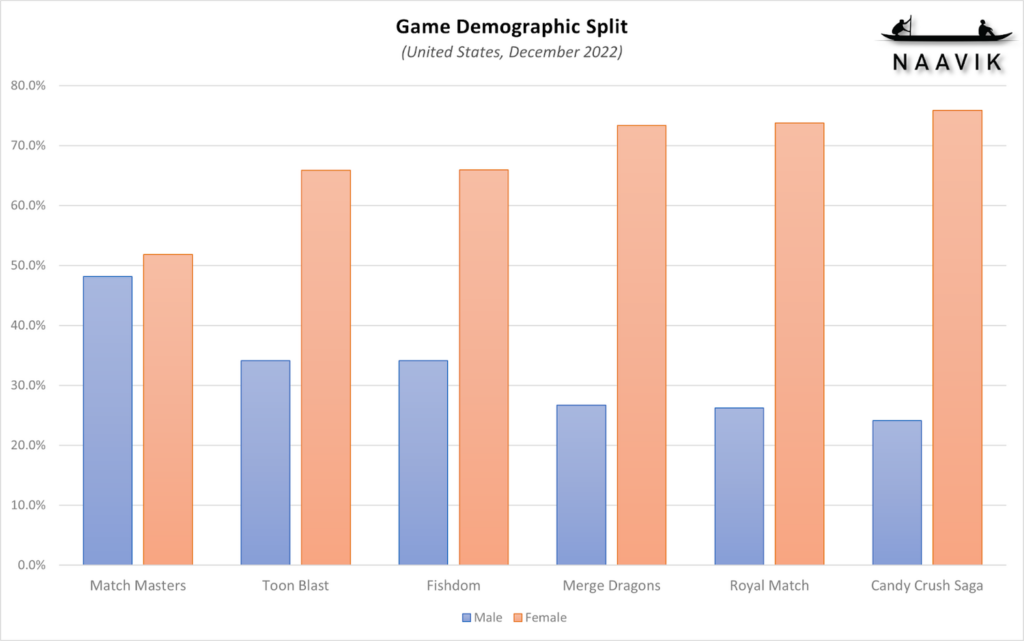

As a PVP game, Match Masters has a significantly different demographic profile than most puzzlers. A survey conducted by Quantic Foundry found that female players were much less motivated by competition and challenge than males.

This is exactly what we see in Match Masters, which has a more balanced demographic split versus other games in the subgenre.

What this all means is that Match Masters’ combination of PVP and its high concentration of male players who are motivated by competition allows it to effectively monetize its boosters, increasing ROAS.

The team certainly put that money to good use, and you can see in the chart above that downloads and revenue began growing in Q4 2020, with a big spike occurring in Q2 2021. What’s also interesting is the heavy emphasis on Android in both downloads and revenue, which may have been a smart strategic move on Candivore’s part. Apple announced ATT would be coming to iOS in June 2020, and assuming that funding talks were happening at a similar time, it would have given Candivore almost a year to strategize how to use its upcoming war chest. That said, we know Google is going to follow in Apple’s privacy-first footsteps over the course of the year, and it will be interesting to see whether Match Masters can sustain this over the next 12-24 months.

Candy Crush Saga Is Not Sitting Idle

Candy Crush also saw a great 2022 and grew its IAP revenue by +23%, but how does King do it? It so happens that we’ve recently released a research essay on how King has managed to keep Candy Crush growing through the last decade. While the essay details how King has evolved Candy Crush through the years, the most salient point that explains its revenue growth in 2022 is that King is doubling down on social play, as reflected in the company’s Q3 2022 report which stated: "King continues to introduce more player-versus-player features within Candy Crush, fueling engagement and player investment.”

An example of such an event was the Cauldron Challenge that was live in October 2022. Players got matched against nine other players and would compete to climb a leaderboard to win boosters.

PVP Puzzles For Males

As we’ve written above, Match Masters’ PVP gameplay lets it attract male players at a much higher proportion than other games in the genre, making it a unicorn in the puzzle landscape. Could this be an enticing opportunity for others in the space? We’ve not seen many studios jumping on the PVP puzzle bandwagon yet, and according to data.ai, only around 6.6% of Match games feature synchronous PVP. But as we’ve seen with Candy Crush Saga, even King believes that PVP is the future of puzzle games, and we’ll likely see more PVP-based puzzle games on the horizon.

The US-Android Blue Ocean?

The biggest contributor to Match Masters’ revenue is Android users in the US. In the shooter report, we highlighted another Israeli studio, Plarium, that focuses on the Android-US combination. Moon Active (also based in Israel), the developer of Coin Master, also sees the most revenue from its game from the Android-US combo. In all of these cases, the Android versions of the games have outperformed the market. Is there something in these Israeli studios using a similar strategy? A quick look at the executives in the companies doesn’t reveal a shared history, so perhaps there has been some knowledge-sharing between Israeli developers. Either way, these companies have found a way to reverse the industry trend of iOS users spending more than Android.

What’s Going On With Blast Games?

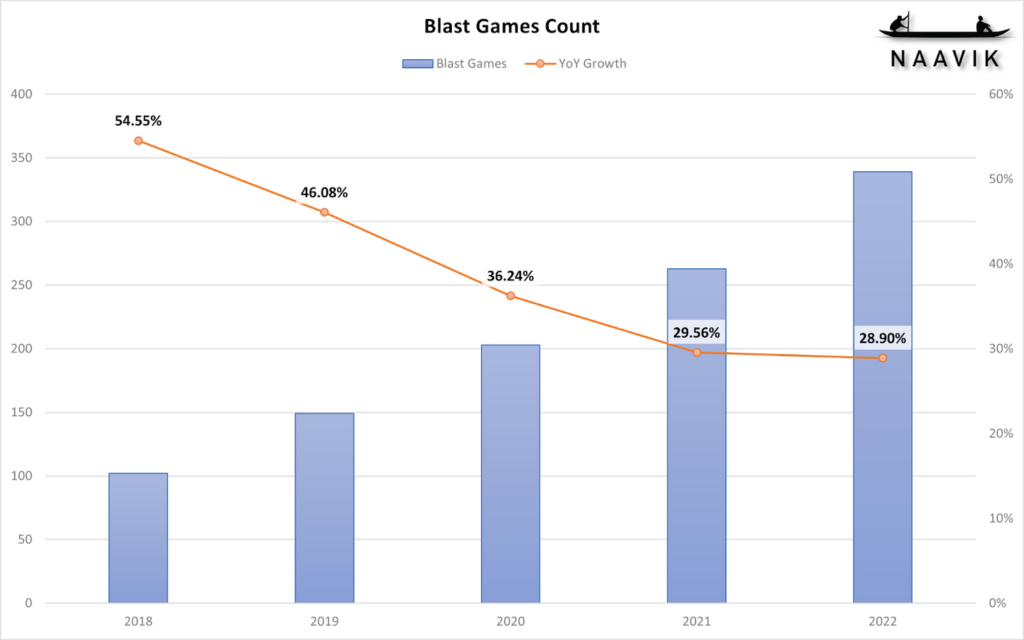

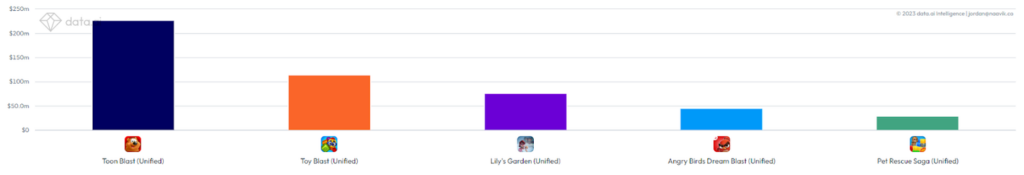

Blast games like Toy Blast and especially Toon Blast seemed to herald a new era of blast games when they burst into popularity in 2015-2017. Since then, there have been some successes like Lily’s Garden, but not a deluge of blast games that we might have expected. By tracking the number of blast games on the app stores, we can see that this sub-category of Match is displaying slowing growth.

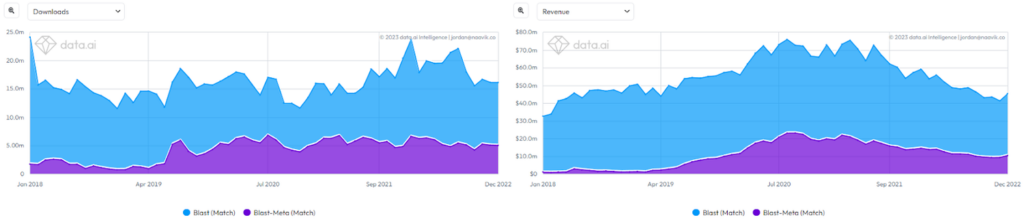

What’s behind the slowdown? We believe it’s the lack of new hits, which serves as an inspiration for other developers to create their own blast games. As we see in the chart comparison below, downloads of blast games have been relatively flat over the past five years, while revenue peaked during the pandemic and is not back to pre-pandemic levels.

The top 5 Blast games by revenue (which comprise 84% of all blast games revenue) are also pretty old, with the most recent newcomer being Lily’s Garden, which was released in November 2018.

All this data paints the picture of the decline of blast games, but why is this so? My hunch is that blast games may be just a little too simple for a puzzle audience that wants something more cerebral, like the more involved pattern matching you need to do in Match-3. To lend some, if imperfect, support to this thesis, the average session duration of a blast game (5m45s) is lower than that of a Match-3 game (8m9s). Is the blast sub-category dead? It seems stagnant at the very least and will need some refreshing in the form of new takes on the core gameplay and a game that becomes a hit to re-spark it to life.

Looking Forward

When one thinks of casual games, a Match-3 game is sure to be one of the first that comes to mind. A developer that wished to release a Match-3 game within the last few years would have been advised to think about it long and hard, as it has been so saturated and filled with titans. Still, we’ve seen smart developers like Dream Games introduce tweaks to the formula and find a significant place in the ranks. Is there room for more innovation, or has this subgenre been wrung dry? I believe there is still plenty of room for a fresh take on Match-3 to succeed.

As an example, narrative games like Episodes also have a very strong female demographic, so perhaps combining a game like it with a Match core could be intriguing. Another place to look for inspiration is in hypercasual, and a popular puzzle game, Sandballs (gameplay video here), could be another choice for a mash-up with Match mechanics. Imagine digging a path for the different colored balls to combine together and form matches.

That said, there’s a new (relatively speaking) kid on the block in the form of Merge, and developers may decide to pursue the new pastures there rather than compete in Match-3. You know what they say, though: the grass always looks greener on the other side.

This Match analysis is one part of Naavik Pro’s recent mobile puzzle genre report. In the full report, we cover top performers, top regions, notable events, and several other important subgenres in similar depth: Merge, Word, Solitaire, Hidden Object, and Other. If at all interested in the puzzle market, this report is an absolute must-read.

We publish a new genre report each month and cover every genre in our six genre groups (Shooters, Puzzle, RPGs, Arcade & Sports, Strategy & Card, Lifestyle & Simulation) twice per year. If you or your team might be interested, visit here for more info and to request a demo.