Two weeks back, mobile game developer Big Run Studios (BRS) raised a second seed funding round of $5.25M through investment firms Transcend Fund and Galaxy Interactive. This comes a few months after BRS’ first seed round of $1.4M, and is most likely due to the recent success of their flagship title “Blackout Blitz” - a mobile Bingo game. Though what makes this particular funding round very interesting is that it’s a bet on the unique monetization engine behind BRS’ complete app portfolio - Skillz!

At its core, Skillz is a platform that allows any skill-based mobile game to convert itself into an esport with real money winnings. However, unlike typical esports-friendly and male-dominated core games like League of Legends or Dota, Skillz prides itself on opening up the top of the funnel by making esports experiences accessible to the casual mobile gaming audience (with a focus on females) through a portfolio of casual mobile games across a variety of genres.

Against the backdrop of the ongoing esports hype train, Skillz is currently seeing unprecedented growth. In September 2019, it was reported that Skillz doubled its revenues from $200M to $400M over a period of 5 months. More recently, Skillz also reported its top 10 earning players won a combined total of ~$25M over 2019. 7 out of these 10 were females, with HestiaX raking in a total of $3.96M - making her the 6th highest earning mobile esports athlete across the entire industry in 2019! Not too shabby at all.

More specifically, Skillz-based mobile games allow players to compete head-to-head in real time for real cash prizes through in-game esports like tournaments. To make this technically possible, Skillz offers a patented SDK that game developers can integrate into their mobile games. The SDK handles key server side activities that ensure fair competition and accurate cash winnings (amongst other things) are taken care of. But making this a financially viable business is where things get interesting.

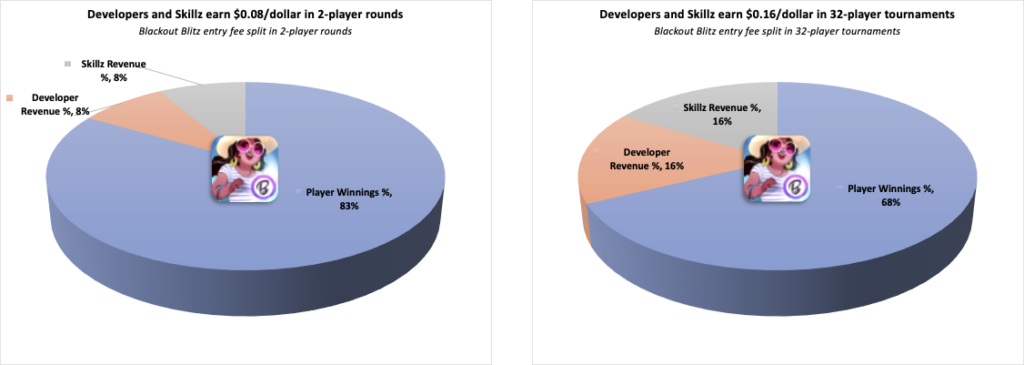

The Skillz business model depends on creating a lucrative opportunity for three key stakeholders: the players, the game developers, and Skillz itself. This results in a three step payout model: players pay a $ entry fee to compete in the game, winners take home a percentage of the total entry fee pool, and the rest is equally split between the game developer and Skillz. Here is what that looks like in terms of percentages for the two game mode types in BRS’ Blackout Blitz:

The data above brings up two interesting questions. First, where does the 30% platform tax figure in? Well given how Apple treats transactions in real money gaming apps, there is no 30% cut! This is because clause 5.3.3 in the App Store Review Guidelines does not classify transactions in real money gaming apps as IAP purchases, and only transactions classified as IAP purchases are charged with the 30% fee.

Second, why would BRS (and likely other developers integrating Skillz) settle for an 8-16% take vs 70% by designing Blackout Blitz on an IAP-driven monetization engine? I’d expect the decision to almost entirely depend on the expected acquisition scale and player lifetime value in either scenario for BRS. The importance of this decision is further amplified by the fact that Bingo is a stagnating sub-genre on mobile (as analyzed here), thereby implying that building a profitable business in a stagnating sub-genre is dependent on innovating/differentiating significantly through either gameplay, or business model, or marketing (including IP integrations).

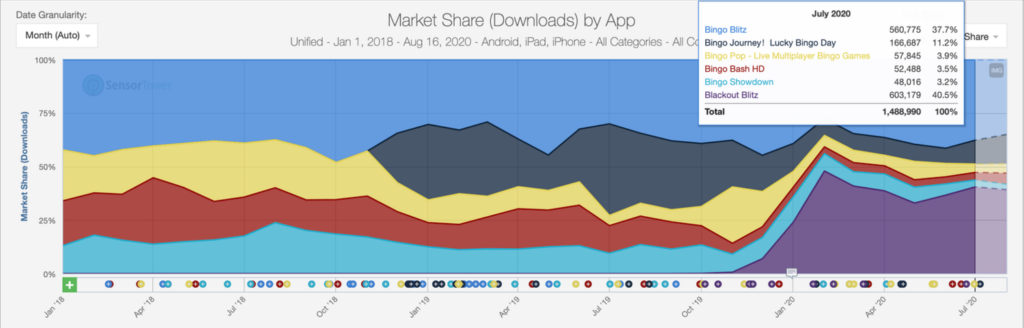

In terms of acquisition scale, the graph below shows how Blackout Blitz is matching monthly download volumes of the Bingo sub-genre’s current market leader, Playtika’s “Bingo Blitz”. It would be safe to say that Blackout Blitz’s unique art style/theme mixed with a strong hook of real money prizes makes for a very potent user acquisition value proposition in a relatively large Bingo-playing total addressable market. Not to mention how well differentiated this market positioning is in a sub-genre that is dominated by IAP-driven games.

With regards to player lifetime value, it would be an understatement to say that providing players with the opportunity to win real money through highly familiar Bingo gameplay boosts retention and monetization metrics to unprecedented levels versus typical Bingo subgenre benchmarks. Further, the percentage of a dollar that goes to players as real money winnings is a variable that is in the developer’s control, and can therefore be tuned to find just the right balance between driving maximum lifetime value and generating ample margins. As Galaxy Interactive’s managing director Sam Engelbardt says - “Blackout Blitz — [Big Run Studio’s] bingo game — is the top game on Skillz. It’s incredible what adding a skills-based wagering component does to the numbers…”.

Both points above are brilliant business strokes and make it clear that Blackout Blitz has primarily double downed on business model and marketing differentiation to achieve success - kudos to BRS! But the fact that the state of the Bingo market also drives these decisions should not be forgotten, as not every sub-genre market behaves like Bingo does.

Looking ahead, there are a few areas that present themselves as potential growth opportunities for both the Skillz platform and developers looking to integrate Skillz to reach their full revenue potential.

First - improving Android distribution. Google isn’t as flexible as Apple when it comes to distributing real money gaming apps on the Play Store. Further, Skillz itself doesn’t recommend implementing their platform if developers are considering distribution through the Play Store. While Skillz does support developers with other means of distribution for Android, it’s quite likely that the lack of Play Store distribution advantages is significantly stunting Skillz’s revenue potential. Not to mention it makes it a much harder sell to developers who’d like to adopt the Skillz monetization engine. Though recently, Android is moving closer to matching Apple’s flexibility, so this might just fix itself given enough time.

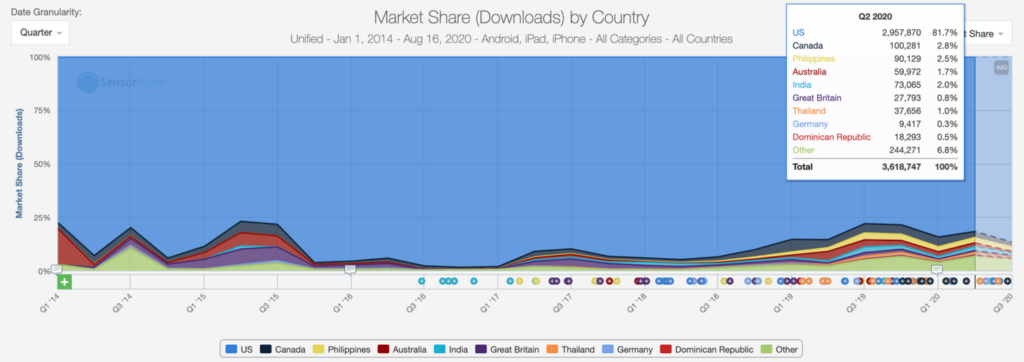

Second - growing a global player base. Even though Skillz cash tournaments are currently available in ~75% of the world, the platform’s top 15 games (ranked by downloads) predominantly consist of a US-only audience. While real money gaming is heavily regulated across the world and lacking common regulatory standards could be a limiting growth factor, there is definitely massive upside in making the increase of global penetration a product priority for Skillz.

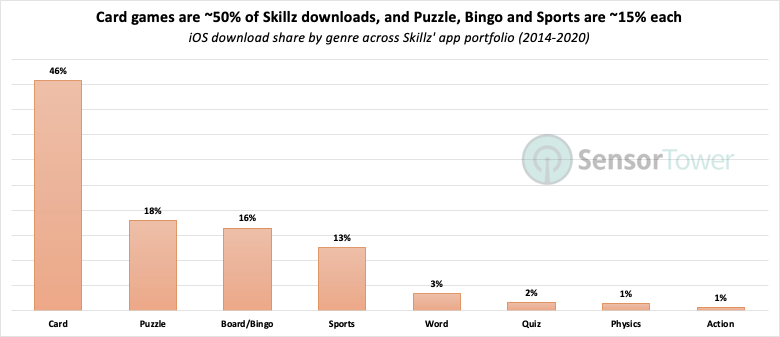

Third - finding creative ways to implement Skillz across many more game genres. The US allows real money gaming on games of skill. Games powered by Skillz take the clear distinction as being games of skill - and not games of chance - a difference which makes Skillz tournaments legal in the majority of the US. While this does the restrict the number of game genres that could be Skillz powered, it does present an opportunity to developers to reimagine a multitude of game genres to make them more Skillz friendly. Currently Skillz’s portfolio spans 8 sub-genres, but many more with even stronger benchmark metric profiles remain untapped.

With all that said, BRS’ recent raise does help validate the viability of the Skillz business model in the mobile gaming ecosystem. We will definitely be watching Skillz closely in the future, especially as esports culture continues to penetrate communities across the world. Link