Executive Summary

- Frozen City is an Idle Building free-to-play (F2P) mobile game with a winter apocalypse survival theme, developed and published by Chinese studio Century Games.

- The game also features light Idle RPG mechanics through the gacha hero collection, which boost resource production, making it a hybrid Idle Simulation-Idle RPG game.

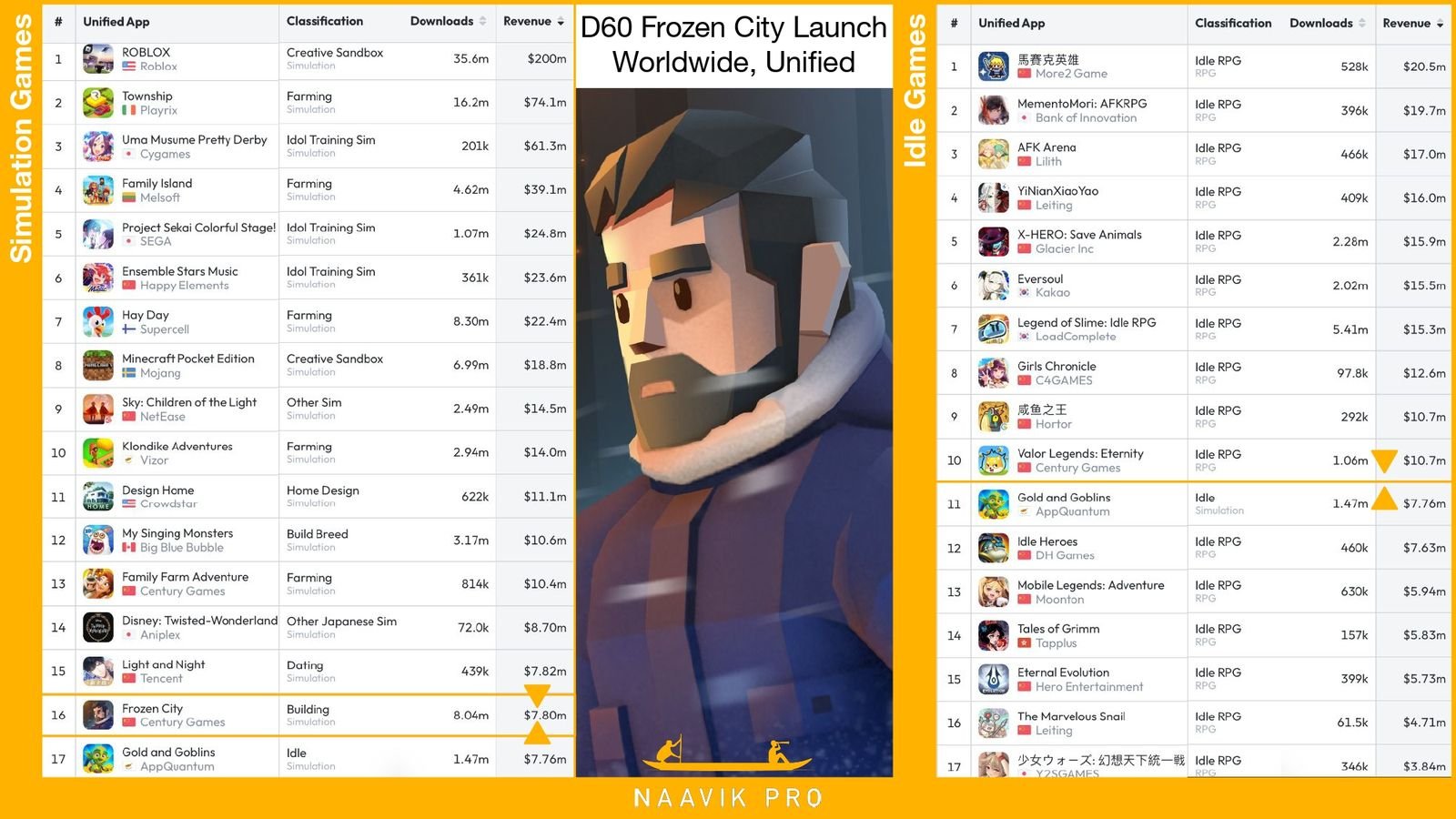

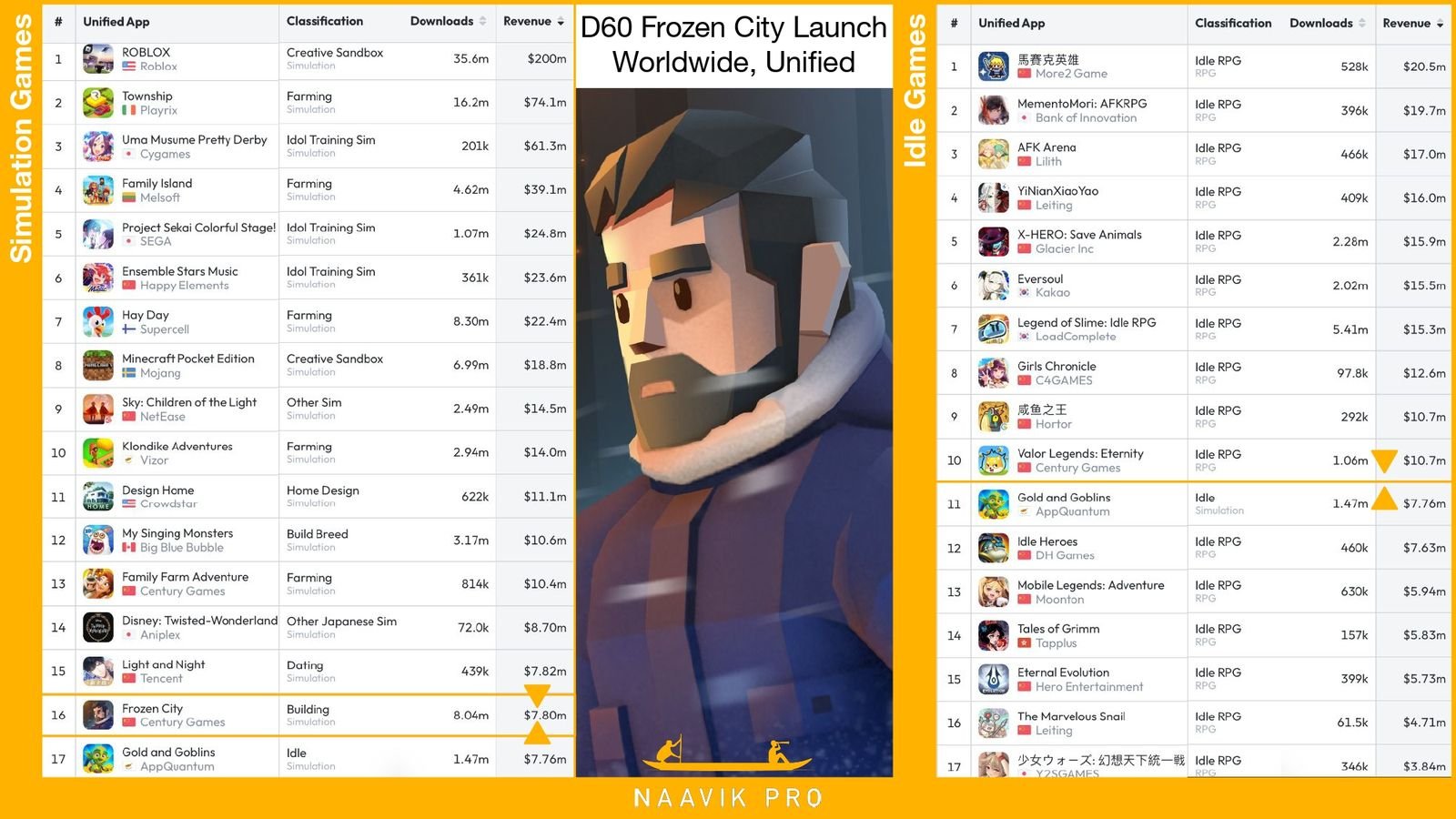

- The game has generated $7.8 million in revenue from 8 million downloads in its first 60 days, making it the top-grossing Idle Simulation game. However, it’s performing as a mediocre Idle RPG game, lacking the deep monetization of other gacha Idle RPGs like AFK Arena.

- Frozen City is opting for only two rewarded video ad placements, therefore lacking in ad monetization (estimated 15-20% of total revenue) when compared to others in the Idle Simulation genre (estimated 30-40% of total revenue).

- Idle games thrive with the feeling of constant, positive progression, something that comes to a halt in Frozen City if players have not drawn the needed heroes via the game’s gacha system.

- The game offers monthly subscription options ranging from $9.99 to $19.99 with uninspiring perks, pricing out casual buyers.

- Frozen City has a strong product market fit with the combination of the snow apocalypse survival theme, which makes for a highly marketable product, and the Casual Idle genre, which is widely appealing on mobile.

- Century Games is clearly inspired by the PC/Console survival game Frostpunk (link) and has since doubled down on exploring more games using the same marketable theme with the launch of Whiteout Survival, a Frozen City-style 4X RPG game (link).

State of Survival

Frozen City is a new F2P Building Simulation game developed and published by Chinese studio Century Games. The game is set in a frozen winter apocalypse where players rebuild the last town on Earth and try and survive in a hostile environment.

The setting creates a unique experience for what essentially plays like an Idle Simulation game: assign workers to collect resources to build and upgrade the town, which allows you to assign more workers to collect more resources and so on. The game also features light Idle RPG mechanics with a collection of heroes, which are special units that can boost production in town and explore the wilderness for resources.Since its launch on December 26th, 2022 the game has generated $7.8 million in revenue from 8 million downloads in its first 60 days.

Century Games was formerly known as DianDian Interactive, a game studio founded in 2010 as the casual games division of FunPlus and known for its first mobile title Family Farm Seaside, a Building Simulation game. Century Games was also responsible for publishing the massively successful F2P Strategy games King of Avalon (2012) and Guns of Glory (2017), made by FunPlus strategy division KingsGroup. In 2016, FunPlus sold DianDian Interactive to Century Group for nearly $1 billion. Following the sale, Century Group renamed the studio Century Games.

In 2019, KingsGroup developed and self-published its next big hit, the Strategy title State of Survival. By June 2022, Century Games’ two most successful published titles, the Strategy games Guns of Glory and King of Avalon, returned to FunPlus for self-publishing.

This caused Century Games’ revenue to drop 36% YoY, from $529 million in 2021 to $338 million in 2022, in turn pushing the company to return to its Casual games roots. Century Games currently operates several Casual games ranging from Farming/Building Simulation games like Family Farm Adventure and Dragonscapes Adventure, Idle RPGs like Valor Legends, and Idle Simulation games like Idle Mafia and Idle Courier Tycoon.

Since the launch of Frozen City, the game has grown to be one of Century Games’ top titles by daily revenue. The game combines the studio’s Casual games mastery of Building, Simulation, and Idle games to achieve a much wider appeal — an Idle Simulation game with a cover of a Building Simulation with light Idle RPG mechanics, presented under a survival theme. The hero collection from the Idle RPG elements of the game is a core part of its Idle progression (boosting the output of the buildings the heroes are assigned to) as well as a large part of the game’s monetization via their gacha-based collection.

Looking at the first 60 days of performance by revenue, Frozen City’s hybrid design (Idle Simulation + Idle RPG) led to it performing above the best Idle Simulation game in the Simulation games category, Gold and Goblins. The Idle games category is led by Idle RPG games with deep gacha monetization like Lilith’s AFK Arena. Frozen City does feature Idle RPG mechanics and gacha monetization, which we’ll dig into, but it's lightweight and not as deep, keeping with the more Casual nature of the game.

In the Idle games category, Frozen City lands between the Idle RPG Valor Legends, which is also a Century Games title, and Idle Simulation game Gold and Goblins. In summary, Frozen City’s early solid performance has landed it at the top of the Idle Simulation genre, largely because of its light Idle RPG mechanics combined with the distinct winter apocalypse survival theme.

The game’s “survive the cold” creatives, low-poly art style (common in hypercasual), and straightforward tutorial on resource collection and building all help make a strong first impression. The initial resource earnings are generous and upgrade costs are low, creating a fun and satisfying game loop with a heightened sense of progress. Returning to the game is always a celebratory moment as it rewards players with resources that were collected while they were away, though limited to a maximum of two hours. Each town comes with a predefined list of resource generating buildings, and once they are fully upgraded players can move on to the next town.

Beginning from the third town, specific heroes can be assigned to resource-generating buildings, which opens more worker slots and boosts the building’s production. These heroes have their own rarity (between rare and epic) and can be collected from a free daily gacha chest every eight hours or from more premium chests with higher drop rates. The steady positive growth of gathering resources and building the town comes to a grinding halt when players have not drawn the needed heroes for their resource buildings. Though this acts as the perfect pinch for the gacha monetization, it also creates friction in the intended low-pressure experience of constant progress in an Idle game.

All the data.ai numbers discussed above only account for IAP revenue. Ad monetization is another strong avenue of Idle game monetization, usually accounting for 30 to 40% of an Idle game’s total revenue. In the case of Frozen City, the game only uses rewarded video (RV) ad placements in two places, one every eight hours to open another free gacha chest and another that intermittently shows up about twice a day for instant bonus resources. With this limited implementation of RV ads, we estimate ad monetization accounts for a maximum of 15 to 20% of Frozen City’s total revenue.

Frozen City can also be evaluated for its success in taking a PC/Console title, 11 Bit Studios’ Frostpunk, to a Casual mobile audience. This translation of the game brings with it the strengths of the city-survival theme while trimming away the high-pressure experience of moral choices like allowing child labor or abandoning the sick and the wounded to survive another day.

What's left is a game trying to balance the constant progression of Idle games with its city-survival theme while choosing to limit ads over breaking the immersion of the high-quality premium experience that inspires it. This balance has led to a strong early performance, but to achieve long-term commercial success will require tweaking this balance in favor of a mobile-tailored Idle game with a heavier reliance on ads. In this essay, we’ll dive into Frozen City in more detail and cover:

- More insights Frozen City’s early performance numbers

- A breakdown of the hybrid Simulation + RPG Idle game

- How Frozen City approaches events and live operations early in its lifecycle

- The game’s monetization hits and misses

- UA strengths and next steps

Let's dive in.

Early Performance

The early performance of Frozen City shows that out of the $7.8 million total revenue and 8 million total downloads in its first 60 days, the U.S. accounted for 38% ($2.94 million) of the revenue and 21% (1.65 million) of the downloads. Other countries that follow (in a similar parity of revenue to downloads) are Germany, South Korea, and the U.K., with an average revenue per download (RPD) of $1.70. Japan, the fifth country by revenue, shows a stronger RPD of $2.04.

All these countries are top markets for mobile game revenue, second only to China where the game is not yet available. This shows the global appeal of Frozen City, plus the strength of its combination of the survival theme and the Idle Simulation genre.

Capital Games has also been able to grow the game’s DAUs over time — even with the downloads remaining stable to slightly declining — accounting for the high stickiness of Idle games with their quick and frequent check-ins for constant positive progression. The growing daily revenue follows the DAU curve: both spike on Saturdays at the start of the weekend event and on Wednesdays at the start of the weekday event (more on events later). Now 60 days since launch, the game has a DAU of 854,000 (approximately 10% of total downloads so far).

With its hybrid Idle nature, Frozen City scores in the middle in terms of average sessions per user and average time per user as below (D60 of Frozen City launch):

These early engagement metrics might show signs of trouble for Frozen City going forward, with its light Idle RPG mechanics (gacha hero collection) slowing down the constant progression of the Idle Simulation elements, leading to lower average sessions and time per user than pure Idle Simulation games. Let’s have a look into what makes Frozen City a unique hybrid.

Chill Thrills

Data.ai best describes these two separate sub-genre classifications as:

- Idle Simulation: Games in which game progression continues even when a player leaves the game session. Notable examples: Gold and Goblins, Idle Miner Tycoon, AdVenture Capitalist.

- Idle RPG: Squad-based RPG that includes idle progression mechanics. Notable examples: AFK Arena, X-HERO, Idle Heroes.

In Idle Simulation games, players collect resources from resource generators, which are then reinvested into upgrading said generators and increasing the rate of production. They continue to generate resources even in the player’s absence. The rapid growth of numbers in costs, power, level of the resource generators, and their increasing rewards makes progress in Idle games fun and satisfying.

This low pressure, constant growth experience (often in the absence of a lose condition) makes these games appealing to a broad swath of mobile gamers. “Grinding” is at the core of Idle games, something game developers were fast to parallel with RPGs, creating the Idle RPG genre in which players form a squad of heroes to auto-battle and generate resources that can be used to upgrade them.

Frozen City is a combination of the two. The Idle Simulation side includes resource gathering, building, and upgrading the city; the Idle RPG side includes hero collection, auto-battling, and leveling up heroes to boost resource production.

Frozen City features a standard Idle gameplay loop every session: collect resources generated while offline, spend them on building and upgrading the town, and complete tasks, which are in-line with asking for the next upgrades or goals to collect a certain amount of resources. Once all the tasks are complete, players move to the next city, essentially resetting their progress in a new empty town. The only element that carries forward between towns are the heroes.

Heroes and Survival

Heroes are collected as cards from chests in the shop and come in two rarities: rare and epic. The free chest is available every eight hours and has a possibility to drop an epic card, whereas the two premium chests drop one and two epic cards, respectively. Heroes are upgraded using Shooting Stars (golden stars), and their level cap can be raised by using duplicates and a resource called Blazing Stars (red stars).

When upgrading, players can buy any missing resources including duplicates for the game’s premium currency, known as Gems. Players still need to pull the hero once from the gacha chests to unlock them before upgrading. This implementation of the hero gacha collection and its simple progression is very light in nature when compared to the variance in hero rarities and equipment options, not to mention depth skill progression, in Idle RPGs like AFK Arena.

Each resource generating building in town has a predefined hero assigned to it. This hero is required to open additional slots for workers to be assigned in the building, essentially increasing the resource generation by 100% with the addition of each worker. Unlocking additional slots requires leveling up the hero to a certain level to unlock them. The hero also adds an overall output multiplier for all the resources generated by the building, increasing with the hero level.

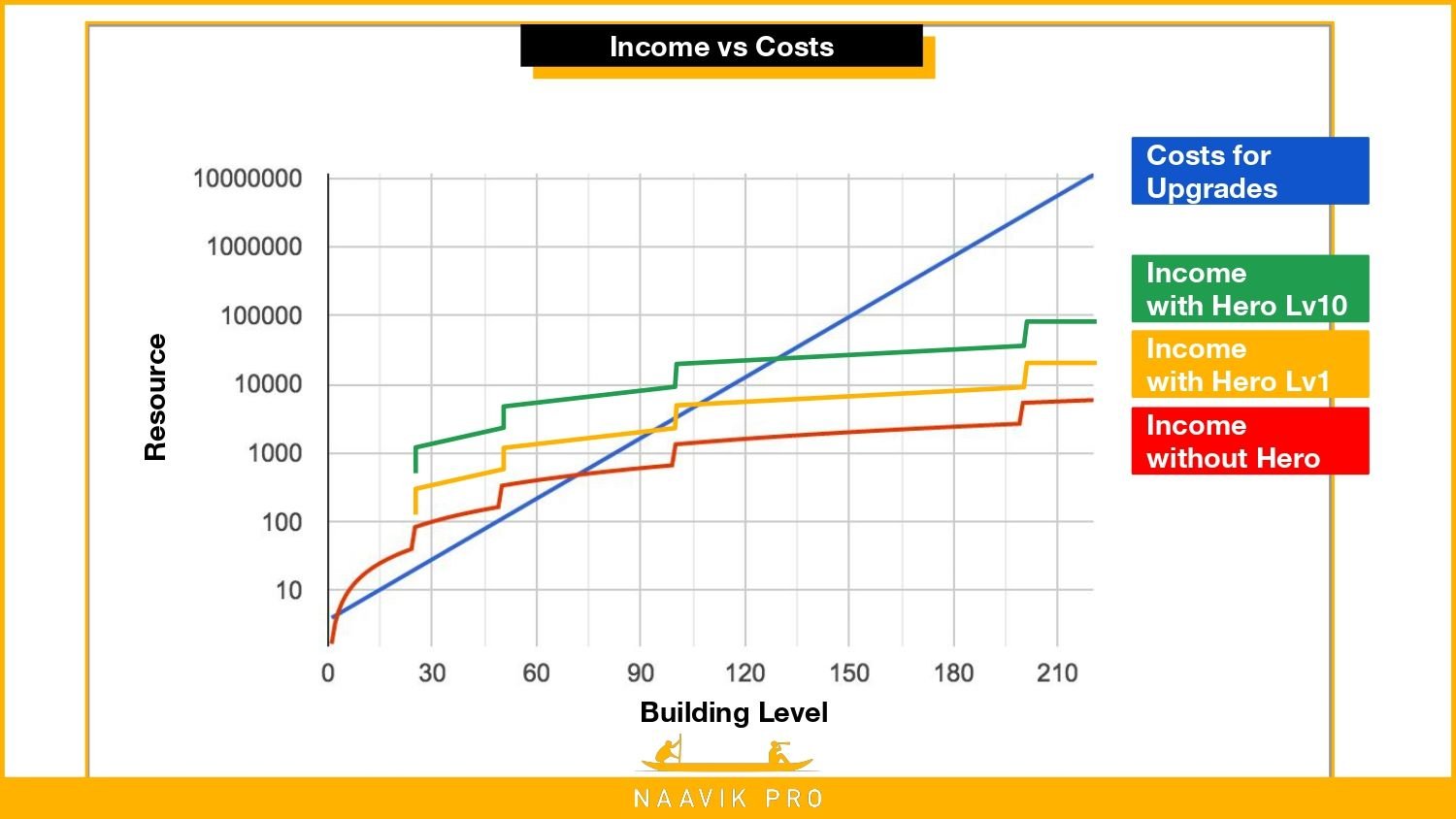

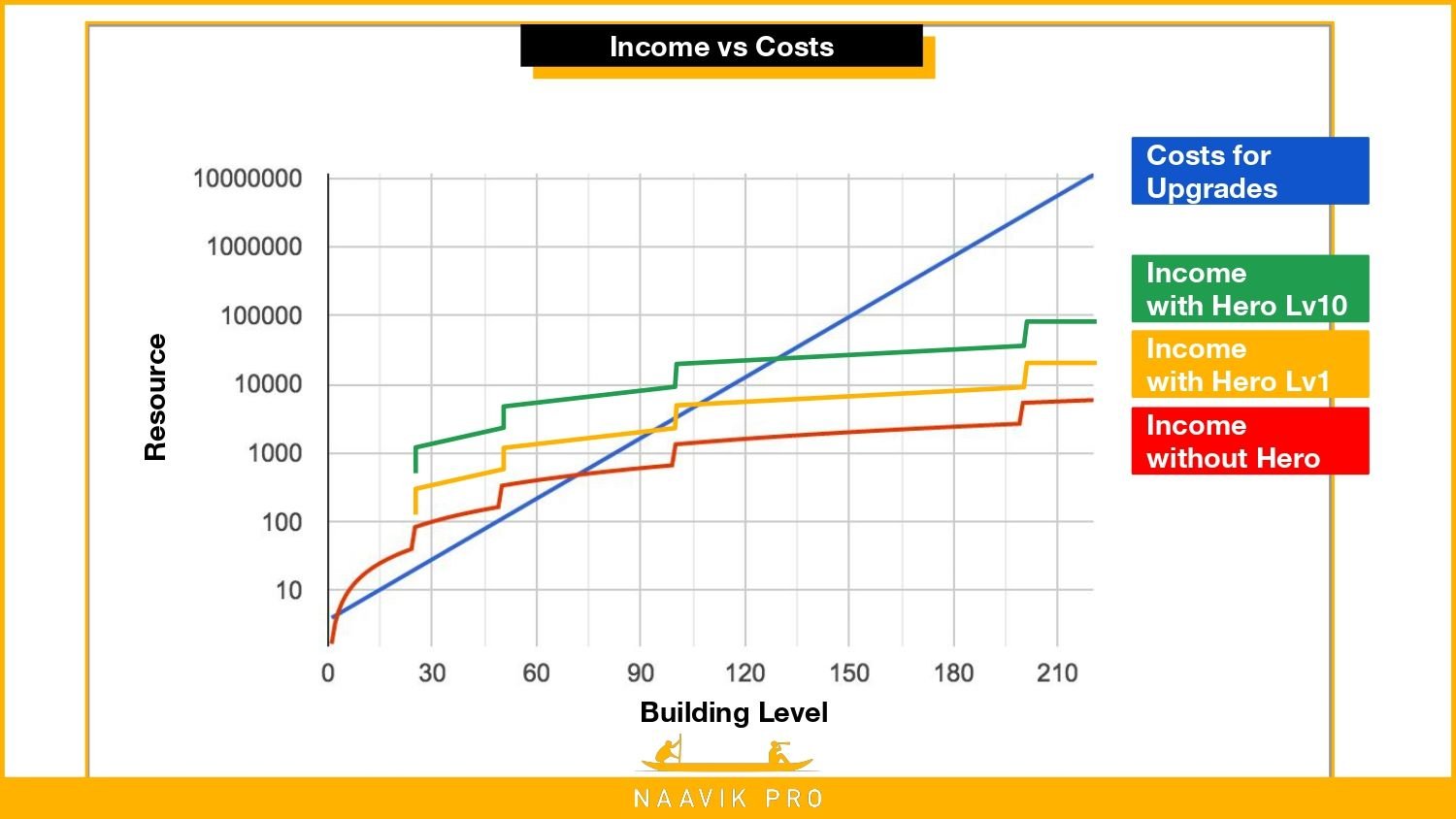

This makes heroes the most influential part of the building resource generation equation: Building Output = A (Hero Output Multiplier) x B (Workers Assigned) x C (Resource Generated per Worker). In the above equation, C is relative to the upgrade level of the building, but A and C are relative to the upgrade level of the assigned hero.

Since the hero collection is limited to pulling from the gacha chests, players who have not collected the needed heroes for their current buildings find their resource generation come to a grinding halt in face of the rising upgrade costs. A simplified version of Anthony Pecorella’s chart from The Math of Idle Games helps demonstrate this. This visualizes the impact on resource generation with and without a hero assigned, and the pinch of lacking resources for upgrades alleviated by collecting and upgrading the needed hero.

The resources needed to increase the level cap of heroes, the duplicates and Blazing Stars, are hard to come by and trickle in when completing tasks and as rewards at the end of events. The majority of low ratings on the mobile stores and comments on social media point toward players frustrated by the lack of progress due to missing required Heroes and the slow rate of their progress, signaling heavily the pay-to-collect-and-upgrade aspect of heroes. Since this is all part of the game’s balance of intricate formulas, this is a very fixable problem. The game team can alleviate drop off points in the game by rebalancing costs and income to smoothen the experience for more players.

Outside the primary use of boosting resource generation, a team of heroes is used to battle on a saga map of increasingly difficult fights to gain Shooting Stars, a resource used to upgrade characters. Players gain a synergy bonus for using a combination of heroes and simply auto-battle to the death. Again, this is a light implementation of Idle RPGs without too much complexity in terms of advantage triangles (rock-paper-scissors mechanics) and hero formations. There is no energy system to these fights, and once players reach a difficult battle they need to find and upgrade stronger heroes before continuing on the saga map.

Adventure is another mode heroes can take part in, limited to once a day. Players choose three heroes who advance through stages of battles with increasing difficulty, temporarily recruiting additional Heroes along the way. The mode is over once all the heroes are dead and the player is rewarded with resources to upgrade their heroes and town. This mode feels more rewarding to play over the Battle mode, due to the resource rewards, but time gating it to play once a day makes it very limiting. Idle RPGs use a mode like this to showcase heroes the player is yet to collect, giving them a hero for a test battle to try out, enticing them for a purchase. In Frozen City, though players get to try out new heroes in this mode, they rarely use them in battles of this kind and fail to leave any lasting impression.

These light Idle RPG mechanics in Frozen City fall short of capturing the essence of what makes that genre of games compelling: a constant drive to collect and upgrade a team of the strongest heroes. This problem of uninteresting battle mechanics is further compounded by how much time the game schedules outside of resource production.

Productivity Inc.

The in-game schedule runs on a fixed, repeating 24-hour clock with each minute lasting a second and each hour lasting a minute. Workers sleep from midnight to 6AM, work from 6AM to noon, eat a meal from noon to 3PM, work again from 3-9PM, and eat again from 9PM to midnight. In essence, in the total 24 minutes of playtime, the workers only work and generate resources for 12 minutes, sleeping or eating for the other half of the time.

Though this is great at maintaining the real-world analog and fantasy, used in a similar fashion in Frostpunk, there is no compelling activity for the player to engage in during this downtime. Frostpunk, on the other hand, has a lot of exploration and negotiation systems for players to engage during slower periods, as well as an ability to fast forward time to the next workday.

Frozen City does have an option to enable an extended shift in resource-generating buildings, making the workers work through the night instead of sleeping. This can cause the workers to revolt and trigger a short negotiation event to keep them from striking or leaving. This feature is buried at the bottom of the building menu and needs to be enabled for each building separately. There are no gameplay nudges that remind the player of this option, and unless players knowingly seek it out and engage with it, most players will play the game without ever going through a negotiation event.

Further gamifying this system of stressing the workers for bonus resource generation and successfully negotiating and de-escalating their propensity to strike would add a much needed variance in the session experience, adding moments of surprise and delight with extra resource generation. Players can be prompted to “extend shifts” when they are close to the next resource goal for the next building or upgrading, or “work harder” prompts during production time for a similar benefit. Similarly, players can be prompted to run “celebration time,” costing resources to de-stress workers, adding to the fantasy of the leader managing the physical and mental health of a group of survivors.

Weekly Events

The events act as a separate game board with a new town to build and upgrade for the duration of the event. This feels refreshing when progression grinds to a halt in the main town, quickly moving through the initial rapid growth and engaging players with the same loop they fell in love with when starting the game. Each event lasts about two days and is centered around a unique theme:

- Fish Farming is about building a fishing town over water to catch and sell different kinds of fish for cash, which is used to build and upgrade the town and unlock event milestone rewards. Cash earned also acts as points on a leaderboard for players to compete for rewards during the event.

- Grandpa’s Farm is the same as Fish Farming with a Farming theme and the addition of a slot machine which can intermittently be used to gain bonus resources. Both Farming events are run on the weekend on an alternating schedule.

- The Last Autumn is the newest event that runs in the middle of the week and is mostly a replica of the base game with reduced workers, challenging the players to assign workers in the best way to progress. Here event progress is based on the newest resource unlocked, starting with wood and moving to wood planks, coal, steel etc.

All three events come with their own Hero collection and progression, limited to boosting the output of buildings with no battles in the events. These are event-specific heroes who cannot be used in the base town. Any investment in the heroes is confined to the duration of the event and are lost once the event ends. Hence the events play out exactly the same, every time, irrespective of the player’s investment in the base game.

This lack of change between repeating events needs addressing, either by using some of the base heroes in the event, giving players a boost from event to event for their investment in the Heroes, or granting permanent access to event Heroes and their progression. Either of these changes will help players start the same event next time with an increased sense of progress from the last time they played it, growing their engagement to explore how much further they can progress over last time. Given it’s still so early, changes like these to the configuration of the events are likely to happen.

Idle Monetization

The gacha chests for heroes cost $3.50 and $8 for the rare chest and golden chest, respectively, making the starter pack offer of $2.99 for a rare chest and 100 Gems the top IAP for the game, likely converting players when pinched for a missing hero for a resource building. A similar offer exists for each of the events, giving a one-time starting boost when beginning a new event.

The primary use of the Gem packs is to purchase the gacha chests, after which players can use Gems for the missing resources when upgrading the level cap of heroes and skipping build and upgrade timers. Limited one time offers are unlocked when players unlock the next town, granting a gacha chest and gems for a boost when starting a new town. Coming up last is a $14.99 event boost that lasts the duration of the event and grants double earnings from all buildings and a 3x increase in offline resource generation time, from two hours to six hours.

Frozen City also has time warp monetization common to Idle games, where players can spend Gems to immediately gain a share of the current rate of resource production. The $0.99 Gems pack corresponds to 120 minutes of Time Machine, immediately granting resources for 120 minutes of current resource production and reducing any active build and upgrade timers by 120 minutes. These make for perfect pay-to-progress purchases as they scale with the increasing production and resource costs. The only thing missing from the game in this regard is an AD monetized option that is always accessible and can reward a smaller 5-10 Minutes of Time Machine rewards.

FC also features 3 kinds of subscriptions:

- Main City+, a $14.99 monthly subscription that doubles the offline reward time limit, from two hours to four hours, doubles the construction queue from two to four, adds an option to increase the auto-battle speed to 2x and automatically swaps sick/dead survivors in buildings with idle ones.

- ADS+, a $19.99 monthly (or $9.99 weekly) subscription to skip ads and still gain the rewards, like the daily free chest.

- GEMS+, a $9.99 monthly subscription to gems that grants 800 Gems worth $7.99 instantly (perfect for the golden gacha chest) and 100 Gems every day for 30 days. This is the best value for Gems, but players do need to log in every day to get the benefit.

None of these subscriptions show up in the top IAPs for the game, and given the $9.99+ pricing in the fairly Casual genre of Idle games, they may be pricing out interested buyers. The Main City+ is designed to be the most lucrative of the subscriptions, but it fails to entice with its thin offering of increased construction queues (players don’t have resources to upgrade two buildings at a time, let alone four), increased battle speeds (players don’t battle as much), and auto assigning survivors after sickness or death (which players actively avoid and hence doesn’t happen as much).

Only the increased offline time limit is appealing but comes with too hefty a price tag of $14.99. The game can alternatively explore reducing the price tag, removing the thin offerings (or at least reducing the focus on them) and trying a benefit they haven’t monetized yet: permanent multipliers, granting players 2x or more bonus to all resource output for a paid monthly subscription.

Players are prompted with the Main City+ subscription purchase every time they return to the game and collect their offline earnings. This is also the perfect place other Idle games use for AD monetization, boosting the offline earnings by a small multiplier for watching a rewarded video, something Frozen City is curiously missing. Overall, Frozen City is light on ad monetization, opting only for two rewarded video ad placements in favor of a more premium player experience. This is an unfortunate balance, as the audience for idle games has come to expect a lot more avenues to watch ads for rewards, like the options discussed above.

Disaster Creatives

Frozen City is using disaster “save them from the cold” creatives to acquire users. This particular kind of creative and related playable ads center around a widely relatable real world parallel: people are suffering in the extreme cold, so can you keep them from sickness or death by making the right choices for generating warmth?

These creatives are instantly captivating, and the mechanics of how to reach the win condition are almost intrinsically understandable. They are particularly used by casual games like Homescapes, Klondike, and many others, but what makes them perfect for Frozen City is the product market fit. The low poly art style is close to the in-game representation, reminiscent of hypercasual games with their use of emojis. The Frozen City store page reflects the same ‘save the survivors from the cold’ fantasy and the game’s FTUE takes players through the steps of saving a band of survivors from the cold by starting a fire.

Endless Winter

So where do we predict Frozen City goes from here? It clearly succeeded right out of the gate, landing at the top of the Idle Simulation genre in terms of IAP revenue with its light Idle RPG mechanics and gacha monetization that feeds back into the resource production loop. It found a widely appealing theme in the causal genre with its winter apocalypse and survival fantasy, which works well in UA creatives and makes for a strong product market fit, with the widely appealing genre of Idle games.

Yet with the game’s uneven progression, reliant on players pulling the necessary heroes from the gacha at opportune times, makes players feel stuck in their Idle progression and risk getting disengaged, showing up in the lower average play time and signaling retention problems ahead. These are still addressable with rebalancing the game, and it’s better to fall short on the side of needing to increase rewards than the side to decrease them.

Furthermore, the game’s monetization is not casual friendly, asking for $9.99 to $19.99 in monthly subscriptions for perks that don’t cost as much in other Idle games. The light gacha monetization makes for a unique mix of Idle Building plus Simulation mechanics that pinch players on collecting Heroes, not primarily for battle but for resource generation. This is what made the game the best performing Idle Simulation game, but simplifying the Idle RPG mechanics makes it a mediocre performing Idle RPG game, giving Frozen City a sweet spot between wide appeal and mid-monetization.

As of this writing, we’re just over 60 days since Frozen City was launched, and Century Games has already launched another title, Whiteout Survival (WS), with the same “survive the winter apocalypse” theme. WS leans more on the Idle RPG side, adding more depth to the gacha hero collection and progression, bringing it closer to games like AFK Arena. The light Idle Simulation of town building is leveled up with a 4X meta of building an alliance of towns and establishing dominion on a shared server, appealing to a narrower hardcore strategy audience.

Century Games can try making both games with similar marketing succeed in their slightly tangential genres. But depending on their difference in audience and performance, using the same UA strategy across both titles can lead to one potentially cannibalizing the other.

Century Games clearly identified this winter apocalypse survival fantasy as a highly marketable theme and has launched multiple projects to capitalize on it. They have drawn inspiration from one the best studios behind hardcore survival PC/Console games, Frostpunk and This War of Mine creator 11 Bit Studios.

Frozen City still requires optimizations of its progression and investment systems to improve overall live ops and events content. For a studio with 11 years of experience making Casual, Simulation, and Idle games, Century Games is more than capable of meeting the challenge of maintaining and growing Frozen City’s strong early performance. By the end of 2023, we expect the game to remain the No. 1 Idle Simulation game, growing its market share using its marketable theme, leaning more on RV ad monetization and investing into growing its events and live-ops cadence.

A big thanks to Harshal Karvande for writing this update! If Naavik can be of help as you build or fund games, please reach out.