In January 2019 a notorious article predicted that the then-booming hypercasual genre would eventually become unsustainable. More than a year later, Apple announced IDFA deprecation. The fallout has kept a few of us here at Naavik busy all the way through 2020 and 2021. The clearest way out, especially for the most established hypercasual companies, became hybridcasual. Now that the dust has settled, there is more clarity around the strategies of the companies that chose this path — a perfect time to look at their best practices.

Firstly: what is hybridcasual? Homa Games defines hybridcasual games as “maintaining the simplicity of hypercasual games while including more sophisticated progression mechanics. This genre requires audiences to make time to play to improve long term user engagement”. While this definition covers part of it, we like to specify that the progression mechanics need to be added onto an Arcade core. But even then the question remains: can every Arcade core serve as a base for a hybridcasual game? Does this definition of hybridcasual encompass everything we now know?

Arcade games – or games with instantly understandable core mechanics – obviously existed since long before hybridcasual or hypercasual. Games like Temple Run (2011), Hill Climb Racing (2012) and Subway Surfers (2012) are great examples as they started out differently and only later in their life cycles modernized their way to monetize, by pivoting towards an ad-driven model. Each of these three classics was downloaded 100M times or more in the last 12 months.

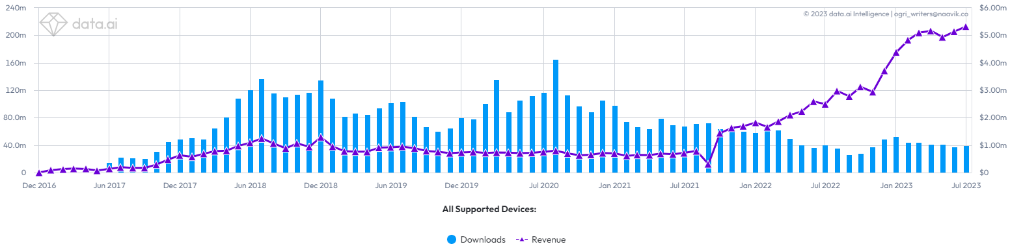

While these games likely earn a pretty penny through ads, they lack significant IAP revenue to be labeled hybrid. The IAP revenue comparison with arguably the biggest hybridcasual game of today looks very different. For example, Subway Surfers has seen 250M downloads and $9.8M in net IAP revenue over the last 12 months. In comparison, Survivor.io has seen 62M downloads and $276M in net IAP revenue over the same time period. These are not the same kinds of games, even though they speak to very similar audiences.

The three games mentioned above don’t have a meta that is deep enough to leverage best-practice IAP monetization as seen in casual (specifically live ops). Games must be built with truly free to play economies and meta games to be able to achieve this. On top of that, practically all hybridcasual hits have a power progression that is used as the main thread to build the meta progression onto. A hypercasual-esque marketing angle also needs to be found to reach the desired marketability, driven by hyper-accessibility.

Next, let’s dive deeper by dissecting some notable hybridcasual titles, including SayGames’ Dreamdale, Voodoo’s Mob Control and Collect ‘em All, Madbox’s Pocket Champs, Habby’s Survivor.io, and Homa’s Fight For America 3D and the upcoming Merge Army.

By doing so, we’ll answer the following question: what are best practices in hybridcasual, which strategies are being used to develop them, and what prerequisites ought to be in place to build these games successfully?

The above games are interesting and successful examples of hybridcasual games with IAP/ad-revenue splits that favor ads more than conventional casual games. They all have instantly understandable core gameplay optimized for maximum accessibility and marketing strategies that leverage this. Most also have metagame features that leverage the power progression on which their cores are built, so they have enough space to keep running meaningful live ops.

These games are also notable for their mass-audience to deep-monetization fits. Hybridcasual games introduce casual F2P audiences to RPG-esque progression mechanics; the best hybridcasual games are able to mature hypercasual players into full-fledged gamers.

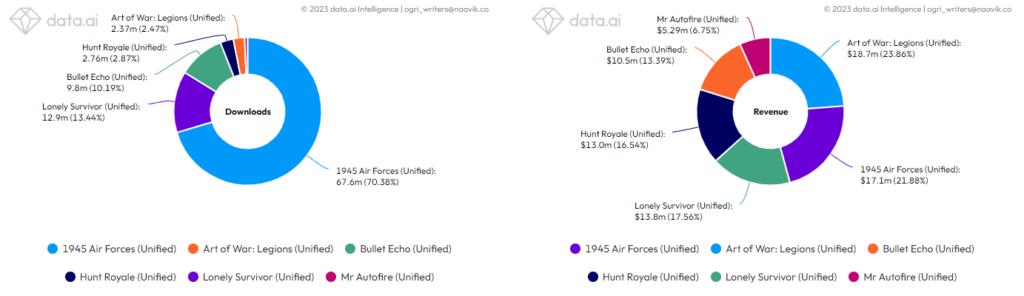

While the game selection covers well-established companies and lucrative games, other emergent companies hoping to claim a slice of the hybridcasual pie are circling. We can’t cover all emerging hybrid titles in-depth, but we can show a downloads and revenue breakdown of games from other notable companies.

Before we jump into the first case study, those that want to delve deeper into the genre should check out:

- 1945 Air Forces by OneSoft

- Bullet Echo by ZeptoLab

- Hunt Royale by Boombit

- Lonely Survivor by Cobby

- Art of War Legions by 89Trillion

- Mr. Autofire by Lightheart

SayGames - a Hybridcasual Hit Machine

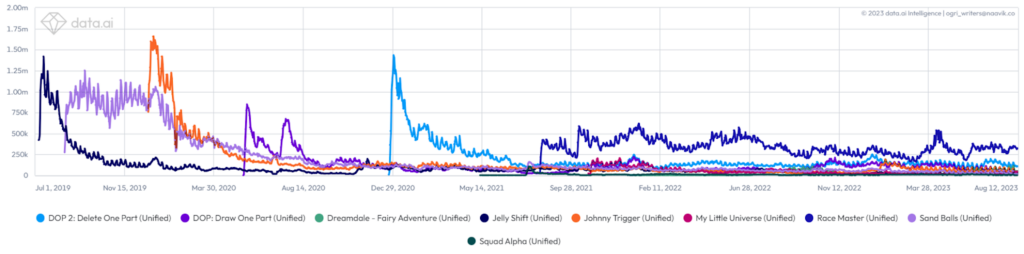

SayGames has seen some huge success over the past few years and reached 4B downloads across its portfolio in February this year. Initial hits include hypercasual bangers Drive & Park, Train Taxi, Jelly Shift, Sand Balls and Johnny Trigger, which all released in 2019.

The publisher saw its first real hybridcasual success with Squad Alpha and My Little Universe, released in the middle and end of 2021 respectively. Both are developed by Estoty. Dreamdale is likely its most notable success, however, and its most recent release My Perfect Hotel saw a massive spike in revenue recently. It’s a little too early to conclude if this sudden success can be maintained, though.

SayGames is the publisher with the richest and most consistent track record in hybridcasual. While not all of their recent attempts have been successful, the company clearly has an open mind and impressive technology. Before we take a deeper look at the company’s hybrid success Dreamdale, let’s clarify SayGames’ approach.

SayGames’ Hybridcasual Strategy

Very high consistency between successful ads and core gameplay

Lots of SayGames’ projects have started by looking at the best-performing advertisements and taking it from there. Just like when Lion Studios created Save The Girl based on the wildly popular ads, SayGames took well-known ‘choice and fail’ scenarios and created the ludicrous yet fascinating Jess’ Stories. Other examples include Delete One Part 2, Tower War and Rope and Balls.

Highly engaging, arcade-inspired core gameplay

The company’s favorite genre is clearly hypercasual-style simulation (like recent hit My Perfect Hotel). This comes with a big perk in terms of second-to-second retention: these games don’t pause. There are no rounds to finish, which creates this gravitational pull that makes it hard to stop – there’s always a little bit more to do and explore.

Heavy focus on ads-to-IAP conversion

The ad-watching experience in most of the company’s games is very, very jarring. Interstitial frequencies are stupidly high and even the numerous RV-placements — which are often inside the game worlds — are used to convert players into paying to be able to skip them, rather than watch them.

Mini-Deconstruction: Dreamdale - a Dream Come True?

Leveraging the success of My Little Universe (October 2021), developer Hypernova Games created Dreamdale (published by SayGames). The game is a single-action resource-management RPG that (initially) takes place on a tranquil island where players walk around and gather what they need from the environment. Step by step, more locations and interactable objects become available as part of the game’s exploration.

A full playthrough of the game is on YouTube. | Source: MINi Game on YouTube

Dreamdale started scaling on Android in the summer of 2022, but only really took off in terms of IAPs a year later when SayGames started scaling the game on iOS.

A Hypercasual Ad-Inspired Core

One way to develop hybridcasual games is to closely base the core gameplay on low-CPI ads of hypercasual games. Dreamdale is not different, with this subgenre of hypercasual resource management being pioneered by games like Voodoo’s Lumbercraft, which released in early 2021. The new and unique thing in these games was the “Tower Backpack” mechanic (showcased below), adopted by many other hypercasual games including Stone Miner, Craftheim, and My Mini Mart, which each raked in tens of millions of downloads throughout 2021 and 2022.

The core gameplay itself was first seen in Playphoria’s Idle Lumberjack 3D, a very engaging game because of its tactile controls and immediately obvious power progression. The core challenge is to chop down a forest of randomly-placed trees as efficiently as possible. These games don’t feature a time limit or other loss condition and require no thinking. The fact that it feels inefficient to chop down one tree at a time, or trees that are too strong, is enough. By selling the resource (be it trees, stones, groceries or whichever theme is chosen), the player earns a currency that allows them to become more powerful and destroy stronger objects, usually visualized as the same asset in a different color.

Dreamdale has taken this mechanic and made it central to the game. It’s so monotonous and yet so gratifying when performed correctly that it opens the door for interesting trade-offs when it comes to rewarded ads. But more on that later.

A Deep Yet Accessible Metagame

The three important drivers that My Little Universe and later Dreamdale added to this mechanic are resource management, exploration and combat, transforming them into adventure games instead of one-dimensional hypercasual games.

In comparison to My Little Universe, Dreamdale added a few more mechanics to make the game more engaging, most notably a sprinkle of lore and dialogue, idle/automated resource spawners and equipment, and there’s rideable animals. It seems that these additions haven’t made much difference in retention, but in terms of experience they did create the feeling of a coherent world.

Don’t be fooled by the game’s simplistic looks. It contains a full-fledged battle equipment collection akin to hybridcasual trendsetter Archero, and in essence Dreamdale is similar to some midcore games in terms of core loop.

Where most adventure games that rely on exploration usually have ways to tell players they shouldn’t yet visit a certain area, games with this new loop make it the player's habit to physically expand the traversable area they walk on by paying for a gathered resource.

It’s a brilliant way to keep players from being overwhelmed while playing into that curiosity of exploration. This mechanic is testament to the hypercasual way of choosing functionality over logic when making design decisions.

As Dreamdale’s meta mostly revolves around resource management, it would be a tricky (and too granular) task to sketch the exact relationship between all game’s resources. Eventually, the player will have acquired so many different kinds of resources that the game’s UI isn’t able to show all of them at once.

The joy of discovering a sink for a new resource and wondering where it could be acquired is simple yet effective, and useful signposts in the world (as above) tell players where they could invest time unlocking next.

In terms of time-limited features, Dreamdale is surprisingly empty. The game is still being worked on and Hypernova does release additional islands to explore periodically. These islands contain their own resources and have monsters that get stronger every time. The developer even tried making Dreamdale seem like an MMO, showing fake players walking around in one of the far-off lands. Clearly, the ambition and drive is there, but live services are far from visible. The result of this is below-average long-term retention compared to other hybridcasual hits (2.64% D30, the lowest of all games covered in this article).

A Healthy IAP-to-Ads Revenue Split

Overview of rewarded ad placements

Let’s look at ad monetisation. The game is balanced and optimized to generate friction in terms of time it takes for resources to be farmed. While the act of chopping itself is rewarding, it does get very, very repetitive, but every bit of grind can be easily fast-forwarded by watching a rewarded video.

These placements can be repeated, making it possible to “play” the game while doing other things and earn resources faster and with less effort than it would take to chop them manually. This interval-based play rhythm is something other games in today’s article also leverage.

Nothing too revolutionary, you might say, but here is where it gets really interesting: normally, games that serve lots of ads try to keep the length of the longest rewarded videos to a minimum, as serving players many of these in quick succession can hurt retention. In Dreamdale though, none of these considerations seem to have been made. Tapping one of the game’s numerous rewarded video buttons more often than not results in lengthy videos with annoying end cards that can’t be exited in fewer than three or four taps. The reason why SayGames doesn’t care is one of the game’s most desirable currencies, Tickets. 30 Tickets are included in the No-Ads IAP, and using them is a joy as they allow players to get substantial rewards that would normally require watching a rewarded video.

More of these tickets are also for sale in the game’s store, for players who want to keep using them. Packs of 40 additional tickets cost $6.99 and account for ~6% of store revenue (July ‘23, iOS).

Does this specific advertisement strategy contribute to the game’s low long-term retention? One could argue that it only indirectly affects retention – players who think the ads are too long will most likely not stop playing because of that, but stop playing because of the sheer monotony of the game experience.

IAP/ad revenue split

In terms of in-app purchases, data.ai shows the game grossed $767k in July (US, iOS) with the “Ad-free Adventure” being the obvious, most frequently purchased placement, accounting for about 50% of IAP revenue.

The aforementioned tickets also play a part of this IAP-heavy revenue split with 7% of revenue attribution. In July’s Two-and-a-half gamers podcast, admon consultant Felix Braberg estimates $0.14 of revenue per purchased ticket, which is a huge upgrade when compared to the average $0.02-0.03 revenue for an RV in the US. Braberg also estimates that with IMPDAUs of 11 for RVs and 4 Interstitials, Dreamdale makes $44k per day worldwide, although data.ai estimates about $39k in T1 countries per week (based on July 2-8, one week before the podcast).

Based on these numbers, Dreamdale’s monthly ad revenue would end up around $1.3M, tilting the scales to a 63/37 percent split in favor of ads, which sounds a lot more realistic.

It's safe to say there’s a huge discrepancy between estimates from data tools and what industry experts predict; it’s wise to take any ad-revenue estimates in this article with a pinch of salt.

Voodoo - the Hypercasual OG Turning the Page

One of the most successful hypercasual game publishers and developers in history has come a long way since its investments into casual games in late 2019. Numerous studios around the world have since been established and about just as many have been disbanded in the pursuit of a business strategy with a more sustainable future.

After a period of exploring casual games in 2020, Voodoo started to define a hybridcasual strategy, with yours truly cross-posting about it on the company’s dev-blog before the company’s more official announcement in August 2021. From that moment, the company has gradually been trading over a billion downloads per year to millions of IAP revenue per month.

At the start of this year Voodoo proclaimed its past core business “is dead”, and a more recent PocketGamer article suggested its pivot has worked. For more information directly from Voodoo itself, we recommend listening to our interview with Alvaro Duarte from March.

Voodoo has been using Mob Control and Collect ‘em All as prime examples of its success in hybridcasual, which is why we’re covering these two games today. Voodoo also has Block Jam 3D lined up as its next hybridcasual candidate, which shows the most promising RPD growth any Voodoo game has ever seen, with over $3 on iOS!

Voodoo’s Hybridcasual Strategy

After becoming the third-biggest company in terms of app installs after Meta and Google in May last year, the company must by now have reached one average download per human around the world. Voodoo is now pursuing more meaningful engagement through the following:

Transform the best hypercasual games into hybrid successes

With one of the biggest assortments of published games in the world, the company has deep experience and lots of data on what it takes to create sticky core gameplay. It is able to identify and leverage core games with the biggest potential (historically hypercasual) hits, but only start scaling when enough effort has been put into adding power progression and live operations.

Simulate experiences to mitigate development time

Voodoo’s biggest hybrid hit is marketed as a competitive multiplayer game but can be played entirely offline. The company is well-known to take smart development shortcuts like these to create a viable business case. It’s all about player fantasy which —to a certain extent— can be faked.

Use hypercasual marketing “hacks”

The company owns Collect ‘em All, one of the only notable hybrid games with a puzzle core and no power progression that is still proving to be a viable business case (more on that below). As long as the CTR calculation makes sense and the game can attract players using one engaging commercial, there’s a way.

Mini-Deconstruction: Mob Control, Adding That Next Dimension

Mob Control was initially developed early 2021 by Vincent Bourçois within Voodoo’s internal hypercasual team at its Paris HQ. The crowd mechanic was hot at the time, as Mob Control was not the only game showing ads in which crowds of blue stickmen were guided through mathematical gates.

Mob Control two years ago. | Source: Game Play Mobiles on YouTube

Mob Control turned out to be one of Voodoo’s most successful hypercasual hits. Around August that same year, a Barcelona-based team of four seasoned casual game developers, lead by ex-Candy Crush Soda Saga Game Lead at King Miguel Santirso, was tasked with turning the game into a hybridcasual evolution of itself. The team then spent nine months adding a card collector metagame, akin to Clash Royale but without the chest opening timers to gate the player.

Sagrada Familia-esque Construction

Mob Control really started picking up a year after Voodoo moved the game to Spain and started scaling.

So what was it that Voodoo’s Barcelona team started adding two years ago? The structure of Mob Control can best be described as a mix between Coin Master and Clash Royale. By playing rounds, users earn coins and card packs that allow them to upgrade their forces. Additionally at the end of every round players steal materials by reaching and attacking another player’s base, which they then pump into building their own.

It’s important to note there is no agency when constructing bases. Players simply transfer collected materials into their base and progress linearly. After 36 themed bases, players will start constructing bases that are simply numbered, basically making visual construction continue infinitely, not unlike Barcelona’s most famous landmark.

Mob Control’s loop when it was still a hypercasual game looked like this:

And now that it has a full-fledged metagame, it looks like this:

Unlike Coin Master, and in true hypercasual fashion, multiplayer in Mob Control is actually all fake. The game features attacks from other players when returning to the game, a questionable world leaderboard and bogus in-game PvP (which is easily discovered as it allows you to pause the game).

In fact, there seems to be suspiciously little reason to use the soft currency and upgrade the strength of your units as the game’s “matchmaking” presents you with opponents based on your upgrade level. The game’s power progression is a clever illusion as well. After playing and upgrading a lot, the core game does get more extreme in terms of enemy attacks and mobs on the screen, which is all a casual player really needs.

Live-Ops and Time-Limited Events

The Mob Control team has implemented a shortlist of top-performing events seen across the board in most GaaS:

- The Season Pass includes daily and seasonal missions to complete for extra reward progression in a free and premium track, purchasable for $4.99 every few weeks

- Gold Rush adds a tactical trade-off to the core game where some gates allow players to collect gold nuggets for extra coins

- Piggy Race adds a collaborative twist to the famous Piggy Bank feature by simulating co-opetition with other players (co-op because the piggy is filled with everyone’s collected gold).

- Infinite Bounty is the classic implementation of the free gift train, with an IAP in between

Mob Control also features the World Clash event where players choose a team and compete in a worldwide competition to earn materials.

With these minimally viable yet effective time-limited features, Voodoo is able to pull the trick all top-grossing casual games do: offer desirable currencies as well as unique collectables to be unlocked periodically. The best examples of the latter are cannons with specific fire patterns and uniquely skinned Mobs.

Monetization

Mob Control features a few rewarded video placements, but when playing the game it doesn’t seem like Voodoo has RVs as a major source of income as the benefits are far from no-brainers:

- Upgrading Fire Rate

- Getting free Booster Packs

- Upgrading units while having insufficient funds

- Skipping Season Pass tasks

In terms of in-app purchases, data.ai shows the game grossed $1.65M in July (Worldwide, Unified), and since Voodoo itself clarified the split was 85%/15%, a rough estimate for the ad revenue during that month would be a whopping $9M.

When looking at individual IAPs, Mob Control’s revenue distribution seems quite equal, with the cheap No Ads and Season Pass purchases making up most of the purchase volume; however, the big coins and RV-skip-tickets also drive outsized revenue.

Voodoo also allowed players to purchase the overpowered Triple Cannon outright at first, but it has now been moved to be a part of the game’s Club Memberships.

Frequency and characteristics of interstitials

Mob Control is built on round-based gameplay, so it has a much easier time driving breaks and interstitial ads than Dreamdale, in which being taken out of the game feels much more intrusive. In this case it’s simple: after every round players get served an interstitial. The end cards are not too aggressive, and it’s over in less than 10 seconds.

Bonus Item: Collect ‘em All, a New Take on Puzzle Games

This is Voodoo’s second successful hybrid game. It doesn’t have a unique or surprising loop or an easily marketable core, and it doesn’t have a meta built on power progression. So Collect ‘em All doesn’t perfectly fit the hybridcasual mold, but it does deserve a mention, especially since Collect ‘em All has a very similar IAP RPD to Mob Control ($0.19 v.s. $0.17).

Collect ‘em All (CeA) is an interesting use-case as it manages to be ROI-positive despite its heavily simplified puzzle core. It is surfing a red ocean in which new games usually get pummeled by waves of extremely high CPIs, only affordable by the biggest and most established developers. In short, the game works because it doesn’t try to compete with deep casual games like Merge Mansion in terms of UA, but acquires cheaper players by showing them hypercasual-style ads instead.

The classic “How smart are you?” play, used in countless hypercasual campaigns. | Source: YouTube

The one specific puzzle shown in the video above has been the center of Collect ‘em All’s UA strategy since May 2022. To keep players from saying it’s fake advertising, Voodoo made this puzzle the initial task for players to solve in the game’s first session. After that, every 10th level of the game is a line-drawing puzzle like the ad, and in case players can’t or don’t want to solve it, they can watch an ad to skip it entirely.

It’s brilliant in a way, as the game’s actual core mechanic is also line-drawing (like Best Fiends and Jelly Splash) but with procedural levels that offer no variation except for the colors that need to be collected.

The game’s meta is a generic-looking room decoration module that could be transported into other games if required. The game’s meta contains a daily spinning wheel, a Piggy Bank (most lucrative IAP), a competitive (yet fake) level race tournament, weekly Quests that award boosts and the most recent addition: a feature that (just like in Mob Control) places players in promotion zones to reach higher (also fake) Leagues if they spend enough time playing levels.

Monetization

Data.ai shows the game grossed $347k from IAP in July (US, iOS). Collect ‘em All’s ad revenue is estimated at $119k (per data.ai) for the same time period, geo and platform. This suggests an ads/IAP revenue split of 25%/75% for Voodoo’s line-matcher, but as seen in the examples above, these are very much estimates. In fact, IAP revenue for CeA must only be a tiny fraction of the total, as the game only sells packs of currency and boosters and a way to remove interstitials (which like in Mob Control are shown after each round). The fact that this purchase is a whopping $9.99 tells us that Voodoo is earning much more on this game’s advertisements than on the ones in Mob Control, where removing advertisements costs $3-5 (depending on segmentation). The majority of Collect ‘em All’s economy seems to be fixed on boosting ad revenue, visible when listing the number of RV placements it features:

- More moves when losing to keep keys

- More moves when losing to keep playing and not lose a life

- Double coins when leveling up

- Double stars and decoration currency when winning

- Double rewards of the spinning wheel

- Spin the wheel three more times (to reach the $0.99 quadruple-rewards wheel)

- Add 300 coins to the Piggy Bank

- Unlock the third (and nicest) decoration option

- Get one more life (if not full)

The game visibly tries to substitute any undesirable situation with the option to watch an ad. In some cases, Collect ‘em All’s player experience is so wild it even comes up with fictional motivations: when running out of moves, CeA tries to coerce the player into watching an ad to keep playing a level by telling them they have collected enough keys “to claim the next reward”, while actually, these keys (nor the reward) are nowhere to be found in the game’s meta!

So is CeA a real hybridcasual game? For the most part it actually skews more hypercasual because of the heavy focus on ad-monetization versus shallow IAP spending depth. The game also has practically no live-ops and it is not built on a core with power progression, nor does it feature enough puzzle variation to retain players in the long-term.

Although with its RPD being slightly higher than Mob Control, there’s definitely an argument that it is a hybrid game.

Does this game’s strategy work? It seems to. CeA seems to play the role of an intermediate funnel for new puzzle players, acquiring them cheaply using Voodoo’s efficient yet elaborate UA strategies, then monetizing them through ads and maybe even a few IAPs. Then, after a few weeks, players realize the game doesn’t provide enough core game variety and get forwarded to a game like Merge Mansion through one of its ads. If it works, it works!

Madbox’s One-Hit Wonder

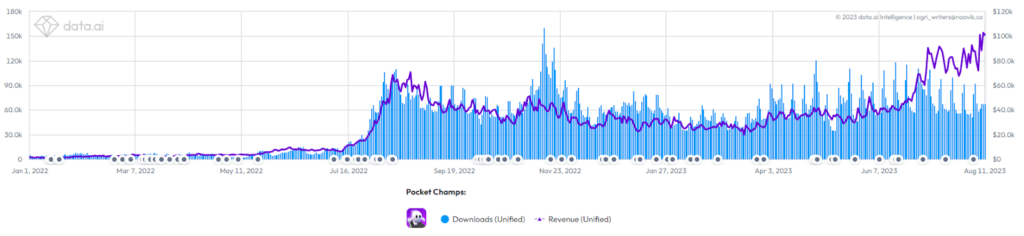

This next French studio with roots in hypercasual publishing (currently housing quite a few ex-Voodoo employees) has done a terrific job of documenting the studio’s history on their website. Its most successful hypercasual games Stickman Hook and Parkour Race have 160M and 80M downloads worldwide, respectively. But Madbox does not have many other notable hybrid games beyond Pocket Champs. Some initial thoughts here:

Reward those ads, HEAVILY

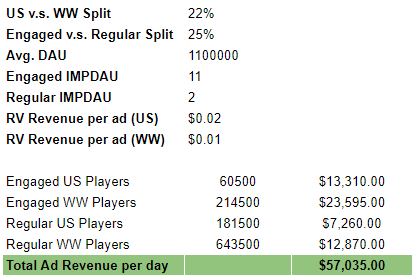

Of all the games in today’s articles, there are none with an estimated IMPDAU that comes close to Madbox’s hybridcasual hit Pocket Champs. The game constantly trades direct power progression against ad-engagement, combined with gacha mechanics for that sweet ad-viewing conversion.

Unique, never-seen-before “gameplay”

Madbox doesn’t have the massive portfolio that SayGames or Voodoo have, but still has about 50 hypercasual games in its catalog. Pocket Champs’ core gameplay is solely idle and spectatorial, which is an ideal engagement pattern to be combined with rewarded videos.

Almost perfect hybrid monetization split

Usually, games have a prime focus with regards to their monetization model – companies often come from an ad-monetization background before attempting to hybridize their product, or the other way around. Pocket Champs doesn’t discriminate and has been developed with both sides equally.

Mini-Deconstruction: Pocket Champs, an Idle Runner

Madbox’s most lucrative game, Pocket Champs started scaling a little more than a year ago and is the firm’s only game with meaningful IAP revenues. With an RPD of almost $2 in the most lucrative segment (US, iPhone), Pocket Champs stands its ground against its competitors when it comes to microtransactions.

Photo Finish Obsession

Building on top of the success of Fall Guys, Madbox came out of nowhere in 2022 showcasing polished, fully automatic core gameplay with a simple yet engaging meta progression on top.

Pocket Champs is an amazing case study in taking a game concept (Fall Guys) and dramatically simplifying it to make the accessible concept ultra accessible.

Matches are visualized as races between players, although the other player characters are ghosts. Madbox was smart enough to not add pause functionality, and the game’s multiplayer is actually not synchronized, because why would it be? The races contain no random factors and need no player input, so the outcome can easily be calculated before a match starts. The game’s fully deterministic nature gives Madbox full freedom to gate players with every match they play.

Simple, Straightforward Strategy

A race plays out as a result of three factors: level layout, a Champ’s four skills and the Gadget they have equipped.

It’s like Stumble Guys without Stumbling. | Source: Pocket Champs

Before a round starts, players get shown a level to race on which always has a mix of four surfaces (land, water, air, and cliff) of varying lengths. Their champ (regardless of which skin is chosen) has four skill levels (running, swimming, flying, and climbing), which serve as the player’s main skill progression. The only agency players have is which Gadget they choose to equip for each race, giving them a speed boost (on top of their skill level) on one of the four surfaces. Gadgets have the following characteristics:

- Speed boost: how much bonus speed the gadget provides (upgradeable using coins)

- Uses: how many times a gadget can be used during one race

- Distance: how far the gadget helps the Champ travel during one use

- A Rarity to show the potential of every Gadget

Some specific, rarer Gadgets not only boost one surface but can have a combination of two, substitute one skill for another, or have an extreme boost on one surface but are extra slow on another.

The game currently has 51 available Gadgets players can collect and upgrade by earning Chests, which are given away mostly as prizes for events and in the game’s Trophy Road. To make it more clear how this plays into the game’s progression, let’s fully dissect the game’s loop.

By racing players fill up their Gym Bag slots, which work exactly like Chests in Clash Royale and provide players with training points. Combined with the aforementioned Chests that reward players Gadgets, this results in a tight yet engaging loop with just enough pre-match strategy to engage hypercasual and casual players alike.

The game’s funnel is highly polished and on-boards players slowly but steadily into its race mechanics, but the game’s most notable feat are its rich live operations.

Eventful Days

Pocket Champs is the game with the second-most elaborate and engaging live-ops calendar in this list, and for good reason; desirable legendary gadgets as the chase prize drives players to re-open the game multiple times a day. Because event races are gated by requiring a ticket to play (normal matches are only soft-gated by the Bag slots), players are poised to keep coming back to the game every few hours (1 ticket replenishes every 20 minutes to a maximum of 5) to attempt more races.

Over the last year, Pocket Champs has seen many seasonal events, which have slowly expanded the game’s Gadget variety. The amount of cosmetics to customize a player’s experience has also increased, but as these are purely cosmetic and there are no real player interactions in the game, it’s questionable that these are a big revenue driver. Still, because the game has such a strong loop and easily expandable meta, it has seen a lot of growth in IAP revenue over the last few months. The game is also brilliant at converting players into watching rewarded videos, so imagine how much advertising revenue is added to Madbox’s bank account each month.

Monetization

The game shows no interstitials and no banner ads, but does provide the player with the option to watch a few incentivized videos. Available placements are:

- 1 more Event Ticket (2x five times a day)

- Get extra skill points from a Gym Bag

- Spin the wheel for a randomized event reward another time

While the selection of placements isn’t that big, the first does generate five rewarded videos every 10 hours for players who are committed to a specific time-limited event. Why would players do this? The rounds of gameplay — which are about 30 seconds long — allow players to be idle anyway! In other words: ad-engagement simply fits perfectly within a session of Pocket Champs.

Pocket Champs had an average DAU of 1.1M players in July. Let’s say that 25% of those are highly engaged (2-3 sessions a day, RV IMPDAU: 10) and 75% are not (1-2 sessions a day, RV IMPDAU: 2). With data.ai showing 22% of players being from the US (where an RV brings in ~0.02 per impression versus about half in the rest of the world), this brings us to the following calculation:

Data.ai shows that in July, Pocket Champs grossed $2.48M in IAP revenue, or $80K per day. Taking the ad revenue estimation above shows a neat hybrid 42/58% revenue split in favor of IAPs.

Habby – Hybridcasual Instigator Nails it Again

Habby pioneered hybridcasual with Archero at the end of 2018 with its one-thumb, top-down shooter gameplay. Around February this year, the crown passed on to Habby’s biggest game yet: Survivor.io. This game also made headlines – but how does Habby mix its Singapore Sling?

Power progression all the way

Habby’s two biggest hits are roguelites, an inherently repetitive genre built on recurring attempts at combat challenges that become easier with every attempt due to the avatar’s growing strength. Very few mechanics retain players more successfully in the short- to mid-term than a clear power progression, which is one of the most common denominators for hybridcasual. Even though we have stated before that Habby’s strategy presents long-term engagement issues, players seem to stick around long enough for Habby’s games to be very lucrative.

Casual game, hypercasual UA

Habby games are casual in terms of feature set, but their UA is not. We’ve covered the company’s marketing strategy already, which is the sole reason Habby’s games still qualify as hybrids.

Elaborate casual monetization

While Live Ops in most other hybridcasual games feel tacked on, Habby invests heavily in original, standalone mechanics to build time-limited events on top of. Whether it be mining, fishing or a board game, this rejuvenates engagement and pushes players to finish these very difficult events.

Update: Survivor.io, a Year Later

Taking inspiration from Vampire Survivors’ core gameplay, Habby smoothed out roguelite action for mobile by letting go of Archero’s room-based progression.

In the time-limited rounds of Survivor.io, players fight off gigantic hordes of enemies and in most levels, the environment is infinite, which leaves the player with only one goal: survive. Players collect XP from killed monsters and unlock more and more abilities, resulting in the slaughter of thousands of mindless enemies in an almost hypnotic fashion.

Picking the right power-ups creates an impenetrable circle of death. | Source: Survivor.io

Post-launch, TikTok and other social media campaigns led to a massive surge in downloads and revenue. Following this early success, we elaborated on the game in detail last October, but a year later let’s dive into a quick update.

Since its launch in August last year, the game has racked up a grand total of 77M downloads worldwide on all platforms, generating a total amount of IAP revenue of $311M.

The game’s metrics are not looking great as downloads have slumped quite heavily. RPD has plateaued at about $4.50 on iOS and just below $3 on Android (worldwide). So the question is: what has Habby tried to grow its biggest hit yet even more, and why have most efforts seemed unsuccessful?

Events

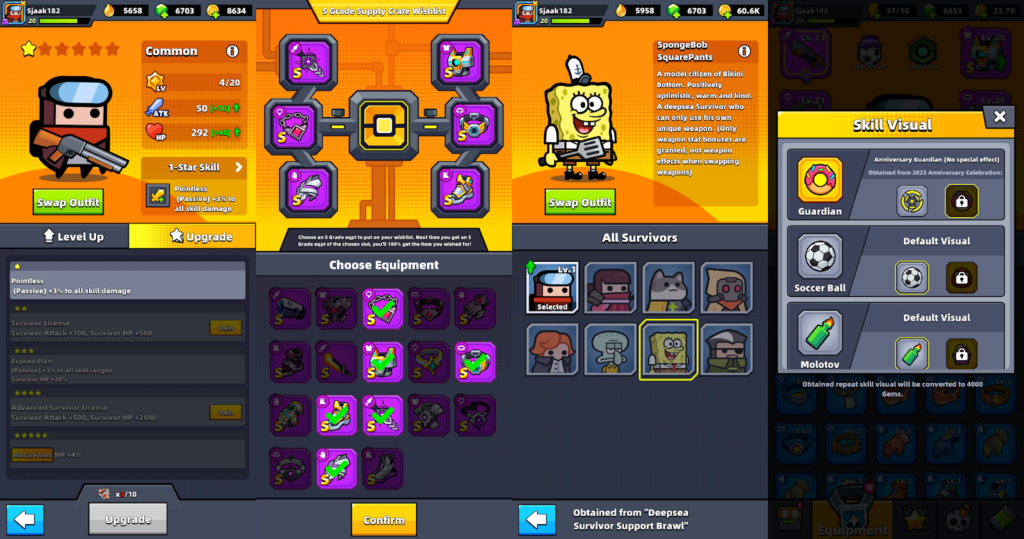

Given the game’s initial success, Habby has spent a lot of time and resources in dressing up Survivor.io to an extent it has a full casual game feature set. First, the additional features added throughout the year required meaningful rewards. By following and expanding on Archero’s loop, Habby increased the game’s reward space to even more elaborate levels by adding Survivor Upgrades, Tech Parts, Outfits, Pets and Skill Visuals.

Next to must-have classics like a Season Pass (linked to the game’s Daily Quests), Idle Income and a Clans feature, the game now also includes features like:

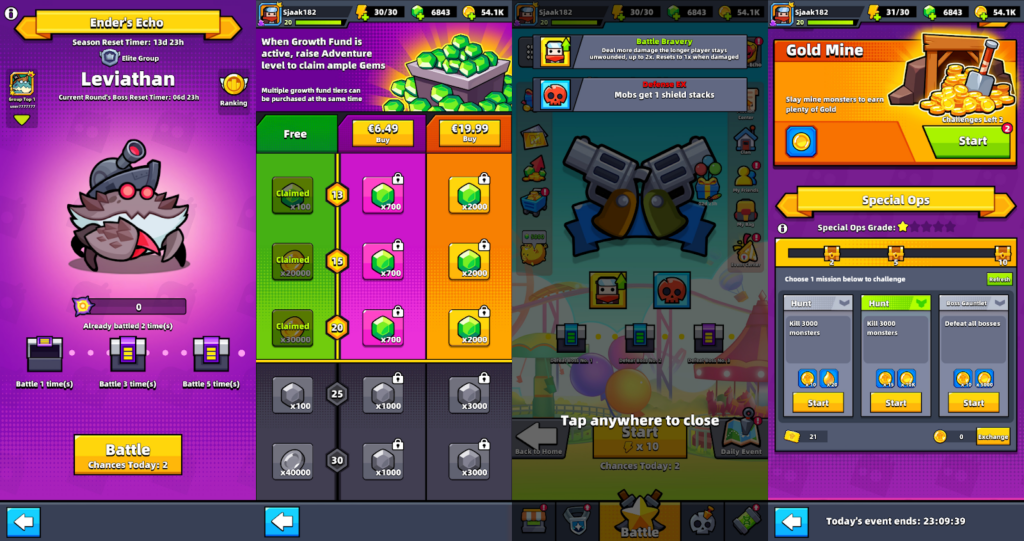

- The Growth Fund, a long-term retention and monetization feature that rewards massive amounts of hard currency all the way throughout the player’s progression for a one-time purchase.

- Ender’s Echo, a daily Boss fight in which randomly created groups of players compete for the highest amount of damage done to rotating bosses in short, 3-minute fights. The feature includes promotion and demotion in ladder divisions.

- A Daily Challenge with gameplay modifications for both the player and their enemies, providing Tech Parts as rewards.

- Special Ops, which are missions the player can accept to earn Survivor Shards, which can upgrade specific Survivors.

Survivor.io has also been running numerous time-limited events like the recent Anniversary event, the Lunar Mine drilling event and the highly engaging GoldFall Coast Carnival. Compared to other games in this article, these live events are very elaborate and in some cases cause real spikes in the game’s IAP revenue. The most recent example is the anniversary event, which caused a 2X spike in daily revenue on iOS.

In general, the game’s IAP structure seems solid with the most lucrative placements tied to progression with the Month Card and Growth Fund features scoring high.

But by far the best placements are the chapter completion-gated bundles that all offer 600% value. These are unlocked every time the player manages to win the next level and are only purchasable once each.

Looking at all these F2P techniques, one would expect a game to keep on growing. Unfortunately for Habby this does not seem to be the case – downloads have been going down since the beginning of the year, and stabilized around 600-700K per week. While these numbers are still very respectable, Habby may not able to grow the game anymore. Long-term retention is fine, but is definitely going down MoM as well. Has Habby found the ceiling of engagement for a game with a core this simple? Survivor.io’s comparatively long session lengths mixed with monotonous gameplay simply create too much player fatigue in the mid- to long-term.

Habby’s UA Strategy

Last year, self-proclaimed UA unicorn Matej Lancaric’s extensive research on Survivor.io’s marketing led to his estimate that the game made $15-30M on ads in October. If we look at IAP revenue that same month, Habby earned $40M, a revenue split of 65/35% in favor of IAPs. This makes Habby’s game an outlier in terms of revenue split, as the games before all skew towards ads. Some might even argue that Survivor.io isn’t a hybridcasual game at all when looking at its monetisation strategy; while this might be true, the game’s instantly understandable, low-strategy core gameplay and Habby’s UA history still make Survivor.io a notable part of this admittedly loose category of games.

Habby’s Portfolio Play

Habby’s latest game SSSnaker — which was released in March this year — seems to have missed the mark. Luckily it must have plenty of cash reserves to keep experimenting.

Habby’s strength lies in making big splashes through smart UA, and it is arguably the most lucrative hybridcasual game publisher out there. But Habby could also start looking at its competition to figure out how to grow revenue as downloads drop.

Homa Games - Belief in Hypercasual, Expansion to Hybrid

Another French hypercasual company that has been very vocal about the hybridcasual model: Homa Games. Since 2019, the company has generated more than 1.3B downloads with its long list of hypercasual games, topped by Sky Roller and Merge Master: Dinosaur Monster (called Merge & Fight on iOS), which have both been downloaded over 100M times each.

Homa’s most recent hit and third most-downloaded game is Attack Hole, a hypercasual game at heart but one that has a 70/30% revenue split as stated by co-founder and CRO Olivier Le Bas. The same article says the company is diversifying its portfolio with games “with better production values and retention” – hybridcasual, in other words. It has announced partnerships with companies such as 8sec to bring this plan to fruition.

Fight For America 3D is also an outlier with an IAP RPD of $0.48 on iPhone (US). In April, Deconstructor of Fun wrote: “In terms of the share between ad revenue and IAPs, [Le Bas] states that Homa’s less-well performing hybridcasual titles generate 15% of their revenue from IAPs, while its top performers like Fight For America can bring in as much as 40%. Ultimately, the consensus among experts we spoke to is that ad revenue is still the key driver for these titles.”

While the revenue split for FFA still favors ads, it is Homa’s most lucrative game in terms of IAP revenue. Its gameplay features a mix of hypercasual adventure controls — as also seen in Dreamdale — and tower defense.

Clearly it’s time to fight! | Source: Pryszard Gaming on YouTube

The game is a pretty shallow experience compared to the other games in this article, though. Let’s see if the upcoming release of Merge Army can propel the company’s IAP strategy forward.

Final Comparisons

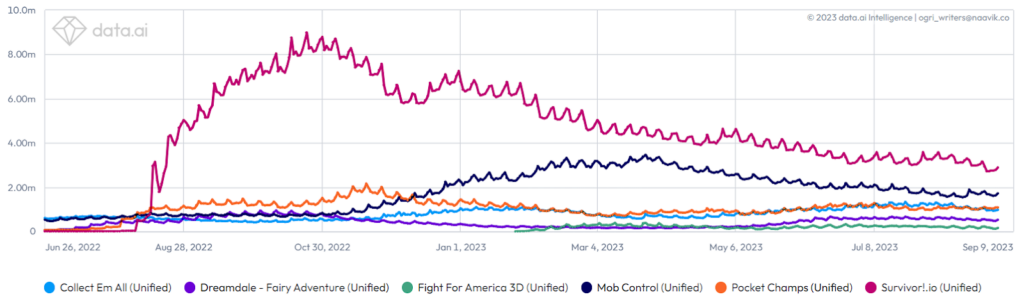

In terms of monetization, Survivor.io earned 85% of all IAP revenue when pooled together with the other games in this article. Comparing engagement KPIs however, is more interesting.

As most games in this article (excluding Homa’s FFA) started scaling at approximately the same time, it’s fair to say that Habby’s roguelite design combined with its viral-based marketing has paid off the most. This is especially true when you look at the IAP revenue Survivor.io has been raking in. But as we say in the Netherlands: tall trees catch much wind. Survivor.io DAUs have declined by over 50% since its peak last year; it’s still well above the other hybrid hits, but it’s likely this trend continues. We’d predict it’d eventually fall below the second-highest game, Mob Control, but its DAU graph also shows a downward trend.

Comparing session data, we see that Survivor.io has the highest session length but lowest session count per day. On the other side of the spectrum are Mob Control and Pocket Champs, with high session numbers but shorter length. In this context, Dreamdale is arguably on top as it takes second place for both.

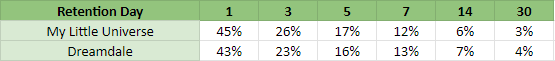

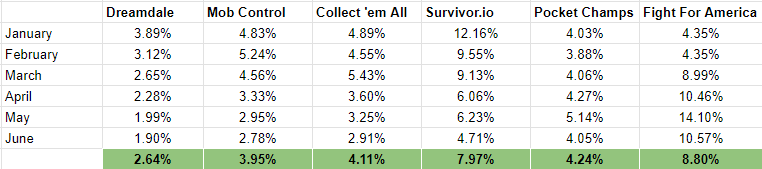

Lastly there’s long term retention, a tricky thing to compare as this fluctuates throughout a game’s lifecycle. Nevertheless, this snapshot of each game’s retention throughout the first half of this year shows some interesting trends.

The retention comparison above isn’t the most fair one, as the games are in different stages of their lifecycle. Survivor.io is on a decline after the game’s golden cohorts slowly stopped playing, while Fight For America seems to be rolling that high just now.

Pocket Champs is the only game where retention (and DAU) has stayed constant over the last six months, while all other established games of a similar age saw a clear decline. This is obviously great for Madbox, as only the most established games will manage to stabilize their MoM retention and be a solid business case for the years to come.

Bye-percasual and Hi-brid

While it’s clear that hypercasual games are still alive, newly-released hypercasual games are increasingly forced to add some kind of meta progression to be a viable business case. For casual games looking to become more accessible and expand their reach, the necessary >50% revenue split towards ads doesn’t need to be taken as the sole requirement, as Survivor.io has been proving. But what is the best strategy for hybridcasual development?

Design Approach

As Homa Games correctly stated: Hybridcasual games can be designed in three ways:

- Hybridizing a hypercasual game (Mob Control, Fight For America 3D, Dreamdale)

- Hybridizing a casual game (Survivor.io, Collect ‘em All)

- Starting out with a native hybrid approach (Pocket Champs)

The first two strategies depend on the game concept and how it can be simplified or enhanced. One could argue that Dreamdale is a stripped down version of a resource management and exploration game. For Survivor.io, Binding of Isaac or God of War could come to mind. Obviously, SayGames and Hypernova haven’t started by looking at the most far-away cousins but rather developed the game by iterating on the already existing (and much closer) My Little Universe.

When starting with a simple core game mechanic, the trickiest thing to do is adding substance to retain players mid- and long-term. Power progression is a good start, but it doesn’t make a game inherently meaningful yet. Most developers never find that meaning, which results in the majority of attempts having core and meta stitched together artificially, leading to friction. This problem doesn’t apply to games like Collect ‘em All, which has a puzzle core, as puzzles are inherently siloed experiences and therefore struggle less with disconnection between core and meta. Mob Control has executed the hyper to hybrid strategy successfully, although parts of it are still an illusion. From this selection, Dreamdale and My Little Universe have most gracefully succeeded in adding depth to a hypercasual mechanic. While this has clearly paid off, fragmenting the power progression — as Survivor.io does — suffices as well.

In terms of monetization there are many different scenarios in terms of revenue split. Where a game like Collect ‘em All wins in terms of CTR, games with clear and engaging power or resource progressions like Pocket Champs or Dreamdale respectively let players trade additions of each for RV engagement. Games like Survivor.io take the IAP route.

The companies that succeed in hybridcasual have all used the same baseline ingredients to create their games:

Expertise - Hiring Casual Game Developers

To create games with deeper meta systems to facilitate live ops and progression, having experienced casual games experts on staff is key. The hypercasual mentality of prototyping for a week and starting a new project the minute a mechanic seems to lose potential seems mostly a thing of the past. Today’s best example is Madbox, which amassed a lot of hypercasual experience and then started applying classic F2P principles to design Pocket Champs from the ground up.

Focus on UA

It requires a lot of time and money to find the optimal ad. An experienced UA team can reduce the time and cost, but it will always require a lot of iteration. Voodoo is obviously the company that is highly advanced at “hacking” viewers of a video ad to tap that Download button, and it is still using its classic hypercasual ad-optimization strategy to get players into Mob Control and Collect ‘em All for the lowest CPIs possible. Habby is also very adept at this, but its strategies lean more towards virality than conversion.

A Critical Mass of Hypercasual Games

When looking at this article’s list of games and their creators, every company has a rich history of publishing rather than developing games themselves. Deep knowledge of the most engaging core games is almost a prerequisite.

This doesn’t mean an independent or smaller company can’t make hybridcasual games. Smart independent developers are often the ones finding engaging core mechanics in the first place, but then usually get contacted by these publishing companies to take care of the rest.

Truly ideological indie developers might be tempted to take their own hybridcasual games from start to finish. However, scouring analytics platforms to hybridize a bigger publisher’s game, make it better and recreate the creatives is usually an ill-fated endeavor. As these games are hypercasual by nature, a huge part of the marketability for their creatives has already been exhausted by the publisher already, resulting in higher CPIs. This makes it risky to invest six months to a year in improving the game loop by adding a meaningful meta. Companies with high publishing volumes can spot a viral mechanic early and temporarily stop UA with the preconceived intention of making the game deeper before going all-out.

A Solid Selection Procedure of Which Games are Hybridized

It all comes down to designing the right combination of core, metagame and marketing strategy. Unfortunately, simple, proven, yet untraditional core mechanics that can be improved with some kind of stat progression are not easy to come by. Developers trying to hybridize games like Helix Jump will suffer a rude awakening as well, and the lion’s share of arcade/hypercasual games can’t be evolved this way either.

It’s likely more feasible to start with a power progression and work your way from there, adding meta progression like gacha and an engaging, instantly understandable core mechanic after, as Pocket Champs has so masterfully done.