Welcome to Master the Meta, the #1 newsletter about the business of video games. Not a subscriber yet? Sign up down below.

Hi everyone,

I’m thrilled to announce that Master the Meta is partnering with Pocket Gamer! Each Monday — starting tomorrow! — we’ll publish 2-3 core snippets of the Weekly Meta as a Pocket Gamer column. We’re excited to share our ongoing analysis with Pocket Gamer’s audience, and if you found your way over here from their website, welcome! If you want to stay up to date on all future Weekly Metas and deep dives, make sure to subscribe down below.

Now, onto your weekly roundup and analysis of what’s happening in the video game industry...

📰 News

Xbox Game Pass Ultimate will include xCloud. PlayStation may top Xbox in terms of next-gen launch numbers (thanks to exclusives and a larger existing player base), but competing with Xbox’s long-term ecosystem ambitions will grow increasingly tough. Xbox’s decision to provide xCloud at no additional cost to Game Pass Ultimate members means that Xbox will offer the best subscription value to gamers compared to any other service on the market, hands down.

Here’s some context:

-

Xbox Live Gold costs $9.99/month (or $60/year).

-

Xbox Game Pass on console costs $9.99/month

-

Xbox Game Pass Ultimate, which will include Live + Game Pass (console & PC) + xCloud, is $14.99/month.

Not only is this a great value to subscribers, especially as Xbox adds more (exclusive) content to Game Pass, but it puts the business in a strategically strong position.

-

Adding xCloud makes Game Pass Ultimate more appealing, which keeps the flywheel spinning: more subscribers → greater content spending → a more compelling service → more subscribers, etc. Like Netflix, the service should earn long-term pricing power, but maintaining a low price is a smart way to continue catalyzing a large, growing user base.

-

Xbox will grow more relevant to more gamers. Even though the Series X console remains the center of Xbox’s strategy, the company’s game plan actually extends beyond proprietary hardware. Game Pass Ultimate is cross-platform, both because Game Pass itself can be accessed on Xbox + PC and because xCloud means a budding number of games can be played on most any device.

-

Read between the lines: xCloud is currently positioned as a complement to hardcore Xbox users (and will always be), but it’s being set up in a way where these services can eventually benefit millions of gamers who don’t even own consoles. Once xCloud is thoroughly tested, it will probably be sold as a separate service for those who don’t need the full bundle. This is how Xbox gains a strategic foothold beyond console and therefore widens its total addressable audience.

-

Many people continue to doubt how successful gaming subscriptions can become. Sure, subscriptions may never be the way gamers access the hottest games, and most publisher-specific subscriptions will remain niche, but bundling together cross-platform (and sometimes exclusive) content and services at the platform/ecosystem level can still become a wildly popular solution.

-

Selling more Game Pass subscriptions increases Xbox’s recurring revenues, which helps reduce overall cyclicality. We’ll probably also see an option to bundle monthly console payments along with Game Pass Ultimate payments.

As Microsoft evolves its master plan, it’s impossible to say just how many millions of new Game Pass subscribers the company will add (there are 10 million today). However, it is clear that 1) there’s room to dramatically upsell the ~90 million Xbox Live MAUs, 2) tremendous long-term opportunity to sell services beyond console, and that 3) most competitors are in a worse position. Stadia, PS Now, and others will continue to improve, but Xbox is several steps ahead and holds advantages most others can’t match. For example, in the case of PlayStation, Sony will leverage Microsoft Azure for cloud gaming, so Microsoft wins no matter what Sony does. Link

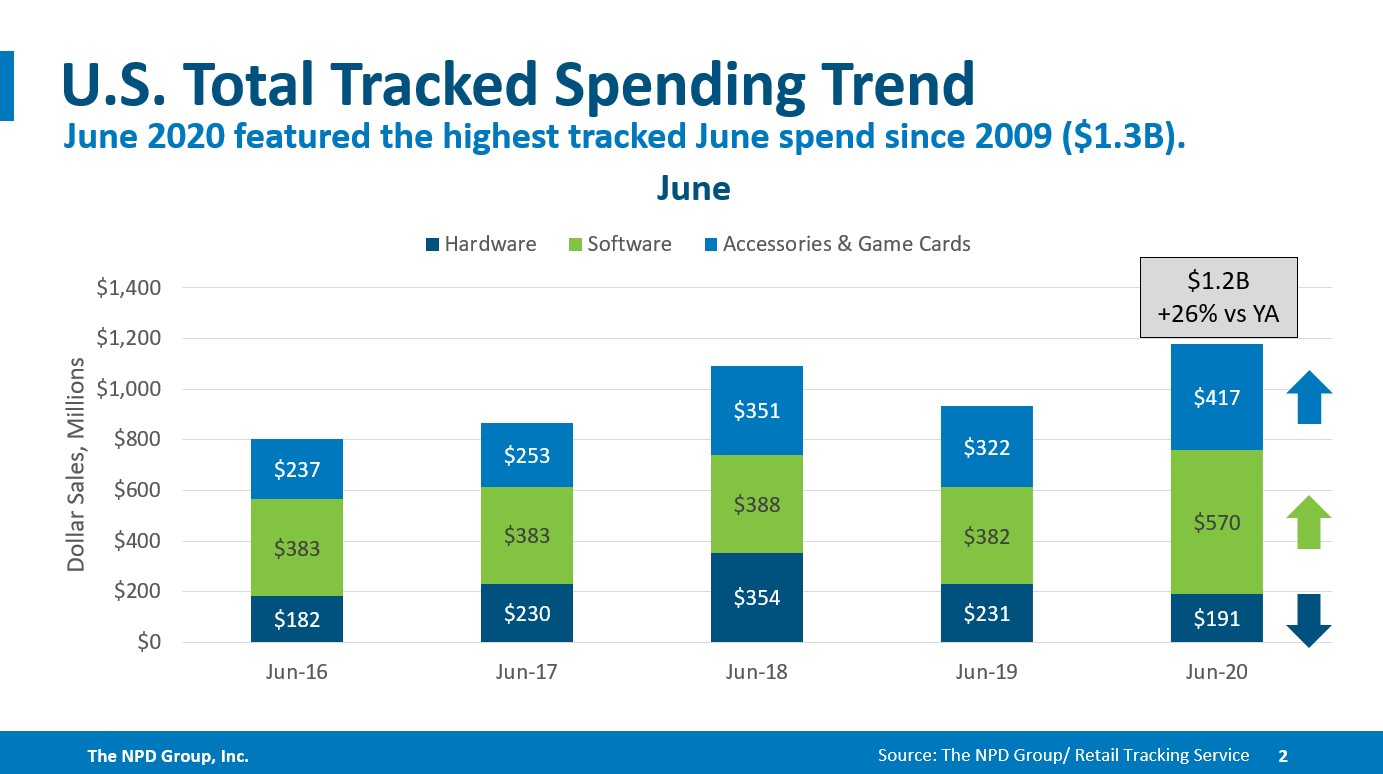

June NPD Data. June’s tracked spending across hardware, software, and accessories (excluding mobile) is estimated to have risen 26% over the past year. Keep in mind, this data is US-specific, but European patterns should be very similar.

This growth isn’t surprising given all the other data we’ve showcased in prior weeks. Also, looking at the top 10 selling games of the year, The Last of Us: Part II is the only big change for the month (Link):

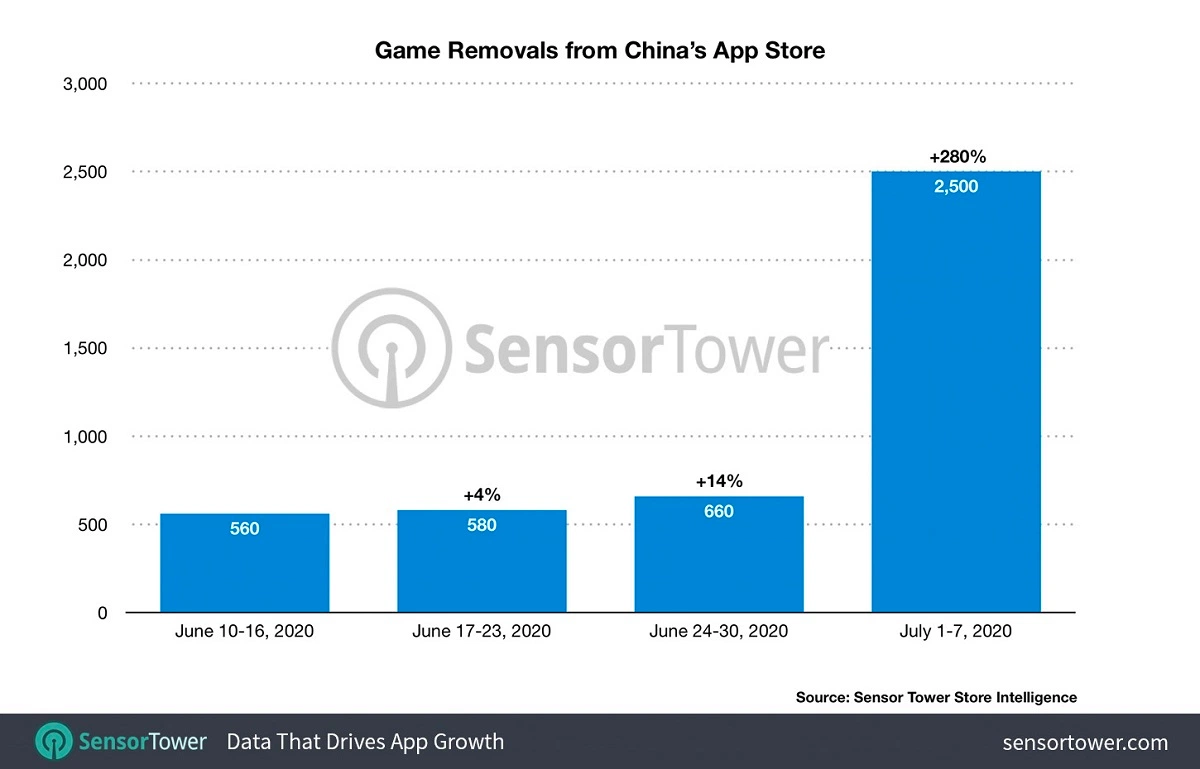

China’s Apple App Store removes more than 2,500 games. China continues to clamp down on developers who fail to follow its required processes, and Apple and Google remain the enforcers. To be clear, this isn’t a surprise. China has had license requirements for years, but developers were still able to launch on iOS without formal approval. Now, however, games must get ISBN license numbers or else they get automatically pulled from app stores. Even though the law isn’t new, the reality of thousands of games getting removed has brought the issue front and center again. The deadline for approval is technically July 31st, but Apple is taking proactive measures. As you can see, these removals have been happening for months and are currently crescendoing:

Some games certainly will go through the process to gain formal approval, but many companies won’t find it worth the hassle (both time and money). It’s worth noting that 97 of China’s top 100 games have the required license, so the financial impact on China’s mobile market will be minimal. It also continues to set companies like Tencent and NetEase up well to be partners of choice for entering the Chinese market, which sets leading Chinese companies up to win no matter what.

As an outsider, it’s impossible to like China’s protectionist and censorship-heavy actions here. It’s the largest mobile gaming market in the world, after all. That said, the more interesting part of this story, in my opinion, is less how China is censoring foreign content and more how the tables might turn back on them (like how India recently banned a few Chinese apps and how the US is considering banning TikTok). Link

New EU regulations give developers more transparency on mobile platforms. App stores are de facto monopolies, and monopolies without safeguards tend to make enforcement decisions in “black box” ways, where there doesn’t need to be full explanations or “good” reasons behind why decisions — like removing apps — are made. As it stands, Apple and Google can essentially enforce whatever they want. Regulations can go too far and have unintended consequences (like GDPR ultimately entrenching the most dominant digital businesses), but digital monopolies still need new rules to govern unfair and parasitic behaviors.

The EU’s new regulations are designed to provide transparency around why certain platform decisions are made. This means providing clear reasons why removals will occur and a 30-day heads-up so developers can make any needed changes. It also means more transparent ranking algorithms, data access rights, and disclosures around any preferential or differentiated treatment. Transparency in general is a positive, and forcing clear feedback about why apps will be removed in all circumstances should protect developers from Apple’s whims. These rules aren’t perfect, of course. Transparency doesn’t strip Apple or Google of power; it does nothing to affect platform take rates, reasons for removal, and how payments are conducted. What it does is give developers more time to react and progress the societal dialogue around how app stores should be further regulated. In my opinion, even if I don’t agree with every rule, there’s only one way regulations will likely move: against platforms (and not just in the EU). Apple and Google have iron grips on their app stores — dictating payment systems, algorithms, take rates, etc. — and regulatory discussions around those more important elements (essentially whether developers should be given more choice and profits) will likely get noisier in the months and years ahead. Link

Facebook and Sony are ramping up hardware production. Sony now expects to produce 9 million PS5s this year (up from 6 million), which signals that gamers have serious pent up demand. It’s been 7 years since the PS4 launch, Sony executed a successful marketing strategy so far this summer, and people are gaming more in general thanks to COVID, so expect a strong launch. As for Oculus, Facebook has struggled to keep up with demand ever since quarantining began. The Oculus Quest, specifically, has seen strong growth so scaling inventory will ensure that healthy growth continues. Oculus has roughly 35% market share, and that should rise if Facebook can get its production act together. Link

Amazon Interactive Video Service. I’m not positive when this service launched, but AWS now has the technology that enables anyone to build and embed their own streaming service. Three main thoughts:

-

AWS is always unveiling new capabilities, so we should’ve seen this coming.

-

This is a typical Amazon strategy. Amazon often builds technology for itself and then finds a way to sell it to everyone else. It built warehouses for itself, then launched Fulfillment by Amazon (FBA); built a shipment network and now offers Amazon Shipping; built Amazon Go stores and now licenses cashierless technology. In this case, it helped scale Twitch and now will sell the underlying technology to others.

-

There’s no threat to Twitch here. Just because Amazon now sells live video tech doesn’t mean others can use it to build legit Twitch competitors. Too many other competitive advantages, primarily network effects, make that prohibitive. That said, there are other niches where embedding live video could be adopted much more. For example, one of Amazon’s Interactive Video Service customers, Blackboard, is looking to use live video for education purposes. And many other communities could embed live video to better engage their communities (note: The Motley Fool, where I work, now does several hours of live video behind our paywall everyday and it’s incredibly engaging). As a result, this interactive video service is less for building new streaming sites and more for embedding streaming into existing sites (and competing with the likes of Zoom and traditional webinars). Expect much more of this in the future (potentially even in gaming circles). Link

Dragon’s Dogma goes to Netflix. Capcom’s action fantasy game, Dragon’s Dogma, is becoming a Netflix anime. This is yet another example of how Hollywood is leveraging video game IP. Every month we seem to get a new example. Link

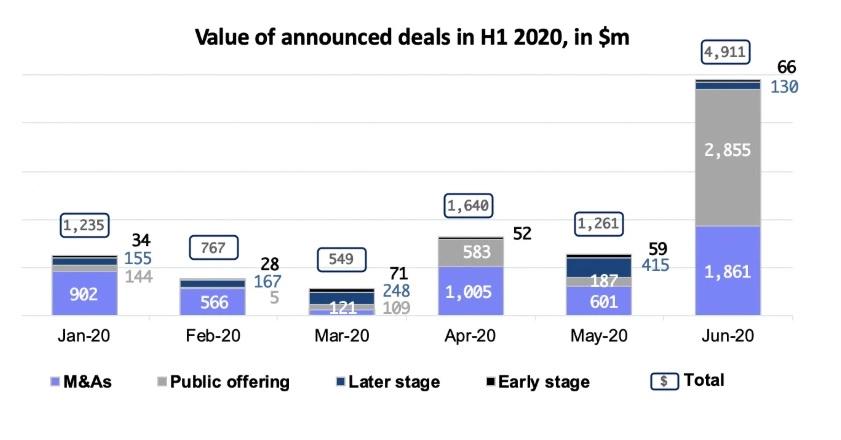

An outsized quarter of dealmaking. Over 100 video game-related deals were conducted in the second quarter, and even though that’s a slight decline from last quarter the total value of those deals was much higher. VC-level deals continue to get made at a healthy pace, but, as you can see in the chart below, the quarter was dominated by large acquisitions and accelerating public offerings.

Image Credit: Sergei Evdokimov

A couple observations:

-

Public offerings are partially driven by companies like Stillfront raising cash for future acquisitions, but much of this burst is Chinese companies like NetEase raising money in Hong Kong. I bet we see more of that in the future. However, it’s also likely we experience another uptick as companies like Unity, Playtika, and maybe Epic Games IPO.

-

M&A occurs regularly in this industry, but this quarter saw larger than usual deals. Zynga’s $1.8 billion acquisition of Peak Games is easily the largest, but the acquisitions of Jagex and Machine Zone (both around ~$500 million) stand out as well.

In general, even though deals will continue to occur at a lumpy pace, there are exciting opportunities to look forward to across every stage. Innovative startups continue to launch and scale, many companies (like Tencent, Stillfront, and Zynga) will continue to acquire, and there are some pretty sizable IPOs on the horizon. Link

Speaking of dealmaking, there were quite a few that were reported this week:

-

Carbonated raised a $8.5 seed round to develop hardcore mobile games. The team is also building their Carbyne platform, which provides live ops and real-time multiplayer at scale. Link

-

Tiny Build acqui-hired Hello Neighbor developers with the intent of investing $15 million in that franchise. Link

-

Tilting Point acquires Plamee Studios + FTX Games assets, marking their third acquisition of the past eight months. Link

-

VGames raises $30 million for its Israeli-based, game-focused investment fund. Link

-

Paradox acquired Iceflake Studios, becoming the company’s ninth studio across six countries. Link

-

Darewise Entertainment raised €3m in seed funding to work on its debut MMO, Life Beyond. Link

🖥 Content Worth Consuming

Rise of the player-fan: The growing opportunity of mobile esports in Asia. “As mobile technology catches up to its PC and console counterparts, mobile esports is quickly taking the spotlight, and gamers in Asia are stealing the show. Home to more than 1.5 billion gamers1 and a fast-growing mobile population, Asia is poised to show the world that mobile esports is the next evolution in player-fan engagement.” Link

IDFA - Everything You Ought to Know with Eric Seufert & Yevgeny Peres. “Monumental changes are coming to the mobile games market. In this episode we dive deeper into the implications of the changes to the marketing ecosystem. What happens to CPIs and CPMs? What is the role of cross-promotion going forward? Will IPs be more important for games looking to grow? How about ad monetization? We also discuss the future of various different type of mobile games companies from hypercasual publishers to mid-core developers, from startups to giants with large and diversified portfolios.” Link

Take Your Game’s Retention To The Next Level With Collaboration Events. “We all know that a key part of sustained success in today’s F2P mobile market requires solid live ops execution – in other words, you need to be able to provide your player base a constant stream of exciting content. Live events are great in grabbing players’ attention and instigating FOMO that converts into retention and hopefully increased LTV. To make your live event truly special, however you might want to explore possibilities to collaborate with other IPs to create a unique promotional collaboration event.” Link

Can Riot Make TFT a Billion Dollar Games? “Needless to say, TFT doesn’t look so hot on the Revenue front. But given Riot’s reputation for fair play and rejecting anything looking like P2W, what are some things that can be added to TFT to help the game monetize more without compromising Riot’s standards?” Link

The US Military Is Using Online Gaming to Recruit Teens. “The practices employed on Twitch by military e-sports teams are part of a system by which recruiters target children in unstable and/or disadvantaged situations. Recruiters take advantage of the poor seeking steady income, the vulnerable longing for stability, and the undocumented living in fear because of their citizenship status. Now, at a time when all those factors are magnified by a pandemic that has left half the country out of work and over 30 percent unable to afford their housing payments, conditions are ripe for recruiters to prey on anxious youth.” Link

See you next week!